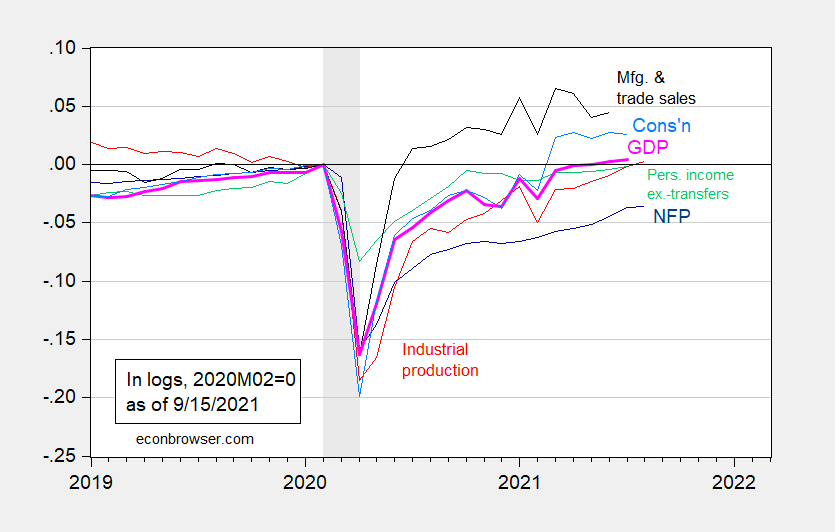

Industrial production finally rises above levels in 2020M02 (the latest NBER peak). We now have the following picture of the macroeconomy (for some key indicators followed by the NBER’s BCDC).

Figure 1: Nonfarm payroll employment from August release (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (9/1/2021 release), NBER, and author’s calculations.

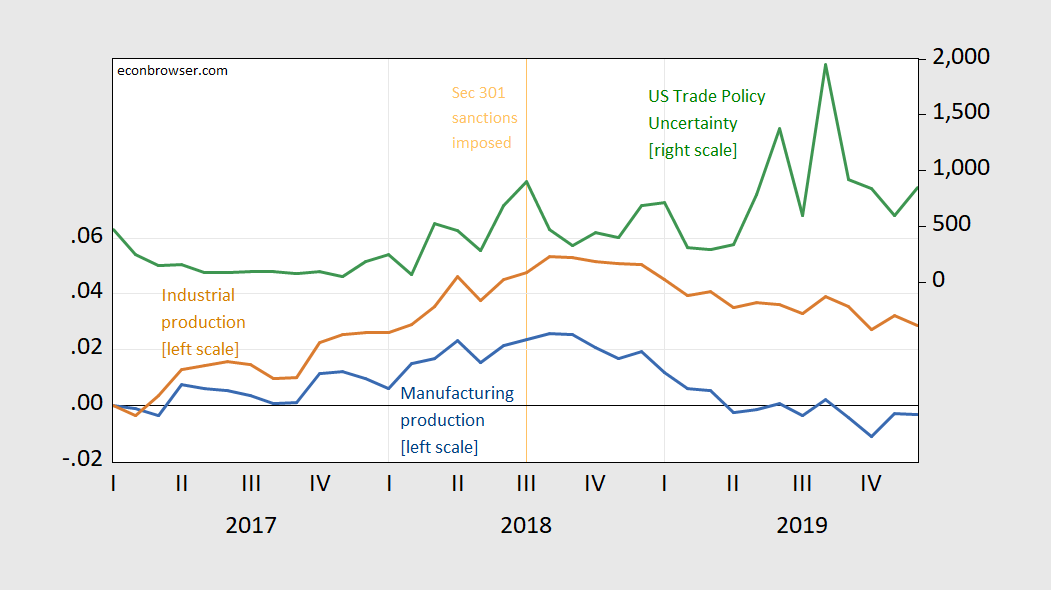

Industrial production hit the Bloomberg consensus, while manufacturing production, at 0.2% m/m, missed the consensus 0.4%.

Interestingly, industrial production has not yet exceeded the prior peak achieved in August 2018; the same is true of manufacturing production (August 2018 is a month after Section 301 tariffs were imposed on China).

