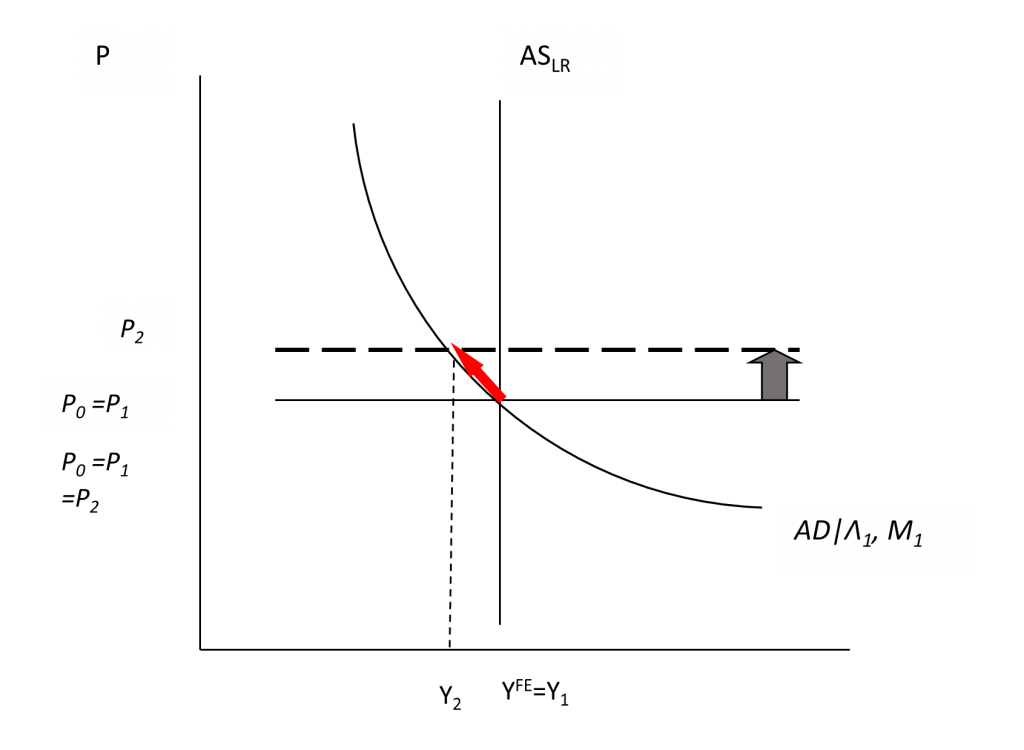

When assessing the course of US inflation, it’s helpful to have a model; the one I use is the AD-AS model described in this post. The cost of imported inputs can be interpreted as a cost-push shock (rather than an overheated economy caused by high aggregate demand relative to low potential GDP). In this context, China — as a major supplier of inputs and commodities to the US — looms large. And hence, developments there loom large. The preliminary findings that the Chinese vaccines are not particularly effective against the omicron variant, combined with the Chinese authorities’ zero tolerance for covid infections, means that the disruptions to imports from China are likely to continue for some time.

From the Mozur and Liu in the NYTimes:

A new study looking at blood samples from people who received two doses of a Covid-19 vaccine made by the Chinese pharmaceutical company Sinovac suggested that the vaccine would be unable to prevent an infection of the new, highly infectious Omicron variant.

The research, which analyzed the blood of 25 people vaccinated with Sinovac, is the latest sign of the new challenge Omicron presents as it spreads across the world. The scientists from the University of Hong Kong found that, in laboratory experiments, none of the 25 samples produced sufficient antibodies to block the variant from invading cells. The researchers said it was not yet clear whether a third shot of Sinovac would improve the results.

The studies are preliminary, and antibody levels do not give a complete picture of a person’s immune response. It is unclear whether the Sinovac vaccine can fend off severe disease or death from Omicron, but it most likely offers some protection.

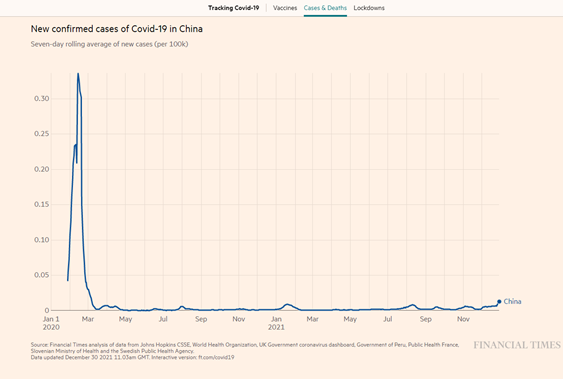

The policy of zero tolerance has clearly paid off in (at least reported) deaths, and cases.

Source: FT, accessed 12/30/2021.

The Chinese have achieved this outcome by use of extensive lockdowns in response to the fewest detected cases. Those lockdowns might be appropriate — especially if the Chinese vaccines are not very effective against omicron in terms of reducing hospitalizations or deaths — but they will certainly reduce output. And that means fewer exports to the US and/or more expensive exports. That in turn will exacerbate upward price pressures.

Figure 1: Cost push shock.

