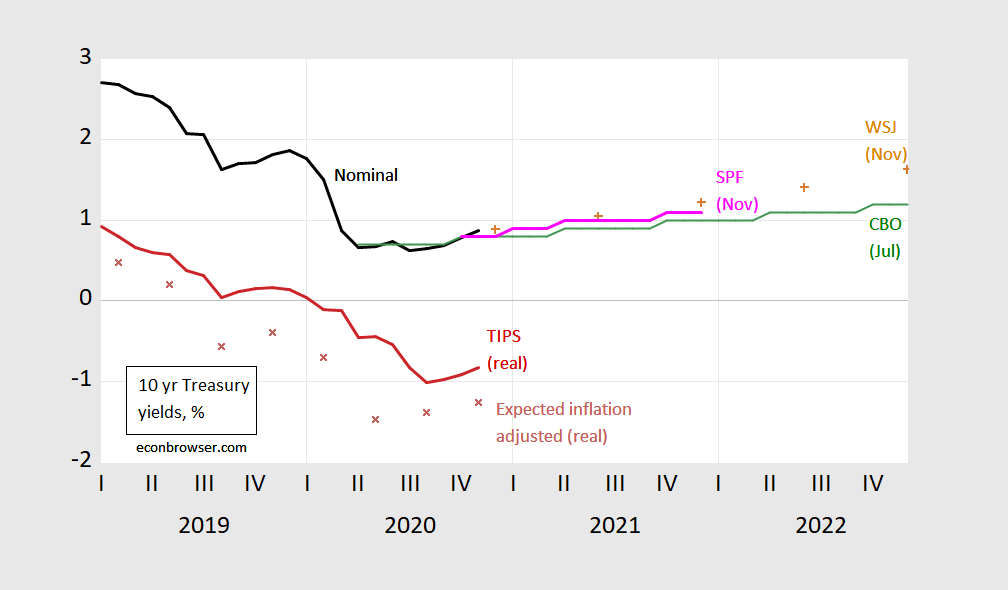

Halfway through November, TIPS 10 year at -0.876% and ten year adjusted for median expected inflation (from November Survey of Professional Forecasters, released today) at -1.264%.

Figure 1: Nominal ten year constant maturity Treasury yields (black line), CBO projection (green line), WSJ November survey mean yields (orange +), Survey of Professional Forecasters November survey mean yields (pink line), TIPS ten year constant maturity yields (red line), ten year expected inflation adjusted (real) yields (brown x). Inflation adjustment using Survey of Professional Forecasters (SPF) median survey response for 10 year CPI inflation. Source: Federal Reserve via FRED, CBO (July), SPF, and author’s calculations.

Perspective on how low real rates are now, and how previous forecasts have overshot the actual ex post increase in yields, in this post.

“TIPS 10 year at 0.876% and ten year adjusted for median expected inflation (from November Survey of Professional Forecasters, released today) at -1.264%.”

Real interest rates are negative 0.876% not positive … Expected inflation is negative??? Not what the link suggests. Is this some of Judy Shelton version of alternative facts or a need to do a little editing?

pgl: typo. added in the negative sign. Apologies!

I get it now. The 10-Year Breakeven Inflation Rate = 1.72% per FRED.

Inflation adjustment using Survey of Professional Forecasters (SPF) median survey response for 10 year CPI inflation must be just over 2%.

Negative real rates so money is essentially better than free. With negative real rates its hard to find any spending that doesn’t have a positive real return.

If McConnell refuses to cooperate in pandemic fiscal relief, Biden should just do what he can by executive order. For example he could just forgive all student loans. Maybe not the best targeted stimulus but better than nothing given Republican obstruction. This would free up spending for young debt burdened families to buy houses, cars and other stuff.

Forgiving student loans is a nonstarter.

It is absolutely the right thing to do. But, Federal Reserve member banks hold/process a ton of student loan debt. (SLABS) No way that’s going to go over well with them. Calls to the white house would be answered when it’s FRB-so-and-so calling with their “concerns.”

Or, you can do what they did during the real estate collapse and pay everyone on both sides of the bet so there are no losers.

