Business cycle indicators mixed, nowcasts overall sideways, manufacturing down.

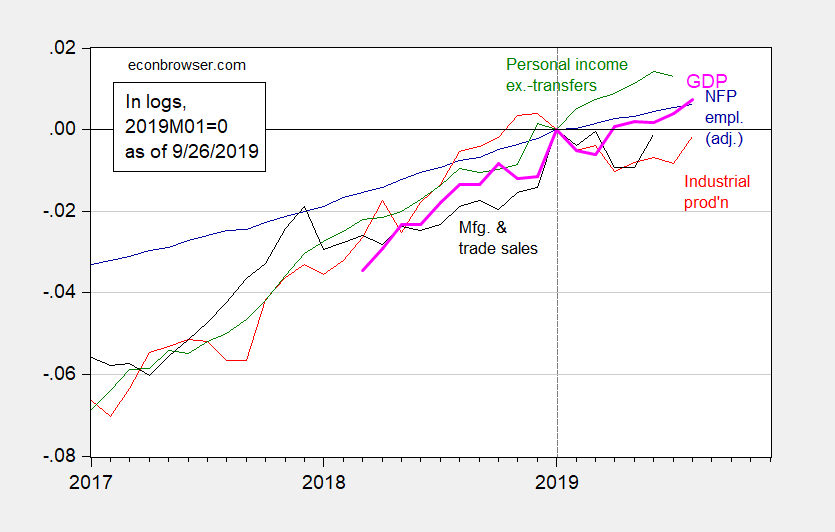

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink bold), all log normalized to 2019M01=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (9/26 release), and author’s calculations.

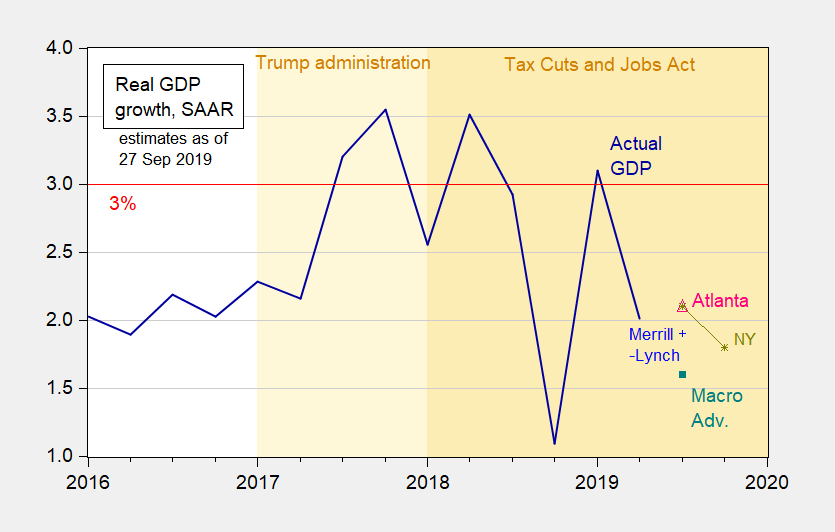

Figure 2: Real GDP growth, actual (dark blue bold), forecast of NY Fed Nowcast 9/27 (tan), Atlanta Fed GDPNow 9/27 (pink triangle), Macroeconomic Advisers 9/27 (teal square), Merrill Lynch 9/27 (blue +), q/q SAAR. Source: BEA, Macro Advisers, NY Fed, Atlanta Fed.