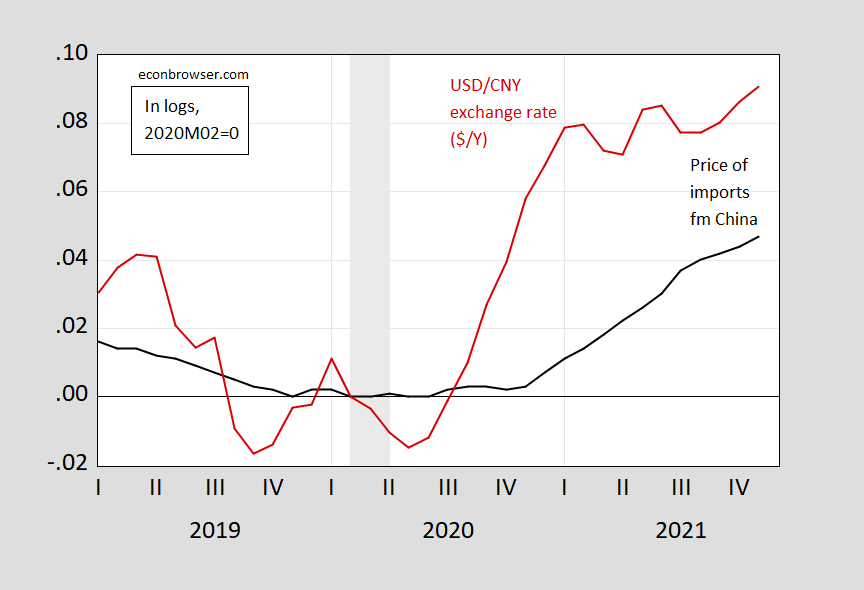

So far, import prices from China have risen about 4.7% since 2020M02 (in log terms, through November). The price of exported goods from China to the US likely fell, given the dollar has depreciated about 9.1% against the CNY over that period.

Figure 2: Price of imported goods from China, in $ (black), and USD/CNY exchange rate, in $/Yuan, both in logs 2020M02=0. NBER defined recession dates peak to trough shaded gray. Source: BLS, and Federal Reserve Board via FRED, NBER, and author’s calculations.

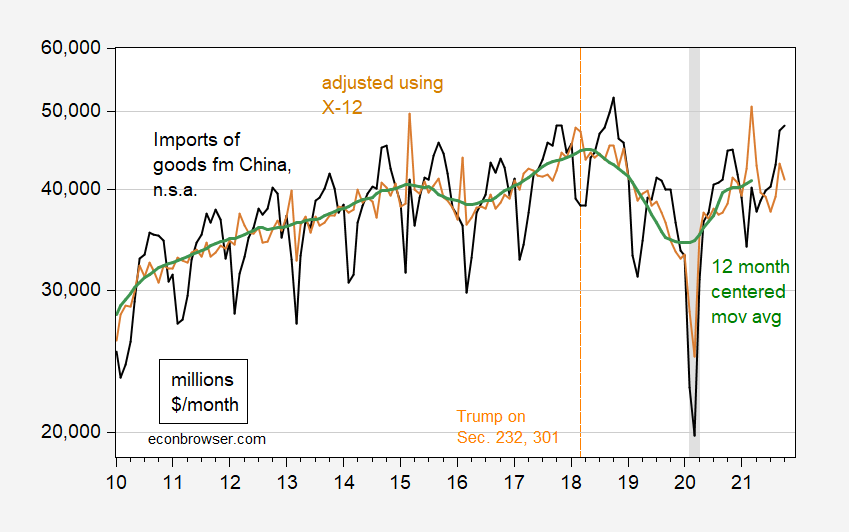

The price index doesn’t capture the disruption due to goods that didn’t get imported. We can only get some impression of this from the aggregate imports from China.

Figure 3: Imports of goods from China, not seasonally adjusted (black), adjusted using multiplicative Census X-12 over full sample (brown), and 12 month centered moving average (green), all in millions of $/month, on log scale. NBER defined recession dates peak to trough shaded gray. Source: BEA/Census via FRED, NBER, and author’s calculations.

How big of an effect will disruptions in China have on the US? Vox doesn’t hazard a guess. A variety of higher frequency (i.e., monthly) indicators only go through November (see Yardeni’s compilation), and would therefore not reflect the most recent set of shutdowns. But at a minimum, the international dimension needs to be kept in mind, when thinking about the course of inflation in 2022.

Update, 1/2/2022:

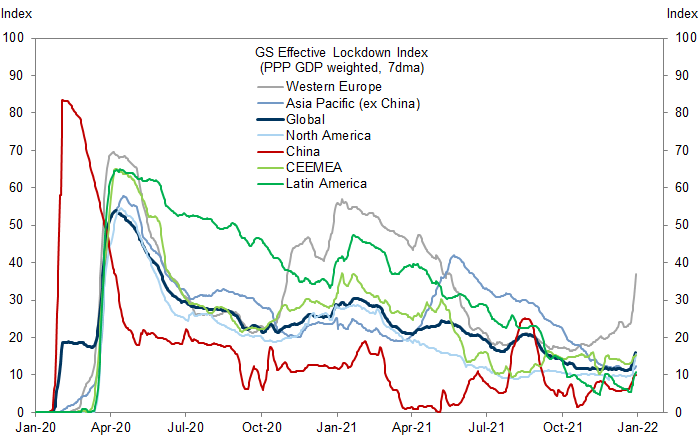

From Goldman Sachs, Effective Lockdown Index: January 3 Update:

“A new study looking at blood samples from people who received two doses of a Covid-19 vaccine made by the Chinese pharmaceutical company Sinovac suggested that the vaccine would be unable to prevent an infection of the new, highly infectious Omicron variant.”

