consider the velocity of M2…

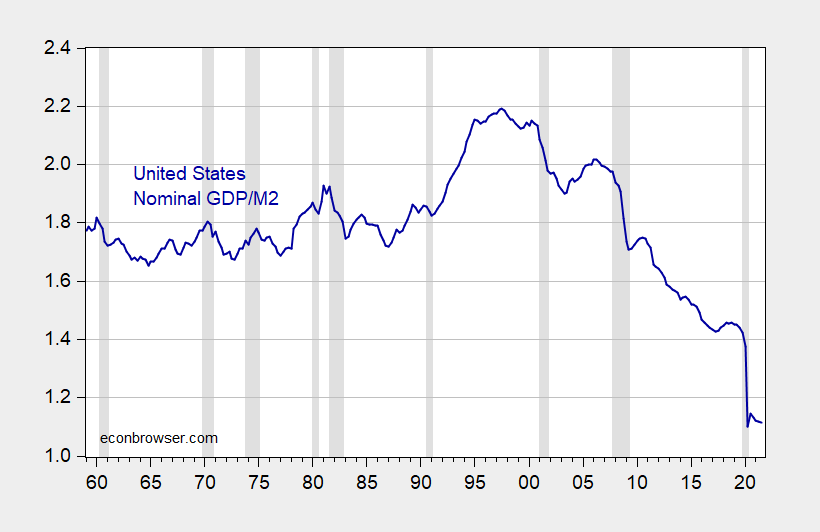

Figure 1: Velocity of M2, defined as nominal GDP divided by M2. NBER defined recession dates peak-to-trough shaded gray. Source: BEA, Federal Reserve, NBER and author’s calculations.

This ratio fails to reject the unit root null using a standard ADF test (constant, trend, using BIC to choose the lag length), a Elliot-Rothenberg-Stock DF test, and rejects a trend stationary null using a Kwiatkowski-Phillips-Schmidt-Shin test.

A Bai-Perron test for structural breaks ( of L+1 vs L sequentially determined breaks, max breaks =5) indicates 5 breaks.

’nuff said.

off-topic

This has no relationship to Economics. It was just a story I thought people should know about,

https://proteanmag.com/2021/11/29/the-american-prison-systems-war-on-reading/

This comes across as a straw man. Monetarists have known about the problems with the instability of M2 since the 1980s at least and QE has put a nail in its coffin. No one with any sense would look at this measure of velocity.

As an alternative, I ran a ADF test (constant, no trend, with one lag) for Divisia M4 [1] velocity and came to a similar conclusion as you on that one (I’m not sure how good Divisia M4 is at capturing the Fed’s monetary policy activity over the past two years, but I come to the same conclusion when I exclude it). It seems to be one of those types of relationships that comes close to rejecting the null, but not quite. For instance, if you fit an AR(2) model to the Divisia M4 velocity in levels, the sum of the coefficients is closer to 0.98, even if it is not significantly different than 1.

[1] https://centerforfinancialstability.org/amfm_data.php

John Hall: I understand that some monetarists allow for variation in velocity, where the variation is systematic (say due to interest rates). However, my point is that even if one found Divisia M4 velocity was mean stationary (!), the variation in velocity would still make implementation of monetary policy on the basis of monetary aggregates very difficult. (I think I’ve tried what you’ve mentioned before, on slightly shorter samples, and its hard to reject the unit root null using a wide variety of tests). By the way, maybe good to share with readers the point that estimates of autoregressive coefficients when the true autoregressive coefficient is at or near unit are downwardly biased.

I’ll grant you the point that implementing monetary policy with monetary aggregates would be very difficult. I’m just not sure there are many people out there advocating that.

Thanks for the reminder on bias. I don’t have a good sense at what point the consistency of the OLS estimates overtakes the importance of your bias point. I was using over 200 data points (quarterly back to 1967).

If I have a series x_t that is hard to tell if I(0) or I(1), is bias an issue if I do the regression chg_x_t = B1 * x_t_1 + B2 + chg_x_t_1 + e_t where chg_x_t is x_t differenced, x_t_1 is the lag of x_t, and chg_x_t_1 is the lag of chg_x_t_1?

