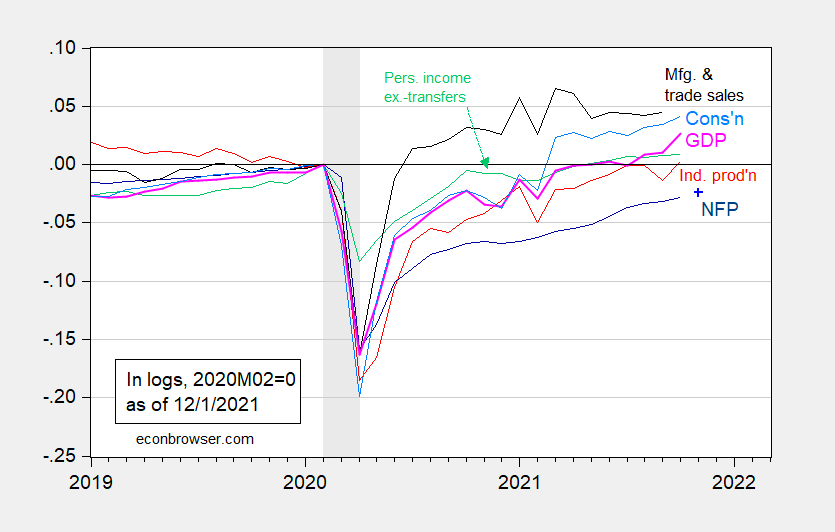

Monthly GDP grows 1.5% m/m, pushed by exports. Along with current expectations for this Friday’s employment release, we have the following picture.

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for NFP as of 12/1 (blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (12/1/2021 release), NBER, and author’s calculations.

We now have October observations for five of six indicators tracked. This picture suggests that through October, economic activity was starting to accelerate. However, all these data predates the information regarding the omicron variant (even the Michigan sentiment index discussed in this post).

Is this tea-leaf reading?

Should you advertise a 1-900 number?

If economists were intellectually honest, would they include error bars in that graph that would stretch way beyond the top of the graph, and maybe below the bottom?

Why not provide a financial markrt bet based on your story, and report its profit and loss? Is that option too observable?

rsm: Until you provide standard error on the estimates of variance you mentioned a couple of comments ago, I suggest you stop commenting.

You really think the error bar goes down to the bottom of the graph? That would mean you are saying the 148 million employment in October 2021 could be actually as low as 118 million. Do you want to stick with that assertion>

https://www.bls.gov/news.release/empsit.tn.htm

《For example, the confidence interval for the monthly change in total nonfarm

employment from the establishment survey is on the order of plus or minus 110,000.》

What was the change?

Am I getting too close? Is the cognitive dissonance gnawing away at you? Do you just know I’m wrong, because dadgummit, right? GNNNNNRRR, huh? Am I posing a credible dental threat, because my words on the internet are making you gnash your teeth? So you’re justified in banning me, right?

Will I keep on you forever? So you might as well ban me, since you can’t provide a coherent answer to my criticisms, huh?

If you won’t listen to me, perhaps you can learn from Blair Fix?

《We argue that real GDP is a deeply flawed metric. It is presented as an objective measure of economic scale. But when we look under the surface, we find crippling subjectivity. Moreover, few economists seem to realize that real GDP is based on a non-existent quantum — utility. In light of these problems, it seems to us that much of macroeconomics needs to be rethought.》

https://economicsfromthetopdown.com/2019/04/29/real-gdp-the-flawed-metric-at-the-heart-of-macroeconomics/

rsm: (1) The change in October NFP was 531K, so far exceeds the confidence interval you indicated. (2) how can I have cognitive dissonance if half of what you say does not make sense, and your responses indicate sheer lack of understanding of statistics. (3) I glanced at Blair Fix’s paper you linked to in an earlier comment – I don’t think I learned a single thing about national income and product accounting. Now, if one wants to rely on income as an aggregate (I thought that’s what GDI was), well I’d say sure – but not to the exclusion of other aggregates.

Since you haven’t violated the terms of use (racism, profanity, misogyny), I don’t see why you are trying to taunt me about banning you. Sheer ignorance is not one of the items.

By the way, I’m still waiting for your statement about the standard error of the variance estimates you are citing.

Harassment x2!!!!!!!!!!

rsm,

Your link is a joke. Acccording to it, indeed, the part you quoted in our post, “utility” is what lies at the base of estimating real GDP. No, it does not. Juist plain wrong.

