I had the pleasure of speaking with UW’s Ian Coxhead and Sandi Siegel, President of MITA and of ME Dey, at Talking Trade last week about trade, direct investment and competition in technology production.

Some of the hotspots depicted are now longer particularly salient:

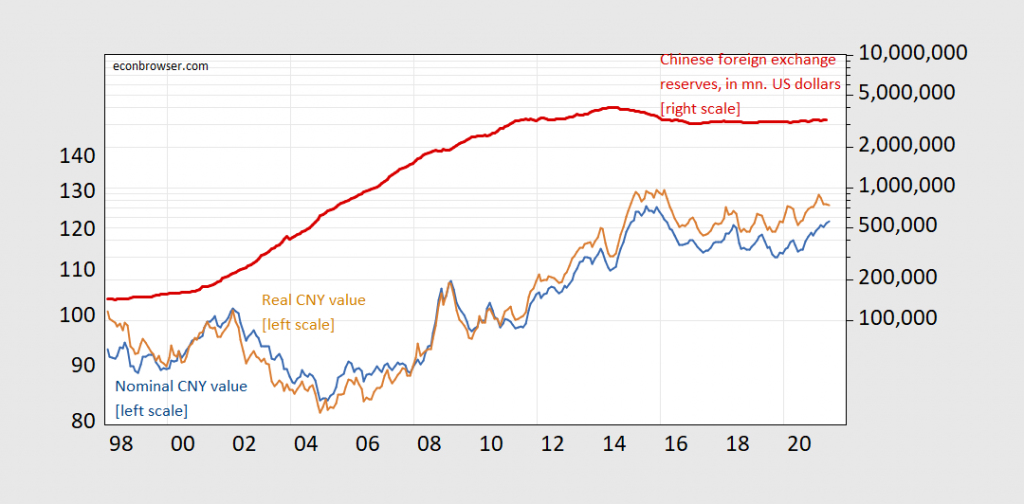

Figure 1: Real trade weighted (broad) measure of value of Chinese yuan (brown, left log scale), nominal (blue, left log scale), and reported Chinese foreign exchange reserves ex-gold at central bank, in millions of USD (red, right log scale). Source: BIS, IMF.

With the CNY fairly strong and observed reserves stable, it’s harder to make a case of currency manipulation.

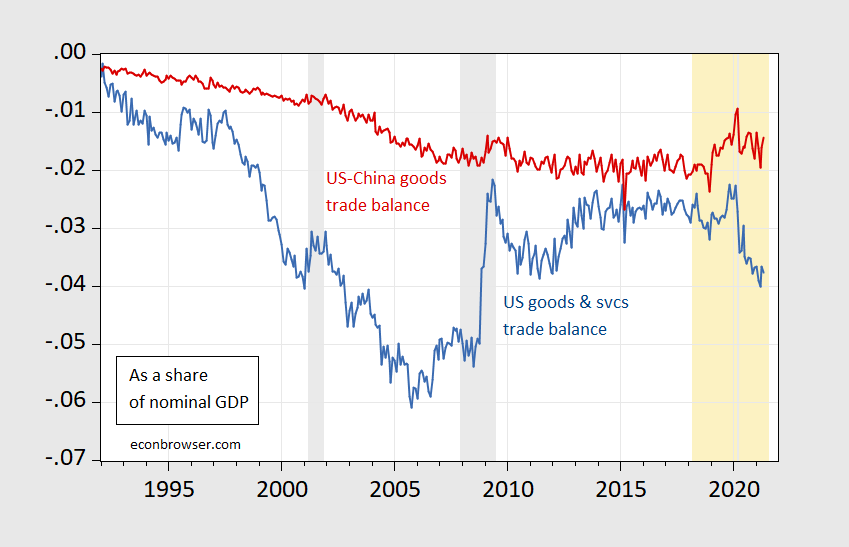

The size of the US-China trade balance has not been at the forefront, either.

Figure 2: US-China goods trade balance as share of US GDP (red), US overall trade balance (goods and services) as share of US GDP (blue). NBER defined recession dates shaded gray. Orange shading denotes period of announcement and imposition of Section 232, Section 301 measures. US-China exports, imports seasonally adjusted by author using X-13/X-11 procedure. Source: BEA via FRED for trade flows, IHS-MarkIt for nominal monthly GDP, NBER and author’s calculations.

