Based upon July 2019 spreads

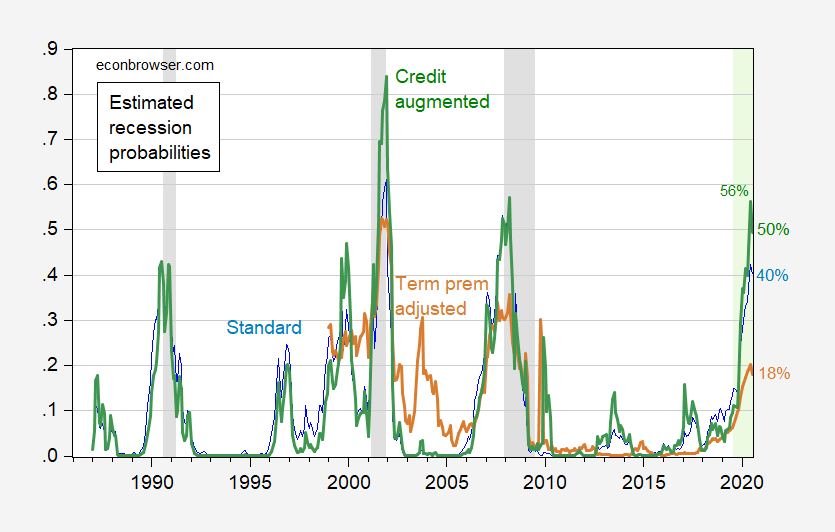

Figure 1: Probability of recession for indicated month, using 10yr-3mo spread (blue), 10yr-3mo adjusted by term premium estimated by SF Fed (orange), and 10yr-3mo spread augmented with BAA-10yr spread (green). NBER defined recession dates shaded gray. Light green denotes out-of-sample. Source: Federal Reserve via FRED, SF Fed, NBER, author’s calculations.

The standard plain-vanilla probit indicates 40% probability of recession in 2020M07, down from 42% in 2020M06. Adjusting by the estimated term premium (SF Fed estimate) implies 18% probability. Augmenting the standard probit with BAA-10yr credit spread implies 50% probability in July, down from 56% in June 2020. (These month by month indications remind one that the cumulative probability of recession by July 2020 is higher than 50%; the exact number depends on degree of dependence between each month’s probability — that is each month’s outcome are not indepedent draws).

“Augmenting the standard probit with BAA-10yr credit spread implies 50% probability in July, down from 56% in June 2020.”

I have always wondered about how this credit spread is calculated as the Moody’s BAA corporate bond rate is based on 20-year corporate bonds. Given that the 2-year government bond rate is about 0.3% above the 10-year government bond rate, I get that this credit spread is 1.8% not 2.1%. A bit high but not exactly the post Lehman Brothers neighborhood.

Round 1 of donald trump’s efforts to manipulate and monopolize America’s intelligence apparatus closes.

https://www.politico.com/story/2019/08/02/trump-rep-ratcliffe-out-of-the-running-to-be-national-intelligence-director-1445150

https://www.youtube.com/watch?v=TonN-rWECTk

Maybe Moscow Mitch McConnell was too busy deterring his wife from turning America’s skies into “Jumbo Jet Demolition Jamboree” to juggle another one of his balls.

There is good news for the White House—by donald trump’s standards, Ratcliffe may still be overqualified for the Fed Res board.

Strange how these things always happen on Friday afternoon/evening……

https://www.youtube.com/watch?v=O47TE371KQ8

So, does this mean the Fed 25 bp rate cut lowered the mid-range probability of recession from 42 percent to 40 percent?

That is my question as well. Is it really that directly and obviously connected? I am not willing to back down from my fearless but weaselly prediction of at least an economic slowdown next year.

Only the very “ethical” and “scholarly” Jerome Powell could tell you. Why don’t you call Jerome up on the phone and ask?? I have this strange perception you two would get along so well. You could form a “mutual admiration of snobbery society”. Your first meeting could be to decide the door entrance fee. Whenever you made a really bad grammar error or quoted papers on DNA distribution through a large sample of population you hadn’t finished reading you could console each other by the fact you both had your Ph.D.’s.

