Usually, the Friday after Thanksgiving holiday is a quiet trading day. Today, there was lots of news to react to.

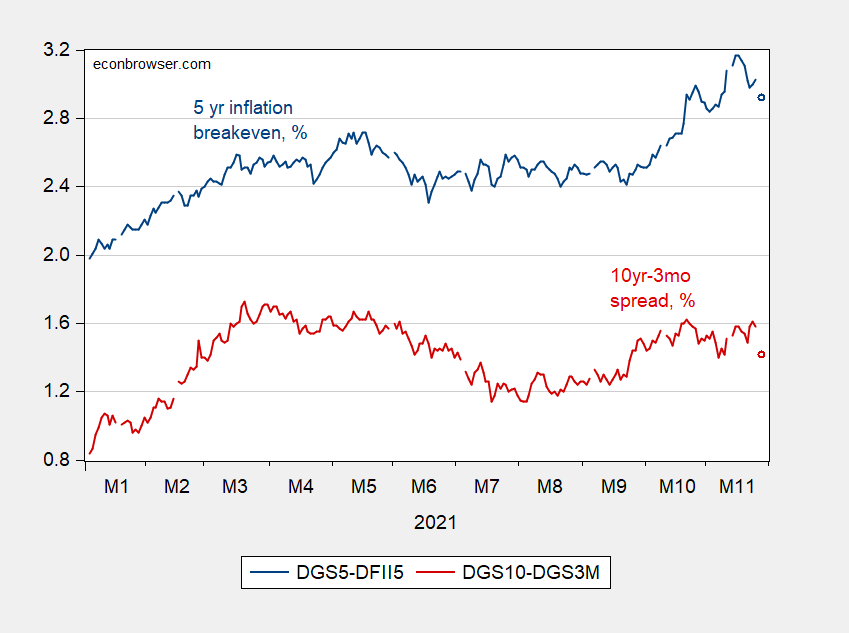

Figure 1: Five year inflation breakeven, calculated as 5 year Treasury yield minus 5 year TIPS (blue), and ten year – three month Treasury spread (red). Source: Treasury via FRED, author’s calculations.

The inflation breakeven (5 year) has fallen (although this spread is not adjusted for risk and liquidity premia), while the yield curve has flattened, suggesting slowing growth.

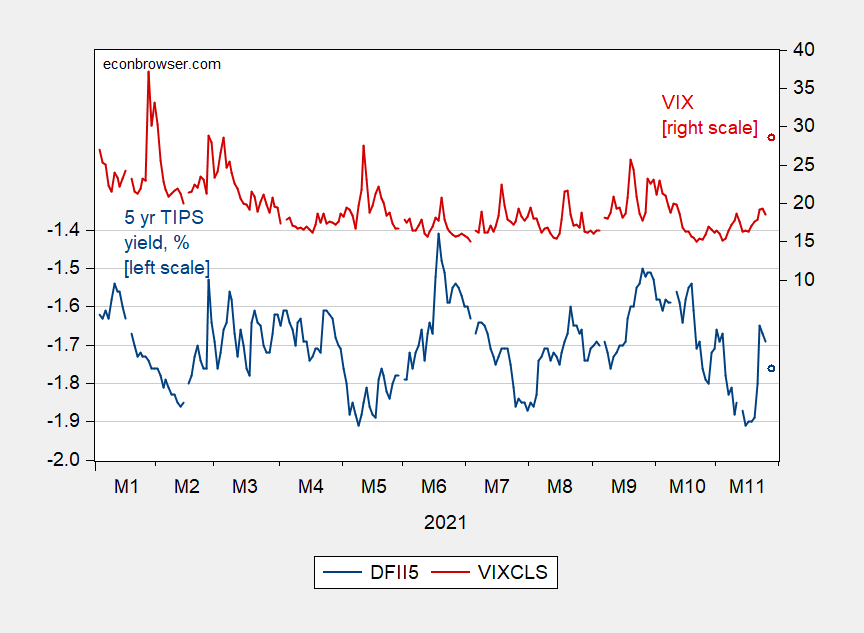

Consistent with downwardly revised growth prospects — for now — real rates have fallen, while implied uncertainty has risen.

Figure 2: Five year TIPS yield (blue, left scale), and VIX (red, right scale). Source: Treasury, CBOE both via FRED.

