ZeroHedge breathlessly announces “Atlanta Fed Says US Economy Suddenly On Verge Of Contraction”. The title is numerically correct, and the article actually provides more context than usual. However, for perspective, I think it’s of interest to see what other organizations are nowcasting.

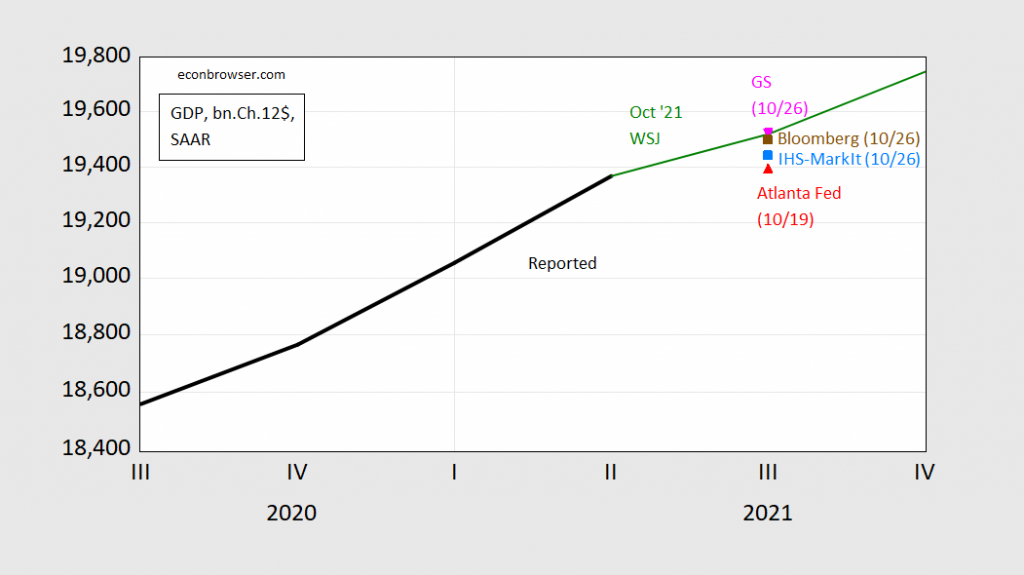

Figure 1: GDP (black), implied GDP from Atlanta Fed (10/19) (red triangle), IHS-MarkIt (sky blue square), Bloomberg consensus (brown square), Goldman Sachs (inverted pink triangle), and mean forecast from WSJ October survey (green line). Levels calculated using reported growth rates and latest GDP for Q2. Source: Atlanta Fed, IHS-Markit, Bloomberg, Goldman-Sachs, WSJ October survey, and author’s calculations.

The Bloomberg consensus reported as of today on the website is pretty much at the WSJ survey mean taken in the first week or so of October. As for nowcasts, the Atlanta Fed’s GDPNow estimate is below the IHS-MarkIt (nee Macroeconomic Advisers) nowcast and substantially below the Goldman Sachs tracking estimate. However, the GDPNow nowcast is now a week old, with a new release set for tomorrow.

A final thought: Even if the advance release reports 0.5% q/q growth SAAR, the mean absolute revision going from advance to second, and going from advance to third release are, respectively, 0.53 and 0.59 percentage points (1996-2018) (see here for more documentation).

“the Atlanta Fed’s GDPNow estimate is below the IHS-MarkIt (nee Macroeconomic Advisers) nowcast and substantially below the Goldman Sachs tracking estimate.”

ZeroHedge does admit that Goldman Sachs is still bullish but only to toss out a quip as if Goldman Sachs is clueless (per ZeroHedge).

Now if there is any substance to his discussion, it goes like this. Household consumption may decline as the COVID stimulus runs out. OK – then isn’t that more reason to pass Build Back Better ASAP?

it’s hard to imagine an actual contraction because we’ll get a big boost from inventories, which fell sharply in Q1 & Q2, and hence even modestly lower Q3 inventories (deflated with PPI components) will add to GDP….but we might see a contraction in real final sales of domestic product, the metric that strips out inventories…

even so, it would be a technical contraction, rather than one necessarily portending a downturn….we had the big jump in PCE in March with the stimulus checks, and that continued into April, but PCE has been flat to lower since…since GDP measures quarter over quarter, April’s artificial high has made for difficult quarter over quarter comparisons since…

this morning’s advance indicators:

