The Section 232 tariffs on steel and aluminum were a bad idea during the Trump administration. They’re still a bad idea.

There are indications that the Biden administration will keep these tariffs in place, at least in the short term. Given the accelerated rise in prices since end-2020, this reluctance to eliminate these counterproductive measures is mysterious to me. The depreciation of the dollar after the Trump-induced flight to dollar assets had already raised import prices.

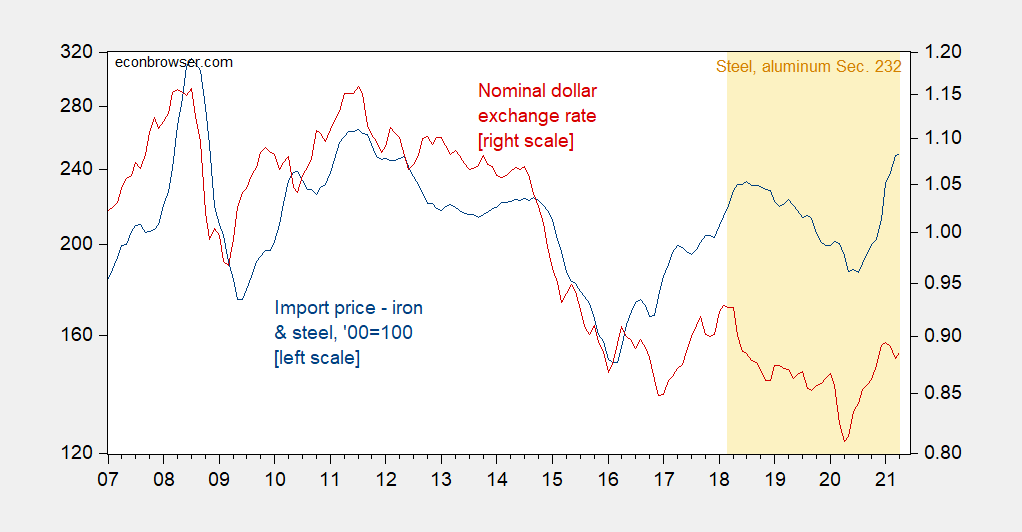

Figure 1: Import price index – iron and steel, 2000=100 (blue, left log scale), and nominal dollar exchange rate against broad basket of currencies, 2006=1 (red, right log scale), up is depreciation. Orange denotes Section 232 actions announced. Source: BLS, Federal Reserve Board, via FRED.

The fact that iron and steel import prices have diverged from the dollar exchange rate is consistent with steel tariffs have “bite” as overall economic activity picks up.

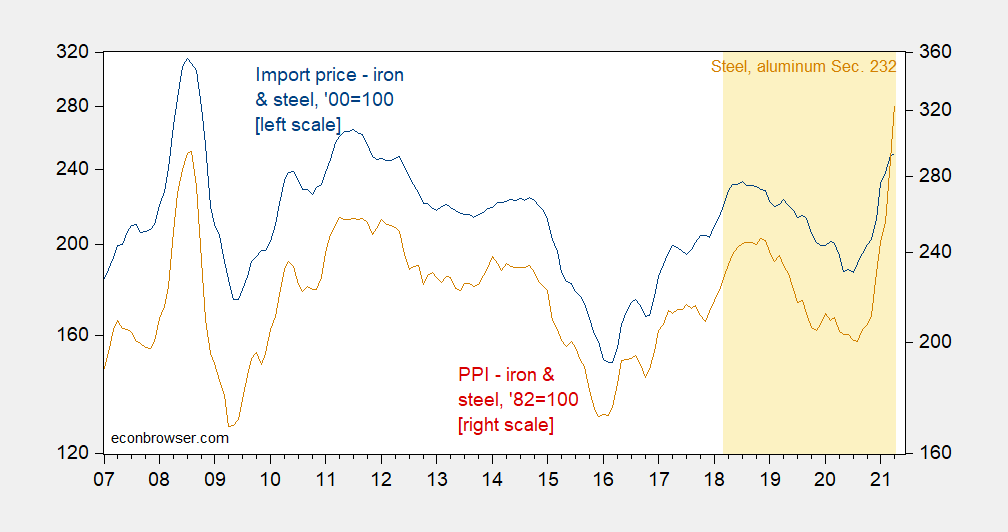

As basic tariff analysis indicates, domestic producers will raise prices along with import prices. This is shown in Figure 2.

