That’s the title of a presentation at the ASSA meetings (YouTube video of the presentation is here) in the ACAES panel “Covid and Recovery in Asia” (see below). Calla Wiemer presented, and I discussed. [Updated 1/19, links to slides added]

You can also see her main points here, tracing out the evolution of macro aggregates and policy responses, and the implications for fiscal space and monetary policy. The slides are here.

In my presentation, I noted two issues to keep a watch on (certainly there are more). The first is that as certain countries retrench fiscally, then current account balances will likely surge, perhaps exacerbating pressures global balances. The second is that as Fed rate tightening gets closer and closer, certain countries will be more exposed than others.

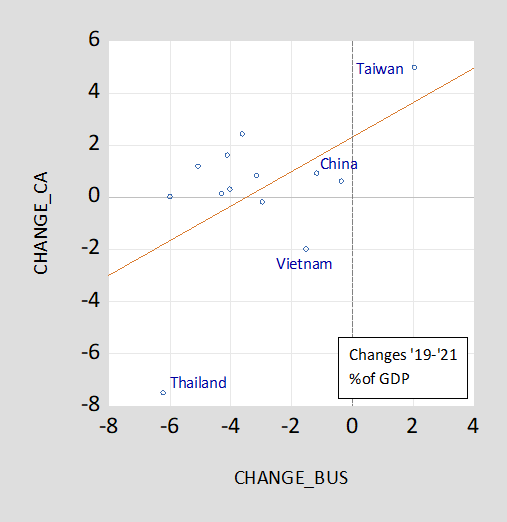

On the first point:

Figure 1: Change in current account to GDP ratio versus Change in primary net government primary lending to GDP. Red line bivariate OLS regression, slope 0.66. Singapore and Taiwan are net government lending. Source: WEO (October 2021) and author’s calculations.

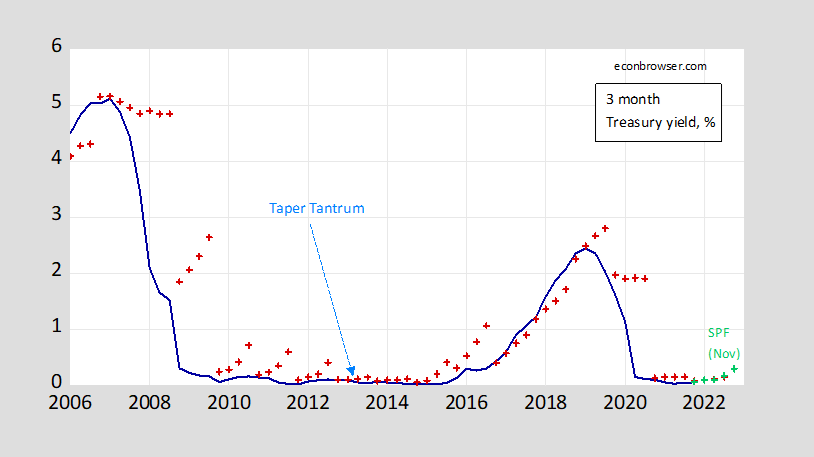

On the second point, I noted that we are on the cusp of a tightening, and the last time a tightening occurred, certain countries were hit hard.

Figure 2: Treasury 3 month yields (blue), Survey of Professional Forecasters Q3 forecasts (red +), 2021Q3 forecast (green +). Source: Federal Reserve and Philadelphia Fed.

The green + are from mid-November (survey taken late October). Expectations are likely for a sooner takeoff.

