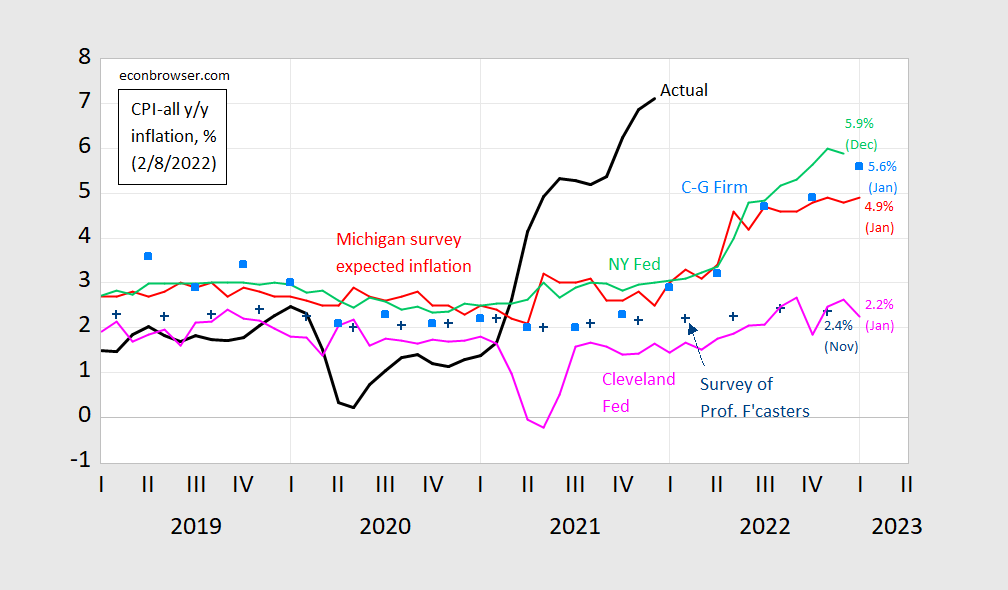

All measures — even those typically upwardly biased — indicate slower inflation over the next year.

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

Households and firms (as measured by Coibion and Gorodnichenko in new release) expect elevated inflation, between 4.9% to 5.9%. The Cleveland Fed indicator, based on both market and survey data, is down to 2.2%. The Philadelphia Fed’s Survey of Professional Forecasters will be out in a week.

The Wall Street Journal’s January survey puts December 2022 y/y inflation at 3.11%

Makes sense in sort of a meta Bayesian way. Reversion to the mean.

I’m kind of hoping the overall economy gets klicking too. 5% growth. Let’s go!!!

I notice that from about 1953 to the present, the average annual CPI-All was about 3.5% and the GS10 constant annual rate was about 5.6%. Any chance of GS10 rates exceeding annual CPI?

Yes the average real rate has been 2% over this 70 period. But note there is a general consensus that real interest rates since the Great Recession are significantly lower than real rates before 2009 – whether we measure this in US$, Euros. yen, pounds. etc.

pgl thanks for the comments.

It looks like from 2009m7 to 2021m12 CPI-All Y/Y % averaged 1.9%, GS10 averaged 2.2% through 2022m1 and fed funds averaged 0.5%. Not great for those wanting interest income materially above inflation. GS10 started as of 2009m7 at 3.56% and ended at 1.76% for the period ending 2022m1, so those who held significant GS10 as of 2009M7 benefited from capital appreciation. For the nimble who sold, GS10 yield showed a low of 0.62% as of 2020m7. GS10 is now at about 1.925%. Are we going to 3.0%? When one looks at the monthly Y/Y CPI-All % from about 2020m5 to the present, the graphic break-out looks alarming even if the curve seems to be bending a bit favorably.

Opps, since GS10 owned as of 2009m7 would mature by 2019m07, best capital gain would be from yield purchase of about 3.56% to about 2.07% at maturity.

https://www.nytimes.com/2022/02/08/opinion/economic-theory-monetary-policy.html

February 8, 2022

When do we need new economic theories?

