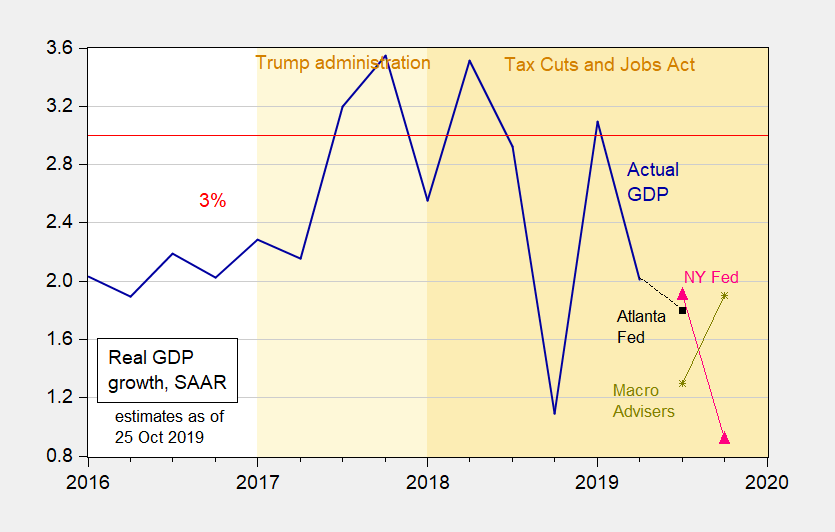

The nowcasts indicate slowdown.

Figure 1: Quarter-on-quarter output growth as measured by GDP (dark blue), nowcasts as of October 25, from Atlanta Fed (black square), NY Fed (red triangles) and Macroeconomic Advisers (chartreuse *), all SAAR. Source: BEA, Macroeconomic Advisers, NY Fed, and Atlanta Fed.

Where are things likely to land, with next week’s GDP release? Deutsche Bank reports:

Source: Luzzetti et al. “Tracking the GDP trackers,” US Economic Perspectives, July 24, 2019.

The path of the Atlanta Fed error makes sense, but seems to be the outlier – what could explain the paths of the other forecasts?

There is a good article on line at the WaPo on the impact of tariffs on the domestic steel industry. It substantiates the point here about growth decelerating. I’m not sure if we are on recession watch but clearly there are some parts of the economy that are not robust.

https://www.washingtonpost.com/business/economy/as-a-kentucky-mill-shutters-steelworkers-see-the-limits-of-trumps-intervention/2019/10/25/a27d3bb2-f02f-11e9-89eb-ec56cd414732_story.html

A. G.

Did the WAPO article mention this:

https://www.prnewswire.com/news-releases/nucor-to-build-new-plate-mill-in-kentucky-300819673.html

Same state, brand new 1 billion dollar mill. Still tough for the people at the AK mill but the hand writing been on the wall there since 2015 when its blast furnace closed permanently.

Ed

Hey Ed – are you a Nucor shareholder? If so – your portfolio has lost a bit over the last 4 years!

https://finance.yahoo.com/quote/NUE/

As of this morning, there’s more evidence of slowing. Recession? Not yet.

You are wrong. the ISM manufacturing index has been sub=50 for two months in a row with Sept being 47.8. This is a harbinger of recession for the last…70 years!. Also, The treasury curve had inverted in late-summer. Also, the same happened in the summer of 2007.