John Hall The ADF test and associated critical values are there to account for the downward bias. There are many variants of this test, but they all have this same general principle. The definition of a “small sample” is not directly reliant on the number of observations (literally, everything under infinity is “small”), but is a function of the persistence.

For more, see this paper for a simple background on ways to account for downward bias.

Thanks.

John Hall: I haven’t done a survey of how many monetarists there are out there — but there are some with lots of money and institutional support. See for instance this post, and particularly this post, re: IIMR.

Menzie et al,

It is quite ironic that these posts you link to have my comment about how the Saudi Arabian Monetary Agency (SAMA) used to have competing series of data for M3. That was in 1981, when I spent most of the year in Riyadh working for the Saudi Computer and information Center, which was owned by the King Faisal Foundation, with it owned and run by the sons of the late King Faisal, top princes who ran much of the nation. The irony is that precisely 40 years ago today I left there flying to London. I am now saying something publicly for the first time ever, having been requested not to by a high US official. The day before that I got five Americans out of a Saudi jail, myself included, who were wrongly arrested. A long and complicated tale lies behind that, and earlier this year I wrote a long account of it for family and close friends, although any here brave enough to reveal your email address to me can receive a copy of it, now a matter of history and a further reason why I know a lot about the Middle East and its oil markets. Oh, it used to be that if you were caught in an authoritarian nation in a dark alley at midnight looking for a black cat that is not there while the nation’s secret police are bearing down on you, I would be about the best person around to have with you. But as “everyone knows,” I am now too aged to be of any assistance in such a situation any more. I would suggest getting Deirdre McCloskey, who not only can handle the metaphysical stuff and maybe even the legal side of things, but also has the hands and size of the football player she was as an undergrad when she was Donald.

Gobbledygook, huh?

Why not just say straight out, the Quantity Theory is dead, rather like the rest of the field of Economics?

Why not follow this guy?

《velocity adds value if you believe that it “ought” to be constant. Many people follow the primitive Quantity Theory of Money and assume that velocity is indeed constant. However, there is no reason to believe the primitive Quantity Theory of Money, and so there should be no reason to invoke velocity in the first place.》

http://www.bondeconomics.com/2021/11/why-we-cannot-measure-money-velocity.html?m=1

In other words, velocity was always a mathematical fudge factor, so why are you confusing the issue with further meaningless tests of a figure constructed out of thin air?

Are you trying to justify the arbitrary price of your unneeded labor, mayhap, by throwing gobbledygook at us acting as if we’re dumb if we don’t see intricate faith-based catechism that went into it?

rsm: If I am engaged in unnecessary labor, then by definition, you are devoting your time reading the output of unneeded labor value, which can then be logically construed as an unnecessary labor on your part. Please feel free to cease and desist.

I will note that for many economists of the past, velocity was not merely a “fudge factor”; and indeed for some (usually lay) people now, it still constitutes an important variable. (You can read many articles in the past that asserted that velocity was evolving with a stable trend – and it actually kind of looks like that through the 1970’s).

Is my labor of love, while you’re just getting paid, right?

rsm: Not sure I understand – it’s a labor of public service in part, roughly substitutable for interviews with media outlets like Bloomberg or Reuters or the like.

FYI. Economic blogs like this one are not for fee outlets – so no he is not getting paid.

I think velocity is useful in one way – it serves to show that monetary policy tools have lost power. The Fed cannot have (paraphrasing) ‘any inflation rate it wants, plus or minus a bit’, and by extension, cannot have any nominal GDP growth rate it wants. And the Fed is limited mostly to monetary tools, to de facto monetarism.

If velocity picks up, as it very likely will as the Fed cuts back on asset purchases, it will be more a reflection of a change in policy behavior than the behavior of private actors.

So instead of the Fed having any inflation rate it wants, the Fed can have any velocity it wants. Not useful.

Velocity does not measure anything other than a silly ratio. The FED has figured out how to monitor much more meaningful data points. Whether monetary power has lost potency is a matter of debate but the volatility of “velocity” has little to do with actual economic policy issues.

