That’s the title of an October 2019 International Finance Discussion Paper (Fed) by Shaghil Ahmed, Ricardo Correa, Daniel A. Dias, Nils Gornemann, Jasper Hoek, Anil Jain, Edith Liu, and Anna Wong, which has taken on heightened relevance given current events. From the abstract:

This paper analyzes the potential spillovers of acute financial stress in China, accompanied by a sharp slowdown in Chinese growth, to the rest of the world. We use three methodologies: a structural VAR, an event study, and a DSGE model. We find that severe financial stress in China would have consequential spillovers to the United States and the global economy through both real trade links and financial channels. Other EMEs, particularly commodity exporters, would be hit the hardest. The U.S. economy would be affected to a lesser degree than both EMEs and other advanced economies, and the primary channel of transmission to the U.S. could well be adverse financial spillovers through increased global risk aversion and negative equity market spillovers.

From the introduction:

First, the VAR estimates suggests that the China adverse scenarios would have sizable effects on global variables in the expected direction. In particular, the dollar would appreciate, U.S. long-term yields would fall, global Emerging Market Bond Index (EMBI) spreads would rise, and world trade would fall (consistent with significant increases in EME risk premiums and safe haven flows to the United States, as well as China’s importance in global trade flows). In addition, there would be a substantial fall in global oil and metals prices (consistent with China being a major source of global demand for commodities).

Second, the VAR estimates also suggest that the hit to economic activity in different countries and regions would generally be significant (consistent with China’s strong trade links with other economies). More specifically, the output hit to EME commodity exporters would be about ¾ as large as the hit to China itself; to other EMEs would be about half; to advanced economies excluding the United States slightly more than a third; and only a relatively modest hit to the United States. The smaller U.S. effect reflects the U.S. economy being more closed, limited direct U.S. financial linkages to China, and greater capacity at the moment (than other advanced economies, say) to ease monetary policy to cushion the blow.

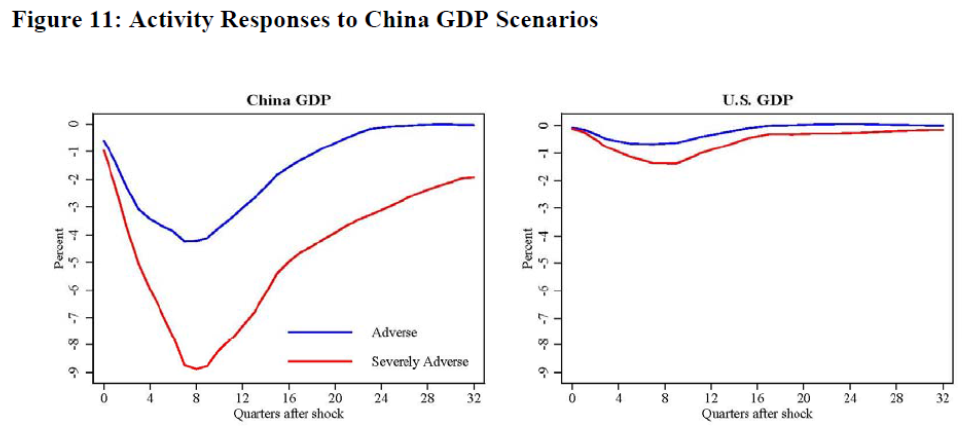

SVAR estimates conditional on a Chinese 4% deviation from baseline (blue) 8.5% deviation (red) suggest a noticeable hit to US output.

The authors also take a more detailed look at the impact on the US economy, using input from the SVAR run through a DSGE (SIGMA). The detailed look suggests an even greater negative impact on the US economy.

Below is Goldman Sachs’ forecast for 2020Q1:

Source: Goldman Sach, February 12, 2020.

i’ve been trying to get a sense of the impact of the virus outbreak on US GDP…with so much of Chinese production already shut down it’s clear our imports will fall…but falling imports boosts GDP…..assuming little initial impact on PCE, that would suggest drawdowns of wholesale and retail inventories, probably of a magnitude similar to the import decrease…the big hit, then, seems to come from reduced exports to China…it was already clear they would never meet the energy goods purchase targets of the phase 1 trade agreement…now, the often cited 20% drop in Chinese oil consumption is a 3% hit to global demand, just as the US is becoming a major exporter…the question is how long it lasts…

If the imports are inputs to final goods produced in US, while on surface lower imports boost measured GDP, in the end GDP will fall because of lower output of the final goods not produced due to the missing inputs from China.

Most economists alive today were not aware of – or even born – the last time China had a hard landing. That was, of course, the Great Leap Forward. Not the Cultural Revolution, or even the boom-bust-readjust cycle of the early Reform Era. The 1988-89 slug fest with inflation might, in a pinch, qualify, but seriously: are we really talking about what people usually mean by a hard landing?

China is more of a continent than a country. Very broad and deep private consumption expenditure keeps the economy going, year after year. In my book, a real hard landing isn’t a one-year phenomena. That’s just a recession.

Interesting paper. A lot of DSGE stuff is lost on me (along with the fact I don’t have strong faith in it based on some of Krugman’s comments). I guess it’s just matrix math mostly and a ton of data inputs. Either way, glad to see the paper and I will try to bumble my way through it sometime