The trajectory of the recovery according to the consensus is little changed from the Wall Street Journal‘s July survey — despite the derailment of the Phase 4 recovery package. However, more analysts perceive a “W” than before.

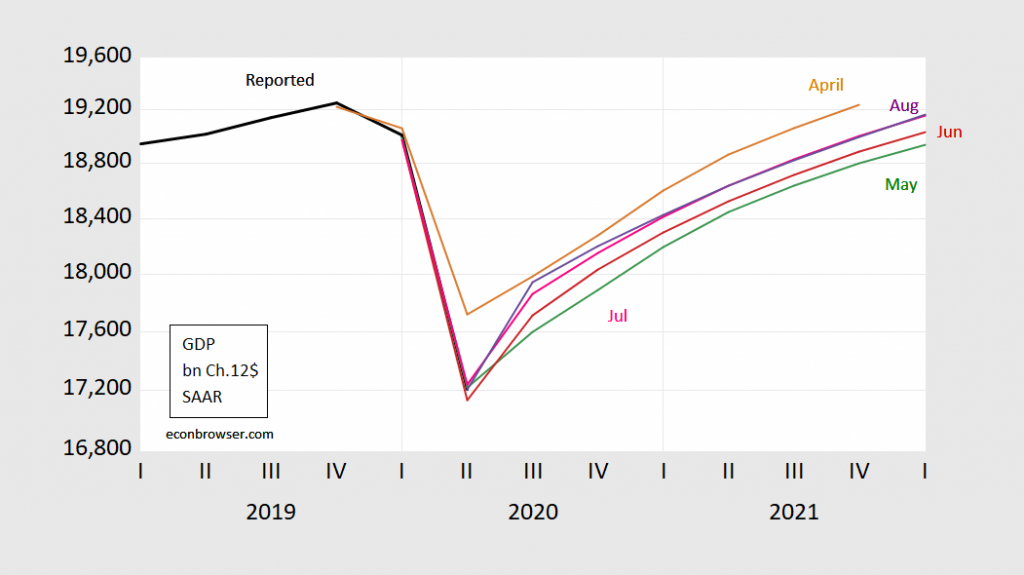

Here are different vintages of consensus views:

Figure 1: GDP as reported in 2020Q1 advance release (black), WSJ April survey (tan), May survey (green), June survey (red), July survey (pink), August survey (purple), all in billions Ch.2012$, SAAR, all on log scale. Source: BEA, various vintages, WSJ survey, various vintages, author’s calculations.

