The Economist says unlikely. Surveys and market expectations concur.

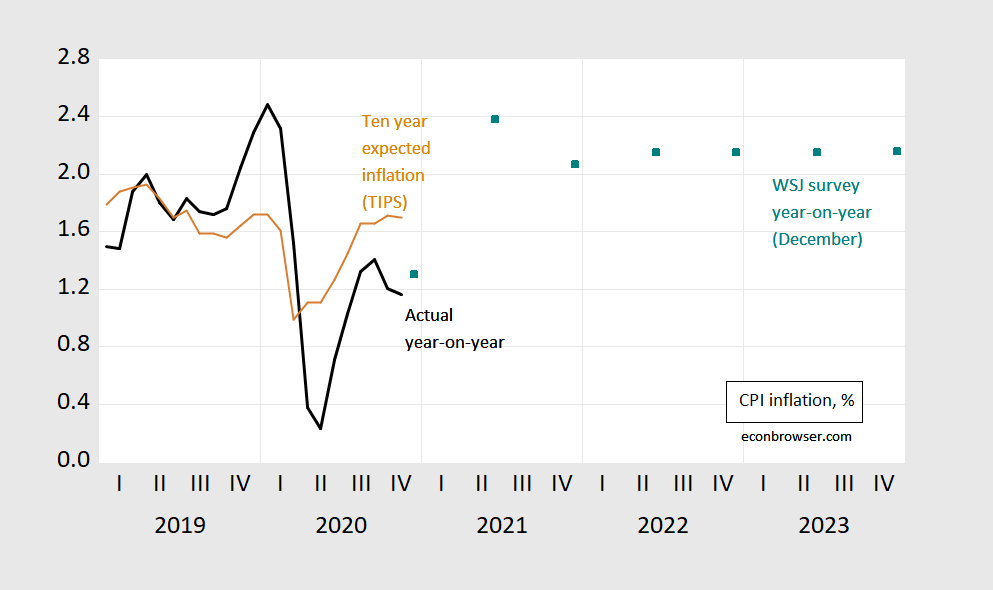

Figure 1: Year-on-year CPI inflation (bold black), WSJ December survey mean of year-on-year CPI inflation (teal), and 10 year expected inflation inferred from 10 year break-even (tan). Source: BLS and Treasury via FRED, WSJ December survey, and author’s calculations.

Could one of the few exceptions be American farm commodity prices in the next year, when the tariffs are lifted and China reciprocates?? Although not sure if that counts as true “inflation” don’t we have to assume the prices rise relatively dramatically in those crops exported to China?? At least a small “shift” in the demand curve there??

hard to see inflation with so many folks out of work or subject to wage stagnation.

Agreed. COVID-19 shutdowns have replaced interest rate hikes to keep inflation down. Meanwhile, stock market speculation is off the charts. https://www.msn.com/en-us/money/companies/airbnb-valuation-reaches-24100-billion-in-trading-debut-surge/ar-BB1bOwip

Somewhere there is some sense to all of this, but….

Lord – Bruce no relationship to Robert Hall thinks stock valuations are part of the consumer price index. Do you exist solely for the purpose of us laughing at your usual irrelevant and utterly stupid comments?

Lord – pgl makes random connections of words. Does he understand the transition “meanwhile”? It’s often use in place of the wordy “in other news”.

I positive pgl is on some sort of psychotic drug.

WTF? Hey if you want to admit you write irrelevant gibberish, fine by me.

Shutdowns would not be necessary if more people wore masks and practiced social distancing. This would result in less unemployment. Unfortunately too many spoiled brats cannot practice self restraint.

And with the added payroll taxes from the higher debt. I don’t recall having to pay a federal unemployment tax. It clearly isn’t the same as the government printing money and introducing it into circulation. I actually think the added taxes from the additional debt are going to stabilize inflation because of the lack of money in circulation. It’s kind of funny, I thought it was BS I had to pay anything back and then I realized that I was living on loans my federal government took out. It kind of spurns articles in the Economist that call this age of debt or handouts as a result. The only people who don’t have to pay it back are those retiring with Roths and Social Security. People permanently out of the labor force for other reasons aren’t really enviable.

Jafar,

Sorry, but you have no idea what you are talking about. Increasing debt does not increase payroll taxes. Payroll taxes go to Social Security and Medicare and are completely unconnected to debt.