Figure 2: Import price index – iron and steel, 2000=100 (blue, left log scale), and PPI – iron and steel, 1982=100 (red, right log scale). Orange denotes Section 232 actions announced. Source: BLS via FRED.

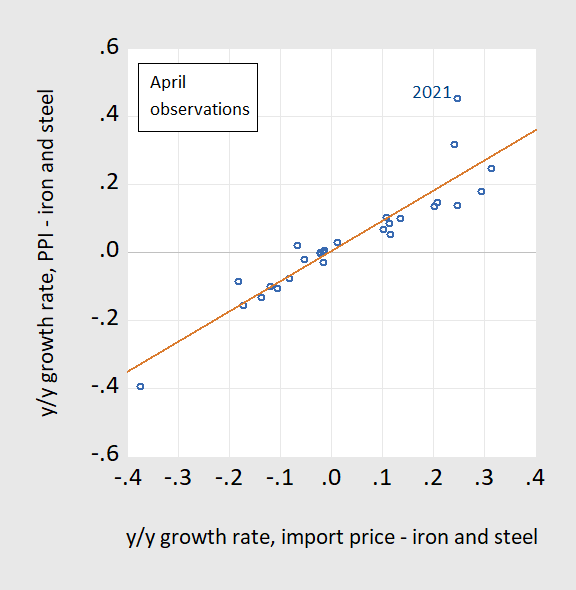

Figure 3 highlights the extent of the divergence in a different fashion.

Figure 3: Year on year April growth rate of PPI – iron and steel vs. year-on-year April growth rate in import price index – iron and steel, 2007-2021. Source: BLS via FRED.

As the economy heats up further, the case for steel and aluminum protection (if there ever was one) gets less and less convincing. This is particularly so if there are concerns about bottlenecks in the supply chain and other cost-push shocks. (See also NYT)

A mystery is how so few US auto workers seem to have noticed the negative impact on their industry of these tariffs and continued to support Trump in such numbers. This was especially noticeable in Ohio where the tariffs played a role in the shutdown of the Lordstown GM assembly plant, but by all accounts a majority of Ohio autoworkers supported Trump anyway for “showing strength” with these tariffs.

And Reagan blamed Jimmy Carter for the 1982 recession.

have an uncle who spent his lifetime working at the lordstown plant, retired long before the current issues played out. but he is a trump supporter, and was happy to see us “showing strength” with the tariffs, intentionally overlooking the damage such things could do to the current plant and its workers.

years ago, i remember driving by the plant next to the turnpike. you could see thousands of new vehicles sitting out in the parking lot, waiting to be delivered. is was depressing, in more recent years, when i would drive by this huge plant surrounded by empty parking lots. this was devastating to the region.

The IMF reports the global price of iron ore ($/metric tons):

https://fred.stlouisfed.org/series/PIORECRUSDM

They hit record prices in 2011 and then tanked but these prices are soaring again. Of course commodity prices tend to be volatile.

Then again I hear that Stephen Moore is working with Bruce Hall to establish a new form of money based on iron ore.

https://www.nytimes.com/2021/05/21/business/steel-prices-boom.html

May 21, 2021

Soaring Prices Herald Boom Time for Steel Makers

A rebounding economy and Trump-era tariffs have helped drive the price of domestic steel to record highs.

By Matt Phillips

For decades, the story of American steel had been one of job losses, mill closures and the bruising effects of foreign competition. But now, the industry is experiencing a comeback that few would have predicted even months ago.

Steel prices are at record highs and demand is surging, as businesses step up production amid an easing of pandemic restrictions. Steel makers have consolidated in the past year, allowing them to exert more control over supply. Tariffs on foreign steel imposed by the Trump administration have kept cheaper imports out. And steel companies are hiring again.

Evidence of the boom can even be found on Wall Street: Nucor, the country’s biggest steel producer, is this year’s top performing stock in the S&P 500, and shares of steel makers are generating some of the best returns in the index.

