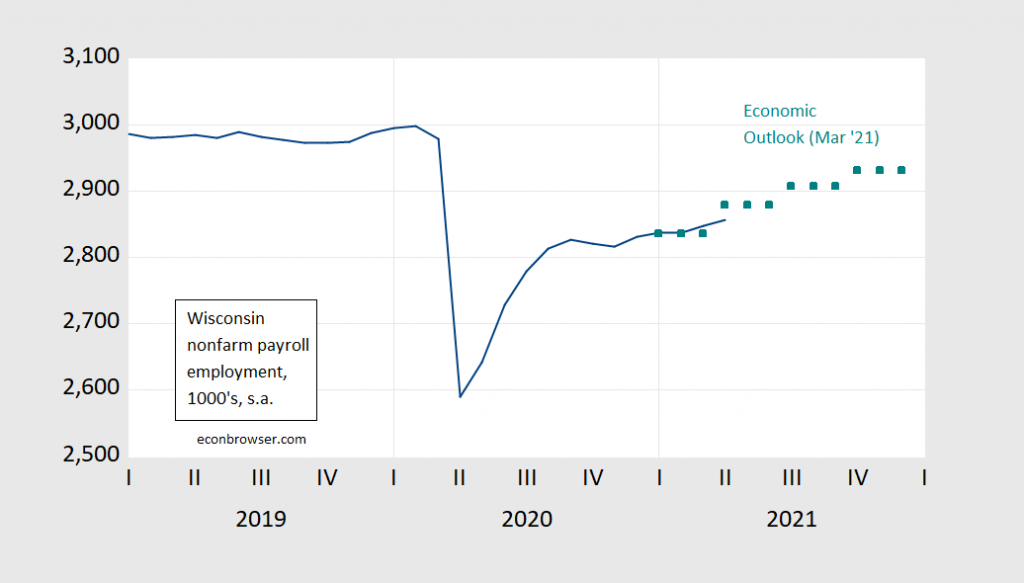

Wisconsin nonfarm payroll employment has stabilized at a level down 4.7% relative to NBER peak in 2020M02, vs. 5.4% for the nation overall (according to figures released by DWD yesterday).

Figure 1: Nonfarm payroll employment from April release (blue), forecast from March 2021 Economic Outlook (teal squares), all in 000’s, seasonally adjusted. Source: BLS, DWD, and Wisconsin Department of Revenue.

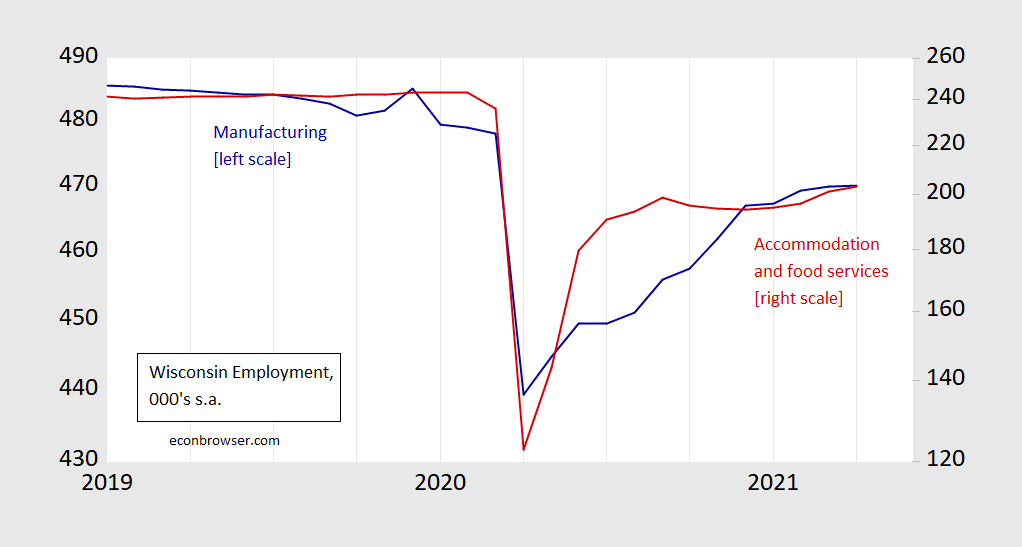

Employment in manufacturing has continued to rise, albeit slowly (0.5% annualized, log terms). Employment in accommodation and food services is currently rising faster (12.5% annualized), but is still only 2.2% higher than levels in September of last year (and 16.5% below February 2020 levels).

