If recoveries don’t die of old-age, then they either have “accidents” or they’re murdered. I’m not sure what a business-cycle accident is, but we can check what might have killed the recovery, should we enter a recession in 2020, as suggested by some forward looking financial indicators. I’ll look at investment spending, a forward looking variable, highly sensitive to interest rates, and the outlook for economic activity and uncertainty.

One thing to note is that real rates were not particularly high; 1.11% in November 2018, as compared to 2.69% in mid-2007. One could pin the recession of 2020 on that, but it’d be a stretch. On the other hand, what’s been true is that (log)equipment investment spending (equip) has underperformed relative to what one would’ve expected on the basis of key observables: (log) GDP (y), and real interest rates (r). I estimate a regression the regression for the recovery (2009Q2-2016Q4), and conduct an ex post historical forecast.

Δ equipt = 0.00 + 1.48Δ yt + 1.81Δ yt-1 – 2.27Δrt

Adj-R2 = 0.22, SER = 0.021, NOBS = 31, DW = 1.09, bold denotes significance at 11% msl using HAC robust standard errors.

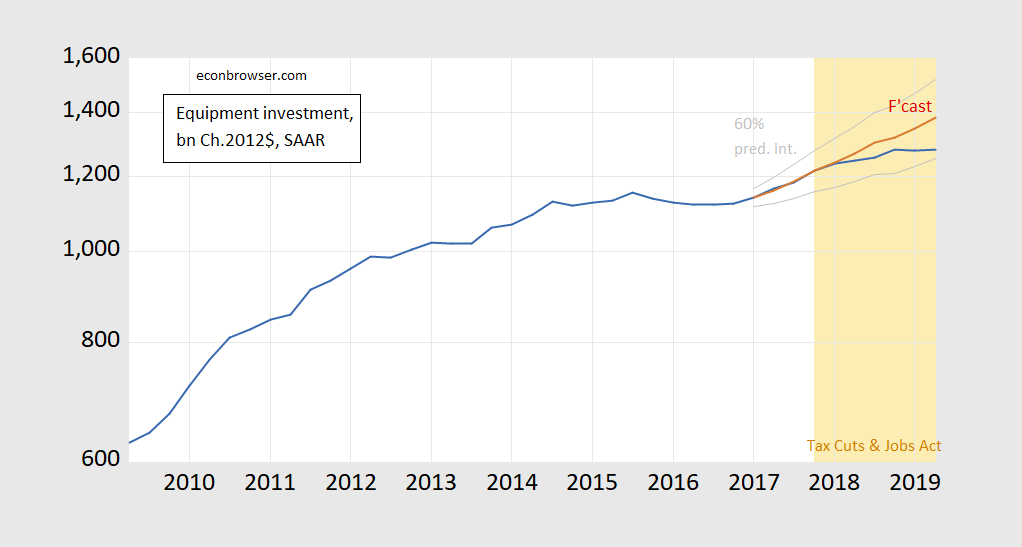

The forecast is shown in Figure 1, along with 60% prediction interval. What is clear is that equipment investment is growing more slowly than what should have been the case, given observed real GDP growth and changes in real interest rates.

Figure 1: Equipment investment, bn. Ch.2012$ SAAR (blue), and ex post historical dynamic forecast (red line) and 60% prediction interval (gray lines), on log scale. Orange shading denotes Tax Cuts and Jobs Act in effect. Source: BEA, and author’s calculations.

The deviation is not yet statistically significant, but then, the empirical model is not particularly precise.

