Today we are fortunate to have a guest contribution by Sam Williamson, Emeritus Professor of Economics at Miami University, and President of Measuring Worth. This is the second post in a series; the first post is here.

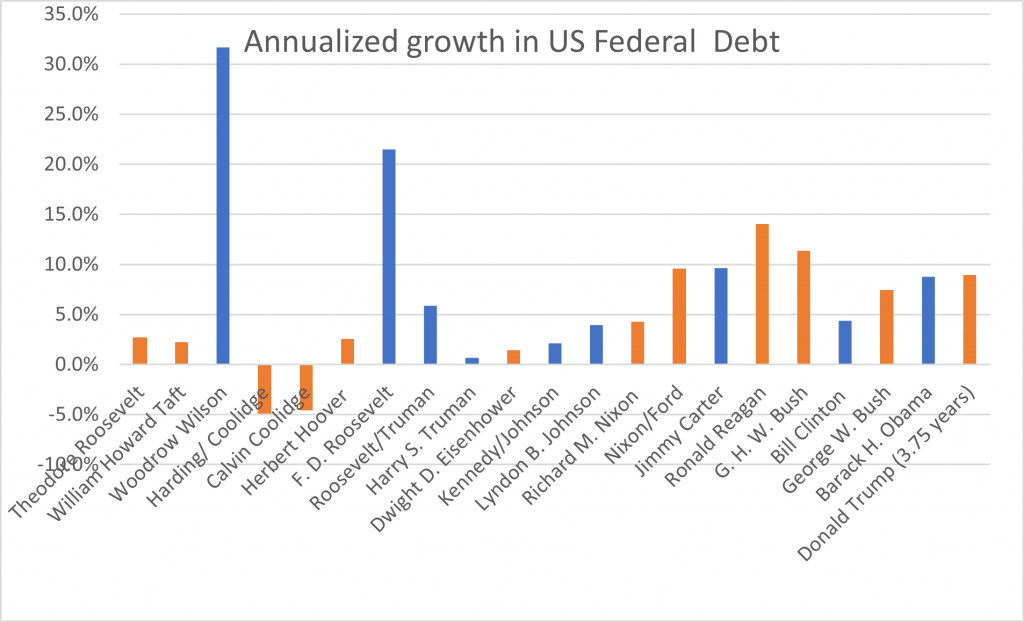

It is not surprising that the largest increases in the debt were during the terms of Wilson and FDR who were financing the two World Wars and both were Democrats. Between the wars and after, the attitude was to reduce the debt by running surpluses to pay off the war borrowing.

In January 1956, Eisenhower was to say “In this connection, I should mention our enormous national debt. We must begin to make some payments on it if we are to avoid passing on to our children an impossible burden of debt.” On that day, the per capita debt was $1,600, today it is over $200,000. Eisenhower was opposed to any tax cuts until the budget was balance. For the next two administrations the growth was back to the peacetime levels. After that the growth rate went up, however, not as fast as GDP so when Carter left office the debt was 32% of GDP, the lowest level since the Coolidge administration. It is now 156%.

