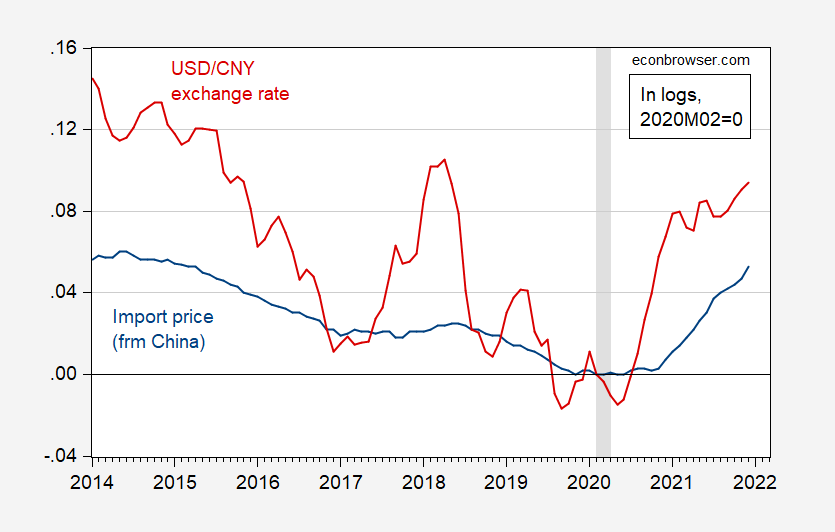

One reason why inflation exceeded my estimates from earlier this year is the price of imports. Since 2020M02, goods import prices from China have risen 5.3%, after declining 5.8% over the preceding six years. The dollar depreciated by 9.4% over the same period, implying a exchange rate pass-through coefficient of 0.56.

Figure 1: US import price of Chinese goods (blue), USD/CNY exchange rate (red), up is dollar depreciation. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Federal Reserve Board via FRED, NBER, and author’s calculations.

This is coefficient is not far off my 2015 guesstimate of 0.45 . Imports of Chinese goods accounted for about 16.5% of total goods and services imports as of late 2021.

Should the CNY weaken against the dollar in 2022 (as some predict, as China tries to support growth through exports), then dollar appreciation will exert disinflationary pressures on the US. (Of course, if there are production disruptions in China due to covid, that could certainly upset that prediction).

I’m the last person here that has any place commenting on this, as I am apparently the last person who views this as transitive inflation, STILL. So…… just suffice it to say, if you were “wrong” here, I don’t think any less of you. That is to say you have my general respect on these topics, among others. In fact, I probably have more respect for you now, because many economist are too cowardly to stick their necks out and give a number on inflation. You had the courage of your convictions and committed to giving a number. I think other economists should look themselves in the mirror and ask “If I’ve studied this stuff my entire life, and am supposed to be an expert on it, why am I too lily-livered to commit to a forecast number or a “range” of probable outcomes??” You don’t have to do that. You had the brass b….. to give a number. That deserves respect. It does not deserve chiding from the cheap seats.

Apparently they’ve completely run out of qualified people who want to be on Copmala Harris’s staff. (I think this must be something similar to the semi-truck driver “shortage”) Hard to figure out since Harris fires one staff member every 5 minutes.

https://www.thedailybeast.com/jamal-simmons-kamala-harris-new-comms-director-apologizes-for-tweets-about-undocumented-folks

Right now I’m imagining Jamal Simmons doing a “photo bomb” during Copmala Harris’s “I feel your pain” moment, when Copmala hugs some little girl at the southern border. Then Copmala awkwardly introduces the undocumented girl to Jamal Simmons as he’s phoning ICE to come pick the child up. “Hey there, isn’t this fun Alejandra?? Say hello to Uncle Jamal!!!! Him and the Ice Officer are going to take you to a cage now with 300 little girls just like you and one jammed up toilet.. Are you excited Alejandra?? Don’t forget to write me from your cage.”

I finally thought of the perfect job for Neera Tanden. Neera!!!!! Neera?!?!?!?!?! Are you out there Neera???? The best boss since Leona Helmsley. Neera, be sure to bring your old brass knuckles from the Hillary/CAP years for the one-on-one interview.