I certainly do not wish to encourage the usual ltr blizzard of how many of these vaccines have been produced as there was a lot of concern about the efficacy of Sinovac even before Omicron. But let’s note the real purpose of a vaccine is not necessarily to avoid infections but to guard against severe cases that lead to hospitalizations or even deaths.

I’ll still take IS-LM and/or AD-AS over DSGE any day of the week. Now some people here will probably say/think “You only say you prefer IS-LM and DS-AS over DSGE because you can’t do the matrix math etc to calculate DSGE”. And there’s probably a segment of truth to that. But you can’t do the short-hand/”back of the envelope” mental exercises with DSGE you can with IS-LM which can give a person deep insights into what is going on in the economy, and often times, the more important factor—vision for what has a high probability of happening in the not terribly distant future.

*AD-AS

“For the week, the PBOC injected 600 billion yuan on a net basis, booking the biggest liquidity support since late October.”

https://www.reuters.com/article/china-markets-rates/china-c-bank-makes-biggest-weekly-cash-injection-in-two-months-idUKB9N2S7023

I don’t think this is only because “end of the year liquidity”. I think there may be other factors. But really I’m mostly shooting in the dark, that’s just a suspicion on my part. What I do know, is that the Chinese central government is good at camouflaging things when they take a mind to it.

https://jabberwocking.com/top-ten-most-interesting-charts-of-2021/

Kevin Drum has his 10 most interesting charts for the year. Go ahead and check them out offering your own interpretations. My only quick summary is the age old adage – reality has such a progressive bias!

The vaxx roll out was trump’s operation warp speed….. which was moving too fast to be safe per biden in summer 2020…..

and is outdated considering recent mortality data.

The American Economic Association’s Journal of Economic Perspectives has an interesting article by David Romer, “Keynesian Macroeconomics without LM Curve”, vol 14, No.2, Spring 2000, pages 149-169. He discusses the IS-LM model compared to the AD-AS model. Download is complimentary.

https://www.aeaweb.org/journals/jep

Thanks for this.

Moses,

Thank you also for some past kind comments. There was no “reply” remaining under your comment at the time for me to say “thanks”.

You EARNED them all. And you are proof compliments and positive words are exchanged on this blog when they are deserved. You are a warrior in your crunching of the numbers with Eviews or Stata and your personal studies of how to use the econometrics methods and an inspiration for me to improve on this in 2022.

Moses,

Another article from the Journal of Economic Perspectives may also interest you.

Stock & Watson, “Vector Autoregression” Vol. 15, No. 4, Fall 2001, pages 101 to 115.

It is an excellent understandable article on the interplay between inflation, unemployment

and interest rates.

In addition, a young Canadian economist using “JD Economics” as a title for his website provides two YouTube videos replicating the Stock and Watson VAR using EViews. Both YouTube parts I and II can be found at the link below. You may be able to get a student copy of EViews to have more fun.

https://www.jdeconomics.com/vector-autoregression-models-in-eviews/

If you like the above, JD Economics replicates another article with another YouTube entry to show how to implement a structural VAR using EViews

Much appreciated AS.

I wish Romer all the luck in the world. If anyone has both the stature and the capacity to make improvements to the model and make them stick, it’s him. Certainly, at a sufficient level of complexity, IS-LM falls short.

I suspect, though, that outside economics departments and central banks, debate is rarely sophisticated enough to benefit from an improved model. And when faced with really big shocks, as has been the case in the last two recessions, the deficiencies of IS-LM may not matter all that much. In the last couple of recessions, a better model of central bank policy targeting hasn’t been all that necessary.a secondary issue. The international sector has been a secondary issue, though in the post-recession period, it has presented problems.

Krugman harped on the usefulness of IS-LM during the Great Recession, and he was right. When you run out of LM, policy should focus on IS. The models doesn’t tell you about inflation, but anyone with the ability to think about the implications of the model knew inflation was not a concern.

Of course, there will be situations in which IS-LM isn’t that useful. Certainly, when the Fed was trying to find an operating scheme suited to a low-inflation environment, a model which misrepresents central bank operation isn’t helpful.

Krugman’s point when standing up for IS-LM was that simple models, chosen wisely, can help cut through to essential issues. This time we have been clubbed with a supply shock at the same time as a demand shock. Not so easy to work things out with IS-LM, but AS-AD comes in mighty handy.

