My answer on Marketplace yesterday was essentially “why not”. On macro grounds, with prospects for economic activity softening, a bit of insurance isn’t too crazy.

Source: Atlanta Fed.

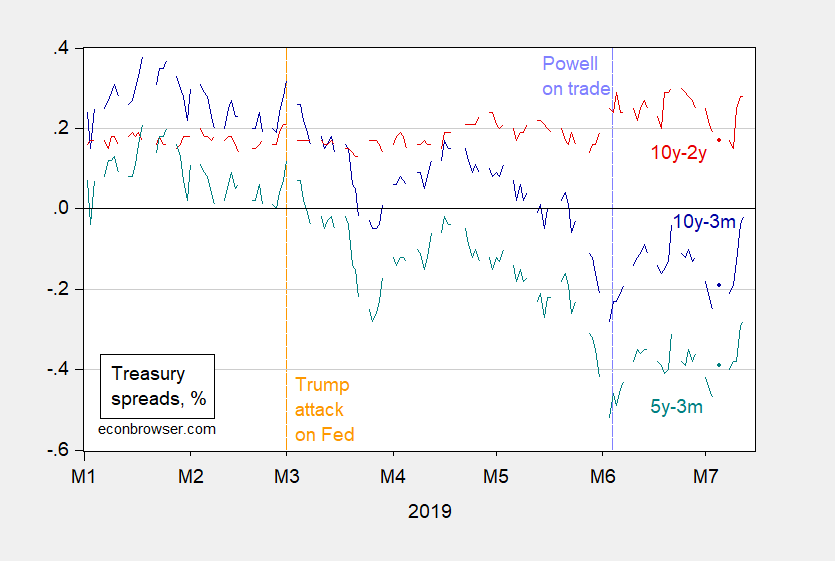

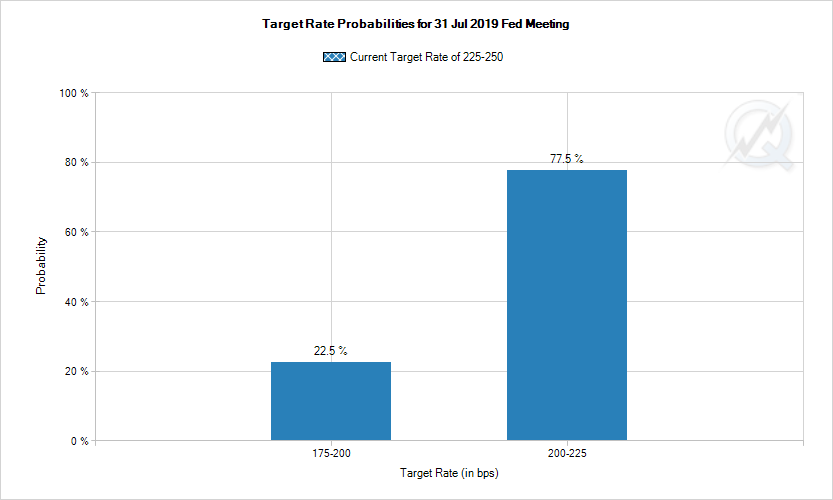

The yield curve has partly uninverted due to the heightened likelihood ascribed to a rate reduction at the next meeting (23% of a 50 bps cut; 77% of a 25 bps cut according to Fed funds futures).

Figure 1: 10yr-3mo Treasury spread (blue), 10yr-2yr (red), 5yr-3mo (teal). Source: Fed via FRED, author’s calculations.

Source: CME, accessed 7/12/2019.

The reason to hold fast was essentially a political economy one, in my view: once Trump perceives that the Fed can be pressured (whether it was or not), he’ll be tempted to pressure again. On the other hand, one could argue he would pressure relentlessly, regardless of Fed action, given his desperation to prevent a recession.

