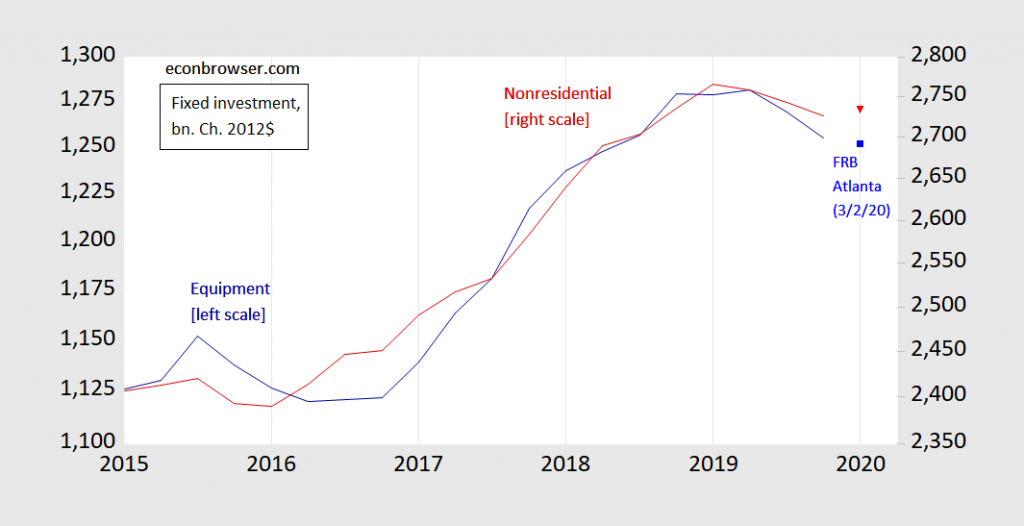

Nonresidential fixed investment has been declining for three quarters, while equipment has been declining for two quarters. If Atlanta Fed nowcasts prove right for the current quarter, then as of 2020Q1, equipment investment will have fallen for three quarters (while nonresidential will still be below peak).

Figure 1: Equipment investment (blue, left log scale), nonresidential fixed investment (red, right log scale), in billions Ch.2012$. 2020Q1 figures are FRB Atlanta Nowcast estimates for 3/2/2020, via FRED. Source: BEA, 2019Q4 2nd release, FRB Atlanta, and author’s calculations.

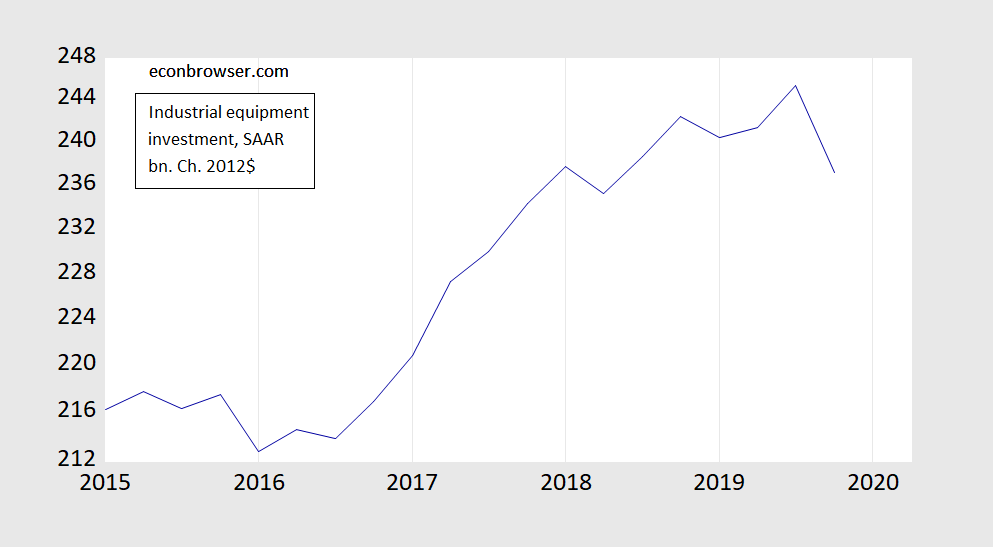

The dropoff in industrial equipment is more recent, but more marked; 2019Q4 change was -13.4% SAAR (in log terms).

Figure 2: Industrial equipment investment (blue, log scale). Source: BEA, 2019Q4 2nd release.