A better version of IS-LM is certainly a good thing, but I wouldn’t want to jettison the old version just yet. I hope Romer’s model proves as tractible to the average mind as the Hicks-Hansen version. If not, well, average minds do a lot of policy making and we don’t want to leave them without tools to understand the world.

macroduck Krugman harped on the usefulness of IS-LM during the Great Recession, and he was right. When you run out of LM, policy should focus on IS.

Right. The old IS-LM model is fairly intuitive and when the problem is a negative demand shock the model at least gets the policy direction right even if it ain’t so good at fine tuning.

A better version of IS-LM is certainly a good thing, but I wouldn’t want to jettison the old version just yet.

Romer’s model and DSGE models are really designed for guiding economic policies when things are running smoothly. In other words, those models are work best when you really don’t need them. For my money I found that a happy medium in complexity and usefulness is in the 3-Equation Model by Wendy Carlin and David Soskice: https://www.ucl.ac.uk/~uctpa36/3equation_book_chapter.pdf. The key innovation in their approach is to include an equation that captures a central bank’s loss function. As I recall, many years ago James Hamilton posted something on the Carlin/Soskice model. Anyway, Carlin and Soskice have a useful intermediate macro text and an interactive model that helps make things more intuitive:

https://global.oup.com/uk/orc/busecon/economics/carlin_soskice/

This is the approach used by Simon Wren-Lewis.

2slugs

Thanks for the links. I am slowly reading the chapter you provided.

Dollar depreciated?

Had to do a double take??

Macroduck: Against CNY, yes.

Admit it Menzie…….. you’ve had fantasies of making this comment since the very day you helped found this blog.

I know you have no feelings on this either way, couldn’t resist the cheap joke.

https://fred.stlouisfed.org/series/DEXCHUS

FRED shows that $1 was worth about 7 CNY in mid 2020 but is worth less than 6.4 CNY now. Of course the Trump trade was had previously let the dollar appreciate against China’s currency.

Something I have wondered about for some time, maybe ltr has answer, is how has China managed to maintain it relatively high rarte of GDP growrth, until maybe very recently, with the intensive use of serious lockdowns that they have made?

I think in that thread you were preoccupied with defending the honor of “Princeton”Kopits’ oil price predictions:

https://econbrowser.com/archives/2021/12/guest-contribution-is-chinas-growth-rate-negative

[ Is it wrong to laugh hysterically at your own jokes?? Asking for a friend ]

The young lady at UofC Boulder who authored the paper I mention in another comment below called it “statistical gamesmanship”. There’s other names for it, but I’ll spare Menzie the venom for tonight. She also references this paper, which I haven’t read yet but have a feeling I know the gist of:

https://wxiong.mycpanel.princeton.edu/papers/Mandarin.pdf

Moses,

No, this has nothing to do with any price predictions of Steven’s even if that issue came up in that thread you cite. But that matter has nothing to do with this question, which neither you nor ltr nor anybody else seems to have an answer for.

It is true that, as I noted in my question, recently there has been a slowdown in Chinese GDP growth, although many think that has to do with the problems in its real estate sector. But as ltr has like to point out, from the time the pandemic hit until well into 2021, PRC continued to have one of the world’s higher GDP growth rates. How did they manage that with such harsh lockdowns? Do you know? Did your experience there provide you with an answer to that question, which I emphasixe has not a thing to do with anybod’y’s predictions about oil price changes?

Are you irrelevantly dragging the matter of people predicting oil prices in because the last time you brought this up and got on my case, Menxie shot you down so hard you made a hole in the ground when you hit it?

Something I have wondered about for some time…is how has China managed to maintain it relatively high rate of GDP growth, until maybe very recently, with the intensive use of serious lockdowns that they have made?

[ A most important question, the answer to which begins with China having had national development plans through which infrastructure was steadily formed all about the country. Of course, the development emphasis about Shanghai was especially intensive, so too Beijing, but the emphasis extended to the reaches of the provinces. There were roads and rail tracks and bridges to nowhere from Beijing, but nowhere was always somewhere and allowed for productive centers to form extending out from Beijing (even to the reaches of inner Mongolia). Not only is there a highway running through the desert of Xinjiang, but there is a now a high-speed rail line running through the Xinjiang desert. There is a high-speed rail line to and across Tibet and roads everywhere about the province, and that means productive potential can be readily realized. ]

Xinjiang, even with a high flow to and from the province was always well protected against the spread of the coronavirus. And, there is the infrastructure. This meant that Xinjiang could grow rapidly as a production and transportation base all through the epidemic period. Then too, production in Xinjiang is highly mechanized. Chinese planners have been emphasizing mechanization of production through the country, and the transformation is evident beyond a Beijing but even Beijing is transforming under planning.

An example of production adaptation could be the transformation of pork production that became immediately necessary in the wake of an international epidemic. Agricultural productivity is being emphasized and the result is that in a difficult growing year such as 2021, basic crops had record harvests. Now, agricultural productivity is being re-emphasized as critical through 2025. But, the development base is already there.