I thought is was funny, within the last 3 days there were lots of “experts” on Bloomberg saying the Fed was getting itchy and about to “go on a tear” (for lack of better phraseology) and start raising rates. Bet they love watching themselves in the internet video 48 hours later. To me, the cases/hospitalizations jump in USA and Germany, and my own resident state’s numbers within the last 2 weeks and the finding of Omicron make for one hell of a coincidence. Could it be “much ado over nothing”?? Yeah, it could, but I put it at about 67% that this is legit going to be a problem with no answerable vaccine (ATM). But I was wrong at the very beginning of Covid~19, viewing it as more like SARS, which when i was in China, struck me as mostly a bad comedy act. You’d have had to have been there to “get” my odd perspective on SARS circa 2002–2003

WTI down ten bucks. Thin trade, so that may be exaggerated. It improves the inflation outlook till further notice. That drop is consistent with the damage to airline shares; travel and hospitality are likely to suffer from new restrictions if good policy prevails.

The Fed tend to respond to financial risks pretty quickly. Volatility is read as risk. The taper has not caused much market response so far, so the Fed may not change course right away, but persist higher market volatility and lower energy and could combine to put the taper on pause.

A rise n volatility is inconsistent with a continued high equity p\e (https://www.jstor.org/stable/4479930).

All of which is less relevant if Omicron turns out to be not so bad.

“WTI down ten bucks.” Is Princeton Steve still telling this will pass $100 this year? Oh well!

I checked with FRED and this price averaged $81.48 per barrel last month. The reason is that JohnH is on some sort of free trade soap box when it comes to Iranian oil – go figure! He wants us to believe that China is getting their oil at deep discounts. The relevant price index for Middle East oil sold to China is the Dubai Fateh index which average $81.22 per barrel last month?

A DEEP discount if one is too damn lazy to check the data!

I thought these were interesting links, related to the topic:

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/110921-china-data-espo-oman-crude-remain-favorites-for-independent-refiners-in-october

https://www.bourseandbazaar.com/articles/2021/10/27/uae-earns-big-as-iran-sells-oil-to-china

https://www.reuters.com/business/chinas-iran-oil-purchases-rebound-lower-prices-fresh-quotas-2021-11-10/

Gonna be interesting to see what the gas station pump prices are around Wednesday. Last time I went to pick up gas it was $2.61.

“The UAE is a major re-export hub, meaning that Iran sources goods from a wide range of countries from suppliers in the UAE. The growth in Iranian imports from the UAE has been so rapid that the Arab entrepôt has now replaced China as Iran’s top import partner.”

Entrepôt essentially is an intermediary that buys goods from one entity and then resells the goods to another entity. Robert Feenstra and Gordon Hanson published a paper in the March 2004 edition of the Journal of Economics and Management Strategy entitled “Intermediaries in Entrepot Trade: Hong Kong Re-Exports of Chinese Goods” that documented the impact of apparel quotas on the exports of goods made in China and sold in the US. If we go back 30 years, a company like Nike might pay $100 for that pair of shoes which you pay over $150 for. The entrepôt would likely keep $6 giving the supplier only $94. Of course free trade has cut that enormous spread in half. But in the real world of tax evasion, Nike now owns the middle man and still charges high intercompany commission rates so it can divert taxable income to Macau. But I digress.

What the commission rate that the UAE gets on this deal would be an interesting question. A quick and dirty explanation might go – China pays the UAE $80 a barrel while the UAE pays Iran only $78 a barrel. The $2 spread would represent a 2.5% commission rate, which strikes me as incredibly high. Maybe they get less as they are essentially doing nothing. Of course they might get more, which would really be a rip off. If any of our informed readers knows what the data shows – this would be interesting.

“ China will also be able to buy any and all oil, gas, and petchems products at a minimum guaranteed discount of 12 per cent to the six-month rolling mean average price of comparable benchmark products, plus another 6 to 8 per cent of that metric for risk-adjusted compensation.”

https://oilprice.com/Energy/Energy-General/China-Inks-Military-Deal-With-Iran-Under-Secretive-25-Year-Plan.html

pgl is under the delusion that all oil must go through the liberalized international oil market!!! How uninformed!!! Just one of many things pgl simply gets wrong…

“JohnH

November 28, 2021 at 6:42 pm”

JohnH is so desperate to make a “point” he leaves out key portions of his own link. To get their oil, China has to invest $400 billion into the Iranian economy and provide other goodies to China. JohnH forgets to tell us those pesky details. No – he wants us to get cheap oil so badly that he is asking Biden to have Congress give a similar deal to China? Seriously? The chances of this passing the Senate are zero as such a deal strikes me as a really poor one.

Come Johnnny boy – keep us the dishonesty laced with extreme stupidity. It amuses us!

