From Mr. Brian Riedl, in NRO:

The multiplier is small because, in the modern economy, idle savings are not common — even during a recession.

I don’t understand Mr. Riedl’s logic (see my puzzlement here), but I’ll just focus my comments on his reliance of Barro’s empirical assessment of the multiplier. I think it useful to survey the academic literature, particularly the recent research, rather than hang everything on one paper.

More systematically, we can do a meta-analysis. Here is the abstract from a paper published in Oxford Economic Papers:

I apply a meta-regression analysis to a unique data set of 104 studies on multiplier effects to derive stylized facts and quantify the differing effectiveness of the composition of fiscal impulses, adjusted for study design characteristics. Public spending multipliers are close to 1 and about 0.3 to 0.4 units larger than tax and transfer multipliers. Public investment multipliers are even larger than those of spending in general by approximately 0.5 unit. Multipliers vary with study design, whose influence should be laid open when drawing policy conclusions. The analysis provides guidance concerning influential factors, their significance, and magnitude.

Ungated working paper version of the article, here.

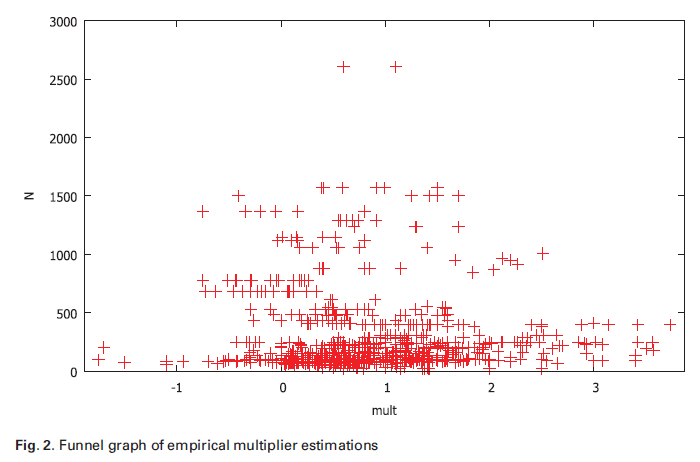

It’s not a long paper, but one can easily see how the multiplier estimates line up against Mr. Riedl’s “near zero” estimates.

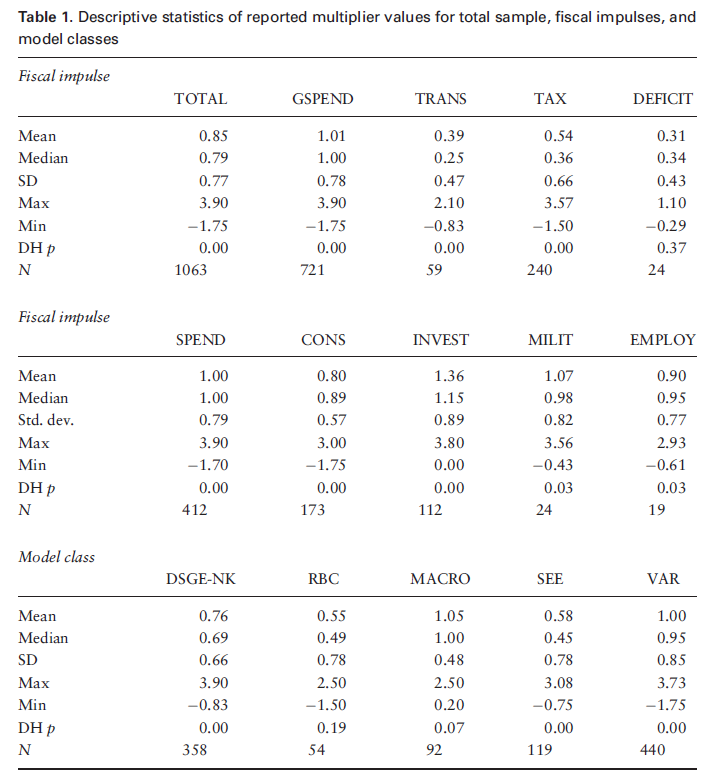

Now, there is a great deal of heterogeneity in multipliers (government consumption, defense spending, government investment, transfers, tax cuts, etc.), so it’s useful to disaggregate a bit. That’s done in Table 1 from the paper.

Key: public consumption (CONS), public investment (INVEST), military spending (MILIT), direct public employment (EMPLOY), transfers to households (TRANS), and tax cuts (TAX), public spending, not specified (SPEND); and budget deficits (DEFICIT).

Mr. Riedl continues his argument against stimulus efficacy by rewriting history:

While the massive 2009 stimulus is often cited as a success, a closer inspection reveals otherwise. The economy was already out of recession by the summer of 2009, before more than a small fraction of the stimulus had even been implemented.

True that the trough was dated at 2009Q2 by NBER — of course the output gap was something on the order -6.2% (log terms, using latest vintage of data, January 2020 CBO estimate of potential GDP). From Riedl’s description, I guess we should’ve just sat back and enjoyed the associated elevated unemployment, rather than try to shrink the output gap.