Interesting information and an analysis. So do have this right? Even though the dollar devalued by almost 9%, the price of goods imported from China rose by only 4% which means the yuan price of these goods actually fell. I ask because JohnH has been highlighting the writing of one of his latest pseudo experts that claims China is massively increasing the prices of the goods it sells us. Of course this pseudo expert is all bombast and no reliable data.

pgl: Yes, so consistent to pricing-to-market literature (see M. Knetter for early instance (https://www.jstor.org/stable/pdf/1804781.pdf?casa_token=PIgAHGDm5FgAAAAA:6m8q96zafom37pEZoFtopftQ4CsR6D3h0KpwQPREhBOOmxwT9tZOaDm-HWL0uwGHjKU0fOqIW7eSS_ygTT-2vkta8ZrzUqXfsHCHzMHnHbz4JUFQWQ8 )

https://scholar.harvard.edu/files/gopinath/files/sb.pdf

“even conditioning on a price change, exchange rate pass-through into U.S. import prices is low, at 22%.”

I love quoting hot chicks. I need extra incentives to study economics.

Everyone: As a favor to me, even if the remark is not misogynistic, I would appreciate people staying away from sexist and objectifying terminology. This applies generally to comments regarding both males and females.

Meanie.

Ok, I will tone it down so none of my refuse splatters up on you. I “get it”, I say something with a pseudonym then you have to deal with it. I mean it mostly in good humor but I guess this middle aged guy has no idea what humor is in 2022. Or maybe I never did, I really don’t know.

Thanks for reminding me of Knetter’s classic. Note he walks through this under the assumption of a perfectly competitive market as well as a model that incorporates market power. Of course Kettner realizes that a dollar devaluation will induce Chinese oligopolists to reduce their markups. JohnH seems to think the economics would have them increase their markups in such situations but then he never understood the economics of oligopolies either.

Of course, a lot depends on the time frame you select.

“Trading at 6.3734 per dollar on Friday, the yuan was eyeing a 2.4% appreciation over the year on the back of strong trade surpluses and robust portfolio inflows despite overall strength in the U.S. dollar.

https://www.nasdaq.com/articles/emerging-markets-most-asian-currencies-set-to-end-2021-in-red-yuan-shines

“Import prices from China increased 4.7 percent over the past 12 months, the largest calendar-year advance

since the series was first published in 2004..”

https://www.bls.gov/news.release/pdf/ximpim.pdf

What does this say?

You are now accusing Dr. Chinn of cherry picking data to mislead. No dude – that is your game.

Your BLS data only repeats what Menzie showed – prices rises at 4% when general prices have risen by 7% means Chinese imports are relative cheaper. But then your preK teacher tells me you think 4 is greater than 7 so hey. Now the opening of your 1st link (which you did not read):

‘Most Asian currencies were on course to end the second year of the pandemic on a negative note, with the Thai baht eyeing its worst year in two decades as the tourism-reliant economy remained under pressure from travel curbs.

The baht THB=TH was the region’s worst-performing currency this year, losing 11.4%.

The Taiwan dollar TWD=TP and China’s yuan CNY=CFXS, the only two currencies in positive territory, were chasing an over 2% annual gain. The yuan, set for a second year of gains, was poised to become Asia’s best performer.’

I guess a moron like you thinks the Thai baht is the same as the Chinese yuan. To you – all Asians are the same thing. But your own source confirms what Dr. Chinn showed – the yuan appreciated.

Of course I’m speaking a foreign language as you never got basic macroeconomics or international finance.

Huh – the opening line was:

U.S. import prices declined 0.2 percent in December, after rising 0.7 percent in November, the U.S. Bureau of Labor Statistics reported today.

But the liar JohnH cannot report this. Yes – JohnH is a true expert at cherry picking and misrepresenting.

Past performance does not predict future results. The source I quoted was talking about Chinese manufacturers getting tired of being squeezed (consistent with data Menzie showed.) He also expects Chinese manufacturers to raise prices in the future.

pgl loves to shift the goal posts and then declare someone wrong…

“Past performance does not predict future results.”

The empirical literature on pass-through effects is rather substantial by now. But leave it to you to quote some flunky who has played the stock market and lost money for his clients on a consistent basis. This way you can go on in your wonderful ignorance of even the most basic economics.

