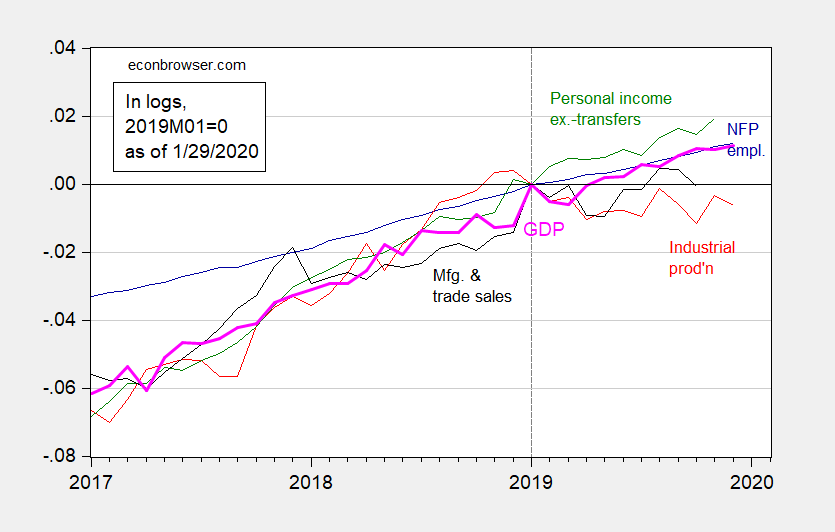

Monthly GDP growth is slow in December:

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M01=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (1/29 release), and author’s calculations.

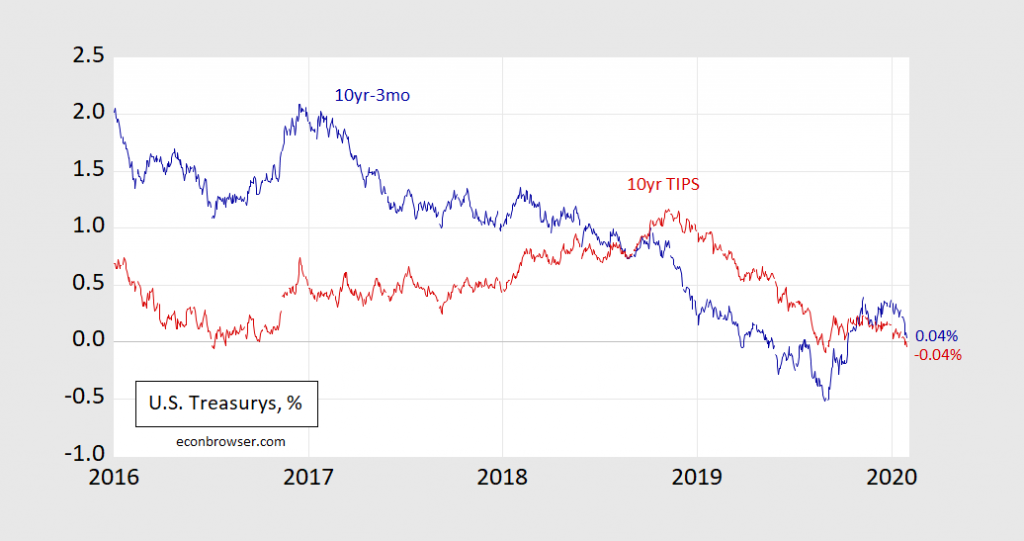

Spreads and the real rate continue flirt with zero.

Figure 2: Ten year – three month Treasury spread (blue), and Ten year TIPS yield (red), both in %. Source: Federal Reserve via FRED, Treasury, and author’s calculations.

Atlanta Fed GDPNow is 1.7% q/q SAAR for 2019Q4 (as of today), NY Fed Nowcast at 1.22 (from 1/24).

It’s not just the US economy. The OECD calls the global economic outlook “unstable”. Check out the scary graph: http://oecd.org/economic-outlook/

Your OECD reference awoke my forgotten lust. Be still, my perverted heart:

https://blogs.imf.org/2020/01/20/tentative-stabilization-sluggish-recovery/

I’d take the time to write me a humorous (sick??) limerick to Gita to put up on this blog but something tells me it wouldn’t get past Menzies’s filter. Maybe a link back to my blog to the limerick?? I have to let my sick self out sometimes you know……..

This one is 6 weeks old, but some great charts. Can I be forgiven for not checking up over 6 weeks??

https://blogs.imf.org/2019/12/18/2019-in-review-the-global-economy-explained-in-5-charts/

That link is very useful as it will allow one to do a chart for each nation as well. The China forecast is even lower than the US forecast. I guess in Trump’s sick world, that is defined as “winning”. After all, it is not about doing well if one can make sure the other side is doing worse.

Seems like so much contradiction in the numbers lately doesn’t it?? And I have to admit the GDP etc is not tapering off as quickly as I thought it would. Kind of like wagering a few bucks on a football game just to get the sweat beads going. There’s enough grey area there to make it interesting spectating.

Wilbur Ross is one sick puppy:

https://talkingpointsmemo.com/news/ross-claims-chinas-deadly-coronavirus-is-an-opportunity-for-us-job-growth

Secretary of Commerce Wilbur Ross sees a silver lining to the fatal coronavirus that’s infected thousands of people in China. During an interview with Fox Business host Maria Bartiromo on Thursday morning, Ross said that while he doesn’t “want to talk about a victory lap” regarding the disease, “the fact is it does give businesses yet another thing to consider when they go through their review of their supply chain.”

Is this sort of like mass murders being good for the bottom line of ammo manufacturers? GEESH!

Less than 2% growth will hurt the incumbent in the fall. We can be sure of some bizarre maneuvering this coming summer.

@ Willie 2% is a pretty standard growth rate. That is why I have quoted 1.5% as the differentiation point. donald trump probably wins even with a 1.5% GDP, but that I think is where you would start to see a downward curve in his popularity numbers. What would it take to really break donald trump’s poll numbers?? I think it would have to be a significant drop in equities prices, a large panic in the USA bond market (which presumably would happen together with the equities price drop) and/or a negative GDP of 0.5% the quarter before the November vote. Either of these two occurrences would then make me think donald trump has less than a 50% chance of re-election. Up and until one of those 2-3 things occur I still have it at 60% donald trump wins in November 2020.

These are not my sentimental wishes, only an objective evaluation looking at the education and intelligence of the average American voter and the fact Republicans are now happy to invite foreign interference in U.S. elections.

Points taken. I am somewhat more optimistic about the American electorate this time around. But I have been disappointed a few times.