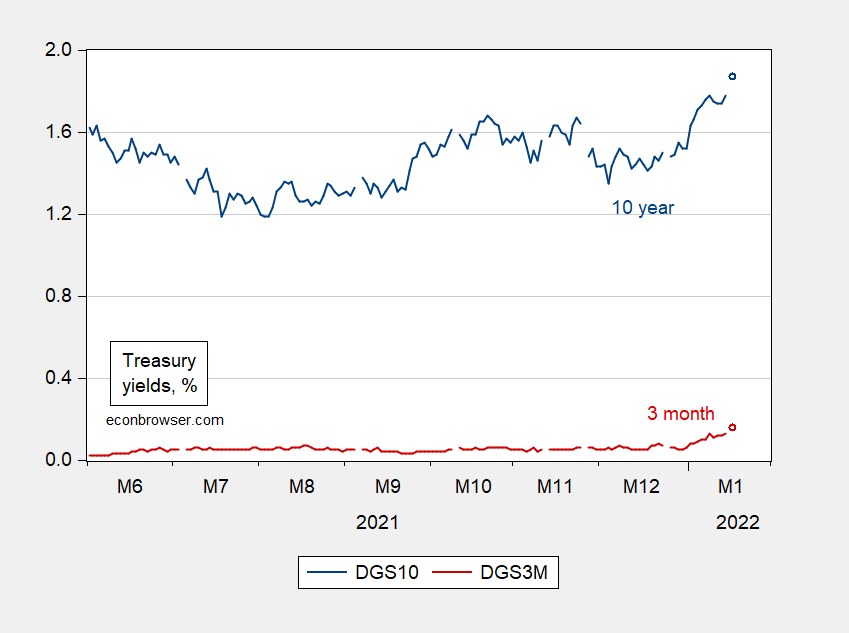

Figure 3: Treasury 10 year yield (blue), and 3 month yield (red). Source: Federal Reserve.

At which point interest rates in emerging markets will be pulled up and exchange market pressure will rise, at least for some countries (See this post, paper).

Here’s the entire panel, below:

Covid and Recovery in Asia (O5, P5)

Sunday, Jan. 9, 2022 3:45 PM – 5:45 PM (EST)

Hosted By: American Committee on Asian Economic Studies & American Economic Association

- Chair: Michael G. Plummer, Johns Hopkins University

-

- Discussant(s):

Shaianne Osterreich, Ithaca College

Ahmed Mushfiq Mobarak, Yale University

Isabella M. Weber, University of Massachusetts-Amherst

Menzie Chinn, University of Wisconsin-Madison

China is responding to slowing growth in part by targeting markets that are high growth with ample opportunity to gain share: semiconductors.

https://www.semiconductors.org/chinas-share-of-global-chip-sales-now-surpasses-taiwan-closing-in-on-europe-and-japan/

Of course, much of the impetus has been in response to the US’ attempt to deny China the latest technology. Much of the activity is occurring in high end chips, a segment dominated by Taiwan’s TSMC. Some delusional folks have suggested using the threat to raze TSMC as a way to deter China. Of course, such a rash move would hurt the US, since it also depends on TSMC.

It looks like the US will have to act fast for that threat to have any credibility.

Now for a look at some strategic idiocy: US’ sole source for semiconductors on some major weapons systems got bought by a UAE company which is shutting down production! This fiasco is so crazy that it would be LOL in any context besides national security. Talk about the mother of “supply chain issues!”

https://www.bloomberg.com/news/articles/2021-11-08/pentagon-swoops-in-to-buy-last-of-kind-chips-for-b-2-destroyer

We knew that DOD procurement was rotten to the core, but this takes corruption-driven incompetence to a whole new level. I mean the world’s greatest military can’t even secure its supply chain!?!

Dude Tsmc is a contract manufacturer so your continuing claim that are high end is stupid. PLEASE stop and. Think

Dude Tsmc is a contract manufacturer so your continuing claim that are high end is stupid. PLEASE stop and. Think

Pgl, I’m not sure what you are getting at, but TSMC has the most advanced fabrication processes in the world. It is the first to produce chips at the 7 nm and 5 nm nodes and will be leading the world to the first 3 nm later this year. It is the first manufacturer to support extreme ultraviolet lithography for the smallest features. They produce the highest end microprocessor chips including AMD CPUs and Apple’s latest M1 CPU for its top end Macs and the cutting edge Nvidia graphics GPUs. The only other chip manufacturer even close in high end chip technology is Samsung.

The magic in high end semiconductors isn’t in the design. It’s in the fabrication.

“The magic in high end semiconductors isn’t in the design. It’s in the fabrication.”

Bit of a false dichotomy there.

I’m defending Joseph and John here. Anyone commenting on this blog, and the server hosting it, is definitely using products from TSMC–which in turn uses Dutch chip-making machines. Diversifying this supply chain and making it more robust would a great thing for humanity, and take a long time to accomplish. The technological systems and manufacturing supply chains that support the modern semi-conductor industry are more complex than textile manufacturing by several orders of magnitude. Scott Walker was one of the many people who didn’t grasp that when he was pursuing the idiocy of the Foxconn plant in Wisconsin.

