Five year inflation breakeven (unadjusted) down, 10yr-3mo term spread down, VIX and EPU up, and S&P 500 down.

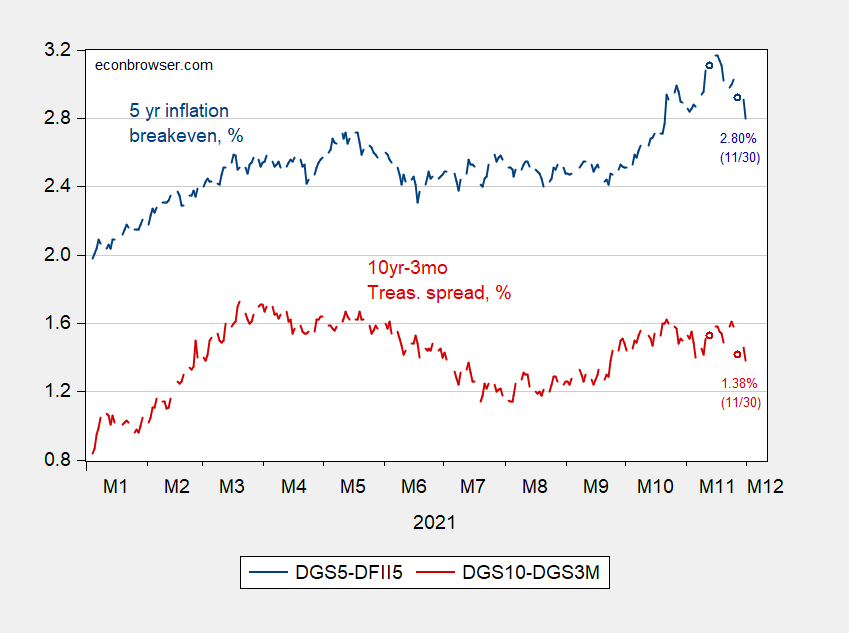

Figure 1: Five year inflation breakeven (blue), ten year – three month Treasury spread (red), both %. Source: Treasury via FRED, and author’s calculations.

Ignoring adjustments for inflation risk term and liquidity premia, implied expected 5 year inflation is down to 2.8%, while growth prospects also revert back to September levels.

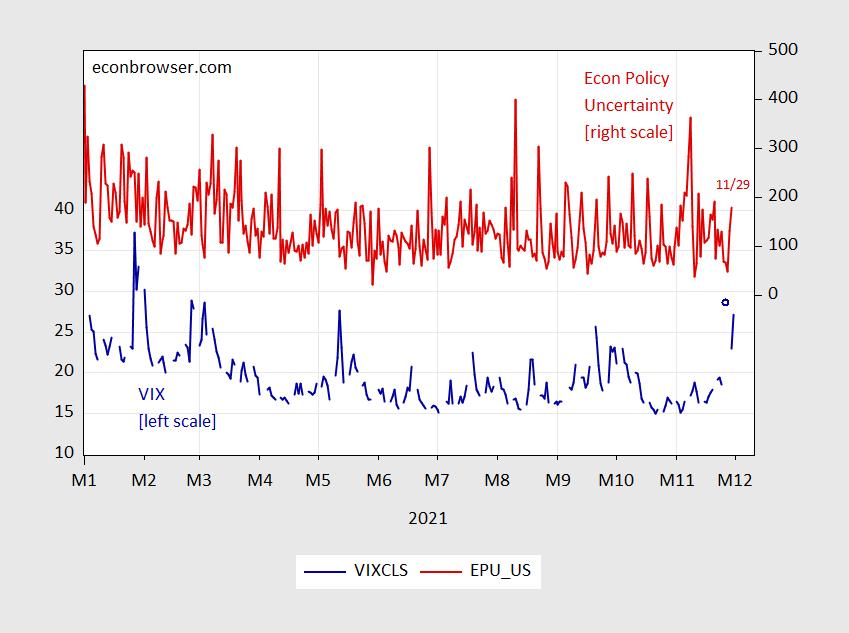

Figure 2: VIX (blue, left scale), and Economic Policy Uncertainty index (red, right scale). Source: CBOE via FRED, policyuncertainty.com.

Risk and policy uncertainty are also at recent highs, but still are dwarfed by Trump era highs (83 for VIX at 27.2; 862 for EPU at 180 on 11/29).