The production question should extend in many ways, but what is happening right now is that American trade restrictions on China, especially trade restrictions meant to limit technology advance in China are being steadily countered by the Chinese. Chinese development of a comprehensive space exploration program after Congress stopped Chinese-American efforts on space exploration in 2011, should have shown that Chinese economic-technology development is not going to be stopped or contained. The less however was sadly lost, as China on the Moon and Mars and a Chinese International Space Station should have shown.

https://news.cgtn.com/news/2021-12-31/China-s-artificial-sun-smashes-1000-second-fusion-world-record-16rlFJZzHqM/index.html

December 31, 2021

China’s ‘artificial sun’ smashes 1000-second fusion world record

By Zhao Chenchen

China’s ‘artificial sun’ set a new world record on Thursday by running for 1,056 seconds at high plasma temperature, the longest duration for an experimental advanced superconducting tokamak (EAST) fusion energy reactor, Xinhua News Agency reported.

EAST already scored a previous record in May, running for 101 seconds at a temperature of 120 million degrees Celsius.

The latest one came after it was announced last week that a new round of testing would be conducted by the Institute of Plasma Physics under the Chinese Academy of Sciences (ASIPP).

The institute, located in Hefei, east China’s Anhui Province, has discharged electricity more than 10,000 times since the inauguration of phase II of EAST in 2011….

A tight lock-down of 20 million people in a population of over 1000 million will have little economic impact. The reason their lock-down policies have been so successful in the pre-Omicron era was that it was super harsh and, therefore, effective – and not needed for extensive time periods in the whole country. However, Omicron is so infectious that they will likely not be able to succeed against it with that policy – particularly if it turns out their vaccine is not effective against Omicron.

Sometimes it seems like Menzie is psychic in terms of putting up stuff that was recently in my thoughts. I had been looking for some excuse (any excuse) to post this paper up, but none of the recent post topics seemed close enough (and you’re going “Since when in any time ever on this blog did you care if your comment matched the post topic??”). But this post topic is close enough, and I thought this was a great paper and would be of interest to “China watchers” Enjoy!!!!!

https://www.colorado.edu/economics/sites/default/files/attached-files/chi_jmp_1108.pdf

Excellent catch.

Reminds me. Once, long age, my old daddy joined the local school board. He discovered that school construction was financed with bank loans. He dragged the school system into th 20th century by insisting they issue bonds. Worked great. Much cheaper financing. Made a life-long enemy of the local bank president.

I have mixed feelings about that topic (how voters seem to accept bonds so easily over taxes). But there’s not much doubt bonds are generally cheaper, and certainly it was all going that way anyway. The fact your Dad was ahead of the curve on that shouldn’t have bothered the bank people.

We’ve had a local development project here for what I think will be a large housing complex (sort of like upper class apartments, but they can get actual ownership I think). They tried to shove it down voters throats 2–3 times and when they couldn’t do that the city commissioners went ahead and tried to ignore the vote. Now, if understand correct it’s either going to court or they want to vote for it what seems like a 4th time now in my mind, 3rd or 4th time to vote on the same project. And guess who usually runs for mayor here??? Usually we have like 4 candidates for Mayor, and the “strange” thing is, when you look at the personal backgrounds, 3 of the 4 candidates you can wager are developers or wives of land developers. I wonder why it always works out that way??/sarc

Why does your model ignore finance? What if firms make more money investing pension fund money in financial markets than they do from real economy sales? Are you blind to the huge volumes transacted daily in finance, which dwarf real economy transactions?

WTF? I definitely think economic discussions should consider financial markets where appropriate but dude – you cannot feed the kids or start the car without dollars in a pension fund. I’m sorry but you incredibly stupid comments have become dumber than rocks.

Oooooh, rsm, because rhe confidence intervals on financial returns are just so yuuuuge that all the data on them is must noise. Nobody can say anything meaningful about them, including what you just said here. Why are insisting on blathering about noise here with talking about confidence intervals, the Most Important Issue for anybody to confront when they make any claim about data here!!!!!!

https://news.cgtn.com/news/2022-01-01/Chinese-mainland-records-231-confirmed-COVID-19-cases-16sAXEfzULC/index.html

January 1, 2021

Chinese mainland reports 231 new COVID-19 cases

The Chinese mainland recorded 231 confirmed COVID-19 cases on Friday, with 175 linked to local transmissions and 56 from overseas, data from the National Health Commission showed on Saturday.

A total of 38 new asymptomatic cases were also recorded, and 514 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 102,314, with the death toll remaining unchanged at 4,636 since January, 2021.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-01/Chinese-mainland-records-231-confirmed-COVID-19-cases-16sAXEfzULC/img/e8513c0c905c440cb5dc1ce526eca220/e8513c0c905c440cb5dc1ce526eca220.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-01/Chinese-mainland-records-231-confirmed-COVID-19-cases-16sAXEfzULC/img/c8ec46f768734a558384d99c42cfd415/c8ec46f768734a558384d99c42cfd415.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-01/Chinese-mainland-records-231-confirmed-COVID-19-cases-16sAXEfzULC/img/a2f04b19fbcd4b35be2a936ccfd232b6/a2f04b19fbcd4b35be2a936ccfd232b6.jpeg

http://www.xinhuanet.com/english/20220101/066f5de82b70430b97c7f21de715f9df/c.html

January 1, 2022

Over 2.83 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Over 2.83 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Friday, data from the National Health Commission showed Saturday.