Most of that “stimulus” was transfers so it did have immediate effect. That was also part of its problem. That is why I use investments rather than Stimulus”. A multi trillion dollar investment plan the Obama administration promised, never happened. Coupled with his administration letting the swine flu kill thousands of people, you understand why it lost favor with the public by the fall of 2009.

Some many definitions of idle – so little time. He starts off with idle resources but then he incoherently flips to idle bank reserves (excess reserves) and finally ends up with that idle savings nonsense. Idle resources are not the same thing as “idle savings” but he was writing this intellectual garbage for the National Review.

“Reflexive calls for fiscal stimulus are often popular during recessions, for obvious reasons: Voters love tax cuts and spending benefits. Celebrity economists get to show off their mathematical models and play the role of economic savior.”

Celebrity economists – what a asinine comment. Showing off their mathematica; models as opposed to his showing off his ignorance of the evidence:

“But more broadly, do temporary infusions of government spending or tax cuts actually stimulate economic growth? The record is not particularly strong.”

Nice take down of this stupid statement!

Now that I have had my morning run, I decided to re-read this National Review quality nonsense.

“Fiscal stimulus may be the wrong tool to address a health crisis in which people decide not to leave their homes. (Where would they spend their rebates?”

I guess he does not know about things like Amazon where one can shop online and have the goods delivered!

“Every dollar that Congress injects into the economy must first be taxed or borrowed out of the economy. So in a typical, full-employment economy, government spending merely redistributes purchasing power from one part of the economy to another.”

Excuse me but I thought this Barro-Ricardian equivalence idea was empirically found not to be a good description of borrowing-constrained household. But wait – he is confusing this hypothesis with classical crowding out when he talks about a full employment economy. Can he be more confused. Oh wait – he can as he notes this Cochrane quote:

“First, if money is not going to be printed, it has to come from somewhere. If the government borrows a dollar from you, that is a dollar that you do not spend, or that you do not lend to a company to spend on new investment. Every dollar of increased government spending must correspond to one less dollar of private spending. Jobs created by stimulus spending are offset by jobs lost from the decline in private spending. We can build roads instead of factories, but fiscal stimulus can’t help us to build more of both. This form of “crowding out” is just accounting, and doesn’t rest on any perceptions or behavioral assumptions. Second, investment is “spending” every bit as much as is consumption. Keynesian fiscal stimulus advocates want money spent on consumption, not saved.”

Cochrane has for years been confused as to whether he is babbling about long-run budget constraints versus an economy at full employment. Neither Cochrane nor Riedl should be taken seriously as experts in macroeconomics.

What a bizarre zero sum view of the world. I guess his paycheck makes all of us poorer.

Notice that Riedl quietly qualifies his claim by saying: …a typical, full-employment economy, government spending merely redistributes purchasing power from one part of the economy to another.

I don’t think there are too many economists who argue for large fiscal multipliers in a full-employment economy.

Keynesian stimulus theory argues that recessions are usually driven by sagging demand, which leads to insufficient spending and idle resources. In that instance, proponents assert that government can borrow those idle savings out of the private economy and then either spend them directly or redistribute them to the people more likely to spend them. Savings become spending, idle resources are put to work, demand rises, and the economy recovers.

Once again he seems to confuse stocks and flows. Savings in the sense of money in your checking or savings account, which is what Riedl has in mind, is a stock variable. The Keynesian multiplier is about a flow variable that leaks out of the income flow. That flow contributes to the stock variable in your checking or savings account, which then gets transformed back into a flow variable called investment. If there’s no demand for private investment, then GDP falls because the leakage in the income flow is not recovered and re-inserted into the economy as an investment flow. When Riedl talks about “idle savings” it tells us that he just doesn’t understand economics as a system of flows. Instead, he thinks of economics as a set of stock variables in the way that an accountant might view the world.

“Once again he seems to confuse stocks and flows.”

Yes – he confuses a lot of things in this National Review quality nonsense. Of course he quotes John Cochrane who is perpetually confused. Both of these clowns pretend to be economists but their own writings prove otherwise.

Didn’t that guy Say have something to say back in the day? Money/the Economy is like the water cycle. It goes round and round. The question is not where it comes from but how it is distributed.

Yes I don’t know jack about money or the economy.

We may be about to see how strong the multiplier is on the downside as the negative shocks coming down from all the coronavirus- hit. How low will we go in the ral economiy, quite aside from all the crashing markets.

Speaking of those, the under the radar mess is going on in the bond market, with 30 day Treasuries behaving very badly. Fed madly scrambling through the repo markets, but apparently there is a major liquidity problem going on in the bond markets, with costs higher than sincce 2008.

Saw an article in the ft regarding treasuries becoming illiquid. Not sure what to make of this. It certainly is concerning some vips in the financial sector. Have not seen much news on it in american sites, yet.

NY Fed is pumping in $1.5 trillion in liquidity to stabilize the “irregularly performing bond marketts.”

BTW, most of Friday’s stock surge in last half hour after word Trump declaring national emergency but market closed before Trump finished press conference. Futures market has since dropped about a half percent, not all that impressed with details.

Amen, alas.

Is this what they mean by “suffering fools gladly”?