So far, the lower paid are seeing the biggest gains…

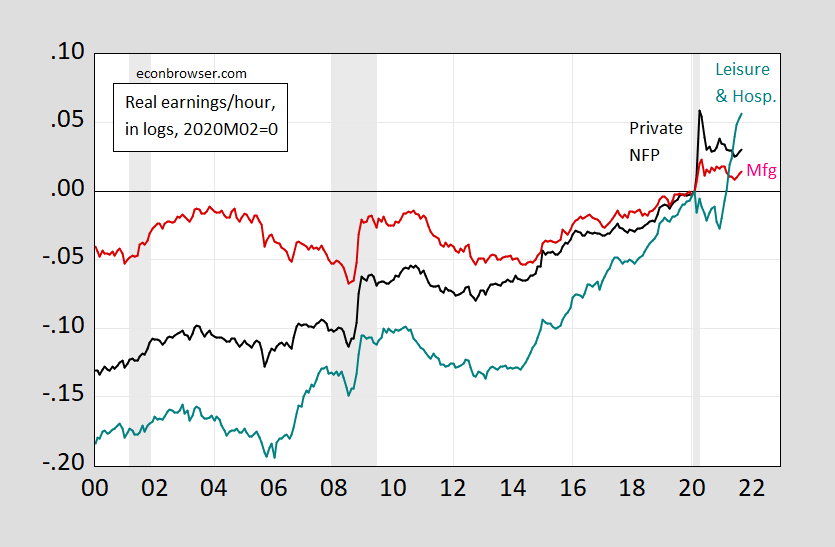

Figure 1: Real average hourly earnings in private nonfarm payroll employment (black), in manufacturing (red), and in leisure and hospitality (teal), CPI deflated, in logs 2020M02=0.All series pertain to production/non-supervisory workers. NBER defined recession dates shaded gray. Sources: BLS via FRED, NBER and author’s calculations.

Real wages are all higher than at the last NBER peak. Leisure and hospitality real wages are noticeably higher, but are still only 2.9% higher than the 2014-19 trendline.

Lumber prices have dropped substantially since their May peak. However, they have risen over 60% since they bottomed in late August. And they have more than doubled in the last five years, at a rate of almost 20% per year since October 2016.

https://www.nasdaq.com/market-activity/commodities/lbs

“Lumber prices have dropped substantially since their May peak.”

There was some troll abusing your good name that said this would never happen. Please tell this troll to stop abusing your name.

Thank you, pgl for your always constructive response.

Lumber prices continue to surge. Prices are now 3.6x their October, 2011 level, for an average annual growth rate of over 13% per year.

https://markets.businessinsider.com/commodities/lumber-price?op=1

Well, pgl, prices may go back down, as you insisted, to where they were at some unspecified time in the the past…but not right now!!!

As for retail lumber prices, which is what I was talking about last summer, they have yet to go down, either: “ Lumber is down from the stratosphere, but still pricey.” https://www.postbulletin.com/business/retail/7197597-Lumber-is-down-from-the-stratosphere-but-still-pricey

Maybe some day you’ll get something right

Gee – lumber prices are volatile. Just like oil, copper, and a host of other commodities. Now we see you have learned from sammy and CoRev how to cherry pick dates. From now on – I will include you as a member of the Usual Suspects!

Gee JohnH – our host did your homework assignment and presented real lumber prices over an extended period of time. And it seems your claim that they have been higher than ever just evaporated.

Absolute nonsense to say that I said that “lumber prices are now higher than ever.” But it is indisputable that at close of business today they were 65% higher than in late August.

Pgl just loves to misrepresent and lie about what others say. Must be a personality disorder.

‘JohnH

October 14, 2021 at 3:50 pm

Absolute nonsense to say that I said that “lumber prices are now higher than ever.”‘

OK – that was the other JohnH that made that claim. I need a program to keep you two straight.

“And they have more than doubled in the last five years, at a rate of almost 20% per year since October 2016.”

Maybe you are too stupid to notice but your little link here had this button called MAX which allows one to see what has been nominal prices since 2012. Maybe you are too blind to notice how much this nominal price declined from early 2013 to 2016.

Or maybe you are not this incredibly stupid but going back to your usual dishonesty. I would ask you to calculate the inflation adjusted lumber price since early 2013 but then that is asking too much from someone like you.

No, pgl.

Insults, ridicule and non sequiturs are not arguments.

Maybe you too should check out our host’s latest post on real lumber prices over time. Look – JohnH has a very long history of misrepresenting economic data. Maybe he is not as bad as CoRev or Sammy but he is close.

JohnH: See most recent post, using PPI.

https://econbrowser.com/archives/2021/10/real-lumber-prices

Well, that 2.9% is going to make everyone very comfortable this winter.

https://www.npr.org/2021/10/13/1045723713/home-heating-costs-this-winter-natural-gas-electric

Still taking your daily dose of bleach?

