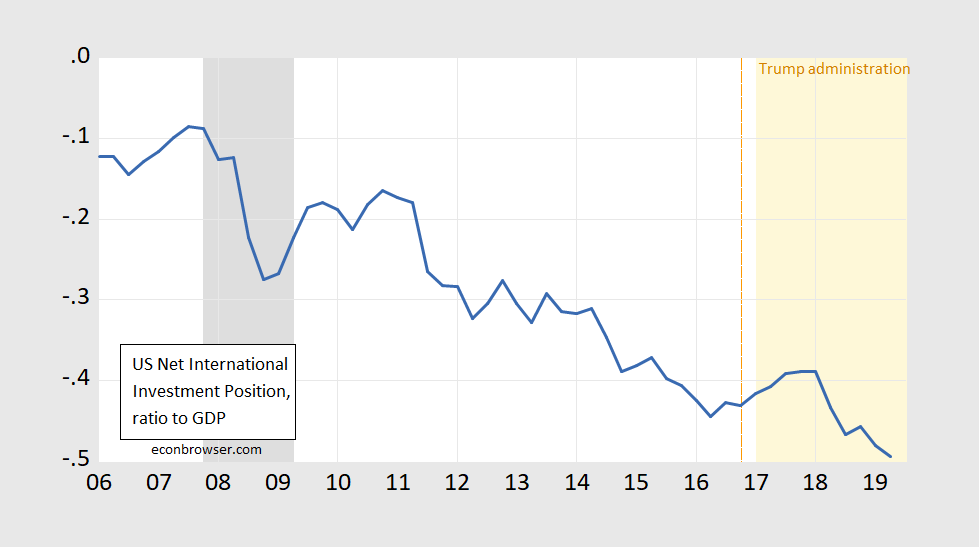

NIIP is the difference between US holdings of assets abroad, minus foreign holdings of US assets. Shown below is the ratio of NIIP to GDP.

Figure 1: US Net International Investment Position ratio to GDP (blue). NBER defined recession dates shaded gray. Light orange shading denotes Trump administration, orange dashed line denotes election. Source: BEA via FRED, NBER, and author’s calculations.

Two big events from yesterday:

Trump’s attempt at Twitter intimidation totally backfired:

https://talkingpointsmemo.com/news/trump-advisers-reaction-yovanovitch-attacks

It seems the GOP talking point about hearsay evidence motivated David Holmes to put the nail into Trump’s coffin:

https://talkingpointsmemo.com/edblog/the-holmes-prepared-testimony-is-a-way-bigger-deal-than-expected

Is utter stupidity also an impeachable offense?

NIP is indicative, but not completely unambiguous. If all that foreign capital inflow is earning a low return but is financing domestic investment with a higher return than US firms could earn abroad, it could still be a good thing.

Thaomas: Agreed – in fact I don’t want to claim increasing indebtedness is necessarily bad. What is true is that we *are* becoming more indebted to the RoW, despite the fact that net income is positive. But I think over time the “hedge fund” aspect of the US NIIP position is becoming less pronounced. And in any case, I think that Mr. Trump promised we were going to have a better deal with the rest of the world, which I would’ve thought would imply a change in direction for the NIIP.

Imagine if some reporter asked me if what Trump was (this is one of those multiple choice questions)

a) Quid pro quo

b) Bribery

c) Extortion

d) Treason

The correct answer of course is (e) all of the above.

Then again the Republicans are playing word salad as in “no collusion”, “no quid pro quo”, “hearsay”, which has only one rebut – BS!

Negative 0.5 times U.S. GDP is approximately $10 trillion. I wonder if this is the number Trump mentioned in Manhattan as to all the net wealth he has created. Oh wow – we are increasing the net wealth of the Chinese and Germans!