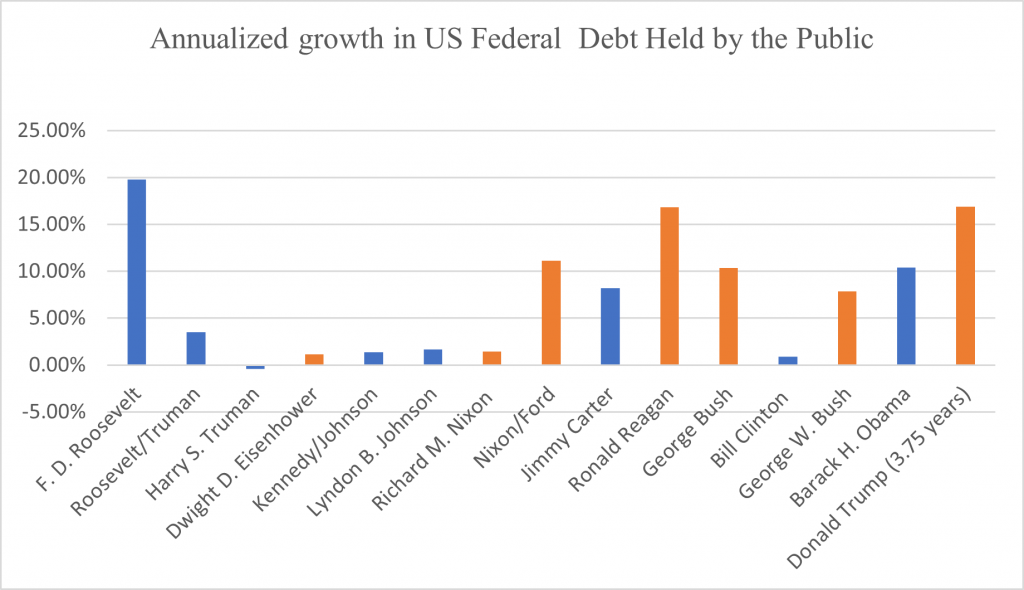

When discussing the impact of the debt on the economy, economists usually prefer to look at the US Federal Debt held by the Public. This is the debt excluding what is held by other government agencies such as the Social Security Trust fund and by the Federal Reserve System. The largest post-war deficit increase in the was during the Reagan administration with an annualized growth rate of 16.8%. Since then, the debt has grown at least 7% in every administration except the years when Clinton was president where there were budget surpluses and the annualized growth rate of the share of the debt held by the public dropped to less than 1%. Eisenhower would have been pleased with what Clinton accomplished. For the entire post WWII period, Trump’s rate at 17% is second to Reagan, and it is over 5% faster than next three of Nixon/Ford, Obama and G. H. W. Bush who are all about 11%.

For the entire twenty-first century the U.S. Federal debt had been growing at over an average of 8% a year. If Biden is elected, we can expect the Republicans to become “serious” about the debt and argue against deficits and they did ten years ago to stop expansionary budgets of the Obama administration.

This post written by Sam Williamson.

“In January 1956, Eisenhower was to say “In this connection, I should mention our enormous national debt. We must begin to make some payments on it if we are to avoid passing on to our children an impossible burden of debt.” On that day, the per capita debt was $1,600, today it is over $200,000.”

I am one of those children Ike was talking about in 1956. The burden of the debt is not impossible. In fact, it is not even noticeable. During the Eisenhower administration, however, there were three separate recessions which were all noticeable, similar to the 1920s when GOP budget surpluses caused 4 separate recessions with the last one ending in the Great Depression.

Instead of ghost stories about the debt, we need to look at the facts: from February, 2010 to February, 2020 the debt doubled, but the economy added 22.8 million jobs and the unemployment rate fell 64% to a 50 year low. The 10 yr T-Bond rate fell from 3.7% to 1.5% and inflation was flat at under 2% (PEC Core 1Q10-1Q20).

We are far better off than we were in 1956. Ike’s fear mongering about the debt was nonsense.

Fiscal policy has become the dominant economic policy issue for Congress, starting with the Reagan years. Republicans claim, when in power, that tax cuts are an economic elixir, good for all ills. The resulting deficits become a great evil when Democrats are in power, and Democrat’s economic goals must be put aside because of that supposed evil.

That game of “heads I win, tails you lose” will inevitably return once Biden is inaugurated, but Democrats needn’t play along. Some form of (not the) “Green New Deal” is desparately needed. Income support for unemplooyed and under-employed households isalso needed. The public option will never have a better chance than in Biden’s first two years. Packed courts should be dealt with quickly if they make partisan rulings.

If Democrats allow themselves to be cornered by Republican deficits again, they won’t deserve the political power they’ll hold next year.