“We are running 24/7 everywhere,” said Lourenco Goncalves, the chief executive of Cleveland-Cliffs, an Ohio-based steel producer that reported a significant surge in sales during its latest quarter. “Shifts that were not being used, we are using,” Mr. Goncalves said in an interview. “That’s why we’re hiring.”

It’s not clear how long the boom will last. This week, the Biden administration began discussions with European Union trade officials about global steel markets. Some steel workers and executives believe that could lead to an eventual pullback of the Trump-era tariffs, which are widely credited for spurring the dramatic turnaround in the steel industry. However, any changes could be politically unpalatable given that the steel industry is concentrated in key electoral states.

In early May, futures prices for 20-ton rolls of domestic steel — the benchmark for most steel prices nationwide — pushed above $1,600 per ton for the first time ever, and prices continue to hover there.

Record prices for steel are not going to reverse decades of job losses. Since the early 1960s, employment in the steel industry has fallen more than 75 percent. More than 400,000 jobs disappeared as foreign competition grew and as the industry shifted toward production processes that required fewer workers. But the price surge is delivering some optimism to steel towns across the country, especially after job losses during the pandemic pushed American steel employment to the lowest level on record.

“Last year we were laying off,” said Pete Trinidad, president of the United Steelworkers Local 6787 union, which represents roughly 3,300 workers at a Cleveland-Cliffs steel mill in Burns Harbor, Ind. “Everybody was offered jobs back. And we’re hiring now. So, yes, it’s a 180-degree turn.”

Rising steel prices are partly a result of the nationwide scramble for commodities such as lumber, drywall and aluminum, as businesses ramping up operations grapple with scant inventories, empty supply chains and long waits for raw materials.

But the price increases also reflect changes both in the steel industry, where bankruptcies and mergers have reorganized the country’s production base in recent years, and in Washington, where trade policies, most notably the tariffs imposed under President Donald J. Trump, have shifted the balance of power between buyers and sellers of American steel.

Last year, Cleveland-Cliffs purchased a majority of the global steel giant ArcelorMittal’s American mills, after buying the struggling producer AK Steel, to create an integrated steel company that owns iron mines and blast furnaces. In December, U.S. Steel announced it would take full control of the Arkansas-based Big River Steel by purchasing the shares in the company that it did not already own. Goldman Sachs predicts that by 2023, roughly 80 percent of American steel production will be under the control of five companies, up from less than 50 percent in 2018. Consolidation gives companies in an industry greater ability to keep prices up by maintaining tight control over production.

High steel prices also reflect efforts by the United States to cut down on steel imports in recent years, the latest in a long line of trade actions tied to steel….

Shareholders for Cleveland-Cliffs, Nucor, and even US Steel have hit the trifecta:

‘Steel prices are at record highs and demand is surging, as businesses step up production amid an easing of pandemic restrictions. Steel makers have consolidated in the past year, allowing them to exert more control over supply. Tariffs on foreign steel imposed by the Trump administration have kept cheaper imports out.’

The rise in global demand for steel is part of the reason prices are up. But we would hope that this rise in demand led to more supply. But we now have market power in the US as well as insulation from foreign competition so the shareholders are winning at the expense of everyone else.

Eliminating the tariffs would at least partially offset the reduction in domestic competitors. But no – shareholders are the only people important I guess. Come President Biden – end this nonsense.

Trump’s stupid trade war did not exactly help the shareholders of US Steel as the stock price fell from 2018 to late 2020. But note the stock price has partially recovered since the Nov. 2020 elections:

https://finance.yahoo.com/quote/X

One would expect prices to be higher simply because China provides low wages and has no environmental standards. Is there a better way to counter China, essentially a US enemy? Is there another policy to counter the dire threat?

Jacques: Section 232 tariffs had essentially no impact on Chinese steel exports to the US, because tariffs had already been implemented against Chinese steel under different provisions of US trade law.

I accept your argument, especially given U.S. imports from China as a whole have exploded just since tarrifs were raised. But then what is the solution?