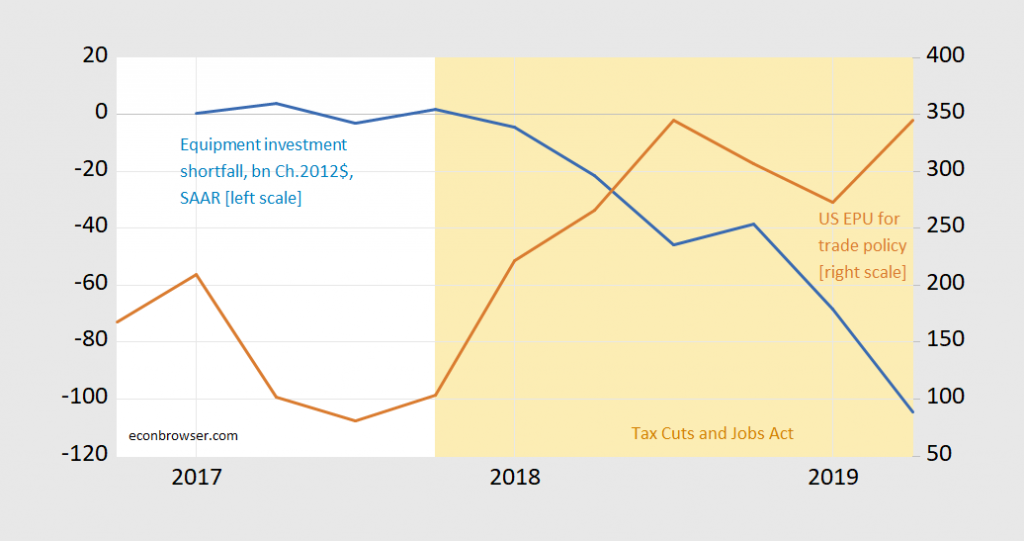

What factor has depressed equipment investment, despite a vibrantly growing US economy? One suspect is policy uncertainty. The shortfall in equipment investment and trade policy uncertainty are shown in Figure 2.

Figure 2: Shortfall in equipment investment, bn. Ch.2012$ SAAR (blue, left scale), and economic policy uncertainty categorical index for trade policy (brown, right scale). Orange shading denotes Tax Cuts and Jobs Act in effect. Source: BEA, policyuncertainty.com, and author’s calculations.

The faltering pace of equipment investment in the face of tremendous fiscal stimulus, and enormous investment incentives (consider the drop in corporate tax rates and faster expensing of equipment investment as resulting in big declines in the user cost of capital) is then quite remarkable.

Now, one can debate whether it’s actual protectionism, or the uncertainty regarding the imposition of protectionist measures. Since in my assessment, Mr. Trump will wimp out in imposing all threatened tariffs on imports from China — especially on consumer goods set to be delivered around Christmas season — and on full-fledged Section 232 tariffs on automobiles, it’ll be the uncertainty that will have killed the recovery.

Update, 8/4 10AM Pacific: I have posted data at here, regression output here.

“One thing to note is that real rates were not particularly high; 1.11% in November 2018, as compared to 2.69% in mid-2007.”

Yep and Robert Barro seems to think real interest rates should be pushed up to near 2.5% as I noted here:

http://econospeak.blogspot.com/2019/08/barros-misstated-case-for-federal.html

Barro is right to call for FED independence but I sure hope that Powell does not raise interest rates by that much!

‘The faltering pace of equipment investment in the face of tremendous fiscal stimulus, and enormous investment incentives (consider the drop in corporate tax rates and faster expensing of equipment investment as resulting in big declines in the user cost of capital) is then quite remarkable.’

Indeed we were promised a yuuuge investment boom which has not materialized. But rich people get to rip the rest of us off so all’s good!

Menzie I’m getting very similar numbers, except the interest rate coefficient is smaller by a factor of 10. I used the TIPS for the 10 year as a proxy for the risk free interest rate. Since the interest rate is monthly, I used the three month average as the quarterly interest rate. I get this equation:

0.00 + 1.51(dlogyt) + 1.89(dlogyt-1) – 0.022(drt)

HAC standard errors, bandwith 2 (Bartlett kernel)

All coefficients significant at p=.07 or lower

Adj-R^2 = 0.24

SER = 0.021

NOBS = 31

DW = 1.12

Residuals are normal (p=0.44)

The CUSUM is out of bounds beginning in 2014Q2, but the CUSUMSQ is always within bounds.

