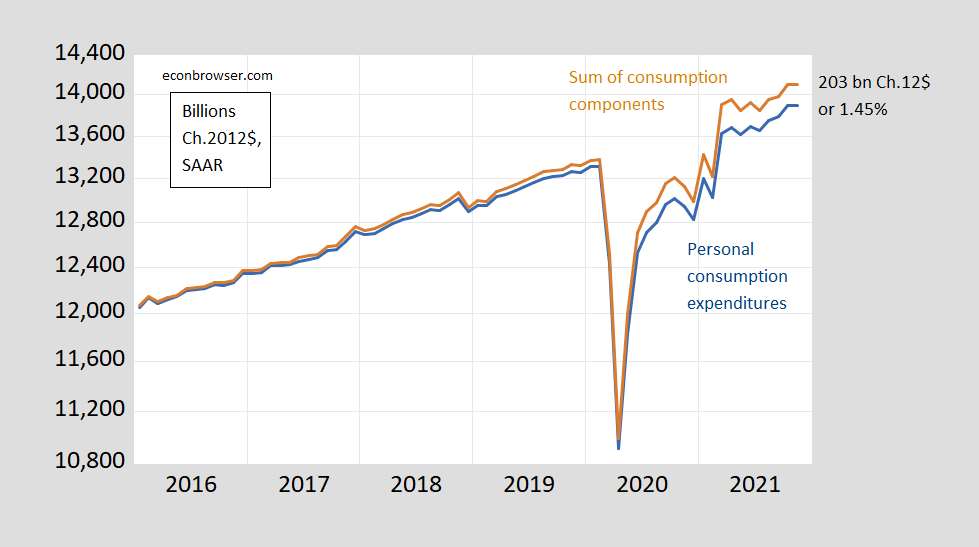

Usually, summing up chained quantities yields relatively small errors. However, when relative prices change a lot, then the differences can be large. That’s the case with relative prices of consumption since the pandemic. Hence, the sum of the components does not equal the total for consumption.

Figure 1: Personal consumption expenditures (blue), and arithmetic sum of PCE services, PCE nondurables, and PCE durables (brown), all in bn.Ch.2012$, SAAR. Source: BEA, and author’s calculations.

So…friends don’t let friends sum chained quantities.

ttps://fred.stlouisfed.org/graph/?g=ImjO

January 30, 2018

Personal Consumption Expenditures for goods and services, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=In7d

January 30, 2018

Real Personal Consumption Expenditures for goods and services, 2017-2021

(Indexed to 2017)

Off topic, except in the sense that inflation is the subject –

I am a fan of the idea that developed-country central banks have lost power in determining inflation outcome and overall macroeconomic outcomes. Big fan. Huge fan.

It is thus unsafe to take my word for anything having to do with appropriate monetary policy. Now that you’re warned, here’s a recent BIS paper which argues that:

1) Co-movement in prices is very much reduced since 1980.

2) Meaning that any common inflationary impulse is very much reduced since 1980.

3) Monetary policy adjustment influenced only about 1/3 of prices in the U.S.

4) This is all the result of monetary policy regime change (Volcker).

5) The Fed now has limited power to maintain inflation within harrow bounds.

https://www.bis.org/publ/qtrpdf/r_qt2109b.pdf

Some really important issues which, to me, are raised by the paper, but which are not addressed, are:

1) Given that the Fed has lost power to determine inflation outcomes, does it have power over other macroeconomic outcomes?

2) If the Fed has influence over the use of leverage to generate income and financial wealth, should the Fed set policy with an eye to distributional outcomes?

3) Given that leverage is positively correlated with economic risk, should the Fed maintain higher policy rates simply as a matter of macroprudential caution?

4) Does fiscal policy also lack power in determining inflation outcomes?

5) Does fiscal policy lack power in determining overall economic outcomes, apart from distributional outcomes?

I have strong doubts about 5. Every other item seems to me at worth a close look.

Keeping in mind that synchronization of price movements is high among developed countries, and increasingly among developed and developing countries: https://www.sciencedirect.com/science/article/pii/S0264999320311974

Global trade drives goods prices. Baumol drives service prices.

So, Menzie, presumably this is yet another example of index number problems, something that people are supposed to be taught about early in principles of macroeconomics courses when they learn about price indexes and issues related to measuring inflation, and related to that measuring changes in real GDP.

I note that perhaps the most dramatic example of the latter involves the old debate about how rapidly the Soviet economy grew during the 1930s in the first several 5-year plans of its centrally planned command socialist economy. This induced huge relative changes in prices and sectoral balances, with very large differences in estimated real GDP growth arising from that depending on how one accounts for those large relative changes, although it must also be recognized that there were outright errors in some of the basic data for propagandistic purposes, with those not resolved. It does remain the case that even if one accepts the lowest estimates of economic growth in the 1930s USSR, the expansion of heavy manufacturing was sufficient to support enough steel production to produce enough tanks and other military equipment to defeat Hitler’s army at Stalingrad and Kursk.

Maybe your model is just so wrong you are having trouble finding excuses to “adjust” the data?

Is the difference likely due to financial market income, which your sacred totem, GDP, ignores?

rsm: No.

rsm Do you understand the math behind the construction of a chained index?

He also does not understand confidence intervals but hey!

Might we suggests you read these posts and try to ascertain the insights they convey before you write another one of your embarrassingly ignorant critiques.