[ Chinese coronavirus vaccine yearly production capacity is more than 7 billion doses. Along with over 2.83 billion doses of Chinese vaccines administered domestically, more than 2 billion doses have already been distributed to more than 120 countries internationally. Nineteen countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

December 31, 2021

Coronavirus

United States

Cases ( 55,696,500)

Deaths ( 846,905)

Deaths per million ( 2,536)

China

Cases ( 102,083)

Deaths ( 4,636)

Deaths per million ( 3)

Importantly, the effectiveness of Chinese vaccines has been such that there has been “no death” of a vaccinated resident of China since the vaccines began to be used on an experimental basis in June 2020. There are a series of Chinese vaccines, from inactivated virus to mRNA and, of recent note, recombinant protein. A recombinant protein vaccine (booster) from Sinopharm has been tested and approved for protection against the latest coronavirus variants, and is evidently safe and “markedly” effective.

No deaths among the vaccinated? That strikes me as prima facie evidence that China lies about mortality data. No deaths? Bull.

I don’t doubt China’s domestically made vaccine has provided “a modicum” of protection from deaths. Which is, as they say, “better than nothing”. But “zero deaths” kind of ranks up there with their GDP figures and other lies.

This gets back to things, I have stated before on this blog (more to my very early days here on this blog). That it’s not only the shear volume of lies the Chinese government tells, but Hillary Clinton style, they tell lies tailored for 5-year olds. Why say “zero”?? They make themselves out to be laughingstocks at the adults’ table. At least throw out a number people can actually believe. I could tell you stories of about 7 years of these style lies. The most amazing part, as far as personal interactions is concerned, is how they manage to keep a straight face when they tell them.

As for the maintaining of economic activity even when lockdowns have been necessary, Chinese coronavirus testing is broad and meticulous, so that when cases occur immediate broad testing shows the extent of infections and allows for targeted as opposed to comprehensive lockdowns. When cases were found at the port of Ningbo-Zhoushan, the cases were found at a single wharf. There are many wharfs at Ningbo and each is highly mechanized and independent of the others. So, the port operation as a whole was only mildly affected.

Then too, Chinese workers have consistently moved from area to area to help when cases have led to targeted lockdowns.

ltr,

Thanks for providing an answer to my question. I do not know if is right, but it at least makes some sense.

As for the maintaining of economic activity even when lockdowns have been necessary…the question is very important and the responses are ongoing and appearing gradually.

https://english.news.cn/20211227/21819c8ff64147bf99c2595ecf32621d/c.html

December 27, 2021

China’s Xinjiang posts foreign trade growth with EU in Jan.-Nov.

URUMQI — Northwest China’s Xinjiang Uygur Autonomous Region recorded around 261.8 billion yuan (about 41 billion U.S. dollars) in foreign trade with the European Union countries in the first 11 months of this year, up 30 percent year on year, the local customs said on Monday.

According to Urumqi Customs, Xinjiang’s exports to the EU hit 197.9 billion yuan, up 27.7 percent year on year in the January-November period, while its imports rose by 37.6 percent to reach 63.9 billion yuan.

Sun Tao, deputy director of the statistics and analysis department of the customs, attributed the robust figures to the booming China-Europe freight train services via ports in Xinjiang, the trade growth of mechanical and electrical products and the surge in the export of clean energy equipment and products.

In the first 11 months, a total of 11,156 China-Europe freight train trips were recorded by land ports in Xinjiang, a year-on-year increase of 26.8 percent….

https://english.news.cn/20211229/6e52d2168f8a4e64949e4c1346c3cfc8/c.html

December 29, 2021

China’s Tibet sees booming tourism in first 11 months

LHASA — Southwest China’s Tibet Autonomous Region received 40.43 million domestic and overseas tourists in the first 11 months of this year, up 15.9 percent year on year, local authorities said on Wednesday.

The region’s tourism revenue surged 22.4 percent from a year earlier to 43.85 billion yuan (about 6.9 billion U.S. dollars) during the period, according to the regional tourism department.

The strong growth was partly due to the effective COVID-19 control in the region….

https://news.cgtn.com/news/2021-12-31/2021-China-s-goods-trade-to-hit-6-trillion-Commerce-Ministry-16r1M5y88Sc/index.html

December 31, 2021

2021: China’s goods trade to hit $6 trillion, Commerce Ministry

China’s total imports and exports of goods are expected to reach $6 trillion in 2021, the Ministry of Commerce said Thursday.

The estimated figure sees an over 20 percent growth from a year earlier, said Vice Minister Ren Hongbin at a press conference.

The year-on-year growth amounted to approximately $1.3 trillion, equivalent to the combined growth volume of the past 10 years, Ren said.

