Courtesy of Hoover Institution:

Open Letter to Ben Bernanke

(Four Hoover fellows signed this letter: Michael Boskin, John Cogan, Niall Ferguson, and John Taylor)

We believe the Federal Reserve’s large-scale asset purchase plan (so-called “quantitative easing”) should be reconsidered and discontinued. We do not believe such a plan is necessary or advisable under current circumstances. The planned asset purchases risk currency debasement and inflation, and we do not think they will achieve the Fed’s objective of promoting employment.

We subscribe to your statement in the Washington Post on November 4 that “the Federal Reserve cannot solve all the economy’s problems on its own.” In this case, we think improvements in tax, spending and regulatory policies must take precedence in a national growth program, not further monetary stimulus.

We disagree with the view that inflation needs to be pushed higher, and worry that another round of asset purchases, with interest rates still near zero over a year into the recovery, will distort financial markets and greatly complicate future Fed efforts to normalize monetary policy.

The Fed’s purchase program has also met broad opposition from other central banks and we share their concerns that quantitative easing by the Fed is neither warranted nor helpful in addressing either U.S. or global economic problems.

Cliff Asness

AQR Capital

Michael J. Boskin

Stanford University

Former Chairman, President’s Council of Economic Advisors (George H.W. Bush Administration)

Richard X. Bove

Rochdale Securities

Charles W. Calomiris

Columbia University Graduate School of Business

Jim Chanos

Kynikos Associates

John F. Cogan

Stanford University

Former Associate Director, U.S. Office of Management and Budget (Reagan Administration)

Niall Ferguson

Harvard University

Author, The Ascent of Money: A Financial History of the World

Nicole Gelinas

Manhattan Institute & e21

Author, After the Fall: Saving Capitalism from Wall Street—and Washington

James Grant

Grant’s Interest Rate Observer

Kevin A. Hassett

American Enterprise Institute

Former Senior Economist, Board of Governors of the Federal Reserve

Roger Hertog

The Hertog Foundation

Gregory Hess

Claremont McKenna College

Douglas Holtz-Eakin

Former Director, Congressional Budget Office

Seth Klarman

Baupost Group

William Kristol

Editor, The Weekly Standard

David Malpass

GroPac

Former Deputy Assistant Treasury Secretary (Reagan Administration)

Ronald I. McKinnon

Stanford University

Dan Senor

Council on Foreign Relations

Co-Author, Start-Up Nation: The Story of Israel’s Economic Miracle

Amity Shlaes

Council on Foreign Relations

Author, The Forgotten Man: A New History of the Great Depression

Paul E. Singer

Elliott Associates

John B. Taylor

Stanford University

Former Undersecretary of Treasury for International Affairs (George W. Bush Administration)

Peter J. Wallison

American Enterprise Institute

Former Treasury and White House Counsel (Reagan Administration)

Geoffrey Wood

Cass Business School at City University London

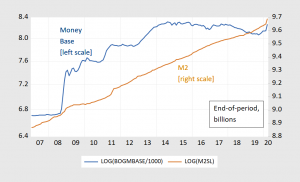

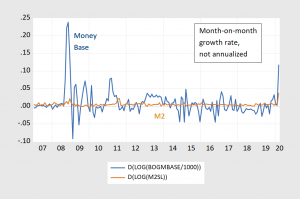

For context, here are some graphs of data pertaining to the current situation.

By the way, did anybody see markedly accelerated inflation and/or currency debasement post-QE2?

Conservatives always talk about economic incentives. If there is no cost to being wrong, why would anyone bother to be right.

In fact, the incentives run in the opposite direction. It can be very rewarding to say what people pay you to say.

(By the way, noted again this is from the Hoover Institution praised by some people here as an intellectual organization rather than the right-wing welfare tank that it really is.)

Currency debasement? Seriously? Like I’ve said before, those conservative economists are forever living in 1979.