While it’s a great idea, student loan debt is securitized like it’s 2007. And, the member banks of the Federal Reserve have a big business securitizing and making student loans. (SLABs)

It’s worth noting, while student loans are sometimes backed by the U.S. government, a meaningful amount are not.

That means “so-and-so-from-the-federal-reserve” would make a call to the Biden administration and their “concerns” about killing the goose laying golden eggs would be heard. I’m sure FRB banks would reduce the debt-holders’ collective moral(!) failure to pay their debts a great “concern” and mention the incentives debt forgiveness would inspire. (As if they have never reneged on a debt)

Nominal rates will surge in 2021 to likely over 2%.

You really are the king of unsupported pronouncements. Student loan forgiveness is a non-starter. Rates are going to rise. The moon is made of green cheese.

You may have noticed that most of the commenters here offer reasons for their views. In the comment section of a blog which offers “Analysis of current economic conditions and policy”, you might see why that’s the case.

What you have to offer is mere opinion. Opinions are like…well, you know. And yours are a waste of space.

November 16, 2020

Coronavirus

US

Cases ( 11,538,057)

Deaths ( 252,651)

India

Cases ( 8,873,994)

Deaths ( 130,552)

France

Cases ( 1,991,233)

Deaths ( 45,054)

UK

Cases ( 1,390,681)

Deaths ( 52,147)

Mexico

Cases ( 1,006,522)

Deaths ( 98,542)

Germany

Cases ( 817,526)

Deaths ( 12,891)

Canada

Cases ( 302,192)

Deaths ( 11,027)

China

Cases ( 86,346)

Deaths ( 4,634)

November 16, 2020

Coronavirus (Deaths per million)

UK ( 767)

US ( 762)

Mexico ( 761)

France ( 690)

Canada ( 291)

Germany ( 154)

India ( 94)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 9.8%, 3.7% and 2.3% for Mexico, the United Kingdom and France respectively.

https://news.cgtn.com/news/2020-11-17/Chinese-mainland-reports-15-new-COVID-19-cases-all-from-overseas-Vu2ipaw9BC/index.html

November 17, 2020

Chinese mainland reports 15 new COVID-19 cases

The Chinese mainland registered 15 new COVID-19 cases on Monday, all from overseas, the National Health Commission announced on Tuesday.

A total of 12 new asymptomatic COVID-19 cases were recorded, all from overseas, while 512 asymptomatic patients remain under medical observation. No COVID-19 related deaths were reported on Monday, and 19 patients were discharged from hospitals after recovering.

As of Monday, the total confirmed COVID-19 cases reached 86,361, with 4,634 fatalities.

Chinese mainland new imported cases

https://news.cgtn.com/news/2020-11-17/Chinese-mainland-reports-15-new-COVID-19-cases-all-from-overseas-Vu2ipaw9BC/img/4826bbac3ae741ffa6395da6596a09c5/4826bbac3ae741ffa6395da6596a09c5.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2020-11-17/Chinese-mainland-reports-15-new-COVID-19-cases-all-from-overseas-Vu2ipaw9BC/img/4204187dcd3844fb9bb33a3af03f749f/4204187dcd3844fb9bb33a3af03f749f.jpeg

[ There has been no coronavirus death on the Chinese mainland since May 17. Since June began there have been 5 limited community clusters of infections, each of which was contained with mass testing, contact tracing and quarantine, with each outbreak ending completely in a few weeks.

Imported coronavirus cases are caught at entry points with required testing and immediate quarantine. Asymptomatic cases are all quarantined. The flow of imported cases to China is low, but has been persistent.

There are now 353 active coronavirus cases in all on the Chinese mainland, 3 of which cases are classed as serious or critical. ]

Which Republican would you trust?

https://www.yahoo.com/huffpost/lindsey-graham-denies-pressuring-georgia-official-to-toss-ballots-003444228.html?.tsrc=daily_mail&uh_test=1_04

Georgia Secretary of State Brad Raffensperger who has been very diligent making sure the vote in Georgia is counted properly. Or Trump sycophant Lindsey Graham who wants to illegally toss out ballots for Biden? Yea – it was an easy question!

lindsey graham is attempting to commit voter fraud.

Graham denies it. One problem – there was another person on the call who confirms what the Ga. Sec. of State said. Graham was advocating a felony and when caught turns out to be a lying little weasel.