We were told that the tax cut which was passed literally behind closed doors would lead to a surge in long-term growth by increasing business investment. And all we got was a temporary and modest increase in investment, which of course has now reversed. Yes – we were lied to.

We also didn’t get much in labor productivity in the manufacturing center. Labor productivity was down 0.8% but hourly compensation was up 2.8%. Unit labor costs up 3.6%. Sounds like a sector that could use some new capital investment…but then the top 1% would miss out on the chance to milk existing capital.

https://www.bls.gov/news.release/prod2.nr0.htm

Cyclical components of Real Gross Private Domestic Investment as measured by various methods (figure here: https://tinyurl.com/vcxq9np) are softening.

Respectfully, I don’t think nonresidential fixed investment is a leading indicator. Not only nominally, but adjusted for inflation and even population, since the series began in 1947 it has typically turned down in the first quarter of a recession. Equipment spending also has only turned down at the outset of recession more often than not.

What I see from your graph is yet more evidence that manufacturing makes up so little of the recent US economy that even a significant turndown no longer is consistent with recession.

Say what? Real investment fell in advance of the 2001 recession. Yea – I get that it was real residential investment that led the Great Recession but note we also had a huge decline in real business investment as well.

New Deal democrat: Perhaps my title is misleading. By forward looking, I mean the behavior is dominated by expectations about the future. In contrast consumption is not as forward looking as implied by the Hall “consumption follows a random walk” model, and government spending is not very responsive to changes in expectations. In other words, I am *not* implying nonresidential fixed investment is a leading indicator. Looks more like a coincident indicator.

QCEW for Q3 2019 came out two days ago. Twelve month growth at +1.1% YoY as of September tied for the lowest, with Sep 2017, since the first half of 2011.

New Deal democrat: Yes – see my post of March 1st. 1.1% compares with 1.3 in September, using BLS establishment survey.

To be fair – real business investment as of 2019QIV was 11.2% higher than it was as of 2016QIV. But as one looks at the data, much of this increase occurred before the Dec. 2017 tax cut. Yea – investment was doing well as a result of the Obama recovery and the low real interest rates Janet Yellen graced us with.

The economy was rolling over before the virus became a factor,

If I am reading the latest 2020Q1 GDP forecasts correctly, there seems to be a bit of optimism prior to the Corona virus epidemic. Maybe the forward looking components and the epidemic will torpedo the optimism.

Atlanta Fed 3/2/20: 2.7%

NY Fed 2/28/20: 2.1%

FRED 2/28/20: 1.6%

Average: 2.1%

I’m completely confounded by what the economy is doing and what the numbers mean. The fed went into panic mode with the rate cut. There are downturns in specific sectors and in investment. We have had yield curve inversions. Employment bounced up and down, but has been reasonably positive so far as I know. There haven’t been massive overall job cuts. Construction powers along, even though it’s not soaring. The virus is putting a damper on things, but the effect hasn’t rippled through yet. The trade wars don’t seem to have done the damage I expected. And finally, the usual cycle hasn’t hit yet. We seem to be getting very lucky with economic strength. Sometimes it’s better to be lucky, but I don’t understand how it can keep up. The tea leaves aren’t telling me much any more.

I saw Jim Bullard, St. Louis Fed prez and widely viewed as the quitely dominant figure in the FOMC. He said it was unanimous to do the 50 bps cut. He said it is defensive to forestall major decline due to coronovirus. He did not rule out further cutting at the march meeting, but basically sais, “we shall see.”

That’s reassuring. The market gyrations aren’t, but then the market tends to do weird things in the short term anyway. I don’t pay a whole lot of attention to daily market movement.

“I don’t pay a whole lot of attention to daily market movement.”

Trump does. I bet he was in a good mood yesterday until a lot of people called the rise in the stock market “the Biden bounce”.

Well, Trump is a moron who bumbles from minute to minute without much thought about anything beyond the next hour or two. What he thinks is only relevant to the impact it has on the nation. Which, unfortunately, is quite a bit right now.

And to follow up on Barkley’s point, Bullard makes those comments at a time when we allegedly have added 273,000 jobs a month in a time of full employment. If that was true, why would you be so worried thar youd do a surprise rate cut.

This tells me the real economy is a lot weaker than the monthly jobs reports show….which is why they’re getting revised down constantly after the QCEW. And why the market tanked after the rate cut – investors could smell the fear from the insiders.