By Paul Krugman

Today’s newsletter isn’t about Modern Monetary Theory (MMT), which has been the subject of a lot of back-and-forth in the economics world over the past couple of days. Suffice it to say that I consider MMT the cryptocurrency of macroeconomics: It sounds edgy and forward-looking, but when you press its devotees on what exactly is its point, what it can do that you can’t do better using more conventional approaches, the response is a lot of bombast but no clear answer.

My topic today is, instead, more meta (not to be confused with Mark Zuckerberg’s Meta). Here’s the question: When do events tell us that we need a fundamental rethink of economic concepts?

You might think that the need for new theory is obvious whenever consensus economic forecasts are wildly off. But it’s a big, complicated world out there, and conceptually sound models may end up being way off because of inadequate data or outside events.

Here’s an example from “real” science: Britain’s Great Storm of 1987, whose severity came as a complete surprise. Nobody suggested that there was something wrong with the fundamental principles of meteorology. Instead, while forecasters came in for a lot of criticism, the main conclusion was that the Met Office’s data collection for the ocean south and west of Britain was inadequate and needed to be reinforced.

What’s an economic example? This may surprise you: Essentially nobody saw the 2008 financial meltdown coming (other than people who predicted many other crises that didn’t happen), but when it did come, there wasn’t much existential angst among economists I talked to. We’ve long had a theory of banking crises; we just thought that regulations and deposit insurance made an old-fashioned wave of bank runs impossible — which they did, for traditional banks….

“We’ve long had a theory of banking crises; we just thought that regulations and deposit insurance made an old-fashioned wave of bank runs impossible — which they did, for traditional banks….”

How did he continue with this thread? We used to have regulations that would do as much but over time dismantled some of the key elements.

For a recession:

Monetary policy: Cut interest rates, no MMT

Fiscal policy: Automatic stabilizers

For a depression:

Monetary policy: FFR to zero, MMT until inflation goals are met (unsterilized cash injections to “Main Street”, not “Wall Street”)

Fiscal policy: Extended automatic stabilizers

For a suppression:

Monetary policy: Minimal interest rate accommodation, no MMT

Fiscal policy: Expansive fiscal accommodation covering a substantial portion of the outage

That’s my view.

Gee – macroeconomics ala paint by numbers!

Well, right now, there is no technical distinction between a recession and a depression. Jim and Menzie have had this discussion earlier on Econbrowser. To my mind, a recession is an income statement event, a depression is a balance sheet event. You need different tools for each of those.

There is no definition of a suppression yet. In a suppression, neither income statements nor balance sheets are impaired. Rather, an external force is preventing the ordinary conduct of commerce. This requires yet another approach.

In this suppression, the Fed really used tools better suited to a depression. That’s why we see blowout appreciation in home prices during covid, whereas home prices went exactly nowhere during the Great Recession using similar tools. By contrast, during the Great Recession (the China Depression), the Fed used policies better suited to a recession, whereas they should have used policies for a depression, that is, MMT, with unsterilized payments to households.

Good grief. And I thought MMT was a long winded waste of time. There is a lot more to macroeconomics than income statements and balance sheets. But I’m sure your favorite CPAs would be impressed.

“That’s why we see blowout appreciation in home prices during covid, whereas home prices went exactly nowhere during the Great Recession using similar tools.”

Never mind that we had incredibly different finance fundamentals for this market lately as opposed to back in 2007. You know what – you need to give back that lollipop after this. And no ice cream cone for you. GEESH!

https://www.nytimes.com/2022/02/08/opinion/economic-theory-monetary-policy.html

February 8, 2022

When do we need new economic theories?

By Paul Krugman

What few had realized, however, was that much of the modern financial system now involved “shadow banks” that did bank-type business but, because they weren’t marble buildings with rows of tellers, lacked both the regulations and the government guarantees that protected traditional banking. As soon as that became clear, the crisis, although unanticipated, was easily slotted into the standard framework; in the weeks after Lehman Brothers fell, you could find economists roaming the halls muttering “Diamond-Dybvig, Diamond-Dybvig” under their breath.

