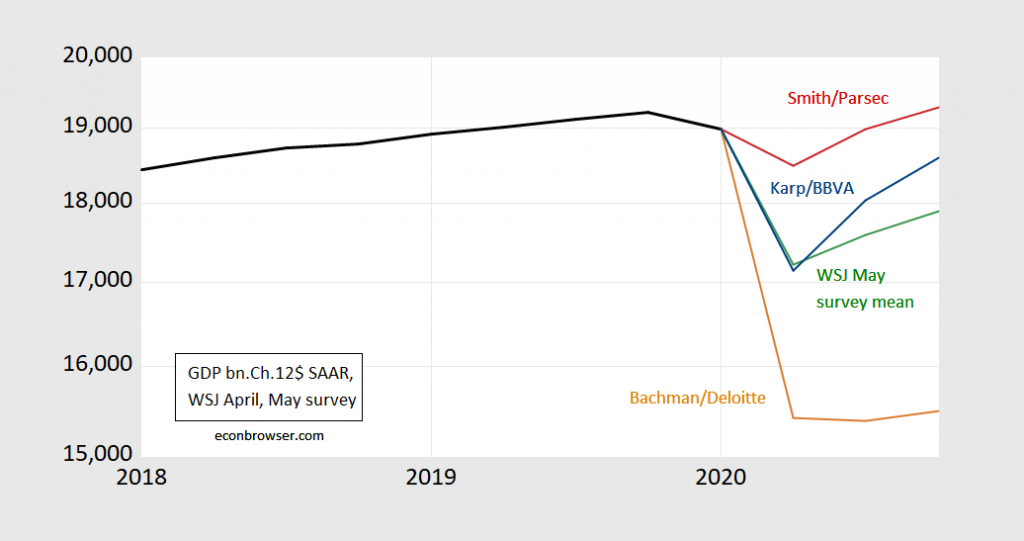

From the Wall Street Journal’s May survey:

Figure 1: GDP in billions of Ch.2012$, SAAR, reported (black bold), WSJ survey mean (green), lowest q4/q4 estimate from Daniel Bachman at Deloitte (tan), and highest from James F. Smith at Parsec Financial (red). Source: WSJ May survey, BEA, and author’s calculations.

James F. Smith from Parsec Financial is once again at the top, as in April’s survey, described in this post. I might as well just type that out and paste it into each post I write on the WSJ surveys.

Doug Porter at BMO Capital is no longer my candidate for most “V” forecast (he actually did not provide forecasts this survey). My top candidate forecast is from Nathaniel Karp at BBVA Compass. That being said, it’s somewhat less “V” than Porter’s “V”, with q4 GDP 13% down from 2019Q4, compared to something less than 1%. This merely highlights the fact that all the forecasts have been downshifted in terms of levels, so that “swoosh” is the forecast of the day…