Jacques: You might be surprised, but no Section 232 tariffs have been removed since Biden took office. In fact, to my knowledge no tariffs against China have been lifted. See https://www.piie.com/blogs/trade-investment-policy-watch/trump-trade-war-china-date-guide

I’m surprised the the folks who were so shocked and outraged at Trump’s stupid tariffs have until now been pretty quiet about Biden’s stupidly maintaining them.

It makes me think that this is yet another instance of the pot calling the kettle black, a practice endemic to partisan politics. This should be obvious to everyone but perhaps the partisans themselves.

JohnH: Things take time in the Federal government – removing tariffs (like putting them on) does not happen instantaneously. (Just sayin’, from my experience in the USG.)

“JohnH

May 26, 2021 at 1:16 pm”

Do you have a clue who JohnH is babbling about now? I don’t.

@ JohnH

That’s an interesting observation by you (no sarcasm). Because a lot of commenters here have accused Professor Chinn of being “partisan” in the comments section. This appears to be a criticism of the Biden administration to me, even if one wants to argue it’s mildly worded, it still appears to be a concrete criticism of an administration only about 4 months old. Not the act of a “partisan” economist, but the act of an academic economist who is arguing for the optimal policies (at least from his own view of economic theory, if not the best facts available).

Well, JohnH, for the record at a minimum I think Biden should remove the tariffs on steel, aliminum, and lumber. Probably some of the ones on Chinese products should go too, but that is a more complicated matter.

OTOH, given that autoworkers in Ohio are so effing stupid they cannot even figure out when tariffs hurt them, that certainly does not provide much political incentive for Biden to remove them. And do you support those steel tariffs that damage US autoworker jobs? You have been very keen on how not being sufficiently protectionist has been the big bad thing that all these awful Dems you do not support were failing to do.

JohnH Sadly, protectionist policies are one of the few bipartisan issues out there. The real divide is geographic. Coastal areas tend to be more free trade regardless of political party, although Democrats happen to dominate the coasts for other reasons. Biden’s economic team needs to set him straight on this tariff issue.

ohio and pennsylvania are still filled with autoworkers and steelworkers, or those who once were employed in those fields. irregardless of party affiliation, most of those folks still believe that cheap foreign imports and labor are what put them out of the job. for their fathers, it was the japanese. for the next generation, it was the koreans and chinese. all it will do is anger those constituents if you reduce the tariffs. if you win ohio and pennsylvania, you win the general election. this is not lost on biden. that is why he is in no rush to remove the tariffs.

Changing policy takes time. Agitating vociferously for policy change can begin on January 20, if not before.There was a big outcry in partisan circles about Trump’s threats to impose tariffs, but a remarkable silence about Biden’s reluctance to remove them. This says to me that those criticising Trump were acting out of partisanship, not principle. Acting out of principle would mean that both Biden and Trump would get their share of criticism.

The other thing that is not mentioned is that China policies are driven mostly by strategic interests. Trump’s tariffs were driven mostly by a desire to hurt China, slow its rise. Biden most likely buys into that, mostly on the QT. Economists like to think that it is all about economics, when in fact any economic benefits are eagerly seized upon as justification, economic costs hushed up. If you read Krugman’s advocacy, that’s exactly what does: start with strategic interest and quickly move to economic benefits while marginalising discussion of economic costs. Don’t forget, Krugman was a regular at Foreign Affairs before he got his bully pulpit at the NYT.

JohnH: (1) USTR in place for just over two months. Kind of hard to criticize inaction without policy-level people in place. (2) My impression is that many economists expect Biden to eventually get rid of many tariffs, and while not clamoring for immediate removal, are certainly happy no additional tariffs have been emplaced.

I don’t know if you are including me in the category of economists, but I certainly am aware that it’s not all about economics. No economist who’s worked in government thinks it’s all about the economics (speaking as one who attended CFIUS meetings while on CEA staff).

Would you say that the “many economists” expecting the tariffs to go away are suffering from irrational expectations given the strategic nature of the decision? Personally, I expect strategic considerations to trump economics.

JohnH: National security concerns (real, not faux a la Trump letting ZTE off the hook) *should* be paramount. But Section 232 tariffs aren’t hitting China at all. I expect that as inflation picks up, pressure will increase to eliminate such tariffs.

https://www.census.gov/foreign-trade/statistics/product/enduse/imports/c0000.html

Census provides yearly data on imports of iron and steel mill products (14100). In 2014, this was $25.7 billion. In 2020, it was only $12.1 billion.

