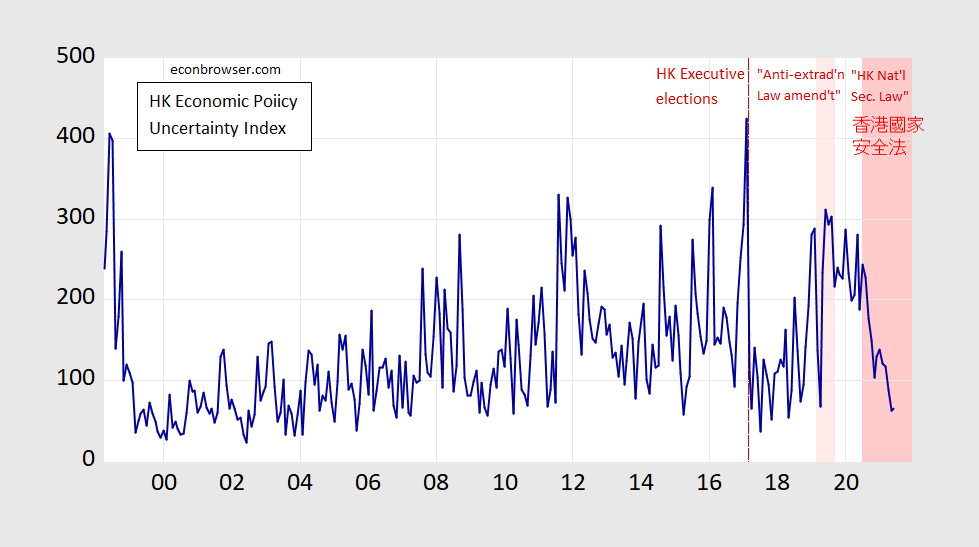

The Economic Policy Uncertainty index, calculated using the Baker, Bloom and Davis methodology:

Figure 1: Hong Kong Economic Policy Uncertainty index (blue). Source: Luk et al. via policyuncertainty.com.

Technically in the above figure, the “HK National Security Law” is “Law of the People’s Republic of China on Safeguarding National Security in the Hong Kong Special Administrative Region” ( 香港國家安全法 ).