September 2021: +1.1 % wholesale Inventories

September 2021: -0.2* % retail Inventories

trade deficit in goods increased to $96.3 billion in September from $88.2 billion in August as exports decreased and imports increased.

durable goods:

-shipments increased $1.1 billion or 0.4 percent to $257.0 billion

-inventories increased $4.0 billion or 0.9 percent to $462.7 billion

those Inventory changes wouldn’t move the needle much on my estimates of the inventory impact, but i’d been holding out for a 3Q positive trade print and that looks to be in the toilet now…

a few notable details on shipments of durable goods…shipments of transportation equipment fell 1.0% to $72.5 billion on a 2.3% drop in shipments of motor vehicles…meanwhile, shipments of nondefense capital goods less aircraft were up 1.4% at $75,893 million, their seventh monthly increase in a row ..

that would be a proxy for equipment investment before any inflation adjustment: https://fred.stlouisfed.org/series/ANXAVS

ZH is one of my go-to guys.

He and I forecasted 75+ of the past six market contractions.

T.Shaw: I am completely unsurprised by your first revelation.

That is precisely why I wrote it.

A different topic which came up as I was correcting ltr’s spin on China and coal prices but one Menzie might have some insights on:

https://www.maritimeprofessional.com/news/china-coal-imports-from-australia-370593

China has traditionally imported a lot of coal from Australia but tensions between the two nations led the Chinese government to cease these imports. Now this has driven up coal prices in China but note China has turned to places like Indonesia and Russia for coal imports. And Australia has found other nations to buy their coal exports.

So coal has become the new soybean?

proly a bit skewed……

“The U.S. is practically drooling at the opportunity to become China’s coal hookup. After reporting almost zero coal exports last year, the U.S. is looking at a fire sale in the making. American miners shipped out 156 million tons this past June alone, 28 million of which went straight to China. ”

with naturl gas prices up 500% in some regions…. coal is not dead……

https://uscoalexports.org/2021/10/26/coal-2022-outlook-its-back-from-the-dead/

in the 20 teens there was much speculation about montana coal going to china.

That revision mean number is actually bigger than I thought it might be (and I can be cynical on “official” numbers sometimes). That’s very fascinating and mildly surprising (from my view). The other thing I was thinking (one of the many things I’ve learned and then turned around and forgot)~~~Wasn’t there some statistical “trick” or looking at a certain small number of factors to know which direction the revision would usually go at any particular point in time?? Any enlightenment on this would be appreciated. Or even to just tell me the latter is hogwash.

https://twitter.com/YuanTalks/status/1452619266415423490

YUAN TALKS @YuanTalks

#China’s daily #coal supply to power plants have been more than their coal consumption for 20 straight days, with surplus exceeding 1 mln tonnes since Oct 19 and hitting 2 mln tonnes on Oct 23, said state planner NDRC.

8:53 AM · Oct 25, 2021

More spin? China does not have some massive coal surplus even if your political masters say so.

NakedCapitalism has a great piece on the “transitory” supply chain problem at the Port of Long Beach: “ The only people I read who seemed to have a handle on the Port situation, or the supply chain generally, were logistics specialists — Petersen is CEO of a logistics firm — or truckers on the Twitter. Everybody else, and especially the press, just seemed to be hand-waving.” https://www.nakedcapitalism.com/2021/10/the-last-days-of-the-romanovs-at-the-port-of-los-angeles-where-is-everybody.html

Problem is, who knows how many critical components are involuntarily being stored on the 430,00 containers sitting on container ships off shore. Who knows? Maybe there are parts and assemblies out there that are needed to keep all sorts of systems running. A local heating and AC company noticed inventories of repair parts dwindling, so they stocked up. Nonetheless some parts are simply not available, and they are having to tell customers that they have no idea when they’ll arrive

Now scale that to the economy as a whole. Lots of auto workers furloughed because of a chip shortage. What industries will be next? And how will it affect the economy? Certainly not in a good way.

The worst part is that it seems that no one at a policy level has a clue on how to fix the problem.

This is where someone in the administration with business experience would come in handy. Someone who can figure out the factors that are in the critical path, and remove them to the extent possible. Biden? Kamala? Buttigieg?

Like you are some business expert? PLEASE!

Actually the government already has plenty of logistics experts…in the military. There are probably some who were assigned to supply Afghanistan who are looking for a new challenge, now that the US has decided to let Afghans starve in the name of human rights for Afghan women.