We might as well be measuring the number of fish in Brazil (the punch line of the professor who taught me econometrics).

hmmmm.

bring up silly ratios.

in my misspent youth i did inventory optimization theory applications.

one silly ratio i never saw need was inventory turnover: $sales/$ inventiry ‘iobjectives’…..

is a large, varied retail nventiry system like an economy?

i never saw where we manged very well with uncertainty etc.

Correlation is not causation, but it’s hard to argue that the run up in corporate profits over the last 20 years hasn’t had some deleterious effect on M2 velocity.

If all the money being created is being siphoned up by the corporations, perhaps we need to find a way to free it up? But how?

Taxation is avoidable, especially for corporations. Unless we impose a ‘fee’ for doing business in the US for any company over $XX billion?

Would breaking them up loosen their coffers? Maybe.

Any ideas?

Shall I ask what happens to velocity over a long arch of time in a nation where there’s high inequality of wealth and income??

Just curious what motivated this reminder. Yes – one person here claimed monetarism began in 1975 with those WIN buttons even though the MV = PY nonsense has been around like forever. Did Marjorie Taylor Greene decide she deserved the Nobel Prize in economics?

pgl: One commenter mentioned Friedman and monetarism. Many other commenters here and elsewhere have noted how enormous amounts of monetary expansion must necessarily result in commensurate inflation using some sort of quantity theory; hence, this post.

I figured it was at least somewhat tied to your lesson plans on Taylor. I’m guessing you agree more with Taylor than you do “early years Friedman” if that makes any sense.

I was too referring to that commenter. At least he recognized velocity is not a constant. Although his claim that Friedman changed everything struck me as being very ignorant of economic history.

Time for a post on PMI.

Oprah Winfrey’s snake oil salesman/ infomercial swindler running for Senator of Pennsylvania. With the possible exception of Dr. Phil (who intentionally let his license expire because of his fear of lawsuits for making “entertainment” out of white trash Americans’ personal problems) I’ve never seen a man in my life who was a doctor who screams LOSER louder than this man in all my life than this spineless lying clown. This guy is so amoral if he had been a passenger on the Titanic would have used his mother as a flotation device with her head face down into the water if he thought she would float.

https://www.post-gazette.com/ae/tv-radio/2021/12/01/mehmet-oz-the-dr-oz-show-talk-tv-channel-senate-campaign-pennsylvania-2022-race-republican/stories/202112010110

Related to infomercial swindler Mehmet Oz:

https://www.politico.com/news/magazine/2021/12/01/dr-oz-senate-campaign-523562

With “doctor” Ronny Jackson in the House and “doctor” Rand Paul in the Senate, maybe “doctor” Oz was hoping to join them as the Three Stooges.

With all due apologies to those who love the classic comedy act I just referred to.

For the duration of the hour-long hearing, members of the subcommittee lined up one after the next to grill “America’s Doctor” for statements he made on “The Dr. Oz Show,” his daytime cable program on health and wellness, laying into him for his endorsements of the miraculous powers of green coffee extract and the fat-burning magic of raspberry ketone. From his spot behind the witness table, Oz refused to back down. He brandished print-outs of scientific studies to defend his statements about various weight-loss supplements and cited transcripts of his TV appearances to show how advertisers had taken his words out of context. At one point during the question-and-answer portion of the testimony, Sen. Claire McCaskill (D-Mo.), the subcommittee’s chair, grew visibly agitated at Oz’s evasiveness, blurting out, “I’ve tried to do a lot of research in preparation for this trial and the scientific community is almost monolithic against you.” It was a hearing, not a trial, but McCaskill’s slip was telling: The committee was trying to put pseudoscience on trial, and Oz was the star witness.

I hear Clair McCaskill talk about this during some show yesterday. I was just hoping one of the other guests might say that this green coffee was part of the diet regime for both Chris Christie and Mike Pompei.

I’m not using whatever public bathroom Chris Christie used after drinking green tea or green coffee. You ever notice how extremely obese people can leave a smell that hangs in the air 20 minutes after they left the bathroom?? I’d walk 5 miles just to avoid that. I just hope his wife and children have separate bathrooms. If not, that’s more than enough cause for divorce.

I was about to make dinner but the thought of being in a bathroom used by Chris Christie has made me lose my appetite.