The news of a new variant could be a problem for holiday sales, as well as travel. Brick-and-mortar stores still account for the majority of goods sales and have worked hard to fill shelves for the holidays. A bust for brick-and-mortar is a bust all around. Home delivery is near capacity and can’t make up the difference.

Odds are, we’ll go ahead and shop; no Omicron cases reported in North America so far. There is an outside chance, though, of a bad Q4 due to this new spikey-ball virus.

Oh, what the heck. While I’m at it, there is some informed speculation that infections in immuno-compromised people allow for increased mutation. The virus dies out in most of us before mutations have time to pile up and be transmitted. A host with a weak immune system allows more time for mutation and transmission. South Africa’s high rate of HIV infection may be the reason that new variants crop up there wth considerable frequency.

Taking extra steps to protect those with weakened immune systems might be good value for public health money.

https://twitter.com/trvrb/status/1464353224417325066

“A host with a weak immune system allows more time for mutation and transmission. South Africa’s high rate of HIV infection may be the reason that new variants crop up there wth considerable frequency.”

Really? The corona virus is only transmissible as long as it is in the upper part of the respiratory apparatus, the chance to be killed is for the infected person a direct result of previous infections. IMHO the correlation of developement of variants with HIV is not very convincing.

The African population is very young (-> many unnoticed infections) and the dying happens usually in rural districts with missing medicinal infrastructure. In cities you have HIV related infra strcuture that helps to detect corona cases.

New variants are a direct result of many infections, here Africa has a real “advantage”.

Is your humble opinion informed by extensive research? I ask because the idea that immuno-compromised people are a likely source of many mutations comes from people who are actual experts in immunology.

I’d be happy to hear why your sentence about the upper respiratory system has any relevance to the idea at hand. Perhaps it went over my head.

The question of where multiple-mutation variants come from is down to time. Check Moses link. Either the Omicron developed through multiple transmissions among regular folk which went undetected (unlikely in South Africa) or as a result of a long period of infection in a single person, making an immuno-compromised host a likely candidate. Detection in a single host is unlikely, in South Africa or Denmark or the U.S. So I’m not sure your point about many infections makes sense since the intermediate stages were not detected.

“Is your humble opinion informed by extensive research? I ask because the idea that immuno-compromised people are a likely source of many mutations comes from people who are actual experts in immunology. ”

The data indeed support that immuno-compremised people suffer from higher and longer infections, the issue is that many people have a damaged immune system in Africa, AIDS is only one contribution, parasites are another. You use AIDS infrastructure to detect covid cases, you apply a brutal filter. You may create a correlation with this filter. OK?

I should have been clearer.

Macro makes a really ignorant claim: “Detection in a single host is unlikely, in South Africa or Denmark or the U.S. So I’m not sure your point about many infections makes sense since the intermediate stages were not detected.” How many months and how many times have we heard about the many millions of asymptomatic cases in these very same locales? Detection in a these many, many single hosts is very, very likely.

“Conclusions

In conclusion, one-fourth of SARS-CoV-2 infections are remained asymptomatic throughout the course infection. Scale-up of testing, which targeting high risk populations is recommended to tackle the pandemic.” https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7987199/

That comment was beyond dumb. I would man splain it to you but macroduck beat me to it. Try THINKING before you write your next comment.

“That comment was beyond dumb. I would man splain it to you but macroduck beat me to it. Try THINKING before you write your next comment.”

Maybe you are simply unable to recognise a correct statement. 🙂

1) Transmission is different from generation of mutants.

2) AIDS is only one cause of damaged immune system in Africa, and you use a brutal filter by reporting results from AIDS clinics. Therefore, it is a nice thesis but not more, as other experts have pointed out, a lot of the situation in African rural parts is not documented.

PGL stikes again in his ongoing attempts he is the dumbest and most ideologically driven commenter here.

CoRev: Seriously? You’ve ideologically distorted even the word “blip”.

Menzie, seriously? “Blip” equates to “transitory” in today’s world of inflationary economics.

So 2.5 years is a blip? That’s what you claiming.

Menzie, why such a deep obsession re: soybean prices? “So 2.5 years is a blip? That’s what you claiming.”

What has happened in the past 2.5 years? https://www.nasdaq.com/market-activity/commodities/zs Maybe the 2021 price rise was due to Biden’s policies?

As i said before, I have moved on from soybean prices. I even deleted my URL s of your many claims so that I could actually “quote” your very words. That’s the adult thing to do.