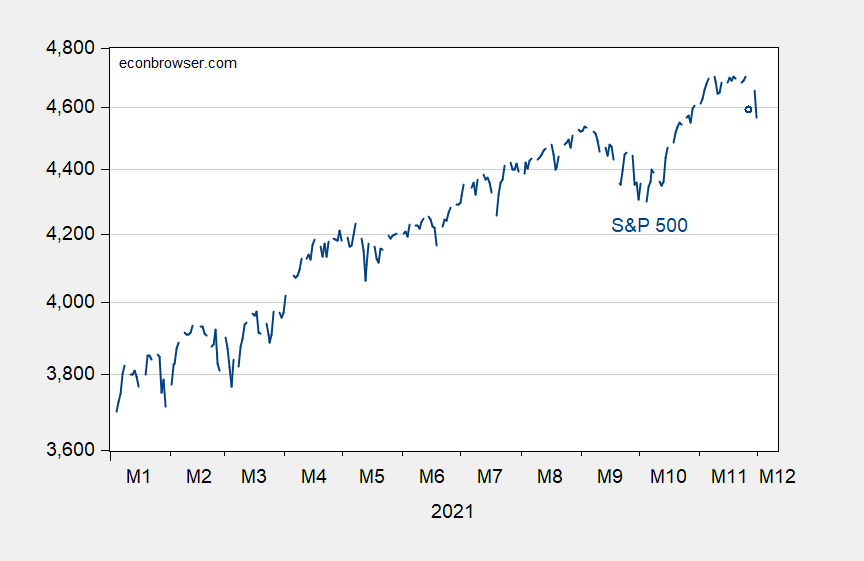

Figure 3: S&P 500 index (blue, log scale). Source: S&P via FRED.

Given this backdrop (lower expectations for growth and presumably profits, due to Omicron, and higher interest rates from Powell’s statement re: inflation persistence), it’s not surprising to see a drop in stock indices.

I see little reason for optimism for corporate profits to slow with slower GDP growth. The data doesn’t seem to show much of a correlation:

https://fred.stlouisfed.org/graph/?g=1Pik

And with ubiquitous oligopolies’ appetite for price increases whetted, profits could easily continue to soar.

“The data doesn’t seem to show much of a correlation”.

You deduced this by observing one variable (profits/GDP)? That must be some new magical high powered econometrics. Never mind there are tons of analyzes that indicate that the profit share is highly cyclical. What do these economists know? I guess JohnH playing in the sand box has much higher analytics!

I was responding to the phrase: “ lower expectations for growth and presumably profits,.” Profits don’t seem to track economic growth, otherwise they would maintain a relatively constant relationship to GDP, possibly rising with expansions. That is not what the FRED graph indicates.

“Given this backdrop (lower expectations for growth and presumably profits, due to Omicron, and higher interest rates from Powell’s statement re: inflation persistence), it’s not surprising to see a drop in stock indices.”

In no way did our host ever imply a constant profits/GDP ratio. Yes – your comment makes no sense. But hey – par for the course for you.

I was responding to the phrase: “ lower expectations for growth and presumably profits,.” Profits don’t seem to track economic growth, otherwise they would maintain a relatively constant relationship to GDP, possibly rising with expansions. That is not what the FRED graph indicates. The relationship is all over the place.

With monopoly pricing power, much of corporate profitability resides in decisions made in boardrooms across the country.

If you think you can discern the relationship between corporate profits/GDP and GDP growth, then you are dumber than even I ever gave you credit for. But in your mind – I bet you think you are doing higher order statistical analysis. Good luck submitting your paper to JASA!

“Profits don’t seem to track economic growth, otherwise they would maintain a relatively constant relationship to GDP, possibly rising with expansions.”

Gee profits are procyclical!!! Which is very contrary to what you originally wrote. May I suspect you listen to your preK teacher when she goes over how to WRITE! DAMN!

Picking a ratio of profits to GDP isn’t a bad first step – ratios are often very revealing. However, the variability of both numerator and denominator in this case obscure the underlying relationship. Look instead at profits against expansion and recession and the pattern becomes clear. https://fred.stlouisfed.org/series/CP

A log scale would help, but I don’t see that option from FRED. You can see the pattern in earlier periods by limiting the period covered by the graph to before 1980.

《inflation is a power struggle over who can raise prices the fastest.》

https://economicsfromthetopdown.com/2021/11/24/the-truth-about-inflation/

“The problem is that it treats inflation as a uniform rise in prices. That’s theoretically convenient, but empirically false. In the real world, inflation is wildly divergent.”

Oh gee – relative prices change. They change when inflation is very low too. Of course, your new guru forgot to put confidence intervals around his word salad.

As many here might have guessed, I didn’t care too much for Powell’s transitive comments. Once again proving Brainard should have gotten the job, The man is a sluggish dope and I have no time for him. Biden can call him non-partisan or anything he wants. He’s a waste of space inhabiting a nice suit.