What happened in American trade policy a single day after Powell’s rate drop?? My memory is so bad anymore, can anyone here remind me?? Any idiot could have told you what was going to happen after Powell’s rate drop, in fact one non-Puh-hud person on this blog had said as much.

Yikes, Moses, you are really losing it again. I realized this must be directed at me because of the clowinshly idiotic reference to “DNA distribution,” which once again reminds us that you somehow have never accepted that a distribution on a genome is not the ame as one on a population. Gag.

So, my simply noting that Menzie’s change of a median probability from 42 percent to 40 percent set this off? Why? This is ridiculous.

I have never met Jerome Powell, and he does not have a PhD. It is true that I was the first person in the econoblogosphere to call for his predecessor, Janet Yellin, to be appointed Fed Chair, all the way back in 2009. I have also known her husband, George Akerlof, for well over a half century.

Regarding Powell and trade policy, apparently you are unaware that not too long ago I posted on Econospeak about how Powell’s move to cut rates was leading to a moral hazard problem regarding Trump’s trade polisy. No, Moses, you are just completely out of it with this comment completely.

You guys are a lot smarter than me on this so I thought I’d pose my query at the risk of appearing ignorant – QE1 and QE2 were very unusual steps. Is it possible that those monetary policies are reverberating through these calculations maybe creating something like false echoes? Is there any attempt now to buy back those dollars that is affecting the rates?

Dear Danj1,

My take is that this is too fancy, and that the immediate response is all that can be attributed. But others may disagree.

J.

This guy explains Logistic Regression the best I have ever seen. Of course seeing it on a 2-dimensional graph also helps conceptualize it quite a bit. Now if I am understanding the “R” program and some of these abbreviations “Logit” is basically a Logistical regression and “Logit” in turn will at least PARTLY help you understand “probit” regressions. So If you wanna really get a grasp on that, I think this video is one of the better things you can watch. And this guy–Courtney Brown—-was the type of guy I would have killed to get in my college days—I mean I would have tossed around my entire schedule to get in this type teacher’s class—you can tell he’s super super sharp–but he doesn’t get snobbish about it—he’s still trying to pass his knowledge off to his students. That is a very very very rare type bird to find in professorial ranks.

https://www.youtube.com/watch?v=EocjYP5h0cE

Just wandering around online, trying not to go braindead on this regression stuff and “R” and my extreme frustration in not being able to install the “car” data set in my Rstudio. Uhm, I was reading Thomas Hsu’s paper (and probably understanding about 1/10th of it) on his CAPE model. I thought it looked pretty interesting. Does anyone here want to join in on my conspiracy to get Menzie to crunch out the current numbers on Hsu’s CAPE model or “full static” model?? I guess in the paper Hsu calls it “Equation 2”?? I’m not sure, he had 4 of them in the paper. The red line one seemed to give some good tip-offs depending which graph you looked at:

https://economics.umbc.edu/files/2017/01/Hsu-Thomas-Capstone-Final-Paper.pdf

Obviously, not in a recession now: https://fred.stlouisfed.org/series/RECPROUSM156N

This chart from the NY Fed may be an indicator of a coming recession: https://www.youtube.com/watch?v=ps4WLZAwp7Q

And then there is the not-so-sure forecast: https://finance.townhall.com/columnists/politicalcalculations/2019/08/01/chances-of-a-us-recession-before-this-time-next-year-n2551047

Going into the FOMC’s July 2019 meeting, we were seeing some evidence that the rate at which the recession probability has been increasing is beginning to slow. The spread between the 3-Month and 10-Year Treasuries in the U.S. Treasury yield curve has gone from being mildly inverted to mostly flat in recent weeks, while the Fed’s action to reduce its Federal Funds Rate should contribute to lowering the recession odds forecast by this model in upcoming weeks, although the Fed’s deviation from market expectations may now lead to the yield curve becoming more inverted, which would counteract that effect.

Townhall pretends to do finance now? I bet it is run by Donald Luskin. Oh wait – I forgot to mention your first sentence:

‘Obviously, not in a recession now’. So sayeth Donald Luskin on September 14, 2008!

whoever, so you have information that Donald Luskin does analysis for the St. Louis Fed?

WTF? Brucie – could you write a coherent statement for once in your life? Or maybe you had no clue that Luskin dismissed we were in a recession the day before Lehman declared bankruptcy. Figures – since you are a true know nothing!

whoever, and how does that relate to the St. Louis Fed chart? You read too much of what is not there and too little of what is.

