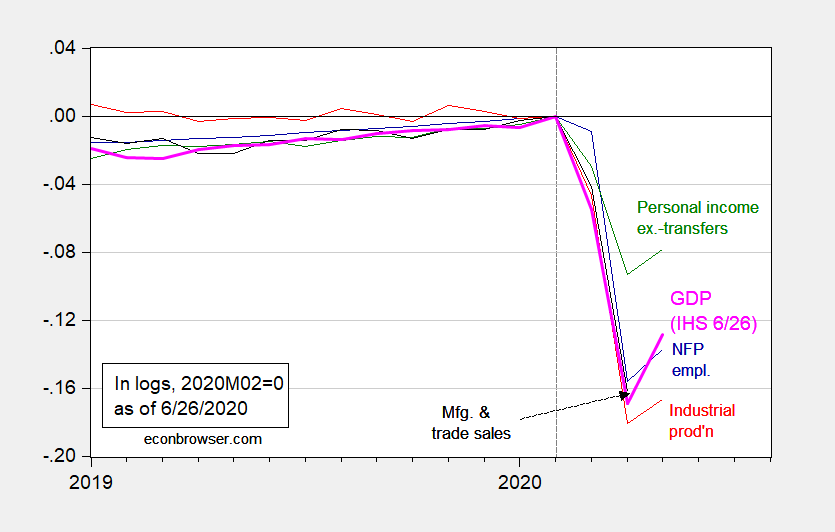

Big positive numbers for growth — but remember the level matters.

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M02=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (6/26 release), Bloomberg, and author’s calculations.

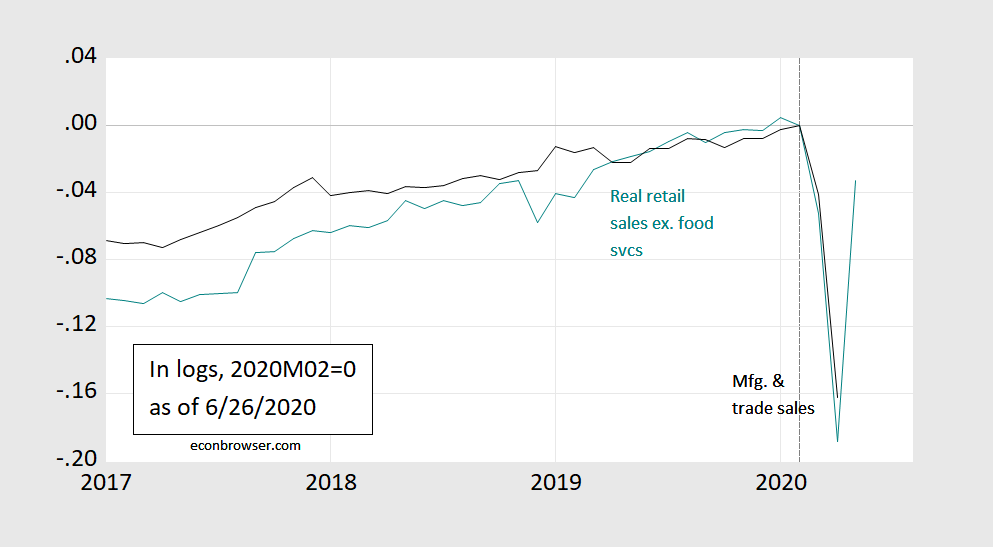

Notice we don’t have manufacturing and trade sales through May, just through April. In fact, that number won’t be released until July 16th. However, we can guess for a substantial rebound in May, given the historical correlation between manufacturing and trade sales and retail sales ex.-food services.

Figure 2: Manufacturing and trade sales in Ch.2012$ (black), and real (CPI-deflated) retail sales excluding food services, FRED series RSXFS (teal), all log normalized to 2019M02=0. Source: BLS, Census, BEA, via FRED, and author’s calculations.

University of Chicago economist Tomas Philipson, Kevin Hassett’s replacement as chair of the White House CEA, is leaving. Philipson defended his boss by downplaying the public health and economic threats of the coronavirus pandemic, saying, “I don’t think corona is as big a threat as people make it out to be.” Philipson asserted that public health threats do not usually cause harm to the economy and that the coronavirus would not be as bad as a normal flu season.

Mr. Philipson praised Mr. Trump’s economic instincts as ‘on par with many Nobel economists I have worked with at Chicago’.

He might be right about that.

@ Joseph

It really kind of shocked me (and I am a pretty cynical person now in my middle age, on human behavior) was Philipson’s comments on Jason Furman. Something like “he had never done peer-reviewed work” and a couple other things. Now I am not an expert on Jason Furman’s bio, and I plan on kind of crosschecking that—but considering the amount of respect he has and his rank in the Obama administration, it’s exceedingly hard for me to buy that he hasn’t done peer-reviewed work. That one really seemed to come out of left field.

It is true that Furman publishes a good bit in non-peer-reviews outlets, but that is because of his role as a public intellectual. Maybe Philipson intended to be snide about Furman’s high public profile. Maybe it’s a Chicago thing – Furman doesn’t have a degree in math, so how could he survive peer review?

The notion that a Harvard professor is short on peer reviewed publications is questionable on its face, right up there will the idea that Trump has Nobel-quality “instincts” (a term very likely spoon-fed to Philipson by Trump or his handlers) regarding economics.

It is often not made explicit that a publication is peer reviewed (one simply knows, what, what?), but here is a Furman paper which clearly states it has been reviewed:

https://www.piie.com/system/files/documents/wp18-4.pdf

This piece does not make an explicit claim, but a bit of snooping shows it is peer reviewed:

https://link.springer.com/article/10.1057/s11369-017-0041-5

My impression is that most papers (as opposed to OpEds and testimony) produced under the aegis of Brookings are peer reviewed. Furman does a good bit of writing there.