OK I left off (15000) Iron and steel products, n.e.c. and (15100) Iron and steel, advanced.

But these have not risen either. And yes I checked with how much we imported from China and our imports of iron and steel products from China have not risen.

Now if you have another data source besides Census, please cite it.

If the orange creature can make an argument that it is a net loss for jobs in the steel industry, he can make sideswipes at Biden. The argument on upstream or downstream costs are going to be negligible because the average IQ of your typical American voter is only going to be able to understand the job losses and gains specific to steel. They will view the rest as a sideshow or diversion.

i.e. It becomes a kind of political “game theory” for the next elections, which Democrats, like Hillary, have NEVER understood. For as foggy as Biden’s brain is, he seems to in part “get this” “game theory” and understands explain supply chains in a political debate is a waste of oxygen. At least it is in America. A nation which can be led around by the nose easier than an Afghan Hound,

https://www.politico.com/news/2020/11/09/republicans-free-fair-elections-435488

Moses,

Hillary turned to opposing the TPP when she ran in 2016, but fat lot of good it did her. Oh, was that a sign of her NEVER understanding how important it is to be mindlessly protectionist when running around in Ohio?

I think some nutty squirrels were running around a nearby transformer or power line, the electricity turned off about 5 times sequentially here, wiping out my long screed on this. Consider it a blessing from God, to you, to Menzie, and to the readers. I still have to get my short version answer. When a candidate changes her stance on TPP in the middle of a presidential campaign, for the openly telegraphed reason that Bernie Sanders is siphoning off many of her votes, all she succeeds in doing is losing voters on BOTH sides of the issue.

https://www.politico.com/story/2016/10/hillary-clinton-trade-deal-229381

And Bernie’s position on this was also poor. Does he support those steel tariffs shutting down autoworker jobs in Ohio? Oh, and most of Trump’s updating of NAFTA, which both you and JohnH think was terrible like Trump did, amounted to going along with the stuff everybody agreed to as part of the TPP, but Tramp pulled out and Hillary shifted to opposing to please all the ignorant fools supporting this worthless protectionism.

Note, this is not to defend Hillary particularly. It is simply to point out that you were wrong to use an emboldened and capitalized “never” in describing Hillary’s views on protectionism, which you now admit she did change for political reasons in the middle of the campaign, instead of having poor views on it all along like Bernie (and I am one who voted for Bernie over her in the VA Dem primary in 2016), but this looks like more of your dump on older powerful women schtick, Moses).

But unlike Barkley Junior and Hillary~~~Bernie is at least sincere and genuine in his arguments. Bernie’s not the type that after over half a life time calling himself a “mathematical economist” makes a horrendous call on 2nd Quarter headline GDP that was 30% off mark and then goes “Oh, what is SAAR?? I never heard of that before”. Because he knows saying things like that is a patent lie and insults the public’s intelligence. And that’s what Hillary did when she saw she was losing votes on TPP. “Oh remember what I said 6 hours ago, it was just a joke. I hate TPP”. That was Hillary’s “What’s SAAR??” moment.

Uh oh, Moses needing to show macroduck that he is tough on Barkley Junior after being sort of agreeable at least briefly. Can’t let that go on for too long.

So, I like Bernie, but he has changed his mind about things from time to time, although I suppose when he does so it is for “sincere and genuine” reasons in contrast to when Hillary does so, who does so strictly for political convenience. But I would note that Bernie did some changing of his position on guns when he started running for president rather than just senator from Vermont, and was pretty open that it was for, yeah, reasons of political convenience. There is also the weird fact that in 1980 and 1984 he supported the presidential candidates of the Trotskyist Socialist Workers Party, although I gather he never became a “card-carrying” member of that party. But then he has run to be the candidate of the US Democratic Party without ever becoming a card-carrying member of it either. The curious thing about Bernie and his odd link to the SWP is that these days he never acknowledges that he did so or talks about it, not that anybody ever brings it up as it is a thoroughly obscure episode these days (most people having no idea what the SWP is or was), although if he had become Dem nominee we most definitely would have heard a lot about it. But, I suppose he was sincere and genunie about his changes of mind about the party and its candidates, but given that he never says a word about it, who knows? My suspicion is that he knows it is politicially convenient to never say a word about it, and he never does, whatevet his current thoughts are about that period of his life.