Trade relations between China and emerging markets are getting closer, with exports to such markets accounting for 49.5 percent of the country’s total exports in the first 11 months, Ren said while speaking of the new trends in China’s foreign trade….

https://fred.stlouisfed.org/graph/?g=lwga

January 15, 2018

Real Broad Effective Exchange Rate for China, Germany, India, Japan and United States, 2007-2021

(Indexed to 2007)

https://www.imf.org/en/Publications/WEO/weo-database/2021/October/weo-report?c=924,134,534,158,111,&s=BCA_NGDPD,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2021

Current Account Balance as percent of Gross Domestic Product for China, Germany, India, Japan and United States, 2007-2021

2021

China ( 1.6)

Germany ( 6.8)

India ( – 1.0)

Japan ( 3.5)

United States ( – 3.5)

ltr,

“there has been “no death” of a vaccinated resident of China since the vaccines began to be used on an experimental basis in June 2020.”

This reminds me — and should remind all of us — that “there were no cases of SARS in Shanghai” in 2003 … for the simple reason that they were shipped out to other provinces, so as to keep Shanghai SARS-free, at least statistically.

The then-Mayor of Shanghai, Han Zheng, is currently sitting on the CCP Politburo Standing Committee; the then-Party Secretary was jailed for corruption, in 2008.

“This reminds me — and should remind all of us — that “there were no cases of SARS in Shanghai” in 2003 … for the simple reason that they were shipped out to other provinces, so as to keep Shanghai SARS-free, at least statistically.”

Now why hasn’t the Democrats thought about a version of this. The majority of people who ended up in the hospital with COVID-19 are unvaccinated with most of them being MAGA hat wearing Trump worshippers. Now if we shipped them all to Mexico and told them they would not be allowed back in the nation, a lot of our issues would just sort of self correct.

Oh wait – that goes against everything America used to stand for. But hey – Trumpians do not believe in America. They believe solely in self interest – so hey!

https://news.cgtn.com/news/2020-06-01/Chinese-mainland-reports-16-new-imported-COVID-19-cases-no-new-deaths-QXAcShMhkk/index.html

June 1, 2020

Chinese mainland reports 16 new COVID-19 cases, no new deaths

The Chinese mainland recorded 16 new imported COVID-19 cases and no new deaths on Sunday, according to China’s National Health Commission

(NHC).

The commission also registered 16 new asymptomatic patients.

The total number of confirmed cases on the Chinese mainland stands at 83,017, the cumulative death toll at 4,634, and 397 asymptomatic patients are under medical observation….

https://news.cgtn.com/news/2022-01-01/Chinese-mainland-records-231-confirmed-COVID-19-cases-16sAXEfzULC/index.html

January 1, 2022

Chinese mainland reports 231 new COVID-19 cases

The Chinese mainland recorded 231 confirmed COVID-19 cases on Friday, with 175 linked to local transmissions and 56 from overseas, data from the National Health Commission showed on Saturday.

A total of 38 new asymptomatic cases were also recorded, and 514 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 102,314, with the death toll remaining unchanged at 4,636 since January, 2021….

https://news.cgtn.com/news/2022-01-01/RCEP-Asia-Pacific-free-trade-agreement-comes-into-force-16ssZOJYWpq/index.html

January 1, 2022

RCEP free trade agreement comes into force, set to contribute to post-COVID recovery

The Regional Comprehensive Economic Partnership (RCEP), the world’s largest free trade agreement, officially came into force on Saturday.

The agreement came into effect with a first batch of 10 countries, including six of the Association of Southeast Asian Nations (ASEAN) members–Brunei, Cambodia, Laos, Singapore, Thailand and Vietnam, together with China, Japan, New Zealand and Australia. The agreement will enter into force on February 1 for South Korea, according to a statement by the ASEAN Secretariat on Saturday.

Once in effect, the RCEP is expected to eventually eliminate tariffs on as much as 90 percent of goods traded between its signatories, expand market access for investment, harmonize rules and regulations, and strengthen the supply chains within the massive free trade zone.

China is well-prepared for implementing the RCEP agreement, spokesperson for the Ministry of Commerce Gao Feng said on December 23, 2021. The core of the agreement lies in its implementation, Gao told a press briefing.

China is ready to fulfill a total of 701 binding obligations under the agreement, said vice-minister of commerce Ren Hongbin at a press briefing on Thursday. So far, the General Administration of Customs of China has completed preparations for the implementation of 174 items alone or jointly, accounting for 24.8 percent of the 701 binding obligations, chinanews.com reported on Wednesday.

The RCEP covers a market of 2.2 billion people with a combined economic size of $26.2 trillion, or 30 percent of the world’s GDP.

https://news.cgtn.com/news/2022-01-01/RCEP-Asia-Pacific-free-trade-agreement-comes-into-force-16ssZOJYWpq/img/e8237716016f4da487e51db7309088b5/e8237716016f4da487e51db7309088b5.jpeg

A total of 15 Asia-Pacific countries signed the RCEP agreement in November 2020, comprising 10 ASEAN members and five of their largest trading partners: China, Japan, South Korea, Australia and New Zealand….

https://twitter.com/paulkrugman/status/1477247341212184577

Paul Krugman @paulkrugman

Deleting, with extreme apologies, my tweet about Isabella Weber on price controls. No excuses. It’s always wrong to use that tone against anyone arguing in good faith, no matter how much you disagree — especially when there’s so much bad faith out there.