Are you telling me I have an idea for a “new” diet craze “sweeping the nation”?? i just need funding for the infomercials now. Watch out Dr. Oz, Oprah Winfrey, and Mike Lindell, I’m coming after your customer base. Suddenly I’m envisioning Johnny Carson, a “fork in the road” and a nearby blonde friend. I just have to find that suit I only ever wear at funerals.

https://www.cnn.com/2021/12/01/politics/donald-trump-covid-19-presidential-debate/index.html

Just before the first Presidential debate Trump reassured everyone that he did not have COVID-19 but it turns out he has just tested positive for the virus. I generally wish no harm on anyone but Trump is so disgusting I would say it is a damn shame that he did not die when he caught this virus.

While we are throwing out quantity of money as a useless and dangerous fiction, how about we also throw out NAIRU.

Economists have done enormous damage to innocent wage earners for decades with their NAIRU dogma. Like pornography, economists can’t define NAIRU but they claim to know it when they see it .. somewhere, looming in the distance. It’s 5.5%, No it’s 5.0%. No it’s 4.5%. No it’s 4.0%. No its 3.5%. No …

It’s rather ironic that it took a non-economist Fed Chair, the first in half a century, to finally take the the Dual Mandate seriously. It reflects rather poorly on the economic profession.

NAIRU is a favorite whipping boy over at Econospeak. If it did not die in the late 1970’s, it was certainly ignored by the FED during the late 1990’s.

https://krugman.blogs.nytimes.com/2015/09/18/the-receding-nairu/

September 18, 2015

The Receding NAIRU

By Paul Krugman

I began my apprenticeship in economics as a research assistant to Bill Nordhaus, who was working on energy * at the time (check the acknowledgments), and one thing I remember was the continual frustration over the failure of alternatives to conventional crude oil to materialize. That’s all changed now, of course; but at the time people used to cite “Weitzmann’s Law”, which said that the cost of alternatives to oil was 40 percent above the current price — whatever the current price happened to be.

It’s hard to escape the sense that something similar is happening now when it comes to estimates of the NAIRU, the lowest level unemployment can reach before inflation becomes an issue. The chart shows the actual unemployment rate versus the Federal Open Market Committee estimate of the long-run unemployment rate (the middle of the “central tendency” until the latest report, which gives us the median). Estimates of how low U can go seem always to be a bit below the current level of unemployment.

[ https://static01.nyt.com/images/2015/09/18/opinion/091815krugman1/091815krugman1-tmagArticle.png ]

What’s driving this ever-falling estimate of the NAIRU? …

https://www.msn.com/en-gb/news/world/kavanaugh-signals-support-for-curbing-abortion-rights-as-supreme-court-hears-arguments-on-mississippi-case-e2-80-93-live/ar-AARlnEq?ocid=uxbndlbing

So Kavanaugh is open to the idea that the Constitution is “neutral” on a woman’s right to choice as if it is all up to state governments. Give him time – the right to vote and basic civil rights will fall under Kavanaugh’s umbrella, which means America returns to where Life, Liberty, and Happiness belongs to white men only. Trump has the Supreme Court he wanted!

https://fred.stlouisfed.org/graph/?g=BkzA

February 25, 2015

Velocity of M2 money stock, * 1960-2014

* http://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable. Once upon a time Milton Friedman called for slow, steady growth in M2 as the key to a stable economy; surely you can’t think that makes sense given developments since the mid-1980s.

Paul Krugman

Milton Friedman noted that it was Irving Fisher who came up with this Quantity Theory of Money. as in The Purchasing Power of Money (1911). According to Fisher, “Other things remaining unchanged, as the quantity of money in circulation increases, the price level also increases in direct proportion and the value of money decreases and vice versa”.

Of course “other things” including velocity and the growth of real GDP are not immutable constants.

I may not be the best economic historian but those who think Friedman cooked up this rather worthless little “theory” really should take a course in the history of economic thought.

pgl,

Fisher codified a simple-minded version of it that Uncle Miltie picked up on. But the idea of it, generally stated with more sophistication such as recognizing multiple measures of the money supply, had been around for at least a century earlier in many discussions. Thomas Humpthrey at the Richmond Fed has written numerous excellent papers on this, easily found by googling, most of them just Working Papers out of the Richmond Fed, although frequently cited. He is the go to man on this.