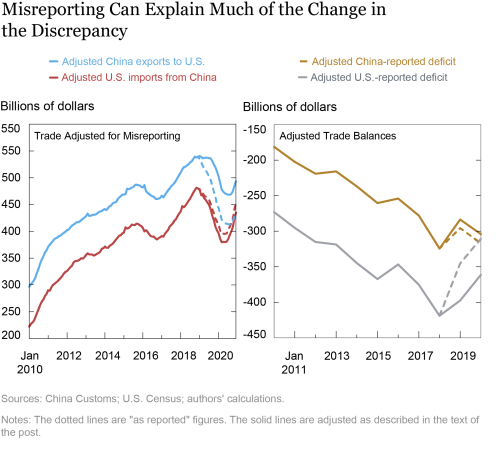

However, it would be a mistake to say that the US-China trade deficit has been “fixed” (and given the full documentation of failure to achieve the Phase 1 deal that Trump negotiated). As Clark and Wong point out, there’s been a lot of incentive to mis-measure trade flows (given taxes, tariffs, etc.).

Source: Clark and Wang (2021).

In addition, as I’ve pointed out numerous times, from a macroeconomic standpoint bilateral trade balances make little difference. And our overall trade balance with the rest of the world as deteriorated – unsurprisingly so given the extent of fiscal stimulus being undertaken in the US. A large share of the imports that originally were coming from China have been shifted to coming from other Asian countries, probably at higher cost (that’s called “trade diversion”).

The points of friction are clearly more in trade in high technology goods and foreign direct investment in the United States. More on these topics in the talk, and in these references below.

Many other podcasts covering numerous trade topics at Talking Trade (produced by WisBusiness).

Well, good people of this blog, regulars I mean, I’m pretty “sauced” now, take it for what you will, But I remember a time here

when I was labeled a donald trump “fan” because I attacked Andrew Cuomo. Take that person’s comments for what you will—-Signed, “drunk” Uncle Moses.

Hey, Unc, are you a resident of the Empire State? I was until I got deported.

Menzie, I suspect Biden would like to get through the mid-term election before stirring up the hornet’s nest that is trade policy toward China. Schumer, for one, is a bit of a China basher. And Biden’s connection to Labor could be a problem if he softens China trade policy too very much.

One would hope something more useful than Trump’s mindless tariff war could be devised, but Biden needs some way of maintaining the political benefits of tough China trade policy. Love to hear suggestions of what could could work better while keeping Schumer’s followers happy.

Actually, New York is more sophisticated than Oklahoma, there’s so arguing that. I was born in a northern state, not OKlahoma, though I’ve lived a good portion of my life in OKlahoma (turns my head to the side, puh!!!!). The problem I have with New Yorkers (or those born in another state trying to pretend they are New Yorkers), Is some kind of “I’m better than you” based on geography. macroduck I know you get this, I’m hoping other people who don’t “get it” are reading this.

*there’s no arguing that.

Such a whine bag and a liar too. My complaint was that you claimed I excused the behavior of Randy Andy. Of course I have always condemned sexual harassment. But I would never abuse this issue to falsely attack someone else. But that is all you do. Enjoy your wine little liar.

A really, really fine post.

https://static.nytimes.com/email-content/PK_sample.html

August 3, 2021

Lock Florida down now!

By Paul Krugman

When you’re a wonk trying to be a pundit — or for that matter any kind of technocrat who wants to have real-world influence — it’s usually not helpful to push for policies that you believe would be right in principle but have no political chance of becoming reality.

The prime example for me has been health insurance. If our goal is to make sure that everyone has adequate, affordable health care, why not just pay for everyone’s care? On policy grounds, I’ve never disagreed with the proposition that we should have Medicare for all; there’s even a pretty good case for direct provision of medical care along the lines of Britain’s National Health Service. Why bother with a Rube Goldberg device like Obamacare, which uses regulations and subsidies to nudge private insurers into covering most people?

But the politics are impossible, and not just because of special interests: You’d have to persuade the 170 million Americans with private insurance to accept something completely different. Even though most of them would probably be better off, that’s too heavy a lift. So incremental reform, possibly evolving over time into single-payer, is how it’s going to have to be.

Sometimes, though, it may be helpful to talk about what a government really should be doing, even if there isn’t a snowball’s chance in Miami Beach that they’ll take your advice, simply as a way of highlighting the wrongheadedness of what that government is actually doing.