Regarding SAAR, while it was and is quite embarrassing that I was not familiar with that acronym while knowing the underlying words it stands for, that is something that did not involve changing my mind about something. It is an acronym that simply rarely appears anywhere. Yeah, it appears in this blog a lot, but go ahead and show us media articles or even academic journal articles where you see it being used. It is not used regularly, indeed almost never, although certainly in some footnotes or explanatory sections of some government agency data sections.. So, I fully grant it is something I should have known much earlier, but I indeed did not, shame on me in the eyes of the taxpayers of Virginia, another reason they should fire me, along with being too sleepy, like Joe Biden is according to Sean Hannity and Donald Trump. But, hey, at least my embarrassing ignorance did not involve me changing my position on something whether sincerely or insincerely, as Hillary Clinton did on TPP in the middle of a campaign or as Bernie Sanders did after 1984 regarding the Socialist Workers’ Party of the USA for reasons we have no idea about because he never talks about it.

https://news.cgtn.com/news/2021-05-25/Biden-s-Trumpy-start-on-trade-10xXaIJZbry/index.html

May 25, 2021

Biden’s Trumpy start on trade

By Anne O. Krueger

Former President Donald Trump did enormous damage to the United States’ reputation and future prospects, both domestically and internationally. Yet while President Joe Biden has set about reversing the previous administration’s legacy in many domains, he has yet to focus his attention on U.S. trade policy.

That needs to change. Trump’s trade policies were not only a disaster for U.S. and world trade; they also have made it more difficult for the U.S. to achieve a broader range of economic and foreign-policy goals. Reversing those policies thus should be a top priority for the new administration.

After all, America’s friends and allies (particularly the European Union, the United Kingdom, Canada, Mexico, Japan, and South Korea) remain deeply shaken by Trump’s protectionist impulses. In addition to slapping tariffs on a broad range of goods, his administration forced a renegotiation of the North American Free Trade Agreement (NAFTA) and the United States-Korea Free Trade Agreement (KORUS FTA), and withdrew the U.S. from the Trans-Pacific Partnership (TPP) to which the U.S. had agreed. It declared a “trade war” with China, despite that country’s membership in the World Trade Organization (WTO), and with no regard for U.S. trading partners’ own dealings with China. Taken together, these policies have done serious damage to America’s standing in the world.

Leading the world toward an open multilateral trading system under the 1947 General Agreement on Tariffs and Trade (GATT, which became the WTO in 1995) was one of America’s crowning achievements after World War II. The system works precisely because members willingly commit themselves to open, rules-based trade policies. Among other things, this ensures that foreign traders have the same rights as domestic nationals when disputes between them arise, and that the principle of nondiscrimination among trading partners prevails, except in the case of preferential trading arrangements.

Trade flourished under the GATT, with the U.S. leading negotiations for multilateral tariff reductions and the removal of other trade barriers (including quantitative restrictions). In later years, developing countries witnessed the success of open markets and decided to start dismantling their own highly protectionist regimes. For most, this resulted in a remarkable acceleration of growth in output and trade. For more than a half-century, world trade grew roughly twice as fast as world GDP.

This growth was far from smooth, of course. Significant slowdowns followed the oil shocks of the 1970s, the Asian financial crisis of the late 1990s, and the Great Recession a decade later. Growth in world output and trade has resumed since the 2008 global financial crisis, but not as rapidly as in the years preceding it. And China, following an overhaul of its trade policies in the 1990s and its accession to the WTO in 2001, emerged as the world’s largest trading power.

In addition to reducing domestic poverty and improving living standards for its own population, China’s dramatic economic ascent was bound to raise issues with other countries. But thanks to the WTO and its dispute-settlement mechanism, there was a multilateral forum where these issues could be addressed – that is, until Trump came along.

Although Biden has reasserted America’s commitment to internationalism and multilateralism, he has moved slowly to repair the damage that Trump did to critical institutions like the WTO.

