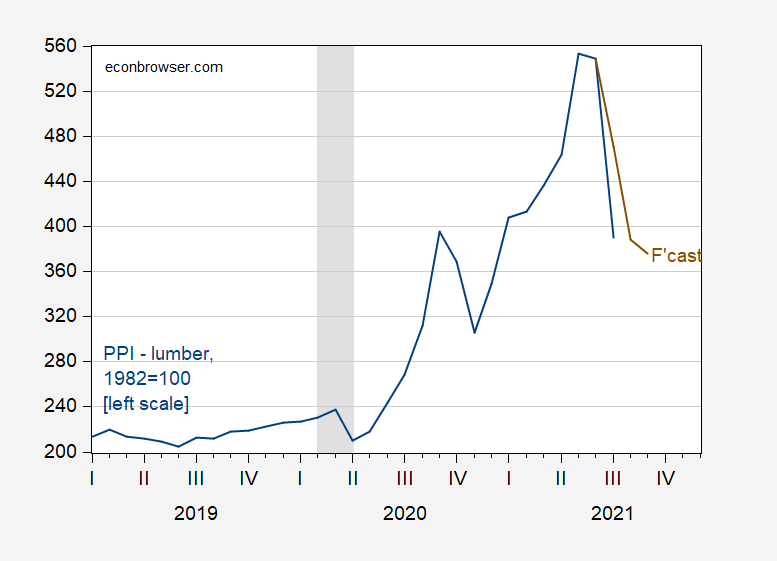

Fell 34.3% (not annualized, in log terms) in July.

And fell faster than I anticipated in my post a week and a half ago.

Figure 1: PPI for lumber and softwood (blue, left scale), and forecast as of August 5 (see post) (dark brown,). NBER recession dates shaded gray. Source: BLS via FRED, NBER and author’s calculations.

The lumber PPI is now below the level recorded in January 2021.

Still a long ways to go to get back to pre-pandemic prices — about 70% above normal.

As mentioned before, this series is only for dimensional lumber, primarily random length 2x4s. Most of the cost of wood in residential and commercial construction is not dimensional lumber but instead for engineered wood products like plywood, OBS and laminated beams.

You can see the PPI for plywood here. Still at its peak.

https://fred.stlouisfed.org/series/WPU083

As mentioned before, dimensional 2×4 lumber can be produced by lots of small low tech mills. Engineered wood products are produced by fewer big high tech mills which apparently are slower to restart. It would be interesting to find out why. Is is labor shortage or transportation issues or raw materials issues? Something is slowing their recovery as producer prices are still more than two times normal and retail prices even higher. The good news is that I’m starting to see actual stock in some areas, particularly the west coast, which had no stock at all even a few days ago.

I think the answer to your question about price difference between dimensional lumber and “engineered” i.e. panel products and LVL, is that glue and resin supply chains are still messed up. Some of that is related to the pandemic and some it is related to the deep freeze in Texas that shut down production.

Plywood! Fred used to produce this series in real terms but that reporting stopped 4 years ago:

https://fred.stlouisfed.org/graph/?g=iGeN

I guess JohnH will mansplain to us how this vast conspiracy of the elites are hiding the real cost of plywood as if no one else knows how to take your nominal series and deflate it.

FRED has all sorts of lumber price series. Hardwood lumber prices are not falling but softwood lumber prices are. And treated wood prices coming back down:

https://fred.stlouisfed.org/series/WPU087

Maybe we should visit Home Depot and have someone explain all of this to us.

Gasoline is cheaper tonight. $2.55, but the local prices are very erratic (different stations, different prices). I’m thinking about getting some around the corner here, not terribly far. cheapest it’s been in awhile. Should I ask Larry Summers what the price will be Friday?? Or maybe Johnny Cuckrant of “Grumpy Economist” fame can run an equation for me??

Actually, I’m looking at this, if that’s in log terms, wow, “Log” kind of “slows” changes, right?? That’s incredibly drastic for a change done in log terms. Am I that sauced?? I mean, that’s an amazing change for something done by log.

Moses Herzog: When rising, yes- when falling, no.