What scares me is we might be helping Canada.

https://www.youtube.com/watch?v=9ATnaiimixM

Bunch uh damned barbaric savages!!!!!

https://www.npr.org/sections/thetwo-way/2015/10/15/449011872/ken-taylor-canadian-envoy-who-hid-americans-during-iran-hostage-crisis-dies

https://www.historians.org/about-aha-and-membership/aha-history-and-archives/gi-roundtable-series/pamphlets/em-47-canada-our-oldest-good-neighbor-(1946)/what-was-canadas-role-in-world-war-ii

https://www.historians.org/about-aha-and-membership/aha-history-and-archives/gi-roundtable-series/pamphlets/em-47-canada-our-oldest-good-neighbor-(1946)

At least 42,000 Canadians died during WW2, often fighting alongside American troops. It’s worth noting that then, as now, Canada’s population was lower than America’s, so the percentage of men dying as a proportion of the overall population, 42,000 would represent a much larger hit than the same number for American deaths. Now Cadet Bonespurs of the orange leathery skin wants to argue about milk trade.

Menzie,

Is it not still the case that the US position regarding international capital income is a surplus, even as the net foreign indebtedness continues to expand? It would seem that the solution to this paradox is that US investors abroad are getting much higher returns than foreign investors in the US, many of whom are parking money here for “safety” rather than gaining a high income return.

I keep waiting for that rising net foreign indebtedness to lead to a deficit on our international income flows, but it seems that day has not yet arrived.

What Barkley is suggesting is one of the explanations for “dark matter”. My two cents from May 2, 2105:

http://econospeak.blogspot.com/2015/05/dark-matter-or-base-erosion-profit.html

A week later I wrote on the Chinese flip side of this coin (Dark Antimatter):

http://econospeak.blogspot.com/2015/05/chinas-dark-anti-matter.html

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 4.1. Foreign Transactions in the National Income and Product Accounts

Line 9 gives income receipts on assets, which was $1170.3 billion per year as of 2019QII

Line 25 gives Income payments on assets, which was only $856.3 billion per year as of 2019QII

The Dark Matter puzzle persists!

Barkley Rosser: Yes, it’s still the case. Mostly it’s because of a differential rate of return on FDI, with US FDI usually more mature with higher returns, than foreign-sourced FDI in the US.

Thanks, Menzie. As I suspected.

Is it fair to say based on my comment history I am one of the last people to defend donald trump?? Menzie (in his usual thoroughness) gives a long backview there on the data. I think we could draw a pretty straight trend line through that, yes?? Now one can argue donald trump promised to fix that or has done nothing to rectify it, and I might be on board for those arguments, but the graph seems consistent.

I’m only doing “eyeball” here, which is a pretty inept way to do these things, but “eyeballing” it the 2011 year seems about as drastic a drop as we are seeing now. Again, I am not arguing we shouldn’t be concerned about this, or that actions couldn’t be taken to make it better.

This seems to be a pretty great breakdown on some of the “why?” here, with at least one reference to a great paper. This could help many in understanding what is happening here, and the extent to which Americans should be (they should be) worried about it. The VOXeu author is located in Amsterdam so arguably in the political aspect he has no dog in this hunt:

https://voxeu.org/article/external-debt-us-no-cause-concern-yet

Before senior citizens of the Virginia region with too much time on their hands cry out for attention, the post is dated 2017, but it seems the majority of the argument still holds.

Uh, Moses, I am the first person here to comment on this, asking Menzie if indeed it is still the case (which seems to be so), and also wondering what he thinks of it, while posing a possible explanation. Still waiting for his comments on this.

This is something I have also posted on Econospeak occasionally about in the past, well before this 2017 paper you linked to, but had not looked at if for awhile. Situation seems basically the same as it has been for a long time. This paradox, “dark matter” as pgl colorfully calls it, long predates Trump.

The canonical reference is Hausman and Sturzenegger, Economic Policy (2007):

ungated: https://www.hks.harvard.edu/sites/default/files/centers/cid/files/publications/faculty-working-papers/124.pdf

Menzie, aren’t you being unfair, not recognizing that Barkley Junior was the first person to mention it “here”?? Where’s your sense of significance and gravitas?? Really Menzie…..

I read just now the Sturzenegger was the head of Argentina’s central bank for awhile. I bet that was a belly laugh a day.

Moses Herzog: It is true that Barkley Rosser was first to mention this “dark matter” issue on this thread/post. This is notable because “dark matter” has not been in the economics Zeitgheist, as Sturzenegger remarked to me last time we talked.