CoRev: It’s been 3.5 years since your “blip” comment. Prices started rising in Fall 2020. Can you not read and comprehend my statement. Regardless of what drove the increase in Fall 2020, 2.5 years is still longer than what I consider a “blip”.

Menzie, exactly my point about you obsession about soybean prices: “It’s been 3.5 years since your “blip” comment.” 3.5 years, and frequent re-visits since??? Living in your head for 3.5 years is getting boring. 😉

corev, the issue prof chinn has with you is a complete failure to acknowledge when you were wrong and correct your thinking. you think it is ok to simply be wrong, be pig headed about being wrong, and never admit that failure. that is what a child does. permitting that type of behavior on a blog brings down its quality, because some people are then constrained by the truth, while others like you are free to lie to promote your argument. that is not a fair fight. its obvious you could care less about your own integrity on this blog.

Baffled, another head conservatives have lived in.

Please let’s add more lumpy/intermittent power to stabilize the Texas grid.

“The February freeze triggered the loss of 61,800 megawatts of electric generation, as 1,045 individual generating units experienced 4,124 outages, derates or failures to start. It severely reduced natural gas production, with the largest effects felt in Texas, Oklahoma and Louisiana, where combined daily production declined to an estimated 20 billion cubic feet per day. That is a reduction of more than 50 percent compared to average production from February 1-5.

Today’s assessment points to freezing of generator components and fuel issues as the top two major causes of generator outages, derates or failures to start. The identified causes in the preliminary report affected generating units across all fuel types. Of the 1,045 generating units affected, 57 percent were natural gas-fired units that primarily faced fuel-supply challenges.”

https://www.nerc.com/news/Headlines%20DL/2021%20Winter%20Freeze%20092321.pdf

this comes from the nerc report on the power failure in texas. not that corev would read the report, but it is interesting to note that 57% of the failures were natural gas fired units. talk about lumpy/intermittent power sources!

Badger fans are lucky today that Mohamed Ibrahim #24 is out with a season ending injury. Dude is the real deal. Watchout next year!!!! Get those linebackers and safeties watching the game tapes.

Michigan 42 THE Ohio State 27. An unstoppable run game.

Fraudulent outcome. I demand a recount. Or another shot at the wolverines.

I did think a lot of the calls were questionable. The guy has his ankles held on to long after the play ends and he’s the one who gets the penalty. It’s like the kid in the back seat of the car that retaliates after getting socked to the head and gets punished by the parents. With replay there’s no excuse for that. He was being baited. But the guy who was holding the ankles was white, and the guy who retaliated was Black, so there’s a “shocker”.

And the non-call on pass interference in the OU vs Oklahoma State game was blatantly bad. I dare you to find anyone who thinks the receiver had any chance to catch that ball. He was 1/8th step away from sexual molestation and you’re not going to make that call??

https://twitter.com/TonyCMKE/status/1464813014889250818?ref_src=twsrc%5Etfw

Why not just forget it and let the defensive back put a horse saddle on the receiver’s back at the line of scrimmage and ride him all the way to the end zone. At that point that refs have decided they refuse to make the call, what’s the difference??

At least pgl got the OSU Michigan score right…

He should stick to football.

And you can stick to your forte – writing incredibly stooopid posts!

Inflation has risen in most countries. There is a nice OECD chart here: https://data.oecd.org/price/inflation-cpi.htm showing the inflationary shock and its principle component – energy. Energy prices have spiked globally thanks to a late northern spring lifting gas consumption, Russian reluctance to increase supply and China less willing to use coal and outbidding Europe for LNG. The other main factor is a global, covid induced shift away from services towards goods consumption – hardly unexpected. Even the double vaxxed are nervous about Delta. The OECD Euro average is 5.3% so I guess the U.S. is a little on the high side, but not by much.

Given the obvious drivers of the current inflation and no sign of inflationary expectations taking hold, particularly in wages, it seems likely the current inflation will moderate naturally. Central banks are aware of this as are professional economists like Menzie. The moderation timeline is hard to predict because the disease itself is hard to predict. Covid is the gift that keeps on taking. With new variants looming none really know what the new year will bring.

Hey new guy, haven’t seen you here before. Welcome.

Thanks for the welcome, happy to join the conversation. This is a valuable forum. Informed debate of current issues that concern economics is rare. Uninformed debate is simply a waste of time.

The OECD chart is interesting. Thanks for providing it.

No surprise that Japan still has a low inflation rate but it is interesting that Germany’s inflation rate is near 5% given how anti-inflation they have always been.

https://www.nytimes.com/2021/11/27/world/africa/coronavirus-omicron-africa.html

November 27, 2021

As Omicron Variant Circles the Globe, African Nations Face Blame and Bans

With countries trying to close their doors to the new coronavirus variant, southern African officials note that the West’s hoarding of vaccines helped create their struggle in the first place.