“The source I quoted was talking about Chinese manufacturers getting tired of being squeezed (consistent with data Menzie showed.)”

Your source was a self promoter blow hard who never once presented any real evidence or data. And for you to say your babble is consistent with the data Dr. Chinn presented is completely backwards. I would say you are lying again but I earlier suggested you would not understand Dr. Chinn’s post.

https://news.cgtn.com/news/2022-01-14/China-s-foreign-trade-volume-exceeds-6-trillion-in-2021-16OeLZ3dr6U/index.html

January 14, 2022

China’s foreign trade volume hits record high of $6.05 trillion in 2021

China’s foreign trade volume reached $6.05 trillion in 2021, surpassing the $6 trillion mark for the first time, data from the General Administration of Customs (GAC) showed on Friday.

Calculated in Chinese yuan, China’s foreign trade volume reached a record high of 39.1 trillion yuan last year, up 21.4 percent from 2020. Exports came in at 21.73 trillion yuan, a 21.2-percent increase from a year earlier, while imports totalled 17.37 trillion yuan, up 21.5 percent, according to the GAC data.

GAC spokesperson Li Kuiwen said the resilience of China’s economy and the recovery of the global economy helped the country to maintain strong growth momentum in trade.

The country’s exports and imports grew more slowly in December compared to the previous month as overseas demand for goods eased after the holiday season, and high costs pressured exporters.

Exports rose by 20.9 percent year-on-year last December after increasing by 22 percent in November, slightly beating a Reuters forecast of 20 percent.

https://news.cgtn.com/news/2022-01-14/China-s-foreign-trade-volume-exceeds-6-trillion-in-2021-16OeLZ3dr6U/img/0bbf31b225e24e9fa6e0f903a2c737f8/0bbf31b225e24e9fa6e0f903a2c737f8.jpeg

https://news.cgtn.com/news/2022-01-14/China-s-foreign-trade-volume-exceeds-6-trillion-in-2021-16OeLZ3dr6U/img/f9e4b605bb0648cb80cdd297934dc2e5/f9e4b605bb0648cb80cdd297934dc2e5.jpeg ….

https://english.news.cn/20220113/b252603b4c2a44a1b9dc999e57986fac/c.html

January 13, 2022

China FDI inflows hit record high in 2021

BEIJING — In a year when the pandemic continued to wreak havoc on the world economy, global investors have cast more votes of confidence on investing in China as the foreign direct investment (FDI) into the country hit a record high.

The FDI into the Chinese mainland, in actual use, expanded 14.9 percent year on year to a record high of 1.15 trillion yuan in 2021, the Ministry of Commerce said Thursday.

In U.S. dollar terms, the inflow went up 20.2 percent year on year to 173.48 billion dollars.

High-tech industries saw FDI inflows jump 17.1 percent from a year earlier, ministry spokesperson Shu Jueting told a press briefing.

Foreign investment in China’s high-tech manufacturing and high-tech services industries rose 10.7 percent and 19.2 percent, year on year, respectively.

The robust growth came as China’s long-term and sound economic fundamentals, and constantly improving business environment retained an appeal to foreign capital, said Zhang Jianping, a researcher at the Chinese Academy of International Trade and Economic Cooperation under the commerce ministry.

Last year, the total FDI inflow into the services sector increased 16.7 percent, year on year, to 906.49 billion yuan.

Investment in the Chinese mainland from countries along the Belt and Road and the Association of Southeast Asian Nations jumped 29.4 percent and 29 percent, respectively, data from the ministry shows….

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=yeYT

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 1994-2021

(Indexed to 1994)

https://news.cgtn.com/news/2022-01-15/Chinese-mainland-records-165-confirmed-COVID-19-cases-16PQQMzELq8/index.html

January 15, 2022

Chinese mainland reports 165 new COVID-19 cases

The Chinese mainland recorded 165 confirmed COVID-19 cases on Friday, with 104 linked to local transmissions and 61 from overseas, data from the National Health Commission showed on Saturday.

