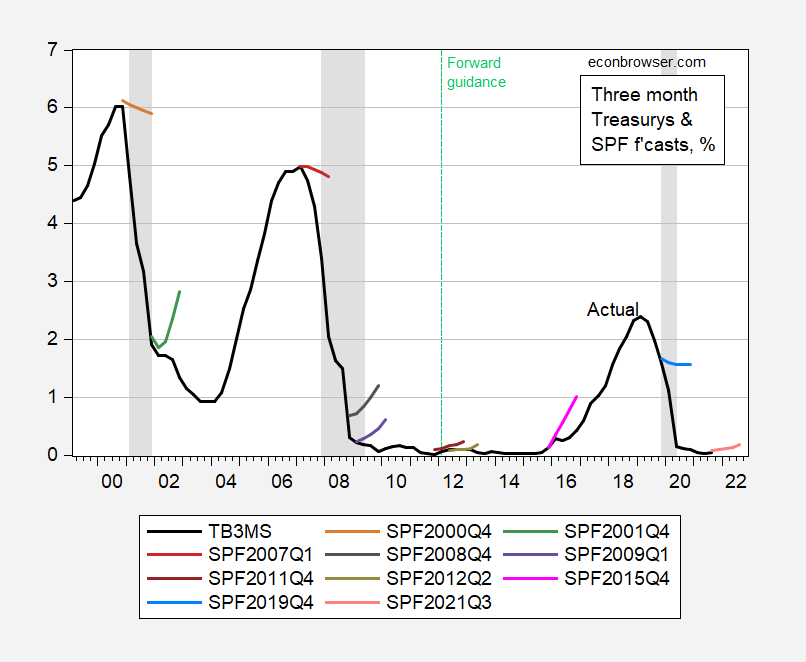

I was looking at survey based forecast errors for short term interest rates, when I generated this graph. It’s certainly a humbling picture.

Figure 1: Three month Treasury yields on secondary market, monthly average of daily data (black), Survey of Professional Forecasters mean forecasts from indicated quarters. NBER recession dates shaded gray. Source: Federal Reserve and Philadelphia Fed Survey of Professional Forecasters, and NBER.

To a certain extent, the tendency to project falling rates when interest rates are high, and to project rising rates when they are low, is a reflection of the belief in mean reversion. On the other hand it’s interesting that even at turning points, consensus views wildly miss the trajectory of short rates.

For forecasts of ten year Treasury yields, see this post, where a similar pattern is found. However, the 3 month Treasury is closely linked to the Fed funds rate (see Rudebusch for those forecasts), so this outcome is really in a way a reflection of how poorly economists can figure out the Fed’s reaction to developments that themselves are largely unpredictable (meltdown in shadow banking, the Covid pandemic).

This may seem strange coming from me as much as I enjoy throwing tomatoes and general whining (I said whining, not wining Menzie). But some of my biggest idols in life have been economists (some of them dead before I was born). They get their views of the horizon (near or far) closer than most people do. You can’t be too harsh on a profession because of not being able to “nail it” on processes that are extremely complex and as a mathematician might say “have near endless permutations”.

Economists are throwing the dart clear from the other side of the Texas roadhouse, otherwise, what’s the point?? They aren’t trying to tell us the sun will come up tomorrow, or tell us that air is lighter than water.

Keep on adding calibrations, eventually something good happens. And the hunt for that magic elixir is part of the fun too. Hell, even Professor Chinn is kind of a semi-idol for me, His ability at math, ability to see politics for what it really is (and not just because he leans a little left). His dry humor (good quality dry humor is in short supply since Letterman left CBS). Hey, economics is a natural/organic magnet for a lot of quality people, for that reason alone it’s a discipline to be admired.

so you do not RATE them at RATES.

What if they had to put their money where their mouth is? Do you think they would develop hedging strategies, i.e. sell bill futures high to fund short-term bond fund purchases?

Why don’t forecasters give us portfolio examples based on their expertise?

a forecaster with a portfolio is a biased cheerleader.

Why do economists forecast? To make the weather man look good.

Dittos.

Plus, both know they won’t get fired no matter how many times they are wrong.

What math could have predicted The Fed raising short rate targets from 0.25% – 0.50% in 2016 to 2.25% – 2.50% in 2018?

“targets” seems like funny terminology here, but I’m sure I’m missing something. I knew they “targeted” inflation but I didn’t know they “targeted” rates.

Moses Herzog: The FOMC sets a target for the Fed funds rate (and for other rates).