6:56 AM · Jan 1, 2022

https://www.theguardian.com/business/commentisfree/2021/dec/29/inflation-price-controls-time-we-use-it

December 29, 2021

We have a powerful weapon to fight inflation: price controls. It’s time we consider it

By Isabella Weber – Guardian

To prevent inflation after World War II, America’s leading economists recommended strategic price controls. Is there a case for doing so today, too?

Isabella Weber is an assistant professor of economics at the University of Massachusetts Amherst.

One of your very rare positive contributions here. Sort of like spotting a fluorescent green unicorn in the backyard. I’m still not sure if I agree with her or not, but I’m glad she threw her 2cents out there, and I think it’s worth pondering.

What is interesting is noticing just how adept China has been in using price controls, but what the likes of a Paul Krugman can do is assure that a policy is arbitrarily dismissed apart from examination and that has happened on several occasions with the dismissal of important policy proposals even from the likes of Joseph Stiglitz or Naomi Klein:

https://fred.stlouisfed.org/graph/?g=ERCj

January 30, 2018

Consumer Prices for China, Germany, India, Japan and United States, 2017-2021

(Percent change)

Yes, because as everyone knows, Naomi Klein is foaming at the mouth with “important policy proposals”. Baaaaaaahahahahahahahaha!!!!!!! She and Neera Tanden brainstorming together at a small folding table. They could come up with new cutting edge ideas, like locating Cheesecake Factory restaurants in poor Black neighborhoods to improve nutrition levels for Black children. Hahahahaha!!! OMG this is killing me, I think my lower stomach muscles just cramped from all the laughing. Oh please God, let these two sit down and brainstorm for “important policy proposals”~~there’s been so much less good comedy since Letterman left the building.

https://fred.stlouisfed.org/graph/?g=KqTz

January 15, 2018

Consumer Prices and Food & Nonalcoholic Beverage Prices for China, 2017-2021

(Percent change)

[ Notice the way in which China was quickly able to bring food prices under control by expressly restructuring pork production in the wake of an international environmental production failure. Pork is a prime part of the Chinese diet and price index component. ]

https://news.cgtn.com/news/2022-01-02/Chinese-mainland-records-191-confirmed-COVID-19-cases-16ueUw8i1cA/index.html

January 2, 2022

Chinese mainland reports 191 new COVID-19 cases

The Chinese mainland recorded 191 confirmed COVID-19 cases on Saturday, with 131 linked to local transmissions and 60 from overseas, data from the National Health Commission showed on Sunday.

A total of 52 new asymptomatic cases were also recorded, and 550 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 102,505, with the death toll remaining unchanged at 4,636 since January 2020.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-02/Chinese-mainland-records-191-confirmed-COVID-19-cases-16ueUw8i1cA/img/5ad6ea6d69bb455ebe406a6f36a780bf/5ad6ea6d69bb455ebe406a6f36a780bf.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-02/Chinese-mainland-records-191-confirmed-COVID-19-cases-16ueUw8i1cA/img/6f89523aa9c6487ea74f8d9ca154b1c6/6f89523aa9c6487ea74f8d9ca154b1c6.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-02/Chinese-mainland-records-191-confirmed-COVID-19-cases-16ueUw8i1cA/img/4477d77608e742bc936ea548e1152ea0/4477d77608e742bc936ea548e1152ea0.jpeg

http://www.xinhuanet.com/english/20220102/8cab8f24ae874cfeafd937535bfcbf65/c.html

January 2, 2022

Over 2.84 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Over 2.84 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Saturday, data from the National Health Commission showed Sunday.

[ Chinese coronavirus vaccine yearly production capacity is more than 7 billion doses. Along with over 2.84 billion doses of Chinese vaccines administered domestically, more than 2 billion doses have already been distributed to more than 120 countries internationally. Nineteen countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

January 1, 2022

Coronavirus

United States

Cases ( 55,864,519)

Deaths ( 847,162)

Deaths per million ( 2,537)

China

Cases ( 102,314)

Deaths ( 4,636)

Deaths per million ( 3)

Menzie, one variable I was surprised you left out on your quantile regression going a few blog threads back–was education levels, If you took the education rankings of each state’s public school K-12 (you could leave out state college rankings if it makes it simper or use it as an “additional”/”separate” variable). I think seeing what the r-squared and coefficient is on that related to vaccine rates would be interesting.

https://www.shadac.org/news/HPSVax-06.21

https://healthpolicy.usc.edu/evidence-base/education-is-now-a-bigger-factor-than-race-in-desire-for-covid-19-vaccine/

https://www.nevadacurrent.com/blog/household-education-levels-insurance-factor-in-vaccine-rate-says-study/

https://www.bridgemi.com/michigan-health-watch/education-levels-drive-michigan-vaccines-whats-rate-your-neighborhood

Honestly Menzie, , the number to me that is the most bewildering is the numbers that shows those with insurance coverage have higher rates of vaccination, with a vaccine that is offered FREE. But I suppose you would correctly tell me, those are other variables that effect the variable of the insurance coverage.

Naomi Klein is of course a brilliant social critic, a brilliant writer, long and widely appreciated as such. Appreciated by Joseph Stiglitz and Paul Krugman.