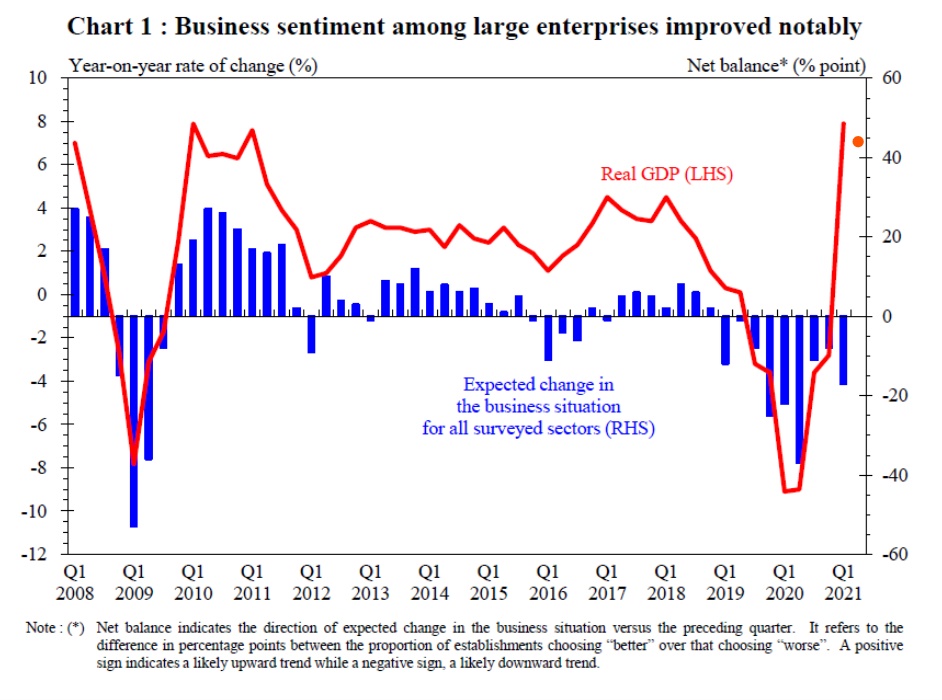

The recent downward movement seems odd to me, given the high uncertainty regarding the direction of political control in Hong Kong. On the other hand, perhaps economic policy is perceived to now be set in stone (in Beijing) so that there is little uncertainty regarding the direction of economic regulation and environment. Or economic policy uncertainty is highly correlated with economic uncertainty, which has declined as economic conditions and business conditions have improved. (A nice primer on the correlations between economic policy uncertainty and economic uncertainty indices is Ferrara, Lhuissier and Tripien (2017).)

Figure 2: Hong Kong GDP (Ch.2019$) growth, y/y, % (red, left scale), and expected change in business conditions (blue bar, right scale), from Chart 1 from Government of Hong Kong SAR. Orange dot at 2021Q2 is advance estimate of 7.5% y/y, as reported by HK Monetary Authority (on 8/2/2021).

Yet another alternative interpretation is that as the sample of newspapers shrinks (the now closed Apple Daily was one of the source papers), and perhaps more importantly as reporting behavior at the remaining papers has changed, the EPU has become less informative. The original set of ten papers was: Wen Wei Po, Sing Pao, Ming Pao, Oriental Daily, Hong Kong Economic Journal, Sing Tao Daily, Hong Kong Economic Times, Apple Daily, Hong Kong Commercial Daily, and Tai Kung Pao. While the authors checked the sensitivity of newspaper inclusion at the time of original construction (see Appendix B in Luk, et al (2017)), it’s unclear whether it would still be so robust to exclusion of Apple Daily at the end of the sample period (Apple Daily ceases publication June 22, 2021 and the last monthly observation in the sample is June 2021, so it’s really a direct effect for the last observation.) The more likely effect is self-censorship at the other papers have responded to state pressure.

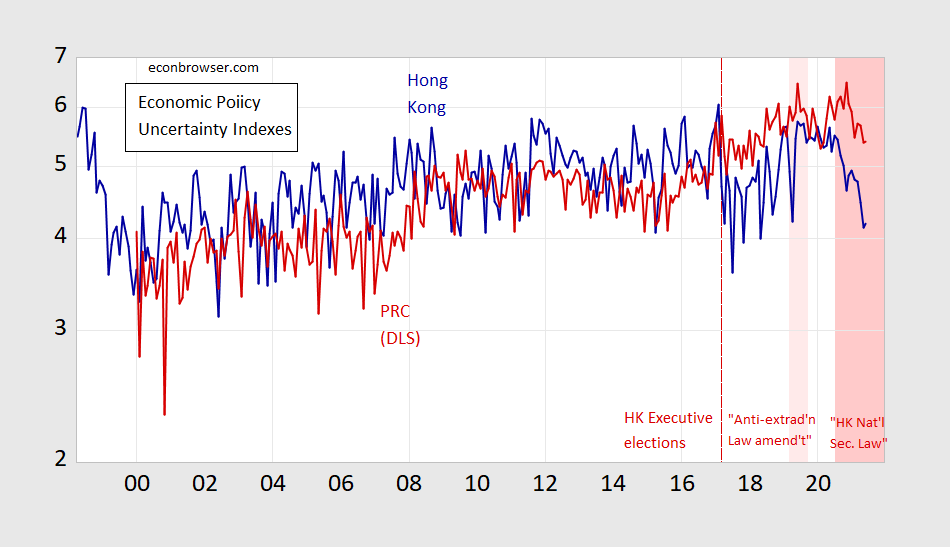

There’s no real way to test any of these hypotheses easily, and with data available to me. What I can answer is whether the relationship between mainland China and Hong Kong uncertainty indices has changed, and when.