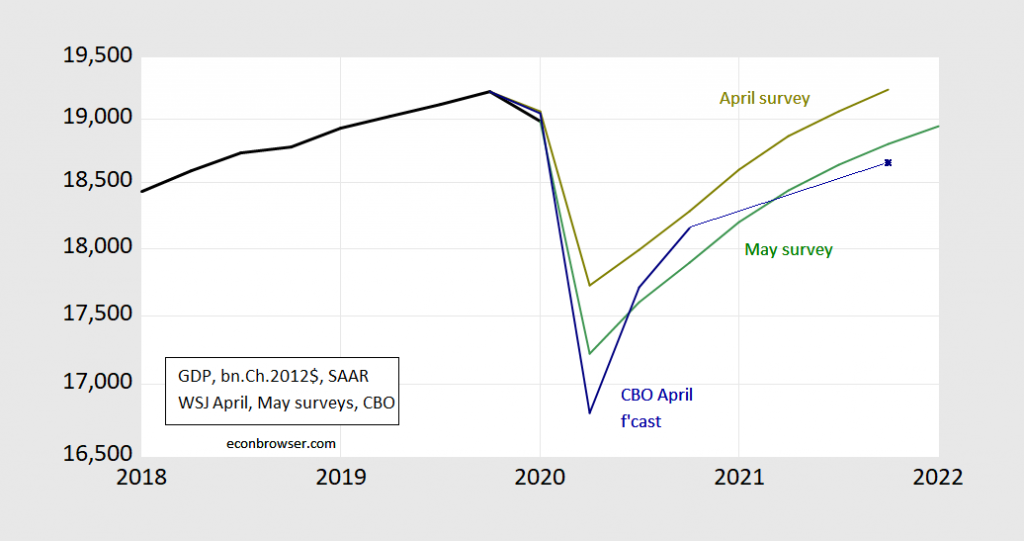

Figure 2: GDP in billions of Ch.2012$, SAAR, reported (black bold), WSJ survey April mean (chartreuse), May mean (green) and CBO April forecast (dark blue). Source: WSJ April, May survey, BEA, CBO, and author’s calculations.

Note that not all forecasters that provided forecasts through 2020Q4 provided forecasts through 2022Q1.

Addendum, 5/14:

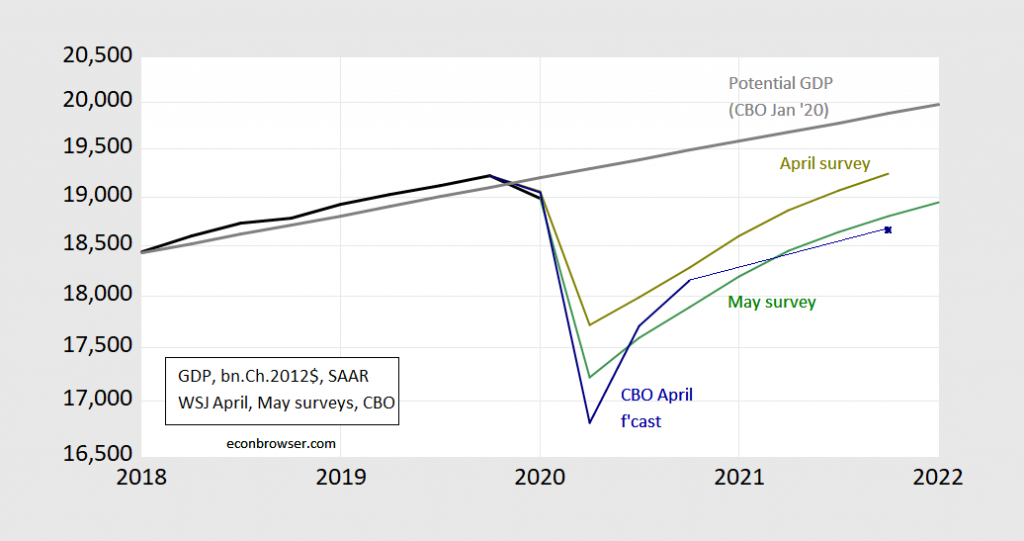

It’s interesting to place these forecasts in the context of what we expected potential output to be as of January this year. (Of course, potential output given public health concerns is probably reduced, but measuring the reduction is fraught with conceptual difficulties — aside from how much the labor force will be reduced if one accelerates or decelerates the opening up of the economy and consequent fatalities (Eichenbaum et al. 2020 provides one instance of feedback effects).

Figure 3: GDP in billions of Ch.2012$, SAAR, reported (black bold), WSJ survey April mean (chartreuse), May mean (green) and CBO April forecast (dark blue), potential GDP from CBO January projection (bold gray). Source: WSJ April, May survey, BEA, CBO (January, April), and author’s calculations.

Noah Feldman’s ‘Deep Background’ podcast is well worth listening to these days as he discusses all things COVID-19 with experts in respective fields: https://pushkin.fm/deep-background Yesterday he talked with hedge fund manager Boaz Weinstein and they went over some the points raised in the graphs. Weinsten is more concerned about the state of the bond markets these days (as am I) and what they may be telling us. I’m not so certain there is going to be as quick a recovery given the amount of debt that is gong to be difficult to service.