So which economic crises clearly demonstrated the need for a fundamental rethink? The Great Depression, of course: Such a thing was undreamed of under the era’s prevailing economic philosophy, and the fact that it happened converted many to the economic vision of John Maynard Keynes.

The stagflation of the 1970s also forced a major rethink. Persistent inflation despite high unemployment seemed to provide a spectacular vindication for the argument of Milton Friedman and Edmund Phelps that sustained inflation would get built into wage- and price-setting — not an entirely new idea but one that became part of the canon.

Conversely, the Volcker recession of the 1980s refuted some of the popular economic models of the 1970s….

ltr,

At the time I remember Krugman writing that what people were muttering in those halls under their breath was “Minsky moment, Minsky moment,” although maybe that was what they were saying out loud, which they were, while muttering “Diamond-Dybvig” under their breaths.

Who needs Minsky or Diamond-Dybvig when we have Princeton Steve’s little income statements and balance sheets? After all CPAs know everything – right?

“Persistent inflation despite high unemployment” of the 1970s?

Inflation was not persistent in the 1970s. It fell significantly from Feb, 1970 to Aug, 1972, and from Nov, 1974 to Dec, 1976. https://fred.stlouisfed.org/graph/?g=gJ4

It rose sharply due to the 10 fold increase in oil prices caused by the Arab Oil Embargo of 1973 and the Iranian Revolution of 1978. Friedman’s monetary theories had nothing to do with the oil price run-up.

Unemployment was not consistently high either. It fell from Dec, 1970 to Oct, 1973, and from May, 1975 to May, 1979. https://fred.stlouisfed.org/series/UNRATE

The severe increase of unemployment from Oct, 1973 to May, 1975 was due to the recession caused by the Arab Oil Embargo. Again, it had nothing to do with monetary policy.

For more than a decade after the Great Recession, Fed policy was extremely accommodative with no inflation effects, but with profound effects on unemployment which hit a 50 year low just before the pandemic. Now, inflation is being driven by reduced oil production in the U.S. (which is below 2019 levels and not expected to hit new highs until 2023) and a world-wide shortage of semi-conductor chips which Friedman never anticipated.

With EVs coming on the automotive market, oil shortages will fade as a driving force of inflation. New chip fab factories will solve that shortage too. Nobody needs to think about Friedman again. Another paradigm shift equivalent to abandoning the gold standard in 1933, is the abandonment of fear-mongering about the federal budget deficit, which may be one good result of the pandemic. Both Dems and GOP seem to have lost interest in kicking that political football around.

Just a wee bit of disagreement with one of your contentions:

“The severe increase of unemployment from Oct, 1973 to May, 1975 was due to the recession caused by the Arab Oil Embargo. Again, it had nothing to do with monetary policy.”

OPEC was an issue but so was those stupid WIN buttons handed out by Gerald Ford who did lean hard on the FED to run tight money.

The Fed Funds rate was 12% when Ford became president in August, 1974. It was 4.61% when he left office in January, 1977. https://fred.stlouisfed.org/series/FEDFUNDS

So I am not clear what you mean by Ford leaning hard on the Fed to run tight money. Seems like just the opposite while inflation declined from November, 1974 through December, 1976. https://fred.stlouisfed.org/graph/?g=gJ4

Paradoxical that Fed Funds would decline steeply and inflation simultaneously would too.

I was referencing FED policy when Ford first became President. Yes Burns went full 180 later in an effort to get Ford a new terms, which of course did not work politically. Burns was a really terrible FED chair. You might enjoy this discussion:

https://www.huffpost.com/entry/federal-reserve-policy-an_b_2010661

Good overview of LNG market evolution in the face of US exports.

https://rbnenergy.com/just-cant-get-enough-part-2-growing-us-lng-output-has-influenced-global-logistics-pricing

Not academic. But reasonably savvy and detailed.

I think this area would be rich for formal economic evaluation of the change from cozy Qatari oligopoly to free(er) competition. Papers, grad student, thesis. It’s not a completely simple story (e.g. customers need to invest in regas, have security of supply worries). But at the 50,000 foot level, it was a cartel and dominant player, with a lot of mechanisms to price discriminate. Now affected by entrants (not just US, Aussies also) screwing up their market.