Sammy, “Biden? Kamala? Buttigieg? Anyone? The administration’s attitude to business might make it difficult to find Anyone?from the business community interested in helping.

This is the world their “pie in the sky, unicorn-based” policies has wrought, and many outside their party predicted and told them it was coming.

2022 elections are coming!

“The administration’s attitude to business”

I presume you are still referring to Trump’s mafia boys as this administration. Most incompetent boobs ever.

PGL: ” Most incompetent boobs ever.” Only the most dedicated ideologue can ignore the results from the past 4 years compared to those of the 1st nine months of your party’s choice for president and their unicorn, pie in the sky policies. Your preferred policies are now implemented how have they helped business? The economy? Inflation? Fight against Covid? Climate? Etc….?

I’ll wait.

CoRev: (1) Over a trillion dollars worth of tax cuts for the rich, and all we got is trend growth; (2) deepest recession *ever* in the US, (3) 130K unnecessary Covid-19 deaths, (4) a trade war in which we can’t even browbeat the Chinese into fulfilling pathetic phase 1 commitments, (5) a soybean price hit to the Midwest farmer that lasts for over 2 years (a “blip”?) and doesn’t recover until after November 2? Shall I continue?

CoRev

October 27, 2021 at 8:53 am

I was going to call you out on your latest BS but our host has done my work for me. But maybe it was less incompetence and more sheer greed and corruption at play. Trump was a con man from day one and people like you fell for his lies hook, line, and sinker.

Menzie responds with: “(1) Over a trillion dollars worth of tax cuts for the rich, and all we got is trend growth;” Not trend but trends growth and

” (2) deepest recession *ever* in the US, ” US or world there was a depression due to Covid not Trumps policy. “The global economy has experienced 14 global recessions since 1870: in 1876, 1885, 1893, 1908, 1914, 1917-21, 1930-32, 1938, 1945-46, 1975, 1982, 1991, 2009, and 2020. The COVID-19 recession will be the deepest since 1945-46, and more than twice as deep as the recession associated with the 2007-09 global financial crisis. https://blogs.worldbank.org/opendata/understanding-depth-2020-global-recession-5-charts and

“(3) 130K unnecessary Covid-19 deaths” Unnecessary? While in the Biden era, well less than a year long we already have 326,999 covid 19 deaths with 3+ years remaining to compare all Biden’s policy initiatives. and

” (4) a trade war in which we can’t even browbeat the Chinese into fulfilling pathetic phase 1 commitments,” Only liberals believe we were NOT in a trade war before Trump changed tactics. BTW, how many of those policies has Biden changed? and

“(5) a soybean price hit to the Midwest farmer that lasts for over 2 years (a “blip”?) and doesn’t recover until after November 2? Shall I continue?” Soybeans, again? How obsessed are you?

Since this is an economics blog let’s address a couple Biden economic issues. (1) Jobs labor force participation down to 61.6 percent, nearly two points below where it was in February 2020 (2) inflation record setting PPI (3) fuel prices sky rocketing.

Since Covid 19 is the cause for many of these policies let’s at least give his policies a mention. (4) blaming the unvaccinated for the recent surge in cases, especially the new variant cases. New variants are the result of vaccinations not being unvaccinated.

with all the falsehoods you provided corev (or is it covid?), menzie should ban you.

if you want to talk about labor paricipation, how about the low point of 60.1% under trump?

“New variants are the result of vaccinations not being unvaccinated.”

just curious, do you actually believe this propaganda or are you seriously that stoooopid? from a probability perspective, new variants will most likely arise from the reservoir with the most hosts-the unvaccinated. we had variants before vaccines were even rolled out.

CoRev,

If the US economy is in such awful shape, then why has Trump’s fave measure of it, the stock market, been hitting all time record highs in recent days? Heck, the Dow is actually getting awfully close to that long awaited Glassman-Hastett forecast of 36,000.

just to be clear, sammy (and JohnH), you are proposing that government intervene on a private sector problem. wow. and i have been told all this time that republicans believe in less government, as the private sector has the best people to solve the business problems. who would have thought republicans believe in government intervention. thanks for clearing that up sammy.

baffling,

There are things in governments control, namely regulations. Apparently California has forced out independent operator truckers through regulation. Suspend that. Have Covid restrictions impacted freight transport? Suspend them. Gas prices skyrocketing? Drill and build pipelines. And, oh yeah, don’t force companies to fire people if they don’t want to get vaccinated.

