In recent exchange [1], some exhibited skepticism that monopsony power exists in labor markets. A recent article documents evidence that manufacturers exhibit such power. From Yeh (2022):

we show that the degree of employers’ market power is substantial and widespread in the U.S. manufacturing sector. A worker in the average manufacturing plant receives only 65 cents on each dollar generated in the margin. … We find that employers’ market power decreased between the late 1970s and the early 2000s but has sharply increased since.

The following results are provided:

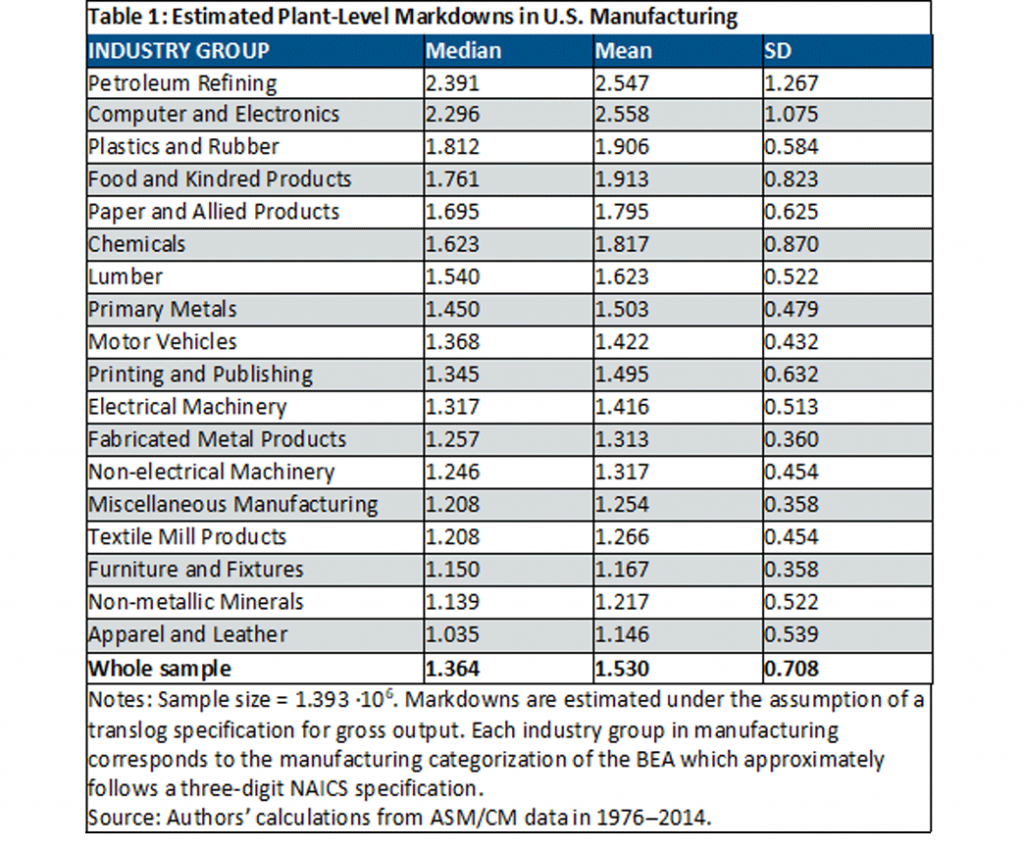

Source: Yeh (2022).

The following interpretation is given:

The average plant charges a markdown of 1.53, implying that workers only collect $1 for every $1.53 (or 65 cents of every dollar) they generate in the margin for their employers.

The results in the Table indicate that there is substantial variation in market power between sectors and within industries in manufacturing. Interestingly, in the analysis concentration is weakly correlated with the measured extent of markdowns.

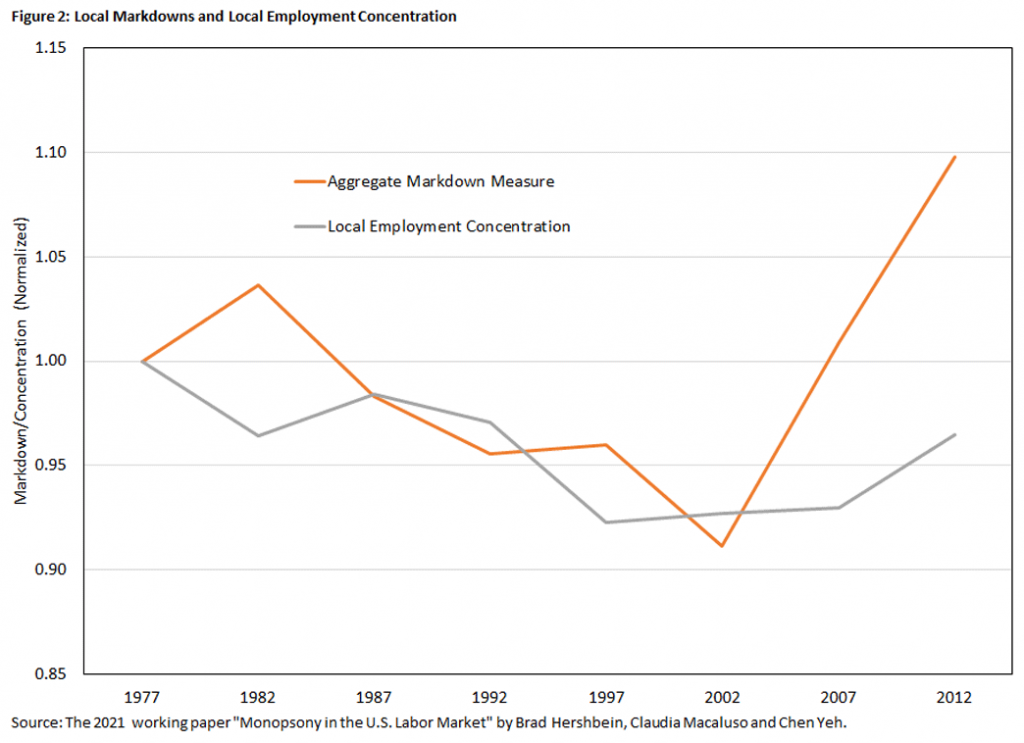

A corresponding aggregate measure of market power shows a decline over time, with a reversal starting in 2002.

Source: Yeh (2022).

An earlier working paper upon which some of these results are based, Hershbein, Macaluso, and Yeh (2019). (On a side note, those who read the paper will find it nostalgia-inducing, if you experienced PhD studies with the first edition of Hal Varian’s Microeconomic Analysis, and ever estimated a translog production function.)

See an earlier discussion of the geographic variation in labor market monopsony, as estimated using concentration.

Why doesn’t universal, inflation-protected, generous basic income solve this problem?

You’re talking like someone who’s interested in MMT. There are actually better books on the topic of MMT, but the one most suitable for you might be Stephanie Kelton’s book. Menzie will probably slightly frown on me pointing to you towards this, and college textbooks might be a better “starting point”, but if something engages your personal interest more, you might actually read it front cover to back cover.

https://stephaniekelton.com/book/

Moses Herzog: If you can actually understand what an MMT theorist is saying, then more power to you. It’s beyond me.