Figure 3: Hong Kong Economic Policy Uncertainty index (blue), China Economic Policy Uncertainty index, from Davis, Liu and Sheng (red), both on log scale. Source: Luk et al. via policyuncertainty.com, and Davis et al. via policyuncertainty.com.

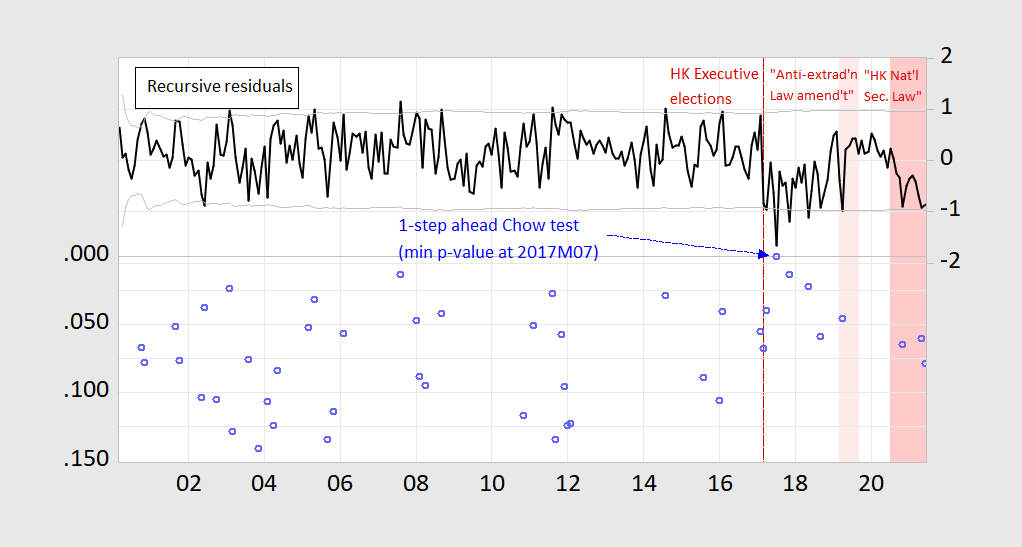

To this end, I estimate a regression of log HK EPU on log China EPU, and check for structural breaks using one-step-ahead Chow tests on recursive residuals. This approach uses the regression up to period YYYY.MM, then examines whether the forecast error for YYYY.MM+1 is likely to have occurred by random chance or not (loosely speaking). The results show a structural break at 2017M07 (at significance level of 0.0135). This is slightly after the HK Chief Executive election which took place in 2017M03.

Figure 3: Recursive residuals (black), and marginal probabilities for one-step-ahead Chow tests (blue circles). Residuals from linear regression of log HK EPU on log China EPU. Source: Author’s calculations.