Are all measures wrong by at least 130%, right now?

Shouldn’t you add “plus-or-minus 130%” to your forecasts?

rsm,

Obviously you need to put some error bounds on that 130% number. Give or take how much?

One forecast error does not define the appropriate confidence interval. You act like this is your forte but based on your comments, you are clueless.

Just saw, 4Q2021 US consumer debt reportedly increased to $15.5 trillion, from recent $15 trillion.

My credit card debt rose, too.

It is eExplained by house purchases and auto sales – higher prices and volumes?

Here is a rough picture of consumer debt. The mortgage series was discontinued in 2019, but you’ll get the basic ideas. Every category of debt is rising, but mortgages overwhelm other categories:

https://fred.stlouisfed.org/graph/?g=LSJD

Thanks!

Saw @ Yahoo Finance from Reuters citing a NY Fed report – Over $4.5T mortgages originated 2021, a historic high. Mortgage balances increased by $258B 4Q2021 to $10.9T a/o 31 December 2021.

With rising GDP and inflation even the ordinary can be called a “historic high”.

‘Every category of debt is rising’ – in absolute nominal terms. It would be interesting how these series would look if expressed as a percent of nominal GDP.

https://news.cgtn.com/news/2022-02-09/Chinese-mainland-records-110-confirmed-COVID-19-cases-17vk97Ra6mQ/index.html

February 9, 2022

Chinese mainland reports 110 new COVID-19 cases

The Chinese mainland recorded 110 confirmed COVID-19 cases on Tuesday, with 73 linked to local transmissions and 37 from overseas, data from the National Health Commission showed on Wednesday.

A total of 24 new asymptomatic cases were also recorded, and 837 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 106,634 with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-02-09/Chinese-mainland-records-110-confirmed-COVID-19-cases-17vk97Ra6mQ/img/7512f3c6dbcf4235b41c975ecd561531/7512f3c6dbcf4235b41c975ecd561531.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-02-09/Chinese-mainland-records-110-confirmed-COVID-19-cases-17vk97Ra6mQ/img/b4d8291726d64f6dab175af276964b67/b4d8291726d64f6dab175af276964b67.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-02-09/Chinese-mainland-records-110-confirmed-COVID-19-cases-17vk97Ra6mQ/img/59060a7f30774be4813844c1e57f1a32/59060a7f30774be4813844c1e57f1a32.jpeg

https://www.worldometers.info/coronavirus/

February 8, 2022

Coronavirus

United States

Cases ( 78,556,193)

Deaths ( 932,443)

Deaths per million ( 2,791)

China

Cases ( 106,524)

Deaths ( 4,636)

Deaths per million ( 3)

Weekly petroleum supply report is out.

https://www.eia.gov/petroleum/supply/weekly/

~6 MM bo draw of crude inventory, about 2 MM draw of products inventory. Jet was actually up. But other products down.

Doesn’t look like they’ve incorporated last STEO crude forecast into the weekly production number yet. That will happen next week. (Rebaselining.)

need a lot of jet fuel to start ww iii

nov 21 announced release of 50 mbbl…..

been watching the change in crude balance in the nat’l petrol reserve.

it is not going out very fast!!

so here is the rest of the story

https://www.energy.gov/fecm/articles/summary-50-million-barrel-release-strategic-petroleum-reserve

and it all comes back with premium by fy 25!

over 15 mbbl/day enter us refineries.

Dr. Lisa Cook has been nominated by President Biden to be on the Federal Reserve. I do not know her but I do know that Peter Navarro suggesting she should coach an NFL team is an incredibly racist slur:

https://thegrio.com/2022/01/29/lisa-cook-facing-racist-smears/

I guess there are two question for Dr. Chinn: (a) do you know Dr. Cook and is she qualified; (b) WTF happened to your former co-author? Yea, I question (b) is one that you might want to pass on.