One marker that I will follow will be hotel occupancy which in many cities is driven by conventions and other types of meetings. Until this goes from zero (the case right now) to some number (whose magnitude will be interesting to see), I don’t hold out much hope for the hospitality industry. Meeting will also be a driver of airline travel as well. A survey of meeting planners is likely a much better surrogate for forthcoming economic activity (this is probably what a Tetlock Superforecaster would look at).

“One marker that I will follow will be hotel occupancy which in many cities is driven by conventions and other types of meetings.”

this used to be driven primarily by one factor, and that was a company’s willingness to foot the bill. that has not changed, and with profits drying up it probably will be a negative for at least a year. in addition, you have a 180 degree change in worker perspective. in the past, many workers felt that conventions were a perk, a short paid vacation of sorts, and workers looked forward to the yearly company excursion. for many many reasons (virus infection, cost, child care, etc) i would guess most workers have absolutely no desire for company travel at this time. when both company and worker lack any willingness to travel, i think your metric will be VERY SLOW in showing a recovery.

@baffling – you note that I said, “i think your metric will be VERY SLOW in showing a recovery.”

That’s exactly the point, I do think it will be slow because of this. Convention cities will be slow to come back and it is not just the hotels but all the surrounding restaurants, bars, etc. that will suffer. This is a significant economic hit.

@ Goldhammer

Thanks for the reminder. He really does score some solid guests doesn’t he?? I bet this one is a good one.

Swoosh or V, its still back to a ‘full employment’ growth path? That is consistent with conventional macroeconomic theory which teachs that long term we are governed by the Solow model. I don’t see much theoretical clarity on why there would be a U or especially an L. A U implies some kind of hysteresis mechanism and a level effect so there is a coherent story there. But how would you explain an L–both a level and a growth effect? To my way of thinking, (heterodox, Keynesian+Classical) that requires a paradigm shift.

If you are curious, here is a heterodox perspective: https://www.peri.umass.edu/component/k2/item/1283-path-dependence-and-pandemics-in-a-classical-growth-model

tom I’m assuming that you are the co-author whose first name is “Thomas.” When theorizing about the effects of the COVID-19 pandemic it seems to me one should distinguish between returns from capital (profits) and returns from land (rent). As Stiglitz points out in a series of working papers, it’s rent (in the sense of returns from positional assets) that represents a whopping share of what gets counted as profits in the naive Solow model.

https://www.nber.org/papers/w21189

https://www.nber.org/papers/w21190

https://www.nber.org/papers/w21191

https://www.nber.org/papers/w21192

So one effect of the pandemic could be to destroy the wealth of folks like Trump and Kushner as people and corporate headquarters flee dense population areas and move to more sparsely populated areas. I won’t be shedding any tears for Trump and Kushner. People can migrate and that migration will affect land values.

One way to explain an “L” recovery in both levels and growth rates might go something like the following. Service sector industries that face the public and are at the far downstream end of the supply chain will be very slow to recover absent some kind of miracle vaccine. The reasons aren’t hard to fathom. Who wants to eat at a restaurant if you have to wear a mask. That will result in a persistent downward level shift. Aggregate demand will shift away from the service sector and towards the goods producing sector, which will require a reshuffling of the workforce. That reshuffling will also show up as a negative productivity shock as new workers fumble their way through their new careers. That will slow productivity growth rates. And supply chains will become less efficient as firms put more emphasis on adaptability & responsiveness and less on cost minimizing efficiency. To take a humble example, the core problem at hog processing plants is that slaughterhouses can only accept hogs that are of a uniform size and weight. That was one of the main drivers behind keeping meat processing plants open at all costs. So we might see fewer large processing plants and more (less efficient) local meat lockers processing hogs and cattle of varying sizes. Another example might be industries that prioritize diversification of sources over lowest cost sources. Those are all strategies that will tend to reduce growth rates. Finally, we shouldn’t overlook the fact that the disease itself might have a negative effect on the long run health and productivity of the labor force.

