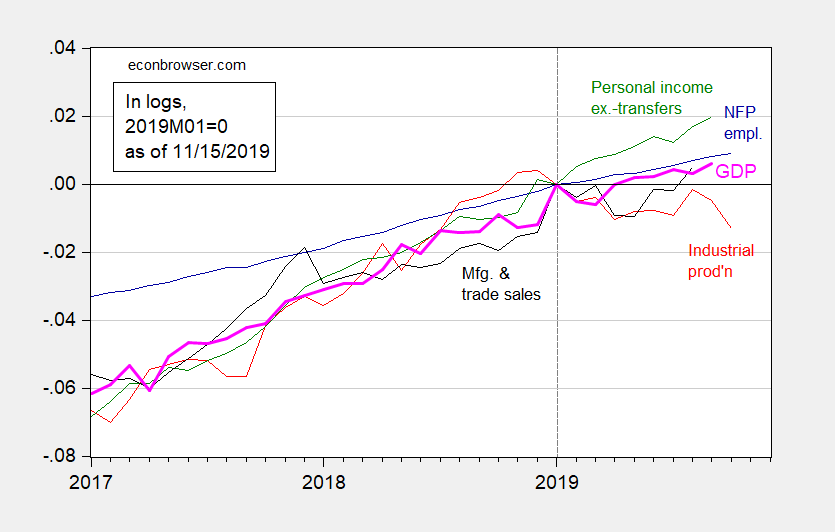

With industrial production continuing its dive in October, we have a mixed picture of economic activity.

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M01=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (10/28 release), and author’s calculations.

https://fred.stlouisfed.org/series/INDPRO/ (use slider to view back to 2000)

It would appear that the decline in IPI is fairly negligible compared with the “great IPI recession (-17%)” of 2008-09 and the “lesser great IPI recession (-5%)” of 2015… and less than 2% off its all-time high in December 2018.

https://www.finanznachrichten.de/nachrichten-2019-11/48193435-u-s-industrial-production-slumps-due-to-strike-at-gm-020.htm

So, while there may be cloudy skies in the IPI forecast, it’s only partly cloudy now.

You are comparing the decline in “IPI” before a possible recession to the decline during the Great Recession. Look Brucie Boy – we all know you are beyond stupid. But this comment of yours is beyond the pale. Stop working so hard as you won Stupidest Man Alive a long time ago.

Bruce Hall: At beginning of last recession, y/y industrial production growth was +2.2%.

Before Bruce gets into the forecasting business, he needs assistance of being able to properly read historical data.

pgl, waiting for your specific forecast. Waiting… waiting… waiting. Oh, just snarky meaningless comments? Figures.

I never advertised I was in the forecasting business. As Clint Eastwood would say “a man has to know his limitations”. Of course if you took his advice you’d stay in the sandbox with the other preK kids.

Menzie, Bruce Hall: At beginning of last recession, y/y industrial production growth was +2.2%. … and the point of bringing up IPI in Figure 1 is???

If you truly believe that IPI is not a significant indicator of economic activity or possible recession then what is the purpose of including it in the post? I’d have to agree that IPI is not necessarily an indicator of an imminent recession by itself as shown by the 2015 drop of 5% not accompanied by a recession.

So, my takeaway is that, for forecasting purposes, this is a nothingburger. As I wrote in my comment (to which pgl felt compelled to troll), “So, while there may be cloudy skies in the IPI forecast, it’s only partly cloudy now.” . I know the anti-Trump trolls like pgl are hoping beyond hope there will be a significant economic decline in the next 6-8 months, but the data don’t show much more than a slowdown in growth. https://www.conference-board.org/data/bcicountry.cfm?cid=1 That’s happened a few times since 2010.

Is there a possibility of recession before the middle of next year? Sure, anything is possible. Are the tea leave predicting it? They’re still in the teabag.

Bruce Hall: I mentioned IP along with 4 other indicators because those are key indicators that the NBER Business Cycle Dating Committee has looked at. The graph includes those 4 other indicators. What I am suggesting is that we look at IP in context; I agree that as of October 2019, sure doesn’t look like we are *in* a recession. But, given the data get revised, we should be circumspect. Signed — a guy who was on CEA staff in March of 2001.

Remember – you are talking to Single Statistic Bruce “no relationship to Robert” Hall. So I call it being no fair to confuse Brucie with 5 indicators.