2slugbaits: Not sure why the small differences, but the coefficient difference on interest rate is because I have the interest rate is in decimal form.

Menzie I’m gonna say operator error. It now matches exactly. Actually, I’m pretty sure that the small difference was due to some software quirks between calculating log differences as a standalone function versus doing it in two steps, first transforming to logs and then finding the difference. I’ve come across this issue before.

@ 2slugbaits

It doesn’t bother me at all you can crunch out those numbers. Not at all……..

https://www.youtube.com/watch?v=kP3wnYe6Muw

Just openly wondering why the change in the data would occur in 2014 as opposed to any other time. The tapering off of QE from the Fed??

Professor Chinn,

I seem to calculate similar coefficients to yours, using FRED series: for equipment (y033rx1q020sbea), GDPC1, and ten year real interest rates (fii10).

My coefficients are:

adj_Rsqd= 0.22

SER = 0.021

NOBS = 31

DW = 1.09

c = 0

dlog(y(t)) = 1.48

dlog(y(t(-1))) = 1.81

d(rt) –0.0227 (only apparent difference on coefficients)

I found some difference from your model on the significance levels. Perhaps my model has problems.

A teaching moment is needed on a few questions if you are inclined. Any enlightenment is appreciated. My comments are related to understanding the model (not a criticism of an attempt to make sense of what may be the culprit in the death of the recovery). I understand that the small sample has some model limitations.

1. I thought I may be able to add economic policy uncertainty as a repressor as a way of testing the significance of uncertainty, but the variable was not significant.

2. When the DW is much different from 2.0, indicating autocorrelation of the residuals, my understanding is that accuracy of a forecast becomes a problem.

AS: Apologies, I am using HAC robust standard errors, “n” option in LS proc in EViews. I’ll add that notation.

AS: Serial correlation in the presence of lagged dependent variables is problematic; should just be less efficient when no lagged dependent variable.

I think you would get different results (possibly) using *trade* policy uncertainty.

I have posted data at here, regression output here.

Thanks for the regression output and data,

1. My regression output is the same as yours after entering interest rate as decimal. Some minor output differences at 3rd and 4rth decimal place due to FRED series, GDPC1, showing more decimal places as compared to GDP12 used in your model. I used GDPC1 since it is a convenient download in EViews.

2. I tried log(trade policy uncertainty) as an additional regressor. Does not seem to be significant. Log(trade policy) seems stationary for the regression period using ADF.

Great post (as per usual) by Professor Chinn.

Speaking of murder, I thought I would present this. For the sake of the broadening education of America based mankind:

https://www.reddit.com/r/GrouchySocialists/comments/clr4i5/political_violence_list_update_38/

You’re welcome.

Meanwhile….. [ insert comic books panel here ] somewhere at an American civil rights protest, 5 Antifa members are committing the “crime” of saving a black man from 20 cowardly KKK members beating the crap out of him until he’s bloody and motionless, as Sarah Palin hides nearby, peaking outside of her living-room window at the Antifa squad with the shakes.

Putting this up because I know he has many fans on this blog. Rest assured, I hate him as much as any readers/posters here do +1 more degree of hate than whatever yours is (No, I am not reticent nor have any conscience about using the word hate to describe my feelings to this……. bag of plasma wearing eyeglasses.

https://www.youtube.com/watch?v=8zgjqvN67iU

September 1. I guess in some ways I may be contradicting myself here, but I agree with Menzie, I think donald trump will chicken out come early Autumn. donald trump’s survival instinct is strong, if the orange creature enacts those tariff’s September 1, it is about as near to a literal self-slashing of the throat as you can get on November 2020. The economic lag is short enough the full tariffs become political suicide. If we are talking the full tariffs it is in fact a VERY SAFE bet they will not be enacted (the full set of tariffs, he could do a wrist slap version of tariffs for FOX news).

