Today, we are pleased to present a guest contribution written by Enrique Martínez-García (Senior Reserach Economist and Policy Advisor, Federal Reserve Bank of Dallas). The views expressed here are those solely of the author and do not reflect those of the Federal Reserve Bank of Dallas or the Federal Reserve System.

The fact that economists—international organizations like the IMF, but also governments and private forecasters—have a poor track record predicting recessions is a well documented finding. And the ongoing global crisis indeed appears to fit this pattern. However, by now little doubt remains that the rapid spread of the COVID-19 pandemic and the governments’ stringent responses to it have put much of the global economy on standstill for the sake of “flattening the curve” and saving lives.

The great lockdown has also come with heightened global uncertainty, challenging decision-making as well as upending the efforts of forecasters to get a grasp of the changing outlook. Global growth forecasts have historically been punctuated by periods of optimism and pessimism, but even so the shift in expectations during the current crisis has been swift and unprecedented in scale.

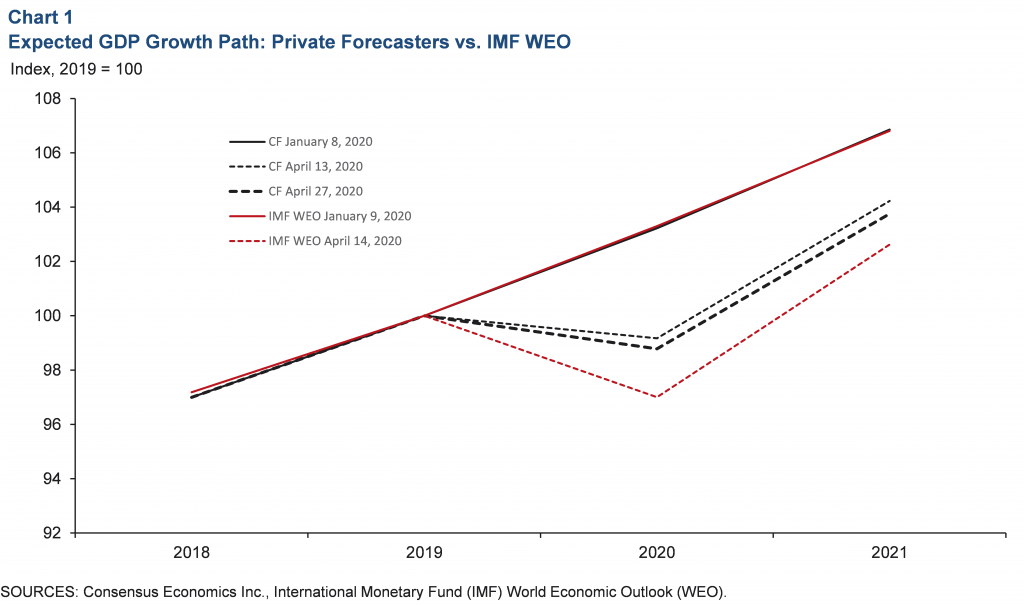

The International Monetary Fund (IMF) projected in its World Economic Outlook (WEO) release of April 14, 2020, that global GDP growth will fall by 3 percent in 2020 followed by a strong rebound of 5.8 percent in 2021. In its WEO update of January 9, 2020, the IMF had still expected solid global growth of 3.3 percent in 2020 and 3.4 percent in 2021.

Once can also glean the remarkable change in expectations from the daily forecasts of the professional forecasters polled by Consensus Economics Inc. I do so following a bottom-up approach that aggregates a sample of 33 country forecasts (accounting for 81.1 percent of world output in PPP terms in 2019, according to the IMF) weighted with PPP-adjusted GDP weights. Private forecasters make their country forecasts based on their own assessment of domestic economic conditions and their own projections about the impact of international spillovers, the path of the exchange rate, etc. that may differ from those of the IMF.

Chart 1 plots the evolution of the global output path projected by the IMF and that implied by the 33-country aggregate of private forecasters’ projections at selected days, using the January 9 and April 14 releases of the WEO as points of reference. What we observe in Chart 1 is that, at the beginning of 2020, the global output path implied by private forecasters looked very similar to the IMF’s own. Differences have become starker particularly since private forecasters began to fundamentally reevaluate their projections for 2020-21 by early March. By the time the April 2020 WEO projections came along, private forecasters had already come to expect a global recession.

While there is a high degree of concordance (qualitatively) between private forecasters and the IMF in their assessments of the recovery path, substantial differences have emerged regarding the severity of the global contraction. As a result, private forecasters still appear to retain a more benign view of the global economy over the 2020-21 forecasting horizon than the IMF does.

What’s perhaps more interesting here is that the April 2020 WEO release has not changed significantly the views of private forecasters about the severity of the global economy’s contraction. As of April 27, 2020, global growth for the 33-country aggregate of private forecasts comes at only -1.2 percent in 2020 followed by a bounce-back to +5 percent in 2021.

