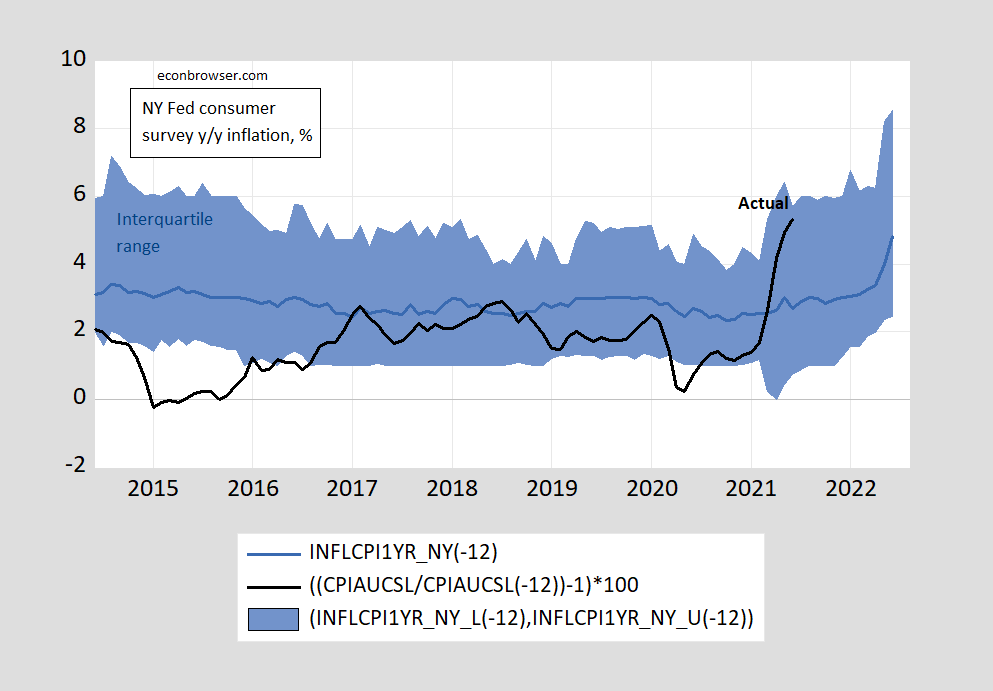

A lot of coverage of how the NY Fed’s survey of consumers’ inflation expectations had moved substantially (e.g. NYT). A couple of observations: (1) household/consumer based expectations are upwardly biased; (2) the high inflation is expected to be temporary, in the sense that the expected inflation in the next 12 months is higher than 12 month inflation ending in June 2024.

Figure 1: Actual CPI year-on-year inflation (bold black), and median inflation (blue line), and interquartile range (blue area). Source: BLS, NY Fed, and author’s calculations.

The dispersion of forecasts has increased in last few months. Over the period of the survey’s existence (shown above), the median forecast is above the ex post realization. This characteristic is shared by the longer running Michigan survey of households (see this post).

Inflation in the 3rd year from now is anticipated to be lower than over the next 12 months.

Figure 2: Median expected inflation over the next year (blue), in the year ending June 2024 (brown), and mean expected inflation in the 12 months ending June 2022 (pink square). Source: BLS, NY Fed, WSJ July survey.

Notice that the professional economists surveyed by the Wall Street Journal in early July expect a substantially lower inflation rate than consumers.

https://www.nytimes.com/2021/07/15/business/economy/inflation-us-japan.html

July 15, 2021

Inflation? Not in Japan. And That Could Hold a Warning for the U.S.

If the United States’ current bout of rising prices soon eases, its economy could fall back into the cycle of weak inflation that preceded the pandemic — a situation much like Japan’s.

By Ben Dooley

TOKYO — In the United States, everyone is talking about inflation. The country’s reopening from the coronavirus pandemic has unleashed pent-up demand for everything from raw materials like lumber to secondhand goods like used cars, pushing up prices at the fastest clip in over a decade.

Japan, however, is having the opposite problem. Consumers are paying less for many goods, from Uniqlo parkas to steaming-hot bowls of ramen. While in the United States average prices have jumped by 5.4 percent in the past year, the Japanese economy has faced deflationary pressure, with prices dipping by 0.1 percent in May from the previous year.

To some extent, the situation in Japan can be explained by its continued struggles with the coronavirus, which have kept shoppers at home. But deeper forces are also at play. Before the pandemic, prices outside the volatile energy and food sectors had barely budged for years, as Japan never came close to meeting its longtime goal of 2 percent inflation.

It wasn’t for lack of trying. Over nearly a decade, Japanese policymakers have wielded nearly every trick in the economist’s playbook in an effort to coax prices higher. They have juiced the economy with cheap money, spent huge sums on fiscal stimulus like public works, and lowered interest rates to levels that made borrowing nearly free.

But as Japan has learned the hard way, low inflation can be an economic quagmire. And that experience carries a warning for the United States if its current bout of inflation eases, as many economists expect, and its economy falls back into the cycle of weak inflation that preceded the pandemic.

“Most economists, me included, are pretty confident that the Fed knows how to bring inflation down,” including by raising interest rates, said Joshua Hausman, an associate professor of public policy and economics at the University of Michigan who has studied Japan’s economy.