There may be serious tension between the risk from population density and productivity gains from population density. The percieved risk from population density is new, so changes the calculation, but the benefit of many good brains in close proximity is enormous. If there is a substantial reduction in population density in highly productive centers, productivity and innovation are likely to suffer. Actual human contact is more important for collaberation than is often realized in “new paradigm” business thinking.

Right. Dense population and a clustering of similar industries & businesses also facilitates worker movement towards jobs with a higher value of marginal product. Shifting to more sparsely populated areas risks the “one company town” effect that leaves people stuck in dead end jobs.

Thanks for the Stiglitz papers.

I think your examples are right. They all seem to be level effects. Some mechanism is needed to translate them into growth effects. I think the shock will reduce employment rates and enlarge profits (possibly including the rents Stiglitz discusses–I don’t see those going down). That will disincentivize innovation. There may also be fewer economies of scale realized–Kaldor-Verdoorn effects.

Off-topic

I want to apologize to Menzie for going off-topic here, but I wanted this to get the most eyeballs. This happened in MAGA-land Oklahoma. The driver was an African American gentleman, who anyone could see at first glance wouldn’t harm a fly unless in defense of himself or his family. He was in a very well marked delivery vehicle. Does anyone believe this neighborhood doesn’t get delivery trucks in and out all the time?? Are we to believe they stop every well-marked delivery truck that enters that neighborhood?? It’s ridiculous on the face of it. So who would you guess stopped this gentleman in red-state MAGA-land Oklahoma City?? The President of that neighborhood’s Home Owner’s Association: David “I’m Not a Racist, I Just Act Like a Racist” Stewart

https://kfor.com/news/caught-on-camera-delivery-driver-blocked-into-neighborhood-by-hoa-president/

How much does anyone want to wager that David “I’m Not a Racist, I Just Act Like a Racist” Stewart is one of the MAGA folks who is saying everyone should go back to work now and the economy should re-open?? Any takers on that wager?? Bruce Hall?? Sammy?? Either of you up for that wager?? But when an African American man delivers products so people can eat and function staying safe from COVID-19 at home, David “I’m Not a Racist, I Just Act Like a Racist” Stewart wants to stop him from performing his job because he has a darker skin tone.

The push for hydroxychloroquine was a payout for Trump cronies after all:

https://www.msn.com/en-us/news/politics/a-trump-official-tried-to-fast-track-funding-for-his-friends-unproven-covid-19-“treatment”-whistleblower-says/ar-BB144kg3?ocid=spartandhp

Last November, Rick Bright, then the director of a federal office that approves funding for medical emergencies, sat in on a meeting between his boss and two men — a pharmaceutical and biotech consultant and an Emory University professor — seeking millions of dollars for an unproven drug. Bright wrote in a whistleblower complaint filed last week that he was wary as professor George Painter and consultant John Clerici described the drug “as a ‘cure all’ for influenza, Ebola, and nearly every other virus.” The team came back in February with an updated pitch after the coronavirus outbreak, suggesting its antiviral medication could be a treatment for COVID-19. Painter, a pharmacology professor and CEO of a nonprofit biotech company, had already received $30 million from the National Institutes of Health and the Department of Defense for small-scale clinical trials. But as Bright described in his complaint, Painter sought more money from Bright’s office, the Biomedical Advanced Research and Development Authority (BARDA). Instead of going through Bright’s formal application process, Painter and Clerici sought funding through a separate, more “opaque” program created by Bright’s boss, Robert Kadlec — a Trump administration appointee and friend of Painter’s. Kadlec’s program was designed to support products, equipment and technology, Bright said, and lacked the expertise to evaluate drug development.

@pgl – I read the paper on the experimental drug in question and it’s got pretty decent anti-viral activity but so do a bunch of other drugs, most of which have already been approved by the FDA for other uses. The big crime is not what was done for this drug which has not even been tested in Phase 1 safety studies but that other drugs have not even been tested that might actually work! There is an excellent editorial in the British Medical Journal on this whole mess: https://www.bmj.com/content/bmj/369/bmj.m1847.full.pdf There are a lot of people whose reputations will be tarnished by their performance during this crisis. It’s not going to be pretty. I’ll have to figure out a way to get nominated to the Blue Ribbon panel that does the post-mortem.

