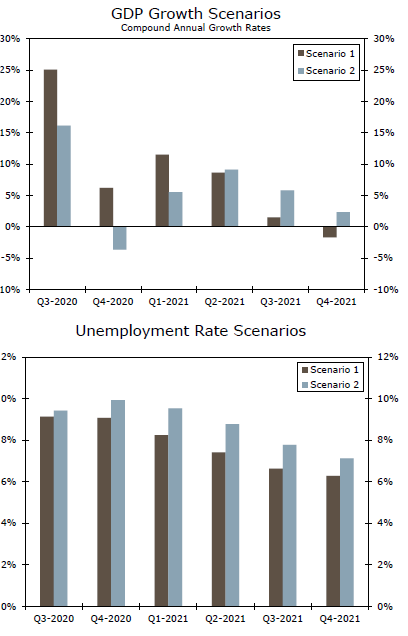

From Wells Fargo Economics today:

To simulate a continuation of unemployment benefits (Scenario 1), we held

monthly nominal personal disposable income constant at its July level of

$1.49 trillion (before the PUC expired) through the end of 2021. To simulate

the expiry of benefits (Scenario 2), we subtracted the $75 billion of monthly

PUC payments from income levels in August through December, and then

we let the $16.8 billion of monthly PUA and PEUC payments expire starting

in January. We then held that level of income constant through the end of

2021.

Here’s the picture:

That is, instead of an approximately 6% growth (SAAR) in 2020Q4, we get -3.6%. That’s what their model projects, although given employment growth, the actual Q4 number might well be better. The more appropriate interpretation is that that keeping enhanced benefits at the nominal level which they were at July would have added about 9.5 percentage points of growth in 2020Q4 (which is about 2.5 percentage points, not annualized).

Kevin Drum directs us to a new study by Moody’s Analytics that compares the economic recovery under a Democratic sweep versus a Trump win versus a split result:

https://www.motherjones.com/kevin-drum/2020/09/moodys-a-democratic-election-sweep-would-be-great-for-the-economy/

The economic results are also a clean sweep, with the Democrats projected to outperform Team Trump in every important economic category. Of course, I’m sure CoRev and Bruce Hall and sammy will just chalk this up to another bunch of Democrats plugging away for Team Blue. Oh way…the lead author is a Republican and was Mitt Romney’s chief economic adviser. Well….I’m sure the usual suspects will dream up some rationalization to confirm their uninformed biases about economics.

Here’s the Moody’s study:

https://www.moodysanalytics.com/-/media/article/2020/the-macroeconomic-consequences-trump-vs-biden.pdf

Note this was prepared by Mark Zandi who was McCain’s 2008 economic adviser. Zandi is a highly respected economist who BTW gave McCain some very good advice back in 2008, which McCain for some reason ignored.

Correct. Zandi was McCain’s adviser, not Romney’s. 2008 doesn’t seem that long ago. A sure sign of age.

“Biden plans to increase taxes paid by corporations and high-income and wealthy taxpayers (see Table 1). Lower- and middle-income households, including those in all but the top quintile of the income distribution, are not materially impacted by the tax increases. These groups will bear some modest incidence of the higher corporate income taxes, but this will be more-or-less washed out by the various tax breaks in Biden’s plan. Together, Biden’s tax proposals would raise substantial revenue and make the tax system more progressive.”

Top corporate rate would be placed at 28% rather than 21% and Social Security taxes paid on incomes over $400 thousand per year.

The Biden tax plan is based off the Clinton model including killing the job killing tax cuts that people hate. If Rhino’s have given up on supply side economics due to its debt issues(both public/private), it will rock the electorate. Ending the Reagan era, fracturing the wings of both parties.

Job killing tax cuts? I hope that was said in jest. Clinton raised taxes in 1993 and the economy soared.

But not totally. He kept many breaks that killed jobs.

first time commenter, long-time reader, and not an economist.

the things i find most interesting about the moody’s study are the projections of 10 year treasuries and the s&p 500. they’re predicting 4%+ for treasuries by 2025 and the s&p won’t hit new highs until 2025 under the D sweep and 2026 under the R sweep.

That would shock the hell out of me unless we’re talking longer term maturities, like at least 10 years. Not in the habit of disagreeing with moody’s but that’s a hard one for ME to swallow.

And the current 30-year government bond yield is a mere 1.4%. I provide a few possible explanations but there may be more.

https://fred.stlouisfed.org/series/DGS30

And yet the 30-year yield right now is only 1.4%. What does that mean?

(1) The market expects 4 more years of Trumpian incompetence; or

(2) The market expects McConnell to stymie President Biden’s fiscal agenda; or

(3) The Moody’s model has a wee specification flaw?

Moody’s has the same fed funds rate for all three scenarios through most of the forecast period, but higher corporate profits under the Democratic sweep. That explains the better expected performance of the S&P under a Democratic sweep.

What strikes me as odd is the implication, in all scenarios, of a sharp drop in the value of treasury securities, but no corresponding drop in equity prices. Both asset types have low yields now and their yields should, over time, move together. Moody’s seems to be arguing that stocks will correct by stalling out until yields equilibrate, while treasuries fall. That is a bet I would not want to make.

There is no inflation forecast in the tables, but the fed funds rate forecast implies that inflation will run above or clearly be on its way to running above 2% by 2024. That would add to the nominal yield estimate but would not explain the entire rise in treasury yields. There is an implied rise in term premium in Moody’s yield estimates. I’m down with some rise in term premium, but Moody’s forecast seems to imply term premium near zero by 2025. Term premium was below zero all through 2019, before the pandemic hit.

If memory serves, Moody’s model involves a fairly tight link between corporate profits and treasury yields. Historically, that has been an OK assumption, but the decline in term premium over time may have loosened that link. There is plenty of room for models to be wrong now because of regime change (economic, not political).

A point on Moody’s probabilities on various scenarios – 20% odds of Biden winning with a Democratic Senate vs 35% for Trump winning with a Republican Senate is not consistent with what polls show. Control of the Senate is a toss-up. Biden winning is 70%+. The odds used by Moody’s may reflect an effort to avoid angering clients.

I don’t think it’s necessary for me to go on one of my infamously long blog screeds to say the Lael Brainard is a definitively better choice for Treasury Secretary than Elizabeth Warren,

https://www.bloomberg.com/news/articles/2020-09-24/fed-s-brainard-seen-as-top-of-biden-s-treasury-secretary-list

It’s self-apparent Brainard outshines Warren, by about 10 supernova stars. On top of the obvious fact Brainard doesn’t sacrifice a Senate seat.