I saw the eminent Amity Shlaes’ name, but where were her equally eminent fellow travelers Donald Luskin and CoRev? I’m assuming Bruce Hall is still working on his Virtual IIF Workshop on “Economic Forecasting in Times of Covid-19”s” submission paper, otherwise I’m sure we would have seen his name as well.

Here’s an idea, why don’t all those signatories ignore social distancing and protest in front of the Federal Reserve. Instead of guns they could be carrying their laser pointers.

Wow -you mention Ms. Shlaes who I left off my list. My bad. Her degree was English not economics. And her writings are absurd babbling that the Trump crowd just adores. I hear she teaches a course in NYC somewhere called The Economics of the Great Depression. I’m sure we can file her lecture notes in the Fiction section of your local Barnes and Noble.

I was thinking the “New Age Self-Help” section.

Anyways…….. I’ll be at Yates Center Kansas “Jokers” comedy club for “Amateur Open Mic” this coming Thursday night. I’m providing free adult drinks for whoever reflexively laughs when I cue them by scratching my forehead in an existential angst kind of vibe.

Cliff Asness ought to pay more attention to some of the hedged mutual funds his outfit manages as they have been woeful under performers over the last five years. Chanos had a good trade that Goldman-Sachs set up for him just before the great meltdown and hasn’t done much since. Hasset is still dreaming of Dow 36,000 and looks at this as just a hiccup along the way. Wallinson never understood mortgage backed securities.

I’m still waiting for proof of the massive inflation that took place between 2009 and 2017.

Well commodity prices rose for a while there so Dr. Stephen Moore might tell us that there’s the proof. Oh but wait – what is the price of oil right now?

A lot of the clowns that signed this absurd nonsense are not even economists including Niall Ferguson, James DOW Jones 36000 Glassman, William Kristol, and Dan Senor. I’m sure my list should included a few other names. Now some of this crowd used to be economists before they drank the right wing Kool Aid. But since anyone could sign this stupid letter – I’m shocked that the signatures of the Three Stooges (Lawrence Kudlow, Donald Luskin, and Stephen Moore) were not on it.

BTW – the comment section there is a hoot. Some of the idiots who commented actually think their predictions turned out to be correct. Go figure!

The one on there I find the most surprising is MacKinnon. I was not aware he had signed this embarrassing document. Probably he was pressured by Boskin and Cagan and some others at Stanford, but he of them all should have known better.

Oops. Never mind.

Oh yeah, and Taylor too probably worked o nMacKinnon, may have been the most influential one of them for him.

John B. Taylor is stuck on HIS rule. The one that pretends that the long-run risk-free rate is the same now as it was 40 years ago.

Interesting point. On the Bloomberg box, the Taylor Rule function allows users to vary the risk-free rate. If one picks a risk-free rate that is suggested by market pricing, the Taylor Rule function would return a target overnight rate not all that different from the Fed’s target rate during the middle and later years of the recent expansion.

Originally, Taylor devised his rule to reflect actual central bank behavior, rather than as a prescriptive tool. He has become a rabid prescriptivist, to the detriment of his reputation among people who don’t hand out big checks for “correct thinking”. HIs rule, if allowed to reflect market pricing, still does a good job at what it he originally claimed it did. Taylor’s rule, if used properly, is better than Taylor.

Barkley Rosser I’m confused. According to Wikipedia Ronald I. McKinnon died on 1 Oct 2014.

https://en.wikipedia.org/wiki/Ronald_McKinnon_(economist)

Is there another Ronald I. McKinnon? If so, I don’t see him listed on the Stanford econ faculty page:

https://economics.stanford.edu/people/faculty

You’re referring to Junior’s misspelling?? Don’t worry too much about that, Junior only worries about name spellings of collegial peers that are co-editors of his “Journal of Lab Created Pandemics”. That, or the great minds over at “Quora” are the only ones that hold much weight for Junior.

Nope. Barkley’s right. It was my screw-up, not his.

pgl,

The letter was written in 2010. MacKinnon was very much alive then still.

Of course thinking he is scoring a point, Moses has jumped in here to make a complerely idiotic remark.