Most of the rest of it is about index numbrr problems, which are real and well known, but not fatal. Sure, varying a base year will give you different estimates, and the futther back one goes the greater the variance. But then you dismiss the standard effort to minimize, not eliminate, these problems through chain weighting. The criticism of that is just a joke.

I could say more, but this link is so poor it is not worth it. Of course, Menzie learned nothing from it because there is nothting in it that is not either just plain wrong or misleading or else totally well known.

Somehow you think you are creating this big cognitive dissonance problem for Menzie by sontinuing to bring up thuis nonsensical stuff. Do you really think if economists had reported standared errors for every stat that has them, with, as has been repeatedly pointed out, many do not, that would have saved your late brother’s life? I am sorry i somehow you are so delusional that you think such a silly thing.

I tried to check out what these “economists” have written but even the titles suggested their writing was wacko wastes of time.

pgl,

I do not know Blair, who is a post doc. I do happen to personally know Jonathan Nitzan, whom he cites a lot. He is a nice guy, but also a very serious paleo=-Marxist who takes the labor theory of value a la Vol. I of Capital very seriously. This means that his views on how to measure real GDP are very far from what the vast majority of the econ profession would take very seriously.

Harassment!!!!!!!!!!

You’re right – X2!

Good grief – nothing constructive from you as usual. Please just go away and harass some other blog.

From the entity that posted this…

https://econbrowser.com/archives/2021/12/business-cycle-indicators-as-of-december-1st-2#comment-263170

GTFOH you tragic clown

Econned is just another one of those annoying cheese heads. That explains a lot!

PaGLiacci is just another one of those annoying commenters. That explains a lot!

Is this tea-leaf reading?

[ There is a need to end the attempts at intimidation. Please. ]

Don’t you wish the CCP would just imprison me, because I keep insisting there were tanks at Tiananmen Square in June, 1989?

I can see you’re committed. Or that you soon will be. (CCP imprison you? Oh, Lord!)

Do you need a secret service detail?? Or would a care package from your mother suffice??

https://econbrowser.com/archives/2021/11/so-you-want-to-be-a-monetarist

rsm

December 1, 2021

Are you trying to justify the arbitrary price of your unneeded labor, mayhap, by throwing gobbledygook at us acting as if we’re dumb if we don’t see intricate faith-based catechism that went into it?

[ Please. ]

Dude, you mad??????

Whether mad or just plain stupid it seems a huge waste to spend any time on that idiot. Asking for error bars on this type of data – yet refusing to answer how that would be calculated on this type of data in any meaningful way – indicate that this fool is beyond salvation. One of those “doesn’t know what he is talking about, yet he keeps talking”. But as long as people keep stroking his ego by answering (taking him serious), he will keep talking.

The monthly GDP estimate is consistent with consumption and industrial production, but factory and retail sales seem to account much of the swing in monthly GDP and we don’t have the factory part of retail sales yet.

Thar said, the Atlanta Fed’s GDPNow estimate is currently 9.7% (SAAR) for Q4, which kinda says the acceleration in monthly GDP grow is more than noise.

Even if growth in Q4 is closer to 6% (SAAR) than 9.7%, the output gap as estimated by the CBO will be close to zero a year-end. Firms have increased their pace of capital spending, probably an adjustment to new patterns of demand as well as to scarcity of labor. That seems more likely to keep capacity growing than to accelerate its growth. If the Atlanta Fed’s nowcast is close to correct, the output gap is turning positive as we speak – another reason to expect the Fed to continue tapering asset purchases and to begin signaling rate hikes.

Financial conditions are tightening (https://fred.stlouisfed.org/series/BAMLC0A4CBBB), but that’s what’s supposed to happen – probably not enough to worry policy makers yet. Likewise, the rise in the VIX has to prove persistent before it will be much of a policy concern. Right now, option gamma trades may be the driver of equity volatility and gamma trades tend to wear themselves out. A shift in volatility regime – persistent high volatility – would be a worry to the Fed.

Friday’s jobs report will tell us a good bit about recent behavior, but nothing about life with Omicron. Short term service sector measures (https://www.calculatedriskblog.com/2021/11/seven-high-frequency-indicators-for_29.html?m=1) will become more interesting now.

