Today we are fortunate to present a guest contribution written by Yin-Wong Cheung (City University of Hong Kong), Sven Steinkamp (Universität Osnabrück) and Frank Westermann (Universität Osnabrück). This contribution is based on a paper forthcoming in the Open Economies Review.

In recent years, large and sustained current account imbalances have been a focus of research in international economics. While there is a large literature on deficits and their economic implications, there is only limited research on large and sustained surpluses (Edwards, 2004). This is surprising in the light of a longstanding concern, for instance stressed by Keynes (1941) and Kaldor (1980), about the role of surplus countries in international adjustments. More recently, Christine Lagarde, the IMF’s managing director, aptly pointed out the link between deficits and surpluses when she said: “It takes two to tango.” The deficits of some countries are matched by surpluses in others, and it is important to understand both phenomena.

China and Germany are two prime examples of net exporters that have experienced large and sustained surpluses over the past 20 years; in 2015, they accounted for 42% of the world’s total surplus. They are unparalleled in their current account surpluses, even compared to other stereotype surplus economies, such as Japan, Korea, and Switzerland.

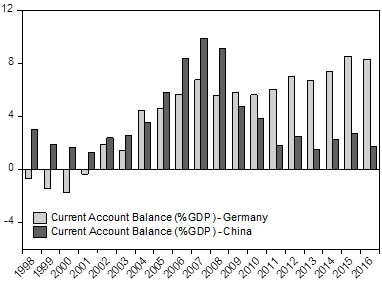

Figure 1: Current Account Balances – China vs. Germany

In a new research paper (Cheung et al. 2019, or view-only share version), we update and extend the comparison of China and Germany (Aizenman and Sengupta, 2011). We illustrate that, during the post-global financial crisis (GFC) period, the two countries have displayed dis-similar current account behaviors (Figure 1). While both countries have been running current account surpluses for most years over the past two decades, China’s surplus has started to shrink after the GFC. Germany’s current account surplus has, in contrast, stayed at a high level and even experienced a steady increase. Apparently, the current account balances of these two surplus countries exhibit a similar pattern before the GFC but have moved in different directions thereafter.

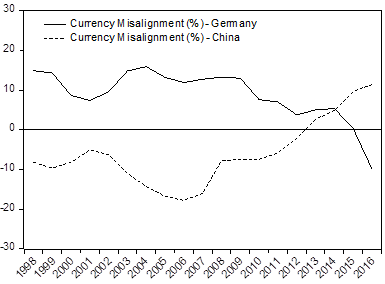

It is commonly believed that China has maintained an undervalued exchange rate, whereas Germany has an overvalued one. Figure 2, however, shows that in recent years, the valuations of these two currencies move in opposite directions according to the Centre d’Études Prospectives et d’Informations Internationales (CEPII). Specifically, these currency misalignment estimates show that the Chinese level of misalignment has been diminishing noticeably since 2007. Since 2012, the Chinese currency is better characterized as being overvalued than undervalued (Almås et al., 2017; Cheung et al., 2017).

In Germany, the reverse pattern holds. Since the implementation of labor market reforms (“Agenda 2010”) in the early 2000s, Germany has considerably improved its competitive position vis-à-vis its trading partners, in particular within the euro area. The currency’s degree of overvaluation has been declining accordingly and, finally, turned to an undervaluation in 2015. Visually, these currency misalignment and current account balance movements are in line with the conventional wisdom that these two variables are inversely related.

Figure 2: Currency Misalignment

Against this backdrop, we estimate the current account equations for both countries and assess the similarities and differences of the Chinese and German behaviors. We find that both countries, currency misalignment plays a significant role in determining the current account balance. While for Germany, the effect is present over the whole sample period, we find that for China it became important after the global financial crisis of 2007/8. The qualitative results on the currency misalignment effect, the post-crisis impact, as well as on other control variables taken from the literature, are robust to the choice of alternative measures of currency misalignment, the inclusion of different sets of control variables, and a seemingly unrelated regression specification. Our empirical findings buttress the negative correlation pattern observed from Figures 1 and 2.

The currency misalignment variable together with selected canonical economic factors, monetary factors, global factors, and country-specific factors can explain over 90% of variations in the current account balances of these two countries. The empirical knowledge of the underlying determinants implies that policy makers – should they decide to steer the current account in either direction – have the information and power to do so.