By Benjamin Mueller and Declan Walsh

Nations in southern Africa protested bitterly on Saturday as more of the world’s wealthiest countries cut them off from travel, renewing a debate over border closures from the earliest days of the coronavirus pandemic and compounding the problems facing poorly vaccinated countries.

A new coronavirus variant called Omicron, first detected in Botswana, put governments on edge after South Africa announced a surge of cases this week, plunging countries into the most uncertain moment of the pandemic since the highly contagious Delta variant took hold this spring.

As in the early days of Delta, political alarm spread quickly across the world, with officials trading blame over how the failures of the global vaccination effort were allowing the virus to mutate, even as researchers warned that the true threat of the new variant was not yet clear.

Bearing a worrying number of mutations that researchers fear could make it spread easily, Omicron was spotted in two patients in Britain on Saturday and another probable case in Germany, leaving in its wake what scientists estimated to be thousands of cases in southern Africa and tens or hundreds more globally. One nation after another shut its doors to southern Africa even as they spurned public health measures that scientists said were far more urgently needed to take on the new variant….

The reasonable policy is to limit spread when a variant is not yet widespread by limiting travel. The goal is to give public health officials a few weeks to prepare for ye new variant. A few weeks is the most we are likely to get.

Once a new variant arrives in a region, travel bans are no longer useful. So travel oimits are unlikely to be necessary for more than a few weeks. South African officials have argued for delay in imposing travel restrictions until we have more information. That’s backward.

It would be bad policy to maintain travel restrictions after Omicron becomes widespread. Under reasonable policy, travel limits should last only a few weeks.

These aren’t new ideas. This is what many epidemiologists advised early in the pandemic. Irrespective of who is to blame for what, best practices are the right answer now. Limiting travel from regions where Omicron is in the population is necessary in the near term.

Oh, and South Africa’s vaccination rate is around 30%, despite the fact that local capacity could provide a higher rate of vaccination. Vaccine reluctance is a big problem in South Africa. Yes, rich countries took care of themselves before becoming generous with vaccines. Now, rich countries are providing doses that are going to waste in poorer countries.

South African politicians and bureacrats beholden to politicians are looking for someone to blame so they aren’t blamed themselves, just like politicians everywhere. The NYT has quoted them, but that doesn’t mean you need to quote the NYT. More mindless propaganda..

Re: South Africa

I think I read somewhere that successful medical campaigns got the traditional “healers” on board first. Can’t just cram down western medical practices on old traditional cultures.

copy/pasted from British newspaper “The Guardian”

“Wall Street’s Dow Jones industrial average is on course to shed around 2.5% on Monday and the broader S&P500 is tracking for losses of 2.2%. Other major indices are heading the same way with the FTSE100 expected to drop 3.8%, the Hang Seng seen losing 1.2%%, and the Nikkei to drop more than 3%. However, there’s a lot that could happen in the meantime. If evidence emerges that the new variant is not as dangerous as previous ones, markets could rebound very sharply so the futures indices will be closely watched for the next 24 hours in the build up to the next session opening in Asia Pacific. Worth quoting comments by Dr Angelique Coetzee, chair of the South African Medical Association and a practicing GP based in Pretoria, who said it was “premature” to make predictions of a health crisis. ‘It’s all speculation at this stage. It may be it’s highly transmissible, but so far the cases we are seeing are extremely mild,’ she said”

On the bright side, “Princeton”Kopits says oil will hit $100 before New Years because of Biden’s infrastructure package, And Barkley Junior says this is very very reasonable. Over $100 in Barkley’s mind, before 2021 year’s end, is a rather boring event. So, say, anything between $40 and say $105. So take note Energy futures traders. You’ve got a pen right?? $40–$105, just in that range there, with $105 being a pedestrian event.

I should have included the link, apologies to the solid journalists of “The Guardian” newspaper.

https://www.theguardian.com/world/live/2021/nov/28/covid-live-news-uk-germany-and-italy-detect-omicron-cases-israel-bans-all-visitors?page=with:block-61a2f5908f08de86f451d91a#block-61a2f5908f08de86f451d91a

Best-case miracle: Omicron crowds out other variants, is mild relative to other variants and is preventable with existing vaccines.

