Today we are fortunate to have a guest contribution by Sam Williamson, Emeritus Professor of Economics at Miami University, and President of Measuring Worth.

When the estimates of Gross Domestic Product (GDP) for the third quarter come out on October 29, they are likely to show a significant growth in the economy compared to the second quarter. If so, we can expect statements by President Trump and his supporters about how great the economy has performed during his term and another tweet claiming that electing Vice President Biden “Will kill your Stocks, 401k’s, and the ECONOMY. BIG CRASH!” As an alternative you have a forecast from Goldman Sachs that says “A blue wave this November led by Democratic presidential nominee Joe Biden would lead to a surge in economic growth.”

How do you decide? An objective way to evaluate these claims would be to compare the performance of various economic indicators during this administration with the performance of previous administrations. I present here two measures for this comparison; the growth in real GDP, and the growth in the stock market as measured by the Dow Jones Industrial Average (DJIA). The time series data of these measures and others discussion are available in an essay on MeasuringWorth.com.

By the way, it is not a measure of the success of an administration to say “we have the greatest economy ever.” In the last 120 years, the economy has grown under every president except Herbert Hoover. To say the economy is the greatest now is the same as saying an 18 year old is bigger than when he was 14. (It is possible Trump may join Hoover with negative growth of GDP in the four years he is in office.)

Economic Growth.

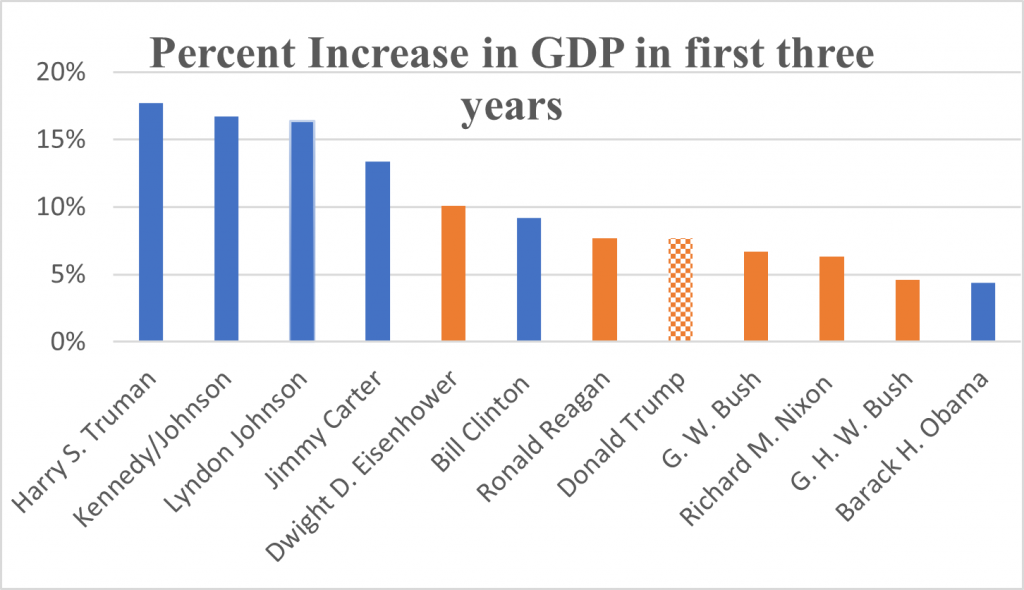

Since World War II there have been six Democrats and six Republicans elected to be President and when ranked by the increase in real GDP for the first three years, five of the first six are Democrats. The chart below shows the ranking.

Trump is eighth 1.5 percentage points behind Bill Clinton.