It’s probably a tinge narcissistic (me?? narcissistic?? I’ve never caught myself being narcissistic when I granularly self-analyze myself, which I do often) to think this post was inspired by my comment in a prior thread. But to say I enjoyed this post, is an understatement, even if i do say so myself. I am the first person to ever say this.

Signed, Barkley Junior V

(That’s Barkley Junior the Fifth, not to be confused with Barkley Junior of “V recovery” infamy) He’s the member of our family that always gets jealous when I’m admiring myself in the mirror in my gorgeous leather pants, which by the way, he could never “pull off” looks wise, like I do.

Moses,

You have been challenged to put up or shut up.

It was a V-recovery at the front end, as I called it before anybody here (the Trumpists said it would go on and on). You have admitted you made a “shape” forecast in a secret email, but do not reveal what it was, perhaps because doing so would bring about a fourth wave of Covid deaths.

Put up or shut up, Moses.

All of these quotes are from Barkley Junior, except for the final one by commenter “AS”, who I would rank as probably one of the top 2 commenters (NO I do not include myself in the Top 2) of this blog. They include the links, so anyone can verify, or check the context.

Barkley Junior said:

“But now it is clear this projection is too conservative. If instead we assume that the increase in June is twice what was forecast, the moves it up by 1,000 to 18,000;. That remains a net negative for the second quarter, but now of only 300. That comes to a measly quarterly decline of -1.6%.

I do not know what that becomes annualized, but it is certainly not as negattive [sic] as a -20% annualized rate.”

https://econbrowser.com/archives/2020/07/continued-recovery-in-june#comment-237996

Barkley Junior said:

“ ’Possibility’ it might be as high as -20% for second quarter? It now looks like consumption is highly likely to be positive for the second quarter kills any chance of overall GDP growth for the second quarter being -20% or lower. Heck, I would be very surprised if it is lower than-10%.”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237778

Barkley Junior said:

“As it is, yes, Frankel is indeed on the list of ‘authorities’ I am challenging regarding these projections of a massive GDP decline in second quarter.”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237929

Barkley Junior said:

“I do not know whether US GDP growth for second quarter will be positive or negative, but as of now it looks to be a close call,”

https://econbrowser.com/archives/2020/06/imf-world-economic-outlook-june-update-forecast#comment-237773

Barkley Rosser said:

“So it is highly likely that global GDP will exhibit positive GDP growth for the second quarter of 2020.”

https://econbrowser.com/archives/2020/06/guest-contribution-defining-recessions-when-negative-growth-is-too-common-or-too-rare#comment-237553

From commenter “AS” June 26th:

“Hi Moses,

As I recall, Barkley was the first and perhaps the only economist to say that we may have a positive 2020Q2 GDP, so I was trying to give credit to his comments which are far different from what the average of the forecasts by the various NowCasts.”

https://econbrowser.com/archives/2020/06/imf-world-economic-outlook-june-update-forecast#comment-237756

Folks….. two things. you might ask at this point. Question 1: Did Barkley Junior, after 3 decades working as a “mathematical economist” at a semi-respected but ill-named University “not know” that the number quoted by IHS, and the different Fed regions and quoted by Jeffrey Frankel, all of them un-camouflaged estimates of the BEA number itself, as apposed to, say, whatever number Larry Kudlow had made up, or some “Rt/R-naught” number the great epidemiologist Ron Vara had pulled out of his head…… did not know that BEA number was an SAAR tabulated number???

And Question 2: Why a PhD who can manage to use his keyboard for many things, can never provide links to anything??~~~(thereby giving him the excuse of not being able to link back to his own continually badly sourced data, while also misattributing quotes, and falsely quoting peoples’ argumentative stances, and having the excuse that “I can’t do links” when he repeatedly misstates the opposing person’s argument in a way that flatters his argument.

Nevermind Junior moving the football goal posts of Barkley’s own arguments….