And yes, Sturzenegger’s time at the Argentina central bank was *something*…

William Buiter had an interesting take on the original Dark Matter paper:

https://willembuiter.com/dark.pdf

“Dark Matter or Cold Fusion”

This paper caused a bit of a stir between the original authors of Dark Mark and Buiter – part of which was captured here:

https://economistsview.typepad.com/economistsview/2006/02/debating_dark_m.html

My two cents on this was sort of a 2015 update. It would be interesting if someone did a 2019 update.

@Menzie

I think that Hausmann and Sturzenegger’s moniker is very appropriate, so don’t get me wrong. But isn’t it kind of funny that “dark matter” could be perceived as an ominous term by many, and yet for Americans it should cause a certain level of mental comfort. Although as you pointed out in your “hedge fund” aspect description it could be a false sense of comfort over time. A person could even say it’s a concern “hanging over our head” if that phrase doesn’t sound too archaic. I’m thinking the strictest definition of “dark matter” is just the amount of assets not captured in the statistics. But Boonstra seems to indicate that difference in rate of return is almost the bigger factor here:

“The large share of relatively high-yielding investments in US international assets on the one hand, and the large share of low-yielding categories in its liabilities on the other, explain why the US has a positive balance of primary capital income. It receives more in dividends and profits on its investments abroad than it has to pay on its (lower-yielding) external liabilities.”

With the value of the dollar playing a bigger role over time (Boonstra again):

“a huge part of US external liabilities is denominated in dollars, while substantial parts of its foreign assets are denominated in foreign currencies. This means that when the dollar decreases in value, the US gains on its foreign assets, while the value of its foreign liabilities, expressed in dollars, is more or less unchanged (see Figures 5 and 6). As a result, its NIIP improves. On the other hand, a stronger dollar has a negative impact on the US NIIP. As a rule of thumb, a 10% depreciation of the US dollar results in an improvement of the US NIIP by $1,000 billion. This means that the moment that markets start to worry about the US debt position, which may result in a weaker dollar, the problem for the US more or less solves itself. The rest of the world, of course, experiences a decline in value of their US assets.”

Moses Herzog: I suppose if we think of “dark matter” as not being perjorative in astrophysics, one should interpret analogously for international finance.

Thanks to both Menzie and pgl for their useful links to classic articles and commentaries involving a variety of complications regarding this issue, with some of these pointing out how some of this data may remain “dark matter” due to lack of public reporting of the values of many assets, especially in some nations abroad, among other things.

I appreciate Menzie noting the latest data on these balances, which are continuing to accumulate, with this some day leading to a move to deficit on the income flow account (actually part of it is in deficit, the secondary income part, while the primary part is in surplus and outweighing the secondary part in the data I looked at).

As it is, worryiing that mounting foreign US net indebtedness might bring about a major crisis has been around for quite some time. I remember that in the years before the housing crash did us in, many focused on this matter, one of them very publicly being Brad DeLong, with whom I had discussions about this. I switched to worrying about housing before he and some others did, but I was in fact in print as late as 2004 making a big deal about “excessive consumption” by Americans compared to foreigners associated with our chronic current account deficits and mounting net foreign indebtedness, even as I noted then then that the dark matter was offsetting this for the time being on the income side of things. I am kind of amazed that this is still the basic state of affairs.

To Moses: when are you going to figure out that putting lots of words into bold does not add anything to the clarity of what you are communicating, and absolutely does not make you look more knowledgeable or intelligent? Quite the contrary, it just makes you look like you are hysterically shouting.

The Republican sycophants keep saying the case for impeachment is “crumbling” but it seems as each witness give his or her deposition, the case for impeachment is getting incredibly strong.

https://talkingpointsmemo.com/news/sondland-carried-out-secret-ukraine-dealings-on-trumps-orders-wh-official-testified

‘Sondland Carried Out Secret Ukraine Dealings On Trump’s Orders, WH Official Testified

National Security Council aide Tim Morrison testified that Ambassador Gordon Sondland had told him he was carrying out the shadow negotiations with Ukraine over the delayed military aid on President Donald Trump’s orders, according to a newly released transcript of Morrison’s testimony. During Morrison’s closed-door hearing earlier this month, the official confirmed to House impeachment investigators that Sondland had told Ukrainian officials that military aid to Ukraine was incumbent on Ukraine announcing an investigation into Burisma, a gas company with ties to Joe Biden’s son, Hunter. Morrison testified that Sondland had briefed him on a conversation he had had with Andriy Yermak, Ukrainian President Volodymyr Zelensky, in which Sondland told Yermak that “what could help them move the aid was if the prosecutor general would go to the mike [sic] and announce that he was opening the Burisma investigation.”’

