That’s the title of an article in Bloomberg:

Shelton, who’s served as an informal adviser to Trump, holds a Ph.D. in business administration with an emphasis on finance and international economics from the University of Utah.

Here is a recent writing advocating return to “sound money” in Cato Journal:

The United States is the world’s largest holder of official gold reserves. Comprising 8,311.5 tonnes or 261 million troy ounces, those reserves are carried at a book value of roughly $11 billion. Notably, the market value is significantly higher at $345 billion (based on the London Gold Fixing for September 30, 2016) as cited in the Treasury’s report filed June 30, 2017 (U.S. Department of the Treasury 2017).

In proposing a new international monetary system linked in some way to gold, America has an opportunity to secure continued prominence in global monetary affairs while also promoting genuine free trade based on a solid monetary foundation. Gold has historically provided a common denominator for measuring value; widely accepted at all income levels of society, it is universally acknowledged as a monetary surrogate with intrinsic value.

Speaking in February 2017, former Federal Reserve Chairman Alan Greenspan defined gold as the “primary global currency” and further added, “We would never have reached this position of extreme indebtedness were we on the gold standard, because the gold standard is a way of ensuring that fiscal policy never gets out of line” (Oyedele 2017). To confront U.S. indebtedness, we need to restore fiscal discipline and sound money through gold convertibility.

We make America great again by making America’s money great again.

For the sake of the institution, I hope she isn’t appointed and confirmed. Her craziness is not confined to the advocacy for gold convertibility. From my February 2017 post entitled “This Makes No Sense“:

Judy Shelton on currency manipulation.

In response to my post on a possible new approach to tackling currency manipulation, reader “Judy” comments by sending me a link:

https://www.wsj.com/articles/currency-manipulation-is-a-real-problem-1487031395

This is a WSJ op-ed, which is behind a paywall. Here is an ungated version:

Certainly the rules regarding international exchange-rate arrangements are not working. Monetary integrity was the key to making Bretton Woods institutions work when they were created after World War II to prevent future breakdowns in world order due to trade. The international monetary system, devised in 1944, was based on fixed exchange rates linked to a gold-convertible dollar.

No such system exists today. And no real leader can aspire to champion both the logic and the morality of free trade without confronting the practice that undermines both: currency manipulation.

When governments manipulate exchange rates to affect currency markets, they undermine the honest efforts of countries that wish to compete fairly in the global marketplace. Supply and demand are distorted by artificial prices conveyed through contrived exchange rates. Businesses fail as legitimately earned profits become currency losses.

…central banks provide useful cover for currency manipulation. Japan’s answer to the charge that it manipulates its currency for trade purposes is that movements in the exchange rate are driven by monetary policy aimed at domestic inflation and employment objectives. But there’s no denying that one of the primary “arrows” of Japan’s economic strategy under Prime Minister Shinzo Abe , starting in late 2012, was to use radical quantitative easing to boost the “competitiveness” of Japan’s exports. Over the next three years, the yen fell against the U.S. dollar by some 40%.

…

Whether China is propping up exchange rates or holding them down, manipulation is manipulation and should not be overlooked.So…let me get this straight. If you lower interest rates and that depreciates a currency, that’s manipulation. If you embark on quantitative easing by purchasing domestic assets and the currency depreciates, well that’s currency manipulation. And if you intervene in the foreign exchange market to keep a currency weak by purchasing foreign currency, that is manipulation, as well as if you intervene to keep it strong by selling off foreign currency.

This expansive definition of “manipulation” means that pretty much every central bank in the world is manipulating their exchange rates — except for those that have their exchange rates at the “correct” levels, as determined by somebody.

That article made me wonder what criterion would result in exchange rates being at correct levels. According to this article, Dr. Shelton believes a fix to gold would do the trick.

“We’re talking about monetary integrity. And if we really do have a some kind of a global economy, it doesn’t make sense that people are using different units of account to measure value.”

Implicitly, this means she views the world as an optimal currency area (e.g., symmetric shocks, and/or free factor mobility and fiscal union). Hmmm.