The bio of Dr. Lisa Cook:

https://lisadcook.net/bio-cv/

Strikes me as far more impressive than the bios of Judy Shelton, Stephen Moore, Lawrence Kudlow, or even Peter Navarro.

pgl,

She has the edge on Powell too, if one wants to focus on scholarly credentials and all that.

There is a major blowup going on on Twitter and ejmr over not Navarro, but Harald Uhlig, formerly editor of the JPE, who is a German national and at the U. of Chicago, who has unloaded a blistering attack on her. He claims there are serious data problems in her much cited paper on blacks and patenting, although it looks to me to be a pretty acasdemic squabble, him making way too much out of a data dispute. They had gone at it previously, so there is blood in the water on this one, with people having demanded he step down as JPE editor. Lots of accusations are being thown over this one, much nastier than the Navarro slam, but setting off a much worse stink.

If she were a white male, this right wing attack would not exist. And of course Ted Cruz thinks the only people who should qualify to be on the Supreme Court are white males. It is going to be a rough few weeks.

Speaking of data disputes – what ever happened with that JMCB project? Data issues abound in academic work and no one goes ballistic. But a dark skinned lady cannot be in the same halls of white males I guess. Sotomeyer went through this garbage and she may just be the best living member on the Supreme Court.

I wonder if Peter Navarro is going to be an NFL coach since the Rooney Rule only applies to the Steelers.

Andrew Gelman (not a right winger) also has methodology concerns about her patent paper.

https://statmodeling.stat.columbia.edu/2022/02/05/how-many-patents-by-african-americans-were-there-in-the-golden-age-of-innovation-1870-1940/

It’s not some obscurity of the causal regression, but just the base curve of black patents by year. Just the observable itself (not the explanation of what caused it).

She she has a data source for black patents (hard core survey) done in 1900 by the USPTO that gives 65% of her info. And then she has bottoms up additions from books, newspapers, etc. added onto that. So surprise, she has a big dropoff right at 1900 (when her main source, the survey ended). Just look at the graph of patents by year from the 1900 survey and then her overall graph. It’s really visually striking the correlation pre-1900. So, then when you know that input ended right when her numbers crashed, kind of a big red flag.

This is the method Cook used for finding more patents than Baker:

The final strategy to extend the Baker data set was to construct a broad-based data set of African

American inventors, i.e., potential patentees, and to match the resulting data to patent data. Among the

historical and contemporary sources used to create a pool of potential patentees were searches of 44

historical newspapers, including obituaries, e.g., from the Ohio Historical Society Newspaper online

database and newspaperarchive.com; correspondence from Carter G. Woodson, Henry E. Baker, and

patent survey participants (Library of Congress); the Garrett Morgan Papers; historical and

contemporary directories of African American medical doctors, scientists, and engineers, e.g., ;

academic journals, including the Journal of Economic History and the Journal of Negro History; historical and

contemporary biographies of African American inventors and general biographies, e.g., Great Negroes

Past and Present; and programs of exhibitors in the African American sections or exhibitions of historical

fairs, including the “Exhibit of American Negroes” at the 1900 Paris World’s Fair, the 1904 “Great

Negro Fair” in Raleigh, North Carolina, and the 1933 Chicago World’s Fair “Negro Day”. Newspaper

and obituary searches and programs of exhibitions allowed the identification of lesser known inventors.

A complete list of sources appears in a companion paper. Not all inventors and others in the pool of

potential patentees were matched to patent records and were dropped from the data set. Others were

dropped if there was not a unique first- and last-name match, e.g., James Young in the patent data.

Ultimately, while second best, this process provides a more systematic and less ad hoc means of

recovering black patentees to extend the data set. ”

But Baker actually did a hard core survey to 75% of patent agents/attorneys.

It’s not some ethical research scandal. But it definitely puts the whole paper in question. I mean if you’re regressing against something that never happened.

Her approach was very conservative. But the problem is undercounting (missing patents) given her issues with data collection. Other methods (e.g. by Brookings researchers, not right wingers) do a top down method and don’t see the temporal crash that Cook saw. Personally, I think Brookings overcounts and Cook undercounts. But the issue is not what the relative black/white patenting rate was, but the temporal feature in the Cook paper. The Brookings papers do not show the 1900 crash that Cook saw (right after her main source of info stopped).

