See the website for the data (available xls and dta formats) and data description.

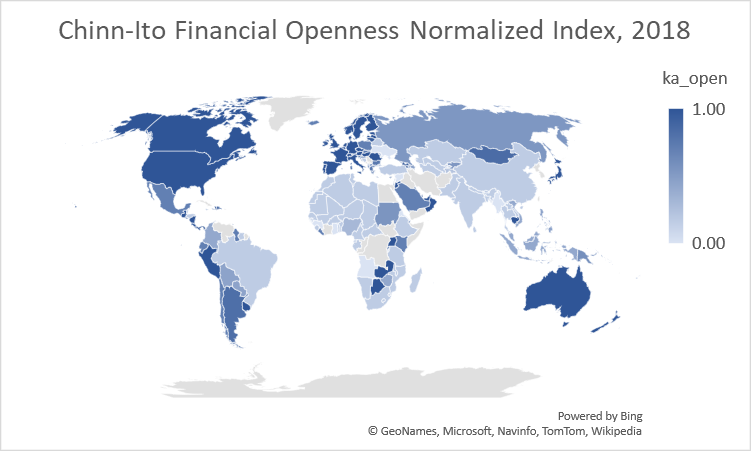

Here’s a map of financial openness in 2018 (normalized index, 1 to 0. The darker, the more open.

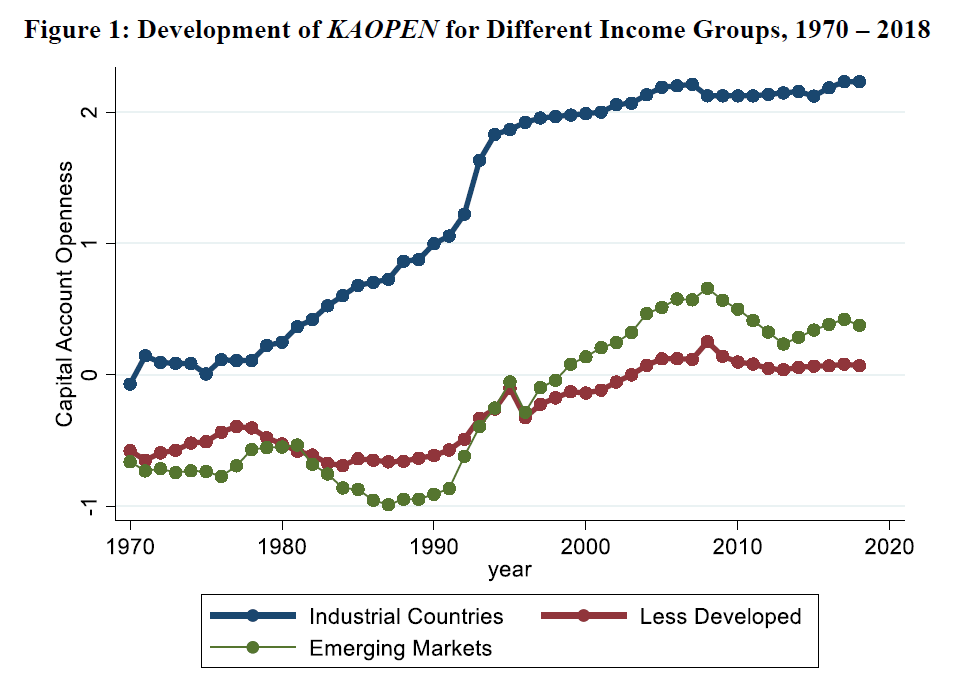

And here’s the evolution of the series, by country income group.

See: Menzie Chinn, Hiro Ito, “A New Measure of Financial Openness,” Journal of Comparative Policy Analysis 10(3) (September 2008): 307-320. [PDF]

Stupid rube Question of the Day: Is there any way to look at this data, isolated for Hong Kong, and how that’s change, say over a 5 year period??

Moses Herzog: Download XLS file, search for “HKG”, and it will pull up the entries for Hong Kong. HKG normalized KAOPEN has been constant at a value of 1 for past five years.

Thank you. I’m going to be sad to see that number lower. Of course most of my former friends (and probably students, although some may have since dispersed) are up around Liaoning, But I still feel for the HK students and others watching it slowly slip away.

As you guys know I’m a little slow to the take sometimes, I just realized it’s sort of regionally organized, (which is a good way to do it, it just wasn’t registering for me at first) so that’s why you might skip over “H” and not see Hong Kong. It’s 532 on the country number. Think of it by regions if you find it skips the country you’re looking for.

This article is about 6 weeks old. But it seems to be well written. We had had some friendly debate on here about how much a no-deal Brexit (I prefer this over the “hard” Brexit terminology for reasons we won’t get into) would effect Britain long-term.

https://www.ft.com/content/4440f83d-7e8a-4510-b8b7-3fb9146da51a

Debt is debt. The obsession with consumption is a disaster. It creates bourgeois decay.

I am a little surprised to see Mongolia as open as it apparently is. Botswana does not surprise me. What little I know about that country tells me it is a fairly well governed and reasonable place.

As to Mongolia, me too. Checking into it, though, Mongolia’s Menzie number is in line indicators of financial openness from other sources. It may be that dependence on director foreign investment in mineral extraction, mostly from China, induces financial openness.

I’ve discussed the “golden age” of blogging here before, which, is largely gone. Andrew Sullivan’s “The Dish” blog when he was at “The Atlantic” was so amazing. There’s nothing like that on the internet anymore, and it’s sad.

https://twitter.com/sullydish/status/1283100444009660423

Could this Friday “announcement” be some kind of reincarnation of what that WAS???

In the little fantasyland that I call my mind I’m always holding out hope—not likely.

No, Moses, there is not much hope for the econoblogosphere. It has been taken over by clunkers like you and me indulging in our endless silly grunge fights, :-).

Those have ALWAYS been there, from the beginning. I’m talking about content and how the information is provided (paywalls, editorial control, etc)

Also you have the same problem with podcasts. Just taking an example off the top of my head (not the “ideal” example I would give) such as Joe Rogan being “bought out” by Spotify, and others being underneath “Stitcher” etc. They get more corporatized. Once they become part of a conglomerate they are less apt to criticize how things are going on.

I’m not completely against monetization of these things, but there are levels and ways to do it without selling one’s soul in the process.