Moses Herzog: Wow.

Let’s just say for the sake of argument Powell’s right (He’s not). What’s to gain by making the proclamation “this is no longer transitive inflation”?? Does he think “the common man” is suddenly going to form puppy love for him because he “feels their pain”?? What’s to gain there? The man is nauseating. The inflation is not systemic. It is a result of special conditions which will inhabit a relatively short window of time. And a large portion of it is just container shipper price gouging.

Moses Herzog: With respect to the adjective “transitory”, it might be that it was no longer seemingly credible to assert inflation was going to be as short-lived as connoted by the term, given the evidence of broadening inflationary pressure across categories.

Excuse me, I should have said transitory, not transitive, anyway you were kind/gracious enough to get my meaning.

I get what you are saying in relation to time (seemingly extended time of the inflation). But I still don’t think it’s helpful of Powell to make such a statement, because it creates a misperception on multiple levels. It encourages the misperception that helping low-income people or unemployed with supplemental income is agitating inflation (it’s not). It encourages the idea that this inflation goes beyond supply bottle necks (it does not, with the possible exception of price gouging). It encourages the idea that inflation “has a life of its own” beyond issues largely related to a virus, which believe it or not, will not always be with us.

The more policy makers try to untether the connection of the virus to the inflation and that the inflation is something “seedier”, the b*stard might as well go on Fox Business channel and praise the orange abomination with Maria Bartiromo. When you are Fed Chair you don’t open your mouth unless is helps the situation. Telling people it is not transitory is feeding the fire which excuses predatory price hikes, which many do not have a relation to input prices or “increasing costs”. Some maybe, yes, but a lot of it (especially the transport of goods) is just price gauging

I should have specified “seedier” in the sense of government policy and government responses to the virus. Just to be more clear. I’m guessing you got that, but I could imagine others reading that as somewhat contradictory in my message.

I think Powell still believes inflation is transitory, but has realized the word has become a rhetorical club used against him. He’s retiring it to get Fed communication out of the dog house. Probably too late for that. Politicians need something to blame. The Fed is something. The Fed must be blamed.

All of which is separate from the issues of correct policy and who should lead. (Trying to restore peace.)

Powell never mentioned OLIGOPOlY yesterday so according to some dude going bonkers on his latest soap box, Powell does not care about the average Joe. Or something like that.

With the Fed being so cozy with four Wall Street banks that dominate the market, why would Powell talk about oligopolies?

Why doesn’t pgl want people to talk about oligopolies’ contribution to the current inflation? Why is he so upset at the thought? Does he have some interest in protecting oligopolies?

JohnH: I don’t know how oligopoly can induce inflation defined as sustained growth in broad price index, since the *level* of oligopoly is bounded and the price level is not. If you want to talk about the *current* inflation, it might be better to characterize it as an upward price adjustment relative to trend (until we know the trend has changed as well). Then one might be able to argue that oligopoly is contributing raising prices for individual category of goods (then to complete the chain, one has to ask how that propagates to a *general* price level increase, rather than a relative price change).

I assume that the BLS could flag consumer products in its basket as coming from an oligopoly, either at the wholesale or retail level. Certainly this should be relatively easy in a supermarket, where much of the shelf space is “owned” by oligopolies in the food, beverage, snacks and personal care industries. With the internet, prices are not exactly a secret.

Some work is readily available in defining oligopolies: https://www.ftc.gov/system/files/documents/public_comments/2018/09/ftc-2018-0074-d-0042-155544.pdf

That report notes that there is a sparsity of data. However, there was also a sparsity of data regarding historical income inequality until Piketty came along.

That said, a major strategy of corporate America since the late 1970s (following the advocacy ofGE, Jack Welch, Michael Porter, and the Boston Consulting Group) has been for a corporationsto dominate a market or exit. The stream of acquisitions reduced many industries to 3-4 players.

Krugman noted that “ Monopoly capitalism is killing US economy.” (Published for the enlightenment of Irish readers!)

https://www.irishtimes.com/business/economy/paul-krugman-monopoly-capitalism-is-killing-us-economy-1.2615956

Krugman relied on anecdotal data to make much of his point.

Why would we assume that oligopolies are NOT exploiting their pricing power as well as their other tools to exploit their market position?

Maybe it’s time for lots of people, particularly economists, to speak out using anecdotal data and advocate for getting the hard data needed to embarrass politicians into taking action.

JohnH

December 1, 2021 at 12:15 pm

Perhaps the first substantive comment you have made all year – finally! Of course all the information linked to refutes your stupid thesis that economists do not care about the role of oligopoly. Welcome to the real world!