A total of 25 new asymptomatic cases were also recorded, and 743 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 104,745, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-15/Chinese-mainland-records-165-confirmed-COVID-19-cases-16PQQMzELq8/img/ab30953f1f5b478d83bf5effd0e13b93/ab30953f1f5b478d83bf5effd0e13b93.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-15/Chinese-mainland-records-165-confirmed-COVID-19-cases-16PQQMzELq8/img/81dab86c7b88444e8811b1ec5a671f19/81dab86c7b88444e8811b1ec5a671f19.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-15/Chinese-mainland-records-165-confirmed-COVID-19-cases-16PQQMzELq8/img/41c18119f442410e8bf7c3afad479455/41c18119f442410e8bf7c3afad479455.jpeg

http://www.xinhuanet.com/english/20220115/58173e8b6cc34f3497ea5dcd610ee33b/c.html

January 15, 2022

Nearly 2.93 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Nearly 2.93 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Friday, data from the National Health Commission showed Saturday.

[ Over 1.22 billion fully vaccinated against COVID-19 on Chinese mainland ]

https://www.worldometers.info/coronavirus/

January 14, 2022

Coronavirus

United States

Cases ( 66,209,535)

Deaths ( 872,086)

Deaths per million ( 2,611)

China

Cases ( 104,580)

Deaths ( 4,636)

Deaths per million ( 3)

This kind of comment got me a threat to be BANNED and many reactive comments re: how it was untrue/different than… That reaction not withstanding, here is another lot of data from Scotland’s DHS: https://publichealthscotland.scot/media/11089/22-01-12-covid19-winter_publication_report.pdf

Please refer to Figures 10 and 12, to see which vaccination group in Scotland is both catching and being hospitalized from omicron.

As I tried to point out in the earlier instance, the apparent determining factors are age, obesity and medical condition co-morbities which determine Covid severity.

In the 1990s, US imports from China (including Hong Kong and Macau) were 7.8% of total merchandise imports, as compared to 22.7% from Japan, Korea, and Taiwan.

In the 2000s, the numbers were 14.7% and 13.5%, and in the 2010s, 20.1% and 10.7%.

Production previously located in Japan, Taiwan, Korea and elsewhere relocated to China for one very simple reason: it was more profitable. Some products that had never been made anywhere in the world (e.g., iPhones), were originally made outside the USA.

The ideas underlying the trade war are simply wrong: production jobs were not taken from the US to China. If anything, they were taken from China’s East Asian neighbors (et al). What WAS taken from the US to China was a portion of the cost of production. As a result, US standards of living — particularly among the least well-off — improved far more than they might have without such trade.

What WAS taken from the US to China was a portion of the cost of production. As a result, US standards of living — particularly among the least well-off — improved far more than they might have without such trade.

[ Really, really important argument. ]

Really, really complete nonsense.

Explain.

You explain. You have waved a few data points around and made an assertion unsupported by the data.

Lots of empirical work has been done on this issue. You’ve ignored all of it.

https://fred.stlouisfed.org/graph/?g=lMoC

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for China and United States, 1994-2021

(Indexed to 1994)

Within this wisdom is the reality that a lot of the goods made by contract manufacturers in China are designed in the US. This includes not only iPhones but also semiconductors as well as apparel. Now if we could ever get this reality into the thick skull of JohnH – maybe we would not have to endure his usual carnival barking.

Within this wisdom is the reality that a lot of the goods made by contract manufacturers in China are designed in the US….

[ Again, an important argument but there is a change coming. The trade limits the United States has imposed on China since 2011, have led to the Chinese necessarily designing goods that would ordinarily have been imported. Chinese space exploration goods that would have been imported, have been designed and produced in China. There is a reason China has a unique, complete GPS system and even an automated satellite manufacturing system. ]

I have no doubt that China’s R&D sector will created new medical developments, new telecom and IT developments etc. Which means the US might leverage off the new technologies and some the incessant whining about China allegedly stealing our IP.

Hisense is a company the US arbitrarily chose to limit technically:

https://news.cgtn.com/news/2022-01-12/China-s-first-AI-image-processor-for-8K-TV-marks-key-tech-breakthrough-16LNjfuImjK/index.html

January 12, 2022

China’s first AI image processor for 8K TV marks key tech breakthrough

By Gong Zhe

China’s first AI image processing chip for 8K TV was released by Hisense on Tuesday in Beijing, which is seen by government officials as a milestone in the country’s development of key TV technologies.