Figure 2: Manufacturing production (blue, left scale), industrial production (tan, left scale), both in logs, 2017M01=0; and US Trade Policy Uncertainty (green, right scale). Source: Federal Reserve via FRED, policyuncertainty.com, and author’s calculations.

Correlation is not causation — but you got to wonder. (And, we have formal analyses linking the trade wars generally to reductions in employment in the manufacturing sector, as discussed e.g., here).

You can see how China has met — or not met — its commitments in the Phase 1 US-China trade agreement here.

The foregoing suggests to me a managed two-sided de-escalation of tariff measures could help spur economic activity (and pretty likely decrease upward price pressures).

Wait until Biden starts replacing ineffective tariffs with tough capital rules on goods such as steel. The global supply chain, cheap debt/consumption era is ending and that isn’t a bad thing. Total growth is meaningless as most “growth” since the middle of 2000 has been debt based, credit growth which doesn’t really help the national economy innovate or produce.

Biden knows what he is doing. It will fracture debt loving suburbanites on the coasts away from the party, but they are overrated anyways. Swing voters 1st

GREGORY BOTT: I am sorry, but could you explain what a “capital rule” is?

I assume you’re “razzing” Greg (i.e. i’m doing my favorite thing and telling you what you already know), but I’m guessing he means quotas here. They might put a “dollar amount” on the quota and that’s where he’s getting “capital” from. As you may have guessed, being in Oklahoma a decent portion of my life, I’ve spent a lot of time interacting with “special ed” rednecks, and so can make a decent guess there.

it’s also possible he has an insight that no one else sees but just lacks the words to express what it is…

or he watches faux news too much, gets all riled up, and rants about things he really knows nothing about.

He who has the capital has the rule. See, Jeff Bezos et al.

That’s about an 8 score on the comedy scale, on a 1scale being the best. I’m kinda pissed I didn’t thank of that one actually.

Wait……. Have we “had it out” before?? I mean argued. Barkley and pgl tell me I’m not supposed to compliment or be nice to those I’ve argued with in the past. Get back to me and tell me if I’ve erred here.

Moses,

When did I ever say that? Heck, both you and pgl have at times given me a hard time about being civil to various people. I note that I have on several occasions in the past made peace offerings to you. Unfortunately, they have never been taken up. Offer still stands, although I understand that for reasons that actually are somewhat mysterious to me you seem to have an awful lot personally invested/committed to dumping on me almost randomly on a regular basis.

Heck, I am mangy street fighter on the internet, but I generally get along with most people in person, even ones I joust with on the internet. There is a good chance we would actually get along if we were to actually meet face to face, despite all the long-running bad blood.

Really really simple. You won’t be able to buy products from foreign nations. Something Wilson and FDR used quite a bit over “tariffs”. Historians struggle to understand the difference.

Gregory Bott: I’d appreciate a reference for “capital rule”; I’ve never seen it in the context of trade policy.

He told us to check the policies of President Wilson. Who of course was a free trade advocate that lowered tariff rates. As usual – this BOTT is just writing horrible word salad.

bot,

Part of the problem is that “capital rule” makes it look like something about a restriction on capital flows. We see lots of these in many nations, but capital flows are not the same as monetary movements tied to trade flows. Trade and capital accounts are different things.

Menzie has been polite not to point this out, but I think this is a major part of what he is driving his question. Tariffs have nothing to do with capital account movement restrictions, which indeed would be the obvious meaning of a “capital rule.” But as it is, like him, I have never heard of such a thing. You appear to have been making this up out of whole cloth, and now you have been caught.

Woodrow Wilson is an example of using trade protection ala your undefined “capital rule”? WTF? Wilson was a free trader who lowered tariffs. I am not aware of any quotas he imposed. And you have not noted any such trade protectionist policies from him or FDR.