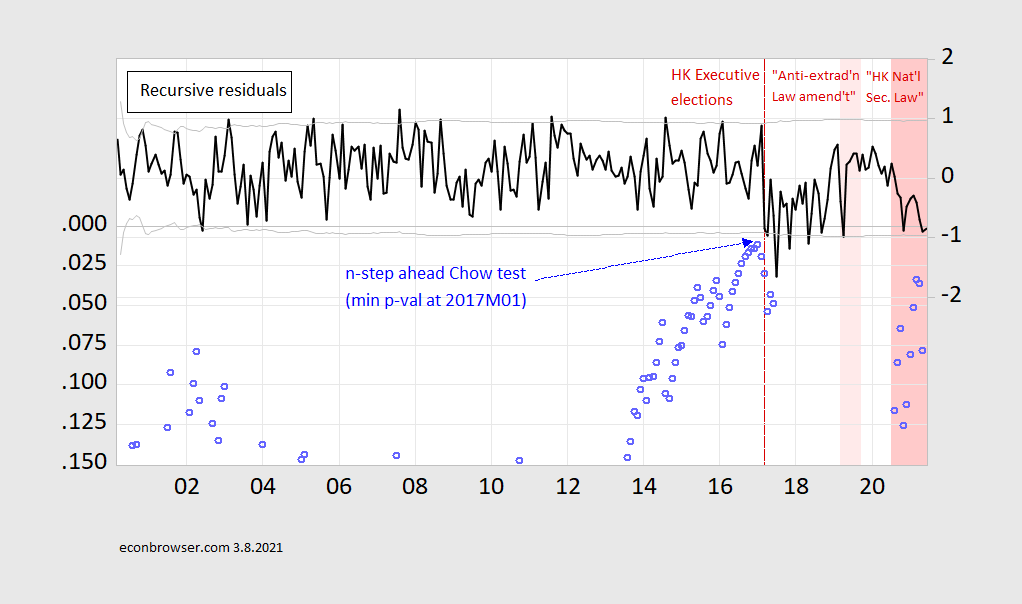

Alternatively, one can look at n-step ahead Chow test, to see where the likely structural break is. This is the case where a series of Chow tests are done for all the possible break points in the sample.

Figure 4: Recursive residuals (black), and marginal probabilities for n-step Chow tests (blue circles). Residuals from linear regression of log HK EPU on log China EPU. Source: Author’s calculations.

These results show a structural break at 2017M01 (at significance level of 0.0116). This is slightly before the HK Chief Executive election which took place in 2017M03.

The data are consistent with a break in the correlation between Chinese and Hong Kong series, with that break occurring around the HK Executive elections or at the time of the implementation of the “HK National Security Law”. One can also see that — using correlations between the Chinese and HK uncertainty indices — the reported HK EPU has been particularly low in the last couple months (although only significantly so at less than the 5% significance level.

Obviously, all the preceding is informal analysis. An alternative approach would be to link HK EPU to some macro and/or financial variables, and test to see for structural breaks in those relationships.

ltr will explain now that it was Uyghurs who shut down the Apple Daily, that China was first to the moon and that Chinese vaccines have prevented any new cases of Covid.

I, on the other hand, will suggest (not entirely facetiously) that actual policy uncertainty in the long run has decreased. Reduced freedom means fewer choices, which will mean less uncertainty. Once china is done squeezing freedom out of Hong Kong, policy uncertainty will be lower than today. That reduction in uncertainty is probably not what is represented in current readings of the index, though.

http://www.xinhuanet.com/english/2021-08/01/c_1310100760.htm

August 1, 2021

Hong Kong stronger as global financial hub with national security law

— From investors to businesses, stakeholders have been more optimistic since the national security law in Hong Kong took effect;

— Over the past years, Hong Kong’s closer financial ties with the mainland, which feature bond and stock trading programs, have cemented its status;

— “There is no better place in Asia to operate the regional office of a multinational than Hong Kong,” a businessman from the United States said.

HONG KONG — One year after the introduction of the national security law in Hong Kong, the international financial hub has retained, if not enhanced, its global appeal with the restoration of a peaceful business environment.

COMPETITIVE AS BEFORE

Hong Kong remains a competitive and attractive financial center, Nicolas Aguzin, chief executive of Hong Kong Exchanges and Clearing Limited (HKEX), has said.

“It is home to open, globalized and transparent markets, robust infrastructure, internationally-aligned regulatory regimes, the rule of law, the free flow of information and capital, and a deep pool of talent,” said Aguzin, who joined HKEX in May after working in Hong Kong for nine years at JPMorgan.

From investors to businesses, stakeholders have been more optimistic since the national security law in Hong Kong took effect on June 30, 2020.

A sequence of positive changes has taken shape. There was neither a capital flight nor exodus of foreign firms, and quite the opposite, major global financial institutions, including Goldman Sachs and Citigroup, have maintained or planned to increase their presence here.

“The law has proved effective in restoring law and order and guaranteeing a stable and predictable environment, where investment is protected and companies feel more secure to operate,” said Liang Haiming, a Hong Kong-based economist.