Oooo, I didn’t know that NPR was one of your antagonists.

OK – let’s read what NPR wrote:

“U.S. households can expect to spend more money to heat their homes this winter compared with last year, federal officials announced. A report released Wednesday by the Energy Information Administration predicts that home heating costs will go up because fuel prices are rising and fuel demand has increased over the previous winter. Many energy prices dropped considerably last winter due to a sharp drop in demand brought on by the COVID-19 pandemic. But the agency said prices have since rebounded, in part because of the economic recovery, and in some cases have reached multiyear highs.”

And your big point was what again? Costs were low last year but are now a bit higher than this low? This is your BIG news Brucie? Seriously dude – why are you posting links that you have not actually read? Oh wait – that is what you always do! Never mind!

Natural gas prices spiked (along with oil) back in the 2004-2008 time frame. Almost 3x the current price. I don’t recall a lot of effect on overall inflation.

https://www.macrotrends.net/2478/natural-gas-prices-historical-chart

KJR, don’cha just luv that short term history chart by Prez: https://www.macrotrends.net/2478/natural-gas-prices-historical-chart, and its not yet Winter in the high gas usage states.

how high to you think nat gas will go this winter?

“KJR, don’cha just luv that short term history chart by Prez”

First of all – you are the king of cherry picking dates to misrepresent data. JohnH has learned your little tricks here so be my guest to charge him royalties for using your brand of dishonesty.

But come on dude – his chart went all the way back to 1995. So WTF are you babbling about now?

PGL does another own goal: “But come on dude – his chart went all the way back to 1995. So WTF are you babbling about now?” Due diligence is needed to actually look at the referenced chart. Complaining that the original source showed the data using a SLIGHTLY different starting date, and then blaming the start on the commenter, well that takes a special person.

PGL you are a special person. Not too smart, but special. How can PGL be so consistently irrelevant?

Well, I personally welcome higher energy prices. Prices are the rationing tool of choice in market-based economies, and we need need stricter rationing of fossil fuel use.

Policy that encourages development of non-fossil energy sources is dandy, but we don’t need to wait around for the transition away from fossil fuels. We could have higher prices now if we’d restrict fracking, impose a carbon tax, stop subsidizing fossil fuel extraction through tax breaks, raise CAFE standards, require bonding of fossil fuel extraction and transportation to cover potential environmental harm… Bunches of opportunity to slow climate change without waiting for our capital stock to become greener.

So bring on the surge in energy prices

Oh, and what do we do about the welfare impact of higher energy prices on lower-income households? Take a look at Menzie’s chart – the answer is right there.

“If You Are Worrying About Inflation Eroding Wages…” that 2.9%, and biggest gaining lower paid must be compared against:

“Consumer prices overall rose 0.4% in September, pushing the year-over-year gain to 5.4%.”

or

” Excluding food and energy, the gain was just 0.2% and 4%, respectively.”

https://www.cnbc.com/2021/10/13/the-consumer-price-index-rose-5point4percent-year-over-year-in-september-vs-5point3percent-estimate.html

Of course these biggest gaining lower paid also spend the bulk of their wages for basic existence consumption, so how does their 2.9% wage increase compare against the 5.4% CPI increase? Yes, inflation is eroding wages and more importantly their buying power.

Just a reminder, these folks also vote. Are you worrying about inflation eroding the democratic vote, yet?

Remember, this is your selected candidate and administration. Are you worrying about its imeptitude eroding the democratic vote, yet?

First off, it’s 2.9% higher than the 2014-2019 trend. If you look at the chart, you’ll clearly see that the gain is more than 5%.

I AM worrying that CoRev’s ineptitude is an example of the innumeracy eroding this country’s ability to reason.

CoRev’s ineptitude? No – he has copied and pasted the talking points Kelly Anne Conway sent him perfectly.

What is scary is the willful ignorance and/or deception being practiced thinking that comparing CPI in Logs for the same period. 2014 -2019 to the current 2021 CPI estimate. Apples and oranges comparisons are not helpful. So let’s do it for KJR, 2014-2019 CPI avg in logs is 1.55 while the 2021 estimated CPI in logs is 5.8*. I dunno but a 3.74 TIMES (374%) increase seems higher than a measly 2.9% increase in average wages for the same period.

* Data from here: https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1913-

These folks also vote.

“these folks also vote.”

Ah yes – another paid campaign commercial for Donald Trump. Of course all Trump did was to give massive tax cuts for the ultra-rich and then ignore this virus.

I realize that it’s extremely difficult to see things when one is viewing through a fog of hate but I looked again and, just like the first time I looked, the graph is clearly labeled, “Real earnings/hour, in logs, 2020M02=0.”

