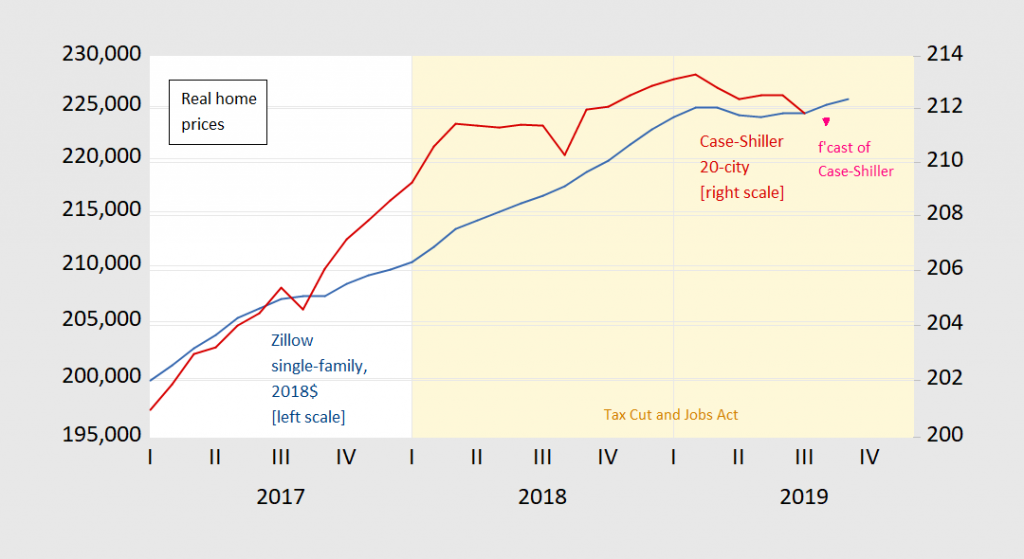

Case-Shiller August prices come out next week. For now, we have Zillow prices through September, and Zillow forecast. Here are the CPI deflated prices.

Figure 1: Zillow single family home prices (blue, left log scale) in 2018$, Case-Shiller 20 city home prices (red, right log scale), Zillow forecast of Case-Shiller based on Zillow prices (pink triangle, right log scale), all deflated by CPI-All. Source: Zillow, S&P, BLS, and author’s calculations.

FRED reports a nominal price index from January 2000 to July 2019:

https://fred.stlouisfed.org/series/SPCS20RSA

S&P/Case-Shiller 20-City Composite Home Price Index (SPCS20RSA)

Before any of the Usual Suspects whine about showing the inflation adjusted index only for a couple of years, maybe as a public services – could you do your inflation adjusted graphs back to 2000?

open to critique, but here’s the index divided by cpi from fred

https://fred.stlouisfed.org/graph/?graph_id=625453

Rocky Shores: Just a note: the FRED series is all-city, while what is shown in this post is 20-city index.

Duly noted. But he took what I put up there. Still it is interesting to note that this inflation adjusted series is 40% higher than it was in 2012.

understood. thank you much!

Thanks for taking the nominal series I pulled off of FRED, which shows a 57% increase since early 2012. The inflation adjusted increase was 40%.

“Here are the CPI deflated prices.”

Yikes – just saw this. So the graph was already inflation adjusted. NICE!

Trump just said that his impeachment would lead to a depression. God – what a pathetic blow hard.

Sure it will. It will lead to a depression in Little Lord Trump-leroy’s fake bankroll. Cut the man some slack.

Maybe it will cause all of his orange hair to fall out. Which would be an improvement.

toupes do not fall out, they simply fall off

A new one – Trump is withholding trade deals until he gets to import dirt on the Bidens from Ukraine:

https://talkingpointsmemo.com/news/trump-administration-ukraine-trade-privileges-withheld-aid

The Trump administration’s United States Trade Representative reportedly withheld his recommendation to reinstate some of Ukraine’s trade privileges with the U.S. in late August, the same time when President Donald Trump had frozen military aid to Ukraine. An unnamed administration official told the Post that Bolton “intervened with Lighthizer to block it,” though the Post could not confirm whether Trump had ordered Bolton to do so. “It was pulled back shortly before it was going to POTUS’ desk,” the official said. Bolton reportedly told Lighthizer that Trump would likely oppose anything that would benefit Ukraine. Lighthizer had recommended that the President restore some of Ukraine’s exports to duty-free status, a benefit that was suspended in 2017 due to U.S. concerns over intellectual property rights violations in Ukraine. Lighthizer reportedly made another effort to submit his recommendation in early October, only to withdraw it again on October 17 amid the growing House impeachment inquiry into Trump’s efforts to push Ukraine for political assistance.