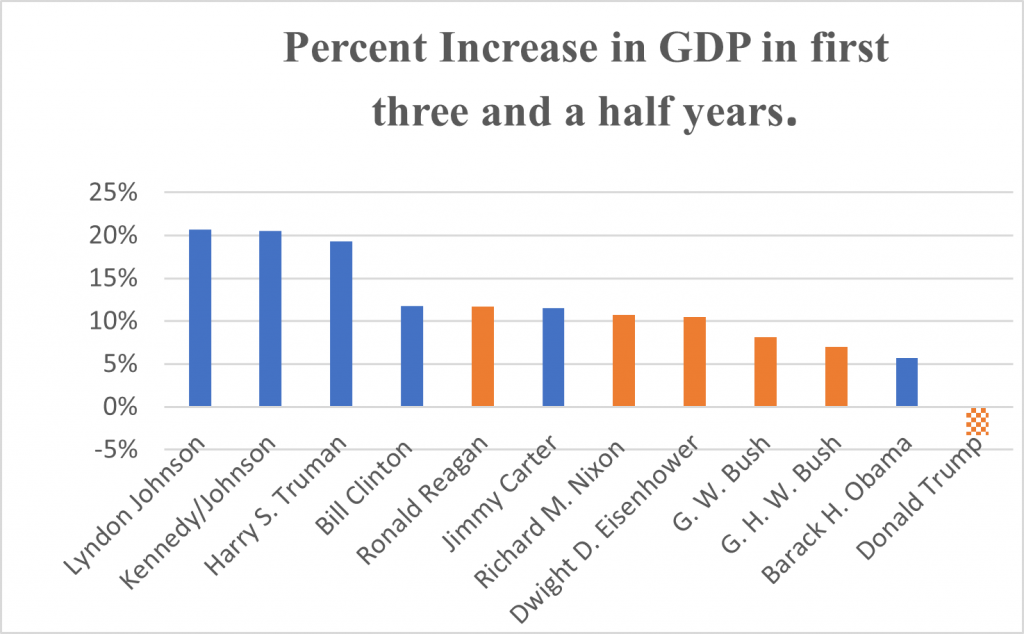

The effect of the pandemic can be seen when you rank these twelve by their first three and a half years and find that Trump is last with a decrease of 3.3%, 9.0 percentage points behind Obama who’s first year had negative growth because of the Great Recession. The economy has grown faster during Democratic administrations.

The Stock Market.

During his 2020 State of the Union Address, President Trump claimed that 401ks and pensions are doing far better than they have ever done before. If he means that the market is higher than it was three years ago, of course he is right. Under every administration for the last 120 years the stock market has gone up some time during their time in office. Even during Hoover’s term the market was 46% higher in September of 1929 than the day he was elected. Investors were pleased with their new president. Of course it did not last and on the day he left office, the DJIA stood at 20% of its value four years earlier on his election day.

Doing well in the stock market is measured by the percentage growth in value. So the question is, which administration had the fastest growth in the stock market (and therefore your 401k?) There are several ways to compare market performance, however, picking one day over another is arbitrary. For Trump, the highest and lowest market values of his term were 28 market days apart. On February 12, 2020, the DJIA was 61% more than it had been on the day he was elected. A few weeks later, on March 23, the average had fallen close to the level on the day of his election and stood at a 0.3% gain.

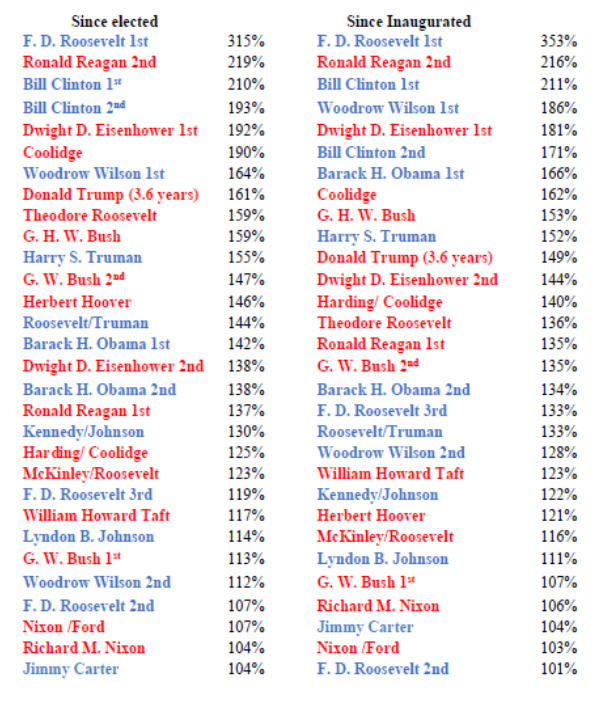

To provide some basis of comparison, we have chosen to compare the highest value of the DJIA during each President’s term with the value on the day he was elected, and the day he was inaugurated. When elected the market may react in anticipation. Two and a half months later, the new president is now in charge. We do not consider when in the term it takes place with some peaks coming early in term and others on the last day. We are just seeing that at some point in his term the market had peaked and how much was that.