JohnH provides a link to an interesting 2018 discussion from the Roosevelt Institute. May be suggest he more carefully READ it. Like this sentence:

‘In this issue brief, we review the estimates of market concentration

that have been conducted in a number of industries since 2000 as part of merger retrospectives and other empirical investigations.’

There have been lot of such investigations but JohnH insists economists are not studying this. Note they review studies over the past 20 plus years but JohnH said there have been only recent work.

I do wish he would cease making such insulting claims that are patently false.

To expand on Menzie’s point, we have had this jump in the rate of inflation in the past year or so, which was initially described as transitory, with many predicting it would come down noticeably by the end of the year. That has not happened, so a lot of those people, including some at the Fed, have been having to back off and reconfigure, even though many of us still think it is transitory, just that it is clearly going to take longer than earlier forecast to get it back down. Crude oil prices continuing to drop into the lower $60 range should help with this sooner.

Anyway, the problem with JohnH’s obsession here is that while we have high levels of oligopoly in the US economy, some of which has gotten worse over recent years, there was no big increase in this oligopoly power in the last year or two that can explain, or even remotely help to explain, this recent surge in the rate of inflation. That clearly is a result of the combination of pandemic-induced supply chain problems, some of which had been building up earlier, with the surge in aggregate demand as incomes rose as people came out of last year’s sharp slump, with stimulative fiscal policies encouraging this.

Barkley—

“The problem” is not really problem at all. The decision to exploit pricing power is entirely a boardroom decision.

So if companies are supposed to meet customer expectations, and if customers expect inflation, is this not the perfect time to meet their expectation and raise prices? These conditions did not exist a year ago. To make matters even better, Any blame gets cast on “supply chain issues” and increasing wages, regardless of the merits.

The long term problem is that once oligopolists discover how little resistance there is to their price increases and how much investors like the results, they will continue to raise prices in “anticipation” of more inflation, making some level of inflation a self fulfilling prophecy and paving the way for ever more price increases

JohnH,

Are you aware that prices of such basic commodities as corn and wheat prices have been massively up this year, including with them continuing to rise into this past month? These markets are about as purely competitive as any there are. Those price increases are not remotely due to any oligopoly power, and the rates of increase of related final goods, where arguably oligopoly power intervenes, have not been remotely as great as the increase of those basic prices.

Sorry, your argument is just wrong, just plain dead wrong.

Barkley Rosser

December 1, 2021 at 2:30 pm

A good point that of course JohnH just ignored. Market concentration has been increasing ever since the Reagan anti-trust revolution back in the 1980’s. And during the same period of time, inflation rates have been quite low.

Now that directly contradicts JohnH’s obsession but we can be guaranteed of this – this lying troll will never concede this basic point.

Further down you replied to Barkley:

“the decision to exploit pricing power is entirely a boardroom decision.nSo if companies are supposed to meet customer expectations, and if customers expect inflation, is this not the perfect time to meet their expectation and raise prices?”

I have read a lot of muddle headed garbage over the years but this confused gibberish really takes the cake. Could you please STFU as your poor mother has been embarrassed enough by your retarded BS.

Moses,

Well, heck, at least he is not senile, which “everyone knows” I am. So, better to be just s “sluggish dope” than out ant out senile like Nancy Pelosi and i are.

Oh but we caught Powell eating some really good ice cream!

https://www.nytimes.com/2021/11/30/business/lululemon-peloton-lawsuit.html

Peloton has overpriced stationary bikes that come with overpriced classes. Lululemon has overpriced yoga pants. It seems Peloton is selling workout clothes, which has generated this patent infringement suit.

Good grief – at least these robber barrons have not figured out how to charge me for running in the park.

https://jabberwocking.com/chart-of-the-day-the-price-of-gasoline/

Kevin Drum plots the inflation adjusted price of gasoline since 1992. Guess what? There is a lot of volatility and a modest upward trend. Duh – we did have a commodity boom over the past 20 years. So yea – prices today exceed prices in 1992 even in real terms. But gasoline is not as expensive as Princeton Steve’s superior “analytics” might suggest.

That Roosevelt Institute paper on market concentration and anti-trust policy noted the 2006 merger of Maytag and Whirlpool with this being the key research paper:

https://www.nber.org/system/files/working_papers/w17476/w17476.pdf

This blog has talked about the washing machine market a lot in terms of Trump’s stupid tariffs on foreign produced washing machines etc. It is interesting that this paper found no effect on washing machine prices from this merger. Now their other products did see price increases from letting two of the major producers merge.