“whoever, and how does that relate to the St. Louis Fed chart? You read too much of what is not there and too little of what is.”

I was not referring to your first chart. Come on Bruce (assuming that is your real name) get a grip. You comments are not only stupid but BORING!

Bruce Hall: You do know that the second link is to the same model as the one I am using (“plain vanilla”), except I’m using data up through July? Your third link is to a guy (Ironman at Political Calculations) who has (1) committed the error (repeatedly) of adding chain weighted quantities, and (2) misunderstood what consumer surplus is.

Please, please, for the pete’s sake stop relying on Townhall for economic analysis.

I hear the National Economic Council has started relying on Townhall so why not Bruce?

Menzie, okay, didn’t realize “Ironman” was the same as the unattributed author of the linked article. I don’t believe, in this instance, that he was disagreeing all that much, if any, from you.

I realize that you are not attempting to actually predict when a recession may begin, but to look at indicators of potential changes to the economy. I thought Ben Casselman at the NYT did a pretty good job summarizing the current outlooks for various indicators last week: https://www.nytimes.com/2019/07/28/business/economy/economy-recession.html

Strangely, I haven’t seen much about how economic weaknesses abroad may affect the U.S. economy. I know that exports are not a huge part of our economy, but I wonder how “contagious” the concerns of a recession are if other countries start showing economic weaknesses. After all, aren’t perceptions really what drive much of economic choices that ultimately drive expansions and contractions?

Here is the headline of your Townhall link:

Chances Of A US Recession Before This Time Next Year – Political Calculations – Posted: Aug 01, 2019 9:37 A

Bruce Hall August 4, 2019 at 6:03 am – Menzie, okay, didn’t realize “Ironman” was the same as the unattributed author of the linked article

WTF Bruce? Unattributed? I have suggested you do not bother to actually read that intellectual garbage you link to. Thanks for confirming as such!

Bruce Hall August 4, 2019 at 6:03 am – “I know that exports are not a huge part of our economy”.

REALLY? I guess you did not know exports in 2018 were $2.51 trillion, which makes up 12.2% of GDP. I guess that it is YUUUUUUGE but I would consider them very significant. Residential investment was less than $787 billion in 2018. And someone using your name the other day thought variations in residential investment was the key to all business cycles. Was that you or some other nitwit pretending to be you?

Bruce “no relationship to Robert” Hall always provides us with some of the most laughable comments of the day!

whoever, 12.2% might be considered important, but not driving the economy. Consumer spending was six times that. Perhaps our perspectives are different.

Bruce Hall: It’s completely attributed — sourced from Political Calculations, and if you click on the link, you’ll see:

Don’t read Ironman – the guy doesn’t (or didn’t) even know what chain weighted quantities were.

Actually I doubt Bruce actually read this fluff. He has a habit of posting links and then not understanding what they had to say. To be fair – I didn’t read this latest link all that carefully but it was from TownHall!

Menzie okay, thanks.

The slowdown has already happened. Government lag’s accepted. Overcapacity in Auto/Energy are the big drivers of US recession in 2020. As layoffs accelerate, the B rated debt market will freeze up damaging the service sector. Sorta of a S&L type of downturn. On the positive side, real wages will continue to grow and once the junk bond markets recovery by the mid-2020’s, the consumer will have a bunch of ammo while getting their jobs back. The downside is, energy prices will likely stage a large increase in the late 2020’s due to recession in domestic energy production. But enjoy it while you can.

Where do you get your babble? You write the stupidest nonsense I have seen in a while with no source for your absurd claims. Oh wait – you are some form of Alexa with a short circuit. Now I get it!

“Oh, say it isn’t so, ‘Middle-class joe’ ”

https://www.politico.eu/article/joe-biden-presidential-bid-family-business-history-democrats/

Gee….. Gosh Gee-wiz Darn…….. Joe…… that sounds like someone who lets himself and his family profiteer off of American taxpayers buy trading and dealing out game cards in policy decisions…….. Well, that couldn’t be true, after all, Joe Biden spends most of his time expressing his “dear love” for Joe Six-pack:

https://www.c-span.org/video/?c4810033/cheney