I hear a lot about “records”. Not so remarkable in levels, but very remarkable in growth rates.

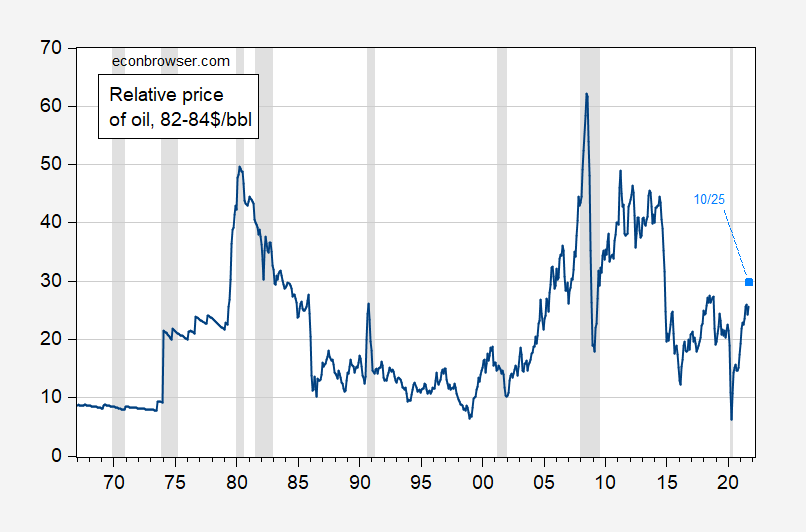

Figure 1: Price of WTI oil, deflated by Core CPI (blue), price of oil (10/25) deflated by nowcast Core CPI (sky blue square). NBER defined recession dates shaded gray. Source: FRED, Cleveland Fed, NBER and author’s calculations.

The September 24 1982-84$/bbl price of 26 is a little over the 1967-2021 mean of 21; the October 25th guesstimated relative price is 30, still less than a standard deviation above mean.

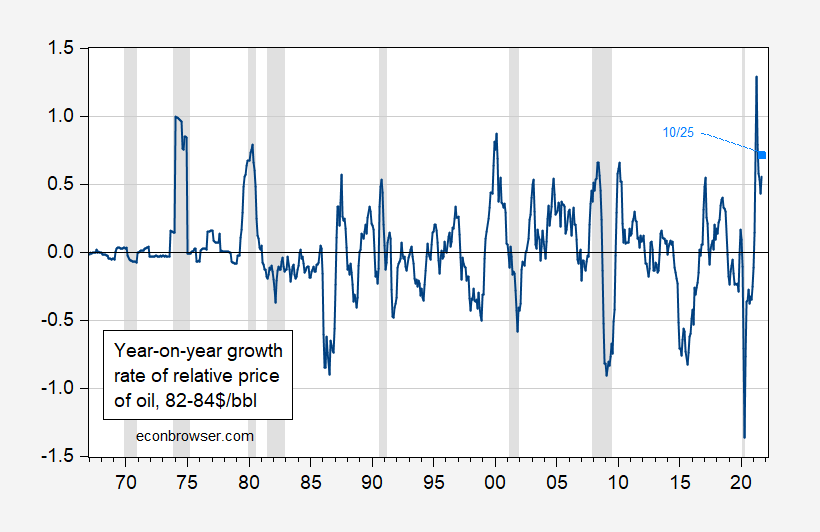

On the other hand, in terms of shocks, one might be interested in the change in relative prices within a short period of time. Figure depicts the year-on-year growth rates (calculated in log-differences).

Figure 2: Growth rate (y/y) of price of WTI oil, deflated by Core CPI (blue), growth rate of price of oil (10/25) deflated by nowcast Core CPI (sky blue square). NBER defined recession dates shaded gray. Source: FRED, Cleveland Fed, NBER and author’s calculations.

The mean y/y growth rate is 0.016, while September’s value is 0.553. The standard deviation of changes in 0.323, so September’s change is about 1.7 standard deviations from mean. If October average price matches today’s price ($83.60 when last I checked on 10/25), then the y/y growth rate will be 0.710.