I suspect it’s VERY transmissive, but not very severe /death AFTER you got it. Cross your fingers friend

Love to you and your family MD

Uncle Moses

“Friday’s jobs report will tell us a good bit about recent behavior, but nothing about life with Omicron.”

Good luck figuring out what it tells us. Employment survey showed 210K increase in employment but household survey said 1100K increase.

From Warsaw to Seoul, this was a distressing day. The sense I have from direct experience and looking to data internationally, strongly suggests people will be increasingly cautious for a long enough time to meaningfully slow services. Then too, personal savings have been falling to 2019 levels while prices are of course higher. So, again, I would expect somewhat slower growth even with increasing government spending and stable monetary policy.

WTI now showing a 5-handle as of JUN23. (current strip, time of this post)

https://www.cmegroup.com/markets/energy/crude-oil/light-sweet-crude.quotes.html

Menzie Chinn-

Thank you very much for your work on this blog. You are providing a valuable service to society. Please keep it going!

All of us commenters try to annoy and aggravate Professor Chinn just enough so he doesn’t get bored (joke, with probably some thread of truth in it). And we are rewarded with much more wisdom and knowledge than most of us deserve to get without paying any tuition.

I for one won’t be watching the Olympics in China. And if I indirectly find out who is advertising and sponsoring the Olympics, I will avoid purchasing their products during the duration of the Olympics and the near term future. The fact they are attempting to bully people into doing otherwise reinforces my thoughts on this:

https://www.theguardian.com/world/2021/dec/02/beijing-warns-china-linked-us-businesses-you-cannot-make-a-fortune-in-silence

Quit abusing people in Xinjiang and Tibet and then I might think about purchasing Chinese products. Until then I’m stuck with your chips/processors that aren’t made in Taiwan or in a government locale with general citizenry who have a modicum of morality. But, trust me, when I purchase computers I’ll be looking for parts from Taiwan or other places that don’t murder/torture people or rape/molest their own tennis phenoms.

Bravo. But be aware that a lot of Taiwanese multinationals rely on Chinese affiliates to produce their products. Foxconn for example relies on Chinese affiliates to assemble those overpriced iPhones.

I have not checked but I heard that the tennis associate is boycotting an important tournament in China.

I for one won’t be watching Phil Donahue on TV. He was disappeared one day for questioning the rationale for the Iraq War. We’ll, he was right, but he remains largely disappeared from TV.

The cold warmongers here obsess about China and Peng Shuai, but the US has its own ways of dealing with prominent dissenters. And it has its own human rights issues, which it conveniently sweeps under the rug while demonizing others.

Those who live in a glass house…

“The cold warmongers here obsess about China and Peng Shuai, but the US has its own ways of dealing with prominent dissenters.”

Seriously? Now I get Randy Andy Cuomo wanted to make his accusers disappear but nothing like that happened here. Leave it to you to dismiss what the Chinese government did to Peng Shuai. I guess you are BFF with Donald Trump after that.

Ever hear of Edward Snowden, Chelsea Manning and Julian Assange? Typically it’s whistleblowers who get punished while war criminals go scot free.

Yet the media obsesses about Chinese and Russian human rights abuses…a lot of it is just propaganda, pure and simple…softening the public up for possible stronger measures, maybe even war, down the road.

“Chinese and Russian human rights abuses…a lot of it is just propaganda”

How much is Putin paying you for such disgusting dishonesty?

Pgl learned nothing from the propaganda blitz leading up to the Iraq War.

So pgl, how many WMDs did Saddam have? You believe US propaganda, so surely you must know.

The wmd propaganda was challenged in real time. I dont think people in the usa are challenging the fact that china is abusive to many of its minority people in western provinces. These cases do not equate. Interesting that you appear to be defending china and russia on human rights, john. Again, you are not the progressive you try to portray on this blog.

“JohnH

December 4, 2021 at 3:10 pm

Pgl learned nothing from the propaganda blitz leading up to the Iraq War.”

This after I informed this lying troll I campaigned against that stupid 2003 invasion. Damn – we knew JohnH is really stupid but it seems this troll never learned to READ!

Right after Trump became President, he sat down for an interview with Bill O’Reilly and was asked about Putin being a killer. Trump’s disgusting excuse for Putin was:

“There are a lot of killers. We’ve got a lot of killers. What, do you think our country’s so innocent?”

Of course Trump is Putin’s little poodle. So WTF is JohnH’s excuse?

“The cold warmongers”.