Has this virus turned Greg Mankiw into a socialist? His blog is promoting this excellent idea:

https://www.brookings.edu/opinions/want-herd-immunity-pay-people-to-take-the-vaccine/

When I was a child, doctors giving vaccine shots used to hand out candy or a little toy to take the sting and fear out of the shot. A similar idea could rescue the U.S. economy when one or more COVID vaccines are approved by the FDA and widely available for mass uptake….The “adult” version of the doctor handing out candy to children, fortunately, points toward a solution: pay people who get the shot (or shots, since more than one may be required). How much? I know of no hard science that can answer that question, but my strong hunch is that anything less than $1,000 per person won’t do the trick. At that level, a family of four would get $4,000 (ideally not subject to income tax) – a lot of money to a lot of families in these difficult times, and thus enough to assure that the country crosses the 80 percent vaccination threshold.

There is a lot more to this excellent essay so please read the entire discussion.

Mankiw’s idea is straightforward economics. Positive externalities and incentives go hand in hand in the textbook. His strong sense of what is needed to motivate people to be vaccinate who would otherwise be reluctant might say more about his privileged position than the state on the world.

I think $1000 is a fine amount. I’d be happy with $2000 or $5000. Get the money out there. Transfers to households are a great idea, and this is a worthwhile method.

Except for the issue of positive externalities, Mankiw’s suggestion misses a lot. The supply of the vaccine(s) will be limited and so vaccines will be rationed. Initially, we would be paying only those who have the opportunity to receive the vaccine when the economy is in greatest need of fiscal stimulus. Mankiw’s draconian suggestion that incentive payments to individuals be mostly held in abeyance until herd immunity is reached is bad fiscal policy (except in the Wilbur Ross world in which anyone can borrow against future income) and assumes that the incentive effect won’t be diminished by the chance that the contingent portion of the incentive may never come. So while a blind squirrel can find a few nuts, and Mankiw has found one here, he is still a blind squirrel.

Want incentives to do more than one job? Anybody who signs up to be vaccinated gets the incentive payment immediately. Fail to be vaccinated once the vaccine is available and you have to pay the money back, win interest (thanks for the idea, Wilbur). This way, we get higher vaccination rates and stimulus when it is most needed.

Mankiw also needs to get off this herd immunity schtick. Higher vaccination rates are good, Herd immunity is a rightwing point.

One would hope Senator Grassley does not have this virus but maybe the silver lining could be that Judy Shelton is not placed on the FED:

https://in.reuters.com/article/us-usa-fed-shelton/senator-grassley-virus-exposure-puts-sheltons-fed-nominee-vote-in-doubt-idINKBN27X1T7

The exposure of a second Republican senator to the coronavirus threw into doubt Tuesday the U.S. Senate’s vote on Republican President Donald Trump’s controversial pick for the Federal Reserve, former economic adviser Judy Shelton. U.S. Republican Senator Chuck Grassley, the chamber’s president pro tempore, said on Tuesday he was in quarantine after being exposed to the coronavirus and was awaiting test results. Grassley, 87, said in a statement that he was “feeling well and not currently experiencing any symptoms” but would follow public health guidelines and would continue to work from home. Grassley is also chairman of the Senate Finance Committee. Republican Senator Rick Scott of Florida is also quarantining because of exposure to the virus. Trump’s Republican Party has a 53-47 majority in the current Senate. Tennessee’s Lamar Alexander on Monday joined Republican colleagues Mitt Romney and Susan Collins in indicating he opposes Shelton’s confirmation. A procedural vote was expected to come on Tuesday afternoon, with a final vote on Shelton’s confirmation later in the day. But Grassley’s absence could deprive Republicans of the necessary majority to muscle through Shelton’s confirmation. Senate rules do not allow for voting by proxy.

Shelton, an adviser to Trump’s 2016 presidential campaign, has argued the nation would be better off returning to the gold standard and as recently as 2017 criticized the Fed’s power over money and financial markets as “quite unhealthy.” Her views on interest rates have moved in lockstep with Trump’s. She lambasted easy money before Trump’s presidency but supported it after he took office, and has expressed skepticism over the Fed’s need to set policy independently from the president and Congress.

pgl Sen. Grassley announced that he tested positive. If he doesn’t make it, then his likely successor will be his dimwitted grandson, Pat Grassley.

https://en.wikipedia.org/wiki/Pat_Grassley

And I do mean dimwitted. Dumb as a fencepost. A dullard if ever there was one.