It is too early to judge the broad macroeconomic consequences of the pandemic on the global economy, but much of it—even the efficacy of fiscal and monetary policies being currently deployed to support the economy—hinges on how private agents’ expectations about the future (such as those in Chart 1) continue to evolve. More on how private forecasters’ global growth outlook is taking shape since the COVID-19 outbreak can be found in my recent Dallas Fed Economics blog post here: https://www.dallasfed.org/research/economics/2020/0505.

This post written by Enrique Martínez-García.

At this time it is not possible to tell the difference between economic forecasting and wishful thinking. Nothing beyond a few months out can be based on data, only on wild-ass guesses and oddly, those all seem to sort of glide happily upward. And the economic forecasters are pessimists compared to stock market buyers. It seems as if all the money that used to go to Vegas for sports betting has now decided to play Wall Street.

It’s important to remember sell-side analysts (the guys you see on TV and hear on business radio) are not investors. They are there to generate commissions and fees~~~they don’t actually care if small individual investors make money on the trade or investment—they only care about generating the actions which create or validate a “service” charge. That’s changing a little, but certainly has been the case until very very recently.

Annoying Pedantic Comment Alert: I believe Chart 1 should be changed to a bar graph rather than a line graph. The line graph coupled with large gaps between the year markers along the horizontal axis misleadingly suggest linear time trends. Okay, annoying pedantry turned off.

It doesn’t look like the growth forecasts have taken account of especially virulent second or third waves in late 2020 through early 2021. If the last few weeks have taught us anything, it’s that the electorate in many OECD countries have the impulse control of a middle schooler. And yes, I’m talking to you sammy and Bruce Hall.

2 slugbaits,

When to admit you’ve made a grievous blunder.

“Peugeot car–owners in the 1980s came in two varieties. The first group owned their lovable lemons fewer than six months. The second group owned their mistakes for ten years or longer.

In former times, Peugeot motorcars were well designed but their construction horribly executed. Manufacturing defects were legion, from crossed electrical terminals, where turning on the headlights also activated the electric windows; where adjusting the electric seats popped open the tailgate; where gas tank vents weren’t installed, so as the fuel level dropped, the resulting vacuum would collapse the tank, stalling the engine; where the transmission selector park position was actually reverse; and where the turbocharger oil leaks sent a plume of blue vapor fogging the windshields of anyone tailgating.

That was the first month.

All Peugeot-owners soon enough realized they had made a huge blunder, a grievous, costly error. The smart ones cut their losses within months, readily admitting they had been snookered into buying a rival to the Soviet-built Trabant. The not so smart privately knew that their Peugeots were pieces of crap but would never admit it to anyone, suffering in obscurity for years, spending a fortune on loaner cars and repairs when the contested warranties expired, hoping no one would notice they had been taken for fools.”

And 2slugbaits keeps on driving his Peugeot, into the ground.

https://www.americanthinker.com/blog/2020/04/when_to_admit_youve_made_a_grievous_blunder.html

“into buying a rival to the Soviet-built Trabant”

The Trabi was actually built in East Germany between 1957 and 1991, nothing Soviet. 🙂

@ Ulenspiegel

Earlier, I was gonna say that many years ago Peugeot made a hell of a great bicycle. But that would have dated me age wise and I was afraid all the cool kids were going to start chuckling at me. It’s our secret ok??

sammy Citing something from The American Thinker? Really? Is that your idea of an intellectually serious source? Sometimes it’s not the car; it’s the immature drivers who can’t be bothered to read the the owner’s manual. Sort of like Trumpsters not following their own guidelines for when it would be okay to start reopening.

Tell me if this personality description reminds you of someone:

…[P]rojection is the process whereby one subject believes they see attributes (both good and bad) in another. The theory views this tendency as a defense mechanism whereby unenviable or unpleasant traits, impulses or ideas are attributed to another. In this way, the projector is able to avoid the unpleasantness in themselves. However, the theory goes on to explain that in severe cases of projection, the condition of projection may degenerate into paranoid delusions to the point that the projector believes others are responsible for the projector’s problems and are secretly plotting against them. The projection basically allows a subject to ignore faults within themselves.

https://psychologydictionary.org/projection/

So, this means you have seen the error of your ways and are going to stop supporting the orange lemon in the White House?

and now trump is furious that his personal valet has tested positive for coronavirus. FURIOUS! apparently all these decisions he is proposing is not supposed to affect him, only other people.

https://www.cnbc.com/2020/05/07/coronavirus-trump-military-aide-at-white-house-tests-positive-for-covid-19.html

at some point, the virus will run rampant through his administration filled with old white men with preexisting conditions. they have been isolating while telling everybody else to return to work, but the gimmick will only work for so long. the question becomes, who survives the gauntlet? let trump and pence continue to tour the nation, hopefully visit some patients suffering from the disease, to get a first hand look. maybe sammy could tag along? after all, there really is no danger here, at least according to folks like sammy. but i betcha sammy, corev, bruce, rick et al are STILL holed up alone in their apartments, afraid to follow their own advice and return to the public sphere. not one of them has ventured out, while pushing others to take on the risk. sad hypocrites.