You got me to laugh Menzie (which I need in these Covid post-MAGAT trauma days). Here is what I will say about it, I think MMT makes more sense than you give it credit for, but I also get your point, and it’s valid. But I do think you should be a tinge more open to it.

Moses Herzog: I was open to it. I tried to understand it. I wrote up a whole set of notes trying to interpret it. https://econbrowser.com/archives/2019/10/mmt-in-relatively-plain-english All I can say is life is too short.

Fair enough Sir. I know you’re thorough, more than thorough. I remember when you shared that on the blog. Even if it’s a very short section of your course, I hope you’ll still give it like “half a unit” of study for the students. Some of the things Keynes said back in the day were wild. Same with Ricardo, Maybe one of your students will plug up those MMT holes or make that equation make more sense one day. It’s possible. I think they should have abbreviated exposure to MMT, even if you have to “hold your nose” while telling them about it. Even the fallacies of MMT might teach them something, kind of like looking under the hood of a car with a broken engine.

MMT types often spend 20 pages mansplaining to the rest of us basic concepts would patiently teach his students in a span of 20 minutes. But I guess they think writing 20 pages on something that should be obvious to other macroeconomists makes them smarter than Tobin ever was. Of course very few people are even half as smart as to the late James Tobin.

I will say starting out with one or the other could add confusion, which is part of why I mentioned it. I think starting with orthodox economics can make MMT more confusing, and I think starting out with MMT can make orthodox economics more confusing if you learn it after reading MMT. Kind of like learning stick shift transmission vs automatic transmission or something?? And as much as I like MMT and have tons of sympathies towards it, I still would say for the beginning learner, for most people, learning orthodox first is the best way.

Is MMT too mainstream? Can I propose Modern Mother#@*%ing Monetary Theory, which eliminates the inflation constraint through full, continuous, indexation, makes taxes voluntary, prints the budget, and sets inflation expectations by buying and selling inflation swaps as needed as part of open market operations?

rsm,

“full continuous indexation” is an impossibiity. It will have to be occurring in discrete chunks in response to discretely reported changes in the cost of living. These are not and will never be reported or measued continyously. Simply impossible.

Voluntary taxes? Are you kidding? Why would anybody pay any taxes? I am unaware of anybody other than you here and now making such an insane suggestion, certainly nobody in the MMT crowd. Maybe some far out libertarian, but not even them, except for maybe the most totally anarchistic type, but I have not seen even Ed Stringham suggest that, although he is about as anarcho-capitalist as any of them out there, government down to a few voluntarily joined coops, private police, this sort of thing.

It is true that the US tends to operate on continuing budget resolutions much of the time, but I think that these do get printed. What does this have to do with anything? Must that printing be on paper or will strictly online suffice? Sheesh.

As for the Fed selling inflation swaps as part of open market ops do anything about anything? We already have TIPS, which in theory should stabilized inflationary expectations, but there is no evidence that it does so.

Looks like not a single one of your suggestions will do anything much at all, and I do not think any of this is part of MMT, if that even matters.

Does a relevant slashdot article today,”Open Source Developers, Who Work for Free, Are Discovering They Have Power”, support my argument that basic income is an effective way to give workers power?

USAToday did not invent the news story which begins with a long anecdote about some family going through whatever thing is the topic of the story. All USAT did was make that approach the standard way of writing about any issue. Anecdote before analysis. There is a risk in this approach that anecdote will force out analysis.

And here you are, confusing an anecdote about some coders for actual analysis. Hurray for USAToday-level thinking.

《I guess you did not read the post as you are babbling irrelevant word salad. Move on as you are wasting everyone’s time.》

Oooo, rsm strikes back! With stuff that’s been said about him. Must have struck a nerve.

Makes sense that you’d parrot other people’s criticism of you. Repeating the same stuff over and over is your usual game.

JohnH got confused thinking inflation and market power were the same thing. If you had paid any attention, a lot of folks including Dr. Chinn pointed out that this linking was rather off.

I have to admit that I give JohnH a hard time for his rants but to be fair – you are FAR, FAR dumber and infinitely more annoying that he could ever be.

So do us all a big favor? STFU!

Why wouldn’t full continuous indexation simply solve nominal inflation, once and for all?

I guess you did not read the post or the paper as you are babbling irrelevant word salad. Move on as you are wasting everyone’s time.

《you are FAR, FAR dumber and infinitely more annoying that he could ever be.

So do us all a big favor? STFU!》

rsm,

Because continuous indexation is imposible and full indexation has historically tended to feed accelerating hyperinflation, in which case the indexation is unable to keep up as the system gets out of control. The most dramatic case of this involves the absolutely worst hyperinflation of all time, which happened in Hungary in 1946. They put exponents on the pengo notes and then exponents on the exponents. When it ended they were issuing 5 quintillion pengo notes. This is also the case where there was the fullest effort to have total indexation, and it is widely accepted that this effort played a crucial role in the wild acceleration of that inflation.

Do you now understand why nobody pushes this “solution,” rsm? Please do not push this crackpottery again here.

Dr. Chinn plunked their illustration:

“The average plant charges a markdown of 1.53, implying that workers only collect $1 for every $1.53 (or 65 cents of every dollar) they generate in the margin for their employers.”

Monopsony power allows a firm to pay someone who otherwise would earn $15.30 an hour only $10 an hour. So inflation is not the culprit at all which means your comment was dumber than a rock. Now a $15 minimum wage would be a great idea here. Even if the mere suggestion of raising the minimum wage would drive Princeton Steve screaming his lungs out. After all – it would be a mortal sin if his petroleum refining clients had to pay competitive wages.

See, this is the problem with your know-nothing approach to economics. Universal basic income works to reduce all kinds of economic and social problems, but you don’t seem to have bothered to find out which ones. Basic income payments do not have any direct relation to monopsony. Basic universal income is your new way of making noise. You don’t actually care about, ’cause if you did you’d at least know SOMETHING about it.

Moses has been kind enough to recommend a book. I doubt a book will help. I doubt you have an interest in learning. I think you’ll keep banging on you highchair tray, same as you’ve done since your first comment here.

Why wouldn’t basic income give me the power to say no to any monopsonist employer?

You clearly do not get labor markets. In fact – you do not have a clue what a market even is.

rsm,

Even if it is “generous,” it will still be a fairly small part of the income of many people and will not make much difference.

Richmond Fed actually has some nice research and stuff going on. They seem to get “lost in the mix” with the other regional Fed banks, but there’s some good stuff over there. This looks great. And maybe it’ll help me grasp these regressions better looking at that production function?? I find looking at some of the older texts sometimes they explain things better. Anyways.

You know, just one one of my rambling blathering side-notes here (you were warned) I remember clear back to when I was in my teens, I used to read editorial sections of newspapers, and the write-in letters or comments. And even at that age, it always struck me how they would use the dumbest comments to “highlight” in the write-ins. It was as if the news departments of the papers were trying to send a subliminal message that “look we’re highlighting reader criticisms of our journalism, but it’s only our most idiotic readers who complain”. When you knew there were more legit criticisms who had written in and the editorial dept had ignored, but they chose to ignore the legit criticisms, because indeed the legit criticisms would make the newspapers’ journalism look worse. I thought of this thinking of Kopits and CoRev on this blog. But what I like about Menzie, even though he may not necessarily write a post on it (he probably has) when the better readers/commenters call him out he will admit the error, or admit “they had a point”, and even go so far as making sure the original text is included with the correction.