Nor has Biden reversed Trump’s withdrawal from the TPP. Now called the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), U.S. membership in this 11-country pact would be a boon for U.S. exporters. Currently, U.S. companies are at a distinct disadvantage relative to their competitors in CPTPP countries, because their exports to those economies are subject to duties that do not apply to exports from members of the bloc.

Biden also has not ended the trade war with China, even though that effort has utterly failed to achieve its stated objectives. While the U.S. bilateral trade deficit with China has fallen somewhat, the deficits with Vietnam, Malaysia, and others have risen commensurately as their exports have replaced those from China.

Although the Biden administration has finally agreed to a new director-general for the WTO, it has done little to reduce Trump’s tariffs, and has even announced that it will strengthen “buy American” provisions in government procurement contracts. Biden says he wants to protect American jobs, yet the Trump administration’s tariffs on imported iron and steel, which have cost a net total of around 75,000 jobs (leaving out the additional losses caused by other countries’ retaliatory tariffs), remain in place. If Biden really wants to help American workers, he should recognize that exports create good jobs, and that the export sector’s contribution to U.S. GDP has doubled as a result of open multilateral trade….

Anne O. Krueger is Senior Research Professor of International Economics at the Johns Hopkins University School of Advanced International Studies and Senior Fellow at the Center for International Development at Stanford University.

https://fred.stlouisfed.org/graph/?g=Ehwj

January 30, 2018

Industrial Production and Producer Price Index for iron and steel goods, 2017-2021

(Indexed to 2017)

“Biden also has not ended the trade war with China, even though that effort has utterly failed to achieve its stated objectives. While the U.S. bilateral trade deficit with China has fallen somewhat, the deficits with Vietnam, Malaysia, and others have risen commensurately as their exports have replaced those from China.”

The focus on bilateral trade balances was always dumb. Some of our imports from Vietnam are goods assembled there but mostly made in China. Another reason why the Trumpian focus on the bilateral balance was dumber than rocks.

https://fred.stlouisfed.org/graph/?g=y8tW

January 30, 2018

United States Goods Imports from minus Exports to China Mainland, 2017-2021

https://fred.stlouisfed.org/graph/?g=Ehxd

January 30, 2018

United States Goods Imports from minus Exports to China Mainland and Hong Kong, 2017-2021

Mostly a personal aside, but still related to transitory reflation. I got the gas tank filled today for $2.59 a gallon, when I thought the best I would probably do is $2.61. I would estimate the average price in my area to be $2.67–$2.69. So honestly I think I beat my locality’s average by a dime per gallon. With really no drive out of the way, I just hit the station on the way back from a fast-food joint. In recent years I’ve been a 7-11 guy, but this place has more pumps than even some of the larger 7-11s and is consistently beating 7-11 on price, certainly in the last 3 months or so. So 7-11 is not hitting the price point for me anymore, and will probably be going to this place more regular. The attendants were all wearing masks, the lines were moving with 3 registers open, and the person serving me wasn’t making me stand in front of the register staring vacantly into space while they were discussing with a co-worker their very boring personal adventures–which happened at the 7-11 I used to frequent a fair share of times (with one white trash chick sans mask).

Didn’t get any because we have a full tank, but we saw regular gas today (10% ethanol) priced at $2.45. There may have been one lower, but I can’t swear to it at the moment, so the lowest price here has lowered at least 14cents in one day. That’s a pretty big drop for one day, and going into the summer time, and Memorial Weekend.

Where ever Biden ends up on trade, he is a politician and a centrist. His early announcement of policies appealing to progressives was good politics, but he has elections to win. He has been tepid in his approach to current environmental policy, more aggressive about the future. He came up with a big number on infrastructure spending, agreed to cut his number a a compromise an is now preparing to accept the Republican over which I much larger than he could have hope for on a bipartisan vote prior to stumping fo massive numbers o his own.

We elected a politician, not a reformer. He pleased his progressives, is negotiating with Republicans and is probably going soon run out of ways to keep both sides working toward his own goals. For progressives, this is the sort of thing that won’t help: https://thehill.com/policy/energy-environment/555717-biden-administration-backs-trump-approval-of-major-alaska-drilling

“…offer which is much larger…”