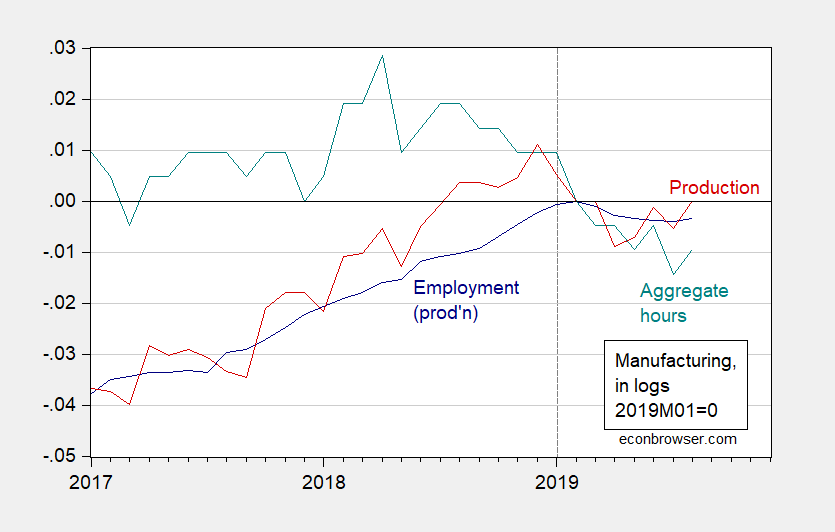

Figure 3: Manufacturing employment (blue), aggregate hours of production and nonsupervisory workers (teal) and production (red), in logs 2019M01=0. Source: BLS, Federal Reserve via FRED, and author’s calculations.

The 90 day graph is the most interesting one.

https://www.predictit.org/markets/detail/5429/Will-the-UK-officially-exit-the-European-Union-by-Nov-1

How ironic is it??—that donald trump tells people he’s pro-brexit, but the fact that it’s not going to happen during his 2nd campaign run probably helps him a lot.

still not convinced they exit at all.

The local city government is opening up a new park. They are ballyhooing it and marketing it to the local populace to the point I HIGHLY suspect corruption is connected to it behind the scenes. Be that as it may….. if you never lived in the state of Oklahoma or only just recently moved there, and want to know how well the municipal and state governments operate—this TV graphic outlining the rules of visiting the “grand opening” of the park from a local station should give you a rough idea:

https://i.redd.it/p0negnt3a2p31.jpg

So, to review for you midwestern America folks who don’t have the undersized brain of an “Okie”— you can bring your gun to the park—but you are not allowed to bring your child’s frisbee. Clear on that??

you can thank your russian sponsored nra and its politicians for such lunacy. considering the nra is now considered an asset of russia, i suppose that makes dick stryker, corev and peak loser as russian agents acting in the usa. reagan must be rolling over in his grave to see the republican party controlled by the russians.

baffling CoRev pays his NRA membership dues in rubles.

@ Menzie

Menzie, people who follow economics closely know that people such as yourself and Paul Krugman are thought of as “stiffs” by the general public. We also know this is a false perception of great economists such as yourself, who have a razor sharp style of humor and are willing to have fun with a joke. Did you see Paul Krugman on Colbert tonight?? Paul Krugman was fully aware of what he was “walking into” with that interview and “played along” so he could give millions of Americans a healthy laugh in these demoralizing times. And Krugman showed his Jewish roots in knowing the true healing power of laughter—if you didn’t see Krugman on Colbert tonight you gotta see it Menzie!!!. It was so great and I think he made ALL economists proud with his ability to have a good time and be self-depricating in only the BEST of ways.

I am a night owl, if they post Krugman’s segment on Youtube tonight I will put the link up in this thread. IT WAS AWESOME!!!!

As promised…… Krugman on the Stephen Colbert show:

https://www.youtube.com/watch?v=NlG-UGUpcbw

Dude is more suave and world savvy than David Ricardo.

Economic confusion is the chop before the fall. It may be a short fall or even a plateau. But It will not be roaring growth. The average person will notice. Whether or not they process it and act like they have historically is another story.

This is an MMT conference that is going on right now, I have to confess I haven’t watched any of this YET, but posting it for those who might have an interest. Menzie this is 3 hours long, but I think since it’s a university event at a 4-year certified college we can rest assured there weren’t any F-bombs etc in this video stream:

https://www.youtube.com/watch?v=Z3UMAFZt3vs

WOW, I didn’t know the audio at the MMT conference was so horrid. I apologize to Menzie’s readers for posting that. It’s nearly not even consumable the audio is so nightmarish. I’m sure all the people involved are good people with good intentions, but let’s all pray to God they get better audio engineers next year if they ever want MMT to spread past that room. Oh my God….. it’s almost like out of a satire comedy skit the audio is so bad.