Come on – stop being a stupid bot.

total oil industry inventories had fallen to a 42 month low last week, and seem likely to fall to a 6 1/2 year low by Friday:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WTTSTUS1&f=W

as of this afternoon, “it is estimated that approximately 29.52 percent of the current oil production in the Gulf of Mexico is shut in. BSEE estimates that approximately 39.40 percent of the gas production in the Gulf of Mexico is still shut in.”

https://www.bsee.gov/newsroom/latest-news/statements-and-releases/press-releases/bsee-monitors-gulf-of-mexico-oil-and-66

look at the weekly inventory analysis..

https://www.eia.gov/petroleum/supply/weekly/pdf/table1.pdf

inputs last week about same as last year,

there was still quite a bit of pandemic related softness in last year’s data….and that data shows our oilfield production, our refinery throughput, our oil imports and our oil exports all remained 10% to 15% lower than two weeks earlier in the wake of Hurricane Ida…but our total crude + product inventories have been falling steadily since last year’s glut, Ida just accelerated the process…

Yeah, but the reversal in October is going to be brutal. Not a great post.

Getting Big Pharma multinationals like Abbott Laboratories to stop funneling profits to tax havens is bringing to remind me of getting an alcoholic to lay off the booze:

https://www.independent.ie/business/personal-finance/tax/pharma-giant-abbott-using-tax-loophole-alleges-christian-aid-40851920.html

Brad Setser has written a few blog posts noting how these games have induced a lot of drug production to be source in Ireland. Now Ireland’s 12.5% corporate profits tax rate is not exactly the lowest on the planet. But wait – that Double Irish Dutch Sandwich scheme allowed these corporations to siphon off around 80% of Irish profits to no tax Bermuda making the effective tax rate only 2.5%.

The goods news is that this scheme has been shut down. Enter the Single Malt scheme (have a drink on me). Ireland still produces the drug and abuses transfer pricing to make sure most of the profits end up with the producer as opposed to the US owner of the product intangibles. But 12.5% tax rates are too high for the greedy representatives of Abbott so the claim is that they have siphoned off most of the profits to Malta.

Of course Abbott denies any wrongdoing. After all they have the God given right to evade taxes and it is all “Perfectly Legal”. Yea – we really need a drink!

“The foregoing suggests to me a managed two-sided de-escalation of tariff measures could help spur economic activity (and pretty likely decrease upward price pressures).”

Perhaps. Whether or not it would be economically smart is irrelevant in the actual politics. Biden has nothing to gain from reducing tariffs except hysterical claims from the right of being a traitor and weak president that would make the Afghanistan withdrawal pale in comparison.

The general public is completely indifferent to the actual economics. Heck, more than half the public says that Biden has done nothing for them economically completely forgetting that they received $1,400 cash checks just a few months ago and are receiving cash child tax credits monthly today. Do you think the public is going to give Biden any credit for reducing the inflation rate by a few basis points by eliminating tariffs?

As long as you have the news media dutifully following Republican misinformation about the economy, you are unlikely to have good economic policy.

joseph: Without disagreeing with the conclusion that Biden would not get political credit, I will write on this *economics* blog, if the Sec 232 and Sec 301 tariffs were a mistake in being implemented, then ceteris paribus they are a mistake being kept on. Of course, not everything was held constant – foreign tariffs were raised in retaliation – so if one could get them negotiated down while we reduced our tariffs, that would be better.

“foreign tariffs were raised in retaliation – so if one could get them negotiated down while we reduced our tariffs, that would be better”

Maybe I’m been out to lunch of that soybean tariff issue. I was going to tell Joseph that soybean farmers would notice but when I wandered over to Census, it told me that we had our best year in terms of soybean exports and most of those exports went to China. Soybean prices finally exceeded even CoRev’s chirping.

So did China get rid of its tariffs on our soybean exports?

In today’s WaPlo Fareed Kakaria raises a concern in light of Biden’s pending speech to the UN General Assembly that he really seems to be normalizing large portions of Trump’s foreign policy, with lots of this not making much sense even politically, if for any other reason. Tariffs look to be one area, although on that one we can see there is a political issue, especially as long as people such as autoworkers in Ohio cannot figure it out that tariffs on steel imports hurt them and vote for people like Trump because of the tariffs. We know Biden is hyp;er-sensitive to industrial worker attitudes in those swing midwestern states, ulitmately irrational as all that is.