This table compares those highs.

Ranking the Greatest Gain in the Stock Market by Presidents terms since 1900.

For Trump, these values were 161% and 149%, respectively. Though representing growth, these figures are nowhere near “all-time” records ranking eighth and eleventh, respectively. Four and six Democrats were ahead of him on the two lists including Clinton and Obama.

Does the political party make a difference? Three of the top four on both lists are Democrats, however, after that it is a toss-up. What is clear is that the stock market has been a bullish and bearish during the terms of both parties.

This post written by Sam Williamson.

Growth in real GDP for the 1st 3 years can be misleading. Obama inherited an economy in free fall and turned it around. Trump inherited an economy that was booming and threw it in the ditch.

Of course it is misleading. If voters are only going to look at what happens during a president’s term, Trump cannot even make the top half of the list.

@ Professor Williamson

I’ve always been amazed and dumbstruck (maybe even felt extreme aggravation) at how Democrats (and I blame many Democrats for this, but Pelosi is somewhere at the top of the list) who passively surrender the national deficit narrative over to the Republicans. Which party has performed better on managing deficits if we break it down by party inhabiting the White House since 1980??

https://fred.stlouisfed.org/series/FYFSD

My argument has always been~~~Republicans say Democrats are the party of “tax and spend”. For the sake of argument, allowing that to be true, then that makes the Republicans the party of “don’t tax and spend”. If you don’t read this blog off and on, I’ll let you guess my party affiliation.

rethuglicans are the party of Borrow And Spend.

Trump’s approval among the public remained low prior to the Covid cock-up. That is a substantial divergence from the historic pattern. In Trump’s case, it is not “the economy, stupid”.

The stock market’s gain has depended on tax policy aimed at enriching equity investors at the expense of future tax payers and, arguably, at the expense of other current uses for the budget. Credit where credit is due.

In fact, Trump’s economic record, as unremarkable as it is, was bought at the cost of a massive deficit increase during an expansion. All he did was move demand forward. Any equally irresponsible president and Congress could do the same, but we’ve never had a national government this irresponsible outside of the run-up to war.

The one area where Trump can claim some credit is with employment. The rate of payroll employment growth is pretty much the same as it was under Obama, which is another way of saying that Trump’s chief accomplishment was to avoid screwing things up. But Trump does deserve some credit for increasing the size of the labor force and for some decent growth in median wages…at least until the pandemic hit. But there were some worrying things about those GDP numbers under Trump. The lion’s share of those mediocre GDP numbers came from consumer spending and government spending. Under Trump export growth was miserable. And gross private sector investment was as flaccid as Trump’s performance with Stormy Daniels. From 2010 thru 2016 investment growth average 6.9%. From 2017 thru 2019 (before the pandemic!), investment growth under Trump averaged a pathetic 3.8%. Put another way, Trump’s secret sauce was to increase consumer spending, increase government spending, reduce exports and increase imports. That’s called eating your seed corn. But the typical Trump voter is also a myopic voter who hasn’t learned the old story about the grasshopper and the ant.

Trump employment was noticeably weaker than 2nd term Obama despite slightly higher GDP. Most likely revisions to 2019 will lower GDP that year, but it still doesn’t explain it.

CRE/corporate debt bubble had inflated a consumer bubble in subprime debt. Started before Trump.

As with the election of a dynamic Franklin Roosevelt and a heavily Democratic Congress, the conservative Supreme Court was a significant impediment to New Deal legislation. Then too, much Executive action of the Trump Presidency will be a reversal focus of a Biden Presidency and the Court could at least delay reversals. As with Roosevelt staying away from Hoover after the election, I would hope Biden will stay away from Trump.

https://www.nytimes.com/live/2020/10/26/us/trump-biden-election

October 26, 2020

Senate Confirms Barrett, Reshaping the Supreme Court

Vote Reflects Deep Polarization Over President Trump’s Nominee

With the election just eight days away, Republicans pushed through Judge Amy Coney Barrett’s nomination over the unanimous opposition of Democrats.

The lightning-fast Senate approval handed President Trump a victory and promised to tip the court to the right for years to come.