Which brings me to current pandemic policy in red states, the subject of today’s column. Imagine for a moment that Gov. Ron DeSantis of Florida were to have a sudden attack of conscience — if he were suddenly to admit to himself the carnage his Covid denial has created — and were to do an abrupt about-face, trying to limit the damage. (Like I said, a snowball’s chance in Miami Beach.) What would he do?

The answer, I’d submit, is that he’d call for an immediate, fairly strict lockdown: mask requirements, a ban on indoor dining, the works.

To see why, let’s revisit the logic behind the lockdowns we had in 2020.

In the early days of the pandemic, effective vaccines seemed like a remote prospect, and it looked like a good bet that almost everyone would eventually come down with Covid-19. Even so, it was important that we “flatten the curve” in an attempt to avoid having too many people need hospitalization all at once so as not to overwhelm the health care system. And lockdowns did that.

As it turned out, however, we had a scientific miracle: Remarkably effective vaccines became available faster than anyone had imagined possible. But this miracle didn’t mean that the lockdowns had been a mistake. On the contrary, it meant that they were an even better idea than we realized, because they bought time to get vaccines developed and distributed. People who managed to avoid getting infected during the pandemic’s first year, then got their shots, are now likely to dodge the virus altogether or suffer only a mild case. Infections deferred were infections avoided, after all.

Unfortunately, the U.S. vaccination drive, while very successful at first, eventually ran into a wall….

this is exactly why i posted the other day, we should have schools go virtual until we get the vaccines in the kids under 5 years old. we need to speed up the vaccine approval process as well. otherwise we will vaccinate our nations children in february, after the delta variant has spread like wildfire through all the schools this fall. this is not rocket science we are dealing with here. we can take advantage of the vaccines we developed, or waste them…

If we follow the lead of the city of Atlanta, we can have kids in classes safely under a mask mandate. Alas outside the city – due to the utter incompetence of the state’s governor – kids are going to school without masks. Of course this moron is governor only because he cheated during the 2018 elections. And of course he is leading new wave of election deform. Atlanta should succeed from the rest of the state.

http://www.xinhuanet.com/english/2021-08/04/c_1310107270.htm

August 4, 2021

Over 1.7 bln doses of COVID-19 vaccines administered in China

BEIJING — Over 1.7 billion doses of COVID-19 vaccines had been administered in China as of Tuesday, the National Health Commission said Wednesday.

[ Chinese coronavirus vaccine yearly production capacity is now over 5 billion doses. Along with over 1.708 billion doses of Chinese vaccines administered domestically, another 750 million doses have been distributed internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

Capital Markets Caught in U.S-China Bifurcation, Says Enodo’s Choyleva (Bloomberg)

“Foreign investors [in China] should exit anything that doesn’t have a very clear, exceptional return outlook within the two to three year horizon — but even that’s probably too far.”

https://www.youtube.com/watch?v=RazILH50ra4

Diana Choyleva is the chief economist for Enodo Economics? Well I guess so since he founded this obscure consulting shop. Never heard of them? Neither have I so who knows whether to take her advice on anything.

But I’m sure being chief economist for one’s own little shop carries more weight than Princeton Steve’s gig as chief economist for Fox and Friends.

https://www.wsj.com/articles/SB10001424127887324640104578162713902930112

This “chief economist” was predicting doom and gloom for China’s economy back in late 2012. How did that forecast pan out?

As regards Menzie’s earlier post on Hong Kong policy uncertainty, this is another reason policy uncertainty is higher in the near term than the index suggests.

The New York House will impeach Randy Andy within the next few weeks and it is then off to the NY Senate for a trial. Sound a bit familiar? Well there is a difference between NY procedures and the procedures in Washington DC. After the impeachment, Governor Randy Andy has to step down and make Kathy Holcom the governor during the trial. And he could do the right thing and just resign now.

A bit off topic, ADP reports 330,000 new private jobs in the U.S. in July. Still a pretty good number, but the slowest pace of hiring in 5 months. Leisure and hospitality hiring is still by far the strongest category. ADP’s economist blames Covid and bottlenecks for the slowing and predicts an acceleration in coming months. That seems to take a good bit for granted.

https://www.nytimes.com/2021/08/03/books/the-two-economists-who-fought-over-how-free-the-free-market-should-be.html

August 3, 2021

The Two Economists Who Fought Over How Free the Free Market Should Be

Nicholas Wapshott’s “Samuelson Friedman” looks at a feud that continues to define the economic direction of the United States.