Weekly rig count out a day early (24th holiday):

https://rigcount.bakerhughes.com/na-rig-count/

US oil up 5 and gas up 2. Levels, for price, still remain below what we saw under Obama and Trump, but encouraging to see them build. there can be some lag in decisions versus prices, but I’m hopeful we get continued builds in new year, despite WTI being in 60s versus 80s from the fall.

It’s pretty clear from 2014-2020 that US shale is a destabilizing entrant to the OPEC+ cartel. (As expected based on economic theory…entrants taking rents.) Events proved that out, with even OPEC acknowledging it, in contravention to James Hamilton saying the opposite in early 2010s–“hundred dollars here to stay”, etc. So it is helpful to see shale recover. Both for the direct aspect of future production and the implicit destabilizing threat to the OPEC+ cartel cohesion (which has been relatively strong).

Canadian rigs down dramatically, but that is a normal seasonal holidays thing. For the life of me, don’t know why Canadian drillers take Xmas off (more) than Americans. Maybe have another week or two of Canadian drops depending on exact dates of reporting, but expect big builds back in JAN.

Frac spread count down significantly (-14):

https://www.youtube.com/watch?v=C8xSDIv5R3I

But apparently this is also seasonal. Presenter shows a chart at 4:00 of last seven years and there is a regular DEC drop. I’m not as familar with spreads as rigs, but seems like he’s right about a DEC drop with JAN recoveries, being common.

Canadian

https://news.cgtn.com/news/2021-12-24/Chinese-mainland-records-87-confirmed-COVID-19-cases-16fiMvC3WQo/index.html

December 24, 2021

Chinese mainland reports 87 new COVID-19 cases

The Chinese mainland recorded 87 confirmed COVID-19 cases on Thursday, with 55 linked to local transmissions and 32 from overseas, data from the National Health Commission showed on Friday.

A total of 26 new asymptomatic cases were also recorded, and 497 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 100,731, with the death toll remaining unchanged at 4,636 since January.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-12-24/Chinese-mainland-records-87-confirmed-COVID-19-cases-16fiMvC3WQo/img/f567a2dab56742958ef116f398a46a9a/f567a2dab56742958ef116f398a46a9a.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-12-24/Chinese-mainland-records-87-confirmed-COVID-19-cases-16fiMvC3WQo/img/7880419659c64486bc3a20c632a0bab2/7880419659c64486bc3a20c632a0bab2.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-12-24/Chinese-mainland-records-87-confirmed-COVID-19-cases-16fiMvC3WQo/img/7fe5e0bab50b4c30b89e3b9733d9b40c/7fe5e0bab50b4c30b89e3b9733d9b40c.jpeg

https://english.news.cn/20211223/db45ec88a1834aef80391b08ee0a698e/c.html

December 23, 2021

Nearly 2.72 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Nearly 2.72 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Wednesday, data from the National Health Commission showed Thursday.

[ Chinese coronavirus vaccine yearly production capacity is more than 7 billion doses. Along with nearly 2.72 billion doses of Chinese vaccines administered domestically, more than 1.85 billion doses have already been distributed to more than 120 countries internationally. Nineteen countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

December 23, 2021

Coronavirus

United States

Cases ( 52,788,451)

Deaths ( 834,455)

Deaths per million ( 2,499)

China

Cases ( 100,644)

Deaths ( 4,636)

Deaths per million ( 3)

Bernie Kerik was one of Rudy Giuliani’s police commissioner back in 2000/2001 and a truly corrupt piece of garbage. While he is saying he will cooperate with the 1/6 commission, he is also accusing them of all sorts of vile things. Of course there is no merit to Kerik’s little allegations but then again Kerik has zero credibility on anything:

https://www.cnn.com/2021/12/24/politics/bernard-kerik-january-6-committee/index.html

I still side with the view that the virus came from an animal which was either directly used, or contaminated another animal used as a food product in the local “wet market” (not caused by a lab leak). But I also believe the more information we have, the better. And even academic journals (and/or their editors) are not perfect, as some might have us believe:

https://www.dailymail.co.uk/news/article-10320621/Brit-scientist-took-year-declare-links-Chinese-lab-opposing-Covid-lab-leak-theory.html

If Lancet has been shown publicly to break professional codes of ethics, what are we to think of other academic journals with less status and less reputation?? Are we to imagine that they are “better” than Lancet??

Moses,

Thanks for interesting link. Did not know details about this matter. I note this does not bring us any closer to actually determining where the virus came from, and I shall simply repeat as I have said many times here that very likely we shall never know, certainly not with any certainty.

But I am more interested in commenting on this problem of what editors of academic journals have to deal with, not at all defending Horton, although he was clearly in a difficult situation. In this regard as someone who has been editing academic journals for 20 years now, I have some experience with these sorts of things and have even written about them, in particular a piece I sent to Menzie privately fairly recently. I shall indicate how to find it, noting that a highly redacted version of it appeared in a 2014 book out of MIT Press edited by Michael Szenberg named Secrets of Economics Editors, or something like that. It was heavily redacted because MIT Press was afraid of being sued.

Anyway, the full and unredacted version with all the dirt is on my website at cob.jmu.edu/rosserjb . Unfortunately one must scroll down quite aways through many papers to get at it, but its title there (not the title of the redacted published version) is “Tales from the Editors’ Crypt: Dealing with True, Uncertain, and False Accusations of Plagiarism.”

This is not the issue Horton dealt with, but it is a difficult one that many editors deal with eventually, and I note given how important for the careers of professional academics such accusations are, this is something that can get a tenured prof fired, a lot of pressure sometimes gets brought to bear on editors regarding such matters, with what is going on not always all that clear, but editors’ decisions having serious implications for peoples’ careers.