Sorry pgl and 2slug, my comment was meant to be addressed to 2slug. Ron MacKinnon was alive on November 26, 2010.

Oooops! There I went again. McKinnon. I do not know how I got my misspelling of his name into my head, but it was a long time ago, not some recent bout of senility.

BTW to pgl, I am not going to defend any particular ideas of McKinnon’s but what made me mention him if with a terrible and vicious misspellikng of his name that doubtless led to nobody having any idea who I was talking about, was that I do not remember him being a political hack particularly. He may have leaned right, but he was not a former Bush CEA Chair like Boskin, not to mention the long list of totally worthless signatories to this that various people noted.

Like Taylor, who might arguably be labeled a hack more recently, McKinnon was a serious scholar and in McKinnon’s (not Taylor’s) case a leading figure in the field of international finance. This is why i brought him up as the least likely signatory of this letter, although perhaps one of you, (pgl? Moses?) can name someone else among this set of people more surprising to see as a signatory than the late Prof. McKinnon.

BTW, I can see one other candidate for not being a hack, although more likely to be a signatory than McKinnon, based on his work. That woudl be Philip Cagan, also an emeritus prof at Stanford at the time of the letter as was McKinnon. Ironically he was older than McKinnon by 7 years and died two years before McKinnon, but not so soon as to obviate him from signing this letter. I do not remember him either being particularly a hack, although I think his views more clearly tilted to the monetarist right than did McKinnon’s.

This is clearly the case in that by far his most famous work was his 1956 paper on hyperinflatoin, which was published as a book chapter in one edited by Milton Friiedman. This would certainly set him as someone who would worry about possible hyperinflations without being an obvious hack like most of these signatories are/were. But I think McKinnon remains the least likelyi signatory on the list.

i bet not a single person on that list would acknowledge they were wrong. not one. because we can now use alternative facts in a defense.

WTI Crude was MINUS 40 today! now i understand this is a bit of an illusion, driven by expiring contracts and all, but WOW. shale producers are taking a HUGE beating, as are all the minion traders these days. took a chance and picked up some USO today-if it does not go bankrupt then it will probably rebound nicely. but a risk nevertheless. i know low oil is a benefit to the economy, but this is probably getting way out of hand. wonder what trump thinks of his saudi and russian besties these days? putin and mbs have shown they will put a dagger in your heart if is to their benefit, even short term.

Oops.

how embarrassing. Has anyone recanted like Hayek did on Germany and said public works spending was necessary back then.

I agree with PGL. Shales is a joke. more so about the depression

Requesting an article from Prof JDH on oil.

@RB

It’s very cheap now, and will be into the foreseeable future, because even the countries that want higher prices will be too highly tempted to dump oil past output limit agreements on the international markets. Now I present you with 6 imaginary graphs that are very complicated looking and tell you the exact same thing I just said in very thick language with many polysyllabic words, and how it’s for other more complex reasons than I just stated about.

[ Use your mind’s best imaginations to place six complicated looking graphs here. ]

See what I did there?? You’re welcome.

You asked. Dr. Hamilton delivers!

With such low oil prices, wouldn’t Stephen Moore’s little commodity rule be demanding a massively expansionary monetary policy right now? Same thing happened to commodity prices at the start of the Great Recession but these right wing gold bugs opposed monetary stimulus back then. Will they oppose it now – and will they all fall in line wearing MAGA hats?

Here’s Your Currency Debasement, Right Here.

Since FDR abandoned the gold standard in 1933, the dollar has lost 95% of its purchasing power. IOW, the 1933 dollar is now worth a nickel.

https://fred.stlouisfed.org/series/CUUR0000SA0R#0

Question: Was this currency debasement beneficial or was 1933 the promised land? Seems to me the answer is obvious, but I don’t work at the Hoover Institution.

(BTW, why would an economic think tank name itself after Hoover? Is Stanford business school going to rename itself after Trump?)

It was originally a donation I think, for a Library, funded by the man himself. All the best laid intentions gone awry.