By Paul Krugman

SAMUELSON FRIEDMAN

The Battle Over the Free Market

By Nicholas Wapshott

Profit-seeking business remained very much the norm — America never went in for significant government ownership of the means of production — but businesses and businesspeople were subject to many new constraints. Taxes were high, in some cases as high as 92 percent; a third of the nation’s workers were union members; vigilant antitrust policy tried to limit monopoly power. And the government, following the ideas developed by Britain’s John Maynard Keynes, took an active role in trying to fight recessions and maintain full employment.

Over the decades that followed, however, there was sustained pushback — first intellectual, then political — against these constraints, an attempt to restore the freewheeling capitalism of yore. Nicholas Wapshott’s “Samuelson Friedman: The Battle Over the Free Market” is basically an account of this pushback and its eventual fate, framed as a duel between two famous economists — Paul Samuelson of the Massachusetts Institute of Technology and Milton Friedman of the University of Chicago.

Maybe the first thing you need to know is that the idea that what happened was a personal duel between economic titans is best seen as a literary conceit, a way to inject some theatrical drama into potentially dry intellectual history, rather than as the way it actually happened. Certainly nobody told Paul Samuelson that he was engaged in a fight for capitalism’s soul.

Indeed, if I had to name someone on the center-left who actually did engage in a sustained intellectual duel with Friedman, it wouldn’t be Samuelson, it would be Yale’s James Tobin, whose stinging criticisms of Friedman’s methods retain much of their force to this day, but who oddly makes almost no appearance in Wapshott’s book….

[ Terrific. ]

Hi Menzie

I’m late to reading this informative post. Also for link to the Talking Trade site – very helpful resource for Wisconsin trade info,

It seemed to me that Trump’s dumb “I alone can fix it” approach to international trade was wrong from the start. And so it has proved to be. I thought backing out of Obama’s TPP because of personal spite was very harmful to agricultural trade and farmers – although most large ag commodity producers love Trump – because he “took care of them” with USDA $$$ direct payments. (By the way, I think most don’t realize that Trump used taxpayer $ with USDA CCC payments in a vote buying scheme – )

Also the Trump trade deal with China – “Buy more soybeans – to make Trump look good to U.S. farmers” looks to be a flop https://www.piie.com/blogs/trade-and-investment-policy-watch/anatomy-flop-why-trumps-us-china-phase-one-trade-deal-fell

Thanks

“US manufacturing exports to China, which had nearly doubled between 2009 and 2017, flattened in the second half of 2018 and fell by 11 percent in 2019 (figure 3). This was partially a result of Chinese retaliation against Trump’s tariffs.”

Their figure 1 shows this lackluster export performance as well as it also shows the rest of the world increased their exports to China during 2017/18. China was importing – just not from us.

Meanwhile, fundamentals and policy in China are likely to keep the trade gap wide and reduce upward pressure on commodity prices:

The Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) fell to 50.3 last month from 51.3 the month before, the lowest level since April 2020.

….

“The economy is still facing huge downward pressure,” said Wang Zhe, senior economist at Caixin Insight Group, in comments released alongside the data. High product prices brought down demand, especially for consumer goods and intermediate goods, said Wang.

A sub-index for new orders slipped sharply into contraction for the first time since May 2020, while another sub-index for production fell to the slowest pace of expansion since March last year.

China’s July factory activity growth slips to 15-month low – Caixin PMI | Reuters

“One of the biggest drivers of the surge in metals prices this year, the world’s top commodity consumer China, is showing signs of a slowdown in demand, which could drag down copper and iron ore prices for the rest of the year after a blistering rally in the first half. ”

China’s Industrial Slowdown Could Kill The Commodity Rally | OilPrice.com

Note to ltr: You see, this is how one might write a comment about China’s economy without engaging in mindless boosterism.

China’s Corporate Crackdown Is Just Getting Started. Signs Point to More Tumult Ahead.

BofA Securities strategists have recently recommended investors shift holdings from Chinese growth stocks into shares elsewhere in the Asia Pacific region, and called the recent history of foreign investors participating in China’s high-growth stocks “incompatible with likely upcoming strategies.”

https://www.wsj.com/articles/china-corporate-crackdown-tech-markets-investors-11628182971