I am sure everyone here is tired of these. I can sure you, I am tired of them as well. And on the day that Junior stops making asinine statements like those enumerated above, that is the same day on which these back-and-forths will HAPPILY end.

Moses,

Oh, repeating something you already posted rather than telling us what you predicted as the shape of the GDP pattern during the second quarter as you were challenged to do? You are not putting up, but you are most certainly not shutting up, far from it.

I have already explained why some of my numerical predictions were wrong for the second quarter: I was mistakenly under the impression that things were measured from end of quarter to end of quarter. On that I was correct that second quarter had positive growth, although you have not acknowledged this point. Of course i have noted I was mistaken in that understanding.

I also find it funny that you somehow bring up the matter of consumption growth. You have various times ridicule my noting that there was record growth in consumption in May, which was true as Menzie had to point out to you. Again, GDP was higher at the end of June that it was at the end of March, although certainly average GDP over second quarter was much lower than in the first quarter. This has already been gone over several times. Why do you keep dragging it up? There is no new news here, none at all.

What would be new would be for you to inform us of your forecast of the GDP pattern. Get real, there is absolutely no reason to be keeping this secret. Your story about how you promised some friend not to reveal it is just hilarious, it is just so totally weird and bizarre.

Oh, yes, I have apologized for being poor at providing links. I do note that I usually tell how to find something via google when there is a link backing up something I have said.

Again, Moses, put up or shut up.

Dear Folks,

I don’t want to get into a political harangue here. My point is simple: if you have to spend money to pay debts, you can’t spend it on infrastructure, or vaccines, or other public goods. If you basically think the government has no real role in the economy, that all it really does is add burdens to the private firms, then you conclude as does Mr. Mathis. If you want the government to take actions to provide new infrastructure, without inflicting high interest rates (at best) on private firms, since it is trying to borrow from the same creditors they are, then you want to reduce the debt.

J.

Mr. Silk, are you aware that the Fed is the biggest holder of our debt and that it buys that debt with dollars that it creates in unlimited amounts? We have plenty of capacity to pay for infrastructure and vaccines and everything else we want as the Fed has clearly demonstrated since 1Q2020. The following chart from FRED clearly illustrates my point: https://fred.stlouisfed.org/series/GFDEBTN

Before 1980, the consensus was that the federal debt needed to be constrained in order for the economy to grow. Back then, the debt-to-GDP ratio was 31%. As of 2Q2020, the ratio is 135%. https://fred.stlouisfed.org/series/GFDEGDQ188S

The past 40 years have proved J.M. Keynes right: deficit spending is fuel for the economy. Gold bugs are wrong.

Mr. Mathis,

I’m not going to get into an argument about the Federal Reserve. If there are unused resources, the Federal Reserve’s action will help get them used in the same way increasing the money supply would. But there is a limit to what you can do with this channel, and Keynes criticized Abba Lerner’s Functional Finance, the same general package as MMT, for ignoring this limit. This has nothing to do with gold, and everything to do with not increasing debt without end.

J.

You circle doesn’t close. Reducie the debt so you can have the debt capacity to allow spending on infrastructure?

Assuming infrastructure spending is both productivity and welfare enhancing, should we wait until debt is reduced to spend on infrastructure?

When borrowing rates, real and nominal, are low, is that evidence that public borrowing is crowding out private borrowing? Hasn’t a great deal of corporate sector borrowing gone to finance mergers, acquisitions and stock buy-backs in recent decades, rather than productive investment?

It may be the case that we have a debt problem, but neither the need for infrastructure spending nor crowding out of productive private investment represents a reason to reduce government debt. In fact, infrastructure spending is probably a useful substitute for private investment when so little productivity-enhancing private investment is taking place.

Republicans are only allowed to use the “crowding out” theory when they are trying to stymy spending programs sponsored by the Democrats.

The deficits are huge and the interest rates are near zero. We are awash with worldwide excess saving and a few governments are the only places that can offer safe projects to finance.

Sam Williamson: a very good, very concise summary. Thank you.