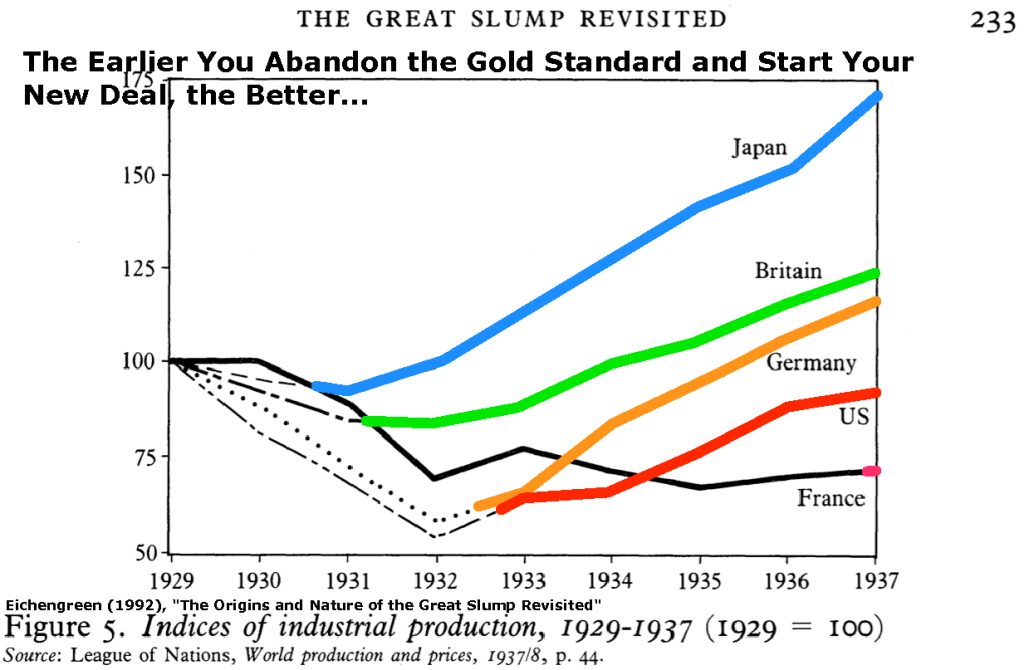

I’ll further observe that if you fix your exchange rate to gold at the “wrong” levels, you might have the real exchange rates less volatile, but still misaligned. Those who know economic history, know the consequences, summarized in this graph:

See also Jim’s post on the subject.

I have read that Dr. Shelton is an economic adviser to President Trump; if so, I think I will miss the days when Donald Trump called Lt. General Flynn for advice on the dollar.

For an econometric evaluation of Dr. Shelton’s proposition of fast adjustment to PPP under gold standard, see here, where I cite Alan Taylor’s “A century of PPP”. (If regressions, and half-lives, befuddle you, then don’t read).

On the other hand, as a social scientist, I am interested in how the combination of (1) a gold standard and (2) a permanent state of trade war would affect the world economy.

Professor Chinn,

Do we need a hyperlink on the “here” in your sentence? “For an econometric evaluation of Dr. Shelton’s proposition of fast adjustment to PPP under gold standard, see here, where I cite Alan Taylor’s “A century of PPP”. (If regressions, and half-lives, befuddle you, then don’t read).”

Menzie’s old post has a great summary of Alan Taylor’s paper as well as this working link.

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.486.2276&rep=rep1&type=pdf

AS: Yes, sorry fixed now.

Curious what Janet Yellen is thinking to herself right now.

She’s thinking – how tall is Judy? Yes Yellen is only 5′ 3″. Of course Milton Friedman was only 5′ 0″.

Cracked me a smile on that one. The situation is actually not very funny, is it??

She has a Ph.D. Oh wait in Business Administration from Utah. But she is the director of the Sound Money Project. My Lord – we have found the female version of Stephen Moore!

pgl: I’ll take Utah over GMU (and MA over PhD even if Bus Ad). And I bet she (1) has not refused to pay back taxes, (2) reneged on (2a) child support, (2b) alimony and (3) not repeatedly made misogynistic statements, and (4) lied about economic facts repeatedly.

Without having done ANY homework on Shelton, I wager she’s a better candidate than Moore. But it’s like the old saying “One needn’t compare themselves to the lowest common denominator”.

Menzie,

Given that mostly in this comment you are putting Shelton over Moore, did not mean to write that you would take a PhD in business admin at Utah over a Masters in econ at Mason?