Her impact could be felt right away. There are two major election disputes awaiting immediate action.

http://www.nytimes.com/2008/11/30/opinion/30leuchtenburg.html

November 30, 2008

Keep Your Distance

By WILLIAM E. LEUCHTENBURG

The court is irrelevant. Nullification, expanding judges and stripped jurisdiction will neuter them.

“But Trump does deserve some credit for increasing the size of the labor force and for some decent growth in median wages…”

What!? Why?? The labor expansion and increase in wages is entirely due to the efforts of Jerome Powell to reverse the horrible wage suppression policies of Yellen and Bernanke. In fact, you can credit Yellen’s increase of interest rates in early 2016 with helping Trump into the White House.

That was rising labor force was long before Trump, nor were there any “wage suppression” . Powell was the idiot that couldn’t tell debt servicing was getting so high, business investment was falling to pay for it and he whined to take on more debt.

New Keynesians need deader than the Austrians at times.

The labor expansion and increase in wages is entirely due to the efforts of Jerome Powell to reverse the horrible wage suppression policies of Yellen and Bernanke.

I’m not following you. The effective FFR did increase somewhat in 2016, the increase was much greater between 2017 and mid-2019.

https://fred.stlouisfed.org/series/fedfunds

you can credit Yellen’s increase of interest rates in early 2016 with helping Trump into the White House

I credit three things with putting Trump in the WH:

(1) The Comey announcement provoked by a Russian disinformation campaign. Voters are stupid.

(2) Mitch McConnell’s ongoing effort to sabotage the economy. Voters are stupid and didn’t see McConnell’s fingerprints.

(3) Hillary Clinton being especially disliked…again, thanks to a Russian disinformation campaign. Voters are stupid.

macroduck:

“Credit where credit is due.” I see what you did there.

2slugs:

Isn’t higher labor force participation a common characteristic of late stage expansions? Ditto for hourly wage growth? IIRC, wage growth showed up late for this expansion compared to historical standards.

Dr. Dysmalist Wage growth may have been late in coming, but it did come. Of course, one reason it came late was because Mitch McConnell was dead set against doing anything that might have helped the economy during the Obama years. I’m hardly a Trump fan, but if you try and look at things from the perspective of the economically illiterate and myopic voter, what that voter perceived prior to the pandemic was low unemployment and improved wage growth. And for the low information voter that’s probably good enough reason to want to re-elect Trump. If back in January you asked voters if they were better off than they were four years ago, most would probably say yes. Granted, very few of those voters would know that those good times were bought at a heavy price and the effects of Trump’s tax cuts for the rich were about to expire just as the bill was coming due, but remember that we’re talking about low information voters. And it’s low information voters that decide elections.

Daily death rate (7-day average) has increased to 828 as of Oct. 26:

https://www.worldometers.info/coronavirus/country/us/

And our Usual Suspects told us a short while ago that this was falling? Well no worries as Trump is telling everyone that by Nov. 4 that no one will be talking about COVID.

Not like it really matters, but the US currency fared under Donald Trump the same it fared during the presidency of all other Republicans since 1970 (and opposite to how it performed during the rule of Democratic presidents, except president Carter) – it fell significantly against the euro:

https://www.earnforex.com/blog/presidential-cycles-in-forex/

If it is Joe Biden who will be sworn in on January 20, 2021, the correlation of of US presidents’ party vs. EUR/USD will once again get confirmed.

Reni: For clarification, there have only been four presidents during the existence of the euro (and only 2 years of the Clinton presidency).

Yes, you are right, but the EUR/USD rate can be calculated historically using inception formula from ECB: https://www.ecb.europa.eu/press/pr/date/1998/html/pr981231_2.en.html

Reni: Yes, I’ve done that myself back in ’01-’02 or so. But it’s not a calculation one wants to do lightly, given the Econometric Policy Evaluation Critique…

@Menzie Chinn, Ugh… I thought the series used were based on AWM weights calculation, but it looks like the EUR/USD history in MetaTrader 5 used in the article is based on USD/DEM rate adjusted ECB’s irrevocable weights. So, it’s USD vs. Deutsche Mark before 1999, not USD vs. EUR.