The chip, named Hi-View HV8107, uses AI-assisted technology to process 8K TV output, making it clearer, more colorful and more fluent in motions.

In addition to its 8K processing power, the chip can also upscale 4K content to 8K at 120 hertz.

“The chip uses 22-nanometer process,” Yu Heng, head of Hisense chip and display branches, told CGTN. “And it’s the fifth-generation product designed by our own teams.” …

I want one of those TVs in time for the NFL playoffs!

“The ideas underlying the trade war are simply wrong: production jobs were not taken from the US to China. If anything, they were taken from China’s East Asian neighbors (et al). What WAS taken from the US to China was a portion of the cost of production.”

Of course the latest utter nonsense from carnival barker JohnH is that China is about to increase the prices of goods it makes for the rest of us. Of course if they do, they might lose a portion of their contract manufacturing operations to the other East Asian neighbors.

“China” doesn’t set prices; hundreds of thousands of mostly foreign-invested companies that happen to be located in China set prices in conjunction with their customers. It’s just biddness.

Unless you’re talking about mandatory wage hikes, significant exchange rate appreciation, or some sort of export tax, please don’t use such lazy language.

It confuses the ignorant.

1. How can we differentiate inflation from a bunch of non-predictable exogenous effects (oil, china exchange, etc.) and just generalized inflation (“money is worth less”) which is worse than average in some areas and better than average in others? Forget Biden and all that. Just if these were Martians or something. How to differentiate?

2. Is “worse” exchange rate a symptom of inflation, not just a cause? (Dim memory of hearing this point made colloquially in the past.) Yes, I know the Chinese set their rates manually, but still if our money is really worth less, wouldn’t it be reasonable for them to change the rate? I guess you can say the 9.4% rate change was more than the 7% inflation, so it’s excessive. But some worsening might still be normal. I hope it’s not indicating CPI is underestimating! Kidding. I think. 😉

3. For that matter, even if some of the headliner areas (oil, China imports) are up more than average inflation, what does it mean that almost everything is up more than customary inflation rate (last 3 decades)? Wouldn’t it support the Occam’s Razor view that yes we’re inflating the currency? I guess, if you buy excluding high outliers (always dangerous, but OK), then you can say ~5.5% instead of ~7%. It’s still definitely a real phenomenon happening no? To be understood. And maybe dealt with.

A.,

Yes, exchange rates are at least partly endogenous to relative inflation rates.

It increasingly strikes me that we may be seeing a revenge of the Phillips Curve right now. A comparison that may show specific US policies the best is with the EU. So the first Economist of the year reports that for last year the US inflation rate was 1.9% higher than that in the EU, the GDP growth rate was 1.0% higher than that in the EU, and the unemployment rate was 3.1% lower than that in the EU.

You seem to think “China” cares about the US more than the evidence would support.

Start here: Not quite every OECD economy is experiencing significantly higher inflation.

Therefore, maybe — just maybe? — it has nothing whatsoever to do with the value of the dollar.

https://jabberwocking.com/misinformation-is-mostly-spread-by-chaotic-evil-conservatives/

Kevin Drum wants you to know liberals do not spread misinformation. But principled conservatives are not the ones spreading misinformation. So who is? The research and Kevin blame this on low-conscientiousness conservatives (LCC). Hey we have another name for LCC – the Usual Suspects.

O.56 plus-or-minus 0.5, if you honestly reported statistical uncertainty, right?

“plus-or-minus 0.5, if you honestly reported statistical uncertainty”

Plus or minus 0.5? WTF did you get this? Oh you just made it up. And you think you have the right to question anyone’s integrity? You are nothing more than an annoying dishonest little troll.

I have not done a sport rant in a while but bear with this unabashed Braves fan who wants Freddie Freeman to stay with the World Series champions and not come to NY to play for the cursed Yankees. Everyone agrees that he should get $30 million a year with the holdup being the Braves want a 5-year contract and Freddie wants a 6-year contract. If that pathetic governor of Georgia had an effing brain – he would agree to get rid of those awful voting rights laws in exchange for $30 million to pay for the 6th year of Freddie’s contract. Come on Braves fans – get this deal done.