That’s interesting, maybe something I noticed in college and had forgotten about all clear to now. It’s actually interesting if you stop and think about it. I wonder how many math operations act that way?? I mean, exponential kind of “multiplies on itself” in a “natural” way or seems to have a “compound interest effect”. I know it’s different, but you get my meaning,

I actually appreciate this reply Menzie, it’s pretty interesting. I’m sure some people (and probably yourself) consider it a very obvious, “pedestrian” thing but something tells me people not that into numbers would generally be surprised by that—I consider myself good at numbers for a guy as lazy as I am, but still that is actually surprising to me. I mean in the immediacy of the question I would assume “e” (that’s kinda what we’re talking about right??) would be the same both ways.

Shouldn’t our resident Australian guy be happy by this math method of calculation?? OK, nevermind

“The wholesale market price of lumber is well off the high nearly $1,700 it reached in early May. After trading around $650 per contract in mid-July, the price has continued to fall to around $500 in mid-August. This is still significantly higher than its price in 2019 when it traded between $300 and $400 for most of the year. Lumber prices in the futures markets have also declined since last month. The January 2022 contract was trading around at $550 as of mid-August, down $100 over the last month. However, prices of futures contracts further out are in the $600 range, indicating that the FUTURES MARKETS EXPECT LUMBER PRICES TO REMAIN ELEVATED FOR SOME TIME.

The price of soft plywood products increased again this month, according to the BLS. The price increases seen for soft plywood products have now far outpaced those of any of the other construction materials we track.

https://yieldpro.com/2021/08/plywood-leads-broad-rise-in-construction-materials-prices/

Lumber is not the only game in town. Prices of many other building materials have been rising, too. As one contractor told me last week, “yeah, lumber prices have come down but metal prices have gone up.

BTW, I never said that lumber prices would never come back down, but I did quote belief among contractors that they would never go back down to where they had been. That seems to be playing out right now, at least into next year. What I did say is that retail lumber prices would be sticky due to high inventories of lumber bought at high prices. This may be starting to finally break.

The kind of “expert” analysis one gets from talking to a single contractor who cannot make up his mind what he is saying!

“As one contractor told me last week, “yeah, lumber prices have come down but metal prices have gone up.”

i have rarely encountered a contractor who would fess up to prices dropping much. usually when they talk to people, they want them to believe costs are rising. this gives them a tactical advantage in their quotes.

If you bothered to read the article I linked to, you would see that prices of many construction materials are rising. My local ‘expert’ only confirmed what the article said.

Did YOU bother to read this article? Try again and note the fall in the price of softwood lumber. Of course the article relies on BLS data which we know you have “proved” is misleading numbers put out by a vast conspiracy of “elites”.

JohnH screams at you to read his link – even though he did not. Note he said the price of softwood lumber rose last month. His own link shows the BLS data which said just the opposite. And copper wire and cable prices fell last month.

I love it when trolls give us links that they clearly have not looked at carefully followed by telling us just the opposite of what their own link notes.

My house value has started to fall, down 1% in the last week. I expect that trend to continue, with the ultimate drop in the 10-15% range. What does that mean for the economy?

Gee the price doubled but then retreated a mere 10%. This is not the housing collapse you kept chirping about.

A decline of 15% would imply a retracement of about half the gains in the last year.

steven, i think you are giving far too much credibility to a zillow price estimate. unless you have a bunch of houses in your neighborhood undergoing the sales process. as i told you before, zillow price estimates are gunk. that is only an accurate price if somebody is making an actual offer. have you gotten an offer from zillow yet?

Baffs –

You are of course right. Zillow is but one estimate. However, potential buyers will also see those estimates, and once prices start to decline, buyers may well balk at signing off on sky-high valuations. So either prices will consolidate and then resume some climb, or more likely, will reset to more reasonable valuations. I am guessing the latter. Given the absurd run-up, I would not be surprised to see the air let out of the balloon pretty fast. That’s my baseline expectation.

The more important question is whether this has any macro impacts. When housing prices fell from 2006/2007, we suffered a depression. It’s harder though to make such a forecast now because covid has scrambled ordinary economic signals so thoroughly. That’s why I brought the topic up. I thought perhaps Menzie or another reader would add some thoughts on possible macro implications.

flipper (boston msra) bought house down street, finished the 3 month job 2 weeks ago.

house still on market last night he dropped price ~10% today.

he will take a bunch of profit for 3 months and 15% tied up.

jackson hole and ending taper will be a sign…

@ “Princeton”Kopits

This seems like some kind of reversal in prognostications on your part. Have you notified Johnny Cuckrant of “Grumpy Economist” blog fame so he doesn’t get vertigo while reading your thoughts on inflation??