I’m wondering why this bastard doesn’t go immediately to jail. Again, if you’re in the golf playing set your sentencing and punishment can just be “whenever”. Wait for the mild wrist slap on the sentence as well, as the judge has already shown she’s a joke and is more interested in protecting the perpetrators than protecting the public form further abuse by similar criminals. When you account for “good behavior” in prison (if he even visits), Stone won’t get 5 years even. Stone never took Jackson serious, and now it’s obvious why:

https://www.theguardian.com/us-news/2019/nov/15/roger-stone-guilty-verdict-wikileaks-hacking-case-latest-news

Chinese call it a “turtle egg”. Shall we call him Roger Turtle Egg from now on?? Join my movement.

Bored and tired of the donald trump clusterF—??

Plenty of weekend reading here (though some may be on the dry side, but can help you as a consumer knowing how products are made and some that might be dangerous to your family):

https://twitter.com/ZivaBranstetter/status/1191715154125295616

It’s a very good time to keep yourself well-read on product safety (buying things for your children for Christmas, etc) when you have a creature like donald trump choosing product safety and food safety agency heads. They don’t care if your children die from using a faulty product, so you are the only line of defense for your family, friends.

Well, I kept looking super thoroughly for Barkley Junior’s name in the list of presenters and his research paper “Why Low Capital Ratios at Banks Are Cool, and Minimum Capital Requirements Are Bad” (And Other Tales of How a Doddering Old Man Got Love and Attention from Bankers”. Hmmmm, well it could have been lost in the mail. Probably.

https://ec.europa.eu/info/sites/info/files/business_economy_euro/events/documents/finance-events-191112-programme_en.pdf

https://www.bloomberg.com/news/articles/2019-11-12/bankers-rev-up-lobbying-against-149-billion-capital-rule-in-eu

From the Bloomberg story written by Silla Brush and Alexander Weber:

But banks shouldn’t necessarily get their way, according to Andrea Enria, chair of the supervisory board at the European Central Bank, who called on lawmakers to implement Basel faithfully.

“European legislators must stand up to national interests and the lobbying of some banks,” he said in his conference speech. “When you are building something that is supposed to withstand earthquakes, you should not opt for cheaper materials in the final stages of your construction work just because your budget is getting tighter.”

Aaaaaahh!!! What the hell does Andrea know?? He’s not a banker and only bankers can tell us how they themselves (bankers) should be regulated. When children start vomiting from too much Halloween candy I take them by the hand to the nearest toilet bowl and I say “regulate yourself, ok??” and that one works for all good parents/guardians. I learned it from Barkley’s infamous “Just Regulate Your Own Damned Selves” manifesto on bank capital ratios. Written shortly after his epiphany that bank funding shortages over multiple months (some of them not happening at the end of the month, but closer to mid-month) are a “liquidity” problem, and not a funding problem. I’m just here to learn people.

Oh gag, Moses, your obsession with trying to prove me wrong on something is becoming an absurd public spectavle.

Did I ever say that the Basel III Accords capital requirements for large banks are a bad idea? No, I did not. You are unable to read,. I simply reported that some observers think they played a role in the repo ruckus that happened in mid-September. Note that this ruckus did not cause any serious problems as the Fed moved to intervene in those markets to stabilize them, and, as I have noted continues to do so, which is fine with me, and as I also reported, with bankers I have spoken with, one of them a former student.

You were the one who suggested that the repo ruckus was somehow connected to current capital requirements being too low. As I noted, that was arguably a problem back in 2007-08, but not now, in part due to the Basel III Accords having come on line (only as of March 2018 in the US actually). It remains the case that having lower capital requirements makes it easier for banks to get liquidity, and whatever was really the source of the repo ruckus, it was whatever was driving an apparent liquidity shortage among banks, especially large ones. That is completely consistent with those large banks running up against the tightened capital requirements from the Basel III Accords, not the completely silly and incorrect theory you pushed of this somehow having something to do with capital requirements being too low.

So, face the fact that you massively screwed up on this, and this stupid post by you simply reconfirms it. However, this is not quite as stupid as your constantly bringing up how you think distributions on genomes must be identical to distributions on populations, which is as I have noted before is at about the level of bragging about how you have revealed to all the readers here that I have not yet figured out that 2+2=5 as you wisely know to be the case.

Really, Moses, this stuff is about that bad. Get it together before your alma mater retracts that finance degree you supposedly have.

You DO realize that by confessing that I made you gag, you’ve made my entire weekend.

You still owe me a public apology for lying about me here, Moses. That has not been forgotten. Until you do that, you can gag all weekend long and more. You are just moral scum.