Blockbuster (absolute level) growth number for nonfarm payroll employment. But does the percentage growth rate in NFP dispell the prospect of recession in the near future? I don’t think so.

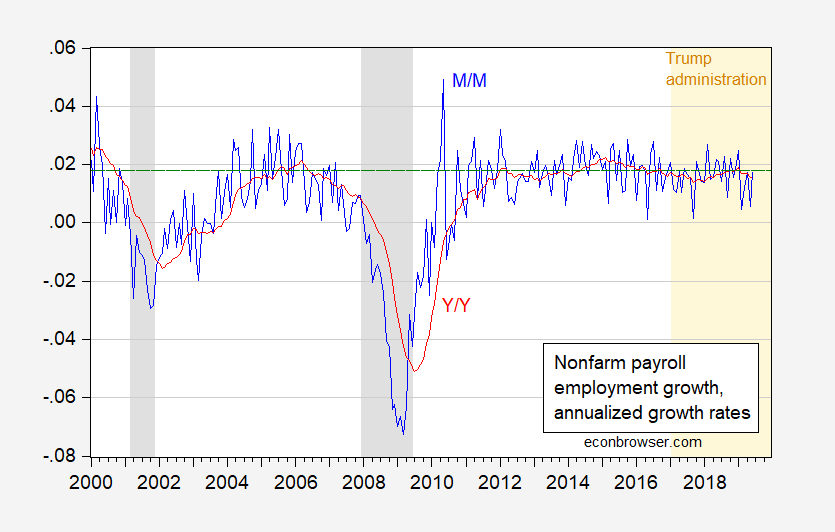

Figure 1: Growth rate in nonfarm payroll employment, month-on-month annualized (blue), and year-on-year (red). NBER recession dates shaded gray. Green dashed line at June 2016 M/M annualized growth rate. Orange shading denotes Trump administration. All growth rates calculated as log differences. Source: BLS, NBER, author’s calculations.

As can clearly seen, the recent growth rate (as opposed to change in level) is not particularly impressive, and similar M/M growth rates have been recorded within months of the beginning of a recession: 9 months before the 2007-09 recession, and 4 months before the 2001 recession.

With that said, one should always be careful with macro data, including the nonfarm payroll (which as I have discussed before is still much preferred to the household series). Jeff Miller has some excellent insights here. Be sure to read.

The year over year growth rate of both measures of employment –payroll and household –are clearly slowing.

The unemployment rate inched up:

https://www.bls.gov/news.release/empsit.nr0.htm

But note this is because the labor force participation rate also inched up. The employment to population ratio remains at 60.6%. Not awful but not exactly the rosy scenario the Trumpsters tout.

Oh wait – the stock market is declining. Maybe the market thinks the FED will not lower interest rates later this summer.

“As can clearly seen, the recent growth rate (as opposed to change in level) is not particularly impressive”.

CoRev alert. He is going to pull out his Excel file and redo all of this with his new filter. But only after he decides that your use of BLS was biased whereas CoRev will source his data from FRED! Can’t wait to see his next set of comments!

In good company:

• https://ivn.us/2012/10/28/peter-schiff-who-predicted-the-financial-crisis-forecasts-the-worst-to-come-around-2013-2/

• https://schiffonthemarkets.blogspot.com/2016/04/us-recession-trump-predicts-very.html

• https://christianpatriots.org/2019/02/15/peter-schiff-this-is-the-beginning-of-the-end-for-the-economy/

http://www.metrolyrics.com/sooner-or-later-lyrics-mat-kearney.html

Peter Schiff aka Dr. Doom? If you think this nutcase is an economist, you truly are dumber than we give you credit for.

Oh, come on, pgl. Look at the dates in the links. I get amused by Peter Cried Wolf and the “a recession is imminent crowd”. We’ll all see a recession coming when the factors are in place. Right now, not so much without a Black Swan flying over.

• https://www.attomdata.com/news/market-trends/attom-data-solutions-q1-2019-u-s-foreclosure-market-report/

• https://www.abi.org/newsroom/chart-of-the-day/national-delinquency-rate-on-first-lien-mortgages-decreased-in-may-2019

• https://tradingeconomics.com/united-states/bankruptcies

• https://www.bls.gov/cpi/

• https://data.bls.gov/timeseries/LNS14000000

• https://tradingeconomics.com/united-states/households-debt-to-gdp

• https://www.bloomberg.com/graphics/startup-barometer/

Bruce Hall: Wow. Weren’t you around in 2007 when so many people were saying output, employment, sales were all booming, why worry? People were also saying “this time is different” with respect to term spread. Or was I on a different planet?