You have to be able to show high aptitude in self-dealing from a federal government post, and deftness at weaseling past felony convictions before you can become a Hoover Institute Fellow though.

https://www.nytimes.com/1988/07/19/us/mckay-report-ambiguous-conclusion-14-month-investigation-prosecutor-finds-meese.html

https://www.latimes.com/archives/la-xpm-1989-08-09-mn-107-story.html

https://www.latimes.com/archives/la-xpm-1988-07-05-mn-5430-story.html

https://www.sun-sentinel.com/news/fl-xpm-1988-07-07-8802090633-story.html

Aim high, and, you too, can be a Hoover Institute Fellow.

Weaseling past felony convictions (a/k/a acquitall) is hard work, which requires extensive investigation, analysis, and (usually) logic. The probability of success is low and the stakes are high. Perhaps weaseling should be considered a qualification.

@ B.A. Badger

I strongly disagree, but your statement is a tenable stance to take (if, still, morally vacuous). You wouldn’t be a Reaganite by any small stretch of the imagination, would you??

You presented the inverse of the CPI but try this:

Consumer Price Index Data from 1913 to 2020

https://www.usinflationcalculator.com/inflation/consumer-price-index-and-annual-percent-changes-from-1913-to-2008/

As of December 1932, CPI = 13.7. As of December 1940, CPI = 14. As an increase of only 2.2% over an 8 year period. Not exactly hyperinflation.

I found it interesting that the vast majority of the “debasement” of the dollar from 1933 occurred before the total debt exceeded $1 trillion in 1981. Since then, the debt has exploded, but the dollar has lost relatively little purchasing power and is far too strong in forex markets. Ergo, all the conventional wisdom exhibited in the 2010 letter was completely wrong. Has anyone predicted where the dollar goes from here? Nobody is willing to put their name on any new model.

Volcker’s thinking on monetary policy has sort of stood the test of time from 1983 til now – even as we have a few bouts of fiscal insanity.

I think Seth Klarman is the name that really disappoints me or lets me down being on this list, because I always hero-worshipped him in my younger years. His seeming ability to find cheap assets and his book on value investing (which I have a copy of by the way, I’ll let regular readers here guess what price I paid for it, think “printer ink cost per paper” here). Uhm, and I remember also in my younger days watching James Grant, he always seemed like a decent guy when he was on Louis Rukeyser’s Wall Street Week. But in latter years he’s written these garbage books and always wants to lecture the poor as a man who was “born on third base and thought he hit a triple”. I may still peruse through Klarman’s value book from time to time, but metaphorically both men are dead to me now.

Inflation and currency debasement did not happen, but why did it not happen? Can you explain please.

LL: It’s in any basic macro or money/banking textbook these days – try Cecchetti & Schoenholtz. IOER prevented excess reserves from leaking out into M2; combined with standard Phillips curve relationship and austerity due to Republican led Congress and many state leaderships, we got low inflation.

Exactly – we never saw the economy going beyond potential GDP. And yet John B. Taylor kept mumbling something about keeping interest rates too low for too long. Look – he may have coined the term the Taylor Rule but over time I think he forgot what it even meant.

pgl,

Actually I do not think Taylor coined the name of his “rule.” It is very rare that any intellectual gets away with naming an idea after themselves. Others do it. Thus “Rosser’s equation,” something I cooked up, was named by Bruce Webb.

As it is, when Taylor did his original study it was a good idea. What he showed was not that this was something that should be done, but that it was effectively what the Fed was doing from the mid-80s on into the early 90s, the period of the so-called “Great Moderatoin.” Later, as others gavie it his name and began saying that is what central banks should do, Tayor himself jumped on the bandwagon and began pusing ii, incuoding well past the its sell-by date, thus making himself look silly.

As it is, It is my guess that it was Taylor who ultimately talked Ron MacKinnon into signing that silly letter. As of 2010, Taylor still had some oldover of prestige from cooking up his “rule,” and I suspect this gave him cred with RM. There was also a factor in his signing of competition with Bernanke to be Fed Chair. Supposedly he was one of Ben’s main rivals for the job at the time, but what did him in was that he had done a poor job as an administrator/manager when he was an Assistant Secretary of the Treasury earlier in the W. Bush admin, and this damaged his candidacy fatallly as being Fed Chaiir involves not just intellect about macro theory or rules, but being the top admiinistrator of a large and complicated operation.