There’s a lot of reasons why I obsessively read this blog, and it’s part of my daily routine. like a morning coffee. And not just because Menzie placates me and answers my occasional questions in the comments (which I admit, for selfish reasons, is part of why I read this blog). it’s because Menzie has the ethics and personal wherewithal to take the criticisms (legit and non-legit) in managing/running the blog.

I’d also like to note, this is often one advantage of blogs over newspapers, there’s less “filtering” of reader criticism. I suspect this is a LARGE PART of the reason guys like David Brooks make snobbish/condescending comments about blogs. Because of the cultural influence of blogs they can’t hide those criticisms any more, and has even forced newspapers like NYT to allow more readers’ freeflowing comments attached to commentary such as David Brooks’ “commentary” (or whatever that “stuff” is Brooks writes)

Moses,

I have not been keeping a list and offhand do not remember any specific ones, but indeed Menzie does from time to time make errors, usually fairly minor ones, but as near as I can tell when somebody does catch him in one, he quickly accepts it, apologizes, and corrects as necessary.

I shall add that he does not just correct errors pointed out by his “better readers/commenters” but those from anybody, including people who give him a hard time and may usually not be all that on top of things. I think what you are catching is that the people most likely to spot his actual errors are more likely to be from the set of his “better readers/commenters,” but not always. However, I do not have any confidence intervals on this, so rsm can jump in to say nothing can be said about this.

It was not a criticism, in fact I was afraid as I was typing it that it was going to be read as a “disguised dig” because sometimes I fail to express myself in my true underlying meaning or intentions. I meant it as a compliment to Menzie, and blogs in general, that he doesn’t do that like you would see sometimes in the old newspaper editorials before the internet and blogs became more prominent. And I believe many professors also aren’t good at taking criticism, so the fact Menzie is good about it, makes it even more remarkable in my personal opinion.

I also realize when I spell these things out it also makes me seem like a Menzie Chinn, “fanboy”. But that’s something that I can live with because I probably am a Menzie Chinn “fanboy”. But as above shown on MMT, I can diverge a little with Menzie. It’s not that he’s wrong about MMT, there are problems. What I think I am attempting to express is I think there is potential for new ideas and new ways and new answers, by exploring MMT. The potential of MMT to be a springboard for new theories and new answers.

Stevie did write: “Why would anyone want to be an economist when the bulk of your views seem to revolve around exceptions to the rule, about presumptions that you are smarter than the market or that markets don’t work?”

Monopsony markets work. But they do not work the way Econ 101 purists like Stevie thinks they must. Of course anyone who writes “exceptions to the rule” thinks more like a closed minded lawyer and not an economist that lives in the real world.

You write above: “Monopsony power allows a firm to pay someone who otherwise would earn $15.30 an hour only $10 an hour.”

Monopsony is a market failure. For monopsony to hold, you should have written, “Monopsony power allows a firm to pay someone who otherwise would earn $15.30 an hour only $10 an hour by acting in explicit or implicit collusion with other employers to restrict competition for employees.”

I think we can agree that $5.30 / hour would represent a massive level of collusion, and it suggests vast and inexplicable wage differences across geographies. After all, a car parts manufacturer in Ohio is unlikely to have material communications with or knowledge of, say, a lamp manufacturer in New Hampshire.

Monopsony should not be confused with separate market equilibria. There is a market for car parts, and there is a market for labor. There is nothing that says that these two markets must necessarily clear at any given price. For example, the price of oil can go up and down by tens of percents without anyone claiming monopsony or monopoly. With the implementation of NAFTA, the rise of China, and the decline of unions, we might expect that, until these developments are fully absorbed, labor will suffer at the expense of capital. And so it has.

I think it’s pretty clear that the transition is complete. Wages in China have been rising rapidly in China, making American labor more competitive. As a result, we’ve seen advertised wages for retail stores like supermarkets go from $11 / hour in 2010, to $13, to $17 during covid, and now $19 in Cape Cod. In real terms, visible minimum wages have risen something like 50% in a decade. I expect wages to fall back a bit, but I think that $17 / hour level will hold longer term.

Wow – putting words into my mouth eh? Yes monopsony power is a deviation from perfect competition which may be called by “market failure” by economists. But that is not the same thing as “markets do not work” which is your incredible STUPID language.

Now it seems you believe that we do not have explicit collusion, firms cannot exercise market power. Guess what old economic know nothing? There is an entire literature that says otherwise. Try buy any text on what is called Industrial Organization as you are the most clueless consultant ever. I would suggest Jean Tirole’s text as it is really excellent but something tells me he is way over your head.

You should have written, “Monopsony power allows a firm to pay someone who otherwise would earn $15.30 an hour only $10 an hour by acting in explicit or implicit collusion with other employers to restrict competition for employees.”

This is the usual clueless arrogant garbage Princeton Steve is known for. I am simply presenting what the linked papers said in terms of a simple illustration. Maybe Princeton Steve should read both of those papers and then write the authors dictating to them how he thinks they should have written their excellent papers. I bet the authors will fall on the floor laughing at this arrogant idiot.

Look Stevie – when you actually bother to learn basic economics, maybe you can then dictate to us how to write. Which of course you have never learned to do. Otherwise, STFU.

pgl,

I know you are a firm believer in the “exploited worker” and the whole monopsony narrative fits right into your weltanschaaung. But others are not so convinced:

https://www.britannica.com/topic/wage/Marginal-productivity-theory-and-its-critics

I used that source rather than list a bunch of critics who you would make snarky remarks about their CVs as if yours was better.

Bruce Hall: Well, if there’s a union and there’s a monopsonist, then standard theory assuming a monopsonist and atomistic workers is not appropriate. Like duh.

If there is a monopsonist and a monopolist-union, then yes, you don’t know what will happen without making more assumptions regarding strategy, degree of market power, etc. *But that doesn’t mean you assume away the monopsony*.

Please for the love of g* will you read a micro textbook (even an intro one) before writing about micro?

https://fred.stlouisfed.org/graph/?g=mQUa

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2000-2021

(Indexed to 2000)

Decline in labor share of income:

93.0 – 100 = – 7.0%

Increase in real profits:

278.0 – 100 = 178.0%

https://fred.stlouisfed.org/graph/?g=EqSq

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2017-2021

(Indexed to 2017)

Increase in labor share of income:

104.5 – 100 = 4.5%

Increase in real profits:

127.0 – 100 = 27.0%

If the article purports that a worker, on average, gets only 2/3 of every dollar generate, I’d have to ask, “what kind of labor”?