The suggestion here is that Moses is advocating war with China. He is not and neither am I. I actively protested against that 2003 invasion of Iraq.

So for you to suggest we are war mongers is dishonest and highly insulting.

But hey – this kind of garbage hyperbole is what you do.

Humorous news note for today. Germany considers their vaccine rate low at 68%. America still hasn’t broached 60% yet.

That is what we get when a lot of us adore Trump rather than Merkle.

there remain a lot of “good germans”.

fwiw, i am estimating that “real October construction spending is falling at a rate that would subtract about 2.20 percentage points from 4th quarter GDP, assuming hypothetically that there would be no change in real construction over the next two months….” but i have almost no confidence in that estimate, given that it was almost entirely due to using the producer price index for final demand construction as a deflator, which in turn had aggregate construction costs up 6.6% month over month in October…the BEA uses dozens of deflators and i am not about to try duplicating that manually…

on the other hand, the report also showed combined upward revisions of $36.0 billion to annualized August and September construction spending figures, which should increase the annualized 3rd quarter construction figures by around $12.0 billion, which in turn would suggest an upward revision of about 0.28 percentage points to the relevant components of third quarter GDP when the third estimate is released on December 22nd, assuming the same mix of deflators as was used in the 2nd estimate…

https://fred.stlouisfed.org/graph/?g=ztIl

January 30, 2018

Total Private Nonresidential and Residential Construction Spending, 2017-2021

https://fred.stlouisfed.org/graph/?g=Jsht

January 30, 2018

Total Private Nonresidential and Residential Construction Spending, 2017-2021

(Indexed to 2017)

https://twitter.com/D_Brautigam/status/1466069878419476493

Deborah Brautigam @D_Brautigam *

Horrified to find my interview with BBC boiled down to a clip explaining “idea” of debt trap diplomacy and the “conventional wisdom” on Sri Lanka. BBC discarded all the evidence I presented debunking DTD, but invited Trump adviser to add nuance. Ugh.

http://www.chinaafricarealstory.com/2021/12/bbc-misrepresents-my-views-on-debt-trap.html

* Director of the China Africa Research Initiative (CARI) and Bernard L. Schwartz Professor at Johns Hopkins University’s School of Advanced International Studies (SAIS) in Washington, DC

10:41 AM · Dec 1, 2021

http://www.chinaafricarealstory.com/2021/12/bbc-misrepresents-my-views-on-debt-trap.html

December 1, 2021

BBC Misrepresents my Views on “Debt Trap Diplomacy”

The BBC misrepresented my views this morning, and I admit I’m stunned. I’m a big fan of the BBC. Living in Taiwan and Hong Kong, in the 1970s doing fieldwork across Africa in the 1980s, I used to listen to the BBC World Service on my shortwave radio and I trusted them to present nuanced and balanced analysis.

Last night I had a call from London. I picked up to find a BBC reporter who wanted my views on Chinese “debt trap diplomacy.” Apparently the head of Britain’s intelligence service, Richard Moore, had given the BBC an interview in which he said that the Chinese have deliberately used debt as leverage to acquire strategic assets. We spoke for a while on background and I outlined why this idea had little basis in fact, drawing on my extensive research with Meg Rithmire about the Hambantota Port in Sri Lanka and other cases, and that of other researchers. I gave examples from Montenegro, Kenya, Zambia, and other places where these fears have been trumpeted in the media, but without evidence to support them. He said that another reporter would call me in an hour and record an interview.

An hour later, a woman called and simply asked me to speak for a minute about this idea: a quick explanation of what debt trap diplomacy is believed to be, an example from Sri Lanka or elsewhere, and why the evidence doesn’t support the story. I briefly explained all of this, she recorded it, and we hung up.

This morning I’ve been getting messages from British colleagues who’ve been doing research on Chinese investment overseas and who know my research….

— Deborah Brautigam

US and UK “public diplomacy” at work. If you can’t use facts to demonize your enemy, you just make them up. Happens every day.

Gee – you finally got a job! How well does Xi pay for such propaganda?