As for how this would be impacted by Fed rate hikes—I haven’t a clue. I’m guessing some things would slow down a bit. But I don’t think that China, or the US, or anyone is going to supplant or disrupt this system within the next decade.

Everything you said here is very sensible. But note you are not defending either one of JohnH’s latest pet thesis. Yea I get it – he is so all over the map it is hard to keep pace with what his insanity is really about.

Let’s be clear what JohnH is trying to peddle. His new claim is that TSMC is a monopolist that will dramatically raise prices. Never mind the fact that the history of semiconductor prices has been a bit of volatility with some rapid declines over the past 30 years. And TSMC has had its edge over process IP for the entire period. Never mind the fact that JohnH has never presented anything close to a value chain analysis even though we provided him with an excellent discussion ala Chad Bown – one of course which JohnH refused to read.

His old claim was that if Xi took over Taiwan – something that JohnH appears to be cheering on – we would lose all of the process IP that TSMC owns. Like their engineers cannot migrate before the invasion JohnH seems to be calling for.

Oh yea – this all over the map troll will deny that he made such claims. But that is what he does when his carnival barking is called out. Deny, deny, deny.

Process IP YES but not the product IP

Did you read this paragraph?

“If China’s semiconductor development continues its strong momentum – maintaining 30% CAGR over the next three years – and assuming growth rates of industries in other countries stay the same, the Chinese semiconductor industry could generate $116 billion in annual revenue by 2024, capturing upwards of 17.4% of global market share. This would place China behind only the United States and South Korea in global market share.”

So the US and Korea are the two top dogs with China passing Taiwan as #3. And yet you think Taiwan is the key link to this industry? I guess you still have not read what Chad Bown wrote.

But yea TSMC has some awesome process IP. Now if Xi decides to do what you seem to be advocating and invade Taiwan, one would think this process IP would migrate to other nations as their engineers would simply leave Taiwan. Oh wait – Xi can stop the airline flights using 5G cell towers, I guess!

JohnH’s link suggests that the worldwide market for semiconductors produces almost $700 billion in revenue per year. This sector is supposed to see rather substantial growth over the decade.

Now TSMC had a great 2020 but has JohnH ever bothered to read its 20-K? Of course not. Had he done so, he would have seen its sales were just $47 billion which is high but certainly not dominating the industry. And I guess JohnH still has not figured out that TSMC has factories in some place called Arizona.

But yea it has some awesome process IP but no product IP. Now if China invades Taiwan as JohnH seems to advocate, something tells me that the TSMC engineers will take this IP with them as they leave Taiwan.

pgl being his usual duplicitous self. Observers whom I quoted never claimed that TSMC dominates the semiconductor market. But it does clearly dominate the high-end, leading edge segment. This intentional misrepresentation is a good example of how pgl argues his point all the time…restating someone’s point and then arguing how ridiculous and I’ll-informed that restated point is.

And he changes the main point I made, which I have to constantly restate to counter his attempts at distraction to less important ones that he can argue against. My point is that it it would be counterproductive to potentially raze TSMC to deter China, as some military analysts have suggested, since the US also depends heavily on their semiconductors and lacks good alternatives.

Now we’ll see yet again how pgl restates my key points to argue against something I never said.

I predicted you would deny your previous comments. You have zero ingerity. None whatsoever. Of course if I wrote your usual gibberish I’d be embarrassed too

‘Observers whom I quoted never claimed that TSMC dominates the semiconductor market.;

They didn’t but you did claim TSMC is a monopolist.

“My point is that it it would be counterproductive to potentially raze TSMC to deter China, as some military analysts have suggested, since the US also depends heavily on their semiconductors and lacks good alternatives.”

No military analyst suggested we destroy TSMC. The broken nest idea was simply Xi would think twice before attacking Taiwan if his invasion destroyed the factories on Taiwan. Of course the US could retain the process IP as the engineers would just move here. Then again you are fanning the flames for Xi to invade for some bizarre reason. Then again you support Putin on that Ukraine matter too.

You are grossly misrepresenting the past discussions but being the pathetic little liar that you always are – you accuse ME of misrepresentations? Nice try troll.