Your story has a gaping hole in it.

Be patient with CoRev. He lost his marbles over 12 years ago.

https://fred.stlouisfed.org/graph/?g=tr30

January 30, 2018

Producer Commodities Price Index, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Fq3G

January 30, 2018

Producer Commodities Price Index for Finished Goods and Finished Goods less Food & Energy, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=HKgn

January 15, 2018

Producer Price Index for lumber and wood products, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=CU0I

January 15, 2018

Producer Price Index for lumber and wood products, 2007-2021

(Percent change)

http://www.news.cn/english/2021-10/14/c_1310244924.htm

October 14, 2021

China’s consumer inflation stable, factory prices rise

BEIJING — China’s consumer inflation remained generally stable in September, while factory-gate prices saw expansion largely due to coal price hike, official data showed Thursday.

China’s consumer price index (CPI), a main gauge of inflation, rose 0.7 percent year on year in September, data from the National Bureau of Statistics (NBS) showed.

The figure was lower than the 0.8 percent year-on-year growth recorded in August.

The slower growth was partly driven by a drop in food prices, which declined 5.2 percent year on year last month. In particular, the price of pork, a staple meat in China, slumped 46.9 percent from a year earlier, said senior NBS statistician Dong Lijuan.

CPI stayed flat on a monthly basis. Food prices dropped 0.7 percent while non-food prices rose 0.2 percent.

Market demand and supply remained broadly steady in September, and consumer prices maintained stability, said Dong.

Considering the relatively weak residential consumption this year and the downward cycle of pork prices, the CPI growth for the fourth quarter will generally remain mild, said Huang Wentao, an analyst with China Securities.

China has set its consumer inflation target at approximately 3 percent for the year 2021.

China’s producer price index, which measures costs for goods at the factory gate, went up 10.7 percent year on year in September, according to the NBS.

The faster expansion of PPI last month was due to the price rises in coal and products of some energy-intensive industries, said the NBS.

Among the major sectors, coal mining and washing, oil and gas extraction, petroleum, coal and other fuel processing, chemical raw materials and products manufacturing as well as ferrous and non-ferrous metal smelting and processing contributed around 80 percent of the increase in PPI inflation in September.

With the accelerated recovery of China’s economy and the advent of massive coal consumption season of autumn and winter, the demand for coal is relatively strong, said Wen Bin, chief analyst at China Minsheng Bank.

He also noted that recent floods in Shanxi Province restricted coal production and transportation, which also strained the power supply.

To cope with the coal price rise and ensure power supply, China has taken a slew of measures to keep the economy running steadily….

The increase in Social Security was a “life line” for older people. Increasing the Los Angeles port’s dock working hours was also very good news. These are TWO great moves by the Biden administration. Are we supposed to believe the orange abomination would have done these two measures if he was still in the White House?? Maria Bartascrotum would still be giving trump a metaphorical blow job “LIVE” on Fox News right now. Hahahah (Menzie, give me just this one time of vulgarity. Tell them I’m slushed now and you were busy eating an upscale lunch.

The increase in Social Security has been baked into our laws for generations. Biden had nothing to with it. Yes – he did FINALLY address the logistics problem but what took so damn long?

You are a VERY strange person.

What – I caught you defending Party Leader and I am not doing so? Sort of undermines your serial lies that I am some sort of Democrat homer. Then again – you lie so much that most of us have tuned out. BTW – no one cares if you were stupid enough to buy a disgusting kids drink from Dunkin Donuts.

Considering that this agreement involves the port owners, a half-dozen or so major retailers, independent truckers, and unions, especially the longshoremen (longshoreworkers?), not only to agree in principle but agree to some specifics, I’m willing to cut Biden some slack on this.

After all, he had to give the private sector some time to prove that it was going to do nothing before he could step in, else the GQP would complain about government meddling. It probably still will complain but the argument has already been proven to have no merit.

OK – this was not exactly easy as you suggest. But we did see the problem coming a while back.

I do not have the data to back this up but it does seem part of the problem is a lack of truck drivers. Which is no surprise since the logistics sector has been doing all it can to keep their real pay as low as possible. I guess the market solution should include a hefty pay increase for drivers.

Gee – lumber prices are volatile. Just like oil, copper, and a host of other commodities. Now we see you have learned from sammy and CoRev how to cherry pick dates. From now on – I will include you as a member of the Usual Suspects!

Keep in mind folks, the person who tacks on to every commenter on this blog, claims everyone but themselves has mental problems. Take that into consideration for roughly 10 seconds,

What a stupid comment even for you. Look I’m sorry that Dunkin Doughnut failed to spike your stupid coolata or what ever garbage kids drink you had to throw away. Have a flask of cheap wine on me – troll.