But then we have other matters I do not get, most especially Iran. Why has he not gotten back into the JCPOA? I really do not get it, and I think it is a huge mistake. There are other areas, such as Cuba, although on that one I get it that he is looking at Florida. But it may be hopeless anyway for him. And he seems to have ticked off some of the allies that he has made some efforts to renew good relations with, such as not keeping them informeed about the withdrawal from Afghanistan.

I do recognize he has made some changes, and those habe mostly been for the better, but there seems to be a lot where he is continuing Trump policies not for very good reasons, and against his own campaign pledges.

https://www.nytimes.com/2021/09/15/opinion/biden-spending-plan-welfare.html

September 15, 2021

Can America Afford to Become a Major Social Welfare State?

By N. Gregory Mankiw

In the reconciliation package now being debated in Washington, President Biden and many congressional Democrats aim to expand the size and scope of government substantially. Americans should be wary of their plans — not only because of the sizable budgetary cost but also because of the broader risks to economic prosperity.

The details of the ambitious $3.5 trillion social spending bill are still being discussed, so it is unclear what it will end up including. In many ways, it seems like a grab bag of initiatives assembled from the progressive wish list. And it may be bigger than it sounds: Reports suggest that some provisions will arbitrarily lapse before the end of the 10-year budget window to reduce the bill’s ostensible size, even though lawmakers hope to extend those policies at a later date.

People of all ages are in line to get something: government-funded pre-K for 3- and 4-year-olds, expanded child credits for families with children, two years of tuition-free community college, increased Pell grants for other college students, enhanced health insurance subsidies, paid family and medical leave, and expansions in Medicare for older Americans. A recent Times headline aptly described the plan’s coverage as “cradle to grave.”

If there is a common theme, it is that when you need a helping hand, the government will be there for you. It aims to assist people who are struggling in our rough-and-tumble market economy. On its face, that instinct doesn’t sound bad. Many Western European nations have more generous social safety nets than the United States. The Biden plan takes a big step in that direction.

Can the United States afford to embrace a larger welfare state? From a narrow budgetary standpoint, the answer is yes. But the policy also raises larger questions about American values and aspirations, and about what kind of nation we want to be.

The Biden administration has promised to pay for the entire plan with higher taxes on corporations and the very wealthy. But there’s good reason to doubt that claim. Budget experts, such as Maya MacGuineas, president of the Committee for a Responsible Federal Budget, are skeptical that the government can raise enough tax revenue from the wealthy to finance Mr. Biden’s ambitious agenda.

The United States could do what Western Europe does — impose higher taxes on everyone. Most countries use a value-added tax, a form of a national sales tax, to raise a lot of revenue efficiently. If Americans really want larger government, we will have to pay for it, and a VAT could be the best way.

The costs of an expanded welfare state, however, extend beyond those reported in the budget. There are also broader economic effects….

N. Gregory Mankiw is a professor of economics at Harvard.

https://cepr.net/alternative-to-mankiws-view-on-tax-incentives-and-work-maybe-europeans-want-more-free-time/

September 15, 20231

Alternative to Mankiw’s View on Tax Incentives and Work: Maybe Europeans Want More Free Time

By DEAN BAKER

Greg Mankiw warned New York Times readers about the dangers of adopting the Biden agenda and moving more towards a European-style welfare state. In his piece, * titled “Can America Afford to be a Major Welfare State,” Mankiw noted:

“Compared with the United States, G.D.P. per person in 2019 was 14 percent lower in Germany, 24 percent lower in France and 26 percent lower in the United Kingdom.

“Economists disagree about why European nations are less prosperous than the United States. But a leading hypothesis, advanced by Edward Prescott, a Nobel laureate, in 2003, is that Europeans work less than Americans because they face higher taxes to finance a more generous social safety net.”

While Prescott and Mankiw attribute the gap in annual work hours between Europe and the United States to the disincentive created by higher European taxes, there is an alternative explanation: Europeans workers may just want to have more leisure time and they have the political power to impose their will.