Figure 1: How are you calculating GDP? You seem to have monthly numbers. I can’t find monthly numbers on FRED.

Ah, that must be Macroeconomic Advisers. Do we believe they can reliably peg GDP on a monthly basis? Maybe the Fed should use MA’s numbers.

@”Princeton”Kopits

You’re so damned dumb, I don’t do one tenth of the reading I should everyday, and even I know the answer to this question: Do you have ANY F’ing idea what Larry Meyer did before he became head of that company?? I wouldn’t entrust Barkley Junior with telling me the goings on of my backyard over a 5 minute time-span and it’s about 5% he knows what Larry Meyer’s job was.

You know how much Menzie patronizes you (in kindness) for not bashing you over the head with that little nugget of knowledge??

I really wanna meet the sideshow freaks who hire you to do any kind of consultancy in any niche listed under the sun with the possible exception of consulting on the shape of your bodily waste immediately after you got off the crapper.

Steven Kopits: as indicated in NBER documents, and previous posts of business cycle indicators, the Macroeconomic Advisers series is used.

How confident do you feel in the monthly MA numbers?

I see Princeton Stevie boy is questioning someone else’s credentials. Of course had Stevie Boy done even the most minimal amount of research – he might have found this:

https://blogs.wsj.com/economics/2018/02/26/the-most-accurate-economic-forecaster-of-2017-macroeconomic-advisers/

“The Most Accurate Economic Forecaster of 2017: Macroeconomic Advisers

The St. Louis-based forecasting firm ranked most accurate in The Wall Street Journal’s survey of U.S. economists”

Or this:

IHS Markit acquires Macroeconomic Advisers

“We are excited to announce that we have acquired Macroeconomic Advisers, an independent research firm based in St. Louis, Missouri. Macroeconomic Advisers, widely recognized as one of the most respected forecasters of the US economy, specializes in monitoring, analyzing and forecasting developments in the US economy. They leverage this foundation to quantify various policy options considered by the new US administration, as well as perform scenario analysis to enable financial institutions to comply with an array of regulatory requirements. The combination of Macroeconomic Advisers with our own award-winning US macro, Industry, and US regional teams will allow us to provide unparalleled coverage to our clients with a special focus on policy and financial markets.”

Hey Stevie – I understand you have found zero people wanting to buy up your little policy analysis outfit. Go figure!

Pretty sure that was not his first time as top forecaster. Maybe not WSJ – I don’t care enough to check – but I recall Meyer’s firm has as history of getting major forecasts closer than anybody else.

I was speaking of actuals, not forecasts. The implication is that MA is substantially better than the Fed or BEA at actuals. Which is pathetic.

Steven Kopits: This is not a well-formulated statement. MA does nowcasts at monthly frequency, Fed might do something like that (but more likely looks at MA nowcasts, along with its portfolio of monthly indices), and BEA does not do monthly GDP (although it might eventually like UK ONS). I don’t see how one assesses “accuracy” in this context.

Let me clarify:

On Figure 1 above, the pink bold line is GDP on a monthly basis. All of the figures shown are historical, not forecasts, with perhaps the exception of July and August 2019, which are historical in the sense of being past, but ‘expected’ in the sense that BEA has not yet issued Q3 GDP numbers.

MA is showing, in effect, two micro recessions, one in Oct-Nov 2018, and another in Jan-Feb 2019. This is historical data — ‘actuals’ — not a forecast, I presume (I certainly hope). If we used instead the BEA’s quarterly GDP numbers and interpolated, then we would show GDP rising smoothly through the whole period, and accelerating from Q4 2018.

Therefore, my questions:

1. Can MA reasonably parse out historical GDP data on a monthly basis when BEA struggles to get quarterly numbers right on an advance, second and third estimate basis? Is MA that much better than BEA?

2. Does the MA number correspond to the BEA number historically, and if so, to which estimate? Are the MA numbers revised? Are the monthly GDP numbers then also revised by MA?

Steven Kopits: Do you know how to do research? You seem clueless in figuring out so much. From MA’s website:

This answers most of your questions.