@ Barkley Junior

It seems very “respectful” of you to misspell a dead man’s name after being corrected (not to mention his name is printed in bold right in Menzie’s post). Shall we do the same favor to the resident narcissist of Harrisonburg Virginia when he croaks?? Asking for a friend.

I guess this must have been Junior’s viewpoint when he claimed he only made mistakes on “petty” things. But we have seen him make many large errors, the most recent “petty” error his claim that L curve recoveries don’t exist and have never happened. Just “petty”/minor stuff there.

The man’s name was Ronald Ian McKinnon at least per this nice LA Times tribute:

https://www.latimes.com/local/obituaries/la-me-ronald-mckinnon-20141006-story.html

In my younger days, I had to read up on some insane currency substitution idea he and others were peddling. I was asked to comment on one of these presentations which made me nervous enough but it seems the great Milton Friedman sat in on the seminar. As I got up to give my 5 minutes of critical comments, I can still remember Dr. Friedman smiling. When I was done – he stood up, acknowledged my comments, and then put much more eloquently than I did his issues with McKinnon’s currency substitution silliness.

But come on – I probably misspelled a few names in my lifetime. Please move on.

OK, Mose, you got me. I misspelled McKinnon’s name. I apologize to one and all.

I also misspelled Taylor’s name in a comment above as “Tayor.” I apologize for that as well. Sometimes I am lazy and do not proofread my posts here adequately before hitting “Post Comment.” Shame on me.

Curiously regarding McKinnon, this is a case of me really having it wrong, as someone who used to win spelling bees when young. But somehow I have long had it in my mind that his name was spelled the way I misspelled it. I really should have known better as I just about a week ago tossed out his book on International Finance as part of a more general purge of my book and journal collection as we are being forced out of our old offices into smaller ones. I actually thought that book was pretty good, but old and not one I was going to look at again, so bye-bye.

Again, this is an error in spelling that has long been stuck in my mind, not something that just popped up yesterday or an uncorrected typo like my “Tayor” above.

As for “larger errors” some other things you reference above as supposedly errors by me are errors by you or not yet determined but not moving favorably for you. You made a snide comment on “Lab Created Pandemics” but increasingly the evidence is weighing in on the side of that conclusion. We do not know for sure, but the leading alternative is really quite fantastic: that a mutation happening in bats in Yunnan got into an as yet unidentified mammal that somehow spread it hundreds of miles to a wet market in Wuhan where it got transmitted to humans. While the lab’s director is loudly denying anything came out of there, it is not only just 300 yards from the wet market, but they were working on viruses very close to what we are dealing with, yes, ironically, in an effort to develop defenses against such viruses, but with a record of various outside observers complaining repeatedly about supposedly unsafe procedures occurring inside this lab. Frankly, the lab origin story is looking more and more likely while the hundreds of miles away bat origin story is looking less and less likely.

As for your reference to Quora, Mose, this is hilarious. I cited Quora once, a site I still know little about, this being a few years ago. It may be a questionable site, but the particular report I cited was by a well-informed person and was completely accurate. You never were able to provide either a logical or factual argument to refute the report I cited, only your bizarre slams at the Quora site itself, I presume because of your inability to actually counter the arguments made in the report. And indeed you were unable to because this involved one of your most embarrassingly wrong arguments that you have nevertheless repeatedly dragged up, only to further your embarrassment. Since probably at this point very few know what this was about, it was Moses’s infamously ignorant and flamingly stupid argument that Native American Indian genes are evenly distributed among the US European-descended population rather than being distributed in a skewed manner. Somehow to this day, Moses has refused to admit and accept that he was outright insane to be pushing this utterly rank nonsense, but here he is at it again effectively, while getting all in a blather because I put an extra letter into the name of the late Ronald I McKinnon, shame on me forever.