Supporting this view is the fact that the European welfare states all mandate far more paid time off than the United States. Germany mandates that workers get 20 days a year of paid vacation, in addition to 13 paid holidays. The Netherlands also mandates 20 days of paid vacation, in addition to 9 paid holidays. Demark mandates 25 days of paid vacation and 9 paid holidays. These countries also all mandate paid sick leave and paid family leave.

In other words, it is not simply that individuals are looking at the tax code and deciding to work less, parliaments are writing laws that guarantee most workers more leisure and less work. This is because politicians win elections based on the promise of more leisure and less work.

It’s true, as Mankiw points out, that Europeans on average have lower incomes than people in the United States, but this is largely because they have made a political decision that they prefer more leisure time to higher incomes. (The gap in income for the typical worker is almost certainly not as large as the gap in the average income, since there is less income inequality in Europe.)

Mankiw may think that it’s better for people to work more and have more money, but apparently people in Europe think otherwise. Since several states and cities have mandated paid family leave and sick leave in recent years, it may be the case that people in the United States also disagree with Mankiw.

* https://www.nytimes.com/2021/09/15/opinion/biden-spending-plan-welfare.html

Thanks for Dean Baker’s counter to Mankiw. Back to Mankiw’s pseudo-economic sniping:

“Economists disagree about why European nations are less prosperous than the United States. But a leading hypothesis, advanced by Edward Prescott, a Nobel laureate, in 2003, is that Europeans work less than Americans because they face higher taxes to finance a more generous social safety net.”

But wait Mankiw wants workers to pay more in sales (or VAT) taxes if we pursue a deeper safety net. After all Mankiw loathes the idea of taxing the Hampton crowd with taxes on capital income.

And Mankiw wonders why the Harvard kids walked out of his class!

There is also the matter that Europeans have much lower costs for health care by several percents worth of GDP, which also seem to generally deliver the health goods better than does the substantially more expensive US system. This is is not all difference, but adds to the lesiure/labor story Dean tells.

Dean Baker and Greg Mankiw at least agree on one thing. We need to end the AMA cartel that makes sure we have too few doctors driving up their high salaries. And one way to get more doctors is to allow talented doctors abroad to move here and practice.

The US has more debt thus isn’t that “prosperous”. The story of capitalism is ending. Period. The Bourgeois state won’t be able to hold up the con forever. Glibers are so self-rightous, they are the kind of morons which would trigger that debt crisis, destroy most of the economy and set the stage for the rise of the commons and the natural elite.

Gregory Bott: Please, what is the definition of “gliber”?

Libertarian put down slang.

“Europeans workers may just want to have more leisure time and they have the political power to impose their will.”

my experience with european professionals, at least since 2000, is that this is pretty accurate. it is not unusual at all for me to deal with somebody from europe to disappear for a couple of months each summer, going on holiday. they rent homes on a european beach, with their extended family, and relax for most of the summer. these folks also appear to be less stressed and more productive when working the remainder of the year. it does put more pressure on the folks they leave behind in the summer, who must pick up the slack in the usa. personally, i think the european model is more sustainable. i know high wage professionals in the usa who never take a day off and are beyond stressed. they may make more money, but probably have a shorter life span to spend it. more hours worked does not necessarily lead to more productivity.

The argument that people will be working less if taxed more, is absurd. It has no actual data behind it. It also has no logic. For the wast majority of people the decision to “slow down” and either stop or reduce work hours, is connected to how much money they feel they need. If I cannot live “comfortably” on the, after tax, income of a 40 hour work week, I will look for ways to increase work hours (and income). If my current, after tax, income leave me more than comfortable, then I may consider slowing down.

The driver is AFTER TAX incomes – so there is a strong logic argument for the exact opposite narrative of what Mankiw and other millionaires like to argue. If you tax people more they will have to work more before they get up to an income level that define “comfortable” to that specific person. However, when you look at business owners and the investor class, the driver is not really a desire to reach a specific level of (comfortable) income – they are mostly driven by a desire for “more/better”. Same goes for the creator class. Most of them accept absurdly low incomes and high risks, because it is their creation that matters more than anything else.