In industries that have become highly automated, I’m not sure how this means much. If a machine does the work of ten people and requires one operator, should one additional operator be paid the equivalent of ten people when the “work” is being done by ten additional machines? Shouldn’t the level of automation be considered in the equation when comparing industries? For example, meat processing, which is increasingly being controlled by Chinese firms, is quite labor intensive (but may be using undocumented immigrant labor which doesn’t have a lot of bargaining power). Compare that to a GM or Ford assembly plant which has high levels of automation and unions and you’ll see that wages remain high and are renegotiated, but the workforce doesn’t necessarily grow over time as output is automated more.

• https://www.nbcnews.com/business/business-news/manufacturers-embrace-robots-perfect-pandemic-worker-n1263434

And then, wouldn’t “local employment” type of industries be more labor intensive to generate additional profit so the higher reliance on workers means less opportunity to reduce labor costs as a percent of total?

Do us a favor. Go read that 2019 paper before you go off on another uninformed rant. BTW – ltr who thinks she is the Chinese expert tells us that your meat packers are Brazilian multinationals. I actually checked. She is right.

pgl, ever hear of Smithfield? Not a Brazilian company. Ever hear of the WH Group? Okay, moving on.

And my comments were not a “rant”. Perhaps I misunderstood the idea of workers getting only 2/3 of the additional marginal value they provide a business (presuming that additional value is directly tied to the worker’s contribution and not from concomitant process or technological changes . Perhaps automation is not a consideration when looking at the recent change in the relationship between business income (in larger corporations that can afford this new production structure) and worker pay, despite the observations in the NBC article. Perhaps use of “undocumented immigrants” in meat process plants has no bearing on their ability to negotiate higher wages.

Perhaps you could explain your objections.

Bruce – if you actually READ the paper Dr. Chinn provided – my objections to your latest babbling might be crystal clear. Well – they would be clear to anyone who got basic economics which of course excludes you.

pgl,

https://itif.org/publications/2021/05/07/myth-local-labor-market-monopsony

https://itif.org/person/robert-d-atkinson

For every economics theory, there is an anti-theory.

“pgl, ever hear of Smithfield? Not a Brazilian company. Ever hear of the WH Group?

Yes I have heard of the WH Group also known as Shuanghui. I also know you are talking about one company not two. I guess dumbest person ever did not know that in n May 2013, Shuanghui purchased your Smithfield Foods (get the name right doofus) for about $7 billion. Now trying comparing the financials for this Chinese company to the TWO Brazilian multinationals.

Brucie – we have been over this before. Kelly Anne Conway lies to you and like the paid little dunce you are – you just repeat her lies without any verification.

I challenged Bruce Hall to articulate the financials for his “Smithfield” which is actually Smithfield Foods. Of course we know Bruce does not real research so I went to http://www.sec.gov to look at their last 10-K filing before that Chinese firm acquired them for a mere $7 billion.

First of all – Smithfield Foods is a pork processor with a lot of their operations in Poland. Polish pigs! Secondly, their worldwide revenue was around $15 billion back in the day which isn’t bad but I’d rather be a Brazilian beef processor. Especially since Smithfield Food’s operating margin was a mere 7% back in the day. And Wall Street thought the Chinese firm paid too much to buy Bruce’s food giant!

Look – Bruce is not exactly the expert in the meat business. But that is not what Kelly Anne pays him to do.

I went back to Bruce Hall’s rant to see if he thought Smithfield International exploits monopsony power or not. Alas his writing is so garbled I cannot tell WTF he believes here. But I did find this old discussion of their return to assets, which was around 5%:

https://csimarket.com/stocks/SFD-Annual-Return-on-Assets-ROA.html#:~:text=In%20%28Jan%2003%202016%29%20Smithfield%20Foods%20Inc%27s%20ROA,year%20ago%2C%20as%20SFD%27s%20assets%20were%20%249%2C894.00%20millions.

If Smithfield ever had market power, it was doing a terrible job of exploiting it.

“For example, meat processing, which is increasingly being controlled by Chinese firms, is quite labor intensive (but may be using undocumented immigrant labor which doesn’t have a lot of bargaining power).”

This is exactly why Robert Hall wants everyone know he is not related to you. Chinese firms may not control meat processing (try Brazil) but they are a lot of Chinese owned manufacturers of apparel. Now you would have it that this sector has a lot of monopsony power. Again – go READ the actual research papers and you will see they are the most competitive in terms of the labor market.

“Chinese firms may not control meat processing (try Brazil)”….

Oooo, so pork is not a meat? Come on, man!

But to your point that Brazilian firms control the “meat” prices, you probably haven’t been to the local grocery store to see shoppers making choices. Those choices would include pork and chicken as alternatives. And you probably blame the processors because exports of beef have surged. Come on, man!

https://www.farmersjournal.ie/world-news-us-beef-exports-surge-in-2021-673152

It’s a bit like automobiles: demand high, production not keeping up. So, pgl, what do you think happens to consumer prices? And, yes, like automobile producers, meat producers are enjoying high prices (at least temporarily) without passing through the profits in the form of wage increases. But you might … might, but probably not… ask yourself whether those producers would force wage cuts if the prices of their products went down. Or would they simply lay off the excess labor force and the remaining workers continue to get their normal wages?

You talk a good game… divorced from reality.

Gee Bruce – I do go to my local grocery store on a regular basis. No – I do not make my mommy go to the store for me like you do. Have you left your basement yet? Geesh.

But yea – I prefer chicken, tuna, salmon, and even sometimes beef. But sorry – pork is a rather disgusting choice of meat.

But yea there is ONE not two Chinese firms do a lot of pork processing. Or did Kelly Anne not tell you Smithfield Foods was part of WH Group as 6 years ago? Please do some original research next time as she lies to you routinely.

Aw, nice that you can get out of the basement and buy your “non-disgusting” food. I take it that’s a religious preference or you haven’t seen the conditions in which chickens and farm-raised salmon exist. You may have to settle on carrots.

Since you remained hunkered down in your basement – I trust your mom is bringing loads of bacon fit for Kelly Anne’s favorite poodle. Yes – dogs love “bacon”!

Since you remained hunkered down in your basement – I trust your mom is bringing loads of bacon fit for Kelly Anne’s favorite poodle. Yes – dogs love “bacon”! LOL! You’re half personal and halfwit.

Just for you: https://www.nueskes.com/gourmet-bacon-assortment/

It an annual Christmas gift for our sons. The applewood smoked, peppered bacon is fantastic. And Menzie would appreciate the fact that you would be boosting Wisconsin’s economy.

You’d like it much more than that farm-raised salmon.

http://www.eurocbc.org/salmon_farming_health_risks.pdf

“It’s a bit like automobiles: demand high, production not keeping up. So, pgl, what do you think happens to consumer prices? And, yes, like automobile producers, meat producers are enjoying high prices (at least temporarily) without passing through the profits in the form of wage increases.”

You see high prices and scream “that’s competition’s response to rising demand”. JohnH see the same thing and cries OLIGOPOLY. Now in same cases, an outward shift in the demand curve in a competitive market is accompanied by higher prices. But I cut and paste your attempt to defend your little thesis and it strikes me that you are indeed describing firms with market power.

Which is to say you know less about basic economics than even JohnH (and I would have not thought that this was possible).

You see high prices and scream “that’s competition’s response to rising demand”.

You see something I write and pick the first half of a statement. That’s consistent with halfwit.