I believe it was Professor Hamilton (and friends) who showed that oil-price shocks are less damaging to growth than they seem at first glance because embargoes are a confounding factor. Serious oil scarcity can cause economic damage, apart from the effect of high prices. High prices alone aren’t all that bad.

China’s recent coal supply curtailment offers an example of the same sort of thing. Seems to support Hamilton’s conclusion.

We’ve been offered dire predictions of fossil fuel supply shortages in the winter ahead. OPEC and Russia learned their pre-Covid lesson and are cooperating to reduce supply. I don’t know how the magnitudes compare between OPEC embagoes and what we are warned of this winter. Perhaps Professor Hamilton could weigh in?

Among the entrails I daily pick through are levels, trends, ratios of Dow:gold; gold:oil; gold:silver. Unscientific ratio benchmarks once were 10:1; 12:1; 23+:1, respectively.

In 1980, Dow: gold was 1:1; in 1999 – 40:1 [skewed by massive BoE gold sales]; and in 2011 – 8:1. Today’s close it was 20:1. Gold:oil is 22:1 – is oil cheap compared to the Dow and gold? Silver looks cheapest of all.

Today, oil at 4:00PM crawler was up 11.3% from 30 September 2021 and 72.2% from 31 Dec 2020. Gold was down 5% from 31 Dec 2020.

Of course, working Americans don’t need twice a week to buy the Dow or gold to get to work or heat their homes.

According to [my go-to guy at] Zerohedge, the Atlanta Fed forecasts 3Q2021 GDP growth at +0.53%.

A crock is what it is. It looks like price gouging to me. But if people don’t adjust their driving habits or look for better prices, this is what they will get. It never ceases to amaze me the variation in prices at stations in just a 3–5 mile radius. Consumer stupidity. If my memory isn’t failing me the last price I paid was $2.81. And if I go out later tonight (depending on the tank level) I’m pretty confident I can get it at $2.73 or lower.

Now I realize my region has lower prices to the national average rate, but I’m having a hell of a time figuring out how $2.73 in late October gets us up to $4.00 national average at the pump, which seemed to be the station pump price “Princeton”Kopits was equating with $100 on the WTI end of year.

As if anyone cares, I got $2.71 per gallon last night. I almost felt guilty for not getting coffee or something to reward the place for having the best prices in the area (aside from if I had a CostCo card or Sam’s card or something, which is arguably cheaper). They got clean toilets too. George Constanza would approve.

clean bathrooms. must be a buccee’s!

Uuuuuuhh no. I’ll just say it’s a well known fuel chain. You’d be shocked—as a former truck driver—how high my standards are on these things. Like I had to sneak spray cleanser into my white trash maternal grandma’s bathroom, because she had one of the “cushion seat” toilets. Do I need to further clarify this after that last part?? Cushion seat toilets are like the bane of humanity. In fact the more I think about it that could have been the last place where the Yunnan bat was before he gave humanity Covid. He had just immediately beforehand used a cushion seat toilet.

I did go to a lot of Texas Stuckey’s back in the day, is that close?? They were a thing in the late ’70s early ’80s.

Another source of inflation adjusted oil prices dating back to 1946 on an annual basis (in today’s dollars):

https://inflationdata.com/articles/inflation-adjusted-prices/historical-crude-oil-prices-table/

Well, in relative terms it got very low last year, down to those low levels in the late 90s, although I admit not to quite realizing that. But that certainly laid the groundwork for an arguably record yoy increase, even if current situation not all that wildly high in comparison to earlier periods. But people do get upset about sudden changes.

We went through this back in 2008. Oil prices temporarily plunged in the latter Bush43 days and then went back up to their previous levels. And of course Republicans cited the increase from the bottom to evidence that Obama’s supposed policies were causing historically high increases in gasoline prices.

Lesson learned – volatility allows liars to lie even more.

《we might define an efficient market as one in which price is within a factor of 2 of value, i.e., the price is more than half of value and less than twice value.11 The factor of 2 is arbitrary, of course. Intuitively, though, it seems reasonable to me, in the light of sources of uncertainty about value and the strength of the forces tending to cause price to return to value. By this definition, I think almost all markets are efficient almost all of the time. “Almost all” means at least 90%.》

Does the above passage from Fischer Black’s “Noise” fairly characterize oil prices?