Ivan: In econ-speak, you’re assuming income effect always dominates substitution effect. Is that reasonable? I don’t know of empirical work that says that is the case in the US.

No I cannot pull out a reference to empirical work in support of my hypothesis. But since we are discussing Mankiw’s postulates – I figured that if he can pull it straight out of his main ass’et, so can I. My personal preferences are at least as good as his 😉

Greg Mankiw lecturing us on fiscal responsibility? Seriously? We could raise a lot more on capital income if we tried. But to the Mankiw crowd – taxing capital income is even more evil than SOCIALISM (ewww).

This is Mankiw pretending to be an economist. He does this quite a bit. That doesn’t mean he is not actually an economist at other times, but not so much when he’s writing for the public at large. The $3.5 trillion in question amounts to 1-ish% of national output over the decade in question. Much of that amount goes into public sector capital goods, so the scary music in the background is over less than 1% of national output.

All the stuff about changing who we are and broader economic effects is too vague to be assessed on its merits, which is exactly why Mankiw wrote it that way. This is Mankiw at his pretend-economist best, wiggling his eyebrows ominously at his masters’ behest. What he means is, the U.S. might no longer be arranged to advantage Mankiw’s political masters, and that would be bad for Mankiw.

Biden is touting this letter from 15 Nobel Prize winning economists about the benefits from his economic proposals:

https://www.documentcloud.org/documents/21063166-nobel-prize-letter-in-support-of-biden-economic-program

Whoa – the last line claims the plan if passed will reduce long-run inflationary pressures. I bet old Donald Luskin is fuming over this. Time for him to call he 15 favorite “economists” which of course includes himself, Lawrence Kudlow, Stephen Moore (the 3 stooges) but he will need 12 other clowns. I bet Johnny Cochrane will be glad to sign onto this “rebuttal” letter!

France is angry that we are selling nuclear powered submarines to the Aussies as France had hoped to sell the Aussies a bunch of diesel power subs:

https://gulfnews.com/world/oceania/australia-dumps-french-submarine-deal-for-us-nuclear-fleet-1.82301787

I can see the execs at Boeing having a little fun over this as it is sort of pay back for Airbus selling more planes to the world than we do.

this is a direct result of the chinese expansion into pacific waters. if china were not illegally claiming the south china seas, i would imagine the aussies would have been content with the cheaper diesel subs. but the usa needs friends in the pacific who can help to contain chinese expansion. with the aussies operating a virginia class nuclear submarine in the western pacific region, it keeps china looking out for multiple adversaries.

Why would you like to have a nuclear sub as attack sub when the AIP version is more silent?

The USA and UK are not able to provide AIP subs, therefore, we see now the nuclear option, which is not the best.

Nuclear subs are much harder to track, as they can stay submerged much longer. Diesel subs need to surface and recharge their batteries. This is not as stealthy. The virginia class subs are a lethal weapon and significant deterrent to adversaries in the western pacific. I dont think france can produce a better submarine than what Australia will be obtaining.

The execs at Boeing shouldn’t be laughing any anybody but themselves for screwing up pretty much everything they have touched since moving their corporate headquarters to Chicago and trying to bust unions by heading to South Carolina.

https://twitter.com/jeremycorbyn/status/1438464651579244547

Jeremy Corbyn @jeremycorbyn

Starting a new cold war will not bring peace, justice and human rights to the world.

#AUKUS

7:27 AM · Sep 16, 2021

[ Why repeated false accusations of ethnic prejudice were used in Britain and echoed through the world of Rupert Murdoch to undermine the Labour leadership of Jeremy Corbyn. ]

I know of no American political leader who supported Jeremy Corbyn as head of British Labour. Surely there must have been such a person, but who? Bernie Sanders, possibly? No matter, I supported Corbyn. I know what integrity and empathy are about.

https://www.nytimes.com/2021/09/14/us/politics/peril-woodward-book-trump.html

September 14, 2021

Fears That Trump Might Launch a Strike Prompted General to Reassure China, Book Says

In a sign of his concerns, the nation’s highest-ranking military officer also gathered commanders to remind them of the safeguards in the nuclear launch procedures.