Ben Bernanke – August 31, 2007:

https://www.federalreserve.gov/newsevents/speech/bernanke20070831a.htm

“Recently, the subject of housing finance has preoccupied financial-market participants and observers in the United States and around the world. The financial turbulence we have seen had its immediate origins in the problems in the subprime mortgage market, but the effects have been felt in the broader mortgage market and in financial markets more generally, with potential consequences for the performance of the overall economy… the downturn in the housing market, which began in the summer of 2005, has been sharp. Sales of new and existing homes have declined significantly from their mid-2005 peaks and have remained slow in recent months. As demand has weakened, house prices have decelerated or even declined by some measures, and homebuilders have scaled back their construction of new homes. The cutback in residential construction has directly reduced the annual rate of U.S. economic growth about 3/4 percentage point on average over the past year and a half. … The outlook for home sales and construction will also depend on unfolding developments in mortgage markets. A substantial increase in lending to nonprime borrowers contributed to the bulge in residential investment in 2004 and 2005, and the tightening of credit conditions for these borrowers likely accounts for some of the continued softening in demand we have seen this year. As I will discuss, recent market developments have resulted in additional tightening of rates and terms for nonprime borrowers as well as for potential borrowers through “jumbo” mortgages. Obviously, if current conditions persist in mortgage markets, the demand for homes could weaken further, with possible implications for the broader economy. We are following these developments closely…. As house prices have softened, and as interest rates have risen from the low levels of a couple of years ago, we have seen a marked deterioration in the performance of nonprime mortgages. The problems have been most severe for subprime mortgages with adjustable rates.”

He had a lot more to say but you get the idea. He was worried about these things back in the summer of 2007 but it seems a lot of other people just ignored these early warning signs

BBB credit spread:

https://fred.stlouisfed.org/series/BAA10Y

In normal times, this spread is around 1.5%. Note it reached 2% in late 2007 before surging to over 5% by the end of 2008. I was a bit alarmed in early 2016 when it started going up but then Janet Yellen was the FED chair. It is now 2.3% which is not awful but who knows what will happen over the next year.

Points I was making in 2005… admittedly early for the nation, but on target for Michigan.

FRIDAY, SEPTEMBER 16, 2005

Excessive Spending – Inflationary Contraction

Housing sales stalling in some areas (inventory trend increasing)

Factory orders stalling in some areas

Energy costs increasing rapidly (you don’t need a link for gasoline costs, but here is one and another for your other energy needs)

Interest rates to continue rising Fed officials have said rates are still too low for an economy facing only a temporary setback from the storm.

Does anyone else see an ominous economic pattern appearing?

Meanwhile…

Northwest and Delta Airlines files for bankruptcy

Ford plans to import at least 50% of its parts requirements … that’s really good for U.S. suppliers, eh?

Let’s resequence these observations:

U.S. moving from a producing nation to a consuming nation

Non-entreprenurial workers (salaried) getting sqeezed by jobs moving overseas through little or no increase in incomes and companies going out of business or sourcing product elsewhere, while the cost of living is going up quickly

The Federal government’s response is to fight inflation by raising interest rates which will make it increasingly difficult for those on fixed or no incomes to obtain necessities (you may not have to drive, but you probably will have to heat and cook… until you can’t afford to live in a house… which fewer and fewer people can afford to buy from you)

So, yes, I could see problems on the horizon for 2006-07. Did it happen?

“We’ll all see a recession coming when the factors are in place.”

Are you including in your “we” Donald Luskin who dismissed any recession as late as September 2008?

Gee – the housing sector is doing OK. Silicon Valley is doing OK. I guess Bruce Hall thinks the only thing that could lead to a recession is some Silicon Valley issue impacting the residential market in high priced Northern California.

Something tells me that people in the heart land will not be amused by this San Francisco arrogance!

Bruce, it’s already here. July data ain’t gonna look good and will be the come to Jesus moment for the no slowdown crowd. When that corporate debt on the full 8 trillion revalues this October, junk bond interest will rise to 5% by Thanksgiving. BBB is clearly the lead this time. It’s the recession driver due to excessive leverage.

“junk bond interest will rise to 5% by Thanksgiving.”

That is likely an underestimate. Maybe credit spreads on junk bonds near 5% and with long-term government bond rates above 3% – I’m betting on these rates being north of 8%!

Here is an interesting chart that shows corporate bond yields through the end of 2018:

https://www.cambonds.com/wp-content/uploads/2019/01/HY-IG-Spreads-to-Treasuries-December-2018.pdf

It is based on the assumption that the corporate bond was 10-year fixed interest and at the end of 2018, the 10-year corporate bond rate was around 2.5%. Page 1 provides rates on corporate bonds rated A- and BBB- (investment grade). Page 2 considers a couple of junk bond grades. For BB- rate bonds, the spread was around 3.5% so the interest rate was around 6%. Naturally as the credit rating gets worse, the credit spread and interest rate gets higher.