“You see something I write and pick the first half of a statement.”

Well gee Brucie – I cannot help that you babble word salad forever. OK, I picked the lettuce and tomatoes and forgot about the radishes. Learn to actually after you figure out how to think.

You are essentially running through a list of possible structural issues that might – or might not – have something to do with pushing labor compensation away from the marginal product of labor. None of them change the fact that labor compensation has fallen further below the MPL since 2000. That widening gap is prima facie evidence of market power. (Hey, Anonymous?)

More machines doesn’t mean workers are being paid their fare share. Higher reliance on workers doesn’t mean labor gets its fair share. (See Menzie’s response regarding restaurants.) This is all just dust thrown in the air to obscure the finding that manufacturers have paid workers less and less of the marginal product of their labor since 2000.

Macro,

More machines doesn’t mean workers are being paid their fare share. Higher reliance on workers doesn’t mean labor gets its fair share. (See Menzie’s response regarding restaurants.) This is all just dust thrown in the air to obscure the finding that manufacturers have paid workers less and less of the marginal product of their labor since 2000.

I did find this article useful and balanced: https://www.econlib.org/are-workers-paid-their-marginal-product-should-they-be/

“By Scott Sumner

This post will probably annoy almost everyone, as I will argue that both the left and the right misunderstand the issue of wages and productivity.”

Scott Sumner is not a labor economist. He is only marginally a macroeconomist. And yea – he is almost as annoying as you are!

And yea – he is almost as annoying as you are!

Pretty thin skin there, pgl. Sumner has been around the block a few times. Your disagreement with him doesn’t necessarily make him incorrect. You hide your credentials (if any), so why should your opinion matter more than his? He has a pretty impressive public track record.

Stick to day trading.

“Sumner has been around the block a few times. Your disagreement with him doesn’t necessarily make him incorrect.”

Have you ever read Sumner’s CV? Beyond Market Monetarism, he has written virtually nothing. Like I said – he has zero expertise in labor economics. And that little blurb he wrote prove he is not a labor economist. But how would you know as you have never studied even Econ 101.

“The second sentence in misleading, as the increased productivity he refers to is a higher average product, not a higher marginal product (MP). That doesn’t mean the theory that workers are paid their MPs is exactly correct, I suspect it’s only an approximation of reality. But you’d need other data to disprove this theory.”

THIS is his rebuttal? Now if he had noted that different types of sectors have different capital to labor ratios, then he might try to work out the math. But I guess he is too incompetent to do so.

Now Scotty did mention intangible assets but I guess this pseudo economistdoes not realize that intangible assets is lawyer speak for market power.

Now Bruce – we expected you to find the lamest possible rebuttal. And you lived up to our expectations!

This is a nicely written paper. Patient discussion of the underlying economic theory followed by some impressive evidence. Permit me to select a tiny slice:

‘However, the degree of labor market power varies a lot across these subsectors: Markdowns for the average plant are highest in the Petroleum Refining subsector, whereas they are lowest in the Apparel and Leather subsector.’

That the apparel labor market is competitive does not surprise me. But isn’t it funny that petroleum refining has the highest measured degree of monopsony power? Princeton Steve fancies himself as some great consultant for the players in the petroleum market. No wonder he goes so far out of his way to deny the obvious. His clients would not like it if he admitted that they were monopsonists!

Your position is humorous if not outright laughable. Those poor refinery employees who are working for practically nothing because of the evil, greedy corporations that own the refineries.

Refinery employees: https://datausa.io/profile/naics/petroleum-refining

Apparel workers: https://www.bls.gov/oes/current/oes516099.htm

The two papers Menzie posted are “humorous if not outright laughable”? Sorry Bruce – but you have no right to say this until you actually read these papers, which we know you have not.

Wow – apparel workers receive $14 an hour! Time to go shopping on Rodeo Drive! Of course it stands to reason that the value of marginal product in the apparel sector is around $14 an hour.

Now you THINK you have a point that people in the petroleum refinery sector get $100K a year, which amounts to $50 an hour. But if the value of marginal product is $100 an hour, which is quite plausible, then your data makes the point this paper is making.

Bruce – we know you are beyond dumb but even a retarded dog would realize that not all sectors are exactly the same. So your comparison of pay in two very different sectors proves what? Oh yea – you are really, really dumb.

pgl, what is laughable is that you find the petroleum workers abused because they don’t get the full value of the marginal product when they are earning as much as they are. You never responded to the question about Apple and Google phones, but that’s okay because they are so woke.

How much non-labor costs go into making a dress versus making a gallon of gasoline? Labor costs are not the only consideration in capital intensive industries. As I drove by the Marathon refinery south of Detroit, I thought, “If they could hire a couple thousand more people, they could produce so much more gasoline.” Not.

Bruce Hall: Irrespective of capital intensity, wages would be less than value marginal product if there is monopsony. So you are confusing issues.

The abstract of that 2019 paper:

“This paper quantifies whether the U.S. labor market is characterized by employer market power and whether the degree of employer market power has increased over time. We find that the vast majority of U.S. manufacturing plants operate in a monopsonistic environment and, at least since the early 2000s, the labor market in U.S. manufacturing has become more monopsonistic. To reach this conclusion, we exploit rich administrative data for U.S. manufacturers and estimate plant-level markdowns — the ratio between a plant’s marginal revenue product of labor and its wage. In a competitive labor market, markdowns would be equal to unity. Instead, we find substantial deviations from perfect competition, as markdowns averaged at 1.53. This result implies that a worker employed at the average manufacturing plant earns 65 cents on each dollar generated on the margin. Furthermore, we document a substantial amount of dispersion in markdowns across plants, even within detailed industries. To investigate long-term trends in employer market power, we propose a novel measure for the aggregate markdown that is consistent with aggregate wedges and also incorporates the local nature of labor markets. We find that the aggregate markdown decreased from the late 1970s up to the early 2000s, but has been sharply increasing afterward.

When we compare often-used indexes of employment concentration with our markdown estimates, we find a dissimilar evolution over time. This weak relationship cautions against interpreting employment concentration as a proxy for employer market power.

Just in case the chief economist for Fox and Friends tries to claim monopsony power is a rare event.

There is a big difference between monopsony and capturing a margin. Having worked for many years in the oil and gas business for many manufacturing companies in Houston, I can assure you I have never even heard of the notion of monopsony in the industry, much less witnessed it.

Oil and gas is of course a quite diverse business, covering all of IT, exploration, production, analytics and consulting, engineering, planning, designing, capital raising, technology and IP development and manufacturing, both at a gross and fine level. I have worked in all these segments.

The Houston offshore oil business, and that is the major US manufacturing center for oil and gas, is driven by a very high level of technology, know how and intellectual property, including both product capability and safety. It has historically paid high wages, generally above market. What is a certainty about the business, however, is that is is profoundly pro-cyclical, specifically related to oil prices. Ten years ago, geology graduates with a BA were earning $115,000 straight out of school, and that in Houston, which is a lot cheaper than New York. It was quite eye-opening to park your car in the lot at FMC or Oceaneering or Drillquip. Lot of pricey metal there.