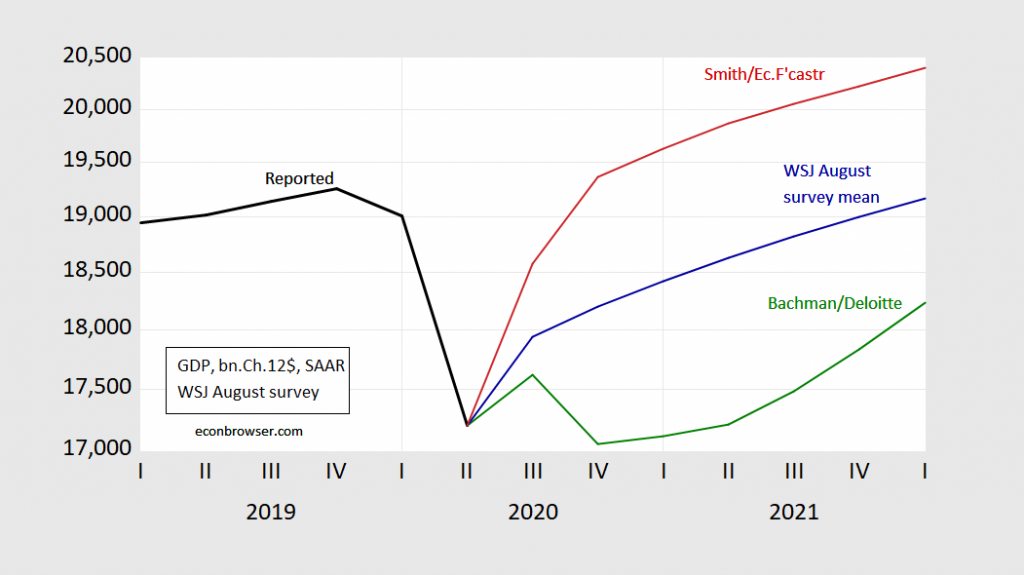

And here are the high (James Smith of Economic Forecaster LLC returns to the top) low (Daniel Bachman at Deloitte still standing at the low end) and consensus.

Figure 2: GDP as reported in 2020Q2 advance release (black), James Smith/Economic Forecaster LLC (red), Daniel Bachman/Deloitte (green), all in billions Ch.2012$, SAAR, on log scale. Source: BEA, 2020Q2 advance release, August WSJ survey, and author’s calculations.

The levitation of the forecasts, despite the breakdown in negotiations, is surprising to me, but probably incorporates a belief a deal will eventually be attained. As the WSJ article notes, the end of the enhanced unemployment insurance payments will definitely hit output growth if it persists:

An overwhelming majority of economists surveyed this month by The Wall Street Journal said the economic benefits of additional jobless benefits to help laid-off workers outweighed concern that the extra payments could deter people from going back to work.

About 82% of economists in the Journal’s survey said they agreed more with the idea that the extra cash boosted the economy than the idea that it held back the labor market’s recovery. Many of them said the benefits should be extended to support the recovery.

…

Without an extension of benefits, “there will be an air pocket in the economy” in the third quarter, said Joe Brusuelas, chief economist at RSM US.

This view matches with that held by academic economists in the IGM/Fivethirtyeight Covid-19 panel, discussed in this post.

Did enhanced unemployment benefits significantly depress labor supply?

A Yale University study last month found that the extra money didn’t affect people’s employment rates. Those whose unemployment payments exceeded their previous income have gone back to their previous jobs at similar rates as other laid-off workers.

My very mixed emotions and semi-contradicting thoughts:

–If I have to choose one of these WSJ forecasts, I think Daniel Bachman is the closest.

–If Bachman’s forecast is dependent on Nancy Pelosi’s TSH therapy and loblolly pine sawdust backbone exhibiting strength for the first time in her life, then his forecast is overly pessimistic. (I don’t believe , from my own individual view, Bachman’s forecast is dependent on whether or not Pelosi gets on her knees for Mitch McConnell for the millionth time)

I have some other thoughts on this, kind of clinking and clamoring in my mind like a bunch of pots and pans. But I want these thoughts to meld and coalesce in my mind and simmer a little. It’s hard to make an exacting forecast I think when it’s dependent on the fickle mind of Nancy Pelosi.

I suspect that it will take longer to get a deal, if there is one at all, than the majority of these forecasters were expecting. The Senate has adjourned and will not return until after Labor Day, so nothing will happen before then, and it should be noted that Mitch McConnell is not a part of this negotiation, which was between Pelosi and Schumer on the one hand and Mnuchin and Meadows on the other. Earlier in the year deals were made when it was just Pelosi and Schumer with Mnuchin, but Meadows has reportedly “blown up” the negotiations in line with the desires of Trump.

It seems that Trump and Meadows have decided that Trump’s “executive actions” from last weekend will suffice to help the economy out, although it does not look like they will do much of anything. There may be some extension of deferring interest payments on student loans, and there may be an extra $300 extra for about five weeks in UI, the states now having been let off the hook, given that the reality of them not having any money has been made clear to the White House (Kudlow at least, if not Meadows, who blew town early in the week). This will not do much. I doubt they will pull off deferring fica tax collections, and the order to HUD to think about evictions is not going to stop evictions from happening.