Figures do not lie. Over 300 billion Hong Kong dollars (38.6 billion U.S. dollars) flowed into Hong Kong from July to October 2020, and there was also a capital net influx for the whole of 2020. As one of the major bourses in the world, HKEX witnessed an over-50-percent year-on-year increase in IPO fund-raising in 2020, while assets under management here amounted to nearly 35 trillion Hong Kong dollars (4.5 trillion U.S. dollars), up 21 percent from the year before.

The IMF recently reaffirmed Hong Kong’s status as an international financial center, citing its resilient financial system as well as the policies and regulatory frameworks. Hong Kong was also the third-largest recipient of foreign direct investment last year, according to a report released by the United Nations Conference on Trade and Development.

BEST OF MANY ADVANTAGES

As a gateway to the mainland, Hong Kong has over the past decades thrived on the rapid growth of the world’s second-largest economy and become one of the most prosperous regions in the Asia-Pacific.

Hong Kong’s success largely hinges upon “one country, two systems,” said Charles Li, a renowned banker who worked for big financial institutions including HKEX, JPMorgan and Merrill Lynch, respectively, over the last two decades.

While foreign investors here find better access to the enormous and ever-expanding mainland market, mainland companies see Hong Kong as a springboard for their global journey and a superior fund-raising platform.

Over the past years, Hong Kong’s closer financial ties with the mainland, which feature bond and stock trading programs, have cemented its status. At the end of 2020, mainland enterprises accounted for more than half the companies listed here and held 80 percent of aggregate market capitalization.

“The more integration, the more benefits,” said Hong Hao, chief researcher at BOCOM International.

While many parts of the world are still struggling with COVID-19, Hong Kong has bounced back thanks to a fast-recovering mainland economy.

Paul Chan, financial secretary of the Hong Kong Special Administrative Region (HKSAR) government, highlighted opportunities brought by a new five-year plan of the country, the Guangdong-Hong Kong-Macao Greater Bay Area and the Belt and Road Initiative.

“The HKSAR government has strong confidence and ability to fully utilize Hong Kong’s unique advantages and competitiveness, and grasp the enormous opportunities… leading Hong Kong’s economy to prosperity,” he said.

“STRONG HEARTBEAT”

Responding to a recent U.S. government warning about doing business in Hong Kong, Jim Thompson, a businessman from the United States, who has operated a business in Hong Kong for 55 years, said the U.S. intervention was pointless….

ltr: From *not* a Chinese state organ of information, i.e., bloomberg:

http://www.xinhuanet.com/english/2021-07/30/c_1310097737.htm

July 30, 2021

Hong Kong’s economy grows 7.5 pct in Q2

HONG KONG — Hong Kong’s economy surged by 7.5 percent year on year in the second quarter of 2021, maintaining a rapid pace of recovery after an 8.0-percent increase registered in the first quarter.

The growth in the second quarter was mainly attributable to the visible increases in both domestic and external demand, the Census and Statistics Department of the Hong Kong Special Administrative Region (HKSAR) government said in a statement Friday.

Analyzed by major GDP component, private consumption expenditure increased by 6.5 percent over a year earlier in the April-June period, compared with a 2.1-percent increase in the first quarter.

Gross domestic fixed capital formation increased by 23.7 percent in the second quarter over a year earlier, much higher than the 4.8 percent growth in the first quarter.

Over the same period, total goods exports recorded an increase of 20.3 percent over a year earlier, and exports of services rose by 2.6 percent year on year, as against a 7.3-percent decline in the first quarter.

The Hong Kong economy is on the path to recovery alongside the improving global economic conditions and receding local epidemic, and for the first half of 2021 as a whole, real GDP grew by 7.8 percent over a year earlier, a HKSAR government spokesman said….

http://www.xinhuanet.com/english/2021-07/30/c_1310097779.htm

July 30, 2021

Tibet sees GDP up 9.1 percent in H1

LHASA — The gross domestic product (GDP) in southwest China’s Tibet Autonomous Region totaled 92.61 billion yuan (about 14.3 billion U.S. dollars) in the first half of 2021, up by 9.1 percent year on year, local authorities said Friday.