I’m pretty sure you can’t demonstrate the validity Black’s notion mathematically. You can identify a price or price trend which fits Black’s description and call that price or price trend “value”. However, if you do the initial math during a period of small price sings and use it to examine a period wih larger price swings, you’ll end up concluding that Black is wrong. Other way around and you’ll conclude he’s right.

A sudden change in fundamental conditions that lead to a sharp rise or fall in price would also imply a sharp rise or fall in value, but math, by itself, would suggest Black is wrong.

Black was ruminating. Not really testable, I suspect. One might make up a set of definitions that would make it testable.

Macroduck, did Black foresee your comments?

《I recognize that most researchers in these fields will regard many of my conclusions as wrong, or untestable, or unsupported by existing evidence. I have not been able to think of any conventional empirical tests that would distinguish between my views and the views of others. In the end, my response to the skepticism of others is to make a prediction: someday, these conclusions will be widely accepted. The influence of noise traders will become apparent. Conventional monetary and fiscal policies will be seen as ineffective. Changes in exchange rates will come to provoke no more comment than changes in the real price of an airline ticket.

Perhaps most important, research will be seen as a process leading to reliable and relevant conclusions only very rarely, because of the noise that creeps in at every step.

If my conclusions are not accepted, I will blame it on noise.》

“Conventional monetary and fiscal policies will be seen as ineffective.” So, print and inflation-proof a basic income? Since prices are pretty arbitrary anyway?

Black’s paper led to this one, which is also worth a look: https://www.journals.uchicago.edu/doi/10.1086/261703

Member subscription link!?!?!?!?!? You know how I grab extra/unneeded napkins and sugar packets on my bi-annual trips to Panera. You know how I grab extra /unneeded napkins and ketchup packets in Burger King. And now you give me this member subscription link. And all this time through our courtship I thought you really understood my soul.

https://www.nccr-finrisk.uzh.ch/media/pdf/DeLongShleiferSummersWaldmann_JPE1990.pdf

fwiw, last week WTI ended at the highest close since October 14th, 2014, after the longest-ever weekly winning streak for front-month WTI contracts, based on Dow Jones Market records going back to April 1983…despite that, a net of two oil rigs were pulled out during the week, and the US rig count remains ~35% below the prepandemic count…DUCs (drilled but uncompleted) wells in the Bakken and the Eagle Ford were at the lowest on record in September, & completions of already drilled wells is about 25% below that of the prepandemic rate…

The suddenness of the price rise may mean there hasn’t been enough time for drillers to round up financing for new wells, or the increased involvement of majors in drilling may cause sluggishness. Either way, there’s a heck of a lot less enthusiasm for poking holes now than in earlier times.

that is politics…..

No, it’s intelligent policy based on a preponderance of evidence of global warming, the death of multiple species, deforestation etc. And if we don’t want more of that, along with coastal cities going under the ocean, we’ll be continuing down this road. And you know the strange thing about it?? Since the orange abomination got his ugly fat weak butt kicked out of the White House, car companies have been happy to jump on board with Biden’s policies. You know why?? They see a change in energy usage that is inevitable and any automobile company will be like Blockbuster video if they don’t “get with the program”. i.e.—the move away from petroleum is market driven change. And you can tell me it’s not market driven change on the same day oil companies stop getting tax breaks and subsidies from every level of American government.

https://www.brookings.edu/research/reforming-global-fossil-fuel-subsidies-how-the-united-states-can-restart-international-cooperation/

https://www.iisd.org/system/files/2020-11/g20-scorecard-report.pdf

https://www.eesi.org/papers/view/fact-sheet-fossil-fuel-subsidies-a-closer-look-at-tax-breaks-and-societal-costs

The USA gives roughly $21 billion annually, in addition to the roughly $480 billion provided by the rest of the world. If the oil business was that “market driven”, they wouldn’t run around asking for handouts from U.S. Presidents and legislators as they continually do now.

i would love to see an engineer “integrating” the green deal machine…..

so far the planned tech is not reflecting effective or suitable to use two broad adjectives about why we adapt new stuff…..