Is China the new Germany? One could say that China is evolving towards the “old” Germany that was an overvalued exporter experiencing a moderate surplus. Germany, on the other hand, is becoming a country with increasing surpluses, both within the euro area and with respect to the rest of the world, with an undervalued exchange rate. In both cases, the surplus can be attributed to currency misalignment and other economic factors.

This post written by Yin-Wong Cheung, Sven Steinkamp, and Frank Westermann.

You should also bring Japan into this discussion. In the 1980s Japan had a very large savings-investment gap and a current account surplus that was used to finance the twin US deficits. But as Japan’s population aged their savings surplus faded away as did their current account surplus. As a consequence the US had to look elsewhere for the foreign financing it needed. So China entered the picture and developed a large savings and current account surplus that was used to replace the Japanese financing of the two US deficits. Now, China is embarked on a new policy of expanded consumer spending that implies the US will need to find another source of foreign financing. Will it be Germany? I do not know, but it is something we should be thinking about.

China’s population is aging, as did Japan’s. They will have a population that requires resources to support and that cannot be as productive as it had been in the past.

Unless I’m sorely mistaken, neither China nor Japan has the level of immigration that Germany has. Whether Germany admits it or not, they will benefit from the influx of immigrants as the native born population shrinks. Germany may become the piggy bank, but they will have trouble if they cannot absorb immigrant populations and make them productive.

This isn’t an argument for endlessly expanding populations. Until somebody explains why this is wrong, I will continue to think that the economic share and benefit of an economy to individuals matters more than the aggregate size of an economy.

A major reason for the change in Japan is the aging of the population and the associated decline in the savings rate.

The situation with Germany may well prove to be the ultimate undoing of the eurozone. The mounting German surpluses have played a crucial role in the problems of the PIIGS economies, with politically the change of government in Italy portending potential conflict down the road over all this.

Needless to say, the Trump gang will not like the findings about China in this at all.

@ spencer

This is just off the top of my head (which isn’t a very reliable way for me to do things), but I would say places like India and Vietnam would be more apt to pick up that “slack” as far as “another form of foreign financing”. i.e. NOT Germany. That’s assuming your assumption is correct. It’s certainly not a bad theory as far as where the course would be headed. The reason China has been that “source of foreign financing” has more to do with currency reserves and China and its citizens needing a stable source of asset value. Germany doesn’t have that problem so much.

Germans don’t sit around wondering when their government is going to F**K them over on their bank deposits. Or their right to express their own opinions on bad government either, without being hauled up to Beijing and magically disappearing under “house arrest” in an undisclosed location. One of the many occult and paranormal results of citizens being able to choose their own leaders through a vote process is the minimization (notice I didn’t say elimination, I said minimization) of these type practices. AFTER you lost that, all you are doing is making leaders laugh over 4-5 shots of Maotai baijiu and leaving barricades and umbrellas for the night crew to pick up.

Germany’s currency is the euro. The question is not whether the euro is over- or under-valued, but rather whether German wages and productivity are in line, relative to wages and productivity in trading partners, with the euro exchange rates. Before the GFC, German wages were too low for the extant euro exchange rates. After the GFC, the euro weakened, partly owing to uncertainty over its fate. (It became widely recognized that the singe currency experiment was a failure, but there is still a question as to whether it would be better to end the experiment .) This put the German wages even further out of line with the euro exchange rates, so the increase in Germany’s trade surpluses is unsurprising.

The graph seems to imply that China’s currency is now overvalued. I don’t know how the authors define or measure the ‘misalignment,’ but I doubt if this is true.

It may not be completely up-to-date but here is an un-gated on the Sengupta and Aizenman paper:

https://economics.ucsc.edu/research/downloads/The_Trilemma_in_China-Draft_Nov_Final.pdf

Enjoy!!!!

Un-gated on the Almas “PPP revisited”

http://perseus.iies.su.se/~ialm/assets/papers/ppp_approach_2017.pdf

This one is super easy to find, but I’ll put it here so as not to imply any disrespect, Cheung, Chinn, Nong, “Misalignment Using Penn Effect”

https://www.ssc.wisc.edu/~mchinn/CNY_misalignment.pdf

If anyone knows where I can access an un-gated digital version on Keynes’ Clearing Union stuff that would be awesome. I may have the hardcopy version under a stack of books here somewhere but it would be nice to have a pdf or and “epub” version to click on.

Wanna know how to identify a narcissist when you see one?? Check out the title to Lawrence Summers’ WSJ column on Martin Feldstein’s death. Nothing like framing someone’s death in terms of yourself.