Some of the manufacturing and assembling work is routine in O&G is not industry specific, like assembling finished components. Some is high end, but generic, for example making high pressure vessels. Some is high end and very specific. Those working is high end, specialized jobs were very well compensated. Those working in generic manufacturing and assembly were paid the overall industry wage for such work. There is nothing specific to oil and gas in assembling say, sonic array assemblies. It’s like assembling a tv or mobile phone. Why should a company yield the profit gained by its IP and reputation for reliability and safety to generic line workers? It shouldn’t and it wont.

I can see you really lack experience in the private sector. If you’d ever hired anyone, you would know all this is just nonsense.

“There is a big difference between monopsony and capturing a margin.”

OK Stevie pooh. Please mansplain the difference to the authors of this paper. This should be a laugh riot.

‘Having worked for many years in the oil and gas business for many manufacturing companies in Houston, I can assure you I have never even heard of the notion of monopsony in the industry, much less witnessed it.’

I bet they PAID you not to witness it. You are bought and paid for and your biases are flaming.

Why don’t you put down the bottle and make a substantive comment.

YOU are asking someone to make a substantive comment? After all your incoherent but bombastic pleading that monopsony power cannot exist since YOU think so? Put away your overinflated ego and actually READ real economics.

One of the things I get paid for as an honest consultant (which of course is the antithesis of what you do) is to evaluate the role of “IP”. And IP in the oil and gas sector is sort of like IP in the baking of cookies. If you think high profit margins are the result of some valuable intellectual property then you are indeed the worst consultant ever!

Here are the conference presentations for this year Offshore Technology Conference in Houston:

Day 1: https://2022.otcnet.org/2022-technical-program

The transition and renewable energy stuff is mostly bs from my perspective, but a lot of the subsea oil talks are technical indeed. AI and HPHT, yeah, that’s not for amateurs.

I would note, however, never to attend a talk after lunch unless you want to get a nap. And never give a technical talk after lunch, unless you want to talk to people who are napping.

“Offshore Technology Conference”

I think I have dropped in some of these conferences. If you think this makes your little claim there is no market power in hiring workers, then you are more deluded than I ever gave you credit for.

Now these folks are promoting some brazen shifting of income to tax havens using economic models for intercompany leasing that are so incredibly dishonest if not dumb that they might embarrass even you – even though we know you flunked Finance 101.

Quit trying to impress people by noting you hang out with this craven crowd and try learning basic labor economics.

You think you have dropped in on the OTC? This is not that sort of event.

It takes over the entire NRG Center in Houston for a week. And it’s only half the size it was ten years ago. At the time, some 70,000 people attended. If you can’t remember whether you were there, then either you weren’t, or you have memory loss.

Try putting down the bottle for a while. You’ll remember more.

https://exhibits.otcnet.org/OTC2022/Public/eventmap.aspx?shMode=E&shExhList=1&ID=29339&_ga=2.222226968.1840140070.1642964152-448372169.1642801291&_gac=1.219383531.1642964152.CjwKCAiAlrSPBhBaEiwAuLSDUHRqhkjk1spTMfpCku26cAGjRUiTl5wKmEz7l4GmaZbysL762w96MhoCPn8QAvD_BwE

Why would you assume monopsony because labor doesn’t capture rents? Monopsony means monopoly purchasing (i.e. market power). And the manufacturers are very fragmented. So how are they coordinating?

Labor is just a factor in the cost equation, like energy, raw materials, paper clips, etc. Companies will try to buy it as cheap as possible. Workers to sell it as expensive as possible. Just because profits are up, doesn’t mean you cut the suppliers bigger checks. You keep buying each as cheap as possible. Some things may go up. But so, you just respond as needed, for that specific factor. Sometimes you might have to pay a little more, no more, a lot more, etc. Just kind of depends on the supply/demand for that factor. But no reason to expect each to scale with margins, the same way. Some specialized skills (or widgets) may go up much faster than overall industry rents during a boom (since they’re difficult to substitute or rapidly increase). This is common in oil for instance. Some may go up slower.

In a competitive market, neither labor nor manufacturers will have market power, same as with widgets. The price will just work out based on supply and demand. But it’s supply and demand that drive the price. Not margins. I mean there are many other drivers of supply and demand other than mfg margins.

Sure demand may increase when times are good (and visa versa). But there’s no reason for a specific factor to scale linearly with margins. Do you expect a factor cost to go to zero because profits are zero? And for that matter the slower increase in labor costs (during booms) is probably the flip side of wages not dropping linearly during a crunch. And are we talking cash margins (nonsunk costs, immediate decisions) or accounting margins (including sunk costs like depreciation, but important for long term decisions)?

In addition to everything else, there are substitution issues. For example workers can move to other industries (or move into mfg). And companies can use capital (“machines”) to substitute for labor. But then this is just part of supply and demand.

Anonymous: Restaurants are fragmented; but they still have some market power – which is why the canonical example of monopolistic competition is …. restaurants!

Wasn’t there some 1994 empirical paper looking at fast food places in New Jersey and Pennsylvania? It attracted lot of deniers too but launched an incredible set of labor market research.

You haven’t addressed several of my questions and have raised a different study. How about we discuss this one here first, since it was the one to prove your point?

I can imagine a million reasons why wages might not scale with profits (in a competitive market) For one, there is some degree to which labor is semi-fixed/semi-variable. Companies don’t fire people immediately for instance (there are hiring and firing costs). (which if you take the flip side…) Also, it’s not uncommon for manufacturing companies with heavy sunk fixed costs (“heavy metal”) to run with negative accounting profits (until cash margin is zero) when the cycle is down. And conversely when the cycle is up. But for a 24-7 operation, you can’t really add labor (have to add a new plant). So, you’re making more/less money based on where you are in the cycle., not based on adding a night shift.

To see monopsony, you’d need not just the whole industry (many industries really!) to be not hiring, when they should (so they can collectively depress wages), you’d need individual firms to be deciding NOT to hire more (or raise wages to outbid others for more labor) when it is in their individual atomistic interest to do so,. Do you have any examples of this? I’ve never seen a client of mine worried about the impact on the overall industry. They might worry about if things turn back down (and then it’s hard to fire or reduce salaries). But they don’t worry about how they are driving up labor rates in general (other than to bitch about wanting to pay less…like they do with every input factor).

Oh…and if they’re able to monopsonically depress wages, can they do the same for all their other inputs? Raws, widgets, lube oil, rent, insurance, etc. etc. That would be awesome. I can fire the purchasing department. We don’t need to search for low cost vendors. We’ll just monopsony them! (Somehow, all together, sans discussion and despite the FDA.)

Instead of looking at some massively oversimplified metric (wages versus profits) and assuming monopsony must be the cause, think of all the conventional possible explanations, which fit fine in a competitive framework.

And I’m actually pretty cynically “saltwater” about companies. Look at the collusion in pricing that goes on. But even there, you need some concentration. It doesn’t work with fragmented markets. I see this in generic drugs all the time. When you have two players, you get this beautiful situation (for the firms) of the entrant behaving “rationally” (collusively) and just selling for a modest discount over the original patened price. And they sure as hell do worry about how a price cut might be viewed by the other player (not wanting a price war, not wanting competition) With three you star to have issues (i.e. become more competitive) And then at four or five the margins go to shit. (The original patent holder will keep better margins with its brand. But the rest of them will all be fighting it out very competitively.)