I mean I guess this (to me) turns into a kind of semantics. I think if you “target” something, it’s somewhat out of your control or “yet to be seen/decided”. Which I think as we see now, a certain inflation rate is being “targeted” by the Fed, and missed. To me, If it’s almost a dictate what the Fed funds rate is, it is being “set”, not “targeted”. I’m not being sarcastic when I say I’d like to be told how I am missing it here~~are you telling me setting the Fed funds rate is not as definitive as I am thinking it is?? I mean maybe not to a single basis point, but pretty damned close. Whereas with inflation, I think an argument could be made, they are 5%+ off their target (currently), Where the Fed funds rate is more “set”, because they’re probably getting it within 25 basis points. So, at least in my mind the “setting” terminology applies better than “targeting” if it’s near to a foregone conclusion the Fed will get what they want.

I mean I know this will sound r***rded, but to me it’s like the certainty of setting your Amana thermostat vs shooting an arrow. There’s a difference in certainty there. Which the different terms imply.

Moses,

The federal funds rate is set by market forces. The Fed carries out various actions to influence that rate to stay near its target, including daily open market operations involving the Fed buying and selling mostly repos to influence what the fed funds rate is.

In contrast the Fed itself, the Board of Governors to be precise, actually sets the IORF and the discount rate. The first is the rate that the Fed pays banks for reserves they deposit at the Fed. It is not set by a market. The discount rate is what banks pay the Fed if they borrow from the Fed, which they do from the district Feds, if and or when they do so. Again there is no market setting that rate; it is whatever the Board of Governors says it will be.

Some time ago here Jim Hamilton explained that it is generally the case that the discount rate is set to be above the IORF, and that these operate effectively as bounds, with the targeted federal funds rate being between those two. But market forces remain what actually determines what the federal funds rate is at any particular moment, even as the Fed intervenes in markets to influence that. But the IOFR and discount rates do not move around in response to market forces. They just sit there at whatever levels the Fed has set them to be.

Got it?

several of these misses are related to going into or out of a recession. with two of the events being nearly unprecedented (financial crisis and pandemic). i find it hard to be too pessimistic about their performance. for instance, the 2008 and 2009 misses are the result of anticipating the bottom. i don’t think the economists anticipated the republican party’s attempt to sabotage the recovery that kept rates continuously low.

the 2019 predictions obviously did not include the oncoming pandemic. they may have been accurate had the coronavirus not spread throughout the world.

i guess if you can improve your fat tail predictions in the world, you can produce better rate predictions. the predictions look a little better outside of those fat tail periods.

i guess economic accuracy will always be overshadowed by black swan events.

https://www.nytimes.com/2021/10/26/business/economy/biden-inflation.html

October 26, 2021

Rising Prices, Once Seen as Temporary, Threaten Biden’s Agenda

Supply chain disruptions, a worker shortage and pain at the gasoline pump have made inflation an economic and political problem for the White House.

By Jim Tankersley

WASHINGTON — At least once a week, a team of President Biden’s top advisers meet on Zoom to address the nation’s supply chain crisis. They discuss ways to relieve backlogs at America’s ports, ramp up semiconductor production for struggling automakers and swell the ranks of truck drivers.

The conversations are aimed at one goal: taming accelerating price increases that are hurting the economic recovery, unsettling American consumers and denting Mr. Biden’s popularity.

An inflation surge is presenting a fresh challenge for Mr. Biden, who for months insisted that rising prices were a temporary hangover from the pandemic recession and would quickly recede….

https://www.nytimes.com/2021/10/26/business/inflation-interest-rates-treasury-bonds.html

October 26, 2021

The Bond Market Says Inflation Will Last. You Should Be Listening.

Inflation is as much a psychological process as an economic one. And a key indicator of inflation expectations has risen in recent days, which could ultimately lead to higher interest rates.

By Matt Phillips

Almost everyone — buyers of used cars, renters, homeowners with big heating bills and stock market investors — has been fretting about rising prices lately. But despite some of the fastest price increases in decades, investors in the Treasury bond market who are keenly attuned to inflation have been steadfast in their belief that it was a temporary phenomenon.

That’s now changing.

A key measure of the bond market’s expectations for inflation over the next five years — known as a break even — rose to a new high, briefly topping 3 percent on Friday. That meant investors expected inflation to average about 3 percent a year for the next five years, far higher than any time in the decade before the pandemic hit. Measures of inflation expectations over longer periods, such as over the next 10 years, also rose to multiyear highs….