True but there were a few lines worth repeating:

“rigorous and close statistical analysis of data can provide better answers to economic questions, and possibly better lives for millions of people. A doctor can treat a patient. An economist, through research or policy advice, can improve life for a population….Marty cared about people’s economic analysis, not their political affiliation.”

Bloomberg notes his tenure as the head of CEA under Reagan:

“Martin Feldstein, the former chairman of the Council of Economic Advisers who successfully persuaded President Ronald Reagan to cut budget deficits by breaking his campaign promise not to raise taxes, has died. He was 79….Nearly two years into Reagan’s first term, Feldstein became chairman of the CEA and the president’s top economic adviser at a time when the administration’s economic policies were under attack by deficit hawks. Tax revenue was falling short of projections as inflation slowed, putting the budget in the red. Feldstein’s advice was to raise taxes — the opposite of what Reagan had promised voters in the 1980 presidential campaign. Reagan, who was trying to increase military outlays while reducing overall government spending and taxes, sided with Feldstein over political aides. He approved revenue-raising levies on corporations, though he stuck with his promise not to raise taxes on working families.”

Feldstein gets credit for the 1986 tax reform as well but it is good thing we did not listen to all of his ideas regarding Social Security. Feldstein was also a severe critic of Trump’s fiscal policy.

The 1986 tax reform was a strange case. Originally it was a Democratic idea (Sen. Bill Bradley) and Reagan opposed it. But it was good economics and Feldstein helped convince Reagan that he should support it. What sold it was that marginal rates came down even though the tax base was broadened so that it was revenue neutral in design. But all Reagan needed to hear was the part about lower rates. The funny thing is that the 1986 tax reform was a complete reversal of the 1981 mess, which was larded up with all kings of indefensible tax breaks and depreciation allowances that were hard to justify in terms of Harberger triangles.

I agree that Feldstein’s notions of privatizing Social Security were unsound; however, at least he was intellectually honest enough to insist that privatizing Social Security would lower private rates of return as well as affect the difference between equities and bonds. A lot of the dishonest “studies” for privatizing Social Security pretended that people would get the same returns on equity as under the current system. So a lot of clueless suckers came to believe that they’d get rich with a privatized Social Security system.

It’s not that I’m not pulling for the people in Hong Kong on some levels, it’s just it’s unrealistic to think this is going to change anything.

https://www.nytimes.com/2019/06/15/world/asia/hong-kong-protests-extradition-law.html?action=click&module=Top%20Stories&pgtype=Homepage

The time to raise holy hell was when they lost the right to vote for their own leaders. Not now. I would use a super-crude analogy here, but…… Let’s just say after you’ve been violated does it do you much good to say something 20 years later?? How much practical use is that in terms of a deterrent??? The time to b*tch, moan, gnash your teeth etc was around the time this column came out:

https://www.scmp.com/comment/insight-opinion/article/1590684/beijing-hong-kong-you-can-vote-we-select-candidates

Your Mom (Beijing is your Mom here, for the slow people) says you can screw any girl in the neighborhood you want, but only the 5 grotesquely fat women she chooses ok?? Any 1 of those 5 are yours to pursue and enjoy. But only 1 of the 5 grotesquely fat females. But you have the “freedom” to choose any of those 5 fatties. Cool with that?? OK, so do you respect a guy who says “Cool” to that??? You know?? I’m just asking a question here, can you (Beijing) respect that guy?? At this point Beijing knows you will stomach anything because you no longer even care about self-determination.

Interestingly, the authors do not discuss energy imports.

Within a few years the German costs for importing oil and NG decreased by 60 billion EUR, almost 2 % GDP.

2012: 93 billion EUR (oil, BNG, coal), that were around 3.5% of GDP.

2016: 29 billion EUR

Well the price of oil fell from $120 a barrel in 2012 to around $40 billion a barrel in 2016:

https://fred.stlouisfed.org/series/DCOILBRENTEU

So yea – they are paying a lot less for their oil.

Pretty solid blogger. The last 1/3 of the post might be interesting to some people:

https://chandniraja.blogspot.com/2019/05/an-all-in-one-post-for-past-three-months.html

Menzie, if this girl doesn’t already have a “full-ride” somewhere, may I suggest to you that La Follette could do much worse than offering this girl a scholarship??

https://www.youtube.com/watch?v=Iyr74Rs6BWU