See, this is how bad my brain works sometimes. I’m getting better at this though, even if it is by excruciatingly slow progression

“NOBS” has to be number of observations yes?? 7X4 and then a three more quarters, right?? gets you close to 31. DW Durbin Watson which Menzie has mentioned. SER has to be standard error term, yes (deviation)?? HAC= heteroskedacity and auto-correlation consistent (measurement of OLS standard errors)

You know, it seems to be somewhat of a “hodge podge” or “gambit” which of these “R” packages will work for me and which packages will NOT work. I can give a decent example. I read on Wiki that two packages will do Newey-West, So Menzie has mentioned Newey West a ton of times so I am thinking “Oh damn, I need to get these two packages so I can do Newey-West, just crunch the numbers even if I haven’t totally grasped it.” So the two packages. One is “plm”, so BOOM I open up Rstudio run it, “plm” gives me the same crap message I’ve seen about 50 times “installation of package ‘bla bla bla’ had non-zero exit status” which usually means it didn’t install into the library. So after about 200 vulgarities go flashing past my brain, I know that it didn’t install, but I have no idea WHY it didn’t install. So then I try the other package which supposedly can crunch Newey-West for me called “sandwich” BOOM that one installs, and it pops up in the Rstudio library, now WHY “sandwich” instals and “plm” does not install, I’m here to tell you your F’king guess is as good as my f’king guess. And in fact if anyone has a guess, 2slugs or Frank, I would love to hear it, because I have this strange and self-loathsome guess you know more why it didn’t than I do.

Economists, time in memorial, have failed to accurately predict

recessions.

Would the distinguish Professor Chinn move to a more productive

topic?

Hans: That’s a new one – recessions can’t be predicted, so stop discussing it. But, actually lots of economists predicted a recession in 2008, if one looks at WSJ survey in early 2008.

By the way, “time immemorial” is what you might be trying to write.

Since weathermen rarely forecast earthquakes – you’d do away with them too? Tell me one profession that forecasts the future perfectly. Oh wait – there is one that does. The people that predict that your next comment will be incredibly stupid have a 100% accuracy record!

Hans Economists, time in memorial, have failed to accurately predict

recessions.

I’ve never quite understood comments like this. All intelligent economic forecasts are conditional. If economists warned that we needed to lower interest rates because a recession appeared likely, were the economists wrong if we did lower interest rates and a recession didn’t happen? When you assess the accuracy of a count model you usually set up a 2×2 matrix that summarizes the observed hits and misses against the predicted hits and misses. The problem with comments like yours is that you are effectively evaluating economic forecasts by only looking at one cell (viz., didn’t predict a recession and one happened) in the 2×2 matrix and ignoring the other three cells. Do you think there would be fewer recessions if we ignored what economists recommend?

Also, you need to distinguish between real economists in the macro field and the faux economist blowhards you see on certain cable “news” shows.

I am not an economist. A recession or something like one is coming in the next 12 months or so. No need to beat on economists who actually know what they are taking about. They give considered odds. I just tell you it is coming. Happy now, Hans?

Professor Chinn and Readers,

See if this analysis makes sense regarding equipment purchases and policy uncertainty. Using FRED data series, Y033RX1Q020SBEA (equipment) and USEPUINDXM (policy uncertainty).

I used dlog(USEPUINDXM) (policy uncertainty) as an explanatory variable to try to explain dlog(Y033RX1Q020SBEA,2) (second difference for log equipment). Neither log(equipment) nor the first difference seemed stationary, when comparing various unit root tests, so I used the second log difference.

Dlog(policy) is significant at the 5% acceptance level. The residuals appear to be non-correlated, non-heteroskedastic and normally distributed. DW=2.35. Various stability tests seem ok, including CUSUM, CUSUM of squares, and Ramsey RESET test.