“A personal valet for President Donald Trump, who among other things serves meals to the president, has tested positive for the coronavirus”

Someone from our military has to bring Donald Fata$$ Trump his meals? Really? Maybe now that this valet has coronavirus, Trump may have to go on a diet.

sammy,

Maybe in the 1980s Peugeots were lemon cars, but in 2019 J.D. Power rated Pweugeot as the most reliable car in Britain. Quite aside from the obvious fact that the lemon is the clown in the White House, you are way out of date, or this “American Thinker” is, who isembarrassing America by claiming to be one of our thinkers.

Sammy,

I talked with the local police and told them you dropped your daughter on her head when she was young, and she couldn’t be held responsible for this. She kept screaming hysterically “Daddy said it’s because Obamacare I can’t get a booth seat!!!!!”. I think all of this will be cleared up by tomorrow morning:

https://www.nytimes.com/2020/05/07/us/oklahoma-mcdonalds-shooting-coronavirus.html

Tomorrow, after she gets released from the county jail, I’m going to teach her about communicable diseases, and Barkley is joining me for his monthly “Getting Your Child To Understand Lab Created Pandemics” sponsored by the charitable foundation “Confederacy Sons…. Good Times….. “

Dear Folks,

The recovery from the COVID-19 virus will depend on the specific damage it does. The forecasts only address the numbers. If the virus forces restaurants to institute a 6-foot distancing rule that lasts past the end of the pandemic, the restaurant industry earnings will be lower, and more restaurants will go out of business. Similarly for hotels, chain restaurants, motels, sporting events, movies, concerts, air and rail travel, etc. Industrial production will become more expensive as more things have to be decontaminated to pass consumer resistance. There will be an adjustment as more goes online, but all adjustments take time. A careful judgement of how long these adjustments will take, and the percentage of sales affected, will help in discriminating between the forecasts.

Julian

Reverting to previous discussions that have characterized these downturn-recovery patterns by means of letter, it looks iike two of these, the ones on top are Js, but not lazy J., vigorous ones that rebound to grow at faster rates than they declined. The third one, at the bottom, is clearly a V.

I am repeating myself, but I see none of these as likely. We are in the midst of an extremely sharp GDP decline, almost unheard of ever even in the Great Depression, which is not shown by any of these predictions, all of which show fairly mild/gradual rates of decline, making them already off. Given all the fears of being in crowds people have, not to mention the massive declines in income many people are experiencing that are not likely to turn around dramatically soon, I continue to see it as highly unlikely that we are going to be seeing rapid growth in the near future, even as I expect some growth once we bottom out, meaning we do not have an L.

None of these projections look at all likely.

Don’t forget about what’s likely to happen to state and local government spending over the next few years if Congress and King Donald don’t come through with some kind of bailout program. State spending accounted for 10.9% of GDP in 2019.

there is only one way to get a massive rebound that resembles a V, and that is to end the lockdown and hope the people will return to their consumer ways quickly. this is also the only path trump has any hope of reelection. this is why it is being pushed so aggressively by trump and his acolytes. but if you look at some of the states that are reopening, such as texas, the disease is still growing. and after a week, most people are NOT leaving home and returning to business as usual. so while some states are ”technically” reopening, in reality they are still remaining quite closed. the people that are going out are mostly trump supporters, and most likely that group will continue to get sick, resulting in even fewer of them to vote in the fall.

the area where the governors and trump could have an influence is in schools. forcing kids back will certainly force the spread of the disease quickly, and those that do get sick and recover will spend more time in the community. this will impact a lot of people, but only have an influence in the fall-probably too late for the election. this is why there was a lot of pushback from trump to keep the schools open for the remainder of the school year-it was his last big chance to enforce herd immunity before the election. for trump, a quiet summer of coronavirus followed by reemergence in the fall is a disaster from a timing perspective.

I have looked back a bit more on the lit on all this and the past as well, and what people see and what has happened has changed over time. Let me focus largely on the US, although some of this applies more globally.