It would seem to me that this case is closed. Guilty as charged!

“It would seem that the solution to this paradox is that US investors abroad are getting much higher returns than foreign investors in the US”.

Barkley’s correct observation stands in direct contrast to the PeakTrader whining about how the Chinese are stealing our IP supposedly. Americans are doing quite well in terms of getting returns on their investments abroad whereas foreigners investing in the US not so much. If this Trumpian demand on the Chinese were to become reality, I guess we would have even more Dark Matter. Of course, that could finance a never ending merchandise trade deficit. I wonder if the economic nitwits in the White House even get this?

Just curious… how much of this effect could be attributed to lack of confidence in RoW investments versus increasing attractiveness and confidence in investing in U.S.? The World Bank data show EU hasn’t done particularly that well since 2008; China’s growth is gradually slowing. https://news.sky.com/story/worrisome-growth-slows-for-chinas-economy-11838213

If the U.S. is increasingly seen as a better investment than the RoW, wouldn’t foreign investment increase here? And couldn’t that also mean that U.S. firms are investing more in the U.S. than they might have if conditions were better in the RoW? And if the RoW offered better investment opportunities for U.S. firms than investing at home, wouldn’t the appreciation of the dollar have accentuated that since U.S. firms were investing with cheaper foreign currency … rather than what has actually happened?

And wasn’t that really Trump’s goal: bring more investment and jobs to the U.S.? Ronald Reagan and George H.W. Bush used the MAGA slogan so it wasn’t something new with Trump. The notion that it was racist rather than provincial (nationalistic) in nature has been a general misreading of intent. The nationalistic interpretation would then let us conclude that Trump is succeeding… at least with regard to investment in the U.S.

Bruce Hall: Balance of payments accounting as I learned it and as I teach it would — if your thesis is correct — have financial capital flows in the form of FDI and portfolio equity increase, and in general non-official capital flows to US increase. The opposite is happening. Just sayin’.

Menzie, and yet FDI may and does take the form of building facilities and employing people in the country of investment.

So, how is my contention that FDI in U.S. does not lead to business investment and jobs? If your contention that FDI is not increasing in the U.S., then how are U.S. liabilities increasing overall? I can’t really tell from a net investment chart. Are RoW investments in U.S. decreasing, but U.S. investments in RoW decreasing even more so the U.S. position becomes more negative? And what are the specifics of FDI in the U.S.? Are foreign investors simply buying real estate and land and not contributing to U.S. growth or are they investing in businesses and production of goods?

So, when you say “The opposite is happening. Just sayin’.”, I’m not sure what you are “sayin'”.

“So, how is my contention that FDI in U.S. does not lead to business investment and jobs?”

One of the big complaints students rightfully have about economic lectures is it is all theory with no applicability to the real world. Well yea if we are talking about some 4th rate school’s economic classes. Never mind you would likely flunk such a course but never mind.

Most real economists know they have to deal with the real world and actual evidence. And this is evidence is abundant at least for the US economy. And anyone with half a brain could go to FRED and find out that investment has not surged. Of course your half brain rotted a long time ago.

“I can’t really tell from a net investment chart.”

This is SO Single Statistic Bruce! And yet you were the friggin moron who wanted to define the value of a firm as its assets with no consideration of of its liabilities as in your stupid Gross Value nonsense. Lord – you just make up $hi# as you go.

“And wasn’t that really Trump’s goal: bring more investment and jobs to the U.S.?”

Nothing in the data – absolutely nothing – suggests any alleged increase in U.S. investment or jobs. Of course you would not know that as it involves international macroeconomics. Definitely not your forte. One might wonder what caused you to write such an absurd comment but then we all know what your forte is. Trump cheerleading 24/7!

https://www.businesslogs.com/policies/impacts-foreign-investment-us-economy

Yes, there were caveats in the article, but Menzie’s chart appears to be indicating that foreign investment in the U.S. (liabilities) continues to exceed U.S. investment in the rest of the world (hence a negative position for the U.S.).

https://www.cnbc.com/2017/12/19/tax-bill-includes-an-incentive-for-u-s-companies-to-invest-in-foreign-manufacturing.html

So, I agree with you that nothing in the data (from Menzie’s chart) would indicate an increase in FDI in the U.S. (as it could simply indicate U.S. investment elsewhere falling off, but it is likely that is not the case with the advantage of a strong dollar).