TSMC dominates its market—high end, leading edge semiconductors. pgl tries to confuse things by arguing that TSMC does not dominate the entire semiconductor industry, which is moot, since it dominates a segment that is critically important to both the US and China and has significant barriers to entry.

pgl just loves to mix thing up, so he can disagree with someone’s point.

John:

Thank you so much for raising the topic of Chinese technology advance, which is decidedly important.

So this is your excuse for Xi invading Taiwan? It figures you and JohnH would agree.

https://www.tellerreport.com/news/2021-11-14-the-shortage-of-semiconductors-threatens-stealth-aircraft—how-did-the-us-military-technology-become-in-the-grip-of-abu-dhabi-.rJ6fsTCDt.html

The part about a UAE company shutting down production for semiconductors used in B2 bombers is missing a lot of context. We are talking about a New York factory owned by Global Foundries – another contract manufacturer like your precious TSMC. Global Foundries decided to move to more lucrative lines of business so they sold this NY factory. So the decision to shut down production was actually made by Global Foundries. Now the UAE company has not closed this line of production yet. If the Pentagon really wants these semiconductors, I’m sure a deal can be made as we do a ton of business with the UAE – for better or worse.

I can’t imagine a Russian or Chinese company shutting down production of a product critical to national security. What kind of supply chain does DOD run if companies are free to do that without an alternative source readily available. It would be interesting to know how much ransom the UAE will extract, though that will surely be highly classified and unavailable to we the people.

pgl sees absolutely no problem with this supply chain mismanagement!!!

No moron – I have a problem with war. Something you are clearly advocating. Do you really think an invasion would have zero impact on the productive capacities of Taiwan’s industry? I bet you do because a chicken hawk like you has never been on the front line of a real war.

BTW Putin is about to invade Ukraine which I suspect you will celebrate with a big old chicken hawk party.

How has the relationship in Figure 1 held during other time periods? What you’re showing looks like a great example of how just because one can fit a line to data doesn’t necessarily mean that one should fit a line to data.

Econned: See Chinn and Prasad (JIE, 2003), Chinn and Ito (JIMF, 2007), Chinn and Ito (RIE, 2008), Chinn, Eichengreen and Ito (2014), Chinn and Ito (2021), and Chinn (FRB KC/Jackson Hole, 2017).

Menzie, can I ask one of my “Damn, man, what a weasel moocher you are.” Questions?? Is there a manuscript free version of Calla Weimer’s upcoming textbook?? I’m not asking you to hunt it down, just if you happen to know “on the spot” as I ask here??

You mentioned her before here yeah?? She is quite the specialist on Asia, Really like what I have seen and read from her. What an impressive woman.

Moses Herzog: No idea. You’d need to contact her.

Was curious about the guy named “Sameer” also. The name is what language??~~so proficient in English. Everyone was most impressive. The host said something about meeting in New Orleans?? Menzie, if you go to New Orleans you got to tell me about one of my food/cooking heroes Kevin Belton and tell me if he is as cool in real life as he is on TV.

Anyways, I was impressed with Calla Wiemer, and how you two created the “synergy” together with the two papers. Admirable work.

Thank you. It’s nice to be appreciated. The first 10 chapters plus the Epilog are posted on the site macroforasia.com. For the five policy chapters, please do buy the book, coming out in November from Cambridge University Press.

http://macroforasia.com/index.php/content

November, 2021

1. Fitting Macroeconomics to Emerging East Asia chapter

2. Taking the Measure of Emerging East Asia chapter

3. Microeconomic Fundamentals chapter

4. National Income & Product Accounts (featuring Taiwan) chapter

Blog post: The Real Reason for China’s Unbalanced Growth

5. Balance of Payments Accounts (featuring China) chapter

6. Money (featuring Myanmar) chapter

7. Finance (featuring Hong Kong) chapter

8. Exchange Rates (featuring Indonesia) chapter

9. Models of Equilibrium and Disequilibrium chapter

10. Business Cycles (featuring the Philippines) chapter

— Calla Wiemer

http://macroforasia.com/images/Chapters/Chapter_1_Fitting_Macro_20211102.pdf

November, 2021

Macroeconomics for Emerging East Asia

By Calla Wiemer

Fitting Macroeconomics to Emerging East Asia

East Asia has given rise to some of the most spectacular economic

performances of the post-World War II era. It has also borne some of the

most serious setbacks. As elsewhere, boom and bust follow one upon the

other in recurring cycles. Notably for Emerging East Asia, as the region

has become more integrated internally and with the rest of the world, the

cycles have become more synchronized.