“We make America great again by making America’s money great again.”

Was she wearing a MAGA hat when she made this blatant proposal to return to the gold standard. Look we know Trump is an idiot but one would think even he would know this women is insane.

pgl,

Are you kidding? This is a guy who thinks that foreigners pay our tariffs and thinks keeping his tariffs on permanently will be good for the US economy. And somehow nobody has managed to correct him on these matters, or if they have, he has forgotten it already.

Judy Shelton on CNBC babbling incoherently on these issues:

https://www.cnbc.com/video/2019/03/05/santelli-exchange-former-trump-economic-advisor-on-the-dollar.html

Of course she starts by saying Trump is really smart so I guess this is what the dumbest President in our life time wants this fool on the FED!

In my city, the New York Sun is known as a right wing worthless tabloid. Yes – they were all in when Trump nominated Cain and Moore. But they are now doing high fives over the idea that Judy Shelton will be nominated:

https://www.nysun.com/editorials/the-right-nominee-for-the-fed/90659/

Yes – the idiots at the Sun think the gold standard would be a fine international monetary system. Maybe I should go find a copy of this publication in some trash can and use it to line the bird cage!

Uncle George is looking pretty good now.

That may be the first time you’ve made me chuckle on this blog in a way which wasn’t directly ironic towards yourself.

🙂

Well, probably she will not have a problem with harassing women in the past, although, who knows?

If she follows what Trump wants and pushes for lower interest rates, will she be guilty of manipulating our currency?

Interesting discussion from Jeff Frankel:

https://voxeu.org/article/no-moore-golden-era-us-monetary-policy

“Moore has been pro-cyclical in his recommendations for monetary policy – that is, opposing stimulus when the economy needed it and favouring stimulus when the economy did not. First, when the Fed sought to boost the economy in response to the 2007-09 recession, Moore in 2009-10 warned of rising inflation, even hyperinflation. Needless to say, the inflation never materialised.”

Frankel was noting why Moore as well as Cain should not be put on the FED. Thankfully they will not be. But Shelton should not be either as she is as much a gold bug as Moore is.

More from Frankel – this being directly on the gold standard issue:

The gold standard versus a commodity standard

A century ago, the gold standard was considered a guarantor of monetary stability. That golden era is long-gone, if it ever really existed at all.

Moore and Cain had both said that they favour a return to gold. Judy Shelton, the US Executive Director at the European Bank for Reconstruction and Development who is rumored a candidate to be Trump’s next choice for the Fed, is a long-time serious and consistent adherent of a return to the gold standard. (She does have a PhD.)

In true Trumpian fashion, Moore last month denied having said he favoured the gold standard, despite the clear video evidence. In any case, he now says he favours having monetary policy focus on a basket of commodities, not just gold alone. This has brought him some ridicule. It is true, however, that a price index based on a variety of commodities would attenuate the volatility of the gold market. There was a time in the 1930s – after FDR took the US off of gold (Eichengreen 1992, Edwards, 2018) – when leading experts Benjamin Graham (1937) and John Maynard Keynes (1938) weighed the advantages of a hypothetical commodity basket standard.

In the case of a country that specialises in exports of mineral or other commodities, one can make an argument for targeting a price index of those export commodities, as an alternative to the option of targeting the CPI (Frankel 2011). Proposing a commodity price target for the US, would be foolish. But commodity prices are sensitive to real interest rates (Frankel 2014), and so one could make a case for including them alongside stock prices and the exchange rate in a Financial Conditions Index. Real commodity price indices correctly reflect that US monetary policy began tightening in 2013-14, while still remaining loose today by historical standards.

In the late 1970s, the supply-siders who hitched themselves to Ronald Reagan’s 1980 candidacy famously campaigned for large tax cuts (which, they said, would pay for themselves). But they also tended to have a particular view on monetary policy: that the US should consider returning to the gold standard. The movement achieved the creation of a high-level official Gold Commission, but lost some momentum after it submitted its report in 1982.