I am not surprised, Steven.

Over on Marginal Revolution very recently Tyler Cowen linked to a recent paper that claimed there really was not a housing bubble back in the noughts because if you tracked housing prices from much earlier in a constant rate of increase through the 2006 peak you got to the current price level (nationwide). So the paper argued this is the fundamental and the Great Recession was a big nothing. Tyler seemed to take this argument quite seriously.

As one of the people who called the housing bubble way back not long after Dean Baker and who used to debate with Jim Hamilton here about it, who held on for quite a long time to the view that the high price to rent ratio was justified by low interest rates and did not show a bubble (he also with Bob Flood who lurks about here) was also one of the originators of the view that it may be impossible, or at least is very difficult, to identiry bubbles econometrically, it was not surprising that Jim held out on accepting that the housing market was a bubble, although he eventually did.

So I view this paper that Tyler thought so highly of as probably indicating that current housing prices have gotten a bit out of line on the high side, with the price/rent ratio back up pretty high again nationally. The main differences with 2006 is that homeowners have muc more equity and there are very few weirdo flaky mortgages, not to mention that rents have been up, arguably the most serious part of the recent inflation outburst. But it has looked that house prices got a bit too high, so not surprising yours may be coming down some now.

Tyler makes the same mistake as Princeton Steve. Ignoring the higher real rents and the lower cost of capital. I linked to a Kevin Drum take down of Tyler. Then again Kevin understands basic finance. Princeton Steve clearly does not. And one has to wonder about Tyler as well.

Off topic, retail sales took a tumble in July, mostly due to vehicles and on-line sales. “Going out” spending categories did well. Looks like people couldn’t find cars to buy and didn’t have tiime to browse Amazon because theye were drinking and dancing. This is not the kind of spending that reflects the massive drop in confidence in early August U. Michigan confidence data. Nor should it be, since it’s July sales vs August confidence. More like “We just got back to having fun last month, and now everybody’s getting sick again!”

we stopped going out to eat. and we will begin having groceries delivered again. for the next couple of months i would imagine.

I have not eaten out in 18 months but I do get to the grocery store when it opens. I’ve become quite the cook!

http://www.xinhuanet.com/english/2021-08/17/c_1310132200.htm

August 17, 2021

Over 1.87 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 1.87 billion doses of COVID-19 vaccines had been administered in China by Monday, the National Health Commission said Tuesday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 1.875 billion doses of Chinese vaccines administered domestically, another 800 million doses have been distributed internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://news.cgtn.com/news/2021-08-17/Chinese-mainland-reports-42-new-confirmed-COVID-19-cases-12NbqJi8mTm/index.html

August 17, 2021

Chinese mainland reports 42 new COVID-19 cases

The Chinese mainland recorded 42 new confirmed COVID-19 cases on Monday, with 6 being local transmissions and 36 from overseas, the latest data from the National Health Commission showed on Tuesday.

In addition, 17 new asymptomatic cases were recorded, while 495 asymptomatic patients remain under medical observation.

This brings the number of confirmed COVID-19 cases on the Chinese mainland to 94,472, with the death toll unchanged at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-08-17/Chinese-mainland-reports-42-new-confirmed-COVID-19-cases-12NbqJi8mTm/img/1181dcf8df684b15af45535d05d13314/1181dcf8df684b15af45535d05d13314.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-08-17/Chinese-mainland-reports-42-new-confirmed-COVID-19-cases-12NbqJi8mTm/img/97c1508cf4be4061a0ccd20a05f9dbfd/97c1508cf4be4061a0ccd20a05f9dbfd.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-08-17/Chinese-mainland-reports-42-new-confirmed-COVID-19-cases-12NbqJi8mTm/img/47a315121d794376b70c1b0a70774d24/47a315121d794376b70c1b0a70774d24.jpeg

https://www.worldometers.info/coronavirus/

August 17, 2021

Coronavirus

United Kingdom

Cases ( 6,322,241)

Deaths ( 131,149)

Deaths per million ( 1,921)

China

Cases ( 94,472)

Deaths ( 4,636)

Deaths per million ( 3)

Can anyone tell me, when the last time Johnny Cuckrant of “Grumpy Economist” blog fame posted on inflation??? Asking for a friend

i believe PPI lumber would be seasonally adjusted…since lumber prices usually fall during the summer (typically after a May peak), actual prices paid are probably down even more…