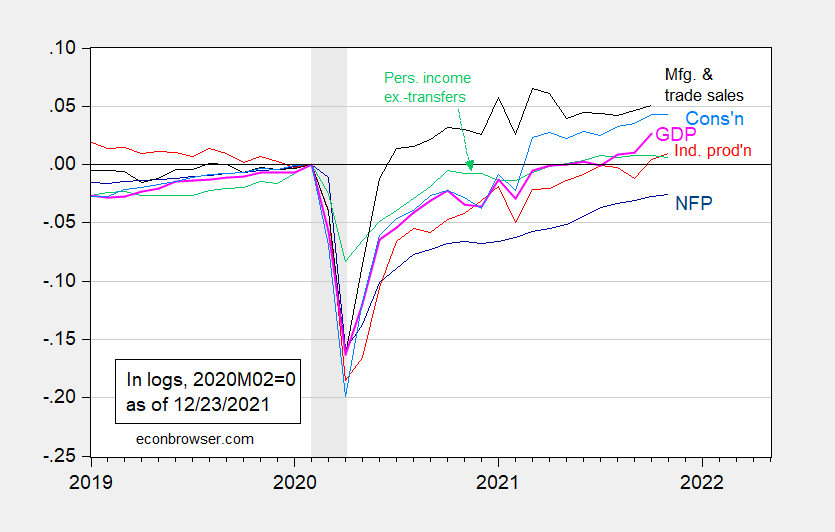

With the release of personal income and consumption, we have some of the last readings we’ll receive this year (although December’s readings will still be coming in in January). Here are some key indicators followed by the NBER BCDC.

Figure 1: Nonfarm payroll employment (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (12/1/2021 release), NBER, and author’s calculations.

Note consumption is flat in November (with some movement toward services); services rose 0.5% m/m, while durables fell 1%, and nondurables fell 0.6%. I would expect December services consumption to take a hit, but we have only tentative indications of that from high frequency indicators. Personal income growth also stalls.

GDPNow as of today signals 7.2% 7.6% [corrected 1:30pm Pacific] growth for Q4 (SAAR), while IHS Markit is at 7.1%. So for now, indications are for strong end of the year.

Kim Potter found guilty of 1st degree manslaughter.

https://newyork.cbslocal.com/2021/12/23/times-square-new-years-eve-celebration-scaled-back-due-to-omicron-surge/

If you are one of those morons who want to welcome in the New Year by joining a crowd at Times Square to freeze your tail off for many hours, our mayor has good news for you. It is on but limited to only 15 thousand morons.

Now it turns out that Fox – which CoRev thinks are all brave MAGA hat wearers who are immune to the virus – has decided to cancel its coverage. I guess they are not so brave after all!

Me? I will be staying warm in Brooklyn watching it like most everyone – on the TV!

pgl thinks that New Years in NYC is a business cycle indicator!!!

Sad that the poor guy has nowhere else to share his New Years plans. Sounds like he needs to go out and get a dog for companionship…

WTF? And I thought CoRev was my Donald Luskin style internet stalking. Dude – you need to get a life.

Durables down, services up means a tiny unwinding of the consumption pattern which has boosted core inflation.

The Atlanta Fed’s GDPNow estimate is up to 7.6% from 7.2% as investment and export data more than offset weak PCE.

Macroduck: Oops, you are right – 7.6% now.

Some high-frequency indicators of service demand: https://www.calculatedriskblog.com/2021/12/seven-high-frequency-indicators-for_20.html?m=1

Apple movement data and movie tickets are the only evidence of weakening activity, to my eye. The new Spiderman may cure one, perhaps both, of those slowdowns. But the weak we’re in matters more than what’s in the data so far.

“The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.”

A friend who lives in Pennsylvania e-gifted me a $50 Grubhub card. I’m checking out the Brooklyn eating establishments and of course how to use Grubhub so I can use it over the holidays. I figured out a vineyard near her that had e-gift cards. Food v. fine wine!

Bring your papers.

You mean will try to check out the diners, drive-ins and dives that haven’t gone bankrupt from the pandemic.

The eastern Queens diner we frequented for decades gave up the ghost last week. One big, busy diner near huge LI Jewish Hospital went belly-up last June.

Anyhow, check out Peter Luger [steaks] over in Williamsburg.

The new Spiderman? I’m looking forward to seeing the new West Side Story.

Spider-Man…per pgl another business cycle indicator. Who knew?

I take the previous comment back – you need some series professional help.

And watching West side Story in his residence due to his irrational fear of Covid. BTW, it will probably be shown on s Fox network station as they will be the network best able to afford it.

I hear FOX News are masters of managing unnecessary costs:

https://www.reuters.com/article/us-fox-settlement/21st-century-fox-in-90-million-settlement-tied-to-sexual-harassment-scandal-idUSKBN1DK2NI

An additional data point from the spending and income report – the personal savng rate fell to 6.9% vs around 7.4% prior to Covid and double-digit rates earlier in the pandemic. Households are eating away at savings, and that’s before the Manchin cut in the child tax credit.

I think Kevin Drum highlighted this drop in the savings rate as a good thing – more consumer spending. Ying v. yang!

Barron’s estimated that, with the end of the child payments and end of the student loan payments moratorium, $25 billion a month less cash would be in the national mix.

Is there anything Joe Manchin single-handed cannot do?

@ T. Shaw

https://www.amazon.com/Kill-Switch-Crippling-American-Democracy/dp/1631497774

https://www.theguardian.com/us-news/2021/jan/30/kill-switch-review-senate-filibuster-republicans-mcconnell-trump

Probably not.