In the 1980s, supply-siders like Congressman Jack Kemp continued to campaign for a return to the gold standard, arguing that this would allow an easier monetary policy, which they thought was the only thing holding back the success of the supply-side strategy. (The price of gold declined in 1981-1984, coming off a record high in 1980. Thus, it was a time when stabilising the price of gold might indeed have implied an easier monetary policy.) It was noted then, as now, that to have small-government populists arguing in favour of the gold standard stood on its head the history of American populism. That history was memorably represented by William Jennings Bryan’s campaign for the presidency during the deflationary 1890s, on a platform declaring that farmers and workers would refuse to be “crucified on a cross of gold”.

On this, Bryan was ahead of his time. The crude handcuffs of a standard based on gold or other mineral commodities may have played a useful role in preventing chronic inflation in the 19th century. But that era is no more. The Fed in recent years has shown that it can do better on its own, with competent appointees working under the protection of institutional independence.

Hey, and no surprise, she is a wingnut welfare fellow at the Hoover Institute.

joseph,

I just checked. She is not.

She herself claims to have gotten a postdoctoral fellowship there once upon a time and to have been a scholar there. These may be true, but she is not currently affiliated with the Hoover Institution, at least not according to them.

Really don’t want to admit you made a complete ass of yourself on the Hoover matter, do you. Well, you did.

The National Endowment for Democracy lays out what seems to be a resume on steroids for her:

https://www.ned.org/experts/dr-judy-shelton-chairman/

“Economist Judy Shelton specializes in global finance and monetary issues. She has testified before Congress as an expert witness at hearings conducted by Senate Banking, Senate Foreign Relations, House Banking, House Foreign Affairs, and the Joint Economic Committee.

Dr. Shelton has been consulted on international economic/financial issues by national security officials at the White House and Pentagon. She received a postdoctoral fellowship from the Hoover Institution at Stanford University as a National Fellow; she was named as a Hoover scholar and was subsequently appointed Senior Research Fellow (1985-1995). Shelton is the author of The Coming Soviet Crash: Gorbachev’s Desperate Pursuit of Credit in Western Financial Markets (1989) and Money Meltdown: Restoring Order to the Global Currency System (1994). Her opinion pieces appear in The Wall Street Journal, Financial Times, The Hill, The Weekly Standard and the Cato Journal.

Shelton was an economic advisor for the National Commission on Economic Growth and Tax Reform chaired by Jack Kemp (1995-1996). She was a founding member of the board of directors of Empower America and has also served on the board of directors for Hilton Hotels and Atlantic Coast Airlines. She also taught international finance as a visiting professor at the DUXX Graduate School of Business in Monterrey, Mexico (1995-2001).

Shelton joined the Atlas Network in 2010, where she serves as Senior Fellow. She has written two monographs for Atlas: “A Guide to Sound Money” (2010) and “Fixing the Dollar Now” (2011). Shelton was a member of the board of directors of the National Endowment for Democracy (2005-2014). She served on NED’s Budget & Audit committee and was the designated board expert on Russia, Ukraine and Belarus. She was appointed and served as Vice Chairman of the NED Board from 2010-2014.

Shelton holds a Ph.D. in Business Administration, with an emphasis on finance and international economics, from the University of Utah.”

How much of this is resume padding versus substance – I’ll leave others to decide.

This just in from the WSJ editorial board. 100% consensus:

https://www.youtube.com/watch?v=p7EAspaqH00

@ joseph

For intimating the negatives of the Hoover Institute I’d tell you “you speak out of ignorance” and tell you how many credentialed people Shelton’s hung out with, but that’s been done already on this blog. What if I just tag you and tell you you’ve got the cooties??

She says on her own CV that she was “appointed a National Fellow by the Hoover Institution”. What is your complaint? That she was once a Hoover Institute fellow but not currently a Hoover Institute fellow? Fellowships are not generally lifetime appointments except for some top name geezers who can pull in big donations.

Doesn’t change the fact that the Hoover Institute recognized her as an up and coming wingnut fitting right into their agenda.

Actually, joseph, it looks like early in her career back in the 1980s she was not as wacko as she has become since. Her book on Gorbachev way back then was not too bad, so her being connected with the place for a decade them was not ridiculous. She seems to have gone off the rails mostly since around 2010-11 when she began seriously spouting her garbled nonsense about monetary policy, which indeed sounds suspiciously like the goofball stuff that both Cain and Moore have also spouted, with the right hints that she would abandon all that in a minute to do what Trump would ask for while praising him as a great and wise leader. All three of these have shown a clear propensity to spout gold bug garbage and then abandon it totally to support Trump’s desire to lower interest rates now to max his chances of reelection next year.