However, I’d be open to your explanation.

A.T. Kearney? Seriously Brucie – I would hurt my sides laughing if I had to read these hacks garbage. Do you have a talent for finding the most discredited intellectual garbage on the fact of the planet of what?

Bruce Hall thinks Joseph LaVorgna is some sort of credible economist. Youtube has 3 minutes of this dude:

https://www.youtube.com/watch?v=C6ESckDCk7U

If you listen to this 3 minutes of babbling and have no clue what he is talking about, trust me. Neither does Joseph LaVorgna. It would be nice if Bruce Hall had the intelligence not to waste our time with the BS. But no – Bruce Hall is really so incredibly stupid that he actually thinks that this worthless babble means something.

“However, I’d be open to your explanation.”

Joseph LaVorgna’s babbling is a lot like yours. Go figure. Dude – I have given you my explanation for the weakness in investment demand as well as the fall in net exports many times. So has our host. It is not my fault you are too slow to follow VERY SIMPLE logic. No I’m not wasting my time responding to incoherent babble from your completely worthless “sources”.

Bruce Hall: The stock of FDI in the US is increasing; the flow is decreasing. See new post.

Only Single Statistic Bruce “no relationship to Robert” Hall could see an increase in our nation’s net foreign indebtness position as somehow meaning real business investment is soaring under Trump. He is one confused dude as his most recent intellectual blunder – that being thinking any increase in assets equates to an increase in net wealth as if he never even heard of the possibility that debt could be increasing. Of course, one can directly observe things like ‘Net domestic investment: Private: Domestic business’ ala something totally foreign to Brucie – RESEARCH which FRED makes easy:

https://fred.stlouisfed.org/series/W790RC1Q027SBEA

Most people would look at this chart and note this series is declining right now. Of course Brucie boy will don his Trump cheerleading skirt and turn himself upside down so he could pretend it is rising.

I think we need a course in basic international accounting for dummies give Bruce Hall’s latest GO TRUMP rant.

Net International Investment Position (NIIP) = “the difference between US holdings of assets abroad, minus foreign holdings of US assets” to quote our host. This is a stock variable that shows how much we are in debt to the rest of the world. The current account is a flow variable which can be seen as hevolves over time. Of course since the St. Reagan tax cut combined with defense spending boom back in the early 1980’s, we have had mostly current account deficits which surprise surprise has meant rising indebtness to the rest of the world.

Back in the early 1980’s some of the dumber Reagan supporters started talking about the alleged flip side of a current account deficit in that investment demand exceeded national savings. Wonderful for long-term economic growth. Except for one thing – the fiscal folly of St. Reagan lowered investment demand. You see – it lowered national savings even more. And the current account = the difference between national savings and investment.

We see that Bruce Hall is equally as stupid as the really dumb Reaganites. He sees a current account deficit (maybe he doesn’t as we all know he confuses stock and flows but anyway) and thinks we are having an investment boom. Yes, the current account deficit has gotten worse but we are not seeing an investment boom as once again national savings has declined from the Trump fiscal folly.

I would have thought after all the nonsense from the macroeconomic debates under St. Reagan that we would never see such stupidity ever again. But Bruce Hall has proven me wrong.

It use to be standard practice for a US multinational making a direct investment in a country to borrow in that currency to finance the capital spending. That way they would balance their foreign assets and liabilities so that currency swings or other shocks would have a zero impact on their

balance sheets. But the returns on the foreign plant or other assets would keep growing while the size of the offsetting debt would remain stable or contract. I’ve long thought this was what was behind the “dark matter” but I have never seen anyone bring the issue up in discussing “dark matter”.

So I was never sure if I was really on to something or not.

spencer,

That would depend on the relative changes in exchange rates between that currency and the USD over time, which vary across nations with no clear pattern involved, although some tendency fo USD to rise against ROW. Offhand I doubt this has been much of a factore in the “dark matter puzzle.”