Now it is true by last week, the 10-year government bond rate had declined to 2%. But who knows what this rate will be later this year or next year. But count on credit spreads for even BB rated corporate bonds to be around 3% if not worse. So I still say having 5% interest rates on junk bonds later on is an optimistic scenario.

I’m actually looking at those stupid links provided by Bruce Hall. They really are a riot. First of all – Schiff did call the Great Recession. So maybe even a Republican nut case can get one right here or there. But this from April 2016?

“U.S. Recession: Trump Predicts A Very Massive Recession In The U.S.

Donald Trump has now predicted a very massive recession in the United States now. He did not say a recession, he is predicting a massive recession and of course must of the pundits on television don`t see any recession at all, not even a mild one. Here we have Donald Trump saying not only the recession is going to be massive but actually it is going to be very massive.”

OK Bruce – I’ll admit that Trump is even a bigger idiot than Peter Schiff!

“Bruce Hall

July 5, 2019 at 11:36 am

Points I was making in 2005… admittedly early for the nation, but on target for Michigan.

FRIDAY, SEPTEMBER 16, 2005

Excessive Spending – Inflationary Contraction”

Bruce – you wrote this some 14 years ago? Gee you have been babbling for a long long time it seems. Excessive spending leads to a recession? OK! I’m glad I was not reading your incoherent rubbish back then!

pgl Aw, my feeling are sooo hurt. Obviously, you weren’t around to read what I was writing back then. Times change and so do problems. You were probably still in high school and don’t recall how home prices were out of control and people were borrowing what they couldn’t afford and banks were all too happy to lend money on the presumption that everything had to keep going up. So, yes, there was excessive spending by both consumers and government.

National debt had increase from $5.7 trillion in 2000 to almost $8 trillion by 2007 and showed no sign of abating. Household debt was growing astronomically and defaults were looming. https://www.nber.org/papers/w21203a But high schoolers such as yourself were not aware of the situation.

But I’m glad to provide you with some of your needed education.

More babbling? By now – your dog is bored with your incessant gibberish. At least one creature in your household has something resembling a brain!

Your NBER paper does not exist. BTW – I was criticizing Bush43’s fiscal policy over at Angrybear while your mommy was changing your diapers. But we Angrybears wrote about economics which assured someone like you would have no clue what we were saying.

https://www.nber.org/papers/w21203

Not sure how the “a” got appended.

We are all aware of the research from Atif Mian and Amir Sufi. Hey Bruce – it might help if you gave us things like authors and/or titles. Or is such a task above your clearly limited abilities?

pgl We are all aware of the research from Atif Mian and Amir Sufi. Hey Bruce – it might help if you gave us things like authors and/or titles. Or is such a task above your clearly limited abilities?

Clicking on the nber link is too difficult? You’re really stretching there “pgl”.

I wish the Trump trolls had a clue how to present data.

“Household debt was growing astronomically”.

Yes – Paul Krugman and the rest of us were worried back in 2007 about the extent of household leveraging. But could Bruce Hall be bothered to cite even one of his posts? Or actual data like this?

https://fred.stlouisfed.org/series/HDTGPDUSQ163N

Household Debt to GDP for United States

It is not that hard but Brucie boy can’t do it. Go figure! But this troll can write:

“But I’m glad to provide you with some of your needed education”.

Seriously?

If one is serious about presenting data on the balance sheets of either households or corporations – that is their assets, liabilities, and net worth – the Federal Reserves Flow of Fund data is a very useful tool. FRED makes it easy:

https://fred.stlouisfed.org/categories/32251

Check out the various series under tables B.101 and B.103. This data is a whole lot more reliable than the various stupid links Bruce Hall loves to torture us with!

pgl you wanted a link? Have at it.

http://hallofrecord.blogspot.com/2005/09/excessive-spending-inflationary.html . I stopped writing in January, 2013 so the blog is not current. Many of the links are probably “dead” by now. The economy was just one of many interests.

My primary interests were climate, war, the economy, culture, China, and Detroit which I enjoyed poking. Hated the non-falsifiable climate nonsense (still do); granted that warming was occurring from a very cold period starting point for record keeping. Thought the war in Afghanistan was totally unnecessary and not because it became Obama’s pet project. Was always fascinated by the non-science of economics and the diametrically opposite conclusions that economists could reach with the same data; admittedly frustrated by the political aspects of it all and how politics always seemed to mis-manipulate the economy (the Fed raising interest rates when the economy was beginning to tank really pissed me off). Loved the way the slow recovery from the “great recession” was Bush’s fault and the record economy under Trump is Obama’s doing. Believe that the only “diversity” that is important is that of thought; color is completely superfluous. But we’ve forgotten how to have rational discourse; now it’s just snarky sarcasm. And Detroit? That was a basket case for the ages starting with Coleman Young and ending with Kwame Kilpatrick (I give Dennis Archer a pass because he really tried and was ethical, but the Detroit government was so corrupt by then he simply gave up). Saw China as a strategic adversary and unethical “trading partner” and still do; totally misplaced trust by the U.S.