Gee – 3% inflation would be the end of civilization … NOT! Especially since smart economists like DeLong and Summers were calling for a 5% inflation target in this era of low nominal interest rates.

https://www.nytimes.com/2021/10/27/business/economy/food-prices-us.html

October 27, 2021

Higher Food Prices Hit the Poor and Those Who Help Them

Many households are being forced to adjust their shopping lists or seek assistance. But food banks, too, are feeling the pinch.

By Nelson D. Schwartz and Coral Murphy Marcos

With food prices surging, many Americans have found their household budgets upended, forcing difficult choices at the supermarket and putting new demands on programs intended to help.

Food banks and pantries, too, are struggling with the increase in costs, substituting or pulling the most expensive products, like beef, from offerings. What’s more, donations of food are down, even as the number of people seeking help remains elevated.

Even well-off Americans have noticed that many items are commanding higher prices, but they can still manage. It’s different for people with limited means….

sorry for off topic, but nice article on how inland cities such as chicago are being affected by climate change

https://www.cnbc.com/2021/10/27/chicago-and-great-lakes-hurt-by-climate-change-need-infrastructure.html

the saltwater coastal cities will begin to deal with very similar issues soon. miami beach already gets flooded regularly with king tides. same thing for the keys. this is going to be costly for our infrastructure. since the denialists dont want to pay for preventive medicine, you better get ready to pay for the damage we are beginning to see today. it is no longer a fiction.

https://news.cgtn.com/news/2021-10-26/High-oil-prices-can-help-the-environment-14G7DOwZEdy/index.html

October 26, 2021

High oil prices can help the environment

By Jeffrey Frankel

Prices of fossil fuels increased sharply in October. European prices for natural gas hit a record peak. Prices for thermal coal in China have also reached all-time highs. The price of U.S. crude oil is above $80 a barrel, its highest level in seven years, prompting U.S. President Joe Biden’s administration in August to call on OPEC and other major oil-exporting countries to increase production.

Although these high prices partly reflect country-specific factors, there must be some more fundamental cause. After all, as with fuel prices, indices of mineral and agricultural commodity prices have also recovered from a six-year slump, re-attaining their 2014 levels. The long-standing correlation of different commodity prices suggests a common macroeconomic explanation. And the obvious reason why energy prices have risen in 2021 is rapid global economic growth.

But what are the environmental implications of elevated fossil-fuel prices, specifically with respect to the fight against climate change? The question is particularly salient as officials from over 200 countries prepare to gather in Glasgow for the UN Climate Change Conference (COP26), where they are expected to declare their intention to achieve net-zero carbon-dioxide emissions by 2050.

On one hand, the effect of high oil, gas, and coal prices on consumers is good for the environment, because they discourage demand for fossil fuels. On the other hand, the effect of high prices on producers is bad for the environment, because they encourage supply.

But today’s higher fossil-fuel prices have so far provided a weaker-than-expected stimulus to private investment in the sector. This suggests that firms may have reached a tipping point in how seriously they take the need to combat global warming. They know a green-energy transition is coming.

Now might therefore be the right time for the United States to reconsider a carbon tax or a (largely equivalent) system of tradable emissions permits, also known as “cap and trade.” Currently, much of the revenue from higher oil and gas prices goes to Russia, Saudi Arabia, and other foreign producers. Why not keep this revenue at home? The proceeds of the tax or permit auction could be returned as a dividend to citizens by cutting other taxes, thereby maximizing the scheme’s political acceptability.

The important point is that putting a price on carbon would be by far the most efficient way to achieve the CO2-emissions reductions necessary to limit global warming to 1.5 degrees Celsius, relative to pre-industrial levels….

Jeffrey Frankel is professor of Capital Formation and Growth at Harvard University.

A very good discussion. Please note the following:

“Prices for thermal coal in China have also reached all-time highs.”

You have persistently said the opposite. Frankel is correct so stop the lying.

“On one hand, the effect of high oil, gas, and coal prices on consumers is good for the environment, because they discourage demand for fossil fuels.”

Oh my – this may set CoRev off. Expect some of his patented rants against WIND.

all the tax incentives, and salesmanship…… for 35 years hearing it is almost too late……

see texas last winter.

frankel should us “might be” ilo “is”……

the carbon tax’s ‘green economy’ is science fiction…

no object no bounds!

paddy,

This is so off it is barely worth responding to. But 1) the problems in Texas last winter were due to mismanagement by those managing natural gas there with a longstanding failure to winterize their facilities by the appropriate firms, which had nothing to do with green energy., and 2) there has been no carbon tax in the US, so how could it have led to any of those problems either.