That is what you do so well. Make up garbage 24/7. Hope you are not living on a glass house!

https://www.tandfonline.com/doi/full/10.1080/23792949.2019.1689828

December 6, 2019

A critical look at Chinese ‘debt-trap diplomacy’: the rise of a meme

By Deborah Brautigam

Abstract

In 2017, a meme was born in a think tank in northern India: Chinese ‘debt-trap diplomacy’. This meme quickly spread through the media, intelligence circles and Western governments. Within 12 months it generated nearly 2 million search results on Google in 0.52 seconds and was beginning to solidify into a deep historical truth. Stories can contain truths and falsehoods. Human emotions, including negativity bias, prime us to think in certain ways. This paper retells a series of stories about China’s international involvement, including in Angola, Djibouti, Sri Lanka and Venezuela, that challenge the media’s spin. It concludes with some suggestions about the relationship between academia and the media and policy worlds, and the need for scholars to speak ‘truth’ to ‘power’.

Deborah Bräutigam is the Bernard L. Schwartz Professor of Political Economy and Director of the China Africa Research Initiative at Johns Hopkins University’s School of Advanced International Studies.

Tesla moved its corporate headquarters from the Bay Area to Austin, Texas:

https://www.businessinsider.com/tesla-texas-headquarters-move-from-california-officiallly-complete-elon-musk-2021-12?r=US&IR=T

Elon Musk likes to evade taxes.

For the record, I strongly believe in the power of prayer. However I don’t like people who make a sham out of the gift of prayer. God gave us a brain to think, and legs and hands to use. That means (IMHO) that he expects us to take responsibility for ourselves as best we can. There are many parts of the Bible which exhibit the lesson that God sometimes expects us to take action. Joseph prepared food inventory for the famine, he didn’t pray for food to fall out of the sky.

https://www.nytimes.com/2021/12/01/us/marcus-lamb-dead.html?action=click&module=Well&pgtype=Homepage§ion=Obituaries

In case people had problems with the NYT paywall:

https://www.complex.com/life/marcus-lamb-anti-vaccine-christian-broadcaster-dead-covid-19

https://jabberwocking.com/wall-street-journal-says-bicycles-are-a-harbinger-of-doom/

Kevin Drum notes that the WSJ is all concerned that higher bicycle prices are leading HYPERINFLATION. Now we know the Bidens bike, John Kerry bikes, and I am all for people staying healthy by riding their bikes. But is the WSJ all that concern about my health? After all – their heroes – Donald Trump, Mike Pompeo, and Chris Christie – do not look like they know what a bike even looks like.

Now Kevin did not go for the fat jokes but he does document that the recent rise in bicycles is not that high after all. So get outside and cycle. After all Peloton’s indoor version is way overpriced.

When I was growing up my Dad loved bikes. Fuji was his favorite brand. By the early ’80s Schwinn had turned into the same era category of Cadillacs—crap. China’s “Flying Pigeon” bikes were solid bikes that gave you a great product for the price (value wise) for awhile. I have no idea if either is the case now. And going way back in time Peugeot used to make a great bike (1970s or maybe before??).

OMG – one of the comments to Kevin Drum’s post on bicycle prices took me to a clip explaining the great bicycle lobbyist scandal that has rocked New York City for the past 8 years:

https://www.bing.com/videos/search?q=bicycle+lobby&view=detail&mid=EFAAC326A553F95D1B66EFAAC326A553F95D1B66&FORM=VIRE

OK – full disclosure. I am a big advocate of Citibike. But yes – there are plenty of privileged NYC motorists who think are cause is pure evil and that we non-drivers should be just run over.

Republican Senators are pushing to shut the government down because they want Biden to life all vaccine mandates? Can we have these clowns drawn and quartered?

Yeah, it looks like the economy is going through its final phase of recovery. Payroll reports will probably lag by 3-6 months, but I suspect by spring, it will look like the Covid recession never happened. I think everybody will appreciate slowing growth starting probably in December(but won’t be counted to the first quarter). I can see steam coming off the top of the car. Cooling the engine down. A bunch of inflation yry will come off in the March-June period.

“…by spring, it will look like the Covid recession never happened.”

Um…no: https://www.nber.org/system/files/working_papers/w26934/w26934.pdf

Pandemics have long-standing effects.

In brief, the above-linked working paper finds the long-term economic consequences of pandemic in Europe and Britain (which provide centuries of economic records fom which to work) are these:

– lower real natural rate

– higher real wages

– higher labor productivity

– lower (negative) r – g

Greater debt sustainability and greater earnings for workers. The authors didn’t look at income shares, so we don’t know if the rise in productivity is the only reason for higher real wages. Received wisdom about the Black Death says labor’s income share rose, but the Black Death was a very special beast.