Fingers crossed…

There is some hope there, I read one respected scientist in a respected publication (my memory is failing me on the publication title) say that few of the cases related to Omicron had been severe up to this point. So I think this is the initial hope, that yes Omicron is highly transmissible, but not any more likely to cause death, but as you intimated Macroduck, still early in the game.

Moses,

That forecast was mad much earlier in the year. There is now only a month left in it. The outer bounds have moved in considerably, although the Friday sudden drop is exactly the sort of thing I noted could and still can happen, farily large movements in very short times.

No, I am not saying what the bounds are now. I do not know, but they have moved in.

Very sad news. A hero to children the world over. Here is a guy I doubt who worried to much if Saint Peter would allow him into the pearly gates:

https://www.theguardian.com/world/2021/nov/28/phil-saviano-catholic-sex-abuse-whistleblower-spotlight-source-dies

Matthew 18:6

New King James Version

Jesus Warns of Offenses

“But whoever causes one of these little ones who believe in Me to sin, it would be better for him if a millstone were hung around his neck, and he were drowned in the depth of the sea.”

“made” much earlier in the year, although it is amusing that I said “mad.” Really need to do more proofreading before hitting “submit.”

South Africa is a country of exceptional inequality, a country that has scarcely grown for more than 40 years, a country that experienced a calamitous epidemic that had reduced the life expectancy to 53.4 years by 2004. Threatened now with another epidemic, South Africa has needed pronounced assistance to protect most residents, but such assistance was too little solicited by a government just holding office.

The problem is however that now South Africans must be protected from this epidemic for all of us to be protected:

https://fred.stlouisfed.org/graph/?g=JcAW

January 15, 2018

Life Expectancy at Birth for South Africa, Zimbabwe and Zambia, 1980-2019

https://fred.stlouisfed.org/graph/?g=JjMG

January 15, 2018

Life Expectancy at Birth for South Africa, Zimbabwe, Botswana and Zambia, 1980-2019

https://fred.stlouisfed.org/graph/?g=Jb9N

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa, Zimbabwe and Zambia, 1980-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=Jba2

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa, Zimbabwe and Zambia, 1980-2020

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=Jiuj

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa, Zambia and Botswana, 1980-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=JiuP

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa, Zambia and Botswana, 1980-2020

(Indexed to 1980)

What that South African government did request, early on, several times, is that the United States allow its patented coronavirus vaccines to be manufactured in South Africa.

A people who were long disabled by being colonized, who were subject to the ruthlessness of Apartheid to the 1990s, such a people are of course beyond “blaming” for the sadness of an epidemic. South Africans are to be appreciated and assisted.

ltr,

I agree with you on this. As it is, South African President Ramaphosa was one of the most responsible and responsive of world leaders early on when the pandemic started, with that substantially driven by the nation’s earlier experience with HIV, which two of his predecessors (not Mandela) had minimized. However, it is unfortunate that there has not been a more complete follow through with respect to getting the population more fully vaccinated.

Biden talked about sending 275 millions vaccine doses, which alas is only 5% of what is needed. The G7 is short changing the Global South in the worst sort of way.

https://fred.stlouisfed.org/graph/?g=Gb0g

January 30, 2018

Consumer Prices for China, United States, India, Japan and Germany, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=HNv2

January 30, 2018

Consumer Prices for Russia, Indonesia, Brazil, France and United Kingdom, 2017-2021

(Percent change)

Yes, I surely needed to reference and quote from this sensitive New York Times article. Understanding and appreciating the people of southern Africa is an obligation for me:

https://www.nytimes.com/2021/11/27/world/africa/coronavirus-omicron-africa.html

November 27, 2021

As Omicron Variant Circles the Globe, African Nations Face Blame and Bans

With countries trying to close their doors to the new coronavirus variant, southern African officials note that the West’s hoarding of vaccines helped create their struggle in the first place.

By Benjamin Mueller and Declan Walsh

I Googled Entrepot UAE Iran to see if things other than that story on oil came up and all sorts of articles popped up including this interesting discussion:

https://www.csis.org/analysis/chinas-middle-east-model

During the period where we put quotas on imported apparel from China, Hong Kong was the center of entrepot trade. Alas the PRC is threatening to clamp down on the freedoms of the residents of Hong Kong even as they set up Dubai to be the next Hong Kong.

Eurozone inflation is up:

https://jabberwocking.com/eurozone-likely-to-report-record-inflation-for-november/

Most people will blame Biden of course. JohnH will get on that soap box and whine over and over that this is all about oligopoly that no economist ever talks about!

As usual pgl gets it wrong…no economist seems to be talking about oligopolies contribution to inflation. Nobody ever said that inflation is entirely caused by oligopolies.