And as it is, taxes do not pay for debt anyway. When old debt is repaid it is paid with new debt, that is it is “rolled over.” What is paid by all taxes is interest on the debt, not the debt itself, and even when interest payments on the debt rise, that does not in and of itself trigger increased taxes of any sort.

I guess you’re right. I looked back and payroll taxes were spelled out better in the way you explained.

That said, I had an undergraduate economics text book say Turkey had hyperinflation when debt was 300 percent of annual GDP. Is that accurate or is it hopeless to predict in a country like the US. The news says the latter.

What an opening:

“In 1975 Adam Fergusson, a journalist on the Times, published a book called “When Money Dies”. A history of hyperinflation in Germany in the early 1920s, it was written with an eye to what was going on in the then-present day. Inflation in Britain was not at the prices-soaring-day-by-day levels seen in the Weimar Republic. But in 1975 it reached an unprecedented 24%—grim enough for Fergusson’s warning that the experience of inflation was “totally absorbing, demanding complete attention while it lasts” to hit home.”

Of course Gerald Ford was running around with his stupid WIN (Whip Inflation Now) buttons and doomed us to the 1975 inflation.

But hey Judy Shelton is consulting with Stephen Moore on that commodity index model to cook up a hyperinflation forecast if Biden becomes President. But be of cheer – Donald Trump has filed another 30 lawsuits alleging voter fraud!

NO!!! WIN meant “Wilbur Is Naughty”. Remember when Wilbur Mills ended up in the Tidal Lagoon with Fanny Foxy?

How dare you imply that I’m old!

https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2002/monetary-policy-and-stagflation-in-the-uk

An interesting paper on what went wrong in the UK by two BoE economists. They note that inflation soared because monetary policy was led astray by overestimates of potential output at the time.

The 1970’s in the US had similar measurement issues back then. Of course of late many have suggested CBO is underestimating US potential output.

Seems like “overestimates of potential output” is another way of saying “pre-Lucas-critique economics”.

But maybe I should read first.

YrY, yes by next spring it will be up to about 4% before dropping back.

Oh man, I am in a good mood. 1 guess why. I intended to get Strawberry daiquiri in tribute to my Dad tonight (not a drinking man at all, one of the few alcohol beverages he admitted to liking). Maybe only two things my Dad looked down on more than drinking. Cigarette smokers and non-college grads (if you were to judge on verbal time haranguing on it, there’s obviously worse sins) And I got Mango daiquiri by mistake. Where does this rank on F-ups?? Small, medium. or major?? Vote now and vote often. The polling places in Harrisonburg VA have been closed because…… just because. The can is largely red, be nice.

There can’t be inflation is world that is in a world depression in terms of unemployment. there simply too much capacity that is not being used. High unemployment; movie theaters that are empty; restaurant that are empty.

Even when the world economy starts to recover, the only benefit of corporate globalization is the ability to produce unlimited goods and services. Now, you can buy a TV from hundreds of places if not thousands. Fifty years ago your were limited to Sears and some local outfit or a high end department store.

We had stagflation in the 1970s, rising unemployment and rising inflation rates simultaneously. That came from the supply side, especially oil prices.

Our host under his Quantity Equation of Money post shared with us 20 minutes of some UK monetarist which was a real hoot. Tim Congdon is his name and he actually thinks that a temporary “HUMP” in UK monetary growth will lead to 5% inflation even though he knows that the difference between nominal UK interest rates and their index rates suggest the market is expecting a lot less inflation.

Trust the market or trust an old and obviously losing it monetarist?

So trillions of dollars printed out of nowhere and still stagflation? Man, either the medicine was just placebo, or we were given LSD and all is just an illusion. Who the hell cares about these official numbers? CPI is built and changed frequently so that it helps the establishment narrative and goals, which is perpetual submission of its population to it’s coercive and arbitrary decisions. We’re all slaves to this system, and the difference between me and others is that I don’t believe in this bullshit. Food inflation is above 20% this year. For everyone that matters in this world, that’s the only inflation it counts.

Somebody forgot their tinfoil hat today!

Sorry, Adi, but the CPI is not “built and changed frequently” at all, so what one sees in the official numbers is not being cooked to “help the estblishment narrative and goals.” Sorry, but this is indeed tinfoil hat bs.

Food prices have been up, but others have been down. There is a tendency for people to get fooled because they tend to focus on those prices rising the most rapidly while ignoring the others. Nobody is manipulating these numbers.