Now I’m sure there are individual examples of monopsony. Sports leagues for instance. Or even top tier consulting firms (the old story of BCG and McKinsey agreeing not to poach associates from each other). But these are examples of very concentrated situations. Not all manufacturing labor. Very different amount of fragmentation.

So 30 years of research got it all wrong according to your religion?

That power is the power of the brand, Menzie. That is the power that the owners and managers of the firm created. Why should that be yielded to line workers? The fact that the goodwill of the franchise has value does not mean it is a monopsony. It only means that it is selling into a monopolistic market and buying labor and supplies from a competitive market. The firm’s goodwill allows it to capture the differential. That’s what building a brand is all about. That has nothing to do with monopsony.

The power of the brand? WTF? If we are talking about fast food places, there are market observations on the royalties captured by brands like McDonald’s or Mrs. Fields. Every local franchisee pays the same for the brand. whether they are in New Jersey or Pennsylvania. But the point of that 1994 classic paper, which is another thing you clearly have not read, was that when New Jersey raised wages via a minimum wage, their employment went up relative to what we saw in low wage Pennsylvania.

That would not happen in the Princeton Steve textbook perfectly competitive view of everything. It would if labor markets exhibited monopsony power. Oh wait – labor market do not work then according the sainted Princeton Steve.

Look dude – you have no clue what you are babbling about. But you babble on anyway.

Steven Kopits

January 20, 2022 at 3:37 pm

I could go on but I have to award this comment as absolutely dumbest thing I have ever read. Is there value in brands? Yea but they are well known and the franchisees pay firms like McDonald’s for those brands. EVERY ONE knows this as it is about as well documented.

But Stevie is trying to tell us that if one makes profits from brand IP or product IP then one cannot be making even more profits from monopsony power. Seriously?This is as dumb as it gets.

Or maybe Stevie thinks labor exploitation is wonderful thing. After all – he is all for the oil sector ripping off the rest of us. Yes – a totally bought and paid for corrupt consultant!

All of what you say may apply to the volatility of things like commodities. But try reading their 2019 paper before you just assume low wages occur at the intersection of a competitive demand curve and the labor supply curve. BTW – try reading that short 2022 discussion as you might learn a little labor economics.

Take a look at the comments under the post Labor Market Monopsony Estimated (February 7, 2021). Princeton Steve went on and on claiming we cannot use the term monopsony if a market has two firms or more. I’m sorry but his banter is even worse than the stupidity we get from Econned over the use of specific terms. None of my past English teachers would have ever suggested that our language was some sort of rocket science. GEESH!

pgl,

Please allow my genitalia breath. Thanks.

Econned,

Why? Have you become a porn star? Does this make your genitalia get out of breath? Oh dear, poor Econned.

Oh geez, is Barkley Rosser is again stressing his discontent with porn stars? Oh dear, poor Barkley.

Interjecting a little profanity into the discussion? I bet you even have an OnlyFans page. Alas – no one is subscribing!

Now now, pgl, “genitalia” is not profanity, but a more formal proper term. There certainly are profane words for genitalia, but as we know, Econned reads lots of dictionaries, so he can find polite words for various things. He should be praised for this.

The more basic question is why did he bring this up? Poor R. Stryker embarrassed himself by picking as a fake name one that belongs to a real prominent porn star. He has assured us he is not that person and is not a porn star.

But now we have Econned bragging about airing his genitalia. Oh, I suggest we do not let him off this hook the next time he tries to trollishly slime people here. Wow, what a bizarre and embarrassing admission!

Bragging? What are you talking about? You and pgl are idiots. The issue is you and pgl can’t get me out of your minds – you two are constantly on my genitalia. Get it? Of course you do because you two struggle to make a comment without mentioning me. Losers.

What profanity?

Do us a favor. Go read that 2019 paper before you go off on another uninformed rant. BTW – ltr who thinks she is the Chinese expert tells us that your meat packers are Brazilian multinationals. I actually checked. She is right.

Labor’s share varied greatly during the 1970-2000 period, while monopsony power was waning. One could read that as evidence that macroeconomic factors were driving outcomes.

Labor’s share fell sharply after 2000 and has since then not varied as much as in the prior period. Almost as if something other than macroeconomic factors were driving outcomes.

Just telling a story that fits the data – no reason to think that story is true.

What’s odd is the disconnect between the level of income shares, manufacturing as a share of GDP, unionization or any other causal factor I can come up with. Except that China entered the WTO in 2001. So not union-busting. Not the increase in service employment as a share of the total. China fits.

Looking forward to hearing from anyone but ltr on this.

Paul Krugman keeps arguing that certain firms are increasing their exploitation of monopoly power. That may also part of the fall in the labor share but I always say monopsony power and monopoly power as sort of complementary factors.

Of course free trade tends to diminish monopoly power but labor is not as mobile as goods.

Neil Gorsuch is an irresponsible jerk:

https://www.huffpost.com/entry/neil-gorsuch-face-mask-supreme-court_n_61e6e090e4b0a864b0783a16

Sotomeyer asked her fellow justices to mask up as she has diabetis. All of them except Gorsuch. Can we have this a$$hole removed from the bench.

So no one has an answer to “why doesn’t basic income solve monopsony” other than incoherent personal insults?

Why does anyone owe you an explanation? You proposed basic universal income without showing why it would solve the monopsony problem. Seems like it should be your job to make a case for your claim.

Basic universal income and indexing have been the latest pet ponies on which you prance through comments. Before that, you pranced around demanding statistic which often couldn’t even be calculated in the case you raised. Repeated efforts to get you to make sense didn’t do any good. So even if one were in an educating mood, why waste effort on you?

So, you first. Make a real argument. Drop the stupid confrontational tone. Show you’re capable of learning. Then, if you have a question, maybe ask it politely and you’ll get an answer.

Me thinks rsm is a parrot repeating “Polly wants a cracker” over and over without even knowing what a cracker even is.

rsm,

Because a UBI is going to be a fairly low level of income. It might solve the problem for somebody for whom it is their entire income, but it will have only a trivial effect on somebody for whom it is only 10% of their income, much less for somebody for whom it is only 1% of their income.

Sorry dude but Barkley answered your question. But I guess you think that a worker who creates $50 an hour in value should receive less than half of that from the firm because the government will write the worker a small check. The firm in the meantime walks away with a lot of income well beyond the marginal product of capital. So where does the funds to pay this worker your check? I guess you would tax Martians or something like that.