The Senate never adopted the sensible social distancing measures that the House adopted. If Grassley dies, the blame should be put on McConnell.

Also worth noting is that the Arizona seat won by Democrats will be sworn in Dec. 1’st. So with 3 GOP senators against, she can only be placed on the Fed if Grassley comes back in 12 days. Tick-tock-tick-tock

to all the selfish jerks on this site who don’t take the virus seriously

https://www.cnn.com/2020/11/17/us/boy-loses-parents-covid-birthday-trnd/index.html

you tell this little boy why it was more important to go out and have a beer than protect his mother and father. orphaned at 4 years of age. because maga folks around the country simply do not care. sad.

Bruce Hall should read this and then apologize for all the nonsense he has written here. He should but the little weasel won’t.

4 trill from Cares(2.8 transfers)

3 trillion from private banking(Fed is regulator not money creator fools

I smell Dow 60000 by 2026. Not even remotely worth that. Rates are going higher as the Pandemic fades next year. Period. But that doesn’t mean much. The debt expansion has already happened.

The Rage: “Fed is regulator not money creator” – is that a positive of normative statement. As a positive statement, it is clearly wrong.

Glassman wrote this in 2011?

https://www.wsj.com/articles/SB10001424052748703584804576144683264748042

Why was they wrong? Two reasons one he sort of notes – risk premiums. But another major reason has to do with the fact that you do not pay 100% of operating profits to dividends if your firm is growing. Something called new investment in capital to support growth. These two mental midgets left that out of their equation. And Glassman never mentioned that glaring error in his 2011 mea culpa? Incompetence!

Did I get the Rage’s latest rant right? He thinks interest rates will rise and he is still expecting the stock market to double in value? He is a Russian bot that has some serious programming defects.

Are you working on a new version of their 1999 classic with Kevin Hassett and James Glassman?

https://www.amazon.com/Dow-36-000-Strategy-Profiting/dp/0812931459

The rates are going higher crowd have been wrong for over a decade. You provide no evidence that somehow you are now correct. Bluster with no substance

Dude, rates going to 2%+ is hardly awing. Yup there going higher.

Dude, you again provide no evidence or reason.

“Rates are going higher”.

Do you know what this troll means by “rates”. I doubt the troll does but if you can be specific as to WTF he is babbling about – please let us know.

The Senate just voted on the Shelton appointment to the Fed and the nomination failed 47-50. McConnell can bring it back for a vote via Senate procedures but it may not pass given Mark Kelley will be assuming the Arizona Senate seat after Thanksgiving. https://www.washingtonpost.com/business/2020/11/17/shelton-fed-mcconnell/

it was quiet convenient for guys like grassley and scott to miss the vote to due coronavirus exposure. i don’t think republicans really want to put her on the fed, and this might be a convenient way out. otherwise it is going to force some moderate republicans to have to vote on a clown for a fed position. mitch could have voted for her and simply ended an appeal, but he didn’t. he voted against her for procedural means. not sure what his calculus is there, other than scared of trump.

Bye bye Judy!

Republican Senators have been more willing to oppose Fed candidates, good and bad, on an only sometimes parisan basis, than for other types of appointment.

https://www.nytimes.com/2020/11/17/technology/digital-economy-technology-work-labor.html

November 17, 2020

Don’t Fear the Robots, and Other Lessons From a Study of the Digital Economy

A task force assembled by M.I.T. examined how technology has changed, and will change, the work force.

By Steve Lohr

L. Rafael Reif, the president of Massachusetts Institute of Technology, delivered an intellectual call to arms to the university’s faculty in November 2017: Help generate insights into how advancing technology has changed and will change the work force, and what policies would create opportunity for more Americans in the digital economy.

That issue, he wrote, is the “defining challenge of our time.”

Three years later, the task force assembled to address it is publishing its wide-ranging conclusions. The 92-page report, “The Work of the Future: Building Better Jobs in an Age of Intelligent Machines,” * was released on Tuesday.

