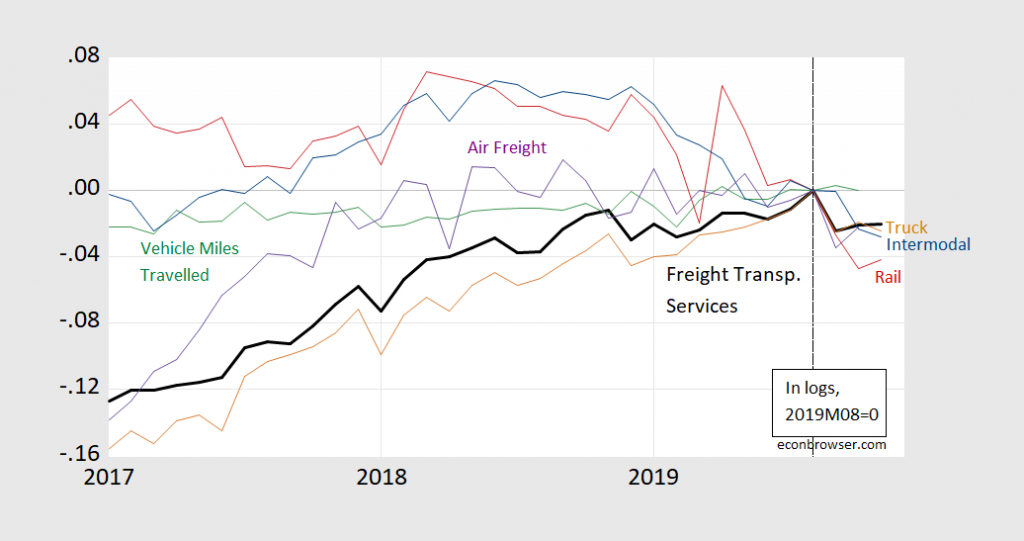

Figure 1: Freight Transportation Services Index (bold black), Truck Tonnage Index (tan), Vehicle Miles Traveled (green), Rail Freight Carloads (red), Rail Freight Intermodal Traffic (blue), Air Revenue Ton Miles of Freight and Miles (purple), all in logs, 2019M08=0. Source: BTS via FRED, and author’s calculations.

All series are below peak.

There is no question that this series is down YoY, and down -2% from peak.

It has been similar down a number of times in the past 20 years without indicating recession vs. slowdown.

A nice, simple K.I.S.S. Metric is, if it is down 4% YoY, that’s an indicator of recession. As of now’ it isn’t.

And the ATA trucking index was just reported up 3% in December, reversing November’s decline.

Well…at least it’s good news for the environment.

If

you hope

a contraction will roll in

on rumbling hippo feet

and snatch Amerika the dauntable

From the jaws of Trumpitude

Let the force be with you

Well, thanks for the good wishes. Generally, however, legitimate economic blogs focus on the economic cycle itself ahead of any political implications. Obviously, the same cannot be said for trolls in the comment section.

Logistics is an interesting sector for lots of reasons. I have had a few debates with brain dead transfer pricing “professionals” over the financials for publicly traded logistic companies such as C.H. Robinson Worldwide, Inc. Their 2018 10-K filing showed a record year and their stock price reached almost $98 per share.

https://finance.yahoo.com/quote/CHRW/financials?p=CHRW

But its current stock prices is less than $80 a share. So the market is signaling a less rosy future for this logistics powerhouse.

To what extent does this reflect a sharp destocking of inventories in the fourth quarter and is that likely to be repeated in 2020? The New York Fed recently estimated a 0.2ppt boost to GDP from inventory investment in the coming year. Would assume that would provide a tailwind to industrial transports. A pick-up in global growth should help too (we’ve seen business sentiment rebound in Germany and the UK). At any rate, vehicle miles driven and passenger air traffic look reasonably healthy.

OK, maybe what we are seeing is the impact of Trumps tariffs and uncertainty on the goods economy, including industrial production that is not showing up in the consumer and/or government sectors. After all, industrial production has been negative for a full year but real retail sales are holding up well. s

Certainly tariffs reduce the exports of goods from one region to another region. Now standard microeconomics would tell us that local consumption and local production may be less efficient than free trade. But then we get to reduce logistics costs so I’m sure Lawrence Kudlow could find some form of analysis that such restrictions on free trade actually leads to a more efficient economy. He is after all an expert on cooking the books!

Eu contraire,

According to David Rosenberg, real sales in q4 2019, were negative so the narrative of sales holding up well is not true.

Yes, and 2.8% of final demand is coming off yry. 2019 was a bubble(though if you balance the falloff the 2018 falloff, it wasn’t that impressive). US consumer spending probably had its best run of things since 2014 between January-August. I think that surprised people/business. It was totally driven by debt however, unhealthy debt. This where the tariff story may have impacted in a move to secure lending before the tariffs come through. Now loan performance is just going to get worse with commercial subprime banks and they are jacking up interest rates in a desperate plea for survival. Business confidence will take a hit as spending doesn’t reboost in 2020 with corporate debt expansion over. Talk about a mess forming.

Maybe what ties this all together is that real imports collapsed in the fourth quarter.

All year retailers and others were bringing in their foreign supplies early to avoid future tariffs.

For retailers that would have kept their imports high, until they collapsed in the fourth quarter

because they already had their Xmas inventories on hand.

I’m looking at

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2

Table 1.1.6. Real Gross Domestic Product, Chained Dollars

Real imports as of 2019Q3 were lower than they were in 2018Q2. Real exports were down over the same period. BEA has yet to release information on 2019Q4. What do you know that BEA does not?

I have the monthly Census real foreign trade data for November.

Imports

million 2012 $

==================

aug…235,123

sep…231,638

oct,,..226,925

nov…,223,960

Thanks. I often use http://www.census.gov so I should have realized you were accessing their data.

is this post meant to show that Trump’s policies have been good for the environment?

Have you looked into how the extremely rapid growth

of online shopping impacts the transportation indices.

I’m not even sure how an item being shipped directly

to the consumer rather than a retail outlet changes the

transportation indices. Maybe a change in the annual

growth rate does not mean what it use to.

For example, Amazon has very large regional retail

warehousing operations that use various methods

— including the post office — to get the goods to the consumer.

I even get my drugs on line rather than at the drug store.

And I am an old man using many drugs.

Spencer: No, I haven’t, so I am agnostic. Perhaps we are becoming an ever more “weightless” economy, although I would think doing a cointegration study where the tendency gets picked up in a trend might be the way to go.