By Michael S. Schmidt

[ Starting a new cold war will not bring peace, justice and human rights to the world.

— Jeremy Corbyn ]

Keir Starmer, the Labour leader chosen this time by Tony Blair, is of course pleased about sending nuclear war-ships to the coast of China (in 15 to 20 years that is), How droll, but telling for a Britain that could not even cope with Germany and France.

https://www.nytimes.com/2021/09/17/world/europe/france-ambassador-recall-us-australia.html

September 17, 2021

Furious Over Sub Deal, France Recalls Ambassadors to U.S. and Australia

By Roger Cohen and Michael D. Shear

PARIS — Calling American and Australian behavior “unacceptable between allies and partners,” France announced on Friday that it was recalling its ambassadors to both countries in protest over President Biden’s decision to provide nuclear-powered submarines to Australia.

It was the first time in the history of the long alliance between France and the United States, dating back to 1778, that a French ambassador has been recalled to Paris in this way for consultations. The decision by President Emmanuel Macron reflects the extent of French outrage at what it has called a “brutal” American decision and a “stab in the back” from Australia….

https://www.nytimes.com/2021/09/17/us/politics/us-france-australia-betrayal.html

September 17, 2021

Secret Talks and a Hidden Agenda: Behind the U.S. Defense Deal that France Called a ‘Betrayal’

In meeting after meeting with their French counterparts, U.S. officials gave no heads-up about their plans to upend France’s largest defense contract.

By David E. Sanger

The United States and Australia went to extraordinary lengths to keep Paris in the dark as they secretly negotiated a plan to build nuclear submarines, scuttling France’s largest defense contract and so enraging President Emmanuel Macron that on Friday he ordered the withdrawal of France’s ambassadors to both nations….

Thinking about the business cycle in my usual non-technical, seat of the pants way has me noting new unemployment claims. At the end of the last recovery, claims were around 200k per week. My usual rule of thumb is that anything less than 400k per week is good. When they fall down around 200k per week, it’s pretty close to the end of the boom. Right now, we are just under 400k per week, which means that we have a pretty good run ahead of us.

I also noted that the consensus for economic growth in this quarter has been revised down (!) to 4.5% from up to 9%. Even with the bounceback from COVID, I don’t see how 9% is a reasonable prediction in an economy as big as the United States.

That’s all of my non-technical lack of wisdom for now, and probably for the next few months. Maybe longer. I don’t smell anything except reasonable recovery in most of the economy for the next year or so.

Willie,

Couple of things —

The Atlanta Fed’s GDPNow pages include a break-out of GDP components in the nowcast,so you can see where one very good adding up of quarterly growth sees that growth coming from: https://www.atlantafed.org/cqer/research/gdpnow?panel=3

You’ll see that personal consumption, business and residential fixed investment have all been marked down recently, accounting for most of the downward revision in is about everybody’s forecast.

The other thing is the Sahm Rule: https://fred.stlouisfed.org/release?rid=456

Claudia Sahm’s clever observation is that a rise in the U3 jobless rate of 0.5% is a reliable predictor of recession. Not quite what you are saying, but yeah, watch the labor market.

macroduck,

Are you aware that apparently the “Sahm Rule,” which against usual convention she named herself on her multiple media outlets, was actually initially developed by former NY Fed President William Dudley? This is now sort of a scandal in the profession, that Claudia Sahm failed to credit Dudley for developing it ahead of her? In her defense, it looks that Dudley presented it initially in a rather obscure outlet that did not get much publicity, and I think everybody agrees that Claudia figured it out independently of him without ever having seen his version of it before she cooked up her version and publicized it widely.