Instead we get administration spokesperson Psaki joking “we are not the Post Office” (actually you are) and “The Tragedy of the Treadmill delayed”

https://ijr.com/psaki-laughs-supply-crisis-jokes-tragedy-treadmill-thats-delayed/

sammy: If a firm proposes a pipeline today, how long until it gets into operation?

“And, oh yeah, don’t force companies to fire people if they don’t want to get vaccinated.”

apparently those people don’t want to work. you get no sympathy from me if you refuse to get vaccinated. the unvaccinated are hindering our ability to return to a prosperous and growing economy. the unvaccinated are the reason we still have mask mandates and covid spikes. the unvaccinated are the reason the virus continues to spread in our communities.

on a separate note, if somebody is willing to shut down the economy because of their refusal to get a jab, there is a problem. its ok to draft a 19 year old and send them to death in a overseas war, but its not ok to make somebody take a shot so they can keep their community safe? these are losing arguments sammy. the vaccine is not political. it is a matter of community safety.

but sammy, i am glad to hear your position that government has the ability to solve problems better than the private sector. again, that came as a surprise. but i guess you are able to learn and grow after all.

“Apparently California has forced out independent operator truckers through regulation.”

Seriously? We documented a while back that real compensation for truckers is now 75% of what it was in 1990. I would suggest you consider the effects along the labor supply curve but now I’m doing basic economics which we know you will never understand.

But come on – even California cannot drive a world wide logistics problem with a few alleged regulations in its own borders.

“truckers on the Twitter” Shout out to the working man. Woop!!!! Woop!!!!!

https://twitter.com/YuanTalks/status/1453014495379472389

YUAN TALKS @YuanTalks

#China’s most-traded thermal #coal futures contract in Zhengzhou, for Jan delivery, tumbles for the 6th consecutive session, sliding over 6% to break through 1,200 yuan/tonne mark on Tue night.

11:03 AM · Oct 26, 2021

Coal prices in China are quite high. So could you please stop with this dishonest parade of yours?

Assuming estimates are near right (which for day-before-release GDP estimates is usually the case), the remarkable thing is the utter miscalculation of early estimates. The median forecast in early August was over 7%. Late August over 6%.

The Covid Era remains subject to high uncertainty. Screwing around with debt ceilings and fiscal policy now is criminal. Wonder if the FOMC’s prospective tapering launch is timed to have a better feel for fiscal policy.

The Atlanta Fed’s GDPNow estimate is now at 0.2% (annualized). An add from inventories partly offset a drag from government spending, with a drag from net exports the kicker.

By the way, the reappearance of sammy and CoRev at the same time, each saying the same stuff, which lacks any connection to real economic logic, looks mighty suspicious. Kinda like they are taking orders from the same place. So lackies, I guess.

I wonder if these two clowns have discovered the new Kelly Anne Conway podcasts on the Dark Web.

I have stated my view on this blog, that many economists are too fraternal with the Federal Reserve. It’s hard for them to view it in an objective fashion. And nearly impossible for economists (academic economists and/or otherwise) to be agnostic about the Federal Reserve. I think this clouds their views of many of the people associated with it—and the extent to which the Federal Reserve is actually beneficial to society at large. I let the gentle reader make his own judgement on how recent events might relate to many economists’ reticence and near indignation to criticism of the Federal Reserve.

https://www.sghmacro.com/media_event/focus-of-fed-trading-furor-shifts-to-powells-activities/

Does that lead to fruition of certain behaviors, VERY similar to the, uh, moral hazard we have witnessed from TBTF bankers?? And do these very similar behaviors by Fed Officials, make it much more, uh, “awkward” for the Federal Reserve to practice/apply/perform/enforce its regulatory function on big banks??

Well, similar to Neera Tanden, I’ve been told by some blog hosts Jerome Powell is a swell guy. Really, he is…… really….. a swell person.

sherrod brown hit it on the head in that article. i don’t think powell did anything nefarious, although i think the optics stink. but in his position, there need to be clear rules on what can and cannot be done, and they need to abide by them. any hint of impropriety is bad and must be avoided. you cannot be one of the captains of the economy and bet on it at the same time. these folks should be required to house assets in a blind trust if they want to be wealthy and run the fed offices. it truly is amazing that the rules are so lax on this subject.

as for being a swell guy or not. powell stood up to trump at a time when many others would have capitulated. we could have had worse personnel in the office during a crisis, like greenspan or volcker or miller. i don’t consider powell a hero, but i don’t consider him a failure either.