I will say that if yield curve inversions (10yr-3mo) is a reasonable predictor of recessions at around a year horizon, and if monetary policy acts with long and variable lags, then we’re likely toast anyways…

This may be one of those self-fulfilling prophecy situations. The market has now priced in its exxpectation of a rate drop, so the Fed had better deliver or the markets will get discombobulated. As it is, the other factor coming in here is that it seems other nations with their weakening economies are lowering rates, at least some of them. The scale of assets with negative nominal rates has gone from about $8.3 tn at the beginning of the year to over $13 tn now.. We still do not have a good theory for why we are seeing so much of bond markets getting these negative nominal yields. This was supposed to be an anomaly, but now seems to becoming de rigueur and widespread.

Professor Rosser and Folks,

Is it not possible that this administration will impose additional tariffs? If so, the U.S. dollar will appreciate against the other currencies, as it has against the Chinese renminbi. Wouldn’t it make sense to delay the rate drop until then to stabilize the exchange rates – not fix them, but stabilize them? Kenzie seems convinced that we will have a recession no matter what, so if the rate drop really will not prevent it, why not use it for other things at the time?

Julian

It is possible, and many are now expecting him to slap tariffs on the EU, especially in respect on aircraft parts and some other items.

I’m not always against rate cuts. But when you’re already near the ZLB and this encourages things like donald trump’s tariff policy?? It’s time both donald trump and the people who voted for the orange leathery creature FACE THE MUSIC They made the decisions that have got us here and now they need to experience the consequences. A rate drop now would be congruent to feckless and senile Pelosi handing over billions in US tax $$$ to Republicans to waste on the border, once again proving the woman is lower and beneath useless. If Republicans controlled things they would watch Dems fry in the pan while laughing. What does Pelosi do??–she hands them a political salvo on a silver platter. If the woman croaked while attempting to swallow a large chunk of San Fran Bay crabmeat tomorrow at lunch she’d be doing working class America a tremendous favor.

https://www.nytimes.com/2019/06/27/us/politics/border-funding-immigration.html

She gave what amounts to a gem studded Faberge egg to Mitch McConnell, donald trump, Kevin McCarthy in return for NOTHING. Please, for the love of God and what is left of rational humanity Nancy, go to the nursing home and make friends with a sadistic nurse so the rest of us can possibly learn what Dems would foster with a real leader. Republicans celebrate every day you arrive at the House of Reps Nancy. PLEASE HIT THE EXIT DOOR NOW!!!!

MH,

If you google “Pelosi Schumer responsibility border bill mess” you will find that indeed the outcome was a mess, and this is not a success for Pelosi. But if you look at the various links, while there is much debate over who did what, probably more people point at Schumer as the one messing up and sending Pelosi and the House Dems a bad bill that gave them a no-win situation. You may claim that Pelosi’s inability to get the moderates among the House Dems not to vote for the Senate bill shows senilty, but nobody inany of these links suggests anything of the sort. She was dealing with a very difficult situation and there was not getting around the split among the House Dems once the Senate Dems under Schumer went along with McConnell’s bad bill.

I think where she can be most criticized is in her recent (mis)handling of AOC and her group more recently. But this is a matter of her playing hardball perhaps overly toughly. But it is certainly not senility.

In any case, if somebody in all this is going senile it is more likely to be Schumer, although I do not think he is either.

I’m glad you posted this as that podcast had too many other people talking. They could have turned it over to you and kept quiet but no. Jabber, jabber, jabber sort of like the Usual Suspects often do here.

Now on the topic of monetary policy and Trump’s inappropriate pressuring. First he is all happy with that former Labor Secretary for talking on how Trump is responsible for the greatest economy EVER (shhh – let’s not talk about Trump’s friend the child rapist Acosta let off) but then he tells the FED to lower interest rates as I bet Trump knows deep down that his trade policies and general economic stupidity are a real threat to create a recession.

I’m now sitting on the sidelines with cash waiting for the imminent recession as predicted by the yield curve inversion. But I don’t want to wait too long. So, how can I get the Fed to raise interest rates instead of lowering them? Recessions can be a good thing if you know when. S&P @ 2,000? Buy, buy, buy.