Where she is facing a lot of criticism now on this is apparently failing to properly accept that he beat her to the punch on this matter, and engaging in a lot of not impressive whining about him and others bringing it up that the “Sahm Rule” should probably be called the “Dudley Rule’ (or maybe the Dudley-Sahm Rule). This is currently a big buzz war on Econ Twitter, which I am glad I am not on as it seems to be a place for people to make serious fools of themselves. It may be that it is a great place, reputedly in sub-parts of it where specialists communicate below the radar with each other productively. But what those of us not there hear from there mostly are all the bloopers and insults and nonsense where well-known economists make fools of themselves.

back on topic for a minute…using appropriate price indexes from the CPI report, i’ve adjusted August retail sales to find that real personal consumption of goods rose 0.3% in August…with a 0.6% downward revision to July’s sales and a 0.1% upward revision to June sales, we find that real personal consumption of goods fell by a revised 2.2% in July and rose by a revised 0.4% in June, after falling by 2.6% in May, and after falling by 0.4% in April, as indicated by the most recent income & outlays report..

with those estimates for the relative change in real PCE goods between the months of the 2nd and 3rd quarter, we should be able to also estimate the change in PCE goods between those two quarters….setting August’s real PCE goods as an index equal to 100, we can then say that July’s PCE goods equals 99.7 (100-0.3%); from that, we get a index value of 101.9 for June, 101.5 for May, and 104.1 for April…we then compute the quarter over quarter change in those index values at a quarterly rate to determine the probable change that would be applied to 3rd quarter GDP…(((100 + 99.7)/2) / ((101.9 + 101.5 + 104.1)/3)) ^4 = 0.900527, which means that real PCE goods are falling at a 9.9% annual rate over the 2 months of the third quarter we have estimates for…since 2 months of PCE goods is roughly 16% of GDP, that suggests that PCE goods over those two months will subtract roughly 1.59 percentage points from 3rd quarter GDP…

does anyone care that i made a mistake in this estimate?

here’s what i did: while July’s retail sales were revised 0.6 lower, June’s were revised 0.1% higher, so the decrease in sales from June to July was 0.7% more than previously indicated…i only revised my estimate of the change from June to July to reflect the 0.6% downward revision to July…

hence, i should have figured real personal consumption of goods fell by a revised 2.3% in July, not 2.2%

however, since i indexed all the prior month’s changes off August, that means that my index values prior to July were off because of that error….those index values should be 102.0 for June, 101.6 for May, and 104.2 for April…

hence, my calculation of the change in real PCE goods that would be applied to 3rd quarter GDP should be (((100 + 99.7)/2) / ((102.0 + 101.6 + 104.2)/3)) ^4 = 0..897, and real PCE goods have thus fallen at a 10.3% annual rate over the 2 months of the third quarter we have estimates for…so the change in real PCE goods over those two months would subtract roughly 1.65 percentage points from 3rd quarter GDP…

i know that no one cares about that, but i have a problem with leaving an error that i’ve made sit out here without a correction…

Don’t be too hard on yourself. Sometime around 200 BC, Eratosthenes calculated the circumference of the world to within 2.4% of the real value, using two sticks and a lucky break. If the description of Erotosthenes’ method provided by Cleomedes is accurate, it involved two errors which were nearly perfectly offsetting. You didn’t have the good fortune of makings two mistakes, but you are still in fine company.

Fortunately the Federal Reserve chooses to credit fine scholarship:

https://fred.stlouisfed.org/graph/?g=GTkg

January 30, 2020

Real-time Sahm Rule and Sahm Rule Recession Indicators, 2000-2021

ltr,

Two problems with this post, which do not support your claim worth a bean.

First is that the source of this is Sahm herself. Did you not catch that? More important is the date on it. It is from January. Most of the fuss over this has erupted since then.

It may well be that it will continue to be called “the Sahm Rule” as there is a large amount of path dependence regarding names of things. Once a name gets established and starts being used for data sourxes and so on, it is generally very hard to change it, even if it is shown that is misleading.

That I think will be the case here. It properly should be called the “Dudley-Sahm Rule,” but that will probably not happen. However, I can tell you that out in various parts of the internet, Sahm has really damaged her own credibility by trying to deny the priority on this of Dudley. There is more to all this, much of it not looking good for her. But I do not think that stuff is relevant here.

In any case, your link only proves you are not on top of this.