Oh, I just noticed.. Mosrs charges me with a “petty error” by saying athat L-shaped recovery curves do not exist.

Well, OK, Moses, name one thaat ever happened, ever,anywhere. Funny thing is that the more I think about this particular episode might well end up being one, certainly a lot closer to it than either a J or a V. But, go ahead. Name one, and do not just provide some link with not explanation. I am not going to open any more of your stupid links ever again.

@ Barkley Junior

I’ll let your self-confessed ignorance on L shaped recoveries and modern economic history speak for itself. Since Menzie insists on babysitting your ego I doubt he’ll be posting any examples of L curve recoveries anytime soon, so you can enjoy that aspect of your Fantasy Island.

Look, Moses, i put to you a serious challenge: namne one recovery that was L-shaped, anywhere, ever. You are not doing so and dismissing this by calling me “ignorant,” when you are clearly the ignorant one who has gotten himself out on an indefensible limb, like your stupid effort to try to bamboozle people into thinking that Noam Chomsky supported your idiotic declaration that it is “ludicrous” to think SARS-Cov-2 came out of a Wuhan lab when ever mounting evidence points to that as the most likely source.

Actually, I think there have beenL-shaped recoveries, but Menzie certainly has not talked about them, and I suspect you would not figure out where to find them without some help from senile me. In poorer nations that have experienced collapses that were then followed by a long period of no recovery at all. I think there are some candidates in latin America at certain points, maybe Mexico in the 1980s, which had a debt crisis followed by low oil prices, leaving its ecnoomy flat for most of the decade.

But I do not think you will find any such thing in the US or any of the other high income nations (although Mexico sort of counts as an OECD member, but it was not one back then).

As it is, you focus on utter trivia because that is where you get your little victories, me misspelling a name or accessing some site you disapprove of. You never actually win on logic or facts or sjubstantive matters, and I rechallange you on this matter of finding an L-shaped recovery in a high income nation, with a big score for you if you can find one for the US, which is what this thread has been about. You will not succeed on that latter point, because there have not been any, and you claiming I am ignorant for pointing that out only shows how ignnorant you are on this matter.

That is because they try to act like “fed purchases” actually create real money……,they don’t. Though it also shows limited power of the FOMC. Something they can’t have either. The last time the dollar was debased was when BW collapsed, which is why they harp on it, but that was due to massive printing by us treasury to keep the deficit down due to wwii debt, nam and the great society. It inflated the real money supply for years even by 1979, money creation had collapsed. Since then the us has used deficits instead(and yes,that has its limits as well).

The dollar collapsed in value beginning in 1940 through 1951. There was no sharp down move after 1971; just continuation of a steady downtrend.

https://fred.stlouisfed.org/series/CUUR0000SA0R#0

Just a question – what is “real money”? OK, two questions – are we sure the Fed’s goal was to create “real money” through asset purchases?

https://www.cnn.com/2020/04/21/health/hydroxychloroquine-veterans-study/index.html

while not a definitive study, i think those promoting hyroxychloroquine owe some people an apology.

on a brighter note, republican leadership in texas display their contempt for the survival of the common person…

“More important things than living”…like making money, texas lt gov dan patrick, on why we need to open up the state of texas. this follows his wonderful observation that “grandparents would be willing to die” to save the economy for their grandchildren. seems patrick has a death wish (he is 70 after all). i think a better alternative is stay alive and find a reasonable way to reopen the economy safely. notice patrick is a do as a i say, not as i do kind of fraudster, as he holes up in his mansion these days.

“We disagree with the view that inflation needs to be pushed higher, and worry that another round of asset purchases, with interest rates still near zero over a year into the recovery, will distort financial markets and greatly complicate future Fed efforts to normalize monetary policy.”

I can agree with them on this point; ZIRP, QE, (negative rates in other locales) can never be exited, not without destabilizing consequence.

Did any of you guys notice who Paul Krugman dedicated his latest book to??

Uwe Reinhardt. 100% class move by Krugman.