Your mother just called me. She is really angry that you keep embarrassing the family. Sorry dude – but she has disinvited you for the holidays.

Meaning no disrespect, please offer possible or likely examples of oligopoly pricing. I have been wondering whether logistics control of 84% of the market by by FedEx, UPS, DHL and USPS * might limit the wage structure for transport and warehouse workers. Also, patent structure as for drugs should be of concern.

* Post Office

There are over 30 publicly traded logistic companies listed on the US stock exchanges. I checked the financials of some of the key players and their profit margins have not sky rocketed at all. But please – do not ask JohnH to do serious research on these type of topics as he is both clueless and as about as dishonest as it gets.

BTW – Menzie provided a 2016 CEA report on the issue of market concentration, which is a must read (I know, I know – JohnH did not read it at all but hey). It shows how market concentration evolved by sector starting with the transportation and warehousing sector.

https://fred.stlouisfed.org/graph/?g=IXuE

January 30, 2020

Consumer Prices and Consumer Prices less food & energy for Euro Area and United States, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=IXud

January 30, 2018

Consumer Prices and Consumer Prices less food & energy for Euro Area and United States, 2017-2021

(Percent change)

https://www.nytimes.com/2021/11/28/us/infrastructure-megaprojects.html

November 28, 2021

Years of Delays, Billions in Overruns: The Dismal History of Big Infrastructure

The nation’s most ambitious engineering projects are mired in postponements and skyrocketing costs. Delivering $1.2 trillion in new infrastructure will be tough.

By Ralph Vartabedian

As Honolulu sprawled into new suburbs west of Pearl Harbor over the last two decades, city planners proposed an ambitious rail transit line that would sweep riders 20 miles into downtown. The $4 billion estimate in 2006 was hardly cheap, amounting to $200 million per mile.

The cost escalation since then has been an engineering marvel all its own. Concerns over Native Hawaiian burial grounds stalled early construction, then problems with welding and cracks in the tracks appeared. Earlier this year, engineers realized that in some sections, the wheels were a half-inch narrower than the rails. Order new wheels? Tear up the tracks?

The launch dates slipped forward and the cost estimates crept upward — at latest count, $11.4 billion, with a target completion date of 2031.

Honolulu’s tribulations are far from a lone cautionary tale. To the contrary, they signal the kind of cost overruns, engineering challenges and political obstacles that have made it all but impossible to complete a major, multibillion-dollar infrastructure project in the United States on budget and on schedule over the past decade.

As the nation sets out on a national spending spree fueled by the $1.2 trillion infrastructure bill signed by President Biden this month, the job ahead carries enormous risks that the projects will face the same kind of cost, schedule and technical problems that have hobbled ambitious efforts from New York to Seattle, delaying benefits to the public and driving up the price tag that taxpayers ultimately will bear.

American cities and states were long renowned for some of the greatest bridges, water systems and freeways in the world, but challenges have grown more potent. Agencies have less internal technical talent. Legal challenges have grown stronger under state and federal environmental laws. And spending on infrastructure as a fraction of the economy has shrunk, giving local agencies less experience in modern practices….

passing acquaintance with the “big dig” where tip o’neal, and dutch reagan agreed to sink two urban interstates with a rail ‘hub’ under the center of a small colonial town called boston….twenty years later when they were wrapping up the $.75b project was ~$8b in 2000 $.

the $1.2t are not projects they are concepts….. for work that is yet to be ironed out in terms of performances on which to develop designs….

about 10% of the infrastructure bill is “roads”, that would do 3 or 4 ‘big digs’ in 2022 $

i have no idea what we will see from $73B to ‘upgrade the electric grid’….. i did not know the grid is owned by the us?

while the $42b for airports will come from the dot air transport trust?

interested to see how the money is allocated and spent.

i would argue even the best engineering firms in the country cannot accurately predict the budget of a multi decade, multi billion dollar intermodal infrastructure project. perhaps the process needs to be improved. but it is extremely naive to believe those initial numbers. they are not incorrect out of shear ignorance or malice. those numbers are simply too difficult to predict. too many uncertainties in the process. do you expect a financial guy to predict the exact return of your investment portfolio over two decades? didn’t think so. but you also cannot build such large projects piecemeal, one year at a time. that would produce more accurate yearly estimates, but the final product would be an unmitigated disaster.

https://www.nytimes.com/interactive/2021/11/28/business/economy/high-inflation-millennials.html

November 28, 2021

Millennials Confront High Inflation for the First Time

By Jeanna Smialek, Sara Chodosh and Ben Casselman

[ Year-over-year change in Consumer Price Index ]

Millennials have spent much of their lives enduring economic calamity. Many were children when the dot-com bubble burst; graduated from high school in the late 2000s, when the real estate market crumbled; and had to compete with a huge generation of baby boomers in an anemic postcrisis job market before Covid-19 brought the global economy to its knees last year.