Awaiting snarky comments by “pgl”.

What’s with that, anyway? pgl? Ashamed of your comments? Afraid to admit who you are? I don’t care if people disagree with me; I don’t care if I am proven wrong; and I’ll even admit I’ve changed my mind a few times when a good, rational argument convinces me. But “pgl”? Just snarky comments and hiding behind anonymity? That’s why I don’t respect his/her comments. Just an anonymous economic #MeToo tax and spender (of other people’s money) from what I gather. Hey, if you write for the left-wing “angry bear”, you should be proud of your identity and credentials, shouldn’t you? Your pal Bernie, or is it Kamala or Beto or Corry, (certainly not Biden) is pushing “the agenda” and maybe one of them might become POTUS, heaven forbid, and then we can all see socialism or pseudo-socialism in action.

The blog is dead indeed. Good thing as I did see a screen shot for a while but my computer gave me one of those One Flew Over the Cuckoo’s Nest warnings. Why do you ALWAYS cite batshit insane right wing babble? Oh yea – your fearless leader has someone in the CIA monitoring your computer to make sure you never cite a reliable economic source.

BTW a$$hole, Angrybear himself advised me to adopt a pseudonym as those of us who work for a living do not the freedom of speech that lazy people living off the dole like you have. Remember Econkash? Good guy – he was outed and lost his position for it. So was Duncan Black (Atrios).

I bet you have someone in the Trump organization trying to out the other economists who dare speak the truth but actually have to work for a living. Suppression of dissent is the first step to dictatorship. Which is Trump’s goal – which of course his servant Bruce Hall is so glad to assist.

pgl, try using Chrome instead of Safari.

BTW, angry-bear contributor. I don’t live off the dole. I started working when I was 12 cleaning other people’s rugs and furniture. Heavy dirty work. I put myself through college working full time in a hot warehouse and attending night courses. I served in the Air Force for 4+ years and Ford for 30. I raised my younger brother when my parents got divorced. Nothing was handed to me. But of course, that’s “right wing”.

I presume you fancy yourself self-made with maybe a lot of help from daddy and maybe some grants along the way. So, you have a “position” to protect? Aw, sure. People who say and do outrageous things generally want anonymity. What have you said that could be so threatening to your “position”? And as far as “outing” goes, I’d say the left are the doxxing and harassing champions. https://www.bizpacreview.com/2019/07/03/8-year-old-mini-aoc-retires-from-social-media-after-harassment-and-death-threats-from-critics-771368

“non-falsifiable climate nonsense”

Uhhh. Non-falsifiable? That’s just . . . a clear indication that you have no idea what you are talking about. Please go away.

Bruce Hall does not know how to find actual NBER papers on household debt but I do:

https://www.nber.org/papers/w20496.pdf

Household Debt: Facts, Puzzles, Theories, and Policies Jonathan Zinman NBER Working Paper No. 20496 September 2014

It leads with:

‘Why do research on household debt? One reason is high stakes, in absolute and relative terms. U.S. households owe $12-13 trillion in debt, down slightly from the peak in mid-2008 (sources: Flow of Funds, Federal Reserve Bank of New York Consumer Credit Panel). A comparable figure for borrowing by non-financial corporations is $10 trillion (up from $8 trillion in 2008). Households borrow using an increasingly rich constellation of loan products, at real interest rates ranging from near zero to quadruple-digit APRs. The comparable range of non-risk-adjusted returns on the asset side of the household balance sheet is smaller by orders of magnitude.’

A very interesting paper even if Bruce Hall will not understand any of the economics!

“Household debt was growing astronomically”.

Not to harp on this undocumented and rather stupid comment from Bruce Hall (there are so many other examples) but the really funny thing about his not being able to document this, it turns out that the household debt to GDP ratio did reach 100% per some FRED link I provided earlier. FRED allows us to do cross national comparisons. It seems that the household debt to GDP ratio for Canada is over 100% for the last several years. Are they in danger of a recession? Or let’s look at Australia:

https://fred.stlouisfed.org/series/HDTGPDAUQ163N

This ratio hit 105% a few years ago but Australia’s last recession was 1991.

Bruce Hall loves to babble all sorts of nonsense. Actual documentation or any substantive economic analysis – not so much!