Yes – the only thing that matters is Brucie boy’s stock speculation. You and Lawrence Kudlow representing his totally self centered “investor class”. Yawn!

pgl (or whoever) aw, economic self-interest = bad? Perhaps you should do some reading.

Enlighten me: haven’t you extolled your excellence in investing? For altruistic purposes?

Self interest is fine but insider trading on the stock market is not. What’s the matter Brucie (assuming that is your real name) – Wilbur Ross is not clueing you in?

Now totally self centered is clearly bad. But that only applies to Trump. You worship your idol.

Of course policy makers should take care of the interest of all people – not just white racist like you. Then again – I’ve seen your lack of analytical abilities over and over so in your case being on the government dole is a good thing!

pgl (or whoever), oh, I would only do insider trading based on your incredible insights. LOL.

So, buying and selling stocks is self-centered? Okay. Then a purely altruistic person such as yourself would never engage in the dirty business of the stock market, right? Because people who buy and sell stocks are white racists, not “pure ethnics” like yourself, right? You’ve got a real thing for Trump, eh? Sorry you’ve lost so much in the stock market.

pgl… making it up as he/she goes along.

ICE agents have already tried to harass certain residents of Brooklyn:

https://brooklyneagle.com/articles/2019/07/13/ice-attempts-two-raids-in-sunset-park/

‘U.S. Immigrations and Customs Enforcement officers attempted two raids on undocumented Brooklynites in Sunset Park Saturday, but neither resulted in arrests, according to sources and the commissioner of the Mayor’s Office of Immigrant Affairs…Mostofi said that the Sunset Park residents refused to open the door for the officials. One of the raids reportedly was at the home of a family of seven who did not open the door for the ICE officials, a source told the Brooklyn Eagle…“Due to law-enforcement sensitivities and the safety and security of U.S. Immigration and Customs Enforcement personnel, the agency will not offer specific details related to enforcement operations,” said an official with ICE. “This is a white nationalist move,” Menchaca said at the press conference of the ICE raids. “This is coming from the top of government from a white man. This is a white man saying, ‘Our country needs to be white and it needs to be whiter and we need to remove the people of color,’” Menchaca said.’

I’ve been to Sunset Park many times. The population is mainly either Hispanic or Chinese but other races including whites enjoy the awesome park there. Apparently the ICE agents did not get warrants for these attempted raids. The city has informed the residents of their rights not to open their doors to these agents of the Racist in Chief.

How sure are you that the Fed actually can affect bond/treasury prices (in the long run) with their blustering proclamations and changes in one tiny little corner of the lending market? Maybe the reason they always seem late is that they are the mouse and Mr. Market is the elephant.

DeDude,

It is well accepted that the Fed has near absolute control over short term rates but much less control over long term rates. I am not going to waste time explaining why those well known facts are true. Google it and find out if you are unable to figure it out or wish to wallow in deluding yourself that one or the other of those is not true.

My read on the situation is purely a graphic one. If you look at rate spreads and the starts of recessions over time, the yield curve inverts. Then it un-inverts. Then there’s a recession. I do not have a mathematical reason to say this, just looking at the pretty pictures. But there it is, big as life. If the yield curve un-inverts, we are about six months away from a recession if the purely graphic pattern holds.

Thought this was a nice blog post that related to the topic. I don’t read Bernanke regular, due to laziness and time constraints, but saw this randomly and thought it related quite well to the post topic:

https://www.brookings.edu/blog/ben-bernanke/2019/02/21/evaluating-lower-for-longer-policies-temporary-price-level-targeting/

I have seen other articles, which I think I have posted links on at least once before, which I thought quite interesting—- relating to the TARGETING of the lengths of debt securities/treasuries the Fed Res should purchase/hold on its balance sheet to keep rates low without expressly/directly using the fed funds rate. I am not necessarily a proponent of that, but find the topic fascinating either way.