Despite the impact of the COVID-19 epidemic, the region’s average annual GDP growth for the past two years came in at 7.1 percent by the end of June, the regional statistics department said.

The value-added output of major industrial enterprises in Tibet increased by 21.1 percent year on year during the period, up 24.2 percent from the first half of 2019.

Its fixed asset investment went up by 16.6 percent over the same period of 2019.

The region also saw strong consumption demand, with its retail sales of consumer goods increasing by 13 percent year on year to 34.63 billion yuan.

Li Fangping, the deputy head of the Tibet survey office, National Bureau of Statistics, said the region’s economic recovery momentum had sustained in the first half….

You’ve already polluted one comment section with this bit of state-sponsored “news”. Since you’ve repeated yourself, I will, too:

“Of course, China’s formal name for Tibet, “Tibet Autonomous Region”, was crafted to erase Tibet’s true status. China annexed Tibet through violence and intimidation in 1951.

“China’s version of history after the annexation was based on Chinese dominance of Tibet in the 13th century AD. China’s claim is that Tibet has been under Chinese dominance ever since, for the past 700 years. That claim is ridiculous on its face. Even China hasn’t been under Chinese dominance for 700 years. When Tibetans resisted Chinese efforts to erase Tibet’s culture in the mid-to-late 2000s, China’s propagandists again rewrote Tibet’s history, claiming Tibet to have become a part of China in some unspecified ancient past. All of which makes one wonder, if Tibet has been Chinese since ancient times, why does China need to erase Tibetan culture now?”

http://www.xinhuanet.com/english/2021-07/29/c_1310095071.htm

July 29, 2021

Xinjiang’s GDP rises 9.9 pct in H1

URUMQI — The gross domestic product (GDP) of northwest China’s Xinjiang Uygur Autonomous Region totaled 732.9 billion yuan (about 113 billion U.S. dollars) in the first half of 2021, up 9.9 percent year on year, local authorities said Thursday.

The steady growth was mainly driven by the secondary and tertiary industries, with their added values rising 10.5 percent and 10.3 percent year on year in the six-month period, respectively, according to the regional government.

Xinjiang’s tourism sector saw robust growth during the period. The region’s 4A and 5A tourist spots received about 23.4 million domestic and overseas visitors, an increase of 58.2 percent over the same period last year.

Song Xiuhong, deputy director of the regional statistics bureau, said Xinjiang’s economy has operated steadily but still faces pressure as “growth of major economic indicators has slowed down.”

Xinjiang will accelerate the construction of a modern industrial system in the second half of this year and focus on developing industries including new energy, new material, biomedicine and high-end equipment manufacturing, Song added.

https://fred.stlouisfed.org/graph/?g=FxOj

August 4, 2014

Real per capita Gross Domestic Product for China, Thailand, Malaysia, Singapore and Hong Kong, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=FxOo

August 4, 2014

Real per capita Gross Domestic Product for China, Thailand, Malaysia, Singapore and Hong Kong, 1977-2020

(Indexed to 1977)

I have long been curious about Kashgar, but will probably never get there now.

Anyway, Xinjuiang is clearly a fascinating place, and I am sure they make a special effort not to take tourists to see the “reeducation” camps.

I had a Chinese friend (around 2002—2008) who asked me to take him to TIbet (he as my guide/translator) and me the dumb white guy paying his way. It was very very very tempting to take him up on that travel expedition. (he was a pretty good friend, I asked hime to be translator in “other situations”, think real hard here Barkley) I decided against it because paper complications (visa type stuff) and where they chose I would get to see.

Moses,

Sorry, I have no idea what it is that I am supposed to “think real hard here Barkley” about. Maybe if I want to go to Kashgar, which I am not going to do (heck would like to go to Tibet also, but missed my chance on that one too), are you suggesting that I go teach somewhere in northeastern China like you did so I can get somebody to offer to be my translator while I go to Kashgar? Just what are you thinking I should think “real hard” about here?