Once again – you are not following the discussion at all. Just writing down nice sounding words that you do not even remotely understand.

https://fred.stlouisfed.org/graph/?g=ns5D

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 1980-2021

(Indexed to 1980)

Decline in labor share of income:

94.4 – 100 = – 5.6%

Increase in real profits:

480.0 – 100 = 380.0%

https://fred.stlouisfed.org/graph/?g=nrSP

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 1992-2021

(Indexed to 1992)

Decline in labor share of income:

94.3 – 100 = – 5.7%

Increase in real profits:

368.3 – 100 = 268.3%

http://www.bls.gov/webapps/legacy/cpslutab3.htm

January 15, 2018

United States Union Membership Rates, 1983-2020

Private wage and salary workers

1983 ( 16.8)

1985 ( 14.6)

1990 ( 12.0)

1995 ( 10.4)

2000 ( 9.0)

2005 ( 7.8)

2010 ( 6.9)

2015 ( 6.7)

2020 ( 6.3)

https://www.nytimes.com/2018/05/20/opinion/monopsony-rigidity-and-the-wage-puzzle-wonkish.html

May 20, 2018

Monopsony, Rigidity, and the Wage Puzzle (Wonkish)

By Paul Krugman

Once a year my academic base, City University of New York’s Stone Center on Socio-Economic Inequality, holds a workshop featuring cutting-edge research on inequality. At this point in my life, I can’t claim to be doing cutting-edge research (hey, even Paul Samuelson was writing mostly survey papers and history of thought by the time he was in his 60s); but I’m still asked to give a talk on research issues that I find interesting, hopefully with some relationship to the general theme of the workshop. One virtue of this grand-old-man role, by the way, is that it forces me to tear myself away for a little while from the awful political headlines.

In the past I’ve used the ECINEQ talk to discuss issues involving inequality and macroeconomic performance, both vulnerability to crises and long-term growth. Both areas are still very much unresolved; but I’m not sure I have anything new to say. So I thought I’d do something different, and focus on an issue some very smart economists have been worrying at: the puzzle of continuing wage stagnation despite very low unemployment….

https://fred.stlouisfed.org/graph/?g=nja1

January 15, 2018

Average Hourly Earnings * and Unemployment Rate, 1968-2021

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Percent change and Percent)

https://fred.stlouisfed… is not opening properly just now.

I went and read the brief. He does make a good point in talking about company towns. There’s a reason why people like to build plants in the sticks. Low labor cost. Obviously the town is better off for having the plant than if they didn’t (that’s why incentives are given to attract or retain plants, for instance). The nearest substitute for working in the Dow plant pays a hell of a lot less.

And then if you’re not on the Gulf Coast, workers may indeed face a situation of few different (local) options. It’s Dow at $35/hr or the auto parts store at $12. OK. [Although labor is not entirely fixed to location…people do move sometimes for $$$. Look at the mancamps…I have lived in one. But sure, it’s not as fluid as shipping widgets around.]

Other than that, I thought the brief seemed very thin. Basically just appeals to this “markdown”, which seems like same thing as the variable cost of labor. And doesn’t show where they all come from. Just sort of argues by assertion, really. Also, doesn’t consider some of the (pretty intuitive) issues that I raised (like mfg output not scaling perfectly from labor, other issues like PPE being the bottlenecks). I’m not even saying I’m right! I’m saying the paper ought to reflect on them.

You read the brief? Try reading the 2019 paper – Dr. Chinn provided a link.

Looking now, missed it before. Yeah, it’s a real paper.

It might be too hard for me. Like it’s being mentioned as settling some hash with Kopits. But then I have to dig deeper and deeper to follow the assertions.

Seems like its a report on recent analysis, but with a lot of foundation on earlier work. And that’s really what’s of interest. Not their recent SIC crunch. But the concepts of last 30 years of labor econ. I did find a review paper (from 1997, Boal and Ransom, but it’s paywalled.)

I’m not clear what marginal value of labor really is and how calculated and how to think about it. Yeah, it’s in the references or references to references. But it’s not in Menzie’s post or the brief . It might be in the paper, but not even sure. (There’s a blizzard of equations and terms and references, not an MBA or plant manager understandable intuitive explanation.)

Does marginal value of labor mean, I could make more money if I hired more staff? And I’m just not doing it? My impression is that most plants don’t work like that. You have bottlenecks in PPE, market, etc. But if you can really just make more money by adding hands, plants will do that very enthusiastically. Plant managers love having bigger plants and it is a lot more fun to hire than fire. And nobody is going to beat you up on cost control, if you’re “tonning and gunning” and delivering more hard cash. [Well they beat you for everything but you prioritize your beatings.]

And even some of your unit level metrics improve if you can spread some of the fixed costs onto a higher throughput. And even if corporate needs some authorization to add employees, you get around it via temps. MANY the times I’ve gone into plants and found the temps the plant manager was hiding…to help him do his job…to help him make throughput increase. “Volume cures all evils.”

I do get it that an electrician can make more in Houston than BFE company town. But then is it evil, wrong when Nucor drops a plant into BFE? People in BFE don’t tend to feel like that. They appreciate Nucor moving in. And hate it when a plant moves out. There’s also some benefits of being a cheaper electrician in BFE (buy a bigger house, cheaper)…so it’s not all bad. After all if you really want to make bank, you go to Saudi Arabia. (Which I agree sucks. Which I agree is why they have to pay more! Haven’t done my time in “The Kingdom” but had buddies who did. And I was in a more secular Muslim country…still…it’s different.)

I’ve been involved in some siting decisions (consolidations, moves). And definitely labor cost plays a role. But if I move a plant from high cost area to low am I being monopsonistic? Or being competitive between the two regions?

For that matter, should I think of land monopsonistically? Obvious Shell can pay more for land than whatever the non-industrial competition is (cow pasture?) But it’s not like they are only looking at one area (they’ll do a proper site search and look at many factors and run some different NPVs). And it’s not like they can just “marginally” buy a little more land and crack a little extra ethane when the cycle is up.

No hash with me. Frankly, some of your comments sound disturbingly as though I had written them.

“I’m not clear what marginal value of labor really is and how calculated and how to think about it.”

Just wow – It is one of the most basic microeconomic concepts. Not exactly hard to find even ala Google. Hey – I know you are trying but did you notice that the village idiot with a superinflated ego named Princeton Steve thinks you and him on basically the same. I bet you desire to be better than that. GEESH!

“It’s Dow at $35/hr or the auto parts store at $12.”

This is the literal counter example to monopsony. In a monopsony situation, where pgl assures us that employers can capture 1/3 of the wage, it would be DOW at $8 / hr of the auto parts store at $8 / hour, with no one else willing to offer more and workers being just too stupid to move.

“I’m not clear what marginal value of labor really is and how calculated and how to think about it.” YOU echoed this comment. Of course you did as you are infamous for not understanding even the most basic of economics.

But now you are telling me that a stock market is paid $8 an hour. Even a robot is smarter than that. But not ever confused Princeton Steve. Learn to effing write troll.

Now if DOW is DOW Chemicals, why do you think that the value of marginal product is well above $35 an hour? Or you have no basis for that other than someone who is a clerk selling auto parts is being paid $12 an hour.

Bruce Hall tried this incredibly dumb analogy earlier which got shot down. And now you peddle out perhaps the dumbest claim I have ever seen? Come on Steve – stop writing and learn basic economist as this is getting embarrassing.

So Karl Marx was right about the exploitative nature of industrialists!

Marx was right about lots of things. Much of what he wrote was standard economics, so it’s not actually as controversial as it was made out to be. His rhetorical style and his prediction of an inevitable socialist future made him a target.