However, the sign on the variable is positive. If the dependent variable were dlog(equipment), I would have thought that the sign should be negative. Since the second difference should be the change in the change, how should a positive change in the charge be interpreted? The model seems to say as economic policy uncertainty increases, the rate of change in equipment purchases increases.

AS: Quick but incomplete response. I think first log difference of *real* equipment investment spending *is* stationary using ADF (rejects unit root null). I plotted *trade* policy uncertainty; I don’t recall if that’s on FRED, but you can download the categorical indices from policyuncertainty.com .

I also found that the dlog(real equipment) is stationary using ADF. In addition, I used KPSS and may have incorrectly used KPSS, since the rejection of unit root using ADF is stronger excluding a constant. The KPSS test assuming a stationary series, also seems to *assume* a constant. So, I seem to have incorrectly concluded from the incorrect use of KPSS that KPSS rejected dlog(real equipment) as a stationary series.

AS I’m finding that the log difference of equipment is stationary. That’s true whether you use the full range or just the 2009Q2 thru 2016Q4 range.

2sugs,

Thanks for checking. I had a technical foul-up as explained above.

I always appreciate your contributions, especially in the educational mode.

The fiscal stimulus under Trump has been compared to what Reagan did back in the early 1980’s. Back in the early 1980’s we did have a significant recession as a huge increase in real interest rates crowded out both net exports and investment demand.

But we just heard from Bruce “no relationship to Robert” Hall the false premise that U.S. exports are not that large. 12.2% of GDP is not that large? Exports certainly dominated residential investment. Now it is true that we had an enormous drop in residential investment as a prelude to the Great Recession. So one could ask about variability as oppose to size. Fair enough.

I just checked with BEA national income accounting data. Real exports fell by $40 billion during the early 1980’s. Yes residential investment also fell but not by as much. But Bruce Hall thinks predicting recessions of all about residential investment and not export demand. To compound his clear confusion, Bruce Hall thinks that if I purchase an existing house from say Barkley, that represents investment. It does not.

I’m sorry to belabor this simple, simple point but we do see a lot of utter stupid comments here. But that is why his name is Bruce “no relationship to Robert” Hall!

Bruce “no relationship to Robert” Hall!

Well, Bruce likes to think of himself as an independent, self-made man. So perhaps he should raise himself by his bootstraps if he wants to be more like Robert Hall. 🙂

The more I read from Bruce – the more I think he would benefit by taking an economics class even if the instructor were CoRev.

Export data for Bruce’s home state–Michigan–is enlightening. From the Office of the United States Trade Representative…

“Michigan was the 7th largest state exporter of goods

In 2018 Michigan goods exports were $57.9 Billion

Goods exports accounted for 11.9% of Michigan GDP in 2017

Michigan goods exports in 2017 ….supported an estimated 271,000 jobs. Nationally, goods supported by goods exports pay up to an estimated 18% above the national average”

Who buys? #1 Canada #2 Mexico #3 China

BTW, if you added the export jobs in Texas ( close to 1 million) California (close to 600,000) to those in Michigan, the total would exceed the population of the state of Idaho.

Safe to say, there would be a considerable number of Michiganders who would disagree with Bruce re: the role of exports in the economy.

GM and Ford are headquartered in Detroit, Michigan. Exports are a big deal for both of these multinationals. Which begs the question – does Bruce Hall even know what a car is?

Checking with Census on U.S. exports in 2018 related to the motor vehicle sector:

https://www.census.gov/foreign-trade/statistics/product/enduse/exports/c0000.html

The total for the sectors where the end user code starts with 3 comes to about $107 billion for the year. I know some of this production occurs outside of Michigan but a lot surely occurs in Michigan. But Michigan resident Bruce “no relationship to Robert” Hall declares that we do not export all that much? Maybe the stupidest comment he has ever made but maybe not as he specializes in stupid comments.

It appears 9 of the top 10 Michigan exports are “motor vehicle” related. The exception is “civilian aircraft.”