As it is, I have had people I know serve as guides, if you will, for visiting in various parts of China. So if that is the suggestions, well, been there and done that, although I am simply doing a whole lot less traveling anywhere anyway. Have no idea if I shall get back to PRC at all ever again, the way things are going on multiple fronts, although I almost certainly could jimmy up an invitation to go lecture at a university or two if I really wanted it.

https://www.globaltimes.cn/page/202107/1229789.shtml

July 27, 2021

‘I want to speak up for China’: Female Uygur university student shares changes in her Xinjiang hometown

Voice of truth

By Ranyila Abulikenmu

[ For a long time, hyping the so-called Xinjiang issue has been an important route for many Western-based anti-China forces to attack China. Under the guise of “protecting human rights,” they turned a blind eye to the achievements in development in Xinjiang Uygur Autonomous Region, while fabricating wild rumors like “forced labor” and “genocide.”

What, however, does the real Xinjiang look like through the eyes of the local people? What happened after a ruthless attack perpetrated by separatist and terrorist groups on their hometown, and how did local people find the courage to carry on? What is the truth about vocational education and training centers and the fabricated situation conjured and hyped by the West media? We find all the answers in this article penned by a Uygur girl from Xinjiang for the Global Times. ]

My name is Ranyila Abulikenmu, a 21-year-old Uygur student from Xinjiang. Now I’m a junior student at the School of Journalism and Communication at Southwest University of Political Science and Law in Southwest China’s Chongqing Municipality.

My hometown, Yangxia town in Luntai County, is located at the foot of the Tianshan Mountains. I started helping my family herd sheep at the age of eight, and I called myself a shepherdess at the foot of the Tianshan Mountains.

The beautiful Tianshan Mountains often bring me infinite imagination. The beauty there all year round is like a memorable landscape painting. As an ancient Chinese poem says, “I bid you farewell at the east gate of Luntai, the Tianshan Mountains pass come under heavy snow as you take your leave; soon I lose sight of you as you follow the turns into the mountains, all there is on the snow are hoof prints where the horses have been.”

Growing up in an ‘injured town’

Yangxia, where I grew up, is a town of a population of fewer than 14,000 people, and home to 2,380 farmer households. Grain and cotton cultivation has been the main source of livelihood here, with the cultivation of small white apricots as a side business. People of all ethnic groups in the town are kind-hearted; we help each other and live a very full life.

However, our peaceful life was interrupted on September 21, 2014, when 10 people were killed, 54 got injured, and 79 vehicles in the town were damaged in a violent terrorist attack.

I watched a video of the bloody and heinous crimes committed by the violent terrorists. Later, I heard a police officer in the town say that at the time, rather than hiding from the presence of police, they instead charged at them, slashing them with knives and tossing explosives at civilians. It was as though they were unhinged. The violent terrorist incident which took place in my hometown made my heart ache. But I believe that those who engaged in violent and terrorist activities were the minority, and most people there are very kind. My grandpa, for example, is a haji who had been to Mecca. He never asks me to study [Islamic] scriptures. I’ve spent much time with him, and what I hear most from him is his hopes for world peace and for me to be happy every day.

Since I was a child, I have had a seed in my heart, a seed of peace and opposing violence.

Walking out of the Tianshan Mountains

When I was a child, my father built a small sheep barn not far from our home, with more than 40 sheep inside. He said they were old, sick, and disabled sheep that were unable to adapt to the harsh climate of the high altitude region, so he brought them back from the mountain pastures for special care. Gradually, I took over the task of herding the sheep, and I took them to the nearby meadow to graze and drink every day.

My father was a quiet man, but he was kind-hearted and upright. He always asked us to remain disciplined and to do things in a down-to-earth manner.

There are three children in my family, when we were in elementary school, our parents made all three of us take classes taught in Putonghua. But we suffered a lot of flak for it, including relatives and friends of our family, who thought we were “heretics” for learning Putonghua.