“the irrevocable conversion rates for the euro were today adopted by the EU Council, upon a proposal from the Commission of the European Communities and after consultation of the European Central Bank (ECB) for effect at 0.00 on 1 January 1999 (local time).”

So this works for January 1, 1999. You do know that these individual currencies were not fixed from 1971 to 1998. Now it is nice that you explained your procedure finally but it is a questionable calculation at best.

Quoting from the link that Reni provided:

“Unfortunately, the Forex test results did not show as much promise as those attained in equities. The test assumes a position of 1 standard lot. At first, it was used to go long with from October 1 of the second year of the presidential term through December 31 of the fourth year. EUR/USD chart data start on January 4, 1971 in my MetaTrader 5 (it is even worse for other currency pairs except USD/JPY). The result was the profit of $5,383, which is significantly lower than $64,470 that would have been attained if a plain buy-and-hold approach were used. Reversing the strategy to buy from January 1 of the first year through September 30 of the second year yielded $65,684, which is slightly greater than the buy-and-hold profit of $63,470.”

I have no idea what MetaTrader5 is and I’m not even sure what the point of these exercises even are. One can look at the exchange rate for the yen v. $ back to 1971 if one wished even though we did not start floating for another couple of years. But whoever wrote this blog post claims he somehow magically had a measure of the Euro v. $ for a good 18 years before the Euro was created. Maybe the author did some currency cocktail of DM, Francs, etc. but if he did – he might have told us how he pulled this off.

https://www.nytimes.com/2020/10/26/opinion/trump-coronavirus-climate-change.html

October 26, 2020

Trump Tells Coronavirus, ‘I Surrender’

The president plays the climate-denial playbook on a pandemic.

By Paul Krugman

As we head into the final stretch of the election, Covid-19 is on a roll.

Coronavirus cases keep hitting records — among other things, five aides to Vice President Mike Pence have tested positive. Hospitalizations, which lag behind cases, are soaring. And deaths, which lag even further behind, are starting to rise, too. Put it this way: Just between now and Election Day, we’re likely to lose almost twice as many Americans to Covid-19 as died on 9/11.

So how is the Trump administration responding? Actually doing anything about the pandemic is apparently off the table. What we’re getting instead is a multilevel public relations strategy: We’re doing a great job. Anyway, there’s nothing anyone can do. And besides, doctors are faking the numbers so they can make more money.

These are, of course, inconsistent stories, and the smearing of health care workers who put their lives on the line to save others is just vile. But none of this should surprise us.

This is, after all, Donald Trump. Also, we’ve seen this combination of denial, declared helplessness and conspiracy theorizing before: Trump and company are following the same strategy on Covid-19 that the right has long followed on climate change.

By now, almost everyone is familiar with the way Trump keeps moving the goal posts to claim success no matter how bad things get. Back in February he predicted zero cases “within a couple of days.” In the spring he said that it would go away when the weather got warmer. Lately he’s been claiming triumph because the coronavirus hasn’t killed 2.2 million people.

The administration was slower to admit that it was abjectly surrendering to Covid-19. But back in August Dr. Scott Atlas, a believer in “herd immunity” — basically letting the virus rip through most of the community — joined the White House coronavirus task force.

Atlas is a radiologist with no known expertise in infectious disease, and actual epidemiologists like Dr. Anthony Fauci are horrified by his ideas. But Atlas, not Fauci, appears to be calling the shots these days.

And on Sunday Mark Meadows, the White House chief of staff, made it more or less official, saying that “we are not going to control the pandemic” because it is a “contagious virus.”

This came after a rally in which Trump — who considers himself a victim because the media keep talking about “Covid, Covid, Covid” — claimed that coronavirus fatalities are being exaggerated because “doctors get more money and hospitals get more money” if they say that Covid-19 was the cause of death.

All of these excuses sound very familiar to anyone who has followed the climate debate over the years….

Good oped but I fear this will set off our Usual Suspects all over again.

I think this is a fair assessment since nothing unusual happened to the economy from an outside agency during Trump’s first 3.5 years in office.

So you are saying his 2017 tax cut was nothing unusual? Careful as this might force Kelly Anne to fire you.

That stupid trade war was nothing unusual? OK!

And there was nothing unusual from Jan. 20, 2017 to July 20, 2020? Really? Then WTF have you been whining about for this entire period?

Now THAT was a stupid comment – even for you.