BTW, joseph, during the time she was there and wrote that book about Gorbachev, Gorbachev himself visited the Hoover Institution.

One small thing although Germany got off the Gold Standard they did not devalue. This caused BOP problems for Hitler when Germany successfully got out of the great depression and achieved full employment. Hitler never attempted a devastation because he was afraid of the political consequences on rising inflation.

Another wonderful nomination ( sarc)

Hitler relied on fiscal stimulus. As far as monetary policy, this is an interesting read:

https://voxeu.org/article/macroeconomics-germany-forgotten-lesson-hjalmar-schacht

German Monetary History in the First Half of the Twentieth Century by Robert L. Hetzel

https://core.ac.uk/download/pdf/6993605.pdf

Note his discussion of the re-introduction of the gold standard with a particular focus on the German economy.

With regard to trade policy, under Schacht Germany shifted to making bilateral direct commodity and goods exchange agreements, mostly with Eastern European states it would outright conquer once WW II got going. This rather resembled how the Soviets dealt with much of the outside world during much of the Cold War period, with the Pepsi-for-Stolichnaya vodka deal that Nixon cooked up with Brezhnev being a classic example. In any case, if one is making these sorts of direct good for goods bilateral deals, what the value of one’s currency is does not matter too much.

https://www.economist.com/graphic-detail/2018/09/17/calculating-the-half-life-of-a-currency

I’m assuming regressions here has the pretty regular mathematical meaning, If I find a link which I think relates to the paper well and discusses regressions I will try to put it up later in this thread. You actually don’t need to be able to do a regression to know this woman spells economic trouble for our nation, but I think learners making the effort should be respected. God bless.

“Venezuela’s hyperinflationary horror is far from unprecedented”.

Interesting. Sort of reminds you of how a lot of Republican economists predicted that Bernanke’s QE would lead to high inflation. How did that prediction turn out?

Here’s a separate link to what I believe is a different Alan Taylor paper relating to PPP. This I think is one Professor Chinn was gracious and kind enough to provide to his students:

https://www.ssc.wisc.edu/~mchinn/taylor&taylor_PPP_JEP.pdf

Related to PPP and half life, lots of math jargon in the roughly last 3/4 of the paper

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.572.2958&rep=rep1&type=pdf

ECB paper on PPP and currency half life which at least at the start keeps things basic. Even mentions a paper done by some egghead and a guy named Meese.

https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1576.pdf

More than one by Meese and Rogoff. As Menzie can attest, they have done some of the most influential work around on international finance. Rogoff messed up on that paper with Reinhart, but in fact he is brilliant and widely respected despite that messup. He was also a presenter in the conference Jim Hamilton spoke in at the Hoover Institution.

@ Barkley Junior

I was referring to the guy with the Puh-hud degree currently residing at La Follette, but as per usual my humor missed some of the slower members of the group. In the name of etiquette we won’t name one particular party.

Oh dear, Moses, you have completely lost it here. There is no such person “currently residing at La Follette,” by which you presumably mean the La Follette School of Public Affairs at UW-Madison that Menzie belongs to as well as the Economics Department there.

Apparently you have been digging around stuff there and saw something that you have now massively misrepresented. There is a Professorial Chair in Applied Econometrics named for the same Meese I was referring to, Richard A. Meese, coauthor of those influential papers with Ken Rogoff, and it is named for him because in 2006 he endowed the chair with $1 million. He got his PhD from UW econ in 1978, worked for awhile at the international Finance section of the Fec Gd of Govs, then was at UC-Berkeley econ, and then in 1998 went to work for Barclay’s Global Investors, where I think he made a wad of money allowing him to endow this professorship in his name at his alma mater.

The current holder of the Richard A. Meese Professorship in Applied Econometrics is Jeffrey A. Smith.

BTW, in the late 80s Ken Rogoff was also in the UW-Madison econ department as a prof, which is when I got to know him.

It looks like the “slower member” of the group is you, Moses, so I can appreciate that it was a matter of etiquette on your point not to point this out. Congratulations.

Barkley Rosser: I think Moses Herzog was referring to Chinn and Meese (JIE, 1995).