It’s not going to be pretty. I’ll have to figure out a way to get nominated to the Blue Ribbon panel that does the post-mortem.

The electorate that got him into office, want/wanted to “hurt the right people.” (typical fascist targets) If there’s a transition out of the current fascist environment, I’m not sure where you would begin with all of the corruption and norms violations, and the residual electorate who still want to “hurt the right people.”

I applaud your dedication to facts and the scientific process though.

There is hysteresis in the mental adjustment to reality. The quicker the drop, the more resistance to accept it, hence the apparent snapback in predictions. It’s not, as many ‘analysts’ claim, a forward-looking optimism. Instead, it is backward-looking denial.

GDP declined in Q4 2019?

Steven Kopits: No. The line that is at “2020” is Q1 of 2020. Hence, GDP declined in 2020Q1.

Well, Q1 GDP is as of March 31. You probably used the way it is labeled in the Fed data. It’s pretty annoying if you’re graphing. As I recall, they use 1/1/xxxx to mean Q1, when really Q1 is 3/31/xxxx.

Steven Kopits: Yes, I’m a macroeconomist, and this seems like a completely uncontroversial way to present the data to macroeconomists.

Is there some point to all this carping? Learn to use http://www.bea.gov. Geesh.

Stevie. I thought you were some analyst. And yet you do not know how to check out the National Income data from the BEA. OK – here is a link to a lot of awesome data:

https://www.bea.gov/data/gdp/gross-domestic-product

Learn to use it. The rest of us have.

Wait…one of the most active and assertive commenters here doesn’t know how data is reported in national accounts data? What is the basis for your claims about the working of the economy if you don’t even know how to read the data? Jeez…

Swoosh vs. V is so yesterday. Tomorrow it will be swish vs. tilde. You heard it first here.

Dwight L. Cramer: Yes, although W is not unlikely.

To hell with all of you, I know what’s really going on here.

https://images.app.goo.gl/2pyQbSQoRiRQonrB9

I’ve been following Barkley Junior’s published papers closely. He refers to this economic recovery shape as “the Lazy Barkley”, and I’ll be damned if I’m going to argue with the guy. He was the very first to refer to it as “the Lazy Barkley” but insists it was one of his colleague’s ideas.

since my request was ignored in the last post, thought i would ask again:

still waiting for folks like bruce hall and sammy to explain whether they are self isolating at home, or actually out risking contracting the virus in public? are you two practicing what you preach, or are you two hypocrites encouraging others to risk their lives for your financial gain and personal safety? inquiring minds want to know.

baffling,

Your question is idiotic

sammy

May 11, 2020 at 8:48 pm

baffling,

I don’t know why you constantly accuse anyone who is in favor of ending the lockdown as scared, hiding out in their basement, etc. If we really were scared we would be AGAINST ending the lockdown, like you are. Even this elementary logic escapes you.

Answer the question sammy. Bruce’s silence confirms he is sitting safely at home. You huff and puff, but my guess is you are also sitting safely at home encouraging others to go out and risk their lives. Very noble and brave of you, sammy the schmuk.

baffling Unlike Bruce Hall, I don’t think sammy is afraid of risking his life. He’s too clueless to understand the risks, but that’s his problem. Unfortunately, he’s also too self-centered to consider how his actions might affect others. No one will really shed a tear if sammy contracts COVID-19 and kicks the bucket. That’s just one more Darwin award winner and one less MAGA hat voter. All good. The problem is that his irresponsible actions are apt to infect innocent people. sammy probably believes that the reason you wear a mask is to protect yourself. I doubt that it’s ever occurred to him that masks protect other people and not the wearer.

“Unlike Bruce Hall, I don’t think sammy is afraid of risking his life. He’s too clueless to understand the risks…”

perhaps true. but i also do not believe he is risking his life in any way shape or form. he is posing, and encouraging others to take risks from the safety of his mom’s basement. he has no responsibilities, family to care for, job or prospects. it is always somebody else’s fault for his failures.