I remember my mother once cried and said that her friends said she was brainwashed to do the wrong thing, which would send her three children to hell. My father was angry when he heard this. “We made the right choice and time will tell,” he said. We three children were also very upset at that time, realizing that our parents were under so much pressure to let us study normally.

My mother is a tough woman….

Well, as long as the comments section is now just a repository for off-topic press clippings, here goes”

“Gulbahar Haitiwaji is an Uyghur woman who ran away from China with her husband and two kids in 2006, alarmed over the persecution and anti-Uyghur policies happening there. They fled to France, where they tried their best to start a new life and live in peace.

“Then she got a strange call in 2016 from a person who said that her retirement pension needed to be resolved back in Xinjiang because the oil company she had worked for needed her signature on important documents.

“Haitiwaji thought it sounded strange but the individual on the phone said nobody else could sign for her and she’d have to come back briefly just to sign. She eventually agreed.

“Coming back to Xinjiang, Haitiwaji went to her old job to sign the papers. Instead she was told she had to go to the police to answer some questions. They interrogated her about why she’d left and then showed her a photo of her daughter holding the light blue flag of East Turkestan at a protest in Paris.

“East Turkestan is the region of Xinjiang that is the ancestral Uyghur homeland. It is illegal to hold or promote that flag in any way in China.

“The Chinese police told Haitiwaji her daughter is a terrorist for being at the protest and jailed her five months at the police station. Then she was taken to a reeducation camp.

“The camp had crowded dorms with boards for beds, a bucket for going to the bathroom and full surveillance 24/7. There was nothing else in the room, including toilet paper, sheets or furniture.”

………

“In addition to the the kind of treatment and entrapment Haitiwaji describes, hundreds of thousands of Uyghur women have been forced to have abortions, sterilized, sent to work in slave labor conditions at factories and also had their husbands, sons and brothers deported to camps where many are enslaved and killed.”

https://www.mainstpress.com/2021/01/13/whats-it-like-in-a-chinese-reeducation-camp-one-woman-just-told-her-whole-story/

Here’s the original story, in Haitiwaji’s own words:

https://www.theguardian.com/world/2021/jan/12/uighur-xinjiang-re-education-camp-china-gulbahar-haitiwaji

the propaganda posted by ltr tends to get a bit more extreme whenever menzie posts data that makes the ccp uncomfortable. the distraction is not too effective though…

“ltr”

You literally make me physically sick and ill and stomach nauseated with your bullcrap,

Back on topic, please?

I’m with macroduck, and hoping “the high uncertainty regarding the direction of political control in Hong Kong” is just a typo.

There is absolutely no uncertainty whatsoever about who is in charge of politics in HK: the CCP’s local allies and appointed officials. I lived and worked in policy analysis in HK for over 30 years, and this is by far the MOST certain anyone has ever been about that city’s future.

Shifting to economic policy, and there might be some analytical wiggle room. For the most part, anything pro-China and pro-business will get the nod, and that’s not much of a change. However, some stock market regulation are “under review” for ways to make them more China-friendly (i.e., less like best practices in the OECD). Anti-union measures, however, are purely political (HK unions are economic wimps).

Using GDP to measure the HK economy is very unwise. The domestic economy is one-quarter the size of foreign trade, which means that consumer sentiment has just about zero influence on the odds of growth or contraction. When global trade is strong, Hong Kong cannot have a recession, and when it is poor, the SAR gets hammered, hard. Examine data for the first half of 2003 for confirmation: SARS killed the domestic economy, and trade kept GDP on the rise; fast-forward five years to The Great North Atlantic Economic and Financial Crisis, and the exact opposite came to pass.

As for the 2017 CE (s)election, recall that CY Leung was certain to run for a second term, until he suddenly didn’t.

That, sir, is uncertainty.

Yes to the point about trade relative to GDP. Singapore is in much the same situation. The Netherlands is not the same story, but has some similar elements.