Do the list of companies presented here look like “pinko commies” to you??

https://www.nytimes.com/2020/08/17/climate/california-automakers-pollution.html

As far as Engineers, you need to read newspapers and solid websites more, and actually read what is on them. Engineers have been the leaders on the issue of a Green New Deal:

https://news.mit.edu/2021/mit-convenes-influential-industry-leaders-fight-climate-change-0128

“Led by the MIT School of Engineering and engaging students, faculty, and researchers from across the entire Institute, the MIT Climate and Sustainability Consortium has called upon companies from a broad range of industries — from aviation to agriculture, consumer services to electronics, chemical production to textiles, and infrastructure to software — to roll up their sleeves and work closely with every corner of MIT.

‘This new collaboration represents the incredible potential for academia and industry to work together on a shared mission to shape research, identify opportunities for innovation, and rapidly advance practical solutions with the sense of urgency needed to address our climate challenge. There are no bounds to what we can achieve together,’ says Anantha P. Chandrakasan, dean of the School of Engineering, Vannevar Bush Professor of Electrical Engineering and Computer Science, and chair of the MIT Climate and Sustainability Consortium.

The inaugural members of the MCSC are companies with intricate supply chains that are among the best positioned to help lead the mission to solve the climate crisis. The inaugural member companies of the MCSC recognize the responsibility industry has in the rapid deployment of social and technology solutions. They represent the heart of global industry and have made a commitment to not only work with MIT but with one another, to tackle the climate challenge with the urgency required to realize their goals.”

https://impactclimate.mit.edu

maybe paddy ought to spend a little time researching what modern engineers are up to these days. apparently the faux news echo chamber is a bit out of date

http://www.engineeringchallenges.org/challenges.aspx

the national academy of engineers-the best of the best in the field-seems quite interested in solving and integrating those green deal issues. paddy you are simply commenting out of ignorance on this topic-as do a few others on this site.

steven, hertz just announced plans to buy 100,000 tesla ELECTRIC vehicles for their fleet. but my guess is you still stand behind your position that electric cars are not making any headway in the automotive fleet. maybe they know something you dont know (or deny)?

Divide the value of an ounce of gold by the price of a barrel of oil.

The number of barrels an ounce of gold will buy is a pretty stable number over the decades.

“The suddenness of the price rise may mean there hasn’t been enough time for drillers to round up financing for new wells, or the increased involvement of majors in drilling may cause sluggishness. Either way, there’s a heck of a lot less enthusiasm for poking holes now than in earlier times.”

This is nothing new. The boom-bust, glut-shortage cycles are as old as petroleum history. We had the fracking boom and then the pandemic shutdown and now the re-opening. Lenders get burned over and over again but for some reason always come back.

Of course there is a record growth rate in oil prices. We have gone from prices we haven’t seen this century just a few months ago to prices we haven’t seen since OMG! 2014. There’s a good reason the Fed excludes roller-coaster energy from their preferred PCE.

1. Definitely agreed that these sort of time series (especially long ones) need to show real (i.e. inflation adjusted) prices, not nominal. Annoys me to see the opposite. I’m not an expert (you are), so won’t get into the minutia of debating what index to adjust with. But for a simple matter, need to inflation adjust.

2. I do think there’s at least the implication of something different going on now, in terms of industry response. Rigs have been extremely slow to respond. See for example,

https://twitter.com/RobertClarke_WM/status/1453017667137323010

Lots of little caveats you could make (inflation adjustment, lag time, year averaging, YTD etc.) But bottom line response from price increase from 20 to 21 seems to have been way slower than from 16-18. Could debate the reasons for that. “Peak oil”, “discipline”, etc. I suspect one issue is the extremely strong stance Biden admin took when they rolled into power (immediate leasing/permit freeze along with cancelling Keystone). It’s not just the actual effect of them, but the (rational actors) market of producers reacting to the risk. Was a much more anti-shale stance than Trump (who embraced shale) or Obama (who basically got surprised by it, but didn’t stop it). Again, it might not be political risk. But it might be. Companies look at countries (and even states–look at losses on lease bonuses for NYS Marcellus land) and consider political risk with investment. The higher the risk, the more price (or sweeter geology) needed to make the risk-adjusted NPV positive.