@ baffling

I don’t know if you have children. I don’t (that’s probably a good thing for humanity in case you were wondering). But I have taught some wild youngsters (*talking 4–10 age range here, just so we’re not holding Jerome up to too high a standard) in a pretty large classroom setting. Have you ever not bothered specifying certain rules of behavior to children before, but say after they had done something a tad naughty to a classmate, hit them in the side of the head, or stuck their entire index finger up their own nose and told that child “You know better than to…… “ Jerome, Mr NOT Economist, Mr. Lawyer, Mr. Catholic “good ol’ boy, Mr. golfing douche, knew better. He knew it was clearly ethically wrong, arguably immoral and like the good ol’ Catholic boy he is, went ahead and did whatever the hell he wanted to do anyway.

I’ve told Menzie I can nearly always (85% ??) smell these types from 400 miles off (ok, I missed Tulsi Gabbard and a few others). One of these days he’s going to believe me.

Bernie got the GAO to audit the Fed. The audit brought to light a lot of dubious dealings and a lack of procedures for identifying and handling conflicts of interest. The report largely fell on deaf ears. Pgl threw a hissy fit every time I mentioned it.

Are you incapable of writing a comment without your daily lie about what I allegedly said? Damn dude – you have serious emotional issues.

It is weird that JohnH is incapable of providing us with this GAO audit of how the FED performed Quantitative Easing – which was mandated in 2011 by the Dodd-Frank act. Read it for yourself to see what the GAO really said.

https://www.gao.gov/products/gao-11-696

BTW – Rand Paul also insisted that we audit the FED but that is because Senator Nutcase hated QE. Go figure!

https://www.brookings.edu/opinions/what-audit-the-fed-really-means-and-threatens/

“Audit the FED” can have different meanings. This discussion notes what Rand Paul is really up to – getting rid of the FED so we can return to the gold standard. Given how JohnH has praised the era of the gold standard – does he agree with Senator Paul?

When does PGL NOT throw a hissy fit? If only he added value instead of guarding the gates to interaction.

CoRev: Seriously, you are the person who spent numerous posts misunderstanding futures contracts, forecast metrics, and basic statistics — all in an abusive tone. If I were to censor somebody for useless hissy fits, you would be candidate one.

Menzie, “all in an abusive tone.”? Most were probably in response to comments like you just made or PGL and the others who took the same path.

What I remember is it was YOU who continued the discussion in the same tone as you just showed. What I also remember was the admittance that the soy bean commodity pricing forecasting method failed in other commodities without understanding why.

I also note that this comment re: soybeans forecasting is after this article from you: https://econbrowser.com/archives/2021/10/economists-are-remarkably-bad-at-forecasting-short-term-interest-rates which included this comment: “pgl

October 27, 2021 at 1:34 am

Why do economists forecast? To make the weather man look good.”

Really!? Weathermen make quite good short term forecasts, PGL’s inadequate beliefs about weather forecasting not withstanding, he is probably correct re: economists attempts to forecast.

CoRev: In the paper w/Coibion (which I am convinced you still have not read), we are using a “market based” forecast – not an economists’ forecast – to predict soybean prices. So your reference to my post on economists forecasts displays an unbelievable amount of misunderstanding and ignorance (and I’m comparing you to my D students!)

My Lord – a classic joke offends you? Get a life dude.

@ CoRev

This doesn’t really need reiterating, but I think Menzie (much to his credit for having empathy to the slow students in the room) spelled out ad nauseam one of the reason commodities behave differently from one another is storage costs and that some commodities “go bad” after a certain time. Here on this blog. Also fungibility can be a factor. Menzie also spelled this out more than once. Here on this blog. There are probably other factors that don’t come to mind right now because my mind is not as agile as Menzie’s.

As far as tones in discourse, if someone gets on public transport (bus or subway) and blows cigarette smoke directly in your face, what do you do?? Hand them a $100 gift card for Starbucks coffee??

Menzie, you really are obsessed with soybeans.

Your comment re: Coibion and follow up: “So your reference to my post on economists forecasts displays an unbelievable amount of misunderstanding and ignorance (and I’m comparing you to my D students!)” Got me thinking that I missed something in the referenced article, https://econbrowser.com/archives/2021/10/economists-are-remarkably-bad-at-forecasting-short-term-interest-rates

After searching for Coibion and following each and every link within the article I was surprised that there was no such reference. I then realized you were talking about your much, much older reference to your soybean commodity price paper, which led me to the conclusion that you really are obsessed with that soybean series you created last year.