Menzie, if you make any NBER appearances on YT you better tell us, or I’m e-mailing your wife to tell her the flute is a substandard orchestral instrument (not really, joke).

You know Menzie, I’m in my weird mind right now. And I keep thinking in my mind, how after I got used to using pinyin for about 7 years, how if I met you in person I would pronounce your name with the first e in your name like the English “uh” sound (short u sound??), and make you angry at me because all this time I had read you and I screwed up the pronunciation of your name, when the sound in my head is always like M-uh-nzie, if that makes any sense.

https://www.nbcnews.com/news/sports/tampa-bays-antonio-brown-suspended-3-games-faking-vaccination-status-n-rcna7470

What is worse than Aaron Rodgers lying about getting vaccinated? Antonio Brown getting a fake vaccination card. Out for three games. If this cost Tom Brady a trip to the Superbowl, that is a very good thing!

The headline news from BLS is that employment per the payroll survey rose by a mere 210 thousand. But wait – the unemployment rate fell even as labor force participation rose. What is going on here:

The Household Survey had employment rising by over 1.1 million so the employment to population rose from 58.8% to 59.2%:

https://www.bls.gov/news.release/empsit.a.htm

But these are survey data so expect rsm to go off with his confidence interval babble!

Ha

The parents knew their son had this weapon and they knew he had a lot of dangerous angry and yet they left him at the school with his gun. They should be charged!

https://www.cnn.com/us/live-news/oxford-school-shooting-michigan-12-03-21/h_0632e1efaed7ceccc8c42660da93990b

How confused is little Marco here?

https://www.yahoo.com/news/sen-marco-rubio-verge-tanking-155002593.html

Look – the forced labor issue is a serious problem with respect to how the Chinese government treats these workers. But does little Marco think tanking the US defense budget is going to pressure China? And of course this clown of a Senator never bothered reading the Constitution or getting that his form of trade protection is an increase in a form of taxes.

Hey little Marco – do something effing useful such as allowing more diplomatic appointments be cleared by the Senate.

Very odd jobs report. Either 1.1 million new jobs or 210,000.

Weekly aggregate hours up 0.5% m/m, so growth implications remain quite good.

Another fine data mess Covid has gotten us into.

https://cepr.net/jobs-2021-12/

December 3, 2021

Unemployment Falls to 4.2 Percent in November as Economy Adds 210,000 Jobs

By DEAN BAKER

The rise in the index of aggregate hours would be equivalent to more than 630,000 jobs with no changes in workweeks.

The unemployment rate fell 0.4 percentage points in November, even though the economy added just 210,000 jobs. The drop in the unemployment rate went along with an increase in the employment-to-population ratio (EPOP) of 0.4 percentage points, corresponding to a rise in employment of more than 1.1 million in the household survey. The unemployment rate had not fallen this low following the Great Recession until September 2017.

The 210,000 job growth in the establishment survey is slower than generally expected, but it is important to note that it went along with an increase in the average workweek. The index of aggregate hours in the private sector increased by 0.5 percent in November. This would be the equivalent of more than 630,000 new jobs, with no change in the workweek.

This fits a story where employers are increasing hours since they are unable to hire new workers. We are seeing a reshuffling of the labor market where workers are looking for better jobs and employers are competing to attract workers, especially in lower paying sectors.

Declines in Unemployment Largest for Disadvantaged Groups

Nearly every demographic group saw a drop in unemployment in November, but the falls were largest for the groups that face labor market discrimination. The unemployment rate for Blacks fell by 1.2 percentage points to 6.7 percent, a level not reached following the Great Recession until March 2018 and never prior to that time. For Hispanics, the decline was 0.7 percentage points to 5.2 percent.

The unemployment rate for workers without a high school degree fell by 1.7 percentage points to 5.7 percent. By contrast, the unemployment rate for college grads fell by just 0.1 percentage points to 2.3 percent, 0.4 percentage points above its pre-pandemic low. The 5.7 percent rate for workers without a high school degree is 0.7 percentage points above the pre-pandemic low, although the monthly data are highly erratic.

The unemployment rate for people with a disability fell by 1.4 percentage points to 7.7 percent, while the EPOP rose by 1.1 percentage points to 21.5 percent. The latter figure is almost 2.0 percentage points above pre-pandemic peaks, indicating that the pandemic may have created new opportunities for people with a disability.

Share of Long-Term Unemployment Edges Up ….