Probably right, Menzie. My slow.

@ Menzie

Menzie, you ever watch a British TV show called “Keeping Up Appearances”?? I mentioned on this blog before my father was a big fan of British television. There was a character on that show named Hyacinth Bucket masterfully portrayed by an actress named Patricia Routledge. Whenever Barkley Junior has one of these little moments, I’m always reminded of Hyacinth Bucket.

https://www.youtube.com/watch?v=-pzRqc022tA

https://www.youtube.com/watch?v=FboWtJiNYro

https://www.youtube.com/watch?v=XhVfDiUJhV4

I’m guessing, if Barkley Junior ever caught this BBC show flipping channels on his TV, much of the humor evaded him.

You are right again, Moses. I had never heard of the show, much less seen it. I watched the first of your links, and you are right again — the humor escaped me, so I did not waste further time looking at the other two.

What Would Keynes Do?

“Never in history was there a method devised of such efficacy for setting each country’s advantage at variance with its neighbours’ as the international gold (or, formerly, silver) standard. For it made domestic prosperity directly dependent on a competitive pursuit of markets and a competitive appetite for the precious metals. When by happy accident the new supplies of gold and silver were comparatively abundant, the struggle might be somewhat abated. But with the growth of wealth and the diminishing marginal propensity to consume, it has tended to become increasingly internecine.

“The part played by orthodox economists, whose common sense has been insufficient to check their faulty logic, has been disastrous to the latest act. For when in their blind struggle for an escape, some countries have thrown off the obligations which had previously rendered impossible an autonomous rate of interest, these economists have taught that a restoration of the former shackles is a necessary first step to a general recovery.” The General Theory, p. 349.

Ms. Shelton is definitely one of those orthodox economists of whom Keynes spoke so long ago. Those who forget history . . .

With the current low unemployment and low inflation can someone tell me the problem the Gold Standard will solve.

We need pretty rocks. Without pretty rocks, bad things happen and the Chinese won’t build the wall. It’s a national emergency.

Guess this comment got lost in the internets.

Someone please tell me the problem the Gold Standard will solve. Esp in an era of low interest rates and low unemployment.

Trump needs money. If the demand for gold goes up – bet the ranch he will be hoarding it ahead of time. ALL of Trump’s economic moves are means for his corrupt family to make money on insider trading.

This gets donald trump votes from his illiterate base. Conservative talk radio’s biggest sponsors are gold brokers and gold funds etc. that have been brainwashing people on this stuff since the very very early days of Rush Limbaugh’s surge to popularity. You probably already know this.

Weird. Now I see both comments are under moderation.

Contradicting dear leader donald trump. Better be careful. Ask Stephen Moore how that one goes. And on the VSG’s favorite channel??

https://www.cnbc.com/2019/05/12/kudlow-says-us-will-pay-for-china-tariffs-contradicting-trump.html

donald trump mentioning this will get worse in his 2nd term. I’m assuming that means status quo on the level of the tariffs staying the same as they are now until Nov 2020. Next “face-to-face” with his intellectual superior Xi appears to be set for Japan.

NO thoughts on Mother’s Day. Only pray yours isn’t a narcissist.

TalkingPointsMemo featured this interview between Kudlow and Chris Wallace (see link below). Kudlow was probably thinking why on earth did Fox have a real reporter question him!

In the 80s when Reagan formed the Gold Commission to look into the role of gold in the domestic and international economy, fixing the price of gold was a red herring. Anna Schwartz was running the Commission and she wanted to talk about money growth rules. BTW we ended up with a de facto monetary rule so said Henderson-Mckibben and we named it for Taylor. WRT who pays for the tariff, theory says it depends on elasticities. Sure domestic consumers shell out to pay the tax, but in theory the terms of trade could fall against foreign producers to compensate. In practice I doubt the elasticities give the US much of an advantage.

Anna Schwartz was a real economist. She probably was wondering WTF am on this committee of clowns. But yea – she managed to avoid the damage the Reagan clowns would have created without her being on the commission.