As to interpolated quarterly numbers are smoother than MA’s monthly series — well of course! Interpolation of a quarterly series is necessarily going to generate smooth a series relative to a monthly series.

BEA could generate a monthly series if it wanted. See UK ONS on how it does it.

My research skills are fine, thank you.

The implication is that MA must revise its monthly numbers up to 6 months after the fact, assuming MA GDP numbers are revised in line with BEA third estimates, which appear to arrive three months after the close of the quarter.

Thus, the third estimate for Q2 is published late September for Q2, which includes the month of April. In principle, that means MA could still be revising its April GDP estimate at the end of September, if I understand this correctly. Or am I?

I don’t know. I think you either take the MA numbers with a grain of salt, or BEA looks badly in need of modernization.

Steven Kopits: I’m as confident in it as any monthly indicator. They use latest releases on components of GDP and historical correlations between real time data to “nowcast” GDP at the monthly frequency.

On some related news:

The US shale sector has been in technical recession since mid-November last year. The horizontal oil rig count is down 20% since then, and the frack spread count is down 20% since April. The data speak to a visible deterioration in operator sentiment since the beginning of September, and we calculate the breakeven to add rigs has risen to about $65 / barrel WTI, which speaks to rigs rolling off through year end.

We are currently at 624 horizontal oil rigs, and we forecast shale oil production to roll over at about 600 rigs in Q1. So things are not quite as rosy out there as you may believe, but the shale sector should be restarted during Q1, which should improve manufacturing and industrial production numbers at the price of materially higher oil prices.

This is complicated by events in the Gulf. We are currently anticipating a follow-on strike by Iran in the October 15-31 window, perhaps as late as Nov. 5. The primary target, as before, is the Abqaiq oil processing facility, with secondary targets the Saudi oil loading facilities at the ports of Ras Tanura or Ras al-Juaymah on the Persian Gulf, or possibly a product tanker loading there.

President Trump’s ‘maximum sanctions’ have substantially improved Washington’s leverage over Tehran, but are now biting too hard. Oil exports at 2.5 mbpd represent 40% of Iran’s government revenues, of which 85% go to things like welfare, pensions, healthcare, education and infrastructure. Oil exports are now in the 0.1-0.2 mbpd range, that is, down 90-95%. I think we all appreciate how infuriated we all would be if someone imposed sanctions leading to 40% across the board cuts in Social Security checks and Medicare spending. That’s where Tehran finds itself.

The Abqaiq attack demonstrates that the US has crossed a line and Iran will do what is necessary to defend its position. I do not expect material progress on negotiations in the next several weeks, hence a follow-up strike during October.

The challenge for the administration is knowing what deal to take. Clearly, Pompeo’s ’12 Points’ list is unacceptable to Tehran. But if a compromise, then what? This involves analysis and judgment from experts, or at least a willingness for President Trump to dig into the details to a level sufficient to give him confidence that he is getting ‘a good deal’.

The President has not demonstrated an appetite for listening to experts nor the willingness to expend effort to educate himself on matters of policy. Consequently, I expect the situation to continue to deteriorate with one or two follow-up strikes, after which events will start to unfold largely irrespective of White House intentions.

A US strike on Iran will cause Tehran to seek to prevent oil exports from leaving the Gulf, and all indications are that Iran can materially accomplish this goal, certainly at the horizon of say, 2-3 months. Were the volumes transiting the Gulf — 20% of the global oil supply — to be materially interrupted for more than, say, 30 days, not even strategic reserves would fully offset the loss. This would in turn create an oil shock along the lines of other conflicts in the Gulf, from the Suez Crisis, to the Yom Kippur War, to the Iranian Revolution, the First Gulf War and the Arab Spring.

I would like to say that cooler heads will prevail. Certainly, the numbers say a quick, favorable deal is available with Tehran. I don’t think things will play out that way, though. So, another strike in October, and if no response, another between Thanksgiving and Christmas. And then there will be a US response, just as US shale production is peaking out.