We heard that the payroll survey measure of employment had a nice rise in Feb. but no one noticed that the employment to population ratio fell? Oh yea it counts the household survey which suggested an increase of only 45 thousand.

pgl Something else that doesn’t get a lot of attention is the drop of 646K in FULL TIME employment since Dec 2019. OTOH, PART TIME employment has risen by 734K over that same time period. Keep in mind, these are Household Survey numbers, so it’s counting people, not jobs. The jobs number we see in the headlines reflects establishment numbers, so one person working three part time jobs counts as three jobs in the establishment survey, but only one person in the household survey.

It’s a livestream if anyone wants to watch:

https://www.youtube.com/watch?v=RUje18olI50

There is a lot of incomplete or contradictory information regarding Covid 19 and it is generating a lot of uncertainty: https://fred.stlouisfed.org/series/USEPUINDXD/

This “fear index” is reflected in local behavior: stocking up on anti-viral supplies, disinfectants, household staples, and storable food products; cancellation of travel plans and community events; and the focus of conversations. People are preparing for the worst because every Covid 19 infection and death is reported repeatedly. This has to have an adverse effect on the economy once the panic buying turns into “hunkering in place”. San Francisco has already declared a state of emergency with only two confirmed cases.

Unless and until there is a declaration that there is a vaccine or cure for Covid 19, or that the fatality rate is no worse than a bad strain of the flu, or that the infection rate has dropped dramatically, people are going to react defensively. This means the economy goes into a holding or declining period for which no economic policy, such as the Fed reducing funds rates, will counteract. We have entered a period of mixed rationality and irrationality. It’s obviously a great time for political finger pointing and for a few healthcare-related sectors to increase revenues, but not so much for the rest of the country.

“There is a lot of incomplete or contradictory information regarding Covid 19 and it is generating a lot of uncertainty”.

Actually you are right and most of this contradictory nonsense is coming from Donald Trump.

BYCD?

Uh Brucie boy – the title of your link is:

Economic Policy Uncertainty Index for United States (USEPUINDXD)

You call this a “fear index”. I guess that explains you the general thrust of your typical comments as we know you have an incredible fear of economics!

As applied to the present situation that is appropriate.

Bruce Hall Okay, some of the defensive stuff we see is absolutely ludicrous. Rep. Matt Gaetz (R-FL) is a case in point. Wearing a gas mask on the floor of the US House? Seriously? The guy has always been a grandstander, but even this was off the charts crazy even by his low standards of proper decorum. OTOH, we don’t need the kind of Pollyannish stuff coming out of Trump’s mouth either.

I would agree with you in saying that monetary policy probably can’t do much, at least right now. But that doesn’t mean there aren’t any economic policies that would help. For example, extending the 15 April tax deadline for people who owe might give people some modest relief in case they have to take off work. And putting IRS agents on paid leave could help slow the spread. Or sending households a check (similar to the Bush tax rebates in 2008) in order to tide them over periods of enforced quarantine. Given the drop in asset values we probably don’t want people dumping stocks and cashing in 401k’s just to cover temporary expenses. The government should also cover the medical expenses of everyone who contracts COVID-19. We really don’t want people without health insurance to not go to the doctor or not go to the hospital because of cost. And oh yes…fully funding the NIH and CDC every year would help as well.

2slug, delaying the tax deadline may help some individuals. I don’t have the source, but I recall reading a few days ago that more people have already filed their taxes this year than at the same time last year. More refunds?

Anyway, the LA Times had an interesting article about the “fluidity” of the coronavirus data: https://www.latimes.com/science/story/2020-03-07/why-the-coronavirus-fatality-rate-keeps-changing

pgl automatically pointed the finger at Trump, but the reality is that the data is based on incomplete reporting and that skews the analysis. As a result, the uncertainty around Covid 19 is now reflected in the Fed’s uncertainty index (which I nicknamed the “fear index” much to the consternation of pgl). In this case, fear is certainly the primary disruptive factor; more so than the disease itself. As I wrote in an earlier comment, fear is driving irrational buying and may lead to self-imposed isolation until there is a vaccine or a cure or a decline in the infection rate. https://www.latimes.com/california/story/2020-03-01/costco-run-on-supplies-coronavirus-stock-up

Humorous aside: my son took his 2-year old daughter to Costco today and they discover many items were out of stock or limited purchases. She heard her daddy telling her mommy that they couldn’t find some things, so she asked why. He told her that people were afraid of the coronavirus so they were getting supplies in case they had to stay home. She ran down the aisle with her arms above her head yelling, “coronavirus, coronavirus”. Unfortunately, there was an Asian couple in the aisle and my son said they looked horrified rather than amused.