Found this excellent paper by Thomas Humphrey:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2117542

Jean Bodin, John Locke, and David Hume! So when I said it began with Irving Fisher – I was a few centuries off!

Professor Chinn,

I assume what you are showing with the ratio of GDP/M2 is that the ratio should be stationary if there is a relationship between the two variables.

In addition to your chart what I find interesting is that the period from 1962 to 1978 on your chart looks like it may be stationary, but when I test the data there is a unit root. If the unit root was evident at the time in the period of 1962 to 1978, why was monetarism so fully accepted?

AS: Ratio could be mean or trend stationary if one wanted to exploit the link between money and price level. It’s not impossible to exploit the link if the ratio is not stationary (see pictures in this post), but I think it would be a lot harder.

In 1978, Engle and Granger had not written their seminal paper on spurious correlations. People were still doing linear detrending with little concern about whether the population mean existed for such an estimated trend.

Great thanks!

Hopefully, I have the “new” concept of what causes inflation somewhat understood.

So, it seems (from my basic understanding) we are left with supply and demand. If monetary increases create wide-spread demand exceeding supply, then we may see general price level changes and thus inflation.

If monetary increases do not create wide-spread demand exceeding supply, then we will perhaps not see general price level changes and perhaps no inflation, but merely price increases in selected items where demand exceeds supply.

AS: Aggregate demand is just the sum of demand, by spender (consumers, firms, government, rest-of-world), and that in relation to aggregate supply which determines the long run price level, and average price level set by firms in short run determines inflation. In other words, see here.

I suspect that most younger monetarists have moved on to what’s called market monetarism where the object of the FED should be to produce a smooth growing nominal GDP, not a smooth growing money supply. Nominal GDP can be considered as the velocity corrected money supply.

in one of the great ironies monetarism worked under regulation. De-regulation killed it dead.

James Tobin sort of anticipated this. Then again he knew that most of the money supply represents bank liabilities (deposits) and banks are profit maximizing financial institutions.

Deregulation has killed many of the once inviolate relationships. The entire financial industry of “balanced portfolios” is about to be challenged once again. Regulations worked to choke off the excesses. But that was defanged ’80’s; tossed aside in the 90’s minimized in the 2000’s and nonexistent today.

Looking at the graphs Menzie posted here and also the links to old threads on this I realize I was wrong about something, namely when V2 destabilized. I had claimed that it destabilized in the mid-80s when in fact it did not really do so until after about 1990 as can be seen in the figures posted here by Menzie. It was V1, old Uncle Miltie’s fave, that destabilized in the mid-80s. Oter V’s continued to destabilize later until none of them had any stability worth a dog.

This is somewhat relevant in that somebody here (CoRev maybe?) just recently linked to a recent WSJ letter by former Fed gov Robert Heller, who expressed full-bore paleo-monetarist views, which look totally silly now. But i note that he served on the Board from 86-89, which was a period during which V2 was still fairly stable, its last gasp at that, even though V1 had gone blooey just about the time he got on the Board. But it took some time for people to seriously realize that.

Oh, and probably the origin of fairly basic monetarism, at least its most famous first appearance, is in the writings of David Hume in the mid-1700s, although he did not write down an equation for it.

Oooops! It was AS who linked to the recent letter to the WSJ by Robert Heller, not CoRev. My apologies to CoRev. However, it was certainly reasonable to ask about the letter, given Heller’s past service on the Fed Board.

Plainly, both fiscal and monetary policy are less effective if we run relatively more open economies rather than closed. Fiscal stimulus tends to drag in imports, monetary stimulus merely lowers borrowing costs. In both cases the desired business investment response is missing. Business investment is increasingly subject to international arbitrage; directed away from developed to developing economies where returns are higher. The above chart illustrates that for monetary policy. Monetary stimulus lowers borrowing costs but investors have little appetite for domestic investment in productive capacity that would grow the economy. The result is weak GDP growth despite increasing money supply, hence the chart. Something similar would be seen for most developed economies.