But there was one powerful phenomenon that millennials, the largest generation in the United States, had never felt, at least as adults: rapid inflation.

Americans born from 1981 to 1996 — along with the younger Generation Z — have been wrestling with sharp price increases for the first time since they’ve been old enough to notice. Growth in the Consumer Price Index, a primary measure of inflation, has been rising for months and is touching its highest level since 1991, when boomers (born from 1946 to 1964) were roughly the same age as millennials are now. The closest that inflation has come to that mark since then was in 2008, when soaring oil prices briefly pushed up the overall index.

Now, supply chain snarls, sky-high consumer demand for goods and worker shortages that are limiting production and lifting wages have pushed up the costs of furniture, cars, housing, food and other products. It’s hard to see when the turmoil might end….

We learned courtesy of Moses that the UAE (Dubai) is playing the role of entrepot (intermediary) buying up Iranian oil and then selling it to China. I speculated (correct me if someone has actual data) that the UAE picks up a modest commission on being the middle man.

Now I remember writing something back in 2016 for Econospeak on how Dubai may be ripping off African producers of rough diamonds before they get sold to polishes in place like India. OK my write-up was rather incomplete as a Google search for “Dubai diamond transfer pricing” turns up some really great discussions.

But this Dubai scam also applies to gold mined in Africa:

https://link.springer.com/chapter/10.1007/978-3-030-65995-0_10

The diamond play goes like this. African nation sells rough diamonds to Dubai for one price and Dubai charges its Indian polishing affiliate a price that is twice that paid to the African mining affiliate. Huge profits in Dubai all tax free. Now a Belgium diamond affiliate gets a 2.1% commission which I argued a few years back is likely arm’s length.

The gold story follows the same pattern. Yes – Dubai has become the new Hong Kong in its lucrative entrepot trade and tax haven status!

I’m wondering if Erdogan appointed Stephen Moore to be his economic advisor. After all with high inflation and a rapidly devaluing currency – only a complete moron would advocate lowering interest rates:

https://www.msn.com/en-us/money/markets/turkish-lira-plunges-10-25-after-erdogan-defends-rate-cuts/ar-AAR2eBx?ocid=uxbndlbing

https://www.cnbc.com/2021/11/24/samsung-announces-17-billion-chip-plant-in-texas.html?recirc=taboolainternal

Designed in Korea but made in Texas. Samsung commits $17 billion to build a massive facility in Texas making semiconductors. Oh gee – I bet Fox and Friend’s semiconductor guru – Bruce Hall – did see this on the horizon!

https://news.cgtn.com/news/2021-11-29/Xi-China-to-supply-Africa-with-additional-1-b-COVID-19-vaccine-doses-15AH0uERQvm/index.html

November 29, 2021

Xi says China will supply Africa with additional 1 billion COVID-19 vaccine doses

Chinese President Xi Jinping on Monday said China will provide an additional 1 billion doses of COVID-19 vaccines to Africa.

Xi made the remarks while addressing the opening ceremony of the Eighth Ministerial Conference of the Forum on China-Africa Cooperation via video link.

The move aims to help the African Union achieve its goal of vaccinating 60 percent of the African population by 2022, Xi said.

The additional 1 billion doses include 600 million as donation and 400 million to be provided through such means as joint production by Chinese companies and relevant African countries, Xi added.

In addition, China will undertake 10 medical and health projects for African countries, and send 1,500 medical personnel and public health experts to Africa, Xi said.

http://www.news.cn/english/2021-09/24/c_1310205556.htm

September 24, 2021

Egypt to inaugurate 2nd Sinovac vaccine production line in 5 weeks

CAIRO — Egypt will inaugurate the second production line for manufacturing China’s Sinovac COVID-19 vaccines in five weeks, said Egyptian Health Minister Hala Zayed on Thursday.

The vaccines are being produced by Egypt’s state-owned vaccine maker VACSERA in the Agouza district of Giza province near the Egyptian capital of Cairo, under an agreement that it signed with the Chinese biopharmaceutical company Sinovac.

“We have already received raw materials for manufacturing 15 million doses and we’re currently receiving those for another 15 million doses,” said Zayed during a joint press conference…