Bob Flood: According to most recent comprehensive papers on tariffs effects, tariff pass through is complete. See http://cep.lse.ac.uk/pubs/download/dp1603.pdf and https://www.nber.org/papers/w25638

Kudlow goes onto Fox News to dismiss any real costs from the Trump trade war. I guess he was not ready for what Chris Wallace had in store for him. This interview is precious – enjoy!

https://talkingpointsmemo.com/news/wallace-kudlow-china-tariff-defend-reading-upside-down

The one problem I have with the study cited by Chris Wallace has to do with the negative impact on jobs. Now over the short run the tariffs will have a negative impact on jobs because factors of production don’t just instantly get redeployed to alternative uses. But over the long run tariffs should not have much effect on jobs. Tariffs increase prices and make consumers worse off, but there’s no obvious reason why tariffs should reduce employment over the long run. It’s the flip side of my complaints when Clinton oversold NAFTA as a jobs program. NAFTA improved consumer welfare and lowered prices, but over the long run it should not have had any significant effect on employment. The whole free trade argument assumes that resources are fully employed and that free trade allows countries to produce more by taking advantage of different resource costs and comparative advantage.

But Kudlow did look like a fool; however, I’m not sure that the average Fox Noise viewer saw it that way. It’s not like Fox Noise viewers like to curl up at night with an international trade textbook. Too busy watching monster truck rallies when they aren’t listening to Rush or Sean.

The one thing that annoys me about these gold bugs is that they never discuss at what price the dollar/gold parity should be placed. Let’s take the early Reagan years when Team Reagan was all mad at Volcker for offsetting their stupid fiscal stimulus. Here is one chart of gold prices:

https://fred.stlouisfed.org/series/GOLDAMGBD228NLBM

Note it soared beyond $650/ounce before the first Volcker contraction which doomed Jimmy Carter and gave us St. Reagan. But Volcker was backing off his tight monetary policy during the 2nd half of 1980. Now gold prices had fallen to around $500 as Reagan entered the White House and the economy was recovering from the Carter recession. And then boom – that toxic fiscal/monetary tug of war where Volcker was offsetting an ill advised fiscal stimulus. OK the FED overreacted. And yes gold prices fell below $350 for a while.

Neither Moore nor Shelton have told us what the desired price of gold should be. Maybe their target would be $500 an ounce. But notice something about the period from 1983 to 1989 when Volcker ran expansionary monetary policy to get the economy back to full employment AFTER he killed inflation. Gold prices hovered around $400 an ounce. Had we had a gold standard, monetary policy would have been more expansionary leading to accelerating inflation.

Also note how low gold prices were during the Clinton boom. Are these gold bugs seriously telling us we should have pursued a much more vigorous monetary stimulus? Seriously?

I believe a large portion of these “goldbugs” are completely insincere or 100% disingenuous about what they say. It’s similar to Republicans saying they are offering a “middle class tax cut” when most of the time it’s for the 1% or for small farmers when it is for conglomerate farms. The soul intention is to sell “a bill of goods”. In fact most of them don’t even want it to become actual law—they say it because it sways votes.

Most Republicans knew damned well there was going to be zero “repatriation” of corporate profits after the change in corporate income taxes. They said it because it lubricates the marketing of the bill through congress.

https://www.nytimes.com/2018/11/14/opinion/the-tax-cut-and-the-balance-of-payments-wonkish.html

https://www.nytimes.com/2019/02/06/opinion/business-economics/trump-tax-reform-state-of-the-union-2019.html

You think people like CoRev and JBH can understand ANY of the above?? CoRev’s busy laying on the sofa jerking it off to his 6 foot donald trump wallposter. The same applies to the gold standard. He (and millions at CoRev’s same literacy level) has no idea what he’s being sold on. He hears Hannity’s or Glen Becks’s enthusiastic voice in the radio and he’s “all aboard!!!!” the idiot train

Even Forbes gets the fact that Trump was a gold bug over two years ago and that this idea is stupid:

https://www.forbes.com/sites/ralphbenko/2017/02/25/president-trump-replace-the-dollar-with-gold-as-the-global-currency-to-make-america-great-again/#645289594d54

“President Trump: Replace The Dollar With Gold As The Global Currency To Make America Great Again”

Check out the discussion!

and to think Republicans had the hide to say Peter Diamnod was not qualified to be on the Fed

Barkley Rosser: “Actually, joseph, it looks like early in her career back in the 1980s she was not as wacko as she has become since. Her book on Gorbachev way back then was not too bad, … during the time she was there and wrote that book about Gorbachev, Gorbachev himself visited the Hoover Institution.”