I really do not know if Trump and Meadows (and Kudlow) actually realize how little effect these actions will have (Mnuchin probably does, but it looks like he wanted to cut a deal with Pelosi and Schumer but got overruled by Meadows). However, even if they do, I suspect they are betting that if the failure to get a new stimulus package soon (or even at all) leads to a noticeably worse economic outcome than they were hoping for, they think they can get away with blaming it on Pelosi and Schumer, more generally the Dems in Congress. But I do not think that will fly. For better or worse, voters hold presidents responsible for the state of the economy, and they will also hold Trump responsible for the state of the pandemic, despite his efforts to avoid responsibility and try to blame problems on governors, the media, scientists, the Chinese, and pretty much anybody out there.

All of this. Even with the election coming up, the administration does not seem capable of a rational, practical, effective response to anything. Trump is used to ripping things up and making messes. He’s got no experience in actually solving problems without bullying and blustering. Those don’t work. Actual work is what is necessary, and he’s never learned to do that. Even if Meadows, Mnunchin, and Kudlow were all sane, practical people with the interests of the average US citizen in mind, Trump would blow things up just because. It’s almost that he wants a mess so he can blame somebody, rather than cleaning up a mess so he can take credit.

For those reasons, I’m looking at Bachman as being most realistic. I don’t know that it will dip down as far as he thinks, but I do believe we will see a W if we are lucky. We will see WWWWWW if we aren’t.

Menzie – I’m looking mostly at financial data to figure out where things are headed. i was listening to Tyler Cowan’s podcast with Nicholas Bloom this week and Bloom offered this insight (which I had already noticed when the stock market began to rebound), “…the stock market does not reflect the US economy. The stock market, for example — right now it’s 30 percent high tech, which has only 7 percent of US jobs. Also, when interest rates drop because the economy slows, it makes the stock market go up because it’s suddenly a relatively better investment. I think the stock market and the state of the US economy are only weakly linked.”

A lot of the unemployed are seeing their jobs gone forever and this will lead to a large disruption in the economic recovery. there are too many confounding signals at this point to determine how it will play out.

Forecasters have to make assumptions about future policy. One way around that is to forecasts under a number of assumptions. (A virtuous practice which leads to “find me a one-handed economist) grousing.)

However, for the purposes of surveys such as referenced here, you gotta pick one forecast. That means picking one set of assumptions. In a fluid political situation, one is faced with a couple of possible approaches. One is to regularly assign new probabilities to various future conditions. The other is to publish an assumption (federal jobless benefits will/won’t be extended by a particular date) and stick with it until you have strong reason to change. From the look of the forecasts that are singled out, they don’t seem to be changing their assumptions. We here can write arguments supporting earlier or later or no extension, but the point of doing so is to present our expectations for discussion. Driving new expectations through forecasts every month is another matter, and is not always helpful to the reader.

I feel for these guys. They are doing their jobs, knowing that the dose of randomness in the outcome is larger than their tools can really deal with.

Republicans don’t really want another round of “stimulus” without major concessions. There is nothing politically that is driving Republicans to bow. Democrats don’t either. I see little harm waiting it out, pushing closer to the October 1st drop dead date.

Except that lots of Americans will drop dead economically in the mean time. It is hard to see too many ways the administration and Moscow Mitch could have botched this any more completely.

Winning a national election during a recession has been a pretty good formula for re-election. While this time may be different, the pattern has been for the economy to heal during the early part of the first term, and public approval to get a lift as a result. So while both sides will blame the other for holding our economic welfare hostage to crass political demands (they always do), the Democrats probably have little fear for their longer-term prospects from Republicans refusing to come to the table now. They are leading in the polls, so the status quo is their friend.

Republicans, meanwhile, have the Senate to lose in the short term. The White House has cut McConnell out of the official negotiations, but I doubt he is sitting still. The nut who is leading the negotiations for the White House is not a mainstream Republican, and doesn’t appear to care whether he hurts other members of the party. He needs to go in order for a deal to be reached. I’d bet McConnell is working to get Meadows out of the way, leaving the more tractable Mnuchin in charge of negotiating with Schumer and Pelosi.