However, “it’s much less clear, partly because of Japan’s experience, that we’re very good at bringing inflation up,” he added….

https://fred.stlouisfed.org/graph/?g=FrOV

January30, 2018

Consumer Prices for United States and Japan, 2000-2021

(Percent change)

Is there any breakdown of consumer expectations either by political affiliation or geographically (as a proxy for affiliation). I wonder if the recent inflation hype by the Fox devotees is leading to a distortion of consumer opinions. It might sound like a ‘duh’ question but I am looking for some fact based understanding.

http://www.xinhuanet.com/english/2021-07/16/c_1310065311.htm

July 16, 2021

China’s national carbon market starts online trading

BEIJING — China’s national carbon market started online trading on Friday, a significant step to help the country reduce its carbon footprint and meet emission targets, according to the Ministry of Ecology and Environment (MEE).

Trading began at 9:30 a.m. at the Shanghai Environment and Energy Exchange, with the opening price for carbon quotas at 48 yuan (7.4 U.S. dollars) per tonne. The first transaction was priced at 52.78 yuan per tonne, with a total value of 7.9 million yuan.

Carbon emissions by more than 2,000 power companies involved in the first trading group are estimated to exceed 4 billion tonnes per year, making the market the world’s largest in terms of the amount of greenhouse gas emissions covered.

Carbon trading is the process of buying and selling permits to emit carbon dioxide or other greenhouse gases.

Companies are assigned quotas for carbon emissions and can sell surplus emission allowances to those that expect to exceed their pollution quotas.

To maintain the healthy and stable development of the national carbon market, trading institutions have established a series of systems including price fluctuation limits, maximum position limits, large account reports, risk warnings and reserves, and abnormal trading monitoring.

It is necessary to further strengthen the top-level design, refine the roadmap, arrange for more industries and trading entities to be brought into the market, and enrich trading varieties to help the carbon market play a better role in controlling greenhouse gas emissions, said Liu Jie, general manager of the Shanghai Environment and Energy Exchange.

China’s national carbon trading market was launched in 2017 after pilot operations in seven provincial-level regions in 2011. Behind its launch was the aim of exploring market-based mechanisms to control greenhouse gas emissions.

The MEE will roll out trading regulations and improve relevant standards and management schemes while expanding the varieties and methods of trading.

As data authenticity and accuracy are the bases of trading, the MEE will work to ensure the quality and transparency of emission data.

The carbon market is also expected to be an important scheme for China in realizing its goals of peaking carbon dioxide emissions by 2030 and achieving carbon neutrality by 2060….

ltr,

I welcome this. A good move by the PRC.

https://www.nytimes.com/2021/07/15/opinion/government-spending-deficits-infrastructure.html

July 15, 2021

How Big Spending Got Its Groove Back

By Paul Krugman

The way it was: Some years ago I attended a meeting in which President Barack Obama asked a group of economists for unconventional policy ideas. I distinctly remember him saying: “Don’t tell me that I should spend a trillion dollars on infrastructure. I know that, but I can’t do it.”

The way it is: Top Democrats have agreed on a proposal to spend $3.5 trillion on public investment of various kinds, to be passed via reconciliation on top of a $600 billion bipartisan plan for physical infrastructure spending. And some news reports are treating this deal as a defeat for the left, because Bernie Sanders proposed spending even more.

Obviously the reported agreement is just a proposal, and turning it into actual legislation will require agreement from every single Democratic senator. Still, there has clearly been an incredible change — a sharp move to the left — in what is considered politically realistic.

So how did big spending get its groove back? Let me offer five explanations.

First, Covid-19, and the extraordinary policy measures America took to limit economic hardship during the economy’s induced coma, had a lasting impact on economic ideology. Large-scale disaster relief was obviously necessary; even Republicans voted for it. But the positive role played by the government during the pandemic helped legitimize an active role for government in general.

Second, the legend of Reaganomics has become unsustainable. It used to be common for conservatives to assert that Reagan’s tax cuts and deregulation ushered in an era of unprecedented economic success; in fact, I still hear that sometimes.

But these days the response to such claims is, “Do you even FRED, bro?” That is, have you even looked at the numbers available in places like the wonderfully usable Federal Reserve Economic Data site? Overall economic growth has been slower since 1980 than it was in the decades before; thanks to rising inequality, growth for the typical family has been much slower. Real wages for most workers have stagnated.

And while most voters don’t FRED, they do have a sense of the underlying reality. Donald Trump’s actual policies were a replay of failed Republican orthodoxy, but his campaign slogan reflected the public’s realization that the post-Reagan era has, in fact, not been so great for workers.

Third, debt scaremongers have lost most of their credibility….

one could argue that the consumer is correct, and inflation is rising. and the current drop in bonds may not necessarily be inconsistent with that observation. if one also believes that the fed will actually act on the inflation readings, and increase rates, that will slow down the economy and justify the lower rates in the long term. perhaps both the consumer and the bond market are thinking along the same lines. the question is how will the fed actually react to this situation? those who believe the fed will sit on their hands are long in the stock market.