Many East Asian economies have managed to sustain double-digit growth rates for a few

years at a stretch – Japan, Hong Kong, Singapore, Korea, Taiwan, China, Thailand, and as of the

2000s even Myanmar and Cambodia, are all members of this club. Singapore stands out for

having achieved growth in excess of 10 percent for nine consecutive years from its independence

in 1965 to 1973. More recently, Myanmar appears to have beaten this record with an 11-year run

of double-digit growth beginning in 1999, if official statistics are to be believed.

Typically though, boom times are short lived, and what’s more, they are often followed

by busts. Spurts of growth intermix with periods of sluggishness or even contraction.

Singapore’s storied success was punctuated by repeated setbacks, with growth going negative in

1985, 1998, 2001, and 2009. The Asian Financial Crisis of 1997-98 plunged much of Emerging

East Asia into negative growth territory. At the epicenter of the crisis, Thailand experienced a

particularly virulent turn, coming through a decade of expansion at near double-digit levels only

to see output growth drop to -1.4 percent in 1997 and then to -10.5 percent the following year.

Fluctuations in economic growth, and the policy measures aimed at containing them, are

the central concern of this book. This chapter introduces the subject matter and explains why the

treatment presented in standard US texts is a poor fit for Emerging East Asia. The 13 economies

within our purview are Cambodia, China, Hong Kong, Indonesia, Korea, Laos, Malaysia,

Myanmar, the Philippines, Singapore, Taiwan, Thailand, and Vietnam.

Our focus in this text is on short-run deviations from long-run potential growth. For our

purposes, the conceptual basis for long-run potential growth can be characterized succinctly, and

we accomplish that in this first chapter. Long-run potential provides a reference against which to

mark output gaps wherein an economy temporarily overshoots or undershoots a sustainable path.

A high degree of volatility around the norm rate of growth is undesirable. Shortfalls involve loss

of employment and income, as well as missed investment opportunities. But overshooting, too,

carries costs as resources are misallocated into projects that are not ultimately viable sowing the

seeds of dislocations to come. More generally, volatility complicates planning for the future and

inhibits entrepreneurial risk taking. Government policy thus seeks to stabilize growth and keep

output gaps – positive or negative – to a minimum….

Bookmarked. Very generous of you.

YOU are an “A Class” Lady Ms, Wiemer , An A Class Lady. I’m having a drink now. I wish I could express to you what a great lady I think you are.

Gosh. An actual fan.

Thanks for sharing her, your friend, with us, Menzie. I really mean that Menzie. If I had met Calla when I was in China, I feel we would have been the best of best friends, I mean that, No BS.

Did hedge funds decide shorting Treasuries was the new momentum trade, and then they bullied the Fed using quack mainstream economic models as a handy, convenient tool?

No. Why do you ask?

He’s got some SMALL point here, in that there were “leaks” (common between the fund industry and the Fed) about rate decisions QE, QT etc. . He is kinda blathering yeah, but he kind of randomly hits something sometimes,

And “funds”, “the investment industry” I think James Carville had a name for them. Carville “wanted to come back as a bond vigilante”. I mean some of this stuff IS there, You can’t put it in a research paper or you won’t be “endowed” with a Chair in the the business dept, but it IS there

I’m half drunk now, Menzie’s gonna be nice and filter me here, But I wish he would kinda, let THIS comment “loose’ Uhm, Menzie gets it reaally right and saves me nearly every time. What I meant to say is the “investment industry” (now this is coming froma goober who majored in Finance) DOES “bully” the Fed sometimes. They do bully the Fed, and anyone who thinks otherwise, isn’t paying attention

https://www.youtube.com/watch?v=rMa2VaV3Voo

Two points of focus in the discussion were fiscal policy in Asia and monetary policy in the Big Three, particularly the U.S. Those two issues have worked very well to explain patterns of economic activity in past cycles (and crises). One lesson of past cycles has that not only does U.S. monetary policy matter to Asian economies, but adjustment in U.S. monetary policy is disruptive. An economy that faced current account pressure under expansionary Fed policy will then face currency, inflation and financing pressure under tighter Fed policy.