As the saying goes: location, location, location. https://www.fhfa.gov/DataTools/Downloads/Pages/HPI-MSAs.aspx#HPIAnalysis

Key Findings of the Quarterly HPI

“House prices in the second quarter increased by 5 percent compared to a year earlier, contributing another quarter of growth to an eight-year run. Prices increased in all states and among the top 100 metro areas. The pace of home price increase, however, has continued its deceleration for the fifth consecutive quarter. The pace of home sales has also slowed over the last two years in response to market conditions, including affordability constraints and tight inventories. As of July, inventories of homes for sale are currently below both 2017 and 2018 levels…

Just “eyeballing” the deflated price chart (ending at the 2nd quarter), it looks somewhere in the neighborhood of a yr/yr increase of 1% which, if the 20 markets were representative of the nation, would mean an inflation rate of 4% (which I’m pretty sure didn’t happen).

Bruce Hall: The FHFA index includes only houses financed/mortgages securitized via Fannie Mae/Freddie Mac.

So Bruce Hall provided evidence that government financing leads to more home owner equity. This should get Bruce fired by the White House. Oh well – time to make sure he can survive on the government dole!

You emphasized the “good” news so let me repeat the part you wanted us to ignore:

“The pace of home price increase, however, has continued its deceleration for the fifth consecutive quarter. The pace of home sales has also slowed over the last two years in response to market conditions, including affordability constraints and tight inventories.”

BTW Brucie boy – that 5% was a NOMINAL increase. Rocky Shores could help you out doing this in inflation adjusted terms. Then again – maybe we should let Rocky do more productive things as we have seen you do not get nominal v. real.

Wow just went back to the nominal series I provided and the % nominal increase was more like 2.5% not Brucie boy’s cherry picked 5%. And if you look at the graph Rocky Shores so kindly provided us, the inflation adjusted series has been virtually flat for the last year. Yea – inflation has not been zero.

But shhhh – don’t tell Brucie. It will only confuse the poor boy. And if Trump learns that he has stumbled onto reality even as he tries dishonestly to suggest the Trump housing market is soaring, Trump will have to fire Brucie the sycophant. And then we will have to subsidize his life style with our tax dollars!

One other thing about the series I linked to. It rose by over 42% during Obama’s last 5 years in office but it has risen by less than 11% since Trump took office. Yea I know the 42% is a nominal increase – which is how Bruce “no relationships to Robert” Hall likes to measure thing so again thanks to Rocky for doing this in inflation adjusted terms. Still an impressive real increase.

Now Trump sycophant Bruce might still cheer the 11% nominal increase in less than 3 years (still a slow down as his own little source) notes. But of course both Menzie’s and Rocky’s graphs show that inflation adjusted housing prices have not risen since Trump took office. Of course Brucie will once again fail to understand the difference.

Bill McBride at Calculated Risk is the expert on this topic.

See his slide deck at this post. It’s excellent.

https://www.calculatedriskblog.com/2019/10/my-slide-deck-2020-economic-forecast.html

Bill has a nice blog but “the expert on this topic”? Come on Stevie – that is absurd. OK Bill is 100 times smarter than you but that does not make him “the expert”.

https://www.zerohedge.com/economics/three-things-i-learned-washington-central-bankers-arent-sure-what-believe-anymore

Tyler Durden is your new guru on monetary economics? I did not think you could get more stupid but you just proved me wrong.

Trump’s DC hotel is for sale. The cash cow will die once Trump is out of power and there is no reason to curry favor with him. A little insider trading, perhaps?

One would think that the potential bidders will take into account that this “cash cow will die” when making offers for this property. Maybe the Federal government should just seize it to pay all the legal bills to clean up the corruption of Trump’s one term in office.