“Now might therefore be the right time for the United States to reconsider a carbon tax or a (largely equivalent) system of tradable emissions permits, also known as “cap and trade.” Currently, much of the revenue from higher oil and gas prices goes to Russia, Saudi Arabia, and other foreign producers. Why not keep this revenue at home? The proceeds of the tax or permit auction could be returned as a dividend to citizens by cutting other taxes, thereby maximizing the scheme’s political acceptability.”

We need tax revenues to pay for Biden’s Build Back Better. That Blue Dog Senator from Arizona has decided we cannot tax corporate profits to do so. Alas that Blue Dog Senator from West Virginia probably hates Dr. Frankel’s suggestion. Can we put muzzles on these Blue Dogs? PLEASE!

biden, when asked ‘when gas prices would come down’…. he fumbled and mumbled

the answer is never..

carbon tax unfettered by engineering is trouble.

paddy,

More nonsense out of you. Oil prices go up; oil prices go down. Gasoline prices have followed crude oil prices up. But those just dropped by 2%. Maybe they will turn around and keep going up again. But Menzie noted here futures markets that suggest they will be going down again in the near future, perhaps quite a bit. If those markets prove right, gasoline prices will also go down.

This is just totally silly.

https://www.atlantafed.org/cqer/research/gdpnow

October 27, 2021

Latest estimate: 0.2 percent — October 27, 2021

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 0.2 percent on October 27, down from 0.5 percent on October 19. After the October 19 GDPNow update and subsequent releases from the US Census Bureau, the National Association of Realtors, and the US Department of the Treasury’s Bureau of the Fiscal Service, a decrease in the nowcast of third-quarter real government spending growth from 2.1 percent to 0.8 percent was slightly offset by an increase in the nowcast of third-quarter real gross private domestic investment growth from 9.0 percent to 9.3 percent. Also, the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth decreased from -1.56 percentage points to -1.81 percentage points.

“China does not have some massive coal surplus even if your political masters say so.”

“Prices for thermal coal in China have also reached all-time highs.”

You have persistently said the opposite. Frankel is correct so stop the lying.

[ Please notice the repeated horrid attempts at intimidation. Horrid intimidation is intolerable.

I have never addressed this person and never will, and I am always polite. ]

Asking people to be honest is not “horrid intimidation”. Give it a rest – and stop LYING.

https://twitter.com/YuanTalks/status/1452619266415423490

YUAN TALKS @YuanTalks

#China’s daily #coal supply to power plants have been more than their coal consumption for 20 straight days, with surplus exceeding 1 mln tonnes since Oct 19 and hitting 2 mln tonnes on Oct 23, said state planner NDRC.

8:53 AM · Oct 25, 2021

https://twitter.com/YuanTalks/status/1453014495379472389

YUAN TALKS @YuanTalks

#China’s most-traded thermal #coal futures contract in Zhengzhou, for Jan delivery, tumbles for the 6th consecutive session, sliding over 6% to break through 1,200 yuan/tonne mark on Tue night.

11:03 AM · Oct 26, 2021

[ China continues to add to the coal surplus, the price of coal in China continues to fall. Coal mining, delivery and storage will be ample through the winter. China is in addition steadily increasing production of oil and gas and renewable fuel supplies and storage facilities. ]

https://twitter.com/YuanTalks/status/1453387913039728645

YUAN TALKS @YuanTalks

#China’s most-traded thermal #coal futures contract hit limit-down again, slumping 13% to hit 1,033.8 yuan/tonne. The contract plunged nearly 48% in eight days.

11:47 AM · Oct 27, 2021·Twitter Web App

Energy is always of concern in China and for years the Chinese have steadily worked to develop fuel sources and delivery systems and energy transmission resources. Years more work will be necessary, but this is not a country that will be energy limited by logistics internally or by international relations vagaries. Homes are to be heated in winter, factories are to be run. So. no matter the always dire China projections of New York Times writers, express measures were immediately taken when the fuel shortage was understood to resolve the problem. Having the sort of infrastructure that China already has is a critical factor in resolving a fuel shortage, that along with administrative flexibility that is always being questioned but is remarkable.

“China does not have some massive coal surplus even if your political masters say so.”

“You have persistently said the opposite. Frankel is correct so stop the lying.”

“Asking people to be honest is not “horrid intimidation”. Give it a rest – and stop LYING.”

[ Again, this person who I never address and never will address persists in trying to intimidate me. Attempts at intimidation are pernicious and intolerable.

Of course, as was documented, I was completely correct. Of course, I was completely honest. ]

quoting something from the ccp propaganda arm does not qualify as verifying your comment is correct.