One stand-out feature of the policy response to Covid has been the big swing in the U.S. fiscal balance – very large and quite timely, relative to prior recessions. I wonder whether the story in this cycle will be that pressure through the FX channel will be as problematic as always for Asian (and Latin American) economies, but that current account benefits will be smaller than in past cycles because of U.S. fiscal contraction. A bunch of shiney new goods in U.S. driveways and homes from the goods consumption surge may add to the problem.

https://news.cgtn.com/news/2022-01-19/Chinese-mainland-records-87-confirmed-COVID-19-cases-16WsqlFxiGA/index.html

January 19, 2022

Chinese mainland reports 87 new COVID-19 cases

The Chinese mainland recorded 87 confirmed COVID-19 cases on Tuesday, with 55 linked to local transmissions and 32 from overseas, data from the National Health Commission showed on Wednesday.

A total of 37 new asymptomatic cases were also recorded, and 767 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 105,345, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-19/Chinese-mainland-records-87-confirmed-COVID-19-cases-16WsqlFxiGA/img/d53244c845234721854a7e1e1a0f6d59/d53244c845234721854a7e1e1a0f6d59.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-19/Chinese-mainland-records-87-confirmed-COVID-19-cases-16WsqlFxiGA/img/31620b4e32724d7db25f5f27cb81e723/31620b4e32724d7db25f5f27cb81e723.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-19/Chinese-mainland-records-87-confirmed-COVID-19-cases-16WsqlFxiGA/img/7f3aaa3eb5c9447b8476df648c1969c7/7f3aaa3eb5c9447b8476df648c1969c7.jpeg

https://news.cgtn.com/news/2022-01-18/Chinese-mainland-administers-over-2-94b-vaccine-doses-16VBLVZgcGQ/index.html

January 18, 2022

Chinese mainland administers over 2.94b vaccine doses

The Chinese mainland had administered more than 2.94 billion COVID-19 vaccine doses as of January 17, according to data released by the National Health Commission.

[ January 15, 2022

Over 1.22 billion fully vaccinated against COVID-19 on Chinese mainland. ]

https://www.worldometers.info/coronavirus/

January 18, 2022

Coronavirus

United States

Cases ( 68,766,247)

Deaths ( 877,240)

Deaths per million ( 2,626)

China

Cases ( 105,258)

Deaths ( 4,636)

Deaths per million ( 3)

https://news.cgtn.com/news/2022-01-17/China-to-provide-another-1b-COVID-19-vaccines-to-Africa-Xi-Jinping-16TLIoxCq0U/index.html

January 17, 2022

China to provide another 1b COVID-19 vaccines to Africa: Xi Jinping

China will provide another one billion COVID-19 vaccine doses to African countries, said Chinese President Xi Jinping during his speech at a virtual session of the 2022 World Economic Forum.

Xi said China will also donate 150 million doses to members of the Association of Southeast Asian Nations.

He reiterated that cooperation is “the only right way” to defeat the pandemic, while holding each other back or shifting blame “would only cause needless delay in response” and “distract us from the overall objective.”

[ Along with over 2.94 billion doses of Chinese vaccines administered domestically, more than 2 billion doses have already been distributed to more than 120 countries internationally. Nineteen countries are now producing Chinese vaccines from delivered raw materials. ]

Does not seem as though chinese vaccines are actually being put in arms in these countries.

https://fred.stlouisfed.org/graph/?g=L0x5

August 4, 2014

Real per capita Gross Domestic Product for China, Japan, Korea and Thailand, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=L0xc

August 4, 2014

Real per capita Gross Domestic Product for China, Japan, Korea and Thailand, 1977-2020

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=FAt1

August 4, 2014

Real per capita Gross Domestic Product for China, India, Indonesia and Philippines, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=FAt4

August 4, 2014

Real per capita Gross Domestic Product for China, India, Indonesia and Philippines, 1977-2020

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=K2Ro

August 4, 2014

Real per capita Gross Domestic Product for China, Malaysia, Singapore and Hong Kong, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=FHhi

August 4, 2014

Real per capita Gross Domestic Product for China, Malaysia and Singapore, 1977-2020

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=FwYE

August 4, 2014

Real per capita Gross Domestic Product for China, Vietnam, Cambodia and Laos, 1995-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=FwYK

August 4, 2014

Real per capita Gross Domestic Product for China, Vietnam, Cambodia and Laos, 1995-2020

(Indexed to 1995)