Andrew Gelman, writing in the Washington Post, “savaged” critically important and correct analytical work by Anne Case and Nobel Prize winner Angus Deaton. The result was considerable neglect of the analytical work precisely when the work needed to be broadly considered.

https://fred.stlouisfed.org/graph/?g=q9MV

January 30, 2018

Mortgage, Consumer and Household Debt Service Payments as a Percent of Disposable Personal Income, 2007-2021

https://fred.stlouisfed.org/graph/?g=q9N1

January 30, 2018

Mortgage, Consumer and Household Debt Service Payments as a Percent of Disposable Personal Income, 2007-2021

(Indexed to 2007)

https://www.nytimes.com/2019/09/30/opinion/economics-black-women.html

September 30, 2019

‘It Was a Mistake for Me to Choose This Field’

Black women are underrepresented in economics, which is bad for everyone.

By Lisa D. Cook and Anna Gifty Opoku-Agyeman

Economics is neither a welcoming nor a supportive profession for women. In 2017, Alice H. Wu, now a doctoral student in economics at Harvard, published an eye-opening study of online conversations among economists that provided convincing evidence that overt sexism was a serious problem in the field. Last year the economist Roland G. Fryer Jr., a star of the Harvard department, faced sexual misconduct allegations, prompting calls to condemn the widespread sexual harassment and discrimination in the profession. (In July, Harvard suspended Professor Fryer for two years.)

But if economics is hostile to women, it is especially antagonistic to black women. Black women account for 6.8 percent of bachelor’s degrees in the social sciences. But in 2017, only 0.6 percent of doctoral degrees in economics and only 2 percent of bachelor’s degrees in economics were awarded to black women.

Sadie T.M. Alexander, who in 1921 became the first African-American to receive a Ph.D. in economics, switched to law because of the racism and sexism she encountered. A century later the experience of black female economists is disturbingly similar.

This month the American Economic Association published a survey finding that black women, compared to all other groups, had to take the most measures to avoid possible harassment, discrimination and unfair or disrespectful treatment. Sixty-two percent of black women reported experiencing racial or gender discrimination or both, compared to 50 percent of white women, 44 percent of Asian women and 58 percent of Latinas. Twenty-nine percent and 38 percent of black women reported experiencing discrimination in promotion and pay, respectively, compared to 26 percent and 36 percent for whites, 28 percent and 36 percent for Asians and 32 percent and 40 percent for Latinas.

“I would not recommend my own (black) child to go into this field,” said one of the black female respondents. “It was a mistake for me to choose this field. Had I known that it would be so toxic, I would not have.”

Many black women who might want to study economics are effectively prevented from doing so at a young age….

Lisa D. Cook is an associate professor of economics and international relations at Michigan State University. Anna Gifty Opoku-Agyeman is a research scholar in economics at Harvard University.

Thank you for putting forth this very timely op-ed.

We’ve got another Susan Collins. Confusing, but well worth it.

The resumes showing up at the Fed are really shiny.

https://twitter.com/haralduhlig/status/1286086897467641857

Harald Uhlig @haralduhlig

Let me politely suggest to replace Paul Krugman with a Black American colleague as columnist @nytimes. Paul had a great run there for more than 20 years. Let’s thank him all for what he has done and move on. @paulkrugman: just graciously step down!#ReplaceKrugman

7:53 PM · Jul 22, 2020

Having inadvertently noticed such intemperate writing by this author, I became cautious about further writings by the author.

Harald Uhlig was once chair of the economics department at the Univ. of Chicago. But then he decided to unfairly attack Black Lives Matter. It seesm the Univ. of Chicago found his open racism a bit troubling.

We’ve got another Susan Collins. Confusing, but well worth it.

The resumes showing up at the Fed are really shiny.

Just a bit of trivia. Cook had David Romer, he of the narrative study, as one of her thesis advisors, but it’s Collins who emphasizes her interest in economic case studies.

David Romer or Paul Romer?