You may (or may not) recall the second quarter comparison of Trump’s failure in Europe versus Trump’s failure in the U.S.

CNN compared the comparably sized economies: https://www.cnn.com/2020/07/31/economy/europe-economy-gdp-recession/index.html

So? Europe took reducing this virus more seriously than idiots like you and Trump.

BTW – I see Kelly Anne Conway has ordered you not to include the relative performance of East Asia in this blatantly dishonest spin of hers. Wonder why? Did she throw little Brucie Boy a bone for this?

I wrote a lengthy blog post on this topic. Trump’s pre-Covid economy was in no way exceptional or clearly better than that of Obama.

https://americancarnage2020.blogspot.com/2020/10/he-didnt-do-it-before-trumps-pre-covid.html

Thanks for the heads up – I’ll enjoy reading something honest and informative on this comparison. We sure don’t get that from Trump and his minions.

“I don’t know if it’s true but many people are saying that Wall Street Journal opinion writers wear red MAGA unitards each morning while they do jumping jacks and sing about industrial policy and managed trade. I don’t know if it’s true myself but I heard that many smart people are saying it…”

This is a funny opening. Yes – anything that takes on the persistent right wing spin from the WSJ oped folks has to be a long post. They lie even more than the clowns at the National Review or the Clown in Chief.

I’ll definitely have to spend some time on this including that WSJ BS that the 2017 tax cut led to some investment boom.

Here’s one for THE RICKSTER:

https://www.motherjones.com/kevin-drum/2020/10/with-a-week-to-go-its-looking-like-a-landslide/

‘With seven days to go, the Economist poll aggegrate shows Joe Biden as far ahead of Donald Trump as ever’

The Economist take this data and put it into a model to predict the Electoral College. Median forecast has Biden getting 352 EC votes. In other words, a blowout.

It would put Biden’s win at around the 57th percentile.

@ pgl

I’ll be very pleased if you end up being correct. But let’s not count our eggs before they hatch. We still have no idea how much the rural vote will play a factor in this. Do “unhappy suburban Moms” outweigh rural voters if rural voters decide to get out and vote?? I don’t think we know that yet. With all due respect, it seems a lot of people are forgetting what NYT, 538, and just about every pundit under the sun was saying on Hillary’s chances on the just 2 prior days to the vote in 2016—not 3 weeks before~~48 hours before the vote they were saying it was a slam dunk win for HIllary. This was all AFTER the FBI email server press conference. Have we learned NOTHING from that little experience???? AT ALL????

Moses,

Are you still sticking with your and Stryker’s 60% probability of a Trump victory?

@ Barkley Rosser

This is a very fair and equitable question you’ve asked, although I would have appreciated it if you had left Mr. Stryker’s name out of the query.

Yes, I am sticking with my 60% probability of a donald trump win in 2020. Although, as I have stated before, I will be quite HAPPY to be shown to be wrong on this.

BTW, suburbanites are 51% of the population. Indeed suburban women can overwhelm other groups, including rural voters, if they move en masse, and most evidence is that they seem to be very much against Trump. But he does still have a chance, although part of that is due to his getting Barrett on the SCOTUS and his clear plans to try to halt counting of votes in various states, something Stryker has expressed open support for, this being a crucial part of his estimate of a 60% probability of a Trump win.

Some people have theorized (I believe correctly) waiting on the Supreme Court appointment would have helped donald trump, as a kind of “holding out of the carrot” to conservative voters. Of course if a person thinks he will lose either way (appointment or delayed appointment) then it makes the current Republican calculus, of an expedited appointment, the correct course. I think delaying would have helped donald trump win. Though how much??~~~I would think the difference is “nominal”, he wins or loses the election separate from this decision.

Some people have also theorized McConnell did this (expedited SCOTUS appointment) on purpose to sell donald trump down the river. This is a semi-credible conspiracy theory, but one I don’t buy.