I’m not obsessed, nor have I referenced them, but you seem to continuously go back to them. Sad, really.

CoRev: Because you have never admitted your complete and utter lack of understanding of basics of futures markets, of forecasting, and basic statistics – I will continue to refer to those points of your sheer stupidity and arrogance. So, not obsessed with soybean, obsessed economic and statistical ignorance.

PGL said: “My Lord – a classic joke offends you? Get a life dude.” Classic jokes are often classic because their based upon truth. Is that what you were trying to convey about economists’ projections?

See? Whenever I mention Bernie’s GAO audit of the Fed, pgl throws a hissy fit. It’s downright Pavlovian!

Oh my – I posted the actual GAO report. But did you read it? Of course not.

Hey JohnH – many thanks! You have proven my point all by yourself – you are a pointless little liar.

Leave it to you to defend JohnH. The two most incompetent and dishonest trolls ever!

BTW – JohnH is incapable of articulating which of the many definitions of “audit the FED” he is babbling. Now if you want to add value here – please provide a clear and concise of whatever “audit the FED” is supposed to be. This should be a lot of laughs!

If you put the standard error around the actual GDP line in the graph, wouldn’t it be so wide that all the predictions would look like noise?

Isn’t GDP over half imputed?

Why are we using GDP at all for public policy?

Isn’t GDP just a story based on surveys no one checks, ignored standard errors, made-up numbers based on arbitrary identities, and a lot of hand-waving?

Why are you ppl obsessed with this GDP fetish?

See J Assa, GROSS DOMESTIC POWER: A HISTORY OF GDP AS NUMERICAL RHETORIC :

《This longer and broader view reveals the exercise of estimating national income or wealth as a form of numerical

rhetoric. Rather than a statistical measure, GDP is an indicator of power (for countries, classes and industries) as well as an instrument for advocating specific policies. Therefore, any critique must go beyond technical issues and fixes, and look at the political context and consequences of various historical versions of GDP, and any possible democratic reform of it.》

rsm,

Once again, you don’t know what you’re talking about.

It’s kinda funny that you are relying so heavily on rhetorical trickery to claim that GDP is just numerical rhetoric. You’re Glenn-Beck-like reliance on posing your view in the form of questions rather than assertions (“I never claimed half of the inputs to GDP are imputed. I just asked a question!”) is pathetic. If you know so little, why are you so certain?

Speaking of rhetorical tricks, your assertion that Jacob Assa “reveals” rather than “argues” is a red flag of bias.

By the way, the Assa article you cite really has almost nothing to do with the claims you are making -‘scuse me, the questions you pretend to be asking. I see how it fits your general anti-data campaign, but Assa’ article is about the treatment of finance in GDP, not the accuracy of GDP data. Maybe you should have cited this one instead: https://scholar.google.com/citations?view_op=view_citation&hl=en&user=HqW3NaoAAAAJ&citation_for_view=HqW3NaoAAAAJ:W7OEmFMy1HYC

Assa is making legitimate arguments about the uses to which GDP data are put. You are misunderstanding Assa and conflating uses with usefulness.

Did you read Menzie’s link? The 90% confidence interval around the advance estimate is….? C’mon, you’re supposed to know this if you make claims about the accuracy of GDP estimates.

And, had you bothered to look, raher than just trotting out your usual unsupported claims, you might have found this: https://www.stlouisfed.org/on-the-economy/2014/may/do-revisions-to-gdp-follow-patterns

You’d have learned that “there are no obvious patterns” to GDP revisions, except that revisions early in recessions tend to be downward. No bias, see? We like unbiased estimates. You’d also have leqrned that the advance estimate includes closer to 2/3 of input data for the quarter, not half.

GDP data remain estimates forever and always. But the estimates are fairly reliable and fairly unbiased. If that’s not a standard you like, then I guess you aren’t a fan of the latest research on sub-atomic particles or of vaccine testing or, well, of science.