Figure 2: Wisconsin manufacturing employment release (blue), and accommodation and food services employment (red, right log scale), all in 000’s, seasonally adjusted. Source: BLS, and DWD.

@ Menzie

I’d appreciate Menzie, or ANY orthodox economists answer this question: Would you call this a “V-recovery” at this point?? Asking for some loser friend of mine, who’d like to hear the answer from a credentialed economist. THANKS!!!!

Moses,

What a completely stupid remark, Moses, especially given that you kept it a permanent secret what your forecast was for the recovery in “letter” form. Indeed,at a point early in 2020 you made statements that made it look like you were forecasting the uttterly incorrect “L” pattern, although you later abjured this claim. This really is now ancient history, so why are you bringing it up now?

As it is, I made some mistakes about a year ago on certain posts about specific numbers because I mistook certain dates regarding the definition of certain data. I immediately admitted I was wrong when this was pointed out, although you have brought this up more times than I can count at this point. On that one you sort of have a point, although it is now old news. Again, for the umpteenth time, I readily admit I am wrong when it is clearly and accurately pointed out, and I have never claimed any kind of perfection of knowledge or whatever, although you have yet to admit you are wrong on a rather long string of things you have gone on and on about here where you were screamingly wrong with numerous people pointing it out to you.

But on this matter of the shape of the recovery, you really are making a super big fool of yourself once again, driven I guess by your ongoing increasingly idiotic and disgusting hatred and sadism, which, I note, you have openly admitted to. Why are you wasting everybody’s time with this seriously sick obsession of yours? Really. Just how effed up are you anyway?

So what I claimed a year ago, which was fully accurate, was that we would have for the short run something that resembled a V pattern more than any other letter. And if you look at any graph of GDP in the second and third quarters of last year, it definitely looks far more like that than any other letter, certainly more than the ridiculous L you and John Cuckrant (as you labeled him at one point) supported. And lots of people here said indeed that was what it looked like at the time back then.

Now, both Menzie and Not Trampis weighed in at some point that it was not really a V because it poozed out before it got all the way back up to where it started declining. But I never claimed it would, as I have stated many times here. I always said this V pattern would be a short term pattern that would then “flatten out.” I have lost count how many times I wrote that here, and I was completely correct.

Oh, so which out of date matter will you bring up next? Krugman’s Nobel? The alleged even distribution of Native American genes across the European-American population? Or maybe you want to double down on Joe Biden being s—-e.

Moses,

BTW, for your “friend” I am unaware of anybody calling more recent developments a “V” although with the Biden stimulus we are seeing an accelerated expansion again after a period of wobbling flatness that almost became the “W” for some variables that Menzie kept suggesting we might see. However rapid the current expansion is, it certainly will not resemble a “V” because it is not following a sharp decline. The foreshortened quasi-V we saw last year involved the super steep decline in the second quarter followed by a super steep increase in the third quarter, although again, as I said it would, it flattened out after the third quarter and before it got all the way back up.

Oh yes, and just to remind you of another major blooper you pulled last year, it was this month last year when consumption grew at an all time record rate, the first sign we were going to get that short term rapid boost that ended up looking like a sot-of-foreshotened V. Just as you falsely clamed recently (although you denied doing so) that my late father never knew Walter Rudin (or that I did), you falsely claimed that I was completely wrong about that matter of the all time rapid consumption boost. Menzie had to correct you on that one.

Of course, if you wish to go on more about this now thoroughly out-of-date stuff, do you want to finally come clean on what your secret “letter” forecast was last year?