October 26, 2020

Coronavirus

US

Cases ( 8,962,783)

Deaths ( 231,045)

India

Cases ( 7,945,888)

Deaths ( 119,535)

France

Cases ( 1,165,278)

Deaths ( 35,018)

UK

Cases ( 894,690)

Deaths ( 44,998)

Mexico

Cases ( 891,160)

Deaths ( 88,924)

Germany

Cases ( 450,258)

Deaths ( 10,182)

Canada

Cases ( 220,213)

Deaths ( 9,973)

China

Cases ( 85,810)

Deaths ( 4,634)

October 26, 2020

Coronavirus (Deaths per million)

US ( 697)

Mexico ( 687)

UK ( 662)

France ( 536)

Canada ( 263)

Germany ( 121)

India ( 86)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 10.0%, 5.0% and 3.0% for Mexico, the United Kingdom and France respectively. These ratios are high, but have been significantly higher, while falling recently as new cases are recorded.

I see several comments about employment. If you look at my full paper on the MeasuringWorth website, you will see that using my technique of comparing all the presidents terms that Trump’s performance, even before this year, measured by annualized job growth rates is in the lower half. For total employment and private employment he is eighth with Democrats five of the first six. For manufacturing and Federal Government employment he is higher. The latter because of the census employees. For State and Local Government workers the growth during his term up to today, ranks last. By August 2020 these governments lost two and a half million workers, the largest percentage drop in post WWII history.

The unemployment rate is one of the noisiest statistics there is, however, in February this year it was quite low. The NBER Business Cycle table shows that at that point it had been 146 months since the previous peak, 20 months more than any other cycle.

A simple hypothesis that as long as an expansion goes on, the tighter the labor market would the explain why the unemployment rate was so low. The massive literature on business cycles might not label the actions of the Trump administration as the main reason for the lengthening.

A simple hypothesis that as long as an expansion goes on, the tighter the labor market would the explain why the unemployment rate was so low.

I think that’s about right. Absent some kind of shock simple inertia explains a lot.

The massive literature on business cycles might not label the actions of the Trump administration as the main reason for the lengthening.

Of course, very few voters follow the massive literature on the business cycle. What they observe are modestly increasing wages, low unemployment and (at least temporarily) slightly lower taxes. Economic growth under Trump has been driven by consumer spending, which represents immediate gratification for voters. The fact that increased consumption today coupled with exceptionally weak investment means a lower standard of living tomorrow isn’t something that registers with the average voter.

These terms can get semi-complicated. I think it’s useful to put it in extremely simple terms. What if you had an unmanned space rocket, such as what SpaceX does. They initially have some kind of fuel supplied propulsion into space, and then often it just turns off (that fuel propulsion) and the initial motion or momentum carries the craft onward through space, to its destination. Now if the Senior “commanding” engineer of the ground operations manages the lift off, then his “shift” ends and his equivalent in rank takes his place in the ground operations seat, does the replacement guy sitting in his seat say “Hey everybody, I got this baby off the ground!!!! The Falcon Heavy had nothing to do with this, it was all me and Red Dragon baby!!!!”. This, in essence, is the argument donald trump has been making this entire time. And if we look at what “W” Bush and Hank Paulson handed President Obama, this really isn’t any kind of exaggerated or aggrandized example at all. One could argue the rockets were in reverse when President Obama became Chief Executive. But that’s expecting a FOX news viewer to have a memory that stretches back 11 and 3/4ths years, and that can read the most basic economic data, never mind academic literature.

With interest rates at near zero, the is no cost constraint for more private investment. What is need for “tomorrow” is public investment to restore our schools, roads, basic research, public medical facilities, etc. To do this we need to bailout the state and local governments the same as we have the airlines, and other businesses hurt by the pandemic.

Those 2.5 million workers missing from state and local governments are hurting everyone, even those suburbs that Trump says he has saved by changing one regulation.

With interest rates at near zero, the is no cost constraint for more private investment.

Completely agree. The problem is that as long as the coronavirus is in command there will be very little appetite for private sector investment. Government should step in as the investor of last resort. Now is the time to ramp up government spending on public investment that will pay off down the line. With exceptionally low interest rates almost any project would pass a benefit/cost analysis.

It’s becoming ever clearer what a big mistake Trump’s tax cuts for the rich really was. It did not lead to the promised boom in private sector investment before the pandemic hit. And while the pandemic continues to rage the private sector is not inclined to increase investments even at near zero interest rates. All we got from the Trump tax cuts was a bump in consumption that resulted large pre-pandemic full-employment deficits. Eventually interest rates will rise and those unjustified pre-pandemic deficits will have to be rolled over at higher interest rates.