I have a piece coming up on this which I hope to publish in The National Interest this week. I will also send a version to my oil email list. If you want to be on it, send an email to info@prienga.com

Steven,

You are probably right that Trump is simply incapable of dealing with the details involved to actually cut a deal any time soon with the current Iranian regime. How bad alll this will get, I do not know. But reportedly the Houthis have taken three Saudi brigades Najran province, after there was supposedly a ceasefire. It certainly is likely that we shall see some more action in that area that will disrupt production or exports or both.

@ “Princeton”Kopits

Unlike some profs from the Virginia area, I don’t make concurring blog replies to racists. I’m not quite that hard up for attention yet. I did send you an email though, you can find it amongst the 3 requests you got from Barkley Junior, your Mother, and me, mine says “Suck it” in the header.

Moses,

Two things.

One is that whether you like it or not, SK does know a lot about the global oil industry. He is not always right about what is going on, in my view, but on this topic his comments are well informed generally and need to be taken seriously.

The other is that in contrast with a most of the pro-Trump crowd that shows up here, he is actually willing to admit at times that Trump makes mistakes and must not be defended at all times on all issues.

As it is, I have long had back and forths with him regarding the oil industry, something both of us know more about than most people. Sorry, if you do not like it, but your claim that I comment on his posts on the oil industry because I am “hard up for attention” is simply ridiculous. After all, Mose, you provide me with lots of attention, even if it is mostly critical and utterly unsupported by anybody at this site, much less anywhere else either.

Oh, I forgot. There was that time you were accusing me of lying about the existence of that poll in Iowa, and CoRev supported you because he was also faslely accusing me of lying, in that case about the role of my late father, J. Barkley Rosser, Senior, in the US space program. So indeed at least once somebody supported your criticisms, but it was a time when both of you were screamingly and embarrassingly dead wrong.

For the record, while I said that Steven and I know more about the oil industry than most people here, one person neither of us knows more than (maybe Steven thinks he does, but I doubt it) is Jim Hamilton, who rarely posts on it these days, but is widely viewed with good reason as probably being the world’s leading expert on the relationship between the oil industry and the macroeconomy.

steven, as you know i am a propoent of electric vehicles. a while back you were adamant that electric vehicles would not play much role in the foreseeable future. in light of basically all of the major auto companies announcing significant migration to EV platforms within the next few years, care to revise your outlook on the EV future?

I bring this up, because your note essentially reduces to an argument for why we should embrace electric and ween off of oil. there seems to be too much negative outlook for oil-both as an economic cost, environmental cost, and military cost. why should we continue to support volatility in oil? take that money and invest in EV. then you do not have so much to worry about with saudi, mbs, iran et al. i understand your job and income depends upon oil continuing as an operating entity into the foreseeable future, but as a general analyst, it seems one displays poor analytical skills if one continues to advocate oil over electric and renewables options. oil is a significant contributor to many of the problems in the world today. let’s eliminate those problems.

I have no problem with electric vehicles. Let the market decide.

Today, as for the last 120 years, EVs

– cost materially more than gasoline or diesel (ICE) vehicles

– have shorter range

– take longer to refuel

– involve substantial environmental damage in the mining, processing, manufacturing and disposal of electric batteries

But, they are more

– powerful

– reliable (except when they burst into flames)

– quiet;

– produce less local air pollution

– and they may (but it is not certain) produce less carbon dioxide

At this point, I — like the vast majority of consumers — don’t put a value on CO2 high enough to warrant the downsides of owning an EV.

Some numbers.

Based on ytd through August

– 300,000 EVs and hybrids will be sold in the US

– representing 45 models, or 6,700 per model sold for the year

– with EV and hybrid sales representing 1.8% of total US light vehicle sales

Let’s consider, say, BMW’s success in August, sales by EV model:

BMW 530e: 186

BMW i3: 385

BMW i8: 90

BMW 330e: 6

BMW x5 40e: 2

BMW 740e: 1

Total: 670

BMW total sales for the year in the US will be around 280,000 light vehicles; thus, collectively, it’s six electric models account for 2.9% of sales by volume.