Your emotionalism is getting in the way of thought and understanding. Now go sit in a corner until you can calm down.

re: Isn’t GDP over half imputed?’

to the extent that the change in the output of goods and services is determined by the change in their dollar value adjusted for an inflation factor, it’s all “imputed”…but unless you are going to have a census agent at the gate of every apple orchard counting the apples as they come of the trees, you’re not going to be able determine the actual change in output…the methodology we use is the best we have, given the circumstances…what would you suggest as an alternative?

re: Why are we using GDP at all for public policy?

who is using GDP for public policy? i’ve seen politicians brag about it or dismiss it, but i’ve yet to see any of them change their policy based on it…

https://journals.aps.org/prl/abstract/10.1103/PhysRevLett.127.180501

October 25, 2021

Strong Quantum Computational Advantage Using a Superconducting Quantum Processor

By Yulin Wu et al.

Abstract

Scaling up to a large number of qubits with high-precision control is essential in the demonstrations of quantum computational advantage to exponentially outpace the classical hardware and algorithmic improvements. Here, we develop a two-dimensional programmable superconducting quantum processor, Zuchongzhi, which is composed of 66 functional qubits in a tunable coupling architecture. To characterize the performance of the whole system, we perform random quantum circuits sampling for benchmarking, up to a system size of 56 qubits and 20 cycles. The computational cost of the classical simulation of this task is estimated to be 2–3 orders of magnitude higher than the previous work on the 53-qubit Sycamore processor. We estimate that the sampling task finished by Zuchongzhi in about 1.2 h will take the most powerful supercomputer at least 8 yr. Our work establishes an unambiguous quantum computational advantage that is infeasible for classical computation in a reasonable amount of time. The high-precision and programmable quantum computing platform opens a new door to explore novel many-body phenomena and implement complex quantum algorithms.

http://www.news.cn/english/2021-10/26/c_1310269646.htm

October 26, 2021

China achieves quantum computational advantage in two mainstream technical routes

HEFEI — A Chinese research team has successfully designed a 66-qubit programmable superconducting quantum computing system named “Zuchongzhi 2.1,” significantly enhancing the quantum computational advantage.

The achievement marks that China has become the first country to achieve quantum computational advantage in two mainstream technical routes.

The study was led by renowned Chinese quantum physicist Pan Jianwei and was published online on Monday Beijing Time in the journal Physical Review Letters and Science Bulletin. *

* https://journals.aps.org/prl/abstract/10.1103/PhysRevLett.127.180501

China does not have some massive coal surplus even if your political masters say so.

[ As for the assertion about China, an increase in domestic coal mining and delivery to electricity producers has already met demand and allowed for a fuel surplus that is steadily growing, assuring winter fuel needs are met and importantly lowering coal costs. Chinese policy is to accumulate significant commodity surpluses. As for electricity supply, adding to renewable fuel sources is continuing while oil and natural gas production are increasing as well. ]

You posted a great discussion by Jeff Frankel. Now go read it as he has the Chinese coal situation right. You do not.

baffling,

” i am glad to hear your position that government has the ability to solve problems better than the private sector.”

Ha, ha. All I am suggesting is that they can ameliorate the problems that they have caused.

You all don’t like Trump. But he would be kicking whatever ass he could on the supply chain problems. Why? Because that’s what businessmen do. Clear blockages in the critical path. This administration doesn’t seem to be doing anything, nothing, zilch, nada except make jokes.

sammy: Like how he fixed the shortage of ventilators by bringing in a lot of defective ventilators sourced from … (wait for it) Russia?

I do think he made sure there was access to hydroxychloriquine, though.

“But he would be kicking whatever ass he could on the supply chain problems.”

it took trump a year to address the lack of masks and other ppe. and those were simple solutions to simple problems. how long do you think it would have taken him to address a complex supply chain problem? hell, he hasn’t even been able to provide copies of his own taxes for five plus years now. trump is not known for getting things done quickly. toilet paper was hard to come by at times last year. who’s fault was that?

but let me point something else out to you sammy. the la ports are near record levels of volume. the delays are not because we have shrunk operations. they are because imports have boomed this year. and if you recall, biden has worked with the ports to get them to operate 24/7. that is exactly what you asked to happen. so stop complaining.

now regarding truck drivers, if you need more drivers you cannot increase that number overnight. it takes quite some time to get a cdl. this is a worldwide problem. at issue is the number of people who have left the field. why? good question. because the pay sucks and the working conditions are terrible. but since the carriers refuse to increase pay, they have been unable to add to the worker totals. that seems to be another market failure brought to you by free enterprise. would you like biden (and government) to solve that problem for you as well?