And the advice she was giving Gorbachev and the USSR as the wall was coming down was that the the most important economic policy they needed to implement was to peg the ruble to the price of gold. Not a joke. That was what she was writing about at that time – 1989-1990 – while at Hoover.

She also stated that her favorite politicians are Jack Kemp, Jon Kyl and Jim DeMint.

Her favorite living economist is Robert Mundell, not for his work on the Euro, but for his invention of supply-side economics and defense of the gold standard.

She has long opposed the IMF because of its failure to impose the gold standard internationally.

I would say she has been nutty for a good long while, which is why the Hoover Institution scooped her up, keeping her on the payroll for more than 10 years.

At least Stephen Moore had the good sense to pretend to disavow his support for a gold standard to aid his nomination. In contrast, I don’t know whether Shelton deserves credit for consistency or demerits for stubborn stupidity in clinging to the gold standard.

By the way, Gorbachev spent most of his visit in 1990 touring the Stanford University campus, gave his speech at the University’s Memorial Auditorium before Stanford students and faculty, and met privately at the Stanford Business School with five Stanford faculty Economics Nobelists (none of whom were associated with Hoover). Gorbachev and his wife then made a brief stop at the Hoover Institution library to view an exhibit of memorabilia from the 1917 revolution.

joseph,

Some of your points are correct, some are not.

At Hoover, Gorbachev met with Milton Friedman, a Nobelist, and praised him.

Regarding Shelton’s book, she did think they should have had a gold-backed ruble as the ruble was very weak. Her book was “The Coming Soviet Crash,” 1989, in which she accurately noted that the Soviet Union had a massive budget deficit and was getting into a sharply rising inflationary situation while trying to borrow from abroad. Her main argument was that the Soviet Union had spent way too much on military while leaving its civilian economy highly unproductive, which was accurate. It did indeed have a full-blown economic crash and hyperinflation with the Soviet Union coming to an end.

joseph,

A bit more on Shelton’s book, whose biggest flaw was her advocacy of USSR using a gold-backed ruble. Yes, she has been into gold pretty much all along.

But the book was on the money about what was going on in the USSR economically and she called its crash, if she missed the role of ethnic division in it, which was probably more important in the end to bringing about the dissolution of the USSR as a nation. What Shelton got right was to use the estimates about the Soviet economy made by the late Igor Birman, who was forecasting economic decline and political disaster in the USSR starting in 1981. He was largely dismissed by officials both in the US and USSR (he had migrated to the US from USSR in 1974). The main part of his argument, repeated by Shelton, was that the USSR was spending a much higher proportion of its GDP on defense than others were estimating. After the USSR collapsed, it was widely accepted in Russia that Birman had been right.

So Hoover was not so dumb to have Shelton on board back then. She was calling it right on the Soviet economy. As it is, I think that was the last time she has called anything right in economics.

Oh, and just to annoy Moses, yes, my wife knew Birman and respected his work. I never met the guy, although I know two of his daughters. While my wife was still being an evil central planner in Moscow she was aware that the authorities in both the US and USSR were seriously off on their numbers. Furthermore, they were feeding off each other. GOSPLAN and IMEMO knew that the numbers being supplied from the periphery to the center were bogus for Hayekian reasons. So they were using CIA numbers. But the CIA numbers were ultimately based on the official Soviet numbers, adjusted somewhat. They were mutually feeding off each other in their delusions.

As it was, prior to 1990 or so, Birman was unable to publish in any US Sovietological journals, although he managed to get into a few British ones, along with the occasional newspaper column. But he was right.

Dear Folks,

I seldom disagree with Menzie on policy. But this is an exception. Haven’t we seen this play before in 1929-1933? If we want to see something from the 1930s, can’t we just watch “The Wizard of Oz” instead?

J.

Julian,

How is it that you are disagreeing with Menzie on policy? Do you think he supports Judy Shelton for the Fed Board? If so, you have not been reading things here very well. Or do you happen to support her for the Board? Based on previous posts I do not think that is the case. I think you have probably just gotten confused with all the goings back and forth here regarding what Menzie’s position is. Yes, I think he views her as marginally better than Cain or Moore, but still unacceptable, which is my position as well.