The great part is that he tested positive for COVID-19 earlier this month. What goes around comes around.

https://thehill.com/homenews/administration/504817-white-house-economist-who-just-announced-resignation-tests-positive

He’s young enough and healthy enough, with probably superior health care to 95% of the nation~~~ he doesn’t care. He’s got “3 years of extended leave” from the University of Chicago. Am I a novice to the academic world if I assume he’s going to be paid during that 3 year extended leave?? Not to mention he probably has multiple other sources of income (which is probably part of his “extended leave” plans, he’s figured out he can make more money outside the Uni in that 3-year window). So you think taking 6 weeks or less to quarantine himself is a big deal?? He’s probably laughing himself to death with a glass of iced Compari in his hands reading this thread right now. Let’s get a reality check here.

It appears we may have to change donald trump’s “Cadet Bonespurs” moniker. How does “Chickenshit-in-Chief” sound??

https://www.nytimes.com/2020/06/26/us/politics/russia-afghanistan-bounties.html?action=click&module=Top%20Stories&pgtype=Homepage

In these confusing and chaotic times, it’s easy to lose heart. It’s easy to let the cynicism dominate your psyche, lose fait in man’s better nature. But in those dark moments, I want you all to remember, that our nation’s President only associates with the highest quality people:

https://www.cnn.com/2020/06/26/politics/george-nader-prison-sentence-mueller/index.html

https://images.app.goo.gl/gCVwMX14b5rE7c9U7

It seems that the very negative forecasts for second quarter growth that were being reported from Macroeconomic Advisers et al will not pan out. Retail sales may have been a squishy number, but we now know consumtpion has been reported to have risen over 6% in May, not fully offsetting over 12% decline in April, but even half that growth in June puts the economy in position to possibly have positive net GDP growth for the second quarter, even with likely slowdown here in late June. May well prove to be a close call for the second quarter, but almost impossible to be some double digit further decline from first quarter.

It may not be double digits from Q1, but based on new unemployment applications, it won’t be growth. The latest shutdowns will hit in Q3, which I thought might be better, but more slowing seems plausible, if not inevitable yet.

Sorry, consumption grew over 8% in May, not just over 6%. This is substantial.

man, thats not politically correct what you are telling us here, Menzie and Joe Biden will not love you any more.

Yes, but from what amounts to a dead stop. We may have a bizarre economy that’s growing, but started at such a low level that it’s still off by something like 20% from where it was before. And then there’s the pending re-shutdowns in places that opened too fast. And all those people whose livelihoods got wiped out. The federal paycheck assistance is making a big positive impact on consumption. If that doesn’t get extended, then we will see consumption hit a brick wall again. My cheap plastic crystal ball just got even cloudier.

@ Willie

Judging from your opening sentence, the Washingtonian who modestly calls himself “the outhouse economist” is grasping this very well. Assuming the number Barkley quoted is correct then “8% from WHAT???” is the question that seems to be extra hard for Barkley Junior to grasp. Which is why, in more than one post Menzie has stressed ” — but remember the level matters.” . This is why nerds love graphs.

Latest tidbit, apparently construction grew substantially in May also. For growth to be negative for the second quarter, we shall have to see substantial slowdowns in several of these elements during June, such as consumption and construction. I do not know whether those are happening or if they are sufficient to have the quarter be negative, but from what I am looking at, that seems to be the question, not whether growth will be more negative or less negative than -20% for the quarter.

My livelihood was dependent on the construction industry for decades, which is why I became an outhouse economist. Construction isn’t the canary in the mine shaft. It is a train that slowly grinds to a halt, and then takes heroic efforts to get running again. If you finish a project as the industry is grinding to a halt, you are up a creek.

What we saw was different from any dip in construction before. Construction does not go from booming to a dead halt under normal circumstances. The shut-down caused that to happen, and so when construction started again, it looked like growth. It was from the dead stop, though, not growth from the previous levels. We are seeing it grind to a halt now. Yes, it will contribute to growth in May when it started, but I expect to see construction taper and be a drag on the economy in the next quarter or two.

That’s just the usual cloudy plastic ball prognostication, but after all these years, it works semi-well. What I haven’t got a good handle on is the lending and insurance climate for construction. Those are big drivers for starts. If those markets haven’t crashed and burned like they do cyclically, then maybe I’m wrong about the next few months. I sure hope to be wrong.

https://www.calculatedriskblog.com/2020/07/construction-spending-decreased-in-may.html

Maybe construction didn’t grow in May. The revisions aren’t all in, but it’s just one more nail in the second quarter.

For all those who somehow think I am unaware of the “from what level?” issue, I am fully aware of it. We can easily have a positive growth second quarter but still be well below where we were in February and with double digit unemployment due to the sharpness of the decline in the first quarter.

As it is, however, I have at least one person quite beside himself that I even dare suggest that there is a non-trivial probability that the second quarter might end up with positive GDP growth. Even if that happens, the US economy will still be well below where it was, and we shall still have high unemployment, not a good situation. Duh.

I will not deny there might be growth in the second quarter. I just think it is unlikely and that it will be tepid if it happens. I will take a promotion from outhouse economist to SaniCan economist if it happens. The third quarter is where the real proof of the pudding lies. The second quarter has bee buoyed up by the stimulus. The third quarter will not be nearly as much, even if there is more unemployment relief on the way. It will not be as much, and the job losses will continue. I do not see much growth in the economy until this pandemic is over. That will be sometime in 2021 if we are lucky and remain uninfected until there is an effective treatment. If we are not lucky, we will all be dead and it just won’t matter. Why worry!