If you don’t believe me, take a look at this time series plot of available US GDP per capita.

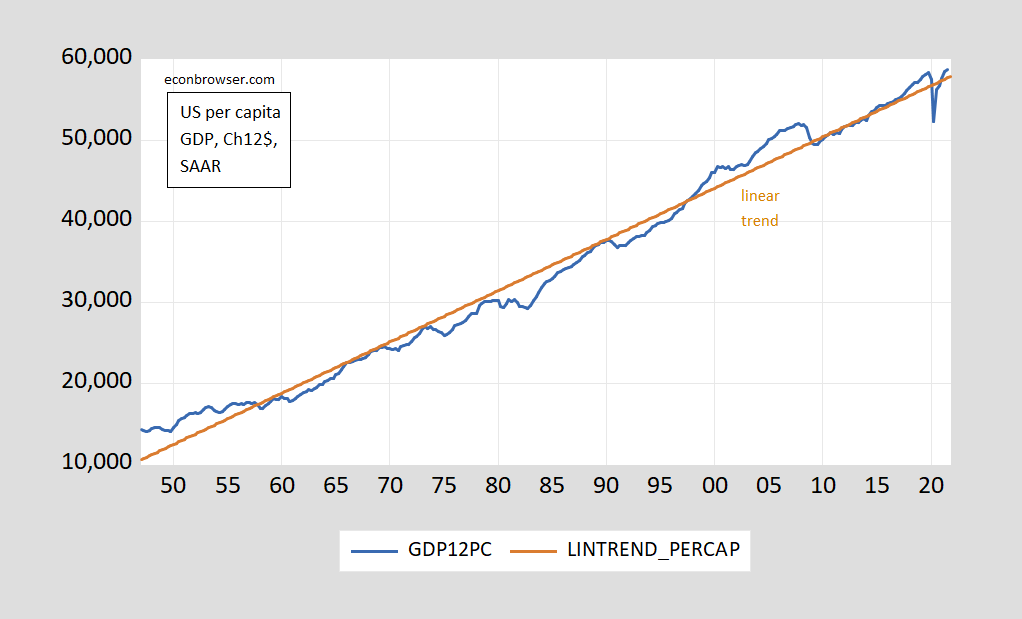

Figure 1: GDP per capita, in Ch.2012$ SAAR (blue); Linear trend (brown). Source: BEA via FRED, and author’s calculations.

Linear regression yields t-stat on time trend of about 60 using robust standard errors. GDP per capita is rising about 40 Ch2012$ per quarter.

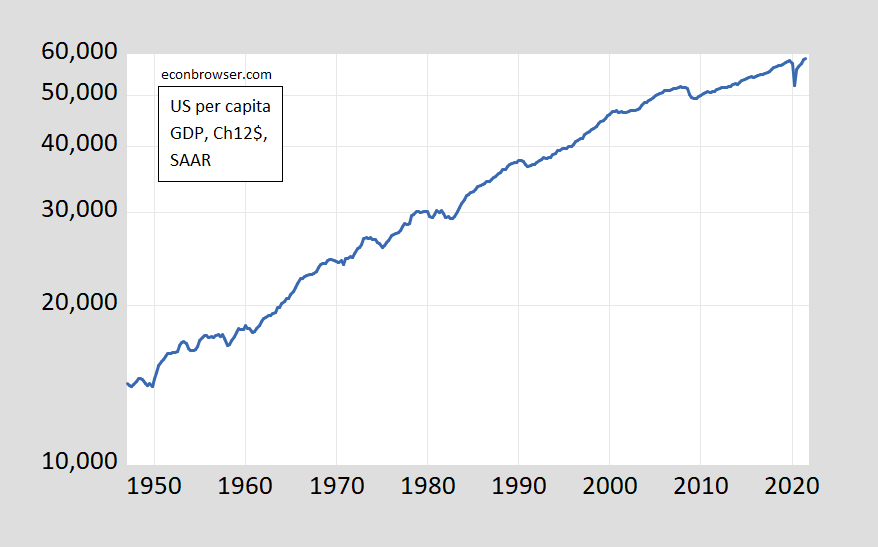

Or, one might think to plot on a log scale.

Figure 2: GDP per capita, in Ch.2012$ SAAR (blue, on log scale). Source: BEA via FRED, and author’s calculations.

Which one is misleading? One reader thinks:

In general, log scales are to be avoided for all but professional audiences, notably when exponential growth rates are involved. I would almost never use one in a commercial setting or for a general audience, because they are so easy to misinterpret. I strongly prefer simple linear scales when possible.

Well, I think one could better characterize this series as exhibiting exponential growth (with unit root) than unit growth.

Update, 12/21 10:49pm:

Moses Herzog reminds me of how Steven Kopits lauded Jim Hamilton’s February 23, 2014 post on logarithms:

I have had to learn to work with logarithms as part of my economics education but I had not (until now) realized just how helpful they can be.

More of this kind of thing, please. 😉