Is that a viable strategy for BMW? Doesn’t look it to me.

https://insideevs.com/news/368729/ev-sales-scorecard-august-2019/

steven, you are using a small snapshot of bmw today to justify your argument. the reality is that EV sales are growing each year, at a rate that is meaningfully impactful going forward. tesla itself is approaching 100,000 cars per quarter. major us automakers are following suit.

“I have no problem with electric vehicles. Let the market decide.”

that is exactly what is going on. some of your arguments are not accurate. tesla for instance, has better range than my old crv or rdx. charging time is really irrelevant, as i can charge at home at no time loss to myself. i need to spend almost 15 minutes in costco parking lot to fill my tank with premium gas. i can pull out of the driveway with full range in a tesla every morning with no wait. and as volume continues to rise, cost will continue to drop. gas vehicles do not have that same proposition. electric vehicles provide a more seamless interaction with smart vehicles. the list goes on.

but i will reiterate, if one is simply looking at the data, any impartial analyst who still advocates for oil over electric vehicles is not really an impartial analyst, or they are a poor analyst.

Premium gasoline, eh? You are the environmentalist.

I decided to take a look at US EV sales trends, and here’s my report:

Are US Electric Vehicle Sales Peaking?

Since July, US sales of battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) have been declining compared to the same month the previous year.

Much of this is attributable to Tesla. With the roll out of the Model 3 in 2018, Tesla’s sales and market share soared, with Tesla controlling nearly 60% of the US electric car market since last summer. However, the Model 3 hit steady state sales in July 2018, and year on year sales have been negative since then. September 2019 sales of the Model 3, for example, were 9% below that of a year earlier.

Moreover, sales of the Model X and Model S have fallen more steeply, down respectively 58% and 71% year on year in September. Without a new model to capture the public’s imagination, Tesla’s sales are likely to be flat to down overall for the indefinite future.

Were other manufacturers capturing the limelight, this might not matter. Unfortunately, the collective market share of the 40+ models offered by everyone other than Tesla amount to only a bit over 40% of the market. Moreover, the non-Tesla market has seen sales below those of 2018 for every month since February, and down by about 20% on average. There is no indication that some great breakout is on its way.

Unless EVs can dramatically reduce their cost and substantially increase their range or reduce their recharging time, the US electric car market looks to be peaking — at under 2% of US light vehicle sales.

Graph on blog post.

http://www.prienga.com/blog/2019/10/2/are-us-electric-vehicle-sales-peaking

Sorry, the email list address for the oil stuff is whathappensnext@prienga.com. My fault.

Steven

While not a huge player, the Leftist have done their job in Colorado. Completely ignoring the voters who voted down denying a referendum designed to cripple the oil and gas industry, the radical democrat Legislature and Governor proceeded to use legislation to invoke an even greater hit on the industry. Already rig count is down almost 25%, since the new legislature new law became likely. But possibly more telling, just last month this statistic became public knowledge.

“Permit approvals this week were down by 198 compared to last week, for total US approvals of 790. Permitting was down in virtually all basins; the largest single move was in the DJ Basin, down 243 to zero this week.” Bold mine.

From OIL 05 Sep 2019 | 21:32 UTC Houston

US oil and gas rig count falls, Permian takes biggest hit: Enverus DrillingInfo Autho Starr Spencer

For those who don’t know DJ is the Denver-Julesburg Basin, the biggest and most important oil and gas production area in Colorado. Perhaps it is just a blip, but I don’t think so.

Ed

Ed –

The rig count in Colorado, materially included in the DJ Niobrara line below, has not dropped much more than elsewhere in the country. Perhaps one can impute some of the reduction to changing regulations there, but it does not leap off the paper otherwise.

Change in horizontal oil rig count for this cycle starting Nov. 16, 2018

Rig Change Percent Change Pct of Rigs Lost

– Williston 0 0% 0%

– Permian -60 -14% 38%

– Eagle Ford -14 -20% 9%

– DJ Niobrara -7 -25% 4%

– Cana Wdford -21 -36% 13%

– Other US -57 -43% 36%

– Total -159 -20% 100%

– Shale Rollover -183 -23%

My sense is that they are holding up permits pending the implementation of the law.

Doesn’t seem to be a tragedy for the moment as the operators have stockpiled permits through 2020.