So in the 19th century the discussion almost universally implied an asymmetric pattern of sharper declines and slower recoveries, what I have been calling a “Lazy J.” This arose from an emphasis on downturns arising from”commercial rises” that drove things down hard, but that were then followed by more gradual upturns

This continued into the early 1900s with Wesley Clair Mitchell, who coined the term “business cycles” following it in his early work (see book of that title, 1913). But then the emphasis began to shift as econometricians and math modelers got into the picture in the 1930s, including Mitchell’s asociates at the NBER and Columbia. Emphasis began to be on sine curves as how “the business cycle” would work, which, if one chops one of those off at the downward and upward inflectoin points, gives one a U, as Frankel posed as a possibility. These are symmetric cycles, as are those looking like a V.

After WW II this remained a dominant approach, although as some later noted, included Econbrowser’s own Jim Hamilton, quite a few fluctuations up until the 1970s actually exhibited more rapid bouncebacks than downturns, thus fitting more the J form posed by Papell, and not the lazy kind I see now, but the alert kind that grows whooshingly above its turndown pont. Jim acontributed to these discussions due to his development of nonlinear regime switching methods.

As it is, he in several papers noted an asymmetry regarding the impact of oil prices: higher oil prices tended to generate sharp downturns, while lower oil prices tend to generate weaker upturns, or even occasionally downturns. If I am misrepresenting his work on this, he should feel free to correct me.

More recently, while there have been people pushing the V idea, such as Jim Morley, there has been a lot of work harking back to th e19th century view, also reflecting how some of the recent patterns have looked, asymmetric patterns with slower upturns than downturns, again, what I have been labeling a “Lazy J.” Examples of this work are a paper in 1998 in the Journal of Monetary Economics by Daron Acemoglu and Andrew Scott, “Asymmetric Business Cycles: Theory and Time-Series Empirical Data.”

Most recently is a December 2019 NBER paper #26351 by Stephane Duprax, Emi Nakamura, and Jon Steinsson also finding such a pattern, “A plucking model of business cycles” (i note the irony that the plucking model was originally developed by Milton Friedman).

Anyway, we have seen various patterns over time, but recent studies have been tilting towards the Lazy J, with this particular situation in the US with th esharpest decline ever observred, likely to end up another Lazy J, unless indeed it just goes flat and sits there, giving the US its first L ever (and a wiggly W remains highly likely also).

it will not be a L and not a W but a V, and here in Germany the V is already visible, the malls are full and the people are restarting the engine. No one cares any more about the virus fearmongering. There is no dangerous virus, ‘the king has no clothes’. “This complete lockdown chinese-style wasn’t necessary at all”, more and more people are saying, and the behavior of the british Professor Lockdown (Ferguson) in meeting his married lover during the lockdown, is a hint of the scam going on … a fearmongering scam, for certain reasons (say Hong Kong ?).

Johnny,

Maybe that will be true in Germany, a V, maybe even a V2, :-). But I seriously doubt it for the US. For one thing the drop was so sharp, a 10% inceease in the unemployment rate in two months wit a lot of ongoing factos such as impending layoffs in state and local governments, that I do not remotely see a symmetric bounceback in the US, although followers of Trump and Trump himself may be fantaszing that such might happen.

Also note that Germany did not fall as far and has a far better testing and tracing system in place than is true in the US. Thus German consumers have more confidence that they can go out and buy more safely than is the case in the US, so the cases will almost certainly not be the same. As Germany did not fall nearly as far or as hard, it has a much better shot at getting a V.

Let’s not pretend what this has evolved into. The federal govt coming in and raining down dollars on local and state governments with huge unfunded liabilities, that existed long before the pandemic.

@ “Mp”

You’re referring to Mitch McConnell’s and Republicans’ efforts to give money intended to keep workers gainfully employed at small businesses to instead subsidize large corporations’ wasteful corporate debt and boardroom salaries??

https://www.vox.com/2020/4/22/21229319/ruth-chris-shake-shack-potbelly-ppp-loans

Maybe you should write a letter to GOP leaders and tell them you don’t appreciate large corporations robbing from middle income taxpayers. You can co-write the letter with Barkley Junior and you’ll both have your first constructive labor you’ve probably done in the last two weeks.

” is a hint of the scam going on … a fearmongering scam”

Open an excel sheet and build a function with the data we have. Then assume a moderate mortality of 0.4% (which is only true with enough ICU beds), what do you get? Could it be that you try to cover the fact that you are math challenged with some kind of comspiracy theory?

IMHO you have only found another way to say that you are not very intelligent. 🙂

germany gets to have a strong start only because they took the virus seriously early on with lockdowns, testing, tracing and quality medical care. those who took early shortcuts to avoid the testing and tracing have fared worse and will not reopen as easily. germany has also acknowledged that a second wave will prompt a new lockdown. this discourages unsafe behavior in the population at large. there is no scam. germany simply did what was necessary. i applaud merkel for strong, direct and wise leadership. i wish other nations could say the same.

OK, this is lockdown “stay at home” related, so, that’s my rationalization that this is not off-topic to the post, and I’m sticking to my story:

https://twitter.com/RBReich/status/1260676420986003456