The group is made up of M.I.T. professors and graduate students, researchers from other universities, and an advisory board of corporate executives, government officials, educators and labor leaders. In an extraordinarily comprehensive effort, they included labor market analysis, field studies and policy suggestions for changes in skills-training programs, the tax code, labor laws and minimum-wage rates.

Here are four of the key findings in the report:

Most American workers have fared poorly.

It’s well known that those on the top rungs of the job ladder have prospered for decades while wages for average American workers have stagnated. But the M.I.T. analysis goes further. It found, for example, that real wages for men without four-year college degrees have declined 10 to 20 percent since their peak in 1980. (Two-thirds of American workers do not have four-year college degrees.)

The U.S. economy produces larger wage gaps, proportionately fewer high-quality jobs and less intergenerational mobility than most other developed nations do, the researchers found. And America does not seem to get a compensating payoff in growth. “The U.S. is getting a low ‘return’ on its inequality,” the report said.

Nor does the lagging position of American workers appear to be the result of technology. “It’s not that we have better technology, automating more middle-wage jobs,” said David Autor, an M.I.T. labor economist and a co-author of the report. “We have worse institutions.”

Robots and A.I. are not about to deliver a jobless future.

Technology has always replaced some jobs, created new ones and changed others. The question is whether things will be different this time as robots and artificial intelligence quickly take over for humans on factory floors and in offices.

The M.I.T. researchers concluded that the change would be more evolutionary than revolutionary. In fact, they wrote, “we anticipate that in the next two decades, industrialized countries will have more job openings than workers to fill them.”

That judgment is informed by field research in several industries and sectors including insurance, health care, driverless vehicles, logistics and warehouses, advanced manufacturing, and small and medium-size manufacturers.

For self-driving cars and trucks, the M.I.T. researchers concluded that widespread use was still a decade or more away. In warehouses, Amazon has made great strides with automated conveyance systems and some robotics, but its warehouses run on human labor, and will for years.

Despite advances, robots simply don’t have the flexibility and dexterity of human workers. Today’s robots learn from data and repetition. They can be remarkably adept at a certain task, but only that one. The report cited a fine-tuned gripping robot that could pluck a glazed doughnut and carefully place it in a box, with its shiny glaze undisturbed.

“But that gripper only works on doughnuts,” the report said. “It can’t pick up a clump of asparagus or a car tire.”

The cost and operational expertise required will also slow the widespread adoption of robots. A research team surveyed dozens of small and medium-size manufacturers in Massachusetts, Ohio and Arizona, and found “very few robots anywhere.” (Small and medium-size companies, with fewer than 500 workers, account for 98 percent of the nation’s manufacturing firms and 43 percent of manufacturing employment.)

Worker training in America needs to match the market….

* http://workofthefuture.mit.edu/wp-content/uploads/2020/11/2020-Final-Report.pdf

Thinking from the MIT work study, back; before the recession, Amazon was looking among cities for another headquarters and New York City was chosen by the company for the geography along with a tax incentive. Thousands of select and routine but importantly stable jobs would have been created by Amazon in New York City. However, there was general union-centered opposition to Amazon and concern about the tax breaks offered and local political figures such as Alexandra Ocasio-Cortez successfully fought against gaining the Amazon headquarters. Paul Krugman as well decided Amazon did not matter to New York.

The decision of Amazon not to locate in New York struck me immediately as a terrible workforce loss to the city. Krugman and AOC were wildly mistaken. They failed to understand what Amazon was becoming. Get the company, fix perceived problems as they develop.

Uh, no. It is not clear Amazon was serious. It is npt clear Amazon would have been willing to fix problems. We did not have to wait for them to occur, because problems would have been immediate. Union opposition was not the only opposition. But nice try.

NYC has been attracting Google employment opportunities in lieu of Amazon’s whining for more tax breaks. Look – all of these hi tech companies are basically tax cheats. Of course Mayor Bloomberg was hoping our city would be a haven for billionaires so I guess these tax cheats feel welcome here.

Please. That plan destroyed jobs as well.

maybe it would have worked out as well as the fox con debacle made by the former republican governor of wisconsin.