Addendum to importance of export trade:

“In 2016, California exports supported 683,772 jobs in the U.S., 92% of which were supported by manufactured goods. In 2015, there were 70,350 small and medium-sized exporters in California, which accounts for 96% of California goods exporters and 43% of known California goods export value.

California is a top exporter….of computers, electronic products, transportation equipment , machinery except electrical, and miscellaneous manufactured commodities…”

That bit of obvious left wing propaganda is from the crazed socialists at the California Chamber of Commerce who obviously would lead us into international temptation without delivering us from international evil.

Most of the problem is the burst around corporate debt in 2017-18 and the energy/auto sector response to increase or autos side, maintaining production in a sea of overcapacity. It’s a market overcapacity just ripe for a S&L style bust. Even the tech junk bond ramp up during the first half of the year was badly planned and not supported by their cfo’s. It just created a illusion of a strong balance sheet, when in fact, their real balance sheets are weaker, which they will be forced to reveal…………causing panic and downgrades.

Tariffs are a recession problem. Not a creator.

The Rage writes a lot of nonsense like this:

“Most of the problem is the burst around corporate debt in 2017-18”.

The Rage NEVER provides a shred of data to support his incessant insanity. Let’s consult with FRED:

Nonfinancial corporate business; debt as a percentage of the market value of corporate equities

https://fred.stlouisfed.org/series/NCBCMDPMVCE

Debt represented 37% of equity back in 2015. Not particular high. It has declined since to 33.7% of 2019QI. I don’t want to Rage a liar. Maybe he believes the undocumented nonsense he writes!

Menzie, I request you add detail to your X axis so we can see which month aligns with each inflection of the lines.

But it looks like equipment investment has inflected near end 2017 which corresponds to the global pmi & CLI top (with US peaking about 4mths later). That is the best lead indicator of US NIPA corp profits which is the best driver of corp investment.

I find the uncertainty indices lag SPX thus are pointless.

@ Menzie

I just now noticed your post update with the extra regression information, THANK YOU Professor Chinn, it is extremely kind and gracious of you.

Menzie, I also want to add per my usual nonsense and baloney style (as you are well aware, I only succeed in entertaining myself therewith) that this link to the regression data is much more greatly appreciated than your automatic download link you gave us to CoRev’s spreadsheet data set. Although it must be said that CoRev’s spreadsheet contained very humorous aspects your data set download does not, my computer was very upset you fed it the CoRev spreadsheet, and suffered what is termed in tech industry parlance as “a Mac nervous breakdown”. It has only very recently started talking to me again after I offered it the flowery makeup gift of an Rstudio update. My Mac still intermittently reminds me I am on thin ice after the CoRev “stunt” though.

Related to a popular topic here—rates—and some thoughts from a Mr. Torsten Slok. I don’t care for how abbreviated time you have been watching markets, or from what prehistoric time mark you have been watching markets—-43% of traded global bonds is a gargantuan and mastodon sized amount:

https://ftalphaville.ft.com/2019/07/31/1564576363000/Negative-yields-are-nuts–when-s-the-crash-/

I suspect at least one of those damned Deutsche Bank Investment newsletter clients has been “holding out” on us. The damned nerve……. (friendly joking)

OK, does anyone want to clue in the real dumb-dumb (me) what “EPUC_US” is??

OK, economic policy uncertainty….. some number that must be over on the other profs’ website. OK, yeah, I’m a little slow sometimes.

Moses Herzog: It’s the categorical EPU for trade policy (should by EPUC_US_TRADE); go to http://www.policyuncertainty.com/categorical_epu.html

@ Menzie

Thanks once again.

Dear Folks (and especially AS),

You all might find Domestic Industry profits, which are way down despite all the tax cuts and tariff protections added, an additional useful variable in predicting recessions. See

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=3&isuri